Experienced investors use futures to hedge the risk of a possible drawdown in their portfolio. How does this happen in practice and what is the difficulty of working with this financial instrument?

Since the beginning of May, investors have the opportunity to trade futures at 1/10 of the value of Bitcoin. This financial instrument was launched by the Chicago Mercantile Exchange CME Group, which added Bitcoin futures in 2022. In February 2022, Ethereum futures also appeared on the CME. It became the first altcoin to be traded on an American stock exchange.

Where can you trade Bitcoin futures?

The best platform for trading Bitcoin futures is Binance Futures from the largest cryptocurrency exchange Binance. In addition to it, there are also specialized platforms CME and CBOE in the USA, but they are strictly regulated by American laws, which actually prevents investors and traders from Europe and the CIS from accessing them.

A special feature of Binance Futures is its much less stringent KYC procedures and AML policy requirements - you can not provide personal data and remain anonymous . In addition, the Binance Futures platform has a much lower barrier to entry, which means that they are accessible not only to large investors, but also to ordinary users.

Also, the Binance Futures platform allows you to trade with minimal commissions and x125 leverage.

Official website of the platform https://www.binance.com/en/futures/

Using bots

Bots are used by traders who have developed their own trading system. In this case, if you use the right leverage, you can get increased profits. The programs also contain built-in and ready-made trading systems that can be connected at will.

The main task of bots is to automate trading, but it is worth remembering that this method of trading can be more risky, as it depends on the settings of the system and the bot.

3Commas

https://3commas.io is a popular bot for trading futures on cryptocurrency exchanges. It has flexible settings that allow you to fully adjust and automate the bot’s work.

Traders can set not only basic options in the form of leverage, opening/closing rate and others, but also intervals between positions, pending transactions to check relevance and other conditions.

RevenueBot

https://revenuebot.io is a robot for automated work on popular crypto exchanges. Since April 2022, it has added support for futures trading on the Binance Futures platform.

Setup instructions: https://blog.revenuebot.io/ru/2020/04/23/binance-futures/

Haasbot's Futures Bot

Starting with version 2.3, Haashbot - https://haasonline.com - now supports futures trading. Currently the bot is configured for:

- Bitmex;

- OKCoin;

- BitVC.

The bot has a fairly user-friendly interface and is configured for three types of actions for opening orders: long, short and “no position”.

It has a wide range of options that allows you to fully customize automated trading with the calculation of risks, sharp fluctuations and other conditions.

DeriBot

https://deribot.info/ is a trading bot that is designed specifically for the Deribit exchange. Allows you to trade futures contracts.

It has a wide range of settings and allows you to fully automate the trading process. DeriBot servers are located as close as possible to the exchange servers, so orders are executed instantly and without delay, which minimizes the number of errors during high price fluctuations.

On the bot's Twitter you can track daily reports, publications on setup and other useful information https://twitter.com/DeriBotInfo.

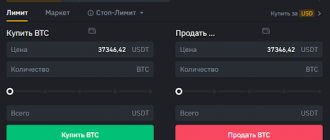

How to start trading futures on Binance Futures?

To trade Bitcoin futures on the world's largest exchange, Binance, you will need to create an account on this site - the registration process on this exchange is quite simple and should not cause difficulties. Trading on Binance Futures is possible without verifying your main Binance account.

Link to register on the official Binance Futures website with an activated 10% discount on all trading commissions https://www.binance.com/.

There is a Futures button in the top navigation menu. Click on it and select the "Futures" option.

At the bottom right, under the order book, there is a separate menu with the “Open account” button. By clicking on this button you will confirm the creation of a futures account. You will then see a menu of orders for opening long and short positions. To start trading futures, you will need to transfer USDT to your futures account.

This is quite easy to do. To do this, you need to click the “Transfer” button. A new window will ask you how much USDT you want to transfer. Simply enter the amount and click the “Confirm Transfer” button. The transfer occurs automatically and without commission; To change the direction of the transfer you just need to press the corresponding button between the wallets.

What are futures for?

These derivative financial instruments (derivatives) are used primarily for making speculative profits. With futures, a trader can take both long and short positions using the effect of leverage. The latter implies high profitability of transactions, as well as increased risk.

However, futures were originally invented as a tool for hedging price risks. Thus, through futures it is also possible to reduce the risks of unfavorable price fluctuations for various assets.

For example, the main risk for Bitcoin miners is a drop in the price of the cryptocurrency to a level at which its mining becomes unprofitable, that is, the cost of electricity exceeds the income from the mined coins.

To secure his business, a miner can sell futures for the amount of bitcoins he has. If the cryptocurrency rate decreases significantly, the futures will provide an opportunity to offset losses from a decrease in the price of the asset with profits from a short transaction.

Leverage

Another advantage of futures is leverage. The term implies a functionality in which the exchange allows you to contribute part of the capital of an investment, providing the remaining funds.

Let's say you want to make a $100 Bitcoin trade, but you only have $10. If the exchange offers you leverage, then, accordingly, it contributes the amount missing before the transaction. If the price rises, your profit will increase 10 times, but the risks here are significantly higher. If the market doesn't go in the direction you bet on, you could lose your capital (in this case $10) much faster than if you bought the same amount of Bitcoin directly.

Let's take a closer look at the example: if you bought $10 worth of Bitcoin and the price of Bitcoin dropped to $9, that means you've already lost a dollar. At the same time, you remain a holder of Bitcoin, which, quite possibly, will rise again at some point in the future.

Now let's say you use that same $10 as collateral for 10x leverage. If the market falls 10%, your $100 position will drop to $90. In this case, the exchange will be forced to close your order and take your capital to cover losses.

An example of a scheme for working with leverage

So, in case of unsuccessful trading, you may face a temporary decrease in the value of your asset or even lose all the funds in your account. In other words, traders who use leverage can easily get out of the market even on relatively modest price movements.

This is very important because exchanges typically allow significantly higher levels of leverage on futures contracts than when trading directly on the market, which makes this asset attractive to high-risk traders.

What types of futures are there?

Futures are either delivery or settlement . The first assume that on the expiration date of the contract the buyer must buy and the seller must sell the underlying asset in the quantity specified in the specification for it.

Examples of deliverable futures include futures contracts for oil or wheat. However, even here, in the vast majority of cases, transactions are carried out without actual delivery of the underlying asset, that is, they are purely speculative.

Also, operations with deliverable futures are often hedging, in other words, aimed at minimizing price risks. Thus, most deliverable futures are closed before the expiration date.

Settlement futures do not initially involve delivery of the underlying asset, but only a cash settlement of the difference between the contract price and the value of the asset on the settlement date. Such instruments are also primarily used for speculative purposes and to hedge price risks.

Risk calculation

Trading activity on a cryptocurrency futures exchange is divided into two goals: making a profit and hedging risks. To make a profit, conventional speculative methods are used by changing the exchange rate and competent forecasting. Hedging is a form of insurance against risks.

For example, if you need to make a certain trade in the future for 10 BTC, but there are concerns about the price going down, you buy a future at a specific price. Thus, after the end of the contract, the buyer is guaranteed to receive the required amount, regardless of price changes. Such an instrument allows you to provide a guaranteed income, although it is poorly suited for speculative trading.

You can calculate futures risks in detail using the formula using the example of universal calculators: https://antiliquidation.gitlab.io/#XbtUsd.

What is special about Bitcoin futures?

Futures contracts can be for a wide variety of assets - securities, stock indices, commodities and cryptocurrencies. In general, Bitcoin futures are not much different from other futures contracts; they also allow you to bet on whether the price will rise or fall in the future.

Note that you can trade futures contracts on BTC without owning the cryptocurrency itself, but only by speculating on its price. This is exactly how transactions take place on such well-known exchanges as CME and CBOE, which are aimed mainly at large investors.

However, the upcoming trading platform Bakkt will feature futures that involve the delivery of physical Bitcoin after the contract expires.

Origin story

The idea behind futures contracts was originally to protect producers and suppliers from sudden or significant fluctuations in the price of a commodity. It is a written agreement that specifies the size (quantity), cost, grade (quality) and terms for delivery of a product at a specified future date. These instruments are traded (bought and sold) between producers, dealers or speculators (i.e. traders seeking to profit from price movements).

The first recorded commodity futures transactions for the sale of rice occurred in the early 17th century in Japan. The United States began producing many agricultural goods in the early 1800s. Most of these products were perishable, the quality of what was stored usually deteriorated over time, and prices for the purchase of agricultural goods could vary significantly. Therefore, the first contracts for a future price appeared, which allowed the buyer to pay for the goods before they were delivered.

The first American exchange was created in 1848, and it was called the Chicago Board of Trade (CBOT). Its creation was preceded by the advent of railroads and the telegraph, which connected the shopping center with the agricultural market.

A group of brokers serving on this board were able to establish a standardized and more efficient method of exchanging commodities through the launch of futures contracts on the exchange. Instead of managing multiple individual contracts between interested parties, they developed futures that were identical in terms of asset quality, delivery time and terms, and simplified the entire process of buying and selling future delivery at the current price.

What is a futures specification?

This is a document approved by the exchange, which sets out all the terms of the futures contract, including:

- name of the contract;

- its abbreviated name or ticker (for example, XBT on the CBOE exchange or BTC on the CME); description;

- contract size (for example, for CBOE it is 1 BTC, for CME it is 5 BTC);

- type (delivered or calculated);

- minimum price step (for example, on CBOE it is five points, which in the USD/XBT pair corresponds to $5);

- delivery date and terms of the contract, etc.

Regulated exchanges for accredited investors

The peculiarity of regulated exchanges is that any trading on these platforms is available only to brokers. This means that to join such exchanges you need to pay a large sum (from thousands to hundreds of thousands of dollars) and obtain accreditation.

CME futures and their closing dates

CME or Chicago Mercantile Exchange is the largest trading platform in the world. For individual investors, finding a broker to trade the CME is a must. The broker provides a margin account (not cash).

After the CME contract is closed, payments are made in dollars, where the amount is equivalent to the cost of Bitcoin. CME BTC Futures Closing Calendar:

- February – 28;

- March – 27;

- April – 24;

- May – 29;

- June – 26;

- July – 31.

You can track Bitcoin futures trading volumes in the section https://www.cmegroup.com/trading/equity-index/us-index/bitcoin.html.

Bakkt

This is a specialized platform for storing and selling digital assets for institutional investors and users. Initially only supports BTC, with the subsequent addition of other cryptocurrencies. A special feature of the exchange is its offer of one-day futures.

Their characteristics:

After the contract expires, investors do not receive an equivalent amount, as on other sites, but the main asset. Financing for the creation of the exchange was carried out taking into account the largest corporations, including Microsoft, Starbucks and others.

The best way to track daily trading volume is Bakktbot, which publishes regular reports on twitter https://twitter.com/bakktbot.

Dynamics of futures contracts for the year:

What are initial, maintenance and variation margins?

Deposit or initial margin is a refundable guarantee fee charged by the exchange when opening a futures position. In other words, this is the amount required to open a position. Typically 2-10% of the current market value of the underlying asset.

However, in the case of Bitcoin futures, due to frequent periods of high volatility, the initial margin is much higher compared to traditional financial instruments. Thus, at CME and CBOE it exceeds 40%.

Initial margin is charged to sellers and buyers and is intended to protect the broker from the risk of default on the transaction.

Maintenance margin is the amount required in the account to keep a position open in order to avoid triggering a margin call (forced closure of a position by a broker, which entails recording the trader's loss and sharply reducing his balance).

Brokers (such as TD Ameritrade and Interactive Brokers) provide access to the CME and CBOE platforms. These companies can set their own margin requirements, which may be higher than those of the exchange. For example, the American broker E-Trade has set margin requirements for Bitcoin futures at 80%.

There is also the term variation margin . This is the amount of money that represents the profit or loss from open or closed contracts. The final value of the variation margin is calculated based on the results of the trading session.

Bitcoin market participants

Analyzing the features of working with contracts, I note that market participants are not only investors, but directly brokers, traders and the exchange with their own conditions. At the same time, each party has its own benefit, for example, earnings on margin and spreads.

Wanting to profitably buy and sell Bitcoin futures, market participants usually use the contango strategy, when distant futures are more expensive than nearby ones on the calendar grid. Each of the parties has its own instruments of influence, so the market is afraid of massive “shorts” - short deals or contracts worth millions.

What are contango and backwardation?

Until the expiration date, the prices of the contract and the underlying asset tend to differ. As the futures expiration date approaches, the difference in prices decreases.

Suppose that before execution the futures price is higher than the value of the underlying asset. This situation is called contango (English Contango, which literally means “price premium”). In this case, market participants are confident that the price of the asset will rise in the future. Contango can occur, for example, before the block reward halving, on the eve of the possible approval of a Bitcoin ETF or the launch of the Bakkt platform.

If the futures price is lower than the market value of the asset, this is backwardation (from the English Backwardation - “lag”). This means that bearish sentiment prevails in the market.

What does this mean for the blockchain industry as a whole?

There are several possible consequences.

First, Bitcoin is considered a kind of indicative cryptocurrency. Therefore, if the price of BTC rises significantly in a short time, whether due to Bitcoin futures or something else, more people will pay attention to cryptocurrencies. As more people become aware of the cryptocurrency industry, the use of altcoins will increase, pushing their prices higher.

The opposite scenario is also possible: investors may want to sell their altcoins for BTC in order to join the Bitcoin bullrun. A massive exit could lead to a sharp collapse of alternative cryptocurrencies.

It is more likely that strong altcoins like Ethereum, Litecoin and Ripple will follow in Bitcoin's footsteps and also become available through futures once investor interest is strong enough.

How can futures affect the Bitcoin price and the crypto industry as a whole?

Many experts believe that the emergence of Bitcoin futures in the traditional market will contribute to the mass adoption and popularization of cryptocurrencies, as mainstream investors will become less skeptical about cryptocurrencies. This, in turn, can stimulate demand and positively impact price and market capitalization in the long term.

The emergence of traditional financial instruments based on Bitcoin actually means its recognition by regulators as an investment object. The fact that Bitcoin futures are gaining popularity in the heavily regulated and largest American market in the world could serve as an example for financial institutions in other countries. Additionally, in jurisdictions where cryptocurrency trading is prohibited, futures allow you to speculate on the price of the underlying digital assets.

On the other hand, large market participants have the opportunity to open short positions, a large volume of which can put pressure on the price of Bitcoin. However, the top manager of the Chicago Mercantile Exchange (CME), Tim McCourt, believes that futures do not affect the price of Bitcoin, since futures contracts for BTC so far represent only a small part of the market. The famous trader Peter Brandt agrees with him, who is convinced that one should not underestimate the influence on the market from a huge number of small Bitcoin investors.

At the same time, deliverable futures on Bakkt may serve as an additional factor in demand for Bitcoin. In addition, as this market develops, the likelihood increases that the SEC will finally approve exchange-traded funds (ETFs) linked to Bitcoin futures.

There is also an opinion that Bitcoin futures help reduce the volatility of its price.

Be that as it may, the integration of the cryptocurrency market with the traditional one could potentially contribute to the mass adoption of new assets, and hence their long-term growth.

Participation in auctions

Bitcoin futures trading does not have any special secrets or differences. The scenario is the same as when using other trading instruments: in order to make a profit, you need to predict in which direction the Bitcoin rate will change. You make a forecast for a certain period of time and buy a futures contract.

For example, the simplest scheme for using a cryptocurrency contract looks like this: knowing that the price of Bitcoin will rise, today you can buy a two-month futures contract for 10 Bitcoins at a price of $7,100. If your predictions come true, and the value of the cryptocurrency really goes up, all you have to do is keep Bitcoin quotes on the market under control. If the price of Bitcoin rises to $7,500 during the contract's life, you can sell the futures without waiting for the expiration date and earn your $4,000.

You can get such a profit without Bitcoin futures: you just need to actually buy 10 Bitcoins and wait for the quotes to change in the desired direction. But in this case, you will have to operate with the full value of the asset: 10 * 7,100 = $71,000. And when buying Bitcoin futures, you will only need to pay brokerage commissions and make a deposit of 10-20% of the futures amount.

As with any trading instrument, futures trading requires not only basic financial literacy, but also a balanced approach to planning, analysis and attention to detail. You must thoroughly study all the conditions of the exchange, its operating schedule, commission fees, and other trading features of the resource on which you are going to trade.

In order to be able to enter into futures trades, you will need to open a brokerage account, and each exchange independently decides whether it will allow you to trade on its platform or not. Margin requirements are also set entirely by the brokers themselves.

Many trading platforms can protect assets from sudden changes in value in various ways. For example, the CBOE exchange has the following rules for suspending trading when the price of a cryptocurrency begins to change sharply:

- if the price rises rapidly or falls within 10%, then trading will be stopped for 2 minutes;

- if the rate rises sharply or falls by 20%, then the use of the instrument will be blocked for 5 minutes.

Futures prices also have different formations. For example, CME sets prices based on data from cryptocurrency platforms Bitstamp, Kraken, Coinbase Pro and ItBit, and CBOE sets the price of a futures contract based on the rate on the Gemini exchange.

How can you predict the price of BTC based on a futures report?

A futures contract can be concluded for anything - a commodity, securities, currency, including cryptocurrency. They can also be resold to others. At the moment, the crypto market is predominantly content with Bitcoin futures, although it cannot be ruled out that in the future we may also see Ethereum futures. So far, regulators have not approved ether contracts.

At the same time, Bitcoin futures are already trading confidently on the CBOE and CME exchanges. True, these instruments do not imply the actual purchase of Bitcoin with them; all settlements with them are made in fiat. That is, you either win or lose on the difference in the exchange rate in currency equivalent, without receiving real bitcoins in your wallet. And when you buy a futures from someone who entered into it earlier, you are not purchasing Bitcoin, but only a contract for it.

Why should we watch futures?

Now that we know the logic behind entering into futures contracts, it becomes clear why it is important to monitor them. Obviously, if a large number of large players open shorts at the same time, it means that it is worth thinking about a possible imminent drawdown in the market. Conversely, when whales begin to swim in long positions, a reversal can be expected.

Also, by the volumes in which futures are sold or bought, one can assess the level of interest in Bitcoin itself, which can affect the market price of the asset.

Where to look?

Futures reports are regularly published by the Commodity Futures Trading Commission (CFTC), one of the main financial regulators in the United States. That is why, by the way, traders are now left without this tool - as a result of the so-called “shutdown,” the work of the American government is blocked.

Until the government comes to an agreement with President Donald Trump on certain issues, regulators will not be able to continue their work, which means we will not see reports. It's time for those who haven't analyzed them yet to gain knowledge and approach the new report fully armed!

The Commission's reports can be found on the official website of the department. They usually go out on Friday around 3:30 pm ET. On holidays, reports are postponed. In the tab on the link above, we scroll down the page to the list of sites. We need reports in Long format from CME and CBOE.

By clicking on the required format, we will receive a whole list of reports, among which we specifically need Bitcoin (to save time, we look for it through a page search - Ctrl + F). Here's what the latest report from December 18 looks like:

It looks scary, but in reality the meaning of each column is quite simple. Let's go through their list:

Open Interest - the total number of open contracts, each contract is 5 BTC. After it there are positions for which there is data that fits the regulations of the Commission’s report.

Non-Commercial are positions of large players that do not file Form CFTC-40. As a rule, speculators and hedge funds end up here. Let's look at the contents of the section. If we have already become acquainted with the concept of longs and shorts above, then Spreading is something new. This column records overlapping positions from the same market participants.

For example, the same speculator has 100 long positions and 50 short positions open. In this case, the difference in the number of positions will be entered in the required column (50 contracts in this case are included in the long position). At the same time, another 50 long and short contracts will be included in the report as 50 spreading contracts. At the same time, a trader usually opens both short and long positions if he wants to insure against possible losses.

Commercial are official large institutional players that are required to file Form CFTC-40.

Total sums up all positions taking into account spread.

Nonreportable positions are small market players whose data does not fall under the Commission’s standard reporting format. It is ironic that in the vast majority of cases they are deceived in their expectations of the market.

Changes in commitments is the difference in the number of different positions compared to last week. In the above report, for example, we see that institutions closed four longs and a short this week. If spreading increases at the same time, it means that contract holders are not very confident in their position and want to hedge their bets.

Percent of Open Interest - shows the ratio of longs and shorts as a percentage, calculated taking into account spreading.

Below is the number of traders in each category; Spreading includes those players who have both longs and shorts open.

The last lines of the report tell us what percentage of contracts in a particular category are concentrated in the hands of four or fewer traders and eight or fewer traders. This allows us to estimate how fat the whales have become in the market and exactly how many contracts they have gotten their hands on.

How Bitcoin futures contracts work

Bitcoin futures represent an obligation to sell or buy BTC in the future. Here's an example of how it works:

Let's assume that the current Bitcoin rate is $10,000. A trader believes that in the future the price will increase to $12,000. He buys perpetual or quarterly contracts in anticipation of an increase in the rate. Thus, he acquired the obligation to buy BTC at the market price at the end of the contract.

If the rate reaches the level set by the trader, then he will make a profit from the sale of contracts (he can also hold the perpetual futures for some more time if it is obvious that the price will rise further). However, if the rate does not reach the target and falls below the purchase price, the trader receives a loss.

You can buy and sell BTC futures at any time and make money on both downward and upward trends.