Hello, dear readers of the KtoNaNovenkogo.ru blog. Often in topics related to business, banking, or simply event planning, the word “ profit

”, meaning the ultimate goal or motivation to achieve goals (for example, making a profit).

What does “profit” mean as a stock exchange term?

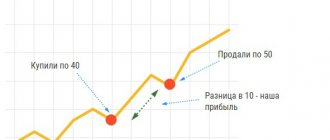

Profit is profit and benefit , as this word is translated from English. But it is used not only in relation to finance, this word is applicable to any goal achieved or that needs to be achieved.

Most often the term is found on the stock exchange , where it denotes profit from a transaction.

For example, a security was purchased for $20 and then sold for $25. The profit is $5, from which the broker's commission must first be subtracted.

Thus, in trading, profit is net income. You can call profit - profit.

Moreover, taking into account that the profit is each time less than the income, since the amount received as a result of the transaction must be subtracted:

- the amount spent on the purchase of a share or other security;

- percentage paid to the broker for services;

- payment for working with the terminal;

- other running expenses.

Why take profit didn't work

An order to take profit may not work or may work at a different price:

- A gap on the stock exchange when a gap has formed in the price. Reasons: payment of dividends, published company reports, news noise, long break in the work of the exchange (weekends, holidays). The broker will execute the order at the first price after the gap.

- High volatility of the security. The quote can jump over the limit you set, which is only a plus for the trader.

- Large transaction volume. Most likely, this will not threaten the readers of our blog. To influence quotes, the volumes should not be large, but very large (several million rubles). In this case, the broker simply does not have enough offers available in the order book at the take-profit price. He will execute the order at a different price.

In rare cases, you may be short without realizing it. This will happen if:

- you placed a stop order to sell an asset and forgot about it;

- you sold part of the position;

- the quote has reached the level specified in the order.

The broker must execute the order, but the required amount of securities is not in the account. Then he lends them to you, i.e. opens a short trade.

Take profit, what is it

The stock exchange often uses the stable expression take profit. It denotes the price value at which the transaction is completed automatically. Income is fixed, so this situation is otherwise called “ profit fixation level ”.

The take profit level can be set at any time without restrictions. Profitability depends on how well the level is determined. Therefore, this level is determined individually in each transaction.

Often speaking about profit, amateurs mean by it not profit, but the total income for the trading session. But this is completely wrong.

When to set the profit level:

- if there are strong pullbacks;

- if it is not possible to closely monitor the progress of the trading session, for example, you have to leave home or go on a business trip;

- if a corrective movement is recorded against the trend, current or expected;

- when there is a type of trading that requires greater accuracy, as a rule, this is scalping;

- if there are pending orders and a clearly established purpose for working with them.

It is believed that it is not necessary to set a profit if you make transactions under the guidance of a mentor. This is logical, a beginner in trading should develop tactics for opening and closing transactions, focusing on the strategy proposed by the mentor: this way you can understand in detail how exactly the work processes take place.

How to set a stop order

You can set take profit in any trading terminal. The interfaces are different, but you should look for them in the form of completing an application to buy or sell an asset.

I’ll show you using my broker as an example. Let's say I want to make money on Sberbank shares. I set take-profit for their sale.

Step 1. Select the desired shares in the portfolio and click the “Sell” button. In the form that opens, click the “Take Profit” button.

Step 2. My broker allows you to choose the type of price at which the order will be executed: market or limit. In the first case, you just need to enable the appropriate checkbox - the broker will sell at the current quote at the time the order is triggered. In the second case, you need to enter your value.

Step 3. In QUIK we set the order activation price, indent and spread for a more flexible response to a stop order:

- The order activation condition is the price at which the order calculation starts. For example, for Sberbank shares it will be 350 ₽.

- Departure from the maximum. The function is activated when the quote reaches 350 ₽. Further, the price will be adjusted taking into account the indentation. Let’s say that for us it is 5 ₽.

- Protective spread. Helps protect against slippage in case of worsening quotes. For us it will be equal to 2 ₽.

Let's consider options for the development of events with Sberbank shares.

Option 1. The quote reached 350 ₽ and did not go higher. The application for 345 ₽ (350 – 5) worked.

Option 2. The quote reached 350 ₽, but went higher, jumping to 360 ₽. The application for 355 ₽ (360 – 5) worked.

Option 3. The quote went up, reached 350 rubles, but then changed direction and came to 348 rubles. The protective spread worked, and the shares were sold at 346 rubles (348 – 2).

More than 100 cool lessons, tests and exercises for brain development

Start developing

Profit factor and other definitions appearing on exchanges

Profit-factor is a numerical value characterizing trading efficiency. It is calculated as the amount of transactions completed with a profit, divided by the amount of transactions completed with losses.

If the profit factor value is greater than one, the trade is successful, and if it is less, the trade is unprofitable.

In practice, it is believed that the optimal values of this value are above 1.6. The higher the profit factor, the more successful the trade.

In the exchange environment and on Forex trading platforms, other definitions related to profit are used :

- profitable transaction - one that brought profit to the trading participant;

- profit indicator – the indicator that will give the correct signal to open a successful transaction;

- A profitable strategy is one that brings regular profits.

Stop loss - what is it and what is it used with?

The English word “stop loss” translated into Russian means “to stop a loss.” In the language of stockbrokers, you can hear the phrase “caught a Moose” - this speaks more of an unsuccessful hunt than of a good catch.

A stop loss order is designed to control losses if the market rate moves in a direction that is unprofitable for the trader.

Stop loss is an automatic type of fixation of loss in a certain transaction. When your asset reaches a certain price, the order is closed automatically according to contractual parameters.

Stop Loss is issued only in conjunction with market or pending orders.

Stop loss is not always unprofitable; it can also be used to take profit. For example, if the trade is in the positive, you can drag this order with the condition of closing the position in the positive zone, that is, in the worst case scenario, your trade will close in the positive.

A stop order is placed in Quik by pressing F6 or right-clicking on a candle on the chart.

Next, we configure SL as shown in the figure below. For example, in this case, I put SL below the minimum on the chart - 115 rubles, in the price field I put SL below SL by 1 ruble - 114 rubles, that is, this is protection against slippage.

Since the price may sharply fall below 115 and SL may not work and the deal may not be closed. And taking into account slippage, the transaction will close for example at 114.55 rubles.

In the Forex market, as in the stock market, placing a stop order requires compliance with the following rules for successful trading:

- closing a loss-making operation at a set price;

- fixing a certain income when the exchange rate moves into the profit zone.

Stop loss is a necessary indicator of technical exchange activity, the correct application of which significantly reduces risks and increases the deposit.

How to calculate SL

Let me explain with an example, let’s say we have a deposit of 100,000 rubles; according to the strategy, we can lose no more than 2% of the deposit, that is, 100,000*2%=2000 rubles.

It follows that if we buy at 119 and set the stop at 115, i.e. in case of a bad game we will receive 119-115 = 4 rubles loss per share. Next, we will calculate the number of shares that can be purchased with this condition: 2000/4 = 500 shares, but since Gazprom is sold at 10 shares in 1 lot, we get 50 lots.

In total, we get the following: we can buy 500 shares for 119 rubles for the amount of 59,500 rubles, and if the stop loss is triggered, we will receive a loss of 2,000 rubles or 2% of our deposit.

Why set a stop loss?

If you do not set a stop loss, then there is a risk of serious losses if the price moves against the position. And if you play with leverage, the loss can be much greater (up to 100%). This is why all successful traders set a stop price to avoid situations where losses accumulate.

In general, there is a rule in trading:

Do not let losses grow (close unprofitable trades), but only allow profits to grow (do not register ahead of time).

As a rule, the stop loss price is set small. They proceed from the basic principles of trading so as not to lose more than 2% on one transaction. If you use leverage, you should adjust your stop loss even closer to the current price to adhere to the two percent rule. For example, if the leverage is 4, then the protective stop should be 0.5% below the price.

The two percent rule is optional. It is rather “classical”, i.e. everyone started with him. There are many examples that such tactics bring positive trading results. I think this is due to the psychology of trading, which allows you to be completely calm about small losses, while giving quotes room to maneuver and reducing your risk of being “thrown out” of the market by random fluctuations.

Professional traders trade according to their own strategies and trading rules. Some people set large stop losses (5..10%), others, on the contrary, set very small ones (0.1..0.3%). Moreover, both strategies can work quite profitably. The question is under what conditions to enter the market and where to set take profit.

Many people place stops behind strong support or resistance levels. This is a reasonable decision, but there is a risk of ending up in a stop loss situation. This is a case when the price touches an important level, and then rebounds sharply in the opposite direction. They also say that the “strong players” (smart money) have thrown the weak ones out of the game.

Placing initial protective stops should become a habit. Linda Raschke

The issue of placing a stop is very complex and important. There are different approaches you can take, and each will have its own valid reasons for being workable.

- Principles of money management;

Conclusions: basic rules for using protective orders

Please note that professional and effective trading requires the mandatory use of a stop loss tool. Always use!

trader's insurance , protecting against losses that may not be noticed simply because you went away for a couple of minutes to make yourself a coffee. Even if this protective order is not required. He will still complete his task. The investor will be calm and will be able to pay more attention to analyzing the general situation on the market.

In order for the deposit to be used with maximum efficiency, you should not set the SL level too low, which does not correspond to the main real quotes. It is necessary to analyze the market situation, and if it is possible to regularly enter the quick terminal, “ pull up ” the stop loss level to the current quotes so that the order is triggered in the profitable zone.

Using take profit in QUIK allows traders to take control of risks and create conditions for accumulating profits.

Invest in stocks with a trusted broker. Visit the page with new online courses. Thank you for your attention, always your “Maximum Income”

[edit] Links

- Profit is such a profit

- "Eurostandard Profit M"

| [ + ] 1) PROFIT 2) ??????? 3) PROFIT! | |||||||||||||||||||||||||||

| |||||||||||||||||||||||||||

Advantages and disadvantages of TakeProfit

According to traders, the advantages of TakeProfit are:

- Closing a deal manually is difficult and sometimes impossible. After the price reaches a high or low level, it immediately rebounds if it is in a narrow channel. And take profit allows you to fix the best profit indicator in advance.

- "Taming" greed. This is true for both beginners and experienced players. An obsession with constantly increasing income will lead to the fact that at one point the price will sharply turn in the opposite direction and the trader’s profit will become zero.

But part of the trading community is neutral or negative towards this instrument. And there are two reasons for this:

- No 100% guarantee. TakeProfit does not guarantee that the price level will change exactly where you set it. In fact, no analytical tool can accurately predict price behavior. Its volatility depends on a huge number of factors, including even news reports or fake news.

- Often, with proper market analysis, it is easy to independently understand when to enter and when to exit.