Ripple cryptocurrency (XRP) is an electronic international payment system. The main principle of operability is the algorithm of agreements (consensus) between users and the use of an open Internet protocol. Calculations are made on the RTGS gross basis. Each real-time payment requires proof of payment. This increases the reliability of all operations performed. For a better understanding, let’s take a look at the main questions, the answers to which will give you an idea of the Ripple algorithm and why the internal xrp cryptocurrency is needed.

Features of cryptocurrency

The main goal that the developers pursued when creating the Ripple crypto platform was to realize the ability to perform the fastest, safest and most accessible financial transactions. Their cost should not depend on the volume of transactions, it should be fixed and minimal.

The Ripple project is of interest not only to ordinary citizens, entrepreneurs or the banking system; the developed technology can significantly speed up all domestic and international money transfers or exchanges.

The functioning of the network is not based on the familiar blockchain technology; Ripple’s design is based on payment gateways. This settlement technology has already attracted the interest of many banks and consortiums. Its blockchain is easily scalable, securely protected and interoperable with various networks.

For example, the very first bank to believe in the seriousness of the project was the Munich bank Fidor. At the moment, successful cooperation has been established with the National Bank of Abu Dhabi, with the American financial giant American Express, the largest financial and credit group in Spain, Grupo Santander, the Ripple protocol is even used in the global payment system Earthport.

Current project partners:

What is a private blockchain

This is a chain in which all blocks are created centrally. In other words, every action in the chain is carried out only by the specific organization that created this blockchain. Any user has the right only to read the chain data, and all checks, database management and other functionality remain with trusted nodes, which are determined and controlled by the founding company.

Thus, this is the complete antipode of the familiar public blockchain. On the contrary, it offers complete decentralization and control over the operation of the system by users. That is, in some way it is controlled by everyone who works with it.

In the modern cryptocurrency community, there is a lot of debate about the advisability of using one or another blockchain. The key criterion of the dispute is the anonymity of the client. Indeed, in a decentralized form there are much more guarantees, since there is no control from one point. In other words, there is no central north.

How the network and transactions work

In order to better understand what the Ripple concept is, let's give a simple example:

Let Tanya live in Ryazan and have a book about artists, and Peter, who lives in America, has a basketball autographed by Michael Jordan. And Vivienne from Paris has two tickets to the concert of the group “The Rasmus”.

So, in the Ripple network, all three participants can exchange their assets without resorting to the services of third parties. They do not need to have a single currency, they can give one resource and receive another in return, while paying only a minimum commission in XRP.

Tanya will be able to get tickets to Rasmus for Peter's basketball, purchased for her book about artists. Just as easily and cheaply, you can buy a thousand bitcoins, a kilogram of gold or a car by paying only 0.00001 XRP.

On the Ripple network, users can store their money in dollars or yen, and make payments in euros, bitcoins or even gold. The network easily converts currency into the desired type through competing market-makers, while charging a single commission.

Here are the main advantages of the project:

- accessibility: communication is maintained between payment networks;

- speed: instant calculation on demand;

- Confidence: funds can be tracked in real time;

- cost: low operating and liquidity costs of the system.

The Ripple system is capable of processing tens of thousands of operations per second! And the cost of its commission fees is only 0.0007 USD for any transaction. For clarity, you can give prices in the Master Card and VISA network - 2 USD or in the Bitcoin network - 1.43 USD.

Unlike Bitcoin or Litecoin, Ripple is not an alternative monetary asset, but a new settlement technology for the global financial industry.

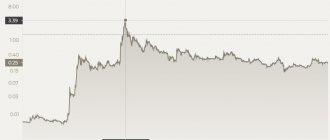

XRP USD exchange rate chart online for today and its history since 2017

XRPUSD chart courtesy of TradingView

What does the XRP USD exchange rate depend on?

The XRP/USD rate is not influenced by either news or forecasts, or rumors on the popular crypto portal bitcointalk.org , as journalists constantly claim, but from

- trends of the alcoin index (which is represented by the NordFX broker) and the dollar index. Yes, when

- in multidirectional trends of these indices, either bullish or bearish trends for XRP are formed;

In unidirectional trends, a flat will be observed on the cryptocurrency chart.

- cryptocurrency capitalization. If the capitalization of XRP grows, then its value increases.

- trading volumes for Buy or Sell for XRP on cryptocurrency exchanges. A strong trend (impulse) in XRP is usually accompanied by an increase in transaction volumes (red arrows); during a correction, volumes either remain relatively constant or fall (blue arrows):

The XRP rate depends little on the rate of the main cryptocurrency - Bitcoin BTC. This is because the XRP coin cannot be mined. Compare charts: XRP and BTC to US dollar:

History of Ripple

Initially, the Ripplepay payment protocol was created in 2004, the purpose of which was to allow individuals in the community to issue their own digital assets. The first version of the project was opened in 2005, in the form of a financial instrument for virtual transfers of participants in web communities.

I liked the idea and seemed quite interesting and in demand. They tried to improve it and instead of classic mining based on the blockchain chain record, an innovative consensus of confirmation by platform users was developed. The updated project was more efficient and completely environmentally friendly.

In 2012, peer-to-peer lending specialist Chris Larsen joined the project, who later became a co-founder of Ripple and the company's CEO. Today he is recognized as the richest person in the world, who earned his fortune ($8 billion) through cryptocurrency investments.

In September of the same 2012, the OpenCoin Corporation began developing a new protocol, RTXP, which was supposed to reduce all operating costs for exchange and payment operations of the network. In addition, the protocol must be able to solve problems with time delays in transactions.

It developed a new security algorithm that could determine the reliability of servers, regardless of their owner (be it an international bank, a brokerage firm or a single user). At the same time, its own cryptocurrency XRP was created, the owners of which could freely send transfers to BTC addresses in the desired currency.

In 2014, the Ripple project had its own hard fork: a new decentralized blockchain platform for instant transactions, Stellar. Its main difference from its parent is that Ripple is mainly focused on the banking sector, while Stellar is an international payment system for individuals and retail businesses.

Not blockchain

There is a misconception that Ripple and XRP Ledger are not blockchains at all because they operate through gateways and paths. However, the functionality is still based on blockchain principles. There are transactions that require confirmation, as well as nodes that do this.

The developers saw many shortcomings in the classic blockchain, so they simply created a better version. As you can imagine, when creating a better version of something, there will be many differences from the original. But this does not mean that Ripple is not a blockchain.

What solutions does Ripple offer?

XRP is a digital asset that can be used by bank and non-bank payment providers for highly liquid and instant money transfers. Ripple offers three important solutions for different applications:

xCurrent

xCurrent is Ripple's enterprise software solution designed for banking institutions. It is implemented in accordance with all the features and requirements of banks, ensuring complete confidentiality of information. Structurally, it is well adapted to the bank’s existing infrastructure, which ensures minimal overhead costs and the absence of uncontrollable business disruptions.

xCurrent is built around an open, neutral protocol, the Interledger Protocol (ILP), which allows interoperability between different ledgers and networks. It offers a cryptographically secure end-to-end payment flow with immutable transactions and complete participant information.

Each pass-through payment has its own identifier, which can be used to track the status of the request at any time during the payment execution: both during the payment process and after its completion, which allows you to more effectively troubleshoot failed or delayed payments.

Using xCurrent, banks communicate to each other in real time confirmation of the required payment details before the transfer begins and confirm delivery after it is received.

xRapid

xRapid is a solution for payment providers and other financial institutions that want to minimize liquidity costs and improve their customer experience. Payment providers are using XRP to reach new markets, reduce the cost of foreign exchange and speed up payment settlements.

Companies running on the xRapid platform can transfer large volume payments at minimal cost to suppliers, merchants or employees. Corporate treasury departments looking to send large payouts across the global supply chain will benefit from greater capital efficiency, visibility and control by using xRapid solutions.

XVIa

And yet another useful solution, XVIa is designed for corporations, payment providers and banks that want to send payments across multiple networks using a standard interface. xVia's simple API requires no software installation and allows users to seamlessly send payments worldwide.

You can send an invoice and track payment status in real time: On-demand payment processing with tracking and delivery confirmation is possible, even in non-traditional networks such as digital wallets. Corporations will be able to use their valuable capital, which is idle in foreign currency accounts.

Protocol functionality

Most modern payment systems are based on trust in the state or financial institutions such as banks. This applies in particular to digital accounts in government currencies, since here the money in principle does not belong to you, but is in the care and disposal of the institution. Ripple is an attempt to outsource this trust mechanism to a digital currency, storing all user transactions and obligations on a public ledger.

The system is based on the so-called IOU, which stands for “I owe (yo)u” or “I owe you” - these are a kind of debt obligations. The Ripple registry stores debt obligations with information about who owes whom, how much and in what currency. In addition to the debt system, the protocol also makes possible a vast currency exchange market that is constantly evolving.

Advantages of Ripple solutions

With traditional cross-border B2B payments, transaction reference data is often minimized, requiring manual reconciliation. With xCurrent, clients will be able to automate their reconciliation process.

Traditional international payments for shipments are subject to frequent delays and additional costs, which inevitably lead to schedule delays, slower deliveries and higher working capital requirements.

With Ripple's support, the international supply chain can avoid additional administrative burdens, costs and delays. Companies can send real-time payments to their international partners on a guaranteed basis with certainty of settlement and delivery.

All Ripple solutions enable them to offer a single global currency account to their corporate and SME businesses, allowing them to tap into a single pool of liquidity for cross-border transactions. This reduces customer administrative burdens and liquidity costs, allowing banks to increase their deposit base.

Mining Ripple crypto coins

Due to the fact that the network does not use blockchain technology, Ripple cannot be mined. The functioning of internal gateways is ensured by dozens of working servers, through which all network transactions pass.

There are already 100 billion XRP coins issued, which have the following distribution:

- 65% is owned by the creators themselves;

- 35% will be available to all users.

XRP is an intermediate platform digital asset that does not need to create trust relationships with third parties. It was released with a limited issue, which protected it from devaluation.

The commission that is charged on the network for conducting transactions expires immediately after use. This decision was made to reliably protect the system from spam actions of attackers. In addition, a gradual decrease in coins will maintain their value in the market (today the low value of XRP is explained by their large number in circulation).

Summarize

Ripple XRP is a global digital payment system that sacrifices decentralization for performance. The network and technology are owned and at least partially operated by the private company Ripple, which controls the underlying infrastructure, issuance, and some of the network's limited validators. While Ripple deviates from the traditional decentralization model adopted by leading cryptocurrencies Bitcoin and Ethereum, it is somewhat consistent with its own custom-designed infrastructure.

While Ripple's primary goal is to provide financial institutions with a gateway for borderless payments and currency exchange, its native cryptocurrency XRP has taken on a life of its own and is actively traded and analyzed by investors. Some investors argue that with highly rated metrics such as fast and low-cost transactions, XRP is a strong competitor to major cryptocurrency blockchains such as Bitcoin and Ethereum. Conversely, the centralization of Ripple's XRP has been a major philosophical and security issue for others, including regulators.

Igor Titov

Economist, financial analyst, trader, investor. Personal interests – finance, trading, cryptocurrencies and investing.

Where can you buy XRP

Ripple's domestic currency is traded on the following exchanges and exchange resources:

- Bitstamp;

- Huobi;

- Coinone;

- Binance;

- OKEx;

- Qryptos;

- Bitbank;

- HitBTC;

- Btcmarkets;

- Litebit.

Where can you store XRP?

At the moment, cryptocurrency developers offer two options for storing XRP:

- on a multicurrency wallet;

- create a crypto wallet on GateHub.

Read the article review of wallets for Ripple.

The first option has several different views. You can install the following types of wallets:

- hardware (for example, Ledger Nano S);

- desktop (Rippex);

- mobile, browser (Toast).

The second option will require identification. It can be found at https://gatehub.net

Ripple storage wallet

Before you buy cryptocurrency, the first thing you need to think about is where it is stored. It’s no secret that leaving currency on exchanges is dangerous, so it’s best to store it in a special wallet.

The best option for saving Ripple is the “cold” wallet Ledger Nano S. A “light” wallet, for example, Toast Wallet, is also suitable. It is created for major operating systems such as Windows, iOS, Linux, Android, Linux and Mac.

In order to open a wallet, you need to download the program, then run it, and create an account. Compared to most exchanges, Ripple's wallet addresses are not free. To activate an address, you need to deposit a fireproof amount equal to 20 Ripple on it, which must be on your wallet at all times. This condition was established directly by the Ripple network, and it is not unchanged regardless of the type of wallet program you choose. This rule is designed to avoid overloading the network with a large number of one-time addresses, as well as to eliminate spam transfers. When you register your wallet, the Ripple wallet address will appear in the application.