When we talk about economics, sooner or later we have to deal with concepts such as the consumer price index (CPI) and inflation. What is the CPI, how does it differ from inflation, where can it be found and how to calculate it - you will find answers to these important questions in the article.

What is the consumer price index and why is it needed?

The change in the consumer price index compared to the previous month or previous year is called the inflation rate. The higher it is, the fewer goods you can buy with the same amount of money.

The Consumer Price Index is the central indicator for assessing the dynamics of monetary value in a country. It is used as a guide, for example, in salary negotiations or in contractual agreements on the amount of recurring payments. It is also used for deflation—increasing the real value of money and lowering the prices of goods—in national accounts, such as when calculating real economic growth.

Based on the CPI, adjustments are used to calculate internationally comparable inflation rates. In particular, it is used by the Central Bank to assess inflation.

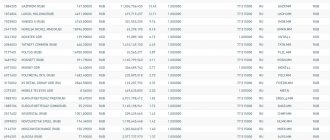

All official CPI values for Russia can be easily found on the website of the Federal State Statistics Service. The basis for the analysis is either December of the previous year or the previous month.

How is the Consumer Price Index calculated?

What's wrong with inflation

A shortcoming of the CPI that many economists often point out is its measurement of the “average hospital temperature.” The main subject of controversy is the composition of the consumer basket. For the poor it will be one thing, and for the wealthy it will be another. For low-income citizens, the share of the food component inevitably increases, which can reach ¾ of the basket. Wealthier people spend less than half of their expenses on food.

I also recommend reading:

Corporate Information Disclosure Center as a Fundamental Analysis Tool

Corporate Information Disclosure Center - how it is useful for investors

This affects the public's perception of official statistics. It is no coincidence that the concept of “personal inflation” appeared. It just so happens that in Russia it usually exceeds the official one. For example, the CPI December 2022 to December 2016 was published with a value of 102.51%. It is unlikely that any of the readers felt that their consumer basket grew by 2.51% over the year. Of course, one can object to this that citizens give only everyday assessments based on sensations. But I think that in such cases a personal calculator works more accurately than an official one.

The second point is related to the cost of living, which, according to Rosstat’s methodology, actually reflects the threshold of human survival. Let's look at the latest data from Rosstat:

In developed countries, this indicator is measured to determine a “decent standard of living.” From this point of view, the index should include, in addition to the basic set, visits to restaurants, beauty salons, keeping pets, spending on taxis, tutors, etc. That is, factors without which it is impossible to imagine the life of a modern person.

There is another flaw in the CPI index: it does not take into account asset prices. And this doesn't just apply to investors who will buy more or less shares with spare cash. The cost of real estate, securities, and credit resources make significant adjustments to the consumer behavior of the entire population. Thus, increasing loan rates reduces consumer demand, and rising housing prices make rent more expensive. Therefore, the CPI should not be looked at in isolation from other important indicators - stock market indices, the key rate, the level of housing prices (the American analogue is HPI, Housing Price Index).

How is the Consumer Price Index calculated?

The calculation of the consumer price index is based on the “consumer basket”, which represents goods and services purchased and used by individuals in Russia.

In Russia, the consumer basket consists of 156 items. It is this minimum of goods and services that allows a person to maintain a standard of living. The products included in the consumer basket can be divided into two categories.

The first includes those that do not change from year to year.

. This could be, for example, baked goods.

The second category is more variable.

These specific individual products represent the second level of the product basket. At this level of individual price representatives, the basket of goods is constantly adjusted, as goods that are no longer relevant or have lost their market importance are replaced or new goods appear, options are added - this is done by Rosstat.

The number of items selected is usually based on the share of expenditure on one item relative to total personal consumption expenditure. Products for smaller areas should also be included to cover the full range of private consumption.

Moreover, it is important to understand that with this approach, the “hospital average” needs are taken as a basis. And these purchases for an individual and a family can differ significantly. Most likely, even if your family most often eats bulgur as a side dish, it will not be included in the consumer basket, and plain white rice will be in the first positions.

Did you like the article?

Subscribe and find out: - how to control your income and expenses, - what is the best thing to invest in this year, - how to get rid of debts, etc.

Benefits of Price Stability

To contents

Price stability is the Central Bank maintaining stable and low inflation. At the same time, there is a slight increase in prices, which does not affect the consumer’s refusal to purchase the product. This is the goal of states linked by trade and political relations.

Low growth makes it possible to plan large-scale development programs, and banks can provide loans to production for long periods at reduced rates. It becomes possible to develop capital-intensive areas and increase social spending. Experts consider the most optimal growth of the Russian CPI to be about 4% per year, this is justified by the calculations of the Central Bank and is supported by the state. A reduction to 2% will increase economic costs, reduce enterprise profits, and lead to job losses.

Getting prices

To measure the price dynamics of individual items in a shopping cart, hundreds of thousands of prices are collected every month. This survey includes a decentralized survey of prices in stores throughout the country.

The additional use of digital data sources will allow the statistical enterprise to significantly increase the number of monthly price observations. For example, for product areas with particularly complex pricing—such as package tours or insurance premiums—additional data sources with more observations could be used.

In addition, it is possible to introduce modern methods - automatic reading of Internet data. For online trading and for individual services such as car rental or long-distance bus travel, the number of monthly price observations will be significantly increased by such procedures to take into account dynamic price changes.

Changes in quantity when calculating the CPI

Changes in quantity

Quantity changes are also included in the price comparison. For example, if a supplier reduces the packaging size of a product while keeping the price constant, this is considered a price increase in price statistics.

Remember, the period when instead of a liter of milk in bags they began to sell only 900 milliliters. To maintain statistical significance, calculations must consider a single volume—a liter of milk. Accordingly, the price must be recalculated.

Model changes, as well as changes in contract terms, may be accompanied by changes in quality, which may be reflected in the price, but should not completely determine the price difference between the old and new product. In these cases, the price difference caused by quality differences is quantified and subtracted from the index definition. Without such quality adjustment, improvements or deteriorations in the quality of goods would be reflected entirely in price indices.

This would all make it difficult to meaningfully interpret the measured price changes.

Scheme for calculating the consumer price index

To calculate the consumer price index, the items in the basket are initially divided into types (for example, milk and yogurt are not counted separately - they are one category). The average year-over-year price movement for a particular type of product is then weighted by the share of spending that private households in Russia spend on that type of product.

Expenditure shares for individual types of goods are based on the expenditures of all households. For example, if a particular household did not purchase consumer durables this year, its expenses are still counted. This takes into account the fact that you usually do not buy a washing machine, TV, car, etc. Every year.

The overall result is a weighted average of price movements.

The basic information thus obtained is supplemented and updated by data from current economic calculations, which provide information on the exact distribution of household expenditures for individual types of goods. These results are then checked using additional information and adjusted if necessary.

Why do we need inflation and CPI?

How to calculate personal inflation for the year?

Official inflation in Russia for 2022 was 3%. Do you know what your real inflation rate is?

So what did we do.

1️.

We made our regular shopping list - what we buy when we go to the store. These are mainly food + non-food items (napkins, toilet paper, etc.). These goods will last us on average 1-2 weeks. Baby food was not included (this is a temporary option). This is how we got our consumer basket (simplified, of course).

2️.

For the purity of the experiment, we looked at the cost of this basket in 3 different stores where we most often shop: Azbuka Vkusa, Perekrestok and Metro. Everywhere we took current prices from the online store. Where there was a promotion, prices were set taking into account the discount. If there was no exactly the same name/manufacturer, a similar product was chosen as a replacement.

3️.

We also separately recorded current prices for other mandatory and regular expenses. Tariffs for Internet, television, housing and communal services, fuel (diesel). We have corporate cellular communications, so it’s not on the list. All this was packed into an Excel spreadsheet and saved on the computer.

Now all that remains is to wait until the end of the year and check current and future prices. And then we will see how our consumer basket has changed, how much certain prices have increased over the year.

Source: https://zen.yandex.com/media/id/5e20c069aad43600ad444acf/kak-poschitat-lichnuiu-infliaciu-za-god-5e4270265217d53be7c21b13?feed_exp=ordinary_feed&from=channel&rid=1459469385.456.15853 24130550.76381&integration=publishers_platform_yandex&secdata=CJjdyvGMLiABMAJQDw%3D%3D

How can you use the consumer price index?

The Consumer Price Index is used, in particular, to measure monetary stability. If the price level rises over a long period of time, it is called inflation; if, on the contrary, it decreases, it is called deflation.

Find out how well you understand personal finance by answering 5 questions.

Get started

Do you keep track of your income and expenses? Do you know how much you spent last month?

Yes, I always stick to the plan

Great. This is a sure sign that you are managing your finances wisely.

No, but I don't go beyond the limits

Commendable. This means that you are on the way to competently managing your finances. Try to understand which items of your spending can be optimized.

I plan and analyze

Commendable. This means that you are on the way to competently managing your finances.

Accounting is not for me

Unfortunately, in order to stay out of debt, save for your dreams, and achieve financial well-being, you need to start by understanding your cash flow.

Further

Are you saving for some big purchase?

Only if it remains

Unfortunately, it is quite difficult for people with low incomes to save monthly. And if all your money is spent on buying unnecessary things, then you are at risk. Think about what will happen if an unexpected situation occurs? Go to friends? Take out a loan? Try to manage your budget wisely in order to save at least a little, but regularly.

Yes, from every salary

Great. Your answer shows confidence in your finances. If you understand why you are saving, you are great!

I’m just saving - someday I’ll still need the money

Simply hoarding is a bad practice, although it is better to save than not to save at all. Make a plan to preserve and increase capital - this is the first step towards financial security.

Does not work

You are at risk, because this does not give you the opportunity to increase your capital and, in the event of an unforeseen situation, will lead to a financial hole. Try to manage your budget wisely in order to save at least a little, but regularly.

Further

If I want to open a deposit in order to receive significant income from it, then which deposit is better to choose?

With interest capitalization

This is the best option as it gives you the most income. Remember about interest on accrued interest?

With receiving interest on the card

This option is better than just hiding money, because you will receive interest on the deposit. This will reduce the depreciation of money.

Better put your money in a jar

A bank is better than a bank, because it cannot close. But money can be stolen. Moreover, they depreciate in value. And by putting money into a state-protected deposit, you can preserve capital.

I don't have any free money

You are at risk, because this does not give you the opportunity to increase your capital and, in the event of an unforeseen situation, will lead to a financial hole. Try to manage your budget wisely in order to save at least a little, but regularly.

Further

Investing involves risks. To reduce the level of risk, it is best...

The state is to blame for everything!

Of course, what about competent management of your own finances???

Risk? No, I haven't heard

To get income, you need to estimate the probability of losing money. On the one hand, the state will protect a small amount on deposit, but the income will also be small. On the other hand, you can make a decent amount of money from cryptocurrency... or lose it.

Invest in different assets

Great. Diversification is the basis of competent financial management

Invest the entire amount for a short term

Investing for the short term does not mean there is no risk. People in Finiko's financial pyramid lost their investments very quickly. Diversification is the basis of competent financial management

Further

I want to buy shares, what will I get as income?

Interest

No. Interest is charged on the deposit (example) and its amount depends on the amount in your account.

Dividends

Right. Their amount depends on the successful performance of the company and the distribution of profits among shareholders.

Salary

Some may consider this a salary, but in reality it is not. You invest in shares so that you can then receive a portion of the company's distributed profits.

I won't receive any income

Maybe you'll get it, maybe you won't. This depends on the type of stock, the company's performance and the distribution of its profits.

Further

Or leave your email and we will send you the most useful content based on your answers.

And if you have questions about the portal or are not sure that you need a course in finance, then leave your phone number. We will contact you shortly and help you sort it out.

Further

Thank you! The first letter is already waiting for you in your mailbox.

The CPI determines the adjustment of the level of wages, and, in addition, the level of social insurance payments and other benefits to partially or fully compensate for changes in the cost of living or consumer prices. Even the calculation of alimony may be related to the index of consumer goods, or more precisely, to the cost of goods in the consumer basket of a particular family.