How to transfer from card to card Yandex without registration

The Yandex.Money service was one of the first to offer the ability to transfer money between credit and debit cards of any banks. The convenience is that you do not need to register in the system. Clients of the service can use the card2card option without creating an account in the system.

With this transfer, funds are credited to most cards instantly, sometimes it can take up to 2 days. Yandex transfer from card to card is profitable due to its low commission: on the website the transaction costs 1.95% of the amount sent, in the mobile application - from 1.9%. In any case, the commission cannot be lower than 40 rubles. This option may become especially popular if it is not possible to send money from card to card directly.

However, it is worth remembering that in this case the Yandex.Money service acts as an intermediary, and therefore takes its own commission - if it is possible to send money directly (for example, from Sberbank to Sberbank) - it is more profitable to use this option.

Both cards that are involved in the transfer of funds must be issued by a Russian bank. Yandex.Money only works with rubles. The transaction is absolutely safe thanks to 3D Secure protection - to confirm the debiting of money, the client receives an SMS with a confirmation code. The transaction is available for cards issued in the Visa, Maestro, MasterCard UnionPay and MIR systems.

In any case, the commission cannot be lower than 40 rubles

For Yandex.wallet owners and registered users

Despite the excellent opportunity to transfer money through the card2card system, the transfer process is even more convenient for Yandex.Money clients. The commission for transfers from card to card costs 1.5%. You need to go to the Yandex.Money website and select the “Money Transfer” tab. Then select the “Send transfer” option.

Transfer limit – from 100 to 75,000 rubles (for identified clients)

Next, a special form appears to be filled out. In it you need to indicate the debit and receipt card numbers, the transfer amount and the e-mail for the receipt. For the sender's card, you must additionally indicate the CVV code and card expiration date. You can add a comment to the translation. An important point is the ability to confirm the sending operation. The card must be linked to a mobile phone.

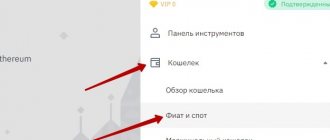

You can also send money from Yandex.wallet to a card of any bank. The conditions for transfers in the system differ for unregistered users and wallet or card holders. When sending money from a Yandex e-wallet to a card of any bank, other conditions apply:

- The transfer limit is from 100 to 75,000 rubles (for identified clients).

- The limit for other clients is up to 15,000 rubles.

- Commission for sending funds 3% + 45 rubles.

- The time for crediting the recipient's money is within 30 seconds.

- The transaction history is saved in the corresponding section of the registered user.

You must indicate the recipient's card details, write the amount to be sent, and the system will calculate how much will be debited from the account, taking into account the commission. Each transfer is then confirmed via SMS.

User requirements

Withdrawal of funds is not available to all users of the Yandex Money service; for example, people who simply created a wallet but did not go through the identification procedure cannot make transfers to bank cards. The minimum requirement is to have the “Named” status; to obtain it, it is enough to:

- fill out a short form with personal data;

- enter the passport number and series;

- indicate SNILS;

- wait for the verification.

Find out your status by clicking on the avatar in the upper right corner of the Yandex.Money page

In addition, you can undergo identification, receiving expanded capabilities and increasing the available limits. This can be done in the company’s offices, in communication stores or online via SMS banking. For example, at Sberbank the service costs 10 rubles, but the number specified in the Yandex Money form must match the number associated with the financial institution’s mobile bank.

Transfer money from a bank card to Yandex.Money

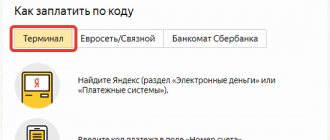

Transfer from a card of any bank to a Yandex wallet is possible on the Yandex.Money website. You need to select the “Top up” button, indicate the details of the card from which the transfer will take place, and enter the amount to receive. The system calculates how much money will be debited from the card, taking into account the commission.

For transfers less than 4,000 rubles, a 1% commission is charged, and above this amount there is no commission. Yandex.Money warns that the bank that issued the card may charge an additional commission at its own rate. In addition, you can top up your wallet from a mobile phone or through ATMs, as well as using Sberbank Online and the personal account of any other bank.

To top up, you need to select the option to top up your Yandex e-wallet and specify the details - wallet number.

Withdrawal via Qiwi card

Qiwi offered its users the opportunity to open their own card, the account of which is linked to an electronic wallet

. Thus, it becomes completely unimportant whether the money was deposited into the card account or came through a transfer. All money will be stored in a common account and can be used without any additional transfers.

For convenience, you can open a free virtual card, or order a personalized plastic payWave. You can withdraw cash from an ATM with a commission of 2% + 50 rubles. from any of the selected cards. However, when using a virtual one, you need to connect it to one of the contactless payment systems.

Transfer time and restrictions

The time it takes for funds to be credited to the recipient depends on the ownership of his bank card. Most banks allow the transaction within a few seconds. If there is a delay in receiving money for more than a day, most likely this is an error of the recipient bank, and not the Yandex system. Information about transfers is saved, and you can study the history of online transactions at any time.

But there are also exceptions. For example, you won’t be able to transfer money to Yandex from a Citibank card

In addition, some banks limit the ability to transfer to Yandex.Money for certain products. This applies to virtual and non-personal, as well as salary cards.

Citibank limits such transfers for all of its cards - sending money to a Yandex wallet from a card of this particular bank will not work. You can withdraw funds from your wallet to your Citibank card without any problems.

Transfer from card to Yandex card via mobile application

For the convenience and time saving of customers, a smartphone application has been created. The system automatically fills in all required form fields.

Card details can be stored in the application, speeding up transactions

The deadline for transfers to cards of any banks, as well as between Yandex wallets, is the same in the mobile and web versions, but in the mobile application there are other differences:

- the transfer fee is 1.9% of the amount;

- the minimum commission amount is 40 rubles;

- the number of daily transfers is no more than 4, with a funds limit of 75,000 rubles per day.

Using the application, you can scan the sender's card into the program without entering data about it manually.

Limits

Now let’s look at the last nuance of cashing out and transferring funds from a Qiwi wallet – the available limits. As stated above, the right to use all the capabilities of the system is determined by the status of the wallet received: minimal, basic and professional.

Since in "Minimal"

No transfers can be made except between Qiwi wallets, so it is not of particular interest.

To obtain the “Primary” status,

you must remotely confirm your identity by transferring bank details of any valid card.

To obtain the “Professional”

, you must contact the Qiwi corporate office or partners (the Contact system, the Olympus bookmaker or the Svyaznoy and Megafon salons). The cost of confirmation depends on the chosen method: free or 150, 200, 300 rubles. respectively. The client must provide a passport and wallet number.

In the “Basic” status, clients are offered the following limits:

- Up to 200 thousand in payments and transfers;

- Up to 60 thousand per operation;

- Up to 15 thousand when transferring to mail or bank card;

- Up to 5 thousand for cash withdrawal per day from a branded QIWI card and up to 40 thousand per month.

Upon receipt of the “Pro” status, clients have access to:

- Payments and transfers in the amount of up to 4 million per month;

- The maximum amount of a one-time transfer is up to 500 thousand rubles;

- Cash withdrawal from a branded card up to 100 thousand per day and up to 200 thousand per month.

As you can see, the higher the status, the more opportunities

the client receives when managing his account. This directly concerns the possibilities of transferring and cashing out funds. Today Qiwi is not just an electronic wallet for virtual money, it is a real opportunity to easily transfer and receive money in a convenient way with a small commission. It’s up to you to decide which method to use.

Yandex wallet and Yandex card

In addition to the electronic wallet, Yandex offers to issue its own plastic card. It is released on the MasterCard platform. This card is linked to Yandex.Wallet and has one account. When you top up your e-wallet, your plastic card account is automatically topped up.

Then you can spend the funds absolutely without any commissions on non-cash payments. You can use the card to pay in any stores, pay for services or purchases online.

5 / 5 ( 2 voices)

about the author

Evgeniy Nikitin Higher education majoring in Journalism at Lobachevsky University. For more than 4 years he worked with individuals at NBD Bank and Volga-Credit. Has experience working in newspapers and television in Nizhny Novgorod. She is an analyst of banking products and services. Professional journalist and copywriter in the financial environment [email protected]

Is this article useful? Not really

Help us find out how much this article helped you. If something is missing or the information is not accurate, please report it below in the comments or write to us by email

If the commission is too high: alternatives to withdrawing funds

Official withdrawal of funds is not always profitable. 2% of the amount is 100 rubles from every 5 thousand. If you withdraw 30,000, you lose 600 rubles. Impressive money. Yandex asks for 3% plus 45 rubles. And this is not the limit.

What to do in such a situation?

You can accept it or use alternative methods.

- Pay for online purchases from your wallet. Yandex, for example, awards cashback points. 1% for every online purchase. They can be used to get discounts from online stores. 1 point = 1 ruble.

- Pay for purchases offline using a debit card. At the same time, you still receive cashback. With points or real money.

- You can pay with a virtual Yandex card in online stores or offline. In this case, the service accrues up to 5% cashback.

This way you will save money. Especially if you actively use cards, often make purchases on the Internet and do not accept cash when paying in offline stores.

The following two tabs change content below.

- About the author of the article

- Latest materials

Artem Galaktionov

Briefly about yourself: aspiring web writer. I'm constantly learning something new. I strive for excellence in everything.

Latest materials by the author Artem Galaktionov (see all)

- Does a copywriter need specialized education - 07/12/2021

- How to withdraw electronic money: step-by-step guide for residents of Russia, Ukraine, Belarus - 09/22/2020

- Graphic editors: 7 programs and 3 online services for copywriters - 09/05/2020

Read similar articles

- How to create a Yandex.Money wallet: step-by-step instructions In this instruction, we will look step by step at how to create a wallet on the Yandex.Money platform and work with…

- “Boss, everything is gone,” or What should a copywriter from Ukraine do? Greetings, people! Rodion Golovanov, junior coach of the School, is in touch, and I have a hot topic.

Comments: 0

Your comment (question) If you have questions about this article, you can tell us. Our team consists of only experienced experts and specialists with specialized education. We will try to help you in this topic:

Author of the article Evgeny Nikitin

Consultant, author Popovich Anna

Financial author Olga Pikhotskaya