Despite all the advantages of cryptocurrencies, they do not yet completely replace real money. Therefore, a situation often arises when you need to withdraw bitcoins to a card in order to make any fiat payment. The editors of Profinvestment.com have compiled an overview of all popular methods for withdrawing BTC to a bank card. They are radically different from each other, and therefore can be convenient in different situations. You don’t have to settle on just one method, but it’s important to be informed about all the options so that you don’t make a mistake at the right time and withdraw your funds as profitably as possible.

Possible difficulties with withdrawing BTC to a card

There are two main issues that you should consider before withdrawing Bitcoin to your bank card:

- Verification may be required. If you plan to work with a crypto exchange, you will need to confirm your identity - provide passport details, full name, residential address, take a selfie, etc. As for exchangers, they do not require you to confirm your identity, but they may ask you to verify the card itself as confirmation that it belongs to you (exchanges without verification).

- Regulation. Recently, increased attention has been paid to operations with cryptocurrencies in Russia. On January 1, 2022, the law on digital financial assets (DFA) came into force, which regulates a number of issues related to cryptocurrency. It is actually equivalent to property. To avoid problems, you need to declare the crypto assets you have, as well as pay 13% taxes on all income (regulated and unregulated exchanges).

The laws of other countries may differ. For example, in Belarus until 2023 it is allowed to carry out activities with cryptocurrencies without paying any taxes. In Ukraine, in December, a law was adopted, in many ways similar to the Russian one, where cryptocurrency is also considered to be property and profits from it are subject to taxation.

All transactions credited to the card are monitored, so if the bank notices suspicious receipts, then questions may arise to you. Dividing large payments into small ones will not help, but will only make things worse. It's better to pay the tax and sleep peacefully.

How to choose an exchanger and work with it

A separate item is “Matbi” - an exchanger where you need to go through a simple registration using a phone number or email, but it also offers the services of a reliable online wallet.

The cryptocurrency purchased on “Matbi” will be protected by three types of confirmation codes: - PIN - From SMS - From an email Exchange to “Matbi” comes from funds credited to the user’s balance in “Matbi”, and not directly from the card.

The reliability of the exchanger is very important. “Matbi” has been operating since 2014, which is a very respectable period for the crypto world.

As for the service, the interface is extremely attractive: everything is simple and clear. There are commissions only for withdrawing funds, but there are no commissions for deposits and exchanges. The course is extremely helpful.

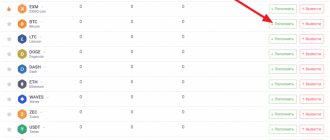

The choice of coins is quite wide and is represented by the following names: Bitcoin, Litecoin, DASH, ZCash, Ethereum, Bitcoin Cash, Chainlink, OmiseGO, WAVES, Monero, Dogecoin, TRON, DAI, Ethereum Classic, DigiByte, BAT, ZRX, QTUM, Lisk, KNC , Bitcoin Gold.

The recently released Matbi mobile application includes all the functionality that was previously provided only on the service website, which is available in the App Store and Play Market. Transactions are carried out automatically around the clock. Technical support works at certain hours, but is very prompt. If the user has any questions, the Matbi team has prepared detailed video instructions.

The market for exchangers is wide (at the time of writing - 406 services). Competing with each other, the platforms offer different advantages:

- Larger reserve

- More payment methods and coin selection

- Higher transaction speed

- Bonus and referral programs

- Anonymity

- Operating mode

The general advantage is a simple interface and the absence of mandatory lengthy verification. Even registration is most often not required: it is needed to get a discount and access to a bonus system or referral program.

There are three types of exchangers:

- Manual - on them the operation is completely carried out by the operator. They often work on a limited work schedule, exchange is not very fast, there are queues

- Automatic is the exact opposite of manual. The exchange is carried out by the platform, the operator does not participate in it. They work 24/7 and are considered the fastest

- Semi-automatic - the platform issues details and deposits/withdraws coins, but the operator switches the stages of exchange. Works faster than manual ones, although the risk of queues remains

The most convenient way is to choose a suitable exchanger on BestChange. This is a monitoring platform that compiles a rating of reliable bitcoin to ruble exchangers.

The rating displays verified exchangers from more favorable to less favorable rates. The table has five columns:

- Exchanger name

- “Give” and “Receive”: the columns are responsible for the exchange rate

- “Reserve”: how much currency of interest the exchanger provides

- “Reviews”: user impressions. The more positive and less negative, the more reliable the exchanger

In small print in the “Give” column, the minimum amount for purchasing the currency of interest on the selected exchanger is often indicated. Based on this parameter, you can find services for exchanging bitcoins from 1000 rubles or even less.

Customize the rating to suit your request: select the currencies for exchange to the left of the table. Bank cards, payment systems, exchange currencies, cash and the most popular coins are available.

BestChange is a convenient tool that will monitor exchangers for you.

Working with the exchanger is simple: go to the platform, enter the amount, wallet address and e-mail, pay for the purchase using the details provided by the platform. The transaction takes from 15 minutes to several hours, depending on the congestion of the Bitcoin network. The purchase status is displayed in your personal account, notifications are sent to the specified email address.

Advantages and disadvantages of withdrawing Bitcoin to a card

pros

- A bank card is the most common and convenient type of fiat payment instrument.

- Cards are supported by a large number of exchangers and other services.

- The only thing that matters is the type of card (Visa, Mastercard) and its currency, and what bank you have usually doesn’t matter.

Minuses

- Increased attention from third parties: banks, governments, law enforcement agencies, tax authorities, etc.

- Often high commissions.

- The need for verification when withdrawing from most exchanges.

FAQ: exchangers according to your parameters

You know at least 25 exchangers that are worth working with. All services offer to exchange rubles for bitcoin online, but they have different specifics. Choose the right one based on your priorities. Many platforms are more profitable for working with a specific system, for example, qiwi wallet. There are exchangers that quickly transfer Bitcoin for rubles from a Sberbank card. A separate category is cases when you need to exchange Yandex.Money for Bitcoin. And here, too, there are more and less profitable options.

Which exchanger is better? We believe that the best bitcoin to ruble exchanger is Kassa.

Here are three tables with the most frequent requests from exchanger users.

The best exchangers from QIWI to BTC

Reliable and profitable exchangers QIWI rubles for bitcoins. They work around the clock with the exception of Betatransfer. Some give the opportunity to exchange qiwi for bitcoin instantly from 1000 rubles.

| Name | Transaction speed | Minimum limit | Reviews |

| Exhub | Up to 15 minutes | Absent | 8825 |

| Bankcomat | 5-15 minutes | 5000 rubles | 1663 |

| BaksMan | Up to 20 minutes | 5000 rubles | 3554 |

| 365Cash | Up to 15 minutes | 5000 rubles | 4793 |

| Betatransfer | Up to 20 minutes | 500 rubles | 2380 |

The best exchangers from Sberbank card to BTC

Not all exchangers support working with bank cards. Here are the more profitable ones where you can exchange bitcoins for Sberbank rubles, even from 1000 rubles.

| Name | Transaction speed | Minimum limit | Reviews |

| Exhub | 5-10 minutes | No Limit | 8864 |

| YChanger | Up to 15 minutes | 1000 rubles | 1163 |

| 60sec | Up to 20 minutes | 5000 rubles | 1834 |

| 24PayBank | Up to 15 minutes | 5000 rubles | 3893 |

| XChange | On average 10 minutes | 5000 rubles | 5227 |

The best exchangers Yandex.Money for BTC

Here are five proven services through which it is convenient to exchange bitcoins for Yandex.Money. They work quickly, the limits are often lowered depending on the reserve.

| Name | Transaction speed | Minimum limit | Reviews |

| NetEx24 | 10-15 minutes | 2000 | 9424 |

| A1Change | On average 5 minutes | 4500 | 553 |

| 7money | Up to 10 minutes | 4500 | 1751 |

| WmExpress | On average 15 minutes | 5000 | 8011 |

| Pocket-Exchange | On average 5 minutes | 500 | 1905 |

Step-by-step instructions for working with the exchanger

We show you how to buy Bitcoin through a card on the ProstoCash exchanger. Registration on the service is not mandatory, but it gives a 0.05% discount, which will grow as you use the site. To receive it, you need to enter the standard e-mail and password.

Now let's move on to buying coins.

Step 1. Go to the website, set up currencies and fill out one of the “Give” and “Receive” fields. The second will be filled out by the platform, calculating the amount at the exchange rate. The minimum purchase amount for Ya.Money is 500 rubles. In this example, we will show you how to exchange 1000 rubles for bitcoin.

Step 2. Specify the exchange details: addresses of both wallets, cards, e-mail for confirmation. Click “Start Exchange” after checking all the data.

Step 3. Receive detailed instructions for the exchange and pay for coins within 30 minutes. After that, click “I paid” and wait for the coins to be credited to your wallet. Check the status of your application in your personal account or mailbox. Please contact support chat with questions if you have any questions.

How to withdraw bitcoins to rubles to residents of Russia

Before you figure out how to transfer bitcoins to rubles to a card, you need to learn more about the legal aspects. The difficulty of working with Bitcoin in Russia is directly related to the lack of legislative decisions on cryptocurrencies. On the one hand, currently digital assets already have legal status and are mentioned in several legal acts in the form of property or its monetary equivalent.

The Central Bank has repeatedly stated that the only means of payment in Russia is the Russian ruble. Payments in cryptocurrency for any goods or services are considered illegal financial activities. However, operations of exchanging cryptocurrency for other banknotes or their electronic equivalents are not prohibited. But there are also some nuances here - when exchanging for a large amount, a financial institution may freeze your funds and ask you to provide documents confirming the legal origin of the money.

Not everyone knows where to withdraw bitcoins and how large the transactions can be. It is worth breaking a large amount into several small transfers of 40 - 60 thousand rubles, using several payment cards for withdrawal or electronic payment systems. You may also be advised not to cash out large sums at once; this may attract the attention of the bank’s security service and the funds may also be frozen. Also, do not forget about reporting such transactions to the tax authorities. If you don’t do this, you can run into a fine or a real sentence.

Direct exchange

You can also withdraw Bitcoins from a Blockchain wallet to a card through a direct exchange.

This means that you do not need to use any intermediaries in the form of exchanges or exchangers. The exchange is made from hand to hand. But these resources acted as something of a buffer against scammers. Even if they did not always cope, the protection was carried out. And now the participants in the transaction are practically not insured by anything. If a fraudster takes advantage of this situation, he cannot even be accused of theft. This is why directly exchanging Bitcoins for fiat money is not the best idea. But this is beneficial because commissions and other expenses that are so disliked when working with exchangers or stock exchanges are eliminated. This is why cryptocurrency continues to be sold from hand to hand, ignoring the risks.

In order to at least partially remove the danger of being deceived in such an exchange, a special exchange was created - LocalBitcoins. This platform is only called an exchange, but its properties differ from ordinary crypto exchanges. It is an intermediary between two people, one of whom sells Bitcoins and the other buys. But the transaction itself takes place not only on LocalBitcoins, but face to face or in another way convenient for users.

Let's take a closer look at the procedure:

. You need to register on Localbitcoins.net. The service will recommend verifying your phone number and identity, as well as using two-factor authentication to protect your account from hacking.

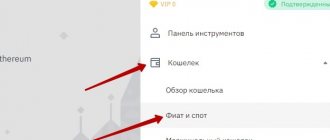

Step one- Step two . You need to transfer cryptocurrency to the internal wallet of the system. To do this, click on “Wallet”, “Receive Bitcoins”, transfer the amount to the address that appears below. Wait until the money arrives.

- Step three . You need to go to the “Sell Bitcoins” tab, where you click “Show more” and select “Transfers through a specific bank.”

- Step four . Here you need to select the user with whom you will conduct the transaction. Collaborating with the first person you meet is risky. To make the right choice, you need to evaluate the following data for each financial partner you are interested in: reputation, percentage of successful transactions, exchange amount. If everything is fine, click on “Sell”.

- Step five . Submit a request for a deal. To do this, indicate the amount and press the large green button. Don't forget to write to the seller indicating your card for transfer.

- Step six. When the seller transferred money to the card, the Bitcoins withdrawn from the Blockchain will be unfrozen. They will be sent to the account of the second participant in the transaction. That is, deception in the system is difficult to implement, because creating an application without

cryptocurrency will not work, and the second participant in the transaction will not receive anything until he replenishes the account.

When the transaction is completed, it is important to leave feedback about your cooperation with this person. This is important, since most of the site’s clients choose the second participant based on reviews.