Binance exchange is one of the most popular and reliable in its industry. The crypto exchange has gained such trust thanks to its responsible approach to business and constant development. There are over 300 tokens and assets being traded in 2022. Today we will look in detail at how to withdraw money from Binance to a card in 2022. We will review the most profitable methods and tell you where you do not need to pay commissions.

Please note that if you want to frequently trade on binance, withdraw fiat or bitcoin to a card, you will definitely need to undergo verification in addition to registration. During the procedure, you will be asked for scans of your passport, biometrics, and a live photo comparison with your face. The check takes from 1 to 2 days.

For any transaction within the exchange, the user pays a commission. To save 20% on interest, register using referral ID: AHJUCEJW and receive a discount of up to 40% on Binance commissions for all transactions.

We withdraw from binance by direct transfer to the card

I’ll say right away that this method involves paying an additional commission and it’s difficult to call it profitable. But it is extremely simple and does not require transitions to additional exchangers. So:

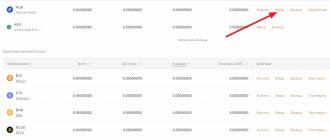

- Let's go to the wallet - fiat and spot. To do this, click on the “user” icon – “wallet” – “fiat and spot”.

- In the main account we will see a list of all fiat currencies in the wallet and current balances.

- Next, as an example, let’s withdraw rubles from Binance to a Visa/Mastercard/Mir card. In the RUB Russian line, click “Withdraw”, indicate the amount and card details.

The method is simple and fast, but there are limitations:

- Withdrawals from the Binance exchange to an Alfa Bank card can take up to 3 days.

- The transfer fee is fixed and does not depend on the amount of funds. It is 250 rubles.

- Output to World maps is still not supported. Withdraw only to Visa or MasterCard.

- Limits: one transaction up to 100,000, per day – up to 400,000, per month – no more than 1,500,000.

Read the current conditions for this method of withdrawing money from Binance to a Sberbank or Tinkoff card during the transfer.

Available options

First, let's highlight methods that allow you to convert virtual currency into fiat. To do this, you can use the following methods:

- Crypto exchangers are special sites focused on converting cryptocurrency in the direction of interest. They provide high transaction speeds and earn money by increasing the rate and/or commissions. Considered the best option for beginners. They allow you to withdraw all popular cryptocurrencies, namely Litecon, Bitcoin, Ethereum and other coins to a bank card, Qiwi, Yumani and other services. Examples of sites are Kassa, Baksman, 60cek, etc.

- Crypto exchanges are platforms designed for buying/selling cryptocurrencies and conducting other transactions. The advantages of the method are a better exchange rate and lower conversion losses. You can withdraw cryptocurrency from the exchange at the best rate to a card, Qiwi, Yumani, etc. Popular exchange platforms are Binance, Eksmo, Bibit and others. Please note that many of these services require verification.

- P2P services are platforms that act as intermediaries for the withdrawal of cryptocurrency. They act as guarantors of transaction security and charge commissions for the operation. Examples - Cryptolocator, Localbitcoins Paxful, etc.

- Payment systems . Many sites are “tailored” for transactions with cryptocurrency. Their feature is the presence of a convenient and simple interface for withdrawing coins from a wallet or replenishing an account. There are many transaction methods available to choose from. Among the minuses, it is worth highlighting the lower rate and the presence of a commission. Popular options are Payeer, AdvCash.

Above are the main ways to withdraw cryptocurrency money. The only difference is the rate, the size of the commission and the degree of transaction protection. Beginners often prefer exchangers and payment systems, while more experienced holders of virtual coins prefer exchanges and P2P services.

How to withdraw money from Binance to a card without commission

If you want to transfer from binance to a Tinkoff, Sberbank, Alfa-Bank, VTB and any other bank card, I advise you to pay attention to P2P. I spoke in detail about this section of the exchange in this article on the website. Below are just step-by-step instructions.

Read the risk notice. Never transfer money to the maker until it arrives on your card!

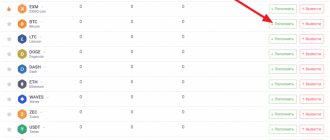

To withdraw fiat or crypto to a card in Binance via P2P you will need:

- Go to the “Trade” section – “P2P”

- Select “Sell”, the desired fiat, payment method (in our case, to the card of which bank to withdraw money from Binance). You can also sort by minimum amount.

- Below you will see a list of makers that suit your conditions. Pay attention to:

- Number of orders

- Success rate

- Current price or exchange rate. Each maker has his own

- Available number of coins

- Limits (min and max)

- When you have made your choice, click Sell ETH (Ethereum) in our case.

- Next we see the current rate, it changes every 30 seconds, the column for how much to give (receive will be filled in automatically) and select the payment method. If you do not have any payment support, you need to add it. That is, just link the card in your personal account.

- Then you will have access to the seller’s details, to which you should send the declared amount of rubles.

- As soon as the seller confirms receipt of funds to his account, you will immediately withdraw money from Binance to your card.

How to withdraw cryptocurrency from your wallet

The essence of withdrawing virtual coins from a cryptocurrency storage is to transfer funds to the recipient’s address. Let's look at the options for the most popular wallets:

For Blockchain wallet:

- Enter the recipient's address.

- Enter the number in Bitcoin.

- Write down a description of the transaction (optional).

- Set a commission for the transaction. The higher the number, the faster the transaction speed.

- Confirm the deal.

A special feature of the Blockchain wallet is the ability to set your own commission. If it is too low, the operation may be refused.

For the MyEtherWallet wallet, do the following:

- Click on “Transfer Ether/Tokens”.

- Enter the recipient's address.

- Enter the transaction amount.

- Follow further instructions.

If you need to withdraw LTC from your LitecoinCore wallet, the algorithm is as follows:

- Click on “Send”.

- Enter the number of Litecoins to be sent.

- Specify the commission.

- Confirm the operation.

After the transaction is completed, it is advisable to monitor the process and ensure that the funds have been credited to the recipient's account. To do this, you can use one of the following platforms:

- Blockchain is the most reliable platform that allows you to verify the correctness of a Bitcoin transaction.

- Coinbase is a service focused on Litecoin, Ether and Bitcoin.

- Etherscan is a platform tailored for ETH.

In all cases, to verify a transaction, it is enough to enter the transaction code / wallet number in a special field.

conclusions

Above, I highlighted the two most popular ways to withdraw money from Binance to a card in 2022. They, in my subjective opinion, are the most convenient. Moreover, through p2p withdrawal is carried out without commission, but at the maker’s rate. In any case, it is more profitable than direct transfer. Of course, someone will say that you can withdraw through third-party services. But I find them labor intensive.

Register using referral ID: AHJUCEJW and receive a discount of up to 40% on Binance commissions for all transactions.

Registration with benefits

Withdrawal of funds from the exchange

Colleagues. One day, on the Internet, I came across some excellent material for beginners. I don’t know its author personally, but I would firmly shake his hand. Of all his contacts, only his email was indicated in the material. At the request of many, I will present the chapter he wrote in its entirety in the form in which I found it. Initially, there was an idea to somehow condense the material in a forum thread, but it was written so accessible and well that I considered it blasphemy.

So. The original chapter about the withdrawal of money by a trader from a brokerage account.

18. Withdrawal of money. Taxes.

First, a little philosophy and psychology. What is your job on the stock exchange? That's right, the answer is simply hidden in the question itself. This is nothing more and nothing less, but work. You can consider the initial six-month experience as a study, the period when you increase your deposit to a comfortable level as an internship, but, ultimately, trading on the stock exchange becomes a job for you that gets paid. It should become.

Hence the logical conclusion is that trading for the sake of trading itself, increasing the deposit, is not entirely correct. Any work must be paid, a person must feel why he is making efforts, and the numbers drawn on the terminal, although they bring joy, do not seem entirely real.

It is not only possible, but also necessary to withdraw money from the exchange from time to time - so that you feel a real return on your work. We rented a little money, bought ourselves a new phone, a car, or just sat with friends... This is all fixed in the mind as a positive result of working on the stock exchange and, as a result, encourages you to treat trading with greater responsibility.

Perhaps you have a wonderful and stable psyche and you don’t need the above. I'm just happy for you. But in the average case, withdrawing profits from the exchange is a prerequisite for successful trading.

In addition to psychology, there is also a very practical calculation. A trader can be considered successful and successful if he has withdrawn more money from the exchange than he brought in. There are different degrees of success, but this is the minimum level.

Remember that even the most experienced traders make mistakes and lose money. No one is immune from this. And even you!

That is why, after you have deposited money into a brokerage account and started trading, your main task should be to receive and, most importantly, withdraw exactly the same amount from the exchange. Only after this can you trade without fear of anything.

Ideally, having withdrawn this amount, no matter in parts or all at once, you should set it aside somewhere far away and for a long time. Perhaps buy foreign currency or open a foreign currency account. It is possible to create a metal account, which may turn out to be more reliable. Perhaps buy physical gold. Well, or just put the money in the bank at interest. This is your money back, an amount that will be enough to start trading again if you lose your deposit.

After that, do whatever you want at the auction. You deserve it.

A little about taxes.

One of the most convenient things about stock trading is that your broker is your tax agent. That is, when you make a profit, you do not need to make tedious calculations and fill out incomprehensible declarations. The broker will do all this for you.

But there are several points here.

The first point is that your broker is trying to withhold tax payments from you at the first opportunity. Namely, every time you withdraw money from the exchange.

Now there will be important information that needs to be comprehended and be sure to be fully understood.

So. When withdrawing money from the exchange, the broker withdraws 13% of your total profit for tax purposes if this amount is less than or equal to the amount of money withdrawn. In the case when the amount of money withdrawn is less than 13% of the total profit, the broker withdraws only 13% of the withdrawn amount.

Example. You earned exactly a million rubles. This is your profit, from which you are supposed to pay the state 13%, that is, 130,000 rubles.

You want to withdraw 200,000 rubles to buy yourself a trip to sunny countries.

If you order the withdrawal of all 200,000 rubles in one operation, this amount will be more than the amount of all your taxes. And the broker will remove them from you completely. As a result, you will pay the tax office 130,000 rubles, but will receive only 70,000 rubles in your hands.

If you withdraw these two hundred thousand in two approaches of one hundred thousand, then each time this amount will be less than your total debt obligations. And in the end, you will pay 13,000 rubles in taxes from the first transfer and the same 13,000 rubles from the second transfer.

As a result, you will receive 174,000 rubles in your hands, but will pay only 26,000 rubles.

Do you feel the difference? Of course, you will still have to pay your taxes in full at some point. But it’s absolutely not necessary to do this right now, especially if you don’t plan on it at all.

If you suddenly do not fully understand this diagram, re-read it as many times as necessary to sort everything out. And in the future, when withdrawing funds, always monitor the balance of profits and taxes.

The second point that is worth paying attention to is that the tax period ends on December 31 and at the same time the broker will want to close it by paying the tax office everything you owe.

Ideally, you just need to know your tax liability and have enough money in your account to cover it. There is no need to worry about anything else at all.

But it happens that there is no free money in the account, and you do not want to sell securities to pay taxes, since all the shares you purchased have a high growth potential. Here you need to consult with your broker, or at a minimum, read your agreement for the provision of brokerage services. Brokers are different and it is possible that some of your securities will be sold automatically in order to pay off the obligations that have arisen.

In some cases, the broker reminds you to close your tax liability within a month or 45 days, after which it assumes that you have decided to take over the tax return and gets behind you. But at this very moment you are faced with the need to file a personal income tax return in April, and then, in fact, pay taxes.

Sometimes at the end of the year you end up with a loss in your account rather than a profit. Believe me, the broker himself will not transfer it to the next financial year. He will consider that the amount you have in your account at the beginning of the year is a new net asset and, if you get a plus, he will immediately calculate your taxes, even if overall you will still be in the minus.

Do not hesitate to communicate with the broker on this topic, write statements and transfer the existing loss to the next financial year.

In general, my recommendation is to trade for profit and have free funds in your account at the end of the year to pay taxes. In this case, you will remember about tax officials and taxes only by watching news about them on TV.

Through other payment systems

For example, it could be Webmoney, or AdvCash, or Payeer. It is advisable that you already have verified accounts there (otherwise you will have to go through verification there too, but it may take a while).

Please note that not all cryptocurrencies are supported!

Copy the crypto address and transfer funds from Binance to it. Of course, if you have funds on the exchange in another currency, you first need to convert it into the desired one.

The translation process itself is standard:

On Binance, go to Wallet -> Withdrawal.

Select what you want to transfer (for example, btc), and enter the wallet address (for example, your wmx wallet on WebMoney)

And after the transfer, you convert it into rubles or dollars and withdraw it to the card. Other systems have a similar output algorithm.

Commissions for withdrawal:

Webmoney: from 2%

Payeer: 2.99% + 45 rubles

Advcash: 2.5% (minimum - 25 rubles)

How to get a favorable rate

Exchanges initially offer more favorable cryptocurrency quotes than exchange services. Therefore, direct cashout is the most profitable option. Transactions through intermediaries are not only an additional risk, but also commissions, as well as a lower exchange rate. It is also worth considering the time when the transaction took place. It is profitable to sell cryptocurrency when it is at its peak. Therefore, exchange coins for fiat when they increase in value.

If we talk about exchangers, the rate will also depend on the direction and reserves of the service. Quotes for popular payment systems are always noticeably higher than for areas that are practically not in demand. Let us remind you once again that new exchange offices offer more favorable rates than proven services. Here everyone must decide for themselves what is more important to them – reliability or the terms of the transaction.

Exchangers, exchanges

So, the main task that the user faces in such a situation is the need to exchange his own cryptocurrency for an equivalent amount in traditional currencies, i.e. fiat.

In order to further withdraw the amount of this real money to electronic wallets of payment systems or bank cards.

One of the main options is to use cryptocurrency exchanges, where many market participants store their coins. If the user has a certain amount of cryptocurrency on the exchange balance, then it can be converted into fiat.

Depending on the capabilities and size of the exchange, conditions may vary, so it is recommended to cooperate only with the largest and most popular ones. It will be enough to carry out an exchange directly on the exchange website using the built-in exchanger, or to carry out an operation with a suitable cryptocurrency/fiat trading pair.

As a result, the amount in the account will be in the form of fiat, i.e. real money, which can be withdrawn to verified wallets and cards attached to the exchange account. Depending on the exchange, the method of withdrawing money may differ.

There is another option that is more suitable for those users who store their cryptocurrency in specialized wallets, which is a more reasonable solution.

This category often includes those who earn cryptocoins not by trading on cryptocurrency exchanges, but by other means, such as mining or staking. We are talking about using exchangers, and this option is faster and simpler.

You will need to find a cryptocurrency exchanger that has a suitable exchange rate, uses all the necessary currencies and provides a sufficient supply of funds for exchange.

The websites of such services provide step-by-step instructions on how to create an application and complete everything step-by-step independently and without difficulty. In addition, there is online support that will help resolve any issues.

Cryptocurrency withdrawal via Binance P2P platform

- Log in to your P2P account.

- Select the desired crypto and sell.

- Go to the Binance P2P platform - a platform for exchanging various types of currencies between verified users.

- Set filters: “Fiat” and “Payment”.

- Select the appropriate one from the displayed list of offers.

- Click "Sell".

- Wait for fiat funds to arrive on the card.

- Confirm that you have received money. After this, the cryptocurrency is automatically transferred by the system to the buyer’s wallet.

To withdraw fiat currency, the process is similar.