To store, send and receive bitcoins, you need to have a special public address. To manage digital coins, you need to create crypto wallet is software

, through which transactions are carried out. Access to it is provided after entering the private key (password). You can draw a simple analogy with the most common wallet in which we store money and bank cards. Only the Bitcoin vault contains information about public and private keys.

Each user will be able to create an unlimited number of addresses for one wallet. This is done to increase the level of anonymity and security. Addresses need to be shared with senders, so it is theoretically possible to track who owns digital coins. Read our previous article about which Bitcoin wallet to choose to protect yourself. Constantly generating new addresses for each transaction will avoid this. There are different types of wallets:

- Internet services: exchanges, exchangers, other multi-currency storage facilities;

- mobile applications;

- hardware devices;

- desktop software;

- paper

Each user selects a wallet that is suitable for themselves, based on individual preferences: its level of security, functionality, interface accessibility, privacy. In previous blogs, we described in detail how to create a bitcoin wallet.

How to find out whose Bitcoin wallet

To store, send and receive bitcoins, you need to have a special public address. To manage digital coins, you need to create a crypto wallet - this is software

, through which transactions are carried out. Access to it is provided after entering the private key (password). You can draw a simple analogy with the most common wallet in which we store money and bank cards. Only the Bitcoin vault contains information about public and private keys.

Each user will be able to create an unlimited number of addresses for one wallet. This is done to increase the level of anonymity and security. Addresses need to be shared with senders, so it is theoretically possible to track who owns digital coins. Read our previous article about which Bitcoin wallet to choose to protect yourself. Constantly generating new addresses for each transaction will avoid this. There are different types of wallets:

Each user selects a wallet that is suitable for themselves, based on individual preferences: its level of security, functionality, interface accessibility, privacy. In previous blogs, we described in detail how to create a bitcoin wallet.

conclusions

- A wallet is software. There are different repositories. Their level of security and functionality may vary.

- All private and public keys are stored in the wallet. Bitcoin storage essentially performs the same functions as the most ordinary wallet, only instead of paper banknotes and bank cards it contains data.

- It is impossible to obtain information about the owner of the wallet using a public identifier. Transaction history, crypto coin balance, and user identity are all sensitive information.

How to find out the wallet address

All addresses are stored in a crypto wallet. Instructions for finding public keys depend on what kind of storage you use. Mostly you need to open the “Settings” section and find the “Addresses” tab there.

Some services and programs generate a new address for each transaction. You can view this information in the “Address Management” section. Here is the complete history of completed transactions.

You can also go to the “Balance” section in the main menu, and then click on “Top up”. As a result, a complete list of all addresses will open. You just need to copy the one you need. This is useful if you need to pass an address to a user who needs to send bitcoins. It is impossible to determine the details of someone else's wallet without the knowledge of the user to whom it belongs.

Blockchain ensures the anonymity of all users.

AMLBot - service for checking crypto wallets

One of the most popular services for checking a Bitcoin wallet is AMLBot. It was created in 2022 and, according to the developers, meets all international requirements. The AMLBot interface can be translated into Russian, Ukrainian, Chinese or Thai.

The abbreviation AML (Anti-Money Laundering) literally means “anti-money laundering.” An example of AML in the cryptocurrency market is the KYC procedure.

The AMLBot algorithm analyzes more than 10 thousand open sources and about 2.5 thousand spam addresses in real time. To check your wallet you need to register by mail.

How to find out information by address

For more information on the address, visit Blockchain.com. However, this only applies to your wallet. This service will not help determine the identity of the user who registered the storage. Transaction history and balance of crypto coins are private information that is not available to other users of the BTC network. By address you can determine the type of storage, for example, on which exchange it is open, nothing more.

How to find out who owns a Bitcoin wallet

A distinctive feature of the Bitcoin network is that it is impossible to determine the owner of the storage using the address alone.

Only his private keys are available to the user. Once you get another user's address, you still won't be able to get any details about its owner. Many beginners often make mistakes. Because of this, they reveal some information:

Is it possible to track and trace a Bitcoin address?

According to Bitcoin:

So essentially, yes, there is readily available data for any given address. A Bitcoin address is a series of letters and numbers unique to its wallet , and its easily accessible information includes:

- Wallet balance

- Transaction history including: Amount of cryptocurrency sent

- Sender's address

- Address of the recipient

- Date of transfer

- Fees charged

- Number of confirmations

What is not provided is the actual owner of the address. Finding the owner is a difficult task, but certainly not impossible with some strategy and determination.

financialcouns

Who sees:

available to everyone

Often on blogs, social networks and forums you can see the following message: “I have a problem! Donate Bitcoin! And the wallet number. Now Google will remember it FOREVER, and will show it in search results and maybe even on the first page. There is no need to explain further how easy it will be to connect a real person with him.

Solution to the problem:

The best option would be to open a separate Bitcoin wallet to publish it on the network and, preferably, not indicate your real data in social network profiles and other sites that require registration.

Exchange trading with mandatory identification

Who sees:

the exchange database can be hacked by hackers.

Most exchanges, from Bitstamp to the bankrupt Mt. Gox requires you to provide real data to register and open an account. Everything is recorded, from your name to your home address. The user agreement prohibits sharing sensitive data with third parties, but hackers or intelligence agencies do not need any permissions.

Solution to the problem:

impossible to completely solve. Opening an account on an exchange or purchasing a real product in an online store quite logically requires entering real identification data and there is nothing to be done about it. But, if possible, look for sites that don't require detailed information.

Purchasing goods and services with cryptocurrency.

Who sees:

administration of a store or processing center.

Solution to the problem:

If you do pay for purchases using your real name, open a separate wallet for this and delete it after the transaction. This will at least to some extent allow you to maintain some anonymity in the future.

Working with thin clients and/or online wallets

Who sees:

administration of the service, all data is stored on third-party servers

Paradoxically, this is one of the most difficult ways to find a person by his crypto wallet, since the owners of such services take security issues much more seriously than shops and exchanges, but it is impossible to protect yourself 100% from requests from government agencies and hacker activity.

Using cryptocurrency without network protection

Who sees:

Internet provider

Bitcoin address tattoo

You can do without comments here.

Solution to the problem:

presence of a brain in the head.

Source

Why Bitcoin is not suitable for criminals

As recently as about three years ago, it seemed that anyone could buy or sell anything with Bitcoin, and such transactions could not be traced, even if they were illegal.

“It’s completely anonymous,” they wrote on cryptocurrency forums in the summer of 2013. "The FBI has no chance of finding out who is who."

But now Bitcoin can no longer be considered invulnerable.

The Federal Bureau of Investigation and other law enforcement agencies disagree with claims about Bitcoin's anonymity. In October 2013, American Ross Ulbricht, the founder of the illegal online market “Silk Road”, promoting the distribution and sale of drugs, where trade was carried out exclusively for bitcoins, was arrested. In February 2015, Ulbricht was sentenced to two life sentences by a New York court. He was found guilty of most charges: drug distribution, participation in a criminal community, money laundering, document forgery and computer hacking.

It was possible to purchase drugs and other illegal drugs on the site; payment was made using bitcoins. All purchases were made anonymously. The site’s total turnover during its existence exceeded $200 million, and its owner received a net profit of about $18 million from commissions.

In March of the same year, the assets of the owner of the Sheep Marketplace black market, Czech citizen Tomas Zirkovsky, who is accused of laundering $40 million in bitcoins, were seized. And these are not all examples of solved crimes using Bitcoin.

Most Bitcoin users are law-abiding people, motivated by concerns about privacy or simple curiosity. But the anonymity of Bitcoin is also a tool for committing illegal acts: virtual money allows you to keep shady transactions secret.

The paradox of cryptocurrency is that the data associated with it creates an indelible trail that can suddenly make your financial history public. Since blockchain data is publicly available, Bitcoin's anonymity is more accurately called pseudonymity. The username is replaced with the address of the cryptocurrency wallet and up to a certain point it can be considered protected, but as soon as the connection between the name and any used address is established, the entire history of transactions along the entire chain of user addresses becomes open.

Scientific developments using encryption technologies have helped create software systems that facilitate the hassle-free use of Bitcoin. Many of these developments also allow law enforcement to catch criminals. The scientists behind the systems are working in a new field at the intersection of computer science, economics and forensics, says Sarah Meiklejohn, a computer scientist at University College London who co-chairs the annual financial cryptography workshop in Barbados, a Latin American country.

When bitcoin first came out, law enforcement “were in a panic,” Meiklejohn says. “They thought these technologies were dangerous and would interfere with their work.”

But as arrests and convictions became commonplace, it quickly became apparent that cryptocurrency could be used as a crime prevention tool. Even in the strange new world of bitcoin, “investigators can follow the money,” FBI Assistant General Counsel Brett Knight said in September 2015.

Unlike government-issued money, Bitcoin has no central bank backing, no gold equivalent, no financial backing, no bank guarantees. Created in 2009 by an unknown person introducing himself as Satoshi Nakamoto, Bitcoin is an “intelligent artifact,” says Patrick McDaniel, a scientist at the University of Pennsylvania.

Strictly speaking, from a materialist's point of view, Bitcoin is nothing more than amounts associated with addresses - unique combinations of letters and numbers. For example, the address “1EbnjY473fTYBxysh5U8hjr89” represents the digital equivalent of a “bank account” containing approximately 30 thousand bitcoins seized during the Silk Road case and corresponding to approximately $12 million.

These bitcoins were auctioned by the US government in July 2014. Since then, the amount has never changed owner, that is, it was acquired for investment purposes. The past and present ownership of each Bitcoin is recorded on an ever-growing public ledger called the blockchain. However, the true name of the owner remains hidden: users use special cryptographic keys that act as an electronic signature in the blockchain.

The work of maintaining the functionality of the system and preventing fraud remains voluntary, it is carried out by the so-called miners. They run calculations to verify every transaction. The calculations performed cannot be carried out without specialized computer programs. During the verification of each block of transactions, 25 new bitcoins are generated for miners. Thus, the “minting” of bitcoins occurs.

As with any currency, the value of Bitcoin in the real world is expressed in the desire to exchange it for goods, services or other currency. If you are not a miner, you can only receive bitcoins from those who already have them. Entire companies have appeared selling bitcoins at favorable rates; These companies also install ATMs where you can exchange bitcoins for cash. And of course, you can sell things in exchange for Bitcoin.

Soon, the anonymity of cryptocurrency users began to be used for illegal purposes. Let's return to the “Silk Road” described earlier. All transactions were carried out in the same way as in the normal use of bitcoins: the purchase was agreed upon by mail, and each transaction and each seller was encrypted. Researchers gradually collected all the data associated with Silk Road, from pictures and text descriptions of drugs to Bitcoin transactions, which are accumulated and reflected in the blockchain. However, the most important detail that will allow researchers to link this chain of evidence to the culprit is missing: the IP addresses of sellers and buyers.

The problem is that Bitcoins are designed to blur the relationship between transactions and IP addresses. All users are connected linearly through the Internet, information spreads as quickly as gossip, so that only the informant himself knows the source of this information.

The system worked so accurately that only negligence led to a breakthrough in the investigation. The founder of Silk Road, Ulbricht, used as a pseudonym a code that was assigned to him back when he was just an assistant in disseminating information about the illegal sale of drugs. His advertisements for illegal goods on forums made him the prime suspect. As a result, the FBI managed to catch him red-handed as the administrator of the Silk Road.

Other criminals reassured themselves that it was a mistake; As long as you don't share your sensitive information yourself and use Bitcoin with caution, your identity is protected by a cryptographic wall. But now even compliance with all measures does not give a clear belief in maintaining one’s anonymity.

Among the first researchers to try to find a hole in the wall were the married couple Philip and Diana Cauchy. In 2014, they created their version of the software that sellers and buyers use to join the Bitcoin network. This software was deliberately designed to be inefficient: it required storing a copy of every packet of data transmitted by every computer on the Bitcoin network. That is, the Cauchy spouses created a giant Bitcoin sniffer.

If the data passing through the network were perfectly coordinated with each computer sending and receiving data, then it would be impossible to associate Bitcoin addresses and IP addresses. However, there is no hierarchical coordination of the Bitcoin network, and the flow of transactions is far from perfect. The Cauchies noticed that sometimes the computer would only send information about one trade, meaning that the person with that IP address was the owner of that Bitcoin address. And sometimes the opposite phenomenon occurred: one IP address was the source of a whole surge of transactions. Most likely, this happened during a client software update. Everything in the system is interconnected: each operation is the key to a Bitcoin address. Once the Cauchies isolated some of the addresses, others followed suit. In the end, they were able to match about 1,000 IP addresses to Bitcoin addresses.

While criminals came up with increasingly ingenious ways to use Bitcoin to their advantage, scientists continued to pursue them. At first, the judiciary monitored the movement of money, but later cooled down from this activity, since it is impossible to know which bitcoins belong to whom at the other end.

From a detective point of view, the beauty of Bitcoin is that the blockchain records everything.

“If you catch a drug dealer on the street, you will arrest him for one crime. But if you catch a criminal through a network like the Silk Road, then you have a whole history of accusations,” says Sarah Meiklejohn.

This is exactly the scenario currently in effect. In January 2016, 10 men were arrested in the Netherlands as participants in an illegal online drug market. They were caught exchanging bitcoins for euros in bank accounts and then withdrawing millions of euros in cash through ATMs. The trail of Bitcoin addresses leads all this money to an illegal online drug store monitored by the FBI and Interpol.

If privacy flaws in the Bitcoin system start to scare users, the currency will quickly lose its value. However, the demand for financial privacy will not disappear, so new cryptocurrencies are already appearing, ready to provide the opportunity to hide your transactions from prying eyes.

Meanwhile, the development of the crypto industry is gaining momentum, and experts believe that the use of cryptocurrencies will soon become mainstream. Some banks are already turning to the Ripple cryptocurrency system to settle large global money transfers.

“Even the United States government is reaching out to the cryptocurrency community and learning from them,” Bill Gleim, head of machine learning at Menlo Park, California-based Coinalytics, said in an interview.

Gleim believes that the federal government will issue its own cryptocurrency, possibly by the end of 2016. If this is the case, users will likely be required to verify their identity. This could defeat the purpose of cryptocurrency in the eyes of privacy advocates and criminals alike. Or another development is possible: in this technological game of cat and mouse, the next move could be from the criminals...

How to find out the owner of a Bitcoin wallet?

To store, receive and sell Bitcoin, you need a special public Bitcoin address, and to manage such an address you will have to use a Bitcoin wallet.

Such a wallet is software that can be used to track all public and private keys (Bitcoin addresses).

An analogy can be drawn with a regular wallet in which banknotes and cards are stored, and a Bitcoin wallet contains information about all Bitcoin addresses.

Any user can generate multiple Bitcoin addresses as needed. This is due to the fact that the addresses are pseudonymous. The wallet can store a large number of user keys and addresses. There are different types and varieties of wallets:

How to find out the owner of a Bitcoin wallet

An exceptional feature of the Bitcoin platform is that it is impossible to find out the owner of any wallet by address. Any network user can see the electronic code, but it is not possible to understand whose it is.

True, there are various user errors , thanks to which access to their personal data is simplified:

Conclusion

Based on the above, regardless of the anonymity of the platform, you can find out the owners of Bitcoin wallets in various ways. To minimize existing risks, follow the written recommendations, be vigilant , attentive and careful.

The paper method of storing cryptocurrency (offline storage) has maximum protection against virus or hacker attacks.

Bitcoin wallet verification addresses are a QR code placed on paper. To identify data, you need to scan the codes with a special application.

Source

Monitoring taxes on cryptocurrency income

What to do with taxes: a question that is especially relevant in light of the introduction of a new bill on taxation of cryptocurrencies? At the moment, the funds that will be spent on finding defaulters are not consistent with the profit - at least until this is done automatically, which will require time, the connection of a large number of resources and the creation of new infrastructure.

However, the process has already been launched: for example, in August, Rosfinmonitoring ordered the creation of a module for monitoring cryptocurrency transactions, which will help analyze the behavior of market participants and identify them. The work will be performed by RCO, a company controlled by Sber. However, we carefully studied this application and came to the conclusion that this software is an incomplete copy of already existing solutions Chainalysis or Bitfury Crystal, which means that the problem, as Rosfinmonitoring sees it, does not yet solve.

Anonymity of Bitcoin users

The fundamental difference between this currency and other electronic money is that:

The lack of personalization of data during its creation was considered the main advantage that distinguishes Bitcoin from bank payments. That is, according to the creator of the cryptocurrency, Satoshi Nakamoto, everyone on the network can see that someone is sending money to someone, but who and to whom is unknown.

However, in practice, everything turned out to be not so clear:

The anonymity and security of the owner’s data depend not least on his experience and skills in managing the wallet.

Common mistakes in managing a Bitcoin wallet

When creating a bitcoin wallet, the owner chooses one of its types:

When choosing one of the listed types, the owner gives preference to either security or accessibility and speed of work.

The application that allows you to store and use this currency is checked against a single database during each transaction - a record of it remains in the blockchain system forever: it cannot be deleted or edited. If you lose your wallet, when reconciling and restoring it, you will have to deal with a large amount of information, so recovery will be very difficult and time-consuming.

To prevent this from happening, after each operation it is recommended to perform a backup - regular copying of the backup file wallet.dat, where all the keys for decrypting the wallet information are stored.

You can lose access to your wallet or your cryptocurrency for a number of reasons:

Another mistake that contributes to the withdrawal of funds is typical for inexperienced users - the code is too simple, it is not saved from prying eyes, or the password is automatically saved when working with the browser.

How to track untraceables

Much of the technology from these companies was presented by Sarah Meiklejohn, then at the University of California, and her colleagues in 2013. The basic idea is simple. By examining blockchain activity, you may discover accounts that appear to belong to the same Bitcoin wallet and are thus controlled by the same entity. The process is called clustering. For example, multiple addresses initiating the same transaction could be the same person or organization pooling small funds into one large account. Over time, this chaos turns into a system.

When multiple accounts are associated with the same owner, you can try to find out who he is. Linking Bitcoin addresses to real people is possible through regulated crypto exchanges (usually in the US or Europe), which must follow the know-your-customer principle, that is, they require identification data from users. Some people simply post their private addresses on online forums. Chainalysis and Elliptic now use machine learning to create address clusters. Artificial intelligence could soon be created to allow police to track blockchain in real time.

Data visualization at Imperial College is a step towards this. The blue-and-yellow web that Knottenbelt noticed could be a Bitcoin mixer, a series of transactions specifically designed to make it difficult to track. The effect is almost the same as if you were transferring money through a bank somewhere in the Cayman Islands, where there are laws regarding the secrecy of bank transfers and accounts.

TOP 3 tips on how to maintain anonymity

Each address created by Bitcoin becomes available to every user - anyone can track its balance and payment history. Therefore, if the user wants to maintain his anonymity, the simplest solution is to create a separate address for each transaction and use it once. And although it is difficult, the game is still worth the candle if we are talking about a large transaction, and not about ordering pizza.

The next piece of advice is not to make your bitcom address public, i.e. do not record it on social networks or places with open access to the Internet. Since this currency system is based on the principles of transparency, any movement of funds from one address to another will forever remain in the protocols, and tracking down the last one will not be particularly difficult.

Another way to hide information about yourself is to block your IP address for the system. Since every transaction reflects this information, figuring out where the owner really stands is not that difficult. To be fair, it is worth noting that in some cases, clients of full nodes broadcast both their own and others’ transactions on the network. In this case, the cue node is taken as its source, which makes it difficult to find the real location of the owner. However, the most reliable way to hide your IP address on this system is to use a tool like Tor.

In order to keep your finger on the pulse, you need to monitor and read more about ways to protect your data in this transparent system, because it is in a state of active growth and change. And with all the openness of the Bitcoin system, you can reliably hide your data if you put effort into it.

Source

Finding the owner of a Bitcoin address off-chain

Since there is no address registry, you must implement creative tactics and “think outside the blockchain.” To discover the owner of an address.

Various tactics to track the owner of a Bitcoin address are:

- Searching for published personal information on the Internet:

This strategy may be the most obvious of all. But it still requires time and effort on your behalf to conduct the research. Look for personalized information giveaways in these situations:

- Collecting donations on a personal blog.

- Placing a Bitcoin address on a site using your real name as the registered domain.

- Posting Bitcoin addresses on forums. Where users' identities are easier to track with some additional digging. If they haven't already used their real identity.

- Using Transaction Analysis:

Some companies, such as Elliptic and Chainalysis, use software to connect Bitcoin addresses to websites or individuals. Unfortunately, their services are reserved for clients and are not available to the general public.

- External Purchase Tracking:

When using a Bitcoin wallet to purchase physical goods, the retailer or payment processor will need personal information. Such as name and delivery address, which. More likely. Will be stored in a database and therefore remain traceable.

- IP Address Tracking:

The Internet Protocol (IP) address is associated with the computer on which the purchase was made. Although it is not possible to directly associate a Bitcoin address with its IP address, with some investigation it can be done. For example, if multiple transactions came from the same IP address, it can be concluded that the addresses are Bitcoin. Related to this computer. Owned by one person.

- Searching for using a thin client or hosted wallet:

Thin clients use servers that disclose Bitcoin addresses and IP addresses to their operators. There are ways to protect user data, but they usually don't implement them.

Hosted wallets store Bitcoin addresses and IP addresses on their servers and are known to. Information is leaked to third parties.

- Bitcoin Exchange Tracking:

A Bitcoin exchange is a market. Where “manufacturers” The platform can also be used for exchange between cryptocurrencies – although Bitcoin is still the most commonly used cryptocurrency of all. To use these services, individuals must disclose their personal information. However, accessing the database can be difficult. Unless you are a government agent or an exchange account insider.

- Tracking National Currency Exchanges:

This is similar to the previous tactic, but this time the exchange is for real money currency. The government will be required to verify your personal identity for such transactions and will retain your information indefinitely. Again, this type of private information is difficult for the general public to obtain.

Reasons to Track a Bitcoin Address

Financial institutions and government agencies such as law enforcement and intelligence agencies. They make up the majority of those. Who is interested in prosecuting the owners of Bitcoin addresses. Because of its anonymity, Bitcoin attracts criminals trying to cover their tracks.

The tactics described above help these agencies:

- Prevention of money laundering

- Preventing illegal drug and firearms trade

- Issuing summonses to identified criminals

- Insurance taxes are paid on profits

- How to Avoid Scams

Bitcoin is actually very effective in catching criminals. Because it shows a whole pattern of criminal history. And not just one copy. This article takes a closer look at crime-fighting stories in Bitcoin.

Ordinary civilians may instead want to track down an address because of misplaced money. It can be easy to miss a number or letter in a stretched Bitcoin address. In the case where money was sent to a non-existent address, it is essentially lost in the void of the blockchain. And unfortunately. There is no way to get them back.

Where can bitcoins be stored?

If we consider Btc from the point of view of physical understanding, then they are not stored in a specific place. You store the keys to access addresses that are public and must be reliably protected. The coins themselves are in storage, it’s like a safe deposit box, the key to which only you have. Let's draw conclusions:

Important! Once you have registered your Bitcoin wallet, save its address in a safe place. To conduct transactions and access your account, each of your transactions is linked to an email address.

Address formats

Just as there are several versions of the Internet Protocol, there are also different formats for Bitcoin addresses. Usually they do not conflict with each other, since transactions move between wallets quite easily.

There are 3 identifier formats in Bitcoin Core: P2PKH, P2SH, bech32. They are found in their entirety only in a few services. The wallet you use most likely does not support at least one of these formats. The most commonly missed one is bech32.

P2PKH is a legacy format that starts with one. It means Pay-to-Pubkey hash, that is, a paid hash of the recipient's public key. Legacy addresses are not compatible with SegWit, but P2PKH transactions on SegWit are still possible.

The P2SH format is similar in structure to P2PKH, but starts with a triple. P2SH stands for Script Hash and provides more complex functionality. This format is used for multi-digit addresses, which may indicate that multiple digital signatures are required to authorize a transaction. Regular users sending transactions do not have to worry about the complex functionality of P2SH addresses. This format is widely supported and can be used to send funds to different addresses.

The bech32 format looks different than P2 style addresses. The addresses start with bc1 and are longer than P2SH and legacy identifiers. Bech32 is a native SegWit addressing format that is supported by most software and hardware wallets. Although Keepkey and Ledger wallets do not currently support this format.

Find out your Bitcoin address and check the cash in your wallet

You need your Bitcoin wallet address primarily to access finance. It can be used to perform various operations:

A Bitcoin address is a unique number used to send and receive cryptocurrency. It can consist of a different number of characters - from 27 to 34.

The most popular tools for finding out a wallet address:

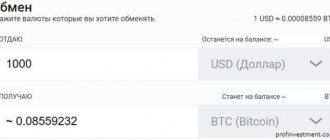

Depending on the resource on which the wallet is opened, you can find out the transaction number in the replenishment section. To do this, click on the “Receive” button, in the pop-up window - a combination of Bitcoin address.

What does an address consist of?

Bitcoin address consists of numbers, uppercase and lowercase letters, which are generated in random order. But to prevent visual ambiguity, the character set never uses the capital letter "I", the number "0" and the letter "O".

As already mentioned, some addresses consist of 36 characters, others - of 26 characters. Regardless of the number of numbers and letters, they are all valid. Each Bitcoin ID represents a number. The shorter code is valid because it denotes missing zeros. This way the address is automatically shortened.

The system uses certain characters as a checksum. Typos are automatically found and corrected. Using a checksum, the software confirms the validity of the address, regardless of its length.