What is the CPI and what does it show?

Macroeconomics is a rather specific science that is based on stereotypes (standards) - indicators, the calculation methodology of which has not changed for decades. One of them is the consumer price index, which is considered one of the most important indicators of the state of the country's economic system.

Essentially, the CPI is the average temperature for a hospital, which does not always reflect the real situation in the economy. On the other hand, the consumer price index, the main indicator of inflation, has a huge impact on decision-making by both consumers and producers, investors and authorities. It allows you to get a general picture of the state of affairs in the country.

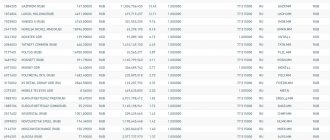

Let's look at the history of the consumer price indicator over the past 8 years. For comparison, let’s take the cost of the consumer basket of a resident of Russia and the consumer basket in the United States of America (USA).

December to December

| Year | Russia Consumer price index for goods and services | USA Consumer Price Index CPI |

| 2010 | 108,78 | 101,50 |

| 2011 | 106,10 | 103,00 |

| 2012 | 106,57 | 101,70 |

| 2013 | 106,47 | 101,50 |

| 2014 | 111,35 | 100,80 |

| 2015 | 112,91 | 100,70 |

| 2016 | 105,39 | 102,10 |

| 2017 | 102,51 | 102,10 |

| 2018* | 102,352) | 102,80 |

*August to December last year

Broadly speaking, the index is a weighted average of the cost of a basket of consumer goods and services, such as transportation, food and health care. The CPI is calculated by measuring prices for each component of a basket and averaging the prices.

What is the CPI used for?

The consumer price index is very convenient in practice

– anyone can obtain the base period data in full, see the impact of price changes on the cost of goods, predict trade turnover and prices for the coming period, and it is also possible to index payments (salaries, pensions, benefits, etc.).

Why is the CPI used in calculations? It has a wide range of characteristics that make it convenient for wide use. This may include:

- Simplicity and clarity of the construction methodology,

- Efficiency of publication,

- Monthly frequency of calculation, etc.

However, experts note a number of disadvantages. The largest one is due to the fact that over time the “filling” of the basket, as well as the distribution of money, changes

. For example, in the 90s, people did not spend money on cellular communications and mobile Internet, but now this makes up a significant share of their expenses.

You can’t just change the consumer basket, which means that the assessment is not entirely correct, it does not correspond to the reality of our days. It is possible that in the future it will still be revised, but for now we are focusing on average indicators

.

Why is an index needed and where is it used?

The CPI is the most used measure of inflation and government performance. It gives an idea of changes in the economy and serves as the basis for decision-making by both authorities, producers, and consumers.

When drawing up a business plan, the consumer price indicator is often used to forecast business cash flows, pricing and sales planning.

The Consumer Price Index can also be used to determine the types and amounts of government assistance to the population, including social security and subsidies. The CPI is one of the main macro indicators of economic growth of any country.

Official figures

Price dynamics in Russia are reflected in the monthly releases of information materials from the Central Bank and Rosstat, taking into account the calculations of the Bank of Russia and estimated statistics.

Calculation of the structure of growth and growth rates of inflation and prices for non-food products is carried out without including gasoline prices for past periods. The final estimate according to Rosstat data is formed on the basis of information from statistics on indexation of prices for consumer goods and expenses of Russian citizens.

Low inflation rates are a reason for joy for the majority of the country's residents, who are worried and experiencing financial problems due to rising prices for goods. However, experts are concerned about the low indicators in the economic environment and the weakening dynamics, which goes in parallel with stabilization. All this is a clear sign of stagnation. Inflation is a symptom of economic well-being and the impact on everyone living in the state.

Let's look at inflation indicators for 2022 and 2022 to make a forecast for 2022. In 2022, the indicator was a record low - 2.5% with a Central Bank rate of 7.75%. Factors that influenced this indicator:

- Increase in volumes in the production of different types of goods.

- Failures in the structure of the state economy.

- A permanent monopoly of some producers who dictate their terms to consumers regarding pricing.

- Weak level of work organization.

- Availability of loans and, as a result, high debt load among the population.

- Unstable and aggravated foreign policy.

- Violations in the process of export-import of products.

One of the socio-economic problems is the so-called oil needle economy and the perception of Russia as an endless gas station. This contradicts the export data. Analysts predict that in the future (in 2022 and 2022) macroeconomic indicators will begin to increase. The oil price rate is expected to stabilize, which will again have a positive impact on the inflation index and other areas of the economy.

Types of price indices

Every month, Rosstat calculates and publishes the following main price indices and inflation indicators:

- RPI and tariffs for goods and services.

- Basic consumer price index (does not include short-term changes in the cost of goods under the influence of administrative or seasonal factors).

- Average consumer price indices for certain types of goods and services.

- Average consumer prices for a particular type of product or service (average of price levels for goods registered in trade organizations).

- Cost of the minimum food basket (set).

- Cost of living index (determines how much the basket of consumer goods and services in various regions and cities of Russia differs from its average cost in the country).

Rosstat also calculates the base value of a fixed set of consumer goods and services for comparison across regions.

A little history: where did it all start?

This economic indicator was first proposed in America in the second half of the 19th century. This was a necessary measure, as there was a need to compensate for losses due to inflation. At the time, inflation was associated with price hikes caused by the Civil War.

The Ministry of Labor was responsible for calculating the consumer price index. Already in our time, the definition of the indicator has been transferred to the Federal State Statistics Service.

In addition, there were several options for determining the price index:

Laspeyres Price Index

Appeared in 1871. It helps to compare the cost of a certain set of services and necessary goods of the current period in comparison with the base. It is not always possible to accurately judge the level of inflation.

If expenses somehow change in structure, then these changes are not taken into account. If prices rise, inflation is overestimated and vice versa.

Paasche Price Index

Appeared in 1874. It helps to understand the dynamics of price growth in the current period. That is, it shows the increase or decrease in the cost of goods over a period.

However, it will not be possible to adequately assess the level of inflation using this index. Each time, new products and services are selected for analysis.

Fisher Price Index

Appeared in 1927. It is not used often, it helps eliminate the shortcomings of previous methods. Calculated as the geometric mean of the Laspeyres and Paasche indices. The peculiarity of this index is that it is time-reversible. But this formula cannot provide any data for forecasting.

Lowe's Index

It is used only when it is necessary to calculate purchases and sales for a long period. This index allows you to take into account changes in the composition of the food basket or assortment of goods.

By the way, despite such a number of tools, only the first method is used for analytics. It is used to determine the level of inflation and take economic measures.

In Russia, the need to use a price index arose only during the transition to a market economy. In 1991, it was decided to move from the temporary index created by Goskomstat to the consumer price index. It meets international recommendations.

The influence of the CPI on currency quotes

Useful articles

6 ways to profitably invest 100,000 rubles in 2022

Which company is the richest in the world today?

Is it profitable to run a video blog and how much can you earn on YouTube for?

Why do some people make a million by the age of 30, while others are doomed to poverty?

The CPI tends to have a significant impact on exchange rates because it determines the direction of government monetary policy as well as consumer sentiment.

For example, when the rate of inflation accelerates, people begin to spend more, while demanding an increase in salaries in order to be able to buy the usual range of products. This, in turn, provokes a new round of inflation - companies increase wholesale prices, which ultimately leads to an increase in household expenses.

For the national currency, this means a decrease in purchasing power, therefore, its reduction in price relative to other currencies. Therefore, traders and investors use the CPI indicator to analyze the foreign exchange market.

Benefits of Price Stability

To contents

Price stability is the Central Bank maintaining stable and low inflation. At the same time, there is a slight increase in prices, which does not affect the consumer’s refusal to purchase the product. This is the goal of states linked by trade and political relations.

Low growth makes it possible to plan large-scale development programs, and banks can provide loans to production for long periods at reduced rates. It becomes possible to develop capital-intensive areas and increase social spending. Experts consider the most optimal growth of the Russian CPI to be about 4% per year, this is justified by the calculations of the Central Bank and is supported by the state. A reduction to 2% will increase economic costs, reduce enterprise profits, and lead to job losses.

Disadvantages of the index

As I have already said, economists have been arguing about the consumer price indicator for decades. The most significant point is the methodology for compiling the basket. It includes, in a given proportion, food and essentials, clothing, utilities, transportation costs, fuel, medicine, spending on leisure and education.

To adequately assess changes in household spending, the basket must reflect the real structure of consumption. Consequently, its composition and the CPI need to be revised over time.

For example, in the 90s, mobile phone costs were not taken into account because they were not common. Now this article is present in 99% of households.

Changes in the basket in Russia from year to year (both the composition of goods and proportions) lead to incomparability of previous CPI data with the present ones.

On the other hand, if you do not revise the basket, after some time it will not correspond to the structure and real dynamics of consumption.

CPI and GDP deflator: what is the difference

The GDP deflator is another tool that is used to measure the inflation rate of a country. However, two indicators differ significantly:

- First, the deflator is calculated based on the value of total production in current year prices (essentially the Paasche index).

- Secondly, the CPI includes certain goods and services, the deflator includes everything that is included in GDP.

The disadvantage of the indicator is that it does not take into account imports. On the other hand, the indicator always reflects changes in prices for new goods and services, unlike the CPI.

Negative consequences of high inflation

To contents

As already mentioned, the Central Bank of the Russian Federation, using various tools, maintains the inflation rate at an optimal level. Both the complete lack of growth and irregular surges are unprofitable for the state and citizens. The powers of the Central Bank are limited to influencing monetary factors, since the agency cannot directly influence production, international economic changes, or mass sales of shock goods.

Inflation is the key to business activity and production growth. But when it is high and unpredictable, entrepreneurs cannot make long-term forecasts. They spend what they earn as quickly as possible, investing it not in development, but in foreign currency, real estate, and valuables. Without long-term investments, the development of science and technology is impossible. Some projects require decades of research and development, and capital protection for the entire period.

In conditions of high inflation, citizens find themselves unprotected, lose their savings, the standard of living is constantly declining, as a result, GDP is falling, unemployment is rising, and the crime rate is rising. Stabilization, even with effective government work, takes years.