Letter from the future about Bitcoin: global catastrophe is inevitable

Many have heard more than once that Bitcoin is the currency of the future, the new gold, the thing that will completely turn our world upside down. We hear such loud words from every second “crypto addict”. But our article today is not about that. It's about a man who visited the future and talked about the Bitcoin world!

Six years ago, on Reddit, in a thread about Bitcoin, a very unusual letter was left from the so-called “messenger from 2025” Luka Magnotta. It talks about the catastrophic changes that will entail the abandonment of the dollar in favor of Bitcoin. In itself, all this sounds ridiculous, if not for one BUT: since 2013, a lot of the “message” has already come true...

So, this is the future Luke predicts for us. The narration is told directly from his words.

“Since the advent of Bitcoin, its price has increased 10 times every year. In 2010, its cost was 10 cents, in 2011 the price increased to $1, in 2012 it reached $10, and in 2013 it reached $100.

Further growth was less intense, now a 10-fold increase was achieved in just 2 years: by 2015, Bitcoin began to cost $1,000, in 2022 – $10,000, and in 2022 reaches the level of $100,000 .

In 2022, Bitcoin crossed the value line of $1,000,000 , from that moment on, banks stopped using printed money, as well as dollars directly. The Bitcoin exchange rate was no longer tied to the dollar, and land resources and cryptocurrency began to be considered the main values of a civilized society. Wealth was expressed in these forms.

Only 19 million were in circulation, although hundreds of thousands were lost or misappropriated by someone. There are still about 7 billion people living on the planet, and cryptocurrency resources are distributed unevenly: the average citizen has only about 0.001 BTC ($1 thousand), although there are also rich people.

I had a neighbor who accidentally discovered a small “tip” on Reddit in the form of 0.01 BTC for a comment left in 2013. This fact forced the guy to immediately board a plane to get to the “citadel” and take refuge in it.

Citadels are isolated high-tech robotic cities that arose on the site of protective structures for machines that mine cryptocurrency. Such cities are a natural extension of the service of protecting wealthy people, the so-called “bitcoin rich”. This layer is sometimes called “early”, since they started using cryptocurrency earlier than others, managed to amass a large fortune and went through the “transition” from one currency to another without losses.

For example, ASICminer has grown from a company producing mining equipment and unique crypto technologies into a stronghold.

At the moment, the governments of most countries have been disbanded, as they are unable to govern the state without effectively collecting taxes from citizens. At first, the rich managed to hide in separatist states like Liechtenstein, Monaco and Luxembourg, their movements were monitored by spy drones, but later the wealth was hidden in the cryptocurrency field.

Bitcoins gave people the opportunity to hide their income through anonymous transactions; government circles did not come up with countermeasures to identify possible wealth.

Governments have tried to regain power and influence by secretly buying up cryptocurrency, which has further increased its value and worsened the economic situation on the planet.

Modern “Snowdens” are not fighters for justice, but dishonest high-ranking officials who managed to withdraw large sums into their accounts and hide in anarchic countries.

The available cryptocurrency is now distributed among four entities:

- The North Korean government controls the lion's share of the resources – 180,000 BTC.

- The government of Saudi Arabia has an amount of 110,000 BTC.

- The Currency Stabilization Fund has 70,000 BTC in stock.

- ASICminer has 50,000 BTC in its fund.

Economic growth is gaining only 2% at most, since there is no need to invest money, and there is no inflation. With 0.01 Bitcoin, a person can live their entire life in peace without needing anything.

The current economic situation is reminiscent of the Middle Ages, when there was also no economic growth, and wealth was measured in gold. Now Bitcoin, as an improved version of gold, has become a measure of wealth and stability. The emergence of new Bitcoins saves the world from collapse, but a new halving can strengthen the cryptocurrency and further reduce inflation, which means the collapse of economic processes.

The first Bitcoin billionaires, the Winklevoss twins, were the first to pay for their wealth. Like many cryptocurrency holders, they were killed by terrorist groups. Moreover, the terrorists themselves were financed by Bitcoin.

The fate of the majority of cue ball holders turned out differently: some skeptics committed suicide because they were waiting for the collapse of the cryptocurrency, others had to cut off ties with their families and loved ones, changing their identity, others found themselves hostages and were forced to “share” or give their wealth to extortionists. At the moment, 25% of Bitcoin millionaires are people who forcibly appropriated other people's assets by extorting passwords and data.

We made attempts to switch to an inflationary currency, but people with average and high IQ scores (above 70) refused to switch to it, seeing the prospect of losing their savings. Bitcoin has become dangerous for society, as it has provoked an increase in greed.

For the African continent, the topic of Bitcoin is one of the most painful, since the ambitious plan to transfer all people from fiat funds to cryptocurrency failed. The African Union has distributed free telephones with identifiers linked to them to citizens. The plan was to attract bitcoins to the economy and improve people's quality of life.

But one day a “Tragedy” happened: a criminal group (approximately from Russia) was able to exploit the vulnerability of the telephone identification system and stole about 60% of all assets from the African continent. The period of chaos, civil wars and anarchic regimes that followed the Tragedy led Africa to complete collapse.

The situation was changed by two superpowers, in which the authoritarian method of leadership allows them to control financial processes. North Korea and Saudi Arabia have distributed almost all African territories among themselves, for which the inhabitants are immensely grateful to them. Until now, Africans believe that Bitcoin was invented by the devil, as the difficult economic situation provoked political and social problems.

Our underground organization is preparing an attack on the world of Bitcoin. We see a way out of this situation in a large-scale nuclear conflict, which would damage the Internet infrastructure. It will be necessary to eliminate all cables between continents and all computer networks, this will help make Bitcoin meaningless. Twenty nuclear submarines and a series of pulsed nuclear strikes will destroy all densely populated areas of the planet and connections between continents.

In the current chaos, we see hope for the restoration of civilization with correct economic values. You must not allow yourself to be forever enslaved by the elite, in whose hands all the blessings of the world are concentrated.

Now you think that you are helping to escape the oppression of central banks into the area of free cryptocurrencies, but in fact you are replacing one dependence with another, even more damaging one. I suggest you stop activities related to bitcoins, you already know what this can lead to. I warned you - now act."

This is the message... The plot is in the best traditions of Nolan or the Wachowskis)) Many, of course, did not believe in such an outcome and directly believe that everything described in the article is complete nonsense of either another Bitcoin hater or a science fiction publicist who wants to hype the trend . In any case, even despite a number of coincidences, albeit quite accurate ones, no one took the message seriously.

What do you think, how possible are the events described by Luke? Share your opinion in the comments!

What is the future of cryptocurrencies and what awaits Bitcoin?

Is it possible to predict the future of Bitcoin? There were many predictions about whether Bitcoin would grow or not, all these predictors were ruined, their predictions did not come true, it was easy to predict when Bitcoin was growing, one could assume that it would always be like this. But as soon as it began to fall sharply, no one could predict the future of cryptocurrencies and their fall.

Cryptocurrencies are still popular, but their future is predetermined

You can now predict the future of Bitcoin yourself based on facts that will allow you to decide the fate of your investment in the exchange. What is an exchange and how to predict whether an investment in cryptocurrency trading will be profitable, you decide for yourself.

No one on the Internet will tell the truth about trading on the stock exchange, because it is not profitable for them.

The entire Internet is filled with advertising information that does not reveal the essence of trading on the cryptocurrency exchange itself. People are simply misinformed for the sake of money, they don’t think about the fate of investors, they are only concerned about their own enrichment. I do not pursue such goals, so I will reveal the whole truth, which, if you participate in trading on the stock exchange, may disappoint you.

Smart people know the future, I have collected their opinions on this matter in my memory and I want to present to you in this article the whole truth about the future of cryptocurrencies.

BlockFi: the most secure crypto broker

BlockFi is a cryptocurrency financial company based in New York City. Founded in 2022, BlockFi complies with US financial regulations, and as a company based there, it has more legitimacy than other exchanges, which are often based in less reputable countries.

BlockFi's digital assets are held in the Gemini Trust Company. Founded in 2014 and regulated by the New York State Department of Financial Services, Gemini Trust Company gives BlockFi additional legitimacy in the cryptocurrency market.

BlockFi is not just a cryptocurrency exchange. In addition to cryptocurrency trading, registered users can access a range of other financial services. For example, users can earn interest by purchasing cryptocurrency with US dollars and then storing it in an account. BlockFi also provides loans to users using their crypto assets as collateral.

The main benefit of BlockFi is that it allows users to deposit funds into accounts and earn high interest on those funds. Additionally, investors can use fiat currency to purchase cryptocurrency and earn interest of up to 7.5% per annum.

Users holding crypto assets on BlockFi are also eligible to receive loans. But to qualify for the loan, the user must have at least $20,000 worth of crypto assets. If users meet this criterion, they can receive a USD loan of up to 50% of the value of their crypto assets.

BlockFi is also one of the leading investors in cryptocurrency companies, supporting the nascent industry with significant funding. For example, in September 2021, they provided a significant cash injection to Yellow Card, which is an online company that allows users to buy and sell Bitcoin.

BlockFi is also a lead investor in the Grayscale Bitcoin Trust, a digital currency investment firm. Additionally, CoinMetrics is another BlockFi-funded company that provides subscribers with financial data and cryptocurrency market analysis to help them manage their crypto investments.

BlockFi also launched a Visa-backed Bitcoin rewards credit card that earns 1.5% in Bitcoin on any purchases a user makes using Bitcoin. However, to avail this service, users need to undergo a credit approval check.

On this platform you can trade Bitcoin, Litecoin, Pax Gold and Etherum, as well as trade some stablecoins such as tether, Gemini dollar, US dollar stablecoin and Paxos Standard.

Moreover, you can set the system to automatically execute trades on a weekly or monthly basis. This option is useful for those users who do not want to waste time on individual transaction processing. In addition to setting up a trade schedule, the automatic schedule is customizable so you can set the currency trade amounts according to your preferences.

pros

- No minimum deposit

- No transaction fees except for some small spread fees

- Bitcoin rewards credit card available

- Users can receive interest on invested funds

- You can also take out loans in US dollars against the user’s crypto assets

- No monthly or annual fees

- Easy user registration

- Trades can be automated on a schedule according to user preferences

Minuses

- No joint or custodial accounts offered

- Limited number of withdrawals from interest-bearing accounts

- The rate at which loans are provided is not stable

Bitcoin is dead (2011)

According to Forbes, in June 2011, Bitcoin experienced one of the worst declines in its history - in a few minutes the value of the coin fell from $17 to a few cents. By the way, this decline began at the infamous Mt. Gox, and long before the famous hack.

As a result of this episode, Forbes confidently sentenced cryptocurrency to death. The magazine wrote:

“...we have certain requirements for currency: it must be a means of exchange and storage, safe and liquid. No currency can be perfect in all respects, but if there is a severe shortage in one of the areas, such a currency will not be able to survive for long.”

Seven years later, Bitcoin is worth more than $6,000 apiece and is looking to rise. And according to Tom Lee, by the end of 2018 the price could reach $25,000.

Where is Bitcoin used?

- No one is interested in this, however, everyone believes that it is useful in some way... And today this is nothing more than a myth...

Everyone wants to know the future of Bitcoin, what will happen next to Bitcoin?

There are, of course, isolated cases when someone buys something for Bitcoins. But we don’t know who does this and what this calculation looks like. It may be that this is done between relatives who trust each other. Or again, it’s being done to advertise Bitcoin.

It turns out that you can only trade Bitcoin on a cryptocurrency exchange.

On the cryptocurrency exchange, the payment system is very convenient and paying with Bitcoin is very easy. But as you understand, by transferring your Bitcoins to the exchange, the security and all the advantages of the blockchain cease to make sense; they are replaced by the security of the exchange itself, which is not guaranteed by anything except the exchange itself.

It turns out that the Bitcoin payment system exists only on cryptocurrency exchanges. This means that Bitcoin itself was created for trading on exchanges. That’s the whole point of Bitcoin’s existence today.

What is a cryptocurrency exchange and what is its meaning?

A cryptocurrency exchange is nothing more than a casino, people play with each other for money, enjoy it, believe in constant profits, and the exchange takes interest from people for each transaction.

It’s impossible to call it work or income, however, there is a rumor that someone is making stable money on the stock exchange.

- This is not true, of course you can win on the stock exchange, but this is done with varying degrees of success, but the commission for the transaction will always be removed. (And there are also commissions for depositing and withdrawing from the exchange)

This process does not bring practical value to people. But the exchange is truly enriched, thousands of transactions take place on the exchange and an abundant flow of money is constantly pouring into the pocket of the exchange.

What is the conclusion? If you like risky transactions, you are a gambling person, then you can get involved in this game, which could exist without the participation of the Blockchain system and without the participation of Bitcoins.

FAQ:

How can you make money on a cryptocurrency exchange?

Cryptocurrency exchanges operate on the same principles as regular exchanges. You buy a stock and then wait for its price to rise. Then, when you believe the stock's price provides you with an acceptable return on your investment, you simply sell the stock.

Cryptocurrency users also sell crypto stocks that are losing value and buy other crypto stocks that appear to be better value. By buying low and selling high, a crypto trader can make money.

What information do you need to know to make money on crypto exchanges?

Crypto traders need to keep an eye on crypto news as any changes in the country's sentiment towards cryptocurrencies could result in price changes. In addition, you should pay attention to the behavior of large companies regarding cryptocurrencies, as prices can increase when a large company invests in cryptocurrency.

Some exchanges provide users with real-time data on current trends in the cryptocurrency market. Sometimes these financial data tools are freely available to users, but not always. If your exchange offers this service for sale, then you should purchase it, as this data will provide invaluable assistance in making investment decisions.

How to determine whether a crypto exchange is legit or not?

It is necessary to determine where the exchange company is registered and whether its activities are regulated by any financial authority.

Exchanges that are listed on stock exchanges are more reliable. Additionally, if an exchange is regulated by a US financial authority, then it is likely to be more reliable than an exchange regulated by a smaller government.

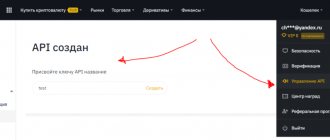

How to start trading on a crypto exchange?

If you want to join a crypto exchange, you need to register as a user on it. The user registration process varies between exchanges, but typically you will be required to enter personal information as required by the government of your country of residence.

After entering the appropriate data, the exchange verifies your user identification. The verification process can take anywhere from 5 minutes to 24 hours, and this time varies from exchange to exchange. After verification, you become an official user of the exchange and can start trading.

Some exchanges also require new users to deposit a certain amount into their account before they start trading. However, this amount is usually small, and some exchanges do not require an initial deposit at all.

Is Bitcoin the best cryptocurrency to invest on a crypto exchange?

Bitcoin was the first cryptocurrency to hit the market in 2008. Although there are now hundreds of other cryptocurrencies, Bitcoin is still the most expensive cryptocurrency. However, the value of other cryptocurrencies is rising, and some of them are becoming as profitable investments as Bitcoin.

Ethereum, Cardano, and Litecoin are some notable examples. Ethereum in particular is becoming a competitor to Bitcoin and could soon have a higher value than Bitcoin. Therefore, if you want to continue to make profits through your exchange, you should be aware that even if it is the best Bitcoin exchange, it may not be the best platform for crypto investing overall.