Rise and Fall

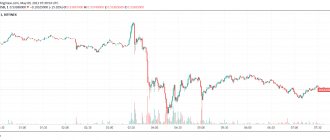

“In hindsight [we realize that] it was inevitable,” Musk wrote on Twitter on January 29, 2022, adding the hashtag #bitcoin to his profile description. This hint was enough for investors - Bitcoin shares instantly soared by 20% to $37,700.

Tesla soon announced that it had invested $1.5 billion in Bitcoin and was going to accept Bitcoin as payment for its products. Just eight days later, on February 16, Bitcoin broke through a record high of $50,000—by that time, the cryptocurrency had grown 72% since the beginning of the year.

Advertising on Forbes

Golden fund of quotes: how Elon Musk's tweets affect the market

However, in May 2022, the entrepreneur announced that Tesla was suspending payment for electric vehicles in bitcoins due to the unenvironmental method of mining cryptocurrencies. As a result, Bitcoin fell by 15% to $46,200. At the same time, Musk said that the company would not sell the cryptocurrency. A few days later, the value of the cryptocurrency fell again - below $45,000 - this happened after Musk’s discussion on Twitter. The billionaire agreed with one of the social network users, who wrote that in the next quarter, Bitcoin owners will be annoyed if they find out that Tesla has gotten rid of its remaining cryptocurrency assets. “Indeed,” Musk replied.

At the same time, the billionaire said during The B Word conference that he will continue to keep cryptocurrency in his portfolio. “If the price of Bitcoin falls, I will lose money. I can pump [cryptocurrency], but I won’t dump [it],” Musk said during the event. He also said that Tesla will accept Bitcoin in the future when mining becomes more environmentally friendly.

Solar brotherhood: why Musk’s decision to buy a business from his cousins could cost him dearly

Another cryptocurrency that Musk can also influence is Dogecoin: it appeared as a joke and is symbolized by a meme with a happy face of a Shiba Inu dog. In early February, Musk posted a photo of a Falcon 9 rocket in flight and captioned it Doge. In less than an hour, the price of Dogecoin increased by 47% to $0.059 per token.

Two days later, Musk called Dogecoin “the people’s cryptocurrency,” and a little later he wrote that he bought it for his son X Æ A-12. “Dogecoin may be my favorite cryptocurrency,” Musk wrote back in April 2019, when users of the cryptocurrency Twitter account jokingly chose him as the head of their project.

Ahead of Saturday Night Live, which Musk was scheduled to host on May 8, Dogecoin rose 30%. And after Musk’s speech, in which he, firstly, admitted that he has Asperger’s syndrome, and, secondly, called Dogecoin “hype,” cryptocurrency shares fell by 28%. At the beginning of the show, the price of Dogecoin was $0.65, and a few hours after the show ended it was $0.47.

If they offer Bitcoin, I will not refuse

One of the richest inventors and businessmen in the world, Elon Musk, admitted that he is not against accepting payment in Bitcoin. He wrote about this on his Twitter page.

Responding to a tweet from Ben Mezrich, who wrote that he would never refuse payment in Bitcoin, Elon Musk indicated that he, too, is not against receiving payments in cryptocurrency.

Sponsored

Sponsored

This message from Musk inspired Twitter users. Many supported the decision of the Tesla founder to use Bitcoin, but there were also those who recalled the environmental consequences of using cryptocurrency.

Thus, a user under the nickname @RationalEtienne asked what Elon Musk thinks about the environmental consequences of using Bitcoin, the mining of which requires a significant amount of electricity, which means that the volume of carbon emitted into the atmosphere will only increase.

Factor Mask

“Elon’s influence [on the cryptocurrency market] will not last forever,” said Vitalik Buterin, the creator of the Ethereum cryptocurrency, in an interview with CNN in May 2022. He noted that the cryptocurrency space first encountered Musk's tweets in 2022. However, Buterin believes that markets will learn to cope with its impact in the future.

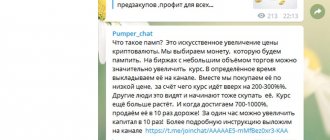

Elon Musk is well aware of the consequences of his actions and statements, says Exante lead strategist Janis Kivkulis. According to him, Musk may be interested in the process of influencing the market and how cryptocurrency quotes change. The successful experience of “rocking” Doge may push him to make new attempts to do this, Kivkulis believes.

The fall of Bitcoin in the spring of 2022 was a kind of blow to Musk’s reputation, the expert continues, since such a sharp change in Tesla’s financial policy looked like a deception of the expectations of investors who were guided by Musk. “Over time, the impact of Musk’s statements on investors is decreasing. Now he has returned to the ranks of Bitcoin supporters. This can be regarded as a rational decision, since Musk himself, Tesla and Space X, according to the entrepreneur, have bitcoins, and the fall in the cryptocurrency rate is not beneficial for him,” Kivkulis believes.

German lessons: how bureaucracy in Germany made life difficult for Elon Musk

Musk has 59.4 million followers on Twitter, his publications are reprinted in all media and read in the crypto community, but his influence on the cryptocurrency market will decrease, agrees Rustam Botashev, chief analyst at the crypto investment bank Hash CIB. “Elon Musk is a PR genius, with his help he has earned hundreds of billions. After all, undoubtedly, when he bought Bitcoin, he knew that its mining was energy-intensive,” says Botashev.

The time is coming in the world when it will no longer be states that will make fateful decisions for countries and people, but large cross-border companies and their owners, argues Alexander Brazhnikov, executive director of the Russian Association of Crypto Industry and Blockchain (RACIB). According to him, Musk is a prime example of this. Each of his statements is a thoughtful action to influence the financial market, Brazhnikov is sure. “Billionaires are already flying into space on their own, and this shows that now a private person can do more than the state,” he notes.

Elon Musk clearly understands the power of his publications and the subsequent impact on markets: they directly benefit him and Tesla, but have devastating consequences for small retail investors, says Velas Network AG Chief Operating Officer Shirley Walge. At the same time, it characterizes a new generation of investors who are more likely to blindly follow celebrities rather than form their own opinions using research and fundamental analysis, she said. According to Valge, the world will soon see more and more large influential people, including politicians, who with their statements will provoke volatility in digital assets. This could be a reason to introduce regulation to prevent manipulation, she noted.

Elon's rocket: how the founder of Tesla became 500% richer in one year

Advertising on Forbes

Previously, Musk had already clashed with the American regulator over messages on Twitter. In 2022, the US Securities and Exchange Commission (SEC) initiated proceedings after a series of comic publications by Musk about the bankruptcy of Tesla. The parties entered into a settlement agreement under which Musk resigned as chairman of Tesla's board of directors, paid a $40 million fine, and agreed that all of his social media posts must be pre-approved if he plans to discuss information material to Tesla's business.

But in the case of cryptocurrencies, the entrepreneur does not face regulatory problems, says Yaroslav Shitsle, head of the “IT&IP Dispute Resolution” department at the legal department. Unlike the securities market, cryptocurrencies are still in a gray area for the SEC, so Musk does not face criminal or administrative liability. At the same time, the SEC is currently considering several applications for the creation of “Bitcoin ETFs,” exchange-traded funds that would use Bitcoin as an underlying asset, Schietzle says. If such funds are approved in the United States, then the story of the SEC's claims against Elon Musk may repeat itself, since in this case his publications may already have an impact on the shares of American citizens, which they will buy on the exchanges, the lawyer warns.

Does Elon Musk understand cryptocurrency?

Elon Musk is a celebrity about whom many have rather conflicting feelings.

On the one hand, he is perhaps the greatest technopreneur of our day; if anyone can send astronauts to Mars, it will be him. On the other hand, he is impulsive in his statements and often tweets such things that the Tesla board of directors is horrified. Thus, in 2022, Musk was fined $40 million at the request of the US Securities Commission (SEC) after he wrote that he would remove Tesla from the stock market. However, Musk's most controversial tweets are about cryptocurrencies. Let’s make a reservation right away: Elon Musk is not a crypto expert or a blockchain developer.

In his relationship with the cryptocurrency market, he acts as both a major investor and a troll who likes to post memes for fun and see the effect.

How much Musk understands Bitcoin technology is not entirely clear, but most likely less than he himself thinks. Thus, his statement that Tesla will no longer accept BTC due to the fact that mining consumes too much fossil fuel is incorrect: according to a study from the University of Cambridge, up to 39% of electricity for mining comes from renewable sources.

However, we are getting ahead of ourselves. To get a complete picture of the “Musk effect”, it is worth tracking what and when the bitcoin billionaire wrote about the bitcoin billionaire in the last two years, and what happened to the exchange rate after that. In this article, we will leave aside Elon Musk’s complex attitude towards Dogecoin: a separate article will be devoted to this extremely interesting cryptocurrency.

The creator of Tesla continues to hype Bitcoin

Let us remind you that this is not the first tweet by Elon Musk about Bitcoin, which was published over the past month. Previously, he asked Michael Saylor, CEO of MicroStrategy, whether it was possible to transfer large Tesla transactions into bitcoins. According to Saylor, by converting Tesla's balance into bitcoin, Musk will not only send the cryptocurrency market to new highs, but will also make a profit.

In May 2022, Elon Musk admitted that he owns only 0.25 BTC and is not yet going to increase his investments in this asset, since he does not believe in the power of Bitcoin. However, after the price of the cryptocurrency exceeded $38,000, he became interested in the possibility of using cryptocurrency to increase capital.

Will Musk follow the lead of retail investors?

If Elon Musk really decides to transfer part of his assets to Bitcoin, then the value of the cryptocurrency will quickly rush to new highs. After all, it was not institutional investors who were behind the December Bitcoin rally, but retail investors. This opinion was voiced by Blockstream CEO Adam Black.

“Three new all-time highs – $24.7 thousand, $24.8 thousand and $25 thousand – in just one day on December 25th. Do you think the institutions did it? Right for Christmas? No, only retail players had their keyboards on this holiday,” he wrote.

Let us recall that in 2022, several private investors immediately transferred part of their assets to Bitcoin. The most significant investment for the market was the investment of Paul Tudor Jones, a famous billionaire and financial guru, who transferred 1-2% of his assets into Bitcoin. Jones’ example became contagious, and following him, the famous billionaire and investor Stan Druckenmiller bought Bitcoin.

Now Stan Druckenmiller, along with Paul Tudor Jones, Jack Dorsey, Michael Saylor and others, have invested part of their huge fortune in Bitcoin.

In December 2022, Mexican businessman Ricardo Salinas Pliego, founder and president of the Salinas group, tweeted that he had invested the majority of his liquid assets in Bitcoin.

This investor activity indicates that Bitcoin is becoming an increasingly popular investment instrument that can quickly generate profits.