The ruble exchange rate (RUB) is the price (quote) of the national currency of Russia in units of other fiat (fiduciary) money of the world , presented as a currency pair on the stock exchange and Forex market.

Where do Russian ruble trading take place on the Forex market?

Main article:

- Participants and place of trading in the Forex market;

- Foreign exchange market of the Moscow Exchange MOEX.

According to the Jamaican currency system, since 1976, the exchange rate of any money in the world for foreign currency is determined on the basis of supply and demand of trading participants on the stock exchange and over-the-counter forex market.

Ruble currency futures are traded

- On universal and stock exchanges , in particular, on the Moscow Exchange MOEX (the former MICEX trades in USD RUB, RUB KZT, HKD RUB, CNY RUB), on BIST (Istanbul Stock Exchange - its listing is TRY RUB), OSE (Oslo Stock Exchange - NOK RUB), GPW (Warsaw Stock Exchange - PLN RUB), PSE (Prague Stock Exchange - RUB CZK), Brasil Bolsa Balcao (Sao Paulo Stock Exchange - BRL RUB), JSE (Johannesburg Stock Exchange - ZAR RUB), etc. .d.

- In the over-the-counter forex market - orders opened by traders to buy or sell from all their STP and NDD accounts, forex brokers are required to automatically display to their Prime broker, and that total (clearing) position to one of the world exchanges);

All platforms for trading the ruble exchange rate are connected to each other by an electronic trading system and the difference in quotes can be only a few kopecks.

What bankers are silent about: why the dollar-ruble exchange rate (USD RUB) is important for the Bank of Russia

Main article and quotes online - see.

- Freely and partially convertible currencies: Masterforex-V dossier

- Status and functions of the world reserve currency

The Russian ruble is a partially convertible currency that can be exchanged for any other official banknotes in the world through one of the reserve or freely convertible currencies (USD, EUR, CNY, GBP, JPY, CHF, etc.) through double exchange:

- first, RUB changes to USD at the current rate;

- then USD to any currency in the world.

As a result, the Bank of Russia provides ruble quotes to more than 100 world currencies , and Russian tourists (exporters, importers, etc.) can pay with bank cards of payment systems (from VISA to Sberbank Online, Contact, Alfa-click, Qiwi, VTB Online) for rubles almost anywhere in the world.

Transfer money via Xe com

To transfer money through Xe com, you must:

- Register an account - on the main page, click the Get Started button, indicate personal data, country of residence, phone number, email address;

- Go through verification – upload a document confirming your identity (driver’s license, passport). Verification takes up to 24 hours, usually about half an hour;

- Specify the details of the transfer – recipient details, amount and currency of the transfer, recipient’s bank account details;

- Pay for the transfer from your bank account.

As a rule, transfers are processed and received throughout the day. You can send money in more than 60 currencies to 170 countries.

How does the Bank of Russia calculate ruble (RUB) cross rates for “today” and “tomorrow”?

- Main article: Cross rate is... definition and recommendations of Masterforex-V.

All ruble cross rates are calculated automatically, according to current stock quotes and market trends. For example, if

- exchange rate USD RUB = 75 rubles per $1;

- exchange rate USD THB = 30.35 Thai baht per $1

- cross rate THB RUB = 2.41 rubles for 1 Thai baht.

Through USD, the Russian ruble (RUB) has almost 150 cross rates to almost all official currencies of the world, including such rare currency pairs as

- RUB-ZMW (ruble to Zambian kwacha exchange rate);

- RUB-RWF (ruble to Rwandan franc exchange rate);

- WST-RUB (Samoan tala to ruble exchange rate);

- RUB-NGN (ruble to Nigerian naira exchange rate);

- RUB-BWP (Ruble to Botswana Pula exchange rate);

- VUV-RUB (Vanuatu vatu to Russian ruble exchange rate);

- RUB-CDF (ruble to Congolese franc exchange rate);

- RUB-KES (ruble to Kenyan shilling exchange rate), etc.

Why does Russia need the dollar? Will the Bank of Russia be able to do without the USD RUB exchange rate?

Main article Gold and foreign exchange reserves

Russian politicians are constantly setting tasks for bankers that it is time for the country to “give up the dollar” and stop “lending interest-free loans to our geopolitical enemy and depending on him.”

In response, Russian bankers are trying to explain as politically correct as possible that something like this... is almost impossible . Why? Because abandoning the dollar threatens numerous difficulties for both the state and the Russians themselves. Specifically:

- All world exports are denominated in US dollars (including Russian - natural gas, copper, gold, oil, gasoline, petroleum, nickel, iron ore, aluminum, electricity, lead, molybdenum, tin, lumber, zinc, steel, fuel oil, palladium, etc. .d.). Is it possible to sell these raw materials for rubles? It’s possible, like in the 90s. through intermediaries in offshore companies, who will be happy to keep hard currency for themselves, and rubles and losses to Russian enterprises. How much will revenues to the Russian budget fall?

- World imports also go through the dollar. The Russian Federation purchases cars, medicines (and their components), sugar, fruits, vegetables, coffee, tea, rubber, etc. You can also buy all this “for rubles” through offshore companies, but it will be much more expensive for obvious reasons.

- Logistics of international transport, tourism, air travel, etc. also denominated in US dollars . Intermediaries will only increase costs.

- Dollars in Russia’s gold and foreign exchange reserves are not “money for a rainy day,” not reserves for the needs of the Ministry of Emergency Situations ; they are money to ensure the current solvency of the country and the free conversion of its national currency on the foreign exchange market. Can you do without them? It is possible by refusing the free (and instant) conversion of Russian rubles into 150 world currencies (and vice versa). Does the Russian Federation need this?

- The Bank of Russia is taking some steps to reduce the influence of the US dollar, but it is impossible to completely abandon the dollar (without losses for the Russian Federation). In particular

- the volume of clearing operations with banks in Europe and China is increasing to use the euro and yuan as an alternative (from the dollar) gateway for withdrawing the ruble to the forex market;

- the share of gold reserves in the gold and foreign exchange reserves of the Russian Federation is growing annually;

- cross rates of the ruble (without the participation of the dollar) are traded on the stock exchanges of Moscow, Warsaw (against the zloty), Prague (against the Czech crown), Johannesburg (against the rand), Dubai (against the UAE diham);

- part of the foreign trade turnover with Kyrgyzstan and Kazakhstan is in Russian rubles;

- Attempts to abandon the US dollar carry political risks , as evidenced by the experience of the USSR, Yugoslavia, Cuba, Iran, Iraq (under Saddam Hussein), Venezuela, Libya (under Muammar Gaddafi), Syria, South Sudan, Yemen, North Korea, etc. An important detail: Beijing’s close connection with South Sudan did not protect the country from international embargoes and the devaluation of the South Sudanese pound, the country’s national currency.

- Experience of other countries: the same China blackmails the United States by refusing to use the dollar, but... does not refuse it , increasing its exports and foreign exchange earnings in US dollars.

Russian bloggers and financial sites (such as banki.ru) have a different opinion than Masterforex-V traders : for many years in a row they have been warning that “goodbye dollar” and Russians have “the last chance to exchange dollars for rubles.”

So who is right? The market is always right - see the trend and chart of the USD RUB exchange rate.

History of Xe.com

The company was founded in 1993 as Xenon Laboratories Incorporated. She specialized in providing computer consulting and internet services to businesses. At the end of 1994, the domain name Xe.com was registered, and a year later a currency converter was launched, providing information on exchange rates in real time.

Since 2001, the company has been working in the field of online currency instruments. In 2002, the international money transfer service Xe Trade was launched, which since 2016 has been called Xe Money Transfer. In 2015, Xe com became a subsidiary of Euronet Worldwide, Inc. and merged with HiFX in 2022.

USD RUB exchange rate trend and chart

Main article and online quotes - see USD RUB: online exchange rate chart and forecasts from Masterforex-V .

The USD RUB exchange rate shows how many Russian rubles are worth $1 . The long-term trend of USD RUB is bullish: the ruble has devalued by 278% over 20 years (from 27.3 to 75.9 rubles per $1).

Xe com for business

You can open a free business account with Xe com to make safe and secure international transfers online. The company offers comprehensive solutions, including for managing currency risks (hedging). The system is available to enterprises of any size.

Xe com also provides expanded opportunities in the field of lending:

- Own credit lines;

- Overcoming possible obstacles to the movement of funds related to liquidity;

- Loans for up to 5 years to cover initial and variation margins;

- Partnership programs.

EUR RUB exchange rate trend and chart

Main article and online quotes - see EUR RUB: ruble to euro exchange rate chart online.

The EUR RUB exchange rate shows how many Russian rubles are worth 1 euro. The long-term trend of EUR RUB is bullish: the ruble has devalued by 329% over 20 years (from 27.4 to 90.04 rubles per euro).

What will happen to the USD RUB exchange rate if the US dollar is banned in the Russian Federation

Main article: What are the roots of the devaluation of national currencies? How the US dollar came to rule the world

I have been asking this question to my long-term opponents for 15 years , who argued in 2005 (then in 2008, 2014, 2018, 2022) that the dollar was “about to be banned” and “there is an urgent need to exchange dollars for rubles.” By answering this question, you can easily understand in which currency it is most profitable to store savings (in dollars or rubles) in such a force majeure scenario.

When the circulation of the dollar is prohibited on the territory of the Russian Federation, the ruble instantly devalues (everyone agrees with this), but then a “freeze” occurs (as in a computer) when you explain that

- the “forbidden” dollar can always be exchanged for the euro, Japanese yen, Swiss franc, Chinese yuan and any other freely convertible currency, gold, platinum, etc.;

- The exchange of dollars for rubles will remain on the “black market”. Is it more profitable to exchange dollars for rubles BEFORE the “dollar ban in the Russian Federation” or after it? It turns out that after.

So in which currency is it more profitable for Russians to keep their savings? Correct answer: not in rubles... then which ones exactly?

“Analysts” immediately suggest that savings should be kept in a “currency basket of euros, dollars and rubles . Think about what they are wrong about and is this thesis a “death sentence” for their professionalism in Forex?

Masterforex-V hint: this “currency basket” is missing the 4th currency, which should come first, because Over the past 20 years, it has been growing against both the US dollar and the euro faster than anyone else in the world.

Can the US dollar rise to 100 rubles? And up to 200 rubles. for $1 - traders’ opinion

In 2005, I asked a provocative question to the students of the Masterforex-V Academy - Russians: can the ruble fall to 100 rubles for 1 dollar? The answers were surprising: almost everyone answered that no, “such a collapse is impossible even in theory,” retelling the strengths of the Russian economy, the importance of rising oil and gas prices, etc. as arguments. Only a few agreed that yes, “the USD RUB trend is bullish,” therefore, a devaluation to 29-30 rubles is possible. for $1, “maybe someday up to 32” from the then current 27.7 rubles. for a dollar.

In 2022, I ask a similar question: can a dollar cost 200 rubles? Why not? Read the ABC or the shortest course in technical analysis of trading when entering the 1st grade of the MF School

- trends move ad infinitum until an MF reversal figure of the same wave level that generated the current trend is formed;

- over 15 years of economic growth in the Russian Federation, the ruble devalued against the dollar by 2.74 times... calculate the next “lengthening of the wave” by multiplying the current exchange rate (75.9) x 2.74 = 207.9 rubles. for $1... how much will the process speed up if instead of a 15-year economic recovery there will be a period of stagnation?

Answers to these provocative questions will help traders and investors objectively understand

- in what currency to store savings, saving them from inflation;

- Do you need to learn to understand the logic of financial markets in order to invest savings in other currencies, in securities, in cryptocurrencies, in futures (or physical) gold and other precious metals.

No, if you don’t see any problems and agree with the head of Sberbank of Russia, German Gref, that “you cannot give knowledge to the people” (01/04/2016), consider that these questions do not apply to you.

Xe com system security

Xe com is one of the largest international currency providers, offering services worldwide. The company is part of the Euronet holding, the third largest in terms of money transfers, and a leading ATM service company. Euronet is listed on Nasdaq. The company's activities by the control and supervision authorities FCA and HMRC in the UK.

XE has also obtained a Financial Services License (AFSL) issued by the Australian Securities and Investments Commission (ASIC).

Is German Gref right or wrong in his statement that “you cannot give knowledge to the people”?

What is cynically right about German Gref that “you cannot give the people knowledge” that is available only to a few?

That the majority of people (90%-97%) do not need this knowledge (including about the ruble exchange rate) , because it is convenient for them to look at the financial world through the eyes of the average person, who “can be manipulated” through TV or “independent media” (such as banki.ru, as shown above), bloggers, etc.. These 90% of the population will sell when the pros are already they buy, store savings in rubles (tenge, hryvnia, Belarusian rubles) in Gref’s Sberbank, “investing” their hard-earned savings in mutual funds, which are advertised on TV by their favorite actors from TV series (“who to believe if not them”?). Read more: How do Russian government officials give “forecasts of currencies” and “prices”, and why do they not come true?

These 90% of the population during the USSR “lived like everyone else,” and now they dream of getting into the middle class or strengthening themselves in it , which they are immensely proud of. They

- they bypass Forex (“scam”), without delving into the reasons why and how 90% of previous traders and investors lost deposits on it;

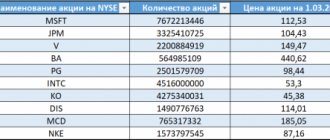

- if they buy shares, then Gazprom or Sberbank, without thinking about the unprecedented losses the owners of Gazprom shares have had over the past 8.5 years;

- if they risk becoming “investors”, they will choose 3000% of the income “from the best Alpari managers” and will be indignant at how the trader lost $30 million on PAMM accounts, and investors... give him more money (look at the profitability chart, would you invest money in this PAMM without MF analysis?);

- They will shrug their shoulders when they find out why successful traders... don’t read analytics? and will continue to watch (read) their favorite “expert”;

- they will not study the fundamental works of Prechter, Neely or Bill Williams (how to increase your trading deposit 20 times in a year?), much less delve into them, studying Elliott Wave analysis and the know-how of MasterForex-V.

- from the “teachers” they will choose someone “simpler” from Yandex.Direct advertising, for example, the same Gerchik (“the wolf from Wall Street!”), not suspecting that out of 1.5 thousand accounts of his students, all 1.5 thousand were drained deposits in 2015-2018 under the Gerchik TS and what is its danger for traders? They won’t even think about why this “wolf” needs naive lambs in his own brokerage company registered offshore?

- they will not purchase cryptocurrencies (“it’s not clear at all”) until they update their historical highs and the pros start selling them.

It is not difficult to understand then Gref’s concern: how then can we live in chaos if 90% of ordinary people receive the “wrong knowledge” and stop being ordinary people and losing their money? How much will the income of the remaining 3%-10% of market participants, including Gref himself, fall? Who then will even open deposits in his Sberbank of Russia if the interest on them does not even cover the losses from the fall in the exchange rate of the ruble against the euro and the Swiss franc?

Comments by Masterforex-V: Gref is worried absolutely in vain . The statistics of 90% of the population who will become “victims of the market” has remained unchanged for decades, regardless of the name of the country, religion or education. A person always has a choice, but most people choose absolutely the wrong road. Why? This is a topic for another discussion.

Do you want to become a pro in the financial markets?

Sources about the Russian economy that determine the long-term RUB trend

According to the fundamental analysis of trading, the exchange rate of the national currency depends to what extent on the economy of a given country. Details can be found in the main materials of Masterforex-V:

- Economy of Russia - gold and foreign exchange reserves of Russia, what is the gold reserve of Russia?, average salaries and average pensions in the Russian Federation, retirement age in Russia over the last 2 years, external debt of Russia, base deposit rate of the Bank of Russia, budget deficit or surplus in Russia?, Moscow — the capital of Russia, the state budget of the Russian Federation, inflation in Russia, calculation of the key rate in the Russian Federation and its impact on the lives of Russians, credit ratings of the Russian Federation from Moody's, Fitch Ratings and Standard Poors, GDP of Russia, unemployment rate in Russia;

- Financial regulators in the Russian Federation : Bank of Russia, Regulations on the Central Bank of Russia and its functions, as well as self-regulatory organizations - RAUFR, NAFD (TsRFIN), FSFM, KROUFR

- Currency of Russia : small change coins of the Russian Federation, the gold standard in Russia, currencies of European countries, banknotes of the Russian ruble, the Russian ruble, is the Russian ruble a reserve currency?, an example of the devaluation of the currency of Russia, is the Russian ruble a freely convertible currency?, the official currency of the Russian Federation and its course, Russian money;

- Exchanges of Russia: SPbMTSB, NTB, MOEX, FORTS, JSC National Commodity Exchange;

- Russian stock market: “blue chips” of the Russian Federation and its stock indices - IMOEX, RTS, MOEXBC;

- Brokers in Russia : PSB-Forex, VTB Forex, Alfa Forex, Finam-Forex;

- Payment systems with online conversion of the Russian ruble (RUB) - Interkassa, VTB Online, Transferwise, VISA, PayOnline, PayPal, HandyBank, Qiwi, Apple Pay, Shopify, Idram, Alfa-click, Contact,

Fondy, Bitpay, Google Checkout, Unistream, Payanyway, Zolotaya Korona, UnionPay, Skrill, Rapida, Payoneer, Stripe, WebMoney, By Moment, MultiCard, Platron, BEST, Neteller, Ecoin, American Express, Payanyway, CardPay, Discover Card, Belcard, Cloudpayments, Yandex.Money, Elexnet, Paysend , RBK Money, Wallet One, Robokassa, Global Payments, Paysafecard, Frisbee, Octopus, Pay-pro, Paymaster, Payza, Payu, ICBC, Paysera, AliPay, Privat 24, Platron, Eccompay, Western Union, Amazon Pay, PayOnline, Google Pay, NixMoney.

Wiki Masterforex-V

API technology from Xe com

Using API technology, Xe com provides:

- World-tested currency exchange rates;

- Easy integration of the Xe com mass payment function into business systems;

- Ease of making international payments by customers directly from the merchant's website.

Business representatives can become referral partners of the system to provide their clients with international payment services, as well as adapt the capabilities of the system to their brand in the White Label program.