The situation on Russian stock exchanges is constantly analyzed using special tools - indices. They are able to show the slightest changes in the market. These indices are calculated using special formulas and are able to express everything that is currently happening at the auction. Today, two equally important indices are used - the MICEX and the RTS. How are they similar and how are they different from each other? And what do they even represent? Let's figure it out.

What is a stock index in general?

A stock or exchange index shows the state of the securities market. When calculating it, a basket of the most liquid stocks and bonds on the market is taken. This index is necessary to correctly assess the state of the stock market. With their help, the moment of the economic cycle is also determined.

In general, stock indices are as follows:

- Arithmetic average. The calculation is standard - the value of individual shares is added up and then divided by the number of shares counted.

- Weighted average. Calculated by capitalization.

- Geographical. Divided into national and international.

The MICEX index is a national index and is used to analyze the situation on the Moscow Exchange stock market. The RTS index is similar, which is also calculated on the Moscow Exchange, which was merged in 2011. Previously, it was considered on the Russian Trading System.

Index Trading - Advantages and Disadvantages

Stock indices are an interesting alternative to other financial markets.

Here are some benefits of index trading:

✅ Trading on the movement of the stock market in general.

✅ Instant diversification compared to the stock market.

✅ Trade with different strategies on different timeframes.

✅ Indices are established markets with minimal possible price manipulation.

✅ Trade on markets you know well: FTSE100 in the UK, SP500 in the US, DAX 30 in Germany and so on.

✅ Possibility of long-term investment.

However, like any financial market, there are a number of disadvantages to trading stock indices:

✔️ Some stock indices are less liquid than other markets, such as Forex.

✔️ Brokerage fees may be higher for less traded indices

✔️ Limited Trading Hours – While Forex can be traded 24 hours a day, 5 days a week, stock markets are only open during local business hours.

✔️ As the market closes, there may be more gaps than in Forex

What are the most popular indices in Russia?

On the largest and most famous stock exchange, MICEX, there are two main indices and one additional one, not counting indicators for individual bonds. This is MMBV (and its “relative” MMBV-10” and RTS. A little more detail about what they mean and what they depend on.

MICEX (Moscow Exchange)

Created and began payments on September 22, 1997. Used on the Moscow Interbank Currency Exchange. Used to monitor market conditions during the trading process. The Moscow Exchange index is weighted by capitalization level, therefore it is somewhat different from its “relative”, the MICEX-10. The latter does not consider capitalization.

This indicator depends on the leading sectors of the Russian economy. That is, from the raw materials sector. Companies involved in exporting also play a significant role. It is quite easy for analysts to predict further fluctuations in the index.

The problem with the index is that it is quite dependent on sanctions, since the companies participating in the calculation are subject to them. It is hit especially hard by the decline in the cost of a barrel of oil.

MICEX 10

The same as the MICEX index. The difference is that it is calculated based on the shares of the top ten companies, without taking into account their presence in quotation lists. It is enough that their shares are the most liquid of all.

RTS

Another stock index used on the Moscow Interbank Currency Exchange after its merger with the Russian Trading System in 2011. Second in importance on the Russian market.

The main advantage of the RTS index is its information content. It reflects the price of the domestic market in US dollars with almost one hundred percent accuracy. And observing its dynamics allows us to draw appropriate conclusions.

For calculations, not rubles are used, as in the MICEX, but US dollars. Consequently, this index is more useful and informative in situations where the ruble exchange rate is unstable or severely devalued.

Now the RTS is under serious pressure because it depends on the raw materials sector and global conditions. It also affects the fact that it is calculated in dollars, whereas now calculations are not made in this currency. Since Russian raw materials are gradually being squeezed out of the international market, this does not have the best effect on the situation.

World stock indices

The most famous all over the world are American stock indices. It was in the USA, as mentioned above, that the first stock index appeared - the Dow Jones index, which still exists today.

In addition to the Dow Jones Transportation Average, there are also industrial (Dow Jones Industrial Average) and utility (Dow Jones Utilities Average) indices.

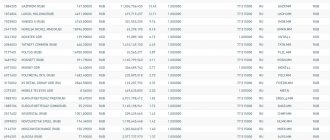

Companies included in the Dow Jones Transportation Average

Dow Jones Industrial Average - calculated based on the stock prices of the thirty largest US industrial enterprises.

Dow Jones Utilities Average - calculated based on the stock prices of the fifteen largest North American utility companies.

Other well-known American stock indices:

The NASDAQ index is calculated on the American stock exchange of the same name. It has two main types: NASDAQ Composite and NASDAQ 100. The NASDAQ Composite Index includes shares of more than 3,000 companies traded on this exchange (these can be both American and non-American companies). The NASDAQ 100 index includes shares of one hundred companies in the non-financial sector traded on this exchange.

S&P indices are calculated by the international rating agency Standard & Poor's Financial Services LLC. The most famous S&P 500 index consisting of shares of industrial (400 items), utilities (40 items), financial (40 items) and transport (20 items) companies with a total capitalization of more than 80% of the capitalization of all companies listed on the New York Stock Exchange. In addition, there is the S&P 100 index consisting of one hundred largest companies, the options contracts of which are presented on the Chicago Options Exchange.

NYSE Composite is an index calculated on the New York Stock Exchange based on shares of more than 2,000 companies (both American and other large international companies listed on this exchange) with a total capitalization of over twenty trillion US dollars.

Among the European stock indices, the most famous are:

The DAX 30 index is Germany's largest stock index, comprising shares of the thirty largest companies listed on the Frankfurt Stock Exchange.

The CAC 40 Index is a French stock index calculated based on the prices of the forty largest companies listed on the Paris Stock Exchange.

The FTSE 100 index is a British index created by the Financial Times analytical agency based on the shares of one hundred blue chip companies on the national stock market.

Euro Stoxx 50 Index - created on the basis of shares of the fifty largest companies located in the European Union.

And of course, Asian stock indices (where would we be without them):

The Nikkei 225 Index is the oldest Japanese stock index, consisting of shares of two hundred and twenty-five companies listed on the Tokyo Stock Exchange.

The TOPIX index is another Japanese stock index, consisting of shares of companies included in the first section of the Tokyo Stock Exchange.

The Hang Seng Index is the largest Chinese stock index, built on the basis of stock quotes of thirty-four companies traded on the Hong Kong Stock Exchange (the total capitalization of these companies is about 65% of the total capitalization of companies traded on this exchange).

What is MICEX

This is an index of share prices of the most liquid companies on the stock exchange. It is considered one of the most important existing on the Russian market today. It is not quoted in itself, but only reflects the current situation. But there are settlement futures that take this index as the underlying asset.

Until 2022, it was called the MICEX index, after which it was renamed the Moscow Exchange index. Since the same year, the indicator has moved from a fixed number of companies (previously there were only thirty) to a floating number of up to 50 organizations.

The MICEX index is calculated once per second every day. That is, when viewing the graph you can find the most relevant information.

What stocks are included in the basket?

The Index Committee decides exactly how many companies need to be taken into account during the recalculation and which companies will be honored to be included in the list. The quota for issuers of shares participating in the recalculation of the index is revised once a quarter.

One of the guidelines is the liquidity ratio, which should be at least 15%. If it drops even below 10%, then the company with its shares drops out of the index. Another criterion for getting into the basket is daily transactions in the stocks being considered.

Companies should also take into account that in order to be included in the calculation, they will have to maintain a free float level of at least 5-10%. If it falls below 5%, then the stock is thrown out of the index basket. Moreover, one share must weigh at least 0.25% of the total size in the index in order to be included in the basket. If it is less than 0.2%, then the paper will be excluded from the calculation.

How is MICEX calculated?

To calculate the index, you must use a certain formula:

In = MCn / Dn

where: I is actually what we are looking for - the index at a specific point in time. MC – capitalization of shares from the basket at the time of recalculation. D is the value of the divisor at the time of calculation.

In this case, the divisor is calculated using a separate formula, which is related to the very first indicators and the current situation. At the moment, its value is equal to 4689729104.0986.

Since market analysis occurs in real time, the index is always up to date. The recalculation takes place every second, and the results are displayed on a graph, which is quite clear.

Total return indices

Will be of interest primarily to “dividend hunters”. How are they different from the main ones? From the same Moscow Exchange index.

The Moscow Exchange index simply shows a change in its value due to the volatility of the price of traded shares.

The total return index includes in the calculation still received dividends for securities included in this index.

When compared, a very interesting picture emerges.

The regular Moscow Exchange index has grown by 9.62% since the beginning of the year. And taking into account dividends, it is 5.5% more.

Over long periods of time, with additional profitability in the form of annual dividends, there is simply a colossal gap in the final results.

Comparison of Moscow Exchange indices and total return (including dividends).

If anyone is interested, you can look at (calculate, poke) the indices, compositions, graphs, and calculation bases yourself.

I recommend starting your acquaintance with the picture below. Some kind of index map. Going to the Moscow Exchange website. Moreover, it is clickable.

What is RTS

It shows the total market capitalization of shares of certain issuing companies. The index dates back to September 1, 1995 and includes fifty companies. The RTS itself, like the MMBV index, is not traded. But there are corresponding futures for it too. Similar to the MICEX, the RTS is recalculated in real time - new values appear every second.

Before the merger with the Moscow Exchange, this indicator was calculated somewhat differently. He took into account the total value of the shares of the 50 companies selected in the basket.

What conditions do the shares in the basket meet?

To be included in the RTS index basket, shares must be listed on the stock exchange for at least six months. At the same time, their liquidity threshold must be at the level of the 50 most traded instruments for some time.

How is RTS calculated?

The index basket of this indicator includes 50 firms and companies with maximum capitalization. It includes exactly the same organizations as those included in the list of the previous index.

The formula for calculating the RTS is almost similar to that of the MICEX index. The only difference is that the index is calculated in dollars. That is, when calculating it, you will first have to convert stock prices into dollars at the current exchange rate. And only then start counting.

Why are both indexes needed?

Indices are needed to track the market. They are like a benchmark that reflects the current state of the market. Almost all Russian mutual investment funds are built on them. There are even separate mutual funds for many banks and other organizations, which include only shares of the MICEX, RTS or MICEX-10.

If, when recalculating the index, it suddenly turns out that the situation has gone beyond certain limits, the exchange stops. By pausing, you can achieve two effects at once:

- Calm the situation on the stock exchange - perhaps the sharp fluctuations were influenced by a psychological factor associated with some news.

- Slow down speculators who, for some reason, decided to shake up the market and manipulate the prices of certain shares.

Consequently, indices act as a kind of regulatory lever that allows you to manage the stock exchange. Such management allows you to avoid critical moments and situations when traders begin to lose money in a wave of panic.

Index Trading - Trading Strategies and Time Frames

Choosing the best strategy for trading indices and index CFDs depends on a number of factors, including your risk tolerance, your affordability and how quickly you want to profit from your investment. One of the main characteristics of your strategy will be your trading period, which can range from scalping to swing trading.

Scalping

Scalping is a short-term trading strategy where you aim to open and close trades within a few minutes. Since the time frames for these trades are very narrow, the profit from each trade is also usually quite small - only a few pips per trade.

This means that traders need to trade very large volumes or make a very large number of trades to make decent profits.

Index scalping can be done manually or using trading robots.

Day trading

Day trading means trading during the day. These trades typically last several hours rather than a few minutes, and day traders open and close positions within a single day.

Swing trading

Swing trading is used on longer time frames - usually from several days to several weeks. Swing trading is often a good approach for new traders because you don't have to constantly monitor your positions.

With swing trading, you are less concerned about small daily price swings because you expect them to level out as you follow the long-term trend.

Because stock indices follow economic cycles, they are well suited for swing trading. We can see this in the Dow Jones, Nasdaq and SP500 indexes over the past decade, as they have all risen and fallen with the US economy.

Comparison of MICEX and RTS - what are the differences and similarities

In fact, these indices are almost identical to each other. After the merger of two exchanges - the Moscow Interbank and the Russian Trading System - almost all of their differences were reduced to zero. Now both are considered on the Moscow Exchange, their index baskets include the same companies, even the formulas are almost identical.

But there is one very important difference that makes the existence of both indicators necessary. Each index uses different currencies to calculate it. The RTS uses US dollars, and the MICEX uses rubles. This affects the driving dynamics. The value of the RTS depends on the dollar exchange rate - the lower it is, the higher the value.

It is believed that the RTS is more accurate regarding the global situation than the IMBV. Because it is calculated in dollars, whose exchange rate is much more stable. The ruble has been constantly changing its value lately, gradually continuing to devalue. But at the same time, the RTS is dependent on the commodity economy and the current situation in the world, and is also “closed” by the shadow of the MICEX, which ultimately puts quite serious pressure on it.

Index Trading vs Forex Trading

Again, both markets have their advantages and your choice will depend on your trading strategy. Forex can be challenging because you need to predict the movement of a single currency pair, which can be influenced by a number of factors and can be very volatile. In contrast, with index trading, you can trade based on predictions of broad market movements.

Forex trading is often suitable for short-term scalpers who benefit from high volatility and low spreads. On the other hand, trading indices, especially indices with wider spreads, may be more suitable for long-term traders, such as swing traders.

Another thing to consider is how well you understand the market. While some traders understand and can trade successfully in a particular economy or sector, which lends itself well to index trading, others have a better understanding of currency movements, meaning that Forex trading is better suited for them.

One of the most popular stock indices for trading is the DAX30, which includes the 30 largest companies by market capitalization on the Frankfurt Stock Exchange. Simply click on the banner below to learn more about the DAX30 and how to trade it.