At the turn of 2022, the Ripple cryptocurrency made a dizzying leap, briefly becoming the second largest cryptocurrency in the world by capitalization after Bitcoin. This was followed by a long and painful decline in the exchange rate and capitalization of XRP. The fall turned out to be, on average, even deeper than the general decline in the capitalization of cryptocurrencies. As a result, XRP dropped from 3rd to 7th place in the cryptocurrency ranking.

What is Ripple's forecast for the near future and long term? Let's figure it out together.

- Ripple forecast for 2022

- Ripple forecast for 2022

- XRP cryptocurrency as an everyday means of payment

- Ripple Long-Term Forecast Positive Scenario

- Ripple: negative scenario

Content

- Expectations for Ripple in 2022

- Ripple forecast for 2022 from the perspective of cryptocurrency features

- XRP cryptocurrency forecasts for 2022 from a perspective perspective

- Ripple forecast for 2022 from a news perspective

- Final Ripple forecast for 2022

In 2022, the Ripple cryptocurrency presented many surprises. The company has entered into dozens of agreements with banks and companies, and XRP coins have been added to the listing of many exchange platforms. Investors started talking about the effectiveness of long-term investments for Ripple, whose capitalization in just one year jumped from 236 million to 85 billion dollars, and the exchange price increased from $0.006 per 1 XRP to 2.7 USD. Such success could not go unnoticed, which made Ripple one of the most interesting assets for investment. The subsequent price reduction made adjustments to the plans of investors, who began to think about the relevance of such actions. What to expect from cryptocurrency in the future? What is Ripple's forecast for 2022? We will consider these and other questions below.

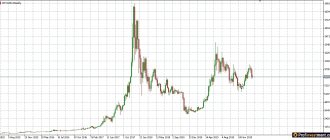

Exchange rate dynamics

The launch of exchange sales of XRP occurred in the summer of 2013, but until the spring of 2022, the value of the asset practically did not rise. In February 2022, the price per coin was ≈ 0.0005 USD, and already in May of the same year it increased to 0.35 USD.

Starting from March 2022 until December, the price chart moved in a flat. A sharp jump in quotes occurred in mid-December, when the price increased from 0.25 to almost 3.5 $. The fifteen-fold increase in the rate created a furor in the crypto-investor community. XRP took a leading position, consolidating its position in the top five digital currencies by capitalization.

From mid-January 2022, a protracted decline began. The downward trend lasted until September, after which the rate switched to sideways movement. As of February 28, 2022, the cost of one coin was ≈ 0.32 USD.

Expectations for Ripple in 2022

Ripple cannot be called a cryptocurrency in the usual sense of the word. This is a platform designed to carry out international transactions with low fees and without delays. As for XRP, it plays the role of “fuel” (a special tool) used during the operation. The peculiarity of Ripple is that the system is located outside the blockchain chain, characteristic of other virtual coins (Litecoin, Ethereum and others).

An important feature of XRP is the absence of mining as such. The creators of the Ripple company issued 100 billion coins back in 2012, some of which (about 40%) went on sale, and the rest of the coins remained in the hands of the developers. At the end of 2022, it was announced that 55 billion coins had been deposited into the escrow account. The creators of Ripple plan to release 1 billion coins to the market every month. The market reacted positively to this step and the XRP rate strengthened. The growth continued until January 5–6, 2022, after which the price went down again. As of March 30, 2022, the price of Ripple is $0.51. Moreover, the bearish trend continues to dominate the market.

The next aspect that has a positive impact on Ripple’s forecast in 2022 is the presence of a technical commission. Its value is 0.00001 XRP. The mentioned amount is charged for each transaction and is destroyed after collection. Its essence is to protect the network from attacks from intruders and attempts to collapse the system. Thanks to commission burning, the number of XRP in the network is gradually decreasing, which is an additional limiting factor for the rate.

Thus, since the beginning of 2012, the number of coins has decreased from 100 billion to 99,992,405,149 coins. As a result, cryptocurrency is less susceptible to inflation and can withstand negative events more calmly. By 2022, there will be even fewer coins, which increases their value and contributes to an increase in the price level.

An equally positive factor is the operating principle of the cryptocurrency network. Unlike other virtual coins, XRP allows for 1,500 transactions per second or more. As a result, Ripple is not afraid of such a concept as scalability. The network is built in such a way that all transactions between users take place as if on credit, based on trust.

Due to the peculiarities of the platform, not only Ripple, but also other currencies can act as a monetary unit. To successfully complete a transaction, two conditions must be met: trust between the parties and compliance with the established limit. For example, Michael decided to exchange 400 XRP coins for $200. At the same time, there is George on the network, who has 20 USD and plans to buy 400 Ripples. These people do not know each other personally, but they have a friend, Claudia, who can play the role of intermediary.

The transaction is then carried out as follows. Michael gives Claudia 400 coins, which the latter gives to George. In turn, George gives Claudia $200, and the girl gives the money to Michael. As a result, the parties conducted the transaction through a proxy. The Ripple platform is Claudia from the example. The situation is considered in a simple situation, but the meaning does not change.

Since 2016, banks and companies have been actively testing and connecting to the system, reducing transaction costs. Today, the Chicago Mercantile Exchange, Japanese and Korean banks, Western Union and other companies work with Ripple. The XRP coin has been added to the listing of the largest exchange platforms, namely Bit Oasis, CoinRail and others. There are active conversations about including Ripple in the list of Coinbase cryptocurrencies, but so far the matter has not progressed further than talk.

Against this background, Ripple’s growth forecast for 2022 is very comforting. Experts are confident that a trend reversal and an increase in the exchange rate price is a matter of time. Ripple has created a base of influential companies and banks that not only work with the platform, but also invest millions of dollars in its development.

Optimistic and pessimistic forecasts from famous analysts

Cryptoprognoz experts tend to make positive forecasts. By the end of 2022, the price of Ripple will be more than three dollars. The project is supported by financial organizations that are interested in its scalability.

The Bitcoin Russia Association believes that in the long term the price of Ripple will rise. According to their forecasts, a significant breakthrough will occur no earlier than 2022. All this time, the cryptocurrency will remain in the top three, increasing capitalization indicators.

Arianna Simpson, head of Avtonomous Partners, is prone to less optimistic forecasts and does not intend to invest in Ripple. The specialist is concerned about the centralization of the project, which will not have the best effect on development.

Elpis Investments employee Anatoly Castella considers XRP not a virtual asset, but a project that combines blockchain and fiat technologies. “Mining is a serious disadvantage of the project,” the expert assures. All tokens were mined by the company's owners, most of which are still in the possession of Ripple Labs.

Lately, the cryptocurrency market has been experiencing a global correction, and some digital assets are behaving so unexpectedly that even reputable think tanks cannot give precise guarantees. For in-depth market analysis, tools are used: technical and fundamental analyses, charts, expert opinions, etc.

Ripple forecast for 2022 from the perspective of cryptocurrency features

When assessing the future of cryptocurrency, it is worth proceeding not only from the current developments and achievements of companies, but also taking into account the features of cryptocurrency. Here, the opinions of analysts, who in their examples point to the positive and negative nuances of the virtual coin, differ.

Unlike competitors, Ripple developers did not focus on the development of cryptocurrency. For them, the main task is to promote the platform and gradually replace the SWIFT payment system. At the moment, the competition between SWIFT and Ripple can be compared to the fight between an elephant and a pug, but in the future the situation may change.

The Ripple platform compares favorably with its competitors. Its features:

- Availability of existing agreements with many banking institutions, for example, the National Bank of the UAE.

- Working to increase the functions available to clients, making the system more user-friendly and interesting for investors. Recently, it became possible to exchange XRP for precious metals (with the participation of partners).

- Advantages when conducting transactions. Experts give a positive forecast for Ripple for 2022, basing their conclusions on the following advantages - low commission (about $0.003 as of March 30, 2022), a large number of transactions per second and high transfer speed. There is no need to confirm the transaction, so transactions between the parties take place in a short time.

The Ripple company has radically changed the understanding of the mechanism of international transactions between banks. All transactions are carried out with a guarantee of security and without delays. Already today, the use of XRP in the banking system is more profitable and convenient than SWIFT. The difficulty is that control of SWIFT is in the hands of a consortium of banks and drastic changes (at least in the near future) cannot be expected.

Along with the positive qualities, there are also negative features - a monopoly in the banking sector, which slows down the advancement of technology, as well as uncertainty on the part of government authorities towards cryptocurrency. The last factor applies not only to Ripple, but also to other virtual coins. Against the backdrop of strong volatility, investors play it safe and try not to invest large sums until the exchange rate becomes stable. Despite the decrease in volatility, the value of virtual currency continues to decline, albeit slightly. To invest money, investors need a trend reversal.

Another difficulty that influenced the position of bankers was the presence of a large number of coins in the hands of the creators. No one can guarantee that at some point additional XRP will not appear on the market, which will lead to a price collapse. This problem occurred earlier, but after transferring 55 billion to the escrow account, this risk was leveled, which allowed investors to breathe more freely. There is little left to do - follow the chart and catch the beginning of a bullish trend.

Based on the features of XRP, its pros and cons, Ripple’s forecast for 2022 can be called positive. Experts agree that by the end of the year the cost of virtual currency could reach 2–3 USD per coin, and in 2022 this figure could double. It’s not worth counting on a jump in the exchange rate, which took place in 2017, and an increase in price to 20–30 dollars. The limiting factor here is the large number of coins (100 billion). It’s hard to imagine that Ripple will surpass Ethereum or Bitcoin in terms of capitalization in the near future.

XRP token price forecast 2030

On the Internet, you can often see a categorical forecast that $1,000 for XRP is a fair and achievable goal. Nobody talks about timing. And rightly so, because even in 2030, with the implementation of all the company’s plans, we see no reason for such a course. What about $100? This is already realistic and quite achievable.

In fact, only when the vast majority of banks integrate RippleNet will it be possible to draw more definitive conclusions. How will the banking system behave? We can definitely say that a complete abandonment of the gold standard will give a very strong impetus to the growth of the XRP rate. For now, let's stick with the price of a hundred bucks.

XRP cryptocurrency forecasts for 2022 from a perspective perspective

If we compare Ripple with competitors who are ahead (Bitcoin and Ethereum) or “breathing in the back” - Bitcoin Cash and Litecoin, the XRP cryptocurrency has more prospects for growth. The reason for this statement is explained above. The bottom line is that Ripple is not a pure virtual coin. This is a tool that ensures the operation of powerful technology for financial settlements.

Analysts are confident that Ripple's value will rise in the coming years. They support their claims with the following factors: high speed of operations and minimal costs, network reliability and security. At the beginning of 2022, the price of XRP exceeded the 3-dollar mark. Despite the short-term growth, virtual currency has shown potential and the ability to grow to this and even greater levels.

According to the most optimistic forecasts, in 3–5 years the technology will be able to capture 30–50% of bank transfers, and by 2027–2030 completely replace SWIFT. Such cooperation is beneficial for everyone - not only Ripple, but also banks, which create favorable conditions for clients and increase opportunities. Existing protocols on the network guarantee transaction security and user anonymity (if required). Unlike blockchain technology, which is typical for competitors, it is easier to establish regulation and resolve the issue with legislative authorities.

If the company continues to attract banks and there is a breakthrough in the attitude of financial institutions to the system, the XRP rate in 2019 will exceed the $5-7 mark, and the capitalization will rise above the level of Ethereum. Today, the difference in this indicator between coins is $19 billion, but this threshold is easy to overcome with the growth of Ripple against the backdrop of stagnation in the Ethereum rate.

When analyzing the prospects, it is worth taking into account the risks that are typical for virtual currency. Sharp price fluctuations have shown that today XRP can hardly be called a stable coin. From January to the end of March, the price fell sixfold, which led to greater caution on the part of investors. Banks and companies are taking a closer look at the situation and are in no hurry to invest large amounts of money in technology.

Tightening legislation in relation to cryptocurrencies (in China and India, for example) has a negative impact on the exchange rate price. Government regulators have not yet been able to find a mechanism that would allow them to take control of cryptocurrency and introduce it into the financial system without consequences for the economy. Taking these factors into account, forecasts for the XRP cryptocurrency for 2022 are made from two perspectives:

- Government regulators find a way out and take control of the virtual currency market. In this case, the use of cryptocurrencies is legalized, which allows increasing demand and expanding the scope of application. The disadvantage is that with this development of the situation, virtual coins will lose their main feature - anonymity. As a result, exchange rate fluctuations will decrease and Ripple will gradually grow depending on the speed of technology implementation in the banking sector.

- Cryptocurrency will be prohibited. In this case, all virtual coins will significantly lose value. As for the Ripple company, it will continue to work, because XRP is a coin that plays the role of a tool for conducting transactions, nothing more. Against the backdrop of a general decline in prices, the Ripple rate will also go down, but over time it will return to its original position. It is worth noting that the likelihood of such a scenario is minimal, because the current financial system needs changes. It is hardly possible to imagine that regulators will refuse such innovations.

Even with a successful forecast, experts are confident that Ripple is not yet ready to compete with SWIFT. Therefore, in the medium term, the company’s main task is to attract new partners, expand the network, and promote XRP on exchange platforms. Despite the negative impact of volatility, this factor has a positive effect on the system as a whole. Sharp price changes attract speculators to the market. If the exchange rate goes into a calm direction, the company will expect an outflow of capital, which will lead to a decrease in price.

The main advantages of Ripple

The Ripple cryptocurrency platform was created as a direct competitor to the banking system and its technologies for transferring money between people. Blockchain technologies used by Ripple allow transactions to be carried out quickly, securely and anonymously. In addition, this method of exchanging funds is cheaper due to the absence of intermediaries. Cryptocurrencies have to prove their worth as a reliable payment instrument, but many people have already begun to invest in the crypto market, which has had a positive impact on the fact that the ripple rate has begun to actively grow.

The Ripple cryptocurrency is based on blockchain, but it has a number of differences from such popular cryptocurrencies as Ethereum, Litecoin, namecoin, nxt, peercoin and Bitcoin. Ripple is a universal payment platform with the goal of conquering the money transfer market. The creators of this currency initially aimed at the fact that they would eventually be able to displace the SWIFT system, offering users a safer, more reliable and faster way to transfer funds. The future of the ripple cryptocurrency will largely depend on how quickly the creators of this payment instrument can achieve their ultimate goal.

There are a number of significant differences between conventional bank transfers and the Ripple cryptocurrency system, namely:

- When carrying out operations to transfer fiat currencies to other countries, the payment will pass through the hands of several intermediaries. In this case, all funds will be converted, which will lead to the need to pay additional fees. Such translations require a lot of labor on the part of people and financial institutions; in addition, they are characterized by high cost and low speed of completion,

- At the same time, the ripple wallet allows you to reduce the number of operations and intermediaries when carrying out such transactions to a minimum. The primary currency will be immediately converted into XRP, and then transferred to the currency required by the recipient. The operation will be completed within a few seconds. When using this system, the distance and size of the transfer does not matter.

To read: How to mine Bitcoin Gold, choosing equipment and setting up software

As for storing coins, there is no difference where to store the ripple cryptocurrency. This currency can be safely stored both in special digital wallets and in a personal account on crypto exchanges.

Ripple forecast for 2022 from a news perspective

Since the beginning of 2022, many events have occurred that have directly or indirectly affected the value of virtual currency. Let's highlight the events that deserve the most attention:

- On January 5, 2022,

the Internet community was actively discussing the problem with Ripple and the banking sector. Many experts argue that banks are not interested in XRP as a transaction tool. Surveys of people close to the banking business showed that at the moment Ripple is only being tested, but there is no direct application in the banking sector. One of the US correspondents conducted an investigation, as a result of which he did not find a single fact of actual use of XRP by banks. Bankers are in no hurry to introduce new technology, because the current system already works. In turn, Ripple’s management responded that pilot projects have shown effectiveness, and the transition to new technology is a matter of several years, and possibly decades. - On January 11, 2022,

news appeared that MoneyGrem had begun testing XRP. The company's management explained this step by the desire to speed up payments using the most promising technology. - On January 28, 2022,

the first news appeared about the inclusion of the XRP cryptocurrency in the listing of the BitOasis crypto exchange. The first operations took place on January 30. Clients of the exchange platform now have access to placing orders to buy and sell, as well as conducting transactions with Ripple. BitOasis management explained the decision by the great demand for cryptocurrency. - On February 14, 2022,

Western Union announced testing of Ripple. Company experts said that at this stage the main task is to study the capabilities of the technology and its impact on the development of the translation system. The details of the cooperation are not disclosed, but the fact of such a partnership has a positive effect on the prospects of XRP - On February 21,

a large bank from Brazil, Itai Unibanco, connected to the Ripple system. The financial institution plans to use xCurrent technology when carrying out cross-border transfers and financial transactions. By the way, the mentioned bank occupies a leading position in Latin America in terms of capitalization. Cooperation with Ripple allows you to establish cooperation with financial institutions in China and Canada. - On March 7, 2022,

the intention to release a mobile application based on Ripple was announced. The developer is a consortium of 61 Japanese banks. It is planned that the program will be in use by the fall of this year. If you look at the experts’ forecast for Ripple for 2022, the mentioned factor may have a positive impact on the value of the virtual currency. The purpose of the application is to give people a powerful and reliable payment tool. At the same time as ordinary users, the application will also be used by banking institutions themselves. - On March 29, 2022,

Ripple was announced to be listed on LBX. On the same day, it was announced that XRP was being included in the Uphold cryptocurrency wallet. According to management, the decision to include Ripple in the listing was made after a survey among Twitter users. More than 12 thousand people took part in the voting and 51% of respondents voted “For”. It is planned that full integration will occur within 1–2 months. Another positive news on March 29 is plans to use Ripple in 8,000 stores in South Korea, which becomes possible after the conclusion of an agreement between the Bithumb exchange platform and the payment operator Korea Pay. As a result, by the summer of 2022, residents of the country will be able to pay for goods and services in many retail outlets.

Competitive Advantages of XRP

The advantages of Ripple, which distinguish the cryptocurrency from its analogues:

- Creditworthiness is the main factor affecting the value of a coin.

- The highest degree of security. Since the emergence of Ripple, there has not been a single major scandal related to hacking or theft of coins.

- Fast transactions – the average speed is only 4 seconds.

- The Ripple system allows clients to make transfers in other cryptocurrencies. The feature is provided by the Bitstamp connection gateway.

- Lack of mining, which has a significant impact on the price movement of the virtual asset.

The project’s popularity in the East Asian region, which is one of the largest local crypto markets, opens up great prospects for the project. Considering that the demand for coins in the world is much lower, the creators have enormous opportunities to find new sales areas. If the demand for ripple in the world reaches the level of demand in China and South Korea, then the coin will be able to claim first place in the world ranking, displacing Bitcoin.

Final Ripple forecast for 2022

As can be seen from the article, the Ripple price in 2022 depends on many factors, but so far the trend is positive. Let's consider the likely development of events taking into account the current situation.

| Month | Exchange rate, dollars |

| January | 4,0–4,2 |

| February | 4,0–4,5 |

| March | 4,5–5,0 |

| April | 5,0–5,2 |

| May | 5,0–5,5 |

| June | 4,5–5,5 |

| July | 4,5–5,0 |

| August | 5,0–5,5 |

| September | 5,5–6,0 |

| October | 5,5-6,0 |

| November | 6,0-6,5 |

| December | 6,0-6,5 |

The given forecast for 2022 is approximate and based on an analysis of changes in quotations over previous years. In reality, the situation may change depending on the position of government authorities, the success of the company and the activity of introducing XRP into the banking sector.

Source: tehnoobzor.com