Ethereum is the second cryptocurrency by capitalization. This electronic currency has enormous potential, which is why it is considered the main competitor of Bitcoin. Today, the Ethereum rate is in the center of attention of investors, miners and users who are just beginning to be interested in cryptocurrencies. Due to its advantages, ether may overtake Bitcoin in the future. Every user, and especially an investor, must understand that in the current conditions, cryptocurrency is a speculative instrument and Ethereum is no exception. The ETH rate is constantly changing, with large traders trying to manipulate its value. Usually, after sudden changes, the price of a cryptocurrency returns to its previous values. However, Ethereum is gradually attracting more and more new users. As the number of people using this tool for financial transactions increases, this has a positive effect on the value of the cryptocurrency. It is logical to assume that the Ethereum rate in 2022 will be higher than in 2022.

Ethereum has become a cryptocurrency, created not only thanks to blockchain technology, but also as a by-product of the Ethereum platform, on which this crypt is issued. It was invented and put into circulation by a Canadian programmer of Russian origin, Vitalik Buterin. The first step in creating Ethereum, oddly enough, was the founding of a cryptocurrency magazine, the first of its kind. Buterin is implementing the ideas together with his partner Gavin Wood. Having borrowed Bitcoin technology, the geniuses launched their own unique system.

The emission of Ethereum, like all cryptocurrencies, is not subject to any authority; all its transactions are clean, but maximally protected. Microsoft, IBM and other major players in the IT industry have become interested in Ethereum. The main goal of Ethereum developers was the ability to make money transfers available at any time, anywhere and anywhere in the world. Thus, cryptocurrency has become an asset that can be transferred from one person to another for further conversion. By the way, the capitalization of Ethereum is about 50 billion dollars.

Reference

The Ethereum forecast for 2022 is determined by the technological features of the project. The main purpose of the Ether coin is to serve as fuel for the operation of the Ethereum platform. It is often called Bitcoin 2.0 or the second generation cryptocurrency, and this is largely justified.

The technology significantly expands the capabilities of traditional blockchain and serves for the development of decentralized applications based on smart contracts and conducting ICOs. The platform is used in a wide variety of areas of human activity, since it uses simple algorithms to conclude agreements and ensures their error-free execution.

Important! A smart contract contains conditions clearly described in the language of mathematical formulas with a clear logic for their implementation; it cannot be forged, violated or canceled.

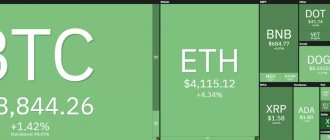

At the current time, Ethereum ranks second in terms of capitalization after Bitcoin and is a sought-after investment object.

FAQ

Is Ethereum a good investment in 2022?

The answer to this question depends on your risk tolerance when trading highly volatile assets and whether you expect cryptocurrency markets to continue to rise in 2022.

Will Ethereum grow in the future?

Analysts expect Ether to grow as the blockchain transitions to Ethereum 2.0 and as developers deploy new DeFi applications. But cryptocurrency prices can fluctuate wildly, and the price could fall again even if Ethereum's 2022 forecast is optimistic.

How high can Ethereum rise in 2022?

If the price of Ether continues to rise following the recent sell-off, some analysts believe the coin's value could continue to rise.

0

Author of the publication

offline 1 year

History of creation and changes in the Ethereum rate

The history of Ethereum begins in 2013, when the author of the idea, Vitalik Buterin, published its first description. The new development almost immediately attracted public attention: the very next year, the young programmer received a World Technology Award and a grant from the Thiel Fellowship program in the amount of $100 thousand for the development of the project.

The ICO was launched in July 2014 and brought in more than $18 million to developers. Full operation of the network began a year later (July 30, 2015), and since then the platform has been continuously improved.

At the beginning of trading, it was possible to purchase Ether on the market for only 0.8-2 dollars. In 2016, after the creation of a wallet for storing coins, the cryptocurrency became more popular and rose in price to $10, and then went through a difficult period of exchange rate fluctuations between 7 and 15 dollars for 1 ETH.

Ethereum to ruble exchange rate now: what’s happening to it

The most interesting thing is that the exchange rate of Ethereum is quite difficult to predict, unlike Bitcoin. At the beginning of December 2017, it gradually went down, and now it has barely reached 25,000 rubles for 1 broadcast. It has leveled off a little and there are even all the prerequisites for growth. Now Ethereum can be bought for almost 27,000 rubles, which is already encouraging. Most recently it fell by more than 20%. What's happening to him? The reasons for the rise and fall are as follows:

- The gas limit for transactions needs to be increased. It is currently too small to handle all transfer requests on the smart contract system and blockchain. In simple words, a large number of Ethereum transactions are canceled and do not go through. It turns out that the gas limit is less than necessary. Since the amount of gas that the user sets when applying for a transfer is higher than the limit, the transaction is cancelled. Due to the large number of such cancellations, the rating and ether exchange rate decreases. At the end of November his big fall occurred.

- The processing speed of transfers in the Ethereum blockchain is low. Mining is also much slower. To mine and add 1 block, a miner needs more time and costs than before. It becomes less profitable for him.

The exchange rate of Ethereum to the ruble now depends on the gas limit and other technical problems

It was technical difficulties and imperfections of the system that befell millions of users who mine and transfer, receive, and exchange ether. Naturally, the exchange rate of Ethereum against the ruble immediately decreased, especially in November 2022. It was assumed that it would continue to fall, because the problems with the gas limit and the speed of adding blocks were not resolved.

But, as we see now, the Ethereum rate began to grow. There was a slight correction towards growth, and it exceeded 26,000 rubles. The rating of the broadcast is also gradually growing, and, fortunately, it was not “leaked” en masse. It seems that users continue to believe in ether and expect a favorable rate from it. Most likely it will. We will look at the ether price forecasts for 2022 and 2022 below. And below are the most incredible reasons for its recent collapse.

What determined the price of Ethereum in 2022?

Throughout 2022, there has been a steady increase in the value of ETH. The first sharp jump in the rate occurred in March, when, according to many experts, the coin reached its maximum level, but continued to rise in price and exceeded it many times over.

Table 1. Significant changes in the ETH rate in 2022

| Period of time | Event |

| March 2017 | Ethereum goes through the first wave of a rapid rise in the price of the coin to $50 and a further correction to $40 |

| Summer-autumn 2017 | Ethereum shows a steady increase in value, successively reaching levels of 100, 300 and 400 dollars, after which it stabilizes at the level of 250-300 dollars |

| Winter 2017-2018 | Intensive increase in the price of ETH to $1,400 followed by a correction in the cryptocurrency rate |

The demand for cryptocurrency is determined to the greatest extent by its technological effectiveness and compliance with the current needs of society, primarily its financial sector. An indirect sign of key market players is the increased attention of large corporations: leading developers and investors.

That is why the entry of Ethereum into the area of interest of Silicon Valley and credit institutions (cooperation with IBM and Microsoft, the joining of JP Morgan, Santander and other technology and financial giants to the Enterprise Ethereum Alliance) caused a steady increase in its value.

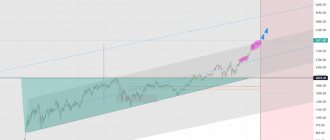

Figure 1. Graph of changes in the exchange rate of the Ether coin in 2022.

What will influence Ethereum’s position in the market?

The Investing Haven research team based its forecast on three fundamental factors.

Current and Future Ethereum Offering

There are currently 92 million Ether tokens in circulation. According to the idea of the development team behind this cryptocurrency, the number of new tokens put into circulation should correspond to the number of withdrawn ones. For now, the number of Ethereum tokens continues to grow, but soon, in a year or two, the target point will be reached. Therefore, for long-term forecasts, supply is not a significant influencing factor, only for short-term ones.

Areas of application of ether (demand factor)

The advantage of Ethereum over Bitcoin is the ability to use smart contracts. These are contracts that occur automatically without human intervention when their conditions are met and the time for execution approaches.

The use of ether in decentralized applications is also a significant indicator. Perhaps this is the intrinsic value of this instrument. Currently, a large number of applications are being developed and launched, and the trend of those services that use Ethereum blockchain technology is clearly visible. Again, there are not enough statistics, since most of these projects are private.

One case in point: The Ethereum Alliance was created to develop the use of Ethereum in the trading of world currencies as an auxiliary element. The alliance was created by such giants as Microsoft, JP Morgan and others.

Investment demand

When large investment players start buying ether as a financial instrument, demand could explode. Currently, institutional investors do not have positions in Ethereum unless through private funds. With the growth of trading volume for this cryptocurrency, the level of its recognition as an asset in which you can profitably invest your money increases.

So, through the analysis of supply and demand, a clear picture emerged of the great potential for growth of Ether in the long term, as over time the supply factor will become neutral, and the ever-increasing demand will push the price higher.

Ethereum Competitors

Competition in the cryptocurrency market is a significant mechanism for determining the price of coins:

- Bitcoin (BTC), contrary to popular belief, is not an analogue of Ethereum and its competitor; the technologies complement each other. The popularization of “digital gold” and the increase in its value have a positive effect on the state of the cryptocurrency market as a whole.

- Cardano (ADA) is not a direct competitor to Ethereum, but is moving in the same direction in terms of the use of smart contracts. The release of innovative product updates may cause a reallocation of investment funds, which will negatively impact the value of ETH.

- Neo (NEO) technology also aims to introduce smart contracts into economic models. A project that allows you to digitize assets and store them on a blockchain with the ability to carry out guaranteed secure transactions can seriously compete with the Ethereum platform.

Ethereum update solves the problem of high gas fees

As part of the upgrade to Ethereum 2.0, Ethereum Improvement Proposal (EIP) 1559 is scheduled to launch on July 14. EIP-1559 will change the way Ethereum charges transaction fees, known as gas prices. It will abandon its current auction mechanism, which has led to excessively high gas prices.

Instead, according to the proposal, fees would “start at some base amount that is adjusted up and down by the protocol depending on how congested the network is.

When the network exceeds the target gas usage per unit, the base charge increases slightly, and when the capacity is below the target, it decreases slightly. Since these base fee changes are limited, the maximum difference in base fee from block to block is predictable. This allows wallets to automatically set gas fees for users.”

In addition to the base fee, the sender will set a priority fee that rewards miners. The base fee will burn, making Ethereum a deflationary asset, which observers believe will increase its value.

“Such a burn balances out Ethereum inflation while still giving miners a block reward and priority fee,” the proposal states. “Ensuring that the block miner does not receive a base fee is important as it removes the incentive for the miner to manipulate the fee in order to extract more fees from users.”

Ethereum gas prices rose to around 298.78 gwei (gwei is a billionth of an ether) on May 19 and fell to 143.67 gwei on May 24, then to 27.69 gwei on June 9. A year ago, on June 9, 2022, this figure was 37.27 gwei. A sharp jump on June 10-11 raised prices to 709 gwei. This has prompted developers to launch Ethereum alternatives with lower fees that can run DeFi and NFT applications, making the EIP-1559 update especially important.

Average price for gas

Analysts' opinion

Most analysts studying the growth prospects of Ethereum agree that in 2022 the coin will rise significantly in price and become even more in demand. Several main factors contribute to this:

- the release of a new cryptocurrency roadmap, presented by Vitalik Buterin in Taiwan in the 4th quarter of 2022 and promising serious technological progress of the platform;

- growing interest in the technology in terms of its use for its intended purpose: for developing applications and conducting ICOs;

- a continuous increase in the number of positive mentions of Ethereum in news and informational articles.

Thus, the first key event - the implementation of the hybrid PoS/PoW protocol (Casper FFG) - should take place in 2022 as part of the second Metropolis (Constantinople) hard fork.

Video review of the Ethereum roadmap:

The success of projects created on the Ethereum platform is also of great importance for the exchange rate of the Ether coin. Thus, the growth of its value at the end of 2022 was significantly influenced by the emergence of the popular game Cryptokitties.

Well-known experts among developers and investors offered their forecast for Ethereum:

1. Stephen Nerayoff, entrepreneur, lawyer, chairman of Global Blockchain Technologies Corp. and one of the founders of the Etherium, Bancor, ZCash, Lisk and Factom projects, expects a threefold increase in the value of the Eth coin during 2022 due to an increase in the number of popular projects based on it.

Figure 2. Steven Nerayoff

2. Jason Cassidy, head of the Crypto Consultant organization, predicts a further increase in the price of ETH, as he sees the platform as an enterprise-level product whose value for large enterprises will steadily increase.

Figure 3. Jason Cassidy

3. Ronnie Moas, founder of Standpoint Research, a financial analyst, advises investors to hold cryptocurrency for a few more years, suggesting that in this way they will be able to make a much greater profit than by exchanging it for fiat money at current conditions.

Figure 4. Ronnie Moas

Important! It must be taken into account that ETH's high volatility levels will likely remain unchanged, although it is considered one of the most predictable cryptocurrencies. Sharp rate fluctuations are typical for digital money and can occur within one day. Most often, they are the result of artificial processes on the exchange, when large traders take profits in fiat currency, thereby reducing the price of the coin.

The reason for the collapse of the Ethereum exchange rate against the ruble is cryptokitties and a universal conspiracy

The reason for the collapse of the Ethereum exchange rate against the ruble is cryptokitties

There is an active rumor among inexperienced users that the exchange rate of ether against the ruble and other currencies was deliberately lowered. Perhaps this is an artificial drop in price for the purpose of buying it up and further machinations when the exchange rate rises. In general, someone reduced it in order to buy it and then sell it at a higher price. This assumption is most likely incorrect, since the decline is associated with a massive failure of transactions, a gas limit problem and other technical difficulties. And the trading volume has not changed much. If someone wanted to engage in mass buying, it would be obvious.

https://youtu.be/shrhl6Cq-l0

Another rumor that is being widely discussed on the Internet is that the game “CryptoKitties” has collapsed the exchange rate of Ethereum against the ruble and other currencies. The information is unlikely to be true for the following reasons:

- Too many news suddenly appeared on the Internet that crypto-kitties had collapsed the price of ether. They seem to be very popular. According to the rules of this application, all cats in it are sold and bought in Ethereum. It was assumed that there were a lot of such transactions, so the system could not stand it, and so the ether fell. According to rumors, the number of transactions with him in the game with cryptotics amounted to 15% of the total number of transfers.

- This couldn’t have happened, because if you look at the popularity of the game itself, almost no one knew it until rumors appeared. Moreover, the news was published almost at the same period. Upon careful analysis of the requests made by users about the game with Critocats, it becomes clear that there were almost none. Roughly speaking, no one was interested in cryptocats at all. How then could there be so many Ethereum transactions on this app? Most likely, they were not there.

- There is also an assumption that the news about crypto-cats was announced specifically to get “hype” against the backdrop of the collapse of the Ethereum exchange rate to the ruble. That is, its reduction happened, and the culprit was made an application. This is how it became famous, and users learned about it for the first time.

Of course, all the above arguments are only subjective opinions and assumptions. Still, experts argue that the decline in the exchange rate of ether is due to technical problems and nothing more. Once the gas limit is increased, growth will occur.

What else you need to know about the state of Ethereum

ETH, according to researchers at San Francisco Open Exchange (SFOX), may soon lose its altcoin status. During the study, experts found a high level of correlation between ETH and BTC. According to the SFOX team, the almost step-by-step repetition of Bitcoin’s movements on the part of Ethereum indicates a similar reaction of the coin rate to events.

Researchers believe that this behavior of ETH indicates a high level of independence of the asset. As a result, the cryptocurrency, in their opinion, is moving towards independence and may lose its altcoin status.

A similar point of view was presented by analysts at Weiss Crypto. In their opinion, in the future Ethereum will be more focused on people who are interested in technical innovations, programming and solutions for creating modern developments. Bitcoin, according to experts, will not be perceived in a similar way.

As time goes on #ETH and #BTC will differentiate more and more. Those who like cool new tech to build stuff on will always gravitate to ETH as opposed to #Bitcoin.

— Weiss Crypto Ratings (@WeissCrypto) July 2, 2020

Previously, we talked about why Ethereum deserves a place in the top 5 promising digital assets for investment in 2020.

ETH also remains one of the most popular coins for mining. Messari analysts came to this conclusion in the course of their research. Experts have found that Ethereum and Bitcoin account for 99% of the income of cryptocurrency miners.

#Bitcoin and Ethereum combine for more than 99% of all miner fees

For now, most blockchains are virtually free to use.

data: @coinmetrics https://t.co/qMpjCi7EB8

— Messari (@MessariCrypto) July 1, 2020

You can learn more about the most promising mining pools for cryptocurrency production from our material.

Regarding the fall 2022 ETH forecast

After the summer increase of ether to $700, by September its rate will approach 900 American money. This will be accompanied, firstly, by the publication of the Russian draft law on the regulation of cryptocurrency, secondly, by the successful holding of the 2018 World Cup, and thirdly, that as part of the ether roadmap announced by Buterin at the end of 2022, the system will be updated with with the help of another hard fork, which partially solves the problem of scaling ETH. Although you can put these events in reverse order.

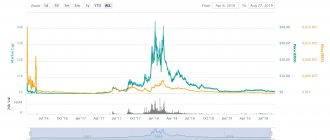

ETH historical chart

Historical chart of Ethereum

If you look at the chart of Ethereum from the historical perspective of its existence, not paying attention to the ups and downs that accompany any crypt, being its kind of “birthmarks” and which attract the speculative part of the user audience, then we can draw the following conclusions:

- that the ether during its life cycle is assessed both more accurately and more competently, if this can be said about its users;

- its rate is more attractive for both large traders and small speculators due to the fact that, on the one hand, it is constantly growing more or less steadily and falling smoothly. On the other hand, this stability of ups and downs leads to a certain predictability of his behavior. This allows both players to choose certain trading strategies in order to receive constant income from transactions;

- ether is more protected from external factors affecting its rate, such as media hype, fake news, and news unfavorable for the crypto industry.

Despite the fact that the very nature of Ethereum has the ability to inflate due to the fact that this system has no restrictions on the emission of tokens, however, trust in this crypto asset is a natural protection against inflation, and trust is formed through stability.

How has the complexity and size of the Ethereum network changed the income of miners?

Compared to Bitcoin, Ethereum has never claimed to be the global currency. It is used to pay for special services, and the market is supported by other cryptocurrencies. This currency has not followed the path of development of Bitcoin, while it can be earned from a home computer; the more nodes, the higher the cost of the cryptocurrency.

In 2014, the creators launched an advertising campaign for the sale of Ethereum and then already received $14 million for them. These funds were able to ensure the further and initial issue of this cryptocurrency. After a few years, the protocol manages to produce 5 ethers for each block; inflation is expected to be constant, that is, infinite. The emission of bitcoins is more stringent, because there are restrictions in the code.

Miners have always influenced the price of Ethereum; they still make money by creating new blocks, for which they receive 5 ETH. When the transition to the new protocol is completed, the size of the reward for miners will decrease, validation of transactions by nodes will become impossible until the deposit is made. As soon as the new algorithm considers that the validator has created something unacceptable, its account will be invalidated.

conclusions

In this article, we looked at the prospects for Ethereum in 2022. Some of the technologies listed here are already being tested and may hit the mainnet very soon. The prospects for the development of Ethereum are very great if the developers cope with all the problems and implement the proposed solutions. What do you think about Ethereum? What is your forecast for the price of the coin at the end of 2018, what are the growth prospects for ethereum? Write in the comments!

If you find an error, please select a piece of text and press Ctrl+Enter.