Dollar exchange rate Yandex. Money is considered the main domestic component, which should be considered when transferring funds from one wallet to another. Using the service, you can perform virtual and real transactions. If previously all transfers were made to similar wallets, today transactions are carried out in any currency, both to individuals and legal entities.

The state payment system Yandex is considered the first in the world to issue its own plastic card. It makes it possible to pay in stores, make purchases on the Internet, and make transfers to other users. However, here you need to take into account that Yandex. Money has an individual conversion rate, built according to the system of the Central Bank of the Russian Federation. In the case of transfers, the size of the commission should be taken into account, sometimes it is 2-3% of the total transaction amount.

Good to know! Tinkoff Bank issues plastic cards; the credit card has a chip and magnetic tape.

What is the Yandex Money payment system?

The owner of 75% of the shares of the electronic payment system (EPS) is Sberbank of Russia, which has multi-billion-dollar capital. In the service you can transfer funds, make payments for housing and communal services, Internet, and mobile communications. Yandex Money has:

- Wide functionality. It is possible to issue a card from EPS or attach a card from any bank to a virtual account. With their help, it is easy to cash out, make payments online, and pay for purchases in regular stores.

- Intuitive and user-friendly interface. Registering a wallet takes a minimum of time due to the most simplified functionality of the system. The currency in which the user will subsequently make transfers through Yandex Money is not particularly important.

- An effective support service, whose security department operates around the clock, allowing you to resolve issues as quickly as possible.

- Increased degree of protection. Authorization in your account requires entering a password - a secret combination consisting of numbers and letters. Account security is ensured by linking it to a phone number. One-time codes are sent to the client’s phone to confirm transactions.

Even an inexperienced PC user can open a wallet.

Yandex Money is used everywhere. Clients have access to their registered wallet 24 hours a day.

Note! In the era of coronavirus, everyone is looking for additional opportunities to earn money. It’s surprising that you can earn much more using alternative methods, up to millions of rubles a month. One of our best authors wrote an excellent article about making money on games with reviews from people.

How to create a YuMoney wallet

To create your electronic account, you need to go to the main page of the yoomoney.ru and click “Create wallet” at the top. Then, you will need to enter your phone number. Next, you will need to confirm it. After creating a request, wait for an SMS with a confirmation code and enter it in the provided field.

Then all you have to do is follow the simple instructions, enter your phone number, enter your email, enter a password, etc. No special actions are required immediately, but initially the user is assigned an anonymous status with certain limits.

If you want full functionality without maximum amount restrictions, you will need to undergo personal identification. After this, it will be possible to use increased limits and 10 more foreign currencies.

- Dollar

- Euro

- Tenge

- Yuan

- Yen

- GBP

- Ruble (Belarus)

- Frank (Switzerland)

- Krona (Czech Republic)

- Zloty(Poland)

After registration, you can already get acquainted with the service interface. At the top right you can see your balance. By clicking on it, 15 digits will be displayed, this is now your new account number. Use it to top up and transfer funds.

You also need to go through the settings; to do this, click on balance, and then on gear. Your phone number, email address, region of residence, password, and status are displayed here. All this can be configured if necessary.

Also, do not forget about security; be sure to save your password in a safe place and set up two-level identification. You can also track the history of all your transactions. If necessary, the wallet can be deleted without restoration.

How to exchange currency on Yandex Money online

Owners of Yandex Money electronic wallets have been able to exchange foreign currencies since 2013, and since 2022 they have the opportunity to use multi-currency accounts.

For conversion, special accounts are used, which can be opened after confirming a certain level in the system.

After completing the identification process, the “Other currencies” window appears on the main page of the site. The user can open an account in one currency or several. Maintenance of such accounts is free.

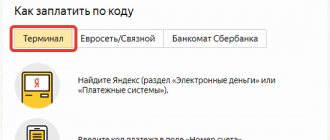

To exchange currency for Yandex Money from a bank card:

- the user must have an account with YaD in the currency that will be transferred, otherwise the funds will be credited to a ruble account and converted at the Central Bank rate + 2% commission;

- For citizens of the Russian Federation, transfers must be sent only from a foreign bank, since transfers between foreign currency accounts of Russian citizens are prohibited by law.

You can also make an online exchange of your existing currency using one of the currency wallets that is open in addition to the ruble wallet. All operations are carried out in the user’s personal account in a short time. If actions are performed in the Yandex Money application, the transfer commission is 0%, on the website - 0.5%.

All transaction parameters are available for review.

The minimum transfer amount is one unit of convertible currency. For example, 1 euro or 1 Polish zloty. The maximum limit is the equivalent of 400,000 rubles in the currency of transfer.

What currencies can be exchanged in the Yandex Money system are explained in this video:

Exchange rate

The exchange rate is as close as possible to the exchange rate and is updated every 5 minutes. There is a link on the site that allows the user to familiarize themselves with the Central Bank exchange rate in effect at the time of exchange.

Why do you need a foreign currency account in Yandex Money?

I see two scenarios so far. Travel and savings. When planning your travels, you can track the exchange rate of the desired currency in advance and instantly convert rubles into dollars or other currencies.

Previously, when paying for purchases abroad with a Yandex card, the conversion took place at the rate of MasterCard + 2.7%. But now, even if you did not have time to transfer the required amount, Yandex will do it for you, but simply at the current rate of the required currency.

But to pay for purchases abroad, do not forget to enable the multi-currency cards option.

My balance in Yandex Money

Exchange Yandex Money with withdrawal to the card of Sberbank and other banks

To transfer money from the Yandex Money virtual wallet to a card, you only need to know its number.

If the user did not identify his identity when registering in the system, i.e. his wallet is anonymous, then it is impossible to carry out an exchange and send funds to the card.

The sources of funds for the transaction can be a ruble wallet and a card linked to it, as well as any bank card. In the latter case, the presence of a wallet in the system is not mandatory. EPS charges a commission for exchanging funds in the amount of 3% of the amount + 45 rubles.

You can withdraw money to Sberbank cards, as well as any other banks of the following types:

- Maestro;

- "World";

- MasterCard;

- Visa.

Exceptions are bank cards that are issued:

- in the USA, Afghanistan, Iraq, Venezuela, Iran, Colombia;

- "Citibank".

Also, the ban on withdrawing funds may apply to plastic cards on which the bank has imposed situational restrictions - for example, salary or virtual ones.

To withdraw funds from an electronic wallet to a card, you must indicate its number and the transfer amount, adding, if necessary, a message for the recipient. The website will display information about the final transfer amount, including a commission of 3% + 45 rubles.

The money will be debited and credited to the card almost instantly. However, depending on the bank chosen, the transfer can sometimes take up to 5 business days.

Statuses and identification

Earlier I already mentioned statuses and possible limits, now let's look into it in more detail. After registration, everyone is immediately assigned the first of 3 statuses: “Anonymous”; there are also “Named” and “Identified”.

Anonymous - given to all new users of the system. It has some restrictions, for example, the account limit is no more than 15,000 rubles. You also cannot withdraw cash from an ATM. There is too little information about you, so there are cases that if there is suspicious activity, your account may be temporarily frozen.

Personalized - assigned after filling out an express form on the website where the owner’s passport details are registered, available only for Russian citizens. You can store up to 60,000 rubles. Withdraw money from the card up to 5,000 rubles. per day. Transfers to other wallets and banks are possible.

Identified - the highest status with maximum capabilities, limit up to 500,000 rubles. and an additional 10 accounts in other currencies. Available for citizens of Russia, Ukraine, Belarus, Kazakhstan, etc. To receive, you need to confirm your identity by going through identification.

To change your account status, go to settings and click “Pass identification”. There you will see your current status, under the identified one, click go again. For the Russian Federation there are 7 methods, you can click on each one to get acquainted. All that remains is to choose the most convenient one and fulfill all the conditions.

It’s better to get tested right away and continue to enjoy all the benefits normally. Plus this is additional security for your money. Only 1 wallet can be linked to one account. If necessary, you can create up to 10 per number and one owner.

Where and how you can get identified:

- Through the Sberbank Online service - Sber ID

- Via mobile operator Megafon and MTS

- Visit the Megafon or Svyaznoy communication salon

- In the office in Moscow, St. Petersburg, Nizhny Novgorod

- Make a special payment through the Unistream system

- Agents' offices

- Application by mail through a notary

If you have any additional questions, visit the help section where everything is described in detail. In general, nothing complicated, especially for Sberbank Online users.

What else can you exchange for poison?

In addition to rubles, 10 currencies can be exchanged for Yandex Money, including:

- pounds;

- Swiss francs;

- U.S. dollars;

- Czech crowns;

- Chinese Yuan;

- Euro;

- Belorussian rubles;

- Polish zlotys;

- tenge;

- Japanese yen.

In the process of transferring Russian money into the currencies of other countries (euro, pounds, tenge, dollars), currency conversion is carried out within the Yandex system

YuMoney mobile application

If you actively and often use your wallet, it is better to install the application on your smartphone, which you always have with you. Through it you can make many financial transactions, and special passwords will be sent for confirmation.

The mobile application is very convenient; your phone is always at hand. You can easily manage your funds at any convenient time, even on the go or in transport. Of course, the application is free and can be quickly installed on Android, iPhone, and iPad smartphones.

Using the application you can:

- Make transfers to other system participants

- Pay for mobile communications, internet, housing and communal services, fines and many other services

- Add the most frequent operations to favorites, it’s convenient and faster

- Through history you can quickly track all completed transactions

To work with the application, you will also need to additionally set a password for authorization into the application itself. This is a mandatory condition that will help you securely store your funds, even if the phone ends up in the hands of an attacker.

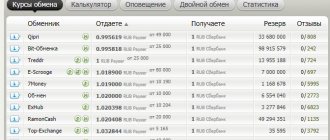

Which exchange method is more profitable?

Clients of the Yandex Money EPS have the opportunity to choose the most financially profitable currency exchange option using aggregator platforms. Such resources continuously monitor the best exchange sites and provide favorable conversion rates.

The Yandex Money system has been criticized for its lack of variety in withdrawal methods and high commission fees. However, using its functionality, you can easily and safely exchange money and top up foreign currency accounts. Increasing the level of user identification increases the degree of trust in him from the system and expands capabilities.