On the Internet, various services exist and are developed every year that allow users of the World Wide Web to carry out various financial transactions.

The most popular services:

- Qiwi;

- WebMoney;

- "Yandex money".

Everyone who is going to have an electronic wallet thinks about ways to cash out the money that will be stored there.

The article will discuss how to withdraw money from an electronic wallet in cash.

Qiwi Visa Card

Currently, this is the easiest option for cashing out funds. The card balance is equal to the balance of the Qiwi e-wallet. You can pay with a Qiwi card in stores without commission.

Cash can be withdrawn from an ATM of any bank with a commission of 2% plus 50 rubles.

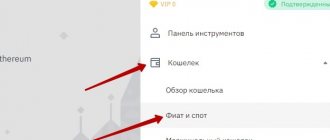

To issue a Qiwi card, you need:

- go to the section for creating an application for creating a card;

- find the item “Purchase of a plastic card”;

- fill in all the data.

The card will be sent as soon as possible.

Rating of the best wallets

Since 2016, Ukraine has limited access to some popular electronic wallets in the country. However, many people continue to use them by resorting to a VPN, which is not entirely legal.

The fact is that some of the prohibited payment systems operate on the international market and offer convenient tools for which it is difficult to find a worthy alternative.

Therefore, the rating of electronic wallets included those systems that users prefer.

WebMoney

Leader in electronic services due to a number of reasons. These include:

- The ability to create several wallets, linking them to the desired currency, including cryptocurrency and precious metals.

- Many options for depositing and withdrawing funds.

- High degree of security, which is constantly being improved.

- A large number of convenient services.

- Small commission for transactions carried out in the system, only 0.8%

- Possibility of lending within the system if you have a certain level of business certificate. You can take out a loan, or you can start issuing loans yourself, earning interest.

- The project is massive - more than 40 million registrations.

- Since November 17, 2015, WebMoney officially operates in the UK and Europe.

- You can link other payment systems to WebMoney: Qiwi, EasyPay or Yandex.Money.

The National Bank of Ukraine has canceled the registration of WebMoney, which is why it is now impossible to pay for utilities from this wallet, top up a mobile phone account, and it is difficult to withdraw money to a card.

Qiwi

Since 2012, Qiwi and the international payment system Visa have been strategic partners. It was then that, in addition to the free virtual one, it became possible to order a physical debit card.

The service currently offers three types of cards:

- standard QIWI payWave: valid for three years, free service, no commission is charged for transfers from another bank’s card if the replenishment amount is 2000 rubles. and more.

- QIWI payWave+: with the same conditions as the previous card. The only difference is that this one is valid for 5 years;

- QIWI Priority: login to the package application of the same name. Users who have signed up for Priority receive higher limits on cash withdrawals, premium service and free annual SMS notifications.

These cards can be used for offline purchases, and each of them can be linked to Apple Pay.

As for commissions, Qiwi offers favorable conditions for cashing out large amounts and transfers within the system. For these operations, the service charges 2% (+50 rubles) and 0%, respectively.

In Ukraine, the payment system is under sanctions.

YuMoney (formerly Yandex.Money)

YuMoney is chosen for its simple functionality and the ability to pay for various services online. The service also offers cashback, affiliate discounts and special offers.

The wallet makes it possible to issue both a virtual and a plastic card for purchases in stores, cash withdrawals from ATMs, automatic payments and other transactions.

The YuMoney payment system is blocked in Ukraine.

EasyPay

There are four ways to pay for a product or service online using EasyPay.

- Visa or MasterCard plastic card. To do this, you need to enter the card number, expiration date and CVV code.

- Cash at the terminal, of which there are already more than ten thousand in Ukraine. When placing an order in the online store, the user can enable the “Delayed payment” function. The confirmation code received via SMS must be entered in the terminal and the purchase will be paid for.

- Electronic money from a virtual account.

- From a mobile phone for subscribers of the Kyivstar operator.

All transactions can be carried out from the EasyPay website or mobile application, available for iOS and Android. Most popular services can be paid without commission by linking a virtual or special EasyPay card from Forward Bank to your wallet.

You can create several electronic wallets in the system by saving different bank cards. Another plus:

- regular payments;

- setting up templates if you need to transfer different amounts to the same details;

- cashback 1% of the cost of card purchases;

- Loyalty program points are awarded, which can be used to pay for services or receive discounts from program partners.

The payment service has been operating since 2007 and has the largest network of terminals in Ukraine.

SharPay and Smart Money

Electronic money of mobile operators Vodafone and Kyivstar.

SharPay is a Vodafone mobile application that must be installed to use your mobile wallet account. Interestingly, a user of any mobile operator can use the service.

Kyivstar provides services to prepaid subscribers.

What services are available:

- Withdrawal of funds to a bank card.

- Pay for utilities and many other services online.

- Applying for a loan.

- Shopping in online stores.

- Transfer money to other users.

Here you can repay a loan, pay a fine, internet, buy a ticket - conveniently and quickly.

LeoWallet (temporarily unavailable)

Since January 2022, the wallet has suspended operation. The service’s website reports that the reason is that the user identification system is not ready. As of January 2022, LeoWallet was still inactive.

Internet wallet in a smartphone, which has been developing rapidly since the beginning of 2022. New functions are added, capabilities become wider, and errors are quickly corrected.

You can top up your account in the terminal, from a mobile phone or a bank card.

Easy registration - all you need is a phone number. A large percentage of cashback is up to 25%; no commission is charged for withdrawal to the main account. In general, most transactions in the wallet take place without commission, but for withdrawing funds to a bank card they will charge 3%.

The limits on the balance of money in the account are 14,000 hryvnia per month, and the annual turnover of the wallet for the year is no more than 62,000 hryvnia. These are the norms of the “Regulations on Electronic Money in Ukraine”.

Global Money

A payment system that has been operating in Ukraine since 2009. To register, you only need an email and phone number.

98% of more than a thousand available services can be paid without commission. Global Money offers profitable transfers between cards of Ukrainian banks - commission 0.5% + 5 UAH.

The wallet has a high degree of protection that complies with the international PCI DSS standard. This makes it possible to receive transfers from all over the world.

After the appearance of the Global 24 mobile application, the popularity of the platform has grown significantly.

The list of wallets above has one drawback - you can pay for goods and services only within the country, but the following options are suitable for international payments.

PayPal

In Ukraine, the service is available, but it works with restrictions, and the hryvnia is not in the list of currencies.

Currently, you can only send money via PayPal: pay for purchases in foreign online stores or transfer money to other users to a PayPal wallet. In addition to Ukraine, this send only system operates in 90+ countries around the world.

In March 2022, the Ministry of Digital Transformation announced that it was negotiating for PayPal to fully enter the Ukrainian market. The payment service itself has not yet announced that it is going to include Ukraine in its business expansion plans.

Payeer

A convenient platform for freelancers working with foreign clients. Transfers are available to 127 countries around the world in dozens of different ways.

Payeer maintains the anonymity of users; only an Email address is required, to which a letter is sent with further instructions.

The system allows you to replenish your wallet balance and deposit funds onto VISA, MasterCard, Maestro/Cirrus, MIR cards with a commission of 1.99%. The recipient does not even have to be registered with Payeer; the system will automatically create an account and offer a large selection of virtual currency withdrawals.

There is an internal cryptocurrency exchange.

You can issue a plastic card and cash out money at Ukrainian ATMs.

AdvCash

An international, multi-currency wallet with an internal exchanger - euro, dollar, hryvnia, ruble, cryptocurrency is also present. Allows you to make transfers to more than 200 countries.

Registration is simple: you just need to provide your email address. The interface is also simple and intuitive. The user configures the level of protection of their funds independently, immediately after registering an account.

You can communicate with technical support in Russian, which is a big plus for many.

Transfers within the system in any currency are free. If you top up your wallet with a hryvnia or ruble card, the commission is 2.5%. There is also a fee for withdrawing funds. For example, to transfer money from a wallet to a Ukrainian bank card you will have to pay 2.5%.

The service has its own virtual and plastic cards.

Perfect Money

The only platform that pays monthly interest on the money in the user’s account is 4% per annum.

The system does not require mandatory identification confirmation. You can use it anonymously, but the service provides some features only to verified users. For example, after verification you can receive lower commissions, and it is also easier to restore access to your account if you suddenly forget your login or password.

Perfect Money offers the option to store assets in cryptocurrency; you can purchase it immediately by replenishing your Perfect Money B wallet.

Plastic card "Yandex"

Yandex is not a bank, but the company allows you to issue a plastic card from which you can withdraw cash at any ATM that accepts MasterCard.

In order to receive a card, you just need to create an application in your personal account on the Yandex.Money service. You can receive the card at the post office you specified when creating your application. Card maintenance costs 300 rubles per year, it is valid for three years.

Transferring money to a card is quite simple:

- select the “Withdraw” menu item in your personal account;

- Click “Yandex.Money Bank Card”

Cashless payment by card - no commission. When withdrawing cash from an ATM, a commission of 3.5% plus 15 rubles is charged.

To accept online payments you need an online cash register

Now, by virtue of Federal Law No. 54-FZ dated May 22, 2003, an entrepreneur cannot simply leave a link to his wallet on the website. Any payments can be accepted only through an online cash register, connecting to a fiscal data operator and sending checks to customers, for example, by email or phone.

But there are exceptions. The following can operate without online cash registers:

- Individual entrepreneurs without employees who provide services personally or sell goods made independently - until July 1, 2022;

- self-employed;

- any business with non-cash payments to legal entities and individual entrepreneurs.

If you are an entrepreneur, resell goods on the Internet and plan to accept money into an electronic wallet, then you need to place orders through an online cash register and issue checks to customers. To do this, it is better to use a special cash register that is integrated into the store’s order processing system - it will check the transaction and automatically send a check to the buyer.

Transfer to a bank plastic card

Withdrawal of money to plastic can be done with the card linked to Yandex.Money or without linking.

You can link cards from the following banks to your e-wallet:

- Promsvyazbank.

- "Alfa Bank".

- Bank opening".

- Tinkoff Bank.

You can withdraw up to 100,000 rubles daily to a linked card. Withdrawal commission - 3%. Linking a card is not mandatory.

The functionality of the Yandex.Money service allows you to withdraw funds to any plastic card, if it is not linked to a wallet. To do this you need:

- select the menu item “Withdrawal of funds to a bank card”;

- enter the withdrawal amount and plastic card details.

The commission for this method of withdrawing money is 3% plus 15 rubles. The withdrawal amount is up to 75,000 rubles.

What does the law say about electronic money?

The circulation of electronic money in our country is regulated by the Banking Code (BC RB), and several other decrees. In particular, the Banking Code includes the issue of electronic money among banking operations. In addition, the website of the National Bank lists electronic money officially registered in our country.

Belarusian banks themselves issue, in other words, they issue:

- WebMoney Transfer – Technobank;

- QIWIBel – Bank Solution;

- MTS Money – Bank Dabrabyt;

- ePay – BPS-Sberbank;

- iPay – Bank Solution and Paritetbank;

- money from the “Pay” system – Belinvestbank;

- Berlio, V-coin – Belgazprombank;

- money on prepaid cards of the MasterCard platform - Belarusbank and Priorbank.

In addition, on the territory of Belarus:

- electronic money BERLIO-CARD and Euroberlio are redeemed by Belgazprombank;

- electronic money YuMoney (Yandex Money) is distributed and redeemed by BPS-Sberbank;

- QIWI electronic money issued in Russia is distributed and redeemed by Solution Bank.

But not a single bank in Belarus works with the well-known PayPal system , so you won’t be able to withdraw them from your wallet.

Now let's look at how to withdraw money from the most popular wallets.

Withdrawal via money transfer system

Is it possible to withdraw money from a WebMoney e-wallet using a money transfer? The answer is clear: yes. You can use the services of the following companies:

- Western Union.

- CONTACT.

- Unistream.

- Anelik.

You can also make a transfer in the “Finance” section. The withdrawal algorithm is similar to transferring funds to a bank account.

Commission - from 2% (depending on the money transfer system you use) plus 35 rubles.

Story

The first stage of development of funds in electronic form is considered to be 1960-1980, from the moment magnetic payment cards were introduced into mass use. At this time, the widespread use of electronic payment methods began.

The second stage begins with the introduction of cards with a certain amount of money and a built-in microcircuit. The peak of their release passed from 1990 to 2000. For forty years, they have not been able to completely eliminate cash from circulation, but they have allowed owners to optimally manage their own bank accounts. The modern method of non-cash payment has clear advantages over paper bills, but the latter remain in use, do not disappear and their number is not reduced.

Today, cash accounts for up to 20% of the total amount of money. The reluctance of the population to part with the outdated denomination is due to:

- With unlimited opportunities to independently manage funds;

- Greater efficiency in calculations;

- Anonymity - it is impossible to track purchases and transfers.

The main purpose of introducing electronic money into circulation is to combine the advantages of cash and non-cash payments.

The third stage of monetary reforms is considered to be the emergence of electronic or network money, which arose in 2000-2011. Payments in this currency have become possible through specially developed programs. The need for electronic payment arose after the spread of the World Wide Web; the first electronic payment systems arose in 1997 - in the Russian Federation the platform was called CyberPlat.

In 1998, the first settlement with virtual currency was carried out on the territory of the Russian Federation, at the same time the WebMoney platform began operating. Currently, the number of its users exceeds 36 million people around the world.

PayPal

Today you can often hear that PayPal does not charge a commission. And, of course, this is a myth, otherwise the system simply could not exist. Of course, within its framework it is indeed possible to carry out many operations with maximum benefit, or even for free, but a considerable number of functions still have to be paid for consistently.

Among them:

- currency exchange – 3-4% plus the current bank rate;

- request for protocols – 12 euros per entry;

- sending funds - for the EU, as well as for countries such as the USA, Canada, the commission amount is 150 rubles. from a PayPal account or 3.4% plus from a bank card; for other countries – 30 rubles. and 3.4% plus, respectively.

As for loyalty programs, you can receive transfers upon request for free. A zero interest rate is also provided for withdrawals from PayPal, return transfers and purchases. In principle, not bad, except for everything else.

These are the conditions for holders of the most popular electronic wallets and accounts. And it is not possible to say unequivocally where it is most profitable. Rather, everything will depend on what functionality is needed for the potential owner.