Main characteristics of the Chinese yuan

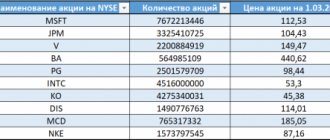

| Main characteristics of the Chinese Yuan by Masterforex-V traders | ||

| 1. | Country of issue | China |

| 2. | National currency | yuan (yuan renminbi) |

| 3. | ISO 4217 code | 156 |

| 4. | Forex ticker | CNY |

| 5. | Change coin (1/100) | Jiao and Fyn |

| 6. | Currency banknotes | 1 and 5 jiao, 1, 5, 10, 20, 50, 100 yuan |

| 7. | Coins | 1, 2, 5 fen, 1 and 5 jiao |

| 8. | Central Bank for Currency Issues | People's Bank of China |

| 9. | Central Bank key rate | 4,35% |

| 10. | Devaluation/revaluation | On the MN and W1 timeframes of the USDCNY chart, there has been a long-term bullish trend since January 2014, i.e. weakening (devaluation) of the yuan against the US dollar. |

| 11. | Financial regulators | CSRC, FinCom |

| 12. | GDP | $14.140 trillion - 2nd place in the world, 2018 |

| 13. | GDP per capita | $19,504 (PPP), 73rd in the world, 2019 |

| 14. | Average salary | $995.5 per month (2019) before taxes |

| 15. | External debt | $6.645 trillion. (2018) or 47% of GDP |

| 16. | Stock Exchange | SSE (Shanghai Stock Exchange), SZSE (Shenzhen Stock Exchange), HKE (Hong Kong Stock Exchange) |

| 17. | Stock indices | SSE Composite, SSE 50, SZI, HSI |

| 18. | Stock market | almost 6,000 ordinary shares (combined across 3 exchanges), as well as stock indices, bonds, depositary receipts, investment funds, currency pairs, ETFs, certificates, warrants, derivatives options, etc. |

| 19. | Stocks - blue chips | BYD, ZTE, Goldwind, Gree Electric, TCL Corporation, Bank of China, Lenovo, Xiaomi, PetroChina, Geely, Sinopec, Industrial and Commercial Bank of China, etc. |

| 20. | Major currency pairs | USD CNY (yuan to dollar rate), CNY RUB (yuan to ruble rate), CNY EUR (yuan to euro rate), CNY JPY (yuan to Japanese yen rate), CNY HKD (yuan to Hong Kong dollar rate), CNY CHF ( yuan to franc exchange rate), CNY INR (yuan to Indian rupee exchange rate), etc. |

| 21. | Famous traders | — |

| 22. | Famous investors | — |

| 23. | Forex brokers | Swissquote, Nord FX, FxPro, FIBO Group, Oanda, Forex club, FXCM, Forex4you, FOREX.com, TeleTrade, ActivTrades, FreshForex, GKFX, Grand Capital, FXOpen, Weltrade, HYCM, LiteForex, Interactive Brokers, etc. |

| 24. | Largest banks | China Construction Bank, ICBC, Agricultural Bank of China, Bank of China, Agricultural Bank of China, Agricultural Bank of China, Agricultural Bank of China, etc. |

| 25. | Payment systems | Alipay, China UnionPay, Tenpay, payEase, 99bill, ChinaPNR, Mastercard, American Express, Western Union, Visa, Scrill, etc. |

| 26. | Commodity exchanges | CZCE - Zhengzhou Commodity Exchange |

| 27. | Commodity futures (export) | rice, barley, corn, wheat, soybeans, soybean oil, soybean meal, live cattle, frozen pork bacon, fattening steers, potatoes, eggs, castor oil, automobiles and electric vehicles, etc. |

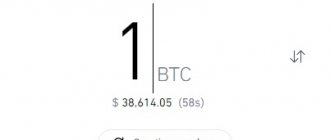

| 28. | Commodity futures (import) | oil, fuel oil, gasoline, liquefied gas, natural gas, computers, industrial machinery and equipment, telecommunications, automobiles, food, feed and beverages, services |

| 29. | Cryptocurrencies | regulation from 2022, crypto is a virtual good, which means it is subject to value added tax, profit tax, income tax, and capital gains tax. Popular cryptocurrencies are: Bitcoin Cash, Ripple, Tezos, NEM, BTC, Ethereum, EOS, OmiseGO, Litecoin, Ethereum Classic, Monero, Binance Coin, Bitcoin Satoshi Vision, TRON, NEO, IOT, Cardano, Zcash, Stellar, DASH, LINK , Dashcoin |

Hieroglyphs and symbols denoting money

The abbreviations CNY or RMB are not often used on price tags attached to Chinese goods. What currency comes to mind when you see the ¥ symbol? That's right, Japanese yens are also designated, so the symbol is often used not alone, but together with the Latin letters CN: CN¥.

In addition to the Latinized symbol, the inhabitants of the Middle Kingdom use their own hieroglyph: 元. It is written separately or, like the previous symbol, together with the abbreviation: CN元. This hieroglyph has many meanings, the main one being “head”. It’s not for nothing that they say that “money is the boss of everything.” This hieroglyph is already the third in the history of the designation of banknotes. It is quite simple to write, as it consists of only 4 lines. His predecessor had 10, and his progenitor had 16 traits. Both denoted the word "round", as a nod to the fact that round currency units were used.

What are the reasons for the growth of China's economy and the stability of the yuan?

Analysts note that the growth of the Chinese economy to the second largest GDP in the world (and the first in terms of GDP PPP) is based on such factors as the presence of an “army” of cheap labor, the undervaluation of the yuan, the opening of access to the market in exchange for technology, the stability of the political system, a sharp increase in exports.

Instead of “shock therapy” for Eastern European countries (liberalization of foreign trade and exchange rates, liberalization of prices, privatization of state-owned enterprises), China is following the path of “gradualism”—the gradual introduction of reforms. As a result, China's development dragged on for many decades.

- Strong growth of the Chinese economy since the 1980s. occurred only after the abandonment of the communist model in the economy. Economic growth began from a very low base - before the start of Deng Xiaoping's reforms, China was not so much a poor, but simply a poor country, which for many years has given low costs to Chinese goods.

- Since 1994, the yuan exchange rate was fixed at 8.27 yuan per dollar (this rate lasted until 2005) - such a low rate helped stimulate exports and gave another competitive advantage to Chinese goods.

- In the 90s, China opened access to its market for foreign corporations in exchange for technology, which gave impetus to the transition from sewing cheap clothes (often just counterfeit) to the production of high-tech devices both under global brands and under Chinese logos (already the whole world knows the brands ZTE, Baidu, Lenovo, Xiaomi, Huawei, Haier, Geely, BYD, Gree, etc.).

- The authorities' policy is manifested in stimulating exports - tax, credit, customs and other preferences are offered to such firms: as a result, private firms provide more than two-thirds of the country's total GDP.

- Since 1993, the country has received more than $1 trillion in investment (of which more than $700 billion is foreign direct investment)—China is the leader in this indicator, competing with the United States.

- As a result, GDP growth was an impressive 10% per year (on average , ranging from 16.1% in the 70s to 2.4% in the 90s)

- The refinancing rate of the Bank of China for commercial banks remains at 4.35% in yuan, which slightly reduces the development of the real sector of the economy.

- The government maintains a balance between exports and imports

- exports $2.5 trillion (2019). Main partners for 2022 - USA 19.25%, European Union 16.43%, ASEAN 12.83%, Hong Kong 12.16%, Japan 5.91%, South Korea 4.37%, India 3.08% , Russia 2.64%

- imports $2.05 trillion (2019). The main partners for the same year are the European Union 12.82%, ASEAN 12.58%, South Korea 9.58%, Japan 8.45%, Taiwan 8.32%, USA 7.24%, India 4.03% , Brazil 3.63%

- External debt is “only” $6.645 trillion. (2018), however, this is less than half of GDP (47%). Compare with Japan - 250.9% of GDP, Italy - 131% of GDP, Portugal - 127%, USA - 105% of GDP, etc.

Difficulties:

- The share of the poor population has decreased several times (if in 1981 there were more than 60% of people living on less than $1 a day in the country, then in the 2000s it was already less than 10%), which automatically removes one of the advantages of exports - the low cost of goods.

- Ineffective investments in infrastructure that are unlikely to pay for themselves - the longest, highest bridges, empty cities with a population of over a million.

- Declining growth rates due to the “trade war” with the United States , the gradual withdrawal of foreign companies from the country, and the government’s decision to reduce the impact of exports and foreign investment on the economy by stimulating domestic consumption.

- The Bank of China is not an independent monetary authority, but is directly subordinate to the government.

When is the best time to trade the USDCNH currency pair?

If you open the chart, you can clearly see periods of activity and periods of calm.

The currency pair's activity periods are from approximately midnight to 13:00 GMT. That is, if we translate this into the language of trading sessions, these are Asia and London. You can easily see this on the chart and compare it with your broker's time. It's pretty clear to see. If you trade this currency pair, then from midnight to 13:00 GMT. Greenwich time can be viewed on the website: greenwichmeantime.com.

As for time frames, I advise you to trade on charts from hourly (H1) and higher. There is no point in going lower. Because if we open the M15 chart, we will see that the situation here is not very beautiful and not very clear.

Plus the spread, if we open a new order, we will see that the account is too large for day trading.

Also, please note that closer to night the spread widens to 10 points, which accordingly excludes lovers of night scalping. It is worth paying attention to the price of the item. It is significantly lower than that of other couples.

For example, let's open an order with a volume of 1.00

Initially we have -3.20 points, the price is now 6.2557 and as soon as the price moves two points:

Profit becomes zero. That is, although our lot is 1.00, the profit has changed only a little. Because the price of one point for one lot is approximately $1. For a 0.1 lot, one point costs approximately 10 cents. For a 0.01 lot, one pip costs a little more than one cent. That is, the cost of a point is 10 times less than, for example, EUR/USD. This is also worth taking into account. If you want to open a position with a lot of 0.1, then open a position with a lot of 1.0 for this pair.

Another very important point, especially for those who trade on daily charts, is swap. The fact is that here it is a noticeable quantity. If you don’t hold trades for more than a week on regular pairs, then you don’t have to pay much attention to this indicator. Because he is very small. In the USD/CNH currency pair, you will have to pay attention to the swap.

Why?

In order to show the swap, I have open buy and sell positions at the same time.

Please note that for purchases the swap is negative. It is equal to approximately 13 points plus for selling short positions. And 13 points minus for buying long positions. Thus, if you hold a purchase for three days and a swap is charged, then automatically the price has changed regardless of whether or not you lose an additional 39 points.

But there is also another side to this coin. If you hold the purchase for 3 days, and the price has not budged, then you will be in the black by 40 points. If you trade on the daily charts or leave the position overnight, then you can proceed in two different ways. Either open only short positions and earn extra money on swaps, or use swap-free accounts, that is, without swaps. There are special types of accounts where there are no swaps, but additional commissions are charged.

Bank of China key rate for the yuan

The next important factor influencing the yuan exchange rate is the key rate of the Central Bank - the Bank of China (this is the percentage at which the Central Bank issues loans to commercial banks). With this percentage, the Central Bank tries to find a “golden mean” between

- low interest rate, which will provide low loans for the national manufacturer (currently in China the key rate is 4.35%). But a low key rate is not beneficial to investors and they withdraw their capital from the country, thereby putting pressure on the exchange rate (the currency devalues);

- a high key rate - which is not beneficial for producers, but beneficial to investors - currency enters the country, the exchange rate strengthens.

For comparison, see the table of key rates of the Central Bank:

| Key rates of the Central Banks of the world on Forex currencies | |||||

| A country | Central bank | Currency and its ticker | Key rate of the Central Bank | Date of entry | Financial regulator |

| Australia | RB Australia | Australian dollar (AUD) | 0.1% | 03.11.2020 | ASIC |

| Great Britain | Bank of England | pound sterling (GBP) | 0.1% | 20.03.2020 | FCA |

| Hong Kong | Hong Kong Monetary Authority | Hong Kong dollar (HKD) | 0.86% | 03.2020 | SFC |

| European Union | European Central Bank | euro (EUR) | 0% | 12.03.2020 | MiFID (EU requirements), ACPR and AMF (France), BaFin (Germany), Consob (Italy), CySEC (Cyprus), MFSA (Malta), AFM (Netherlands), FSAEE (Estonia), CMVM (Portugal), FSMA ( Belgium), CNMV (Spain), FCMC (Latvia) |

| Canada | Bank of Canada | Canadian dollar (CAD) | 0.25% | 27.03.2020 | IIROC |

| China | People's Bank of China | Yuan (CNY) | 3.85% | 04.2020 | CSRC, FinCom |

| New Zealand | Reserve Bank of New Zealand | New Zealand dollar (NZD) | 0.25% | 15.03.2020 | FSCL |

| Singapore | Monetary Authority of Singapore | Singapore dollar (SGD) | 1.26% | 01.2020 | M.A.S. |

| USA | US Federal Reserve | US dollar (USD) | 0.25% | 15.03.2020 | NFA, CFTC, SEC |

| Switzerland | National Library of Switzerland | Swiss franc (CHF) | -0.75% | 12.12.2019 | FINMA |

| Japan | Bank of Japan | Japanese yen (JPY) | -0.1% | 16.03.2020 | JFSA |

| Other European currencies | |||||

| Albania | Bank of Albania | Albanian lek (ALL) | 0.5% | 10. 2020 | FSC Albania |

| Belarus | National Library of the Republic of Belarus | Belarusian ruble (BYN) | 7.75% | 01.07.2020 | ARFIN |

| Bulgaria | Bulgarian People's Bank | Bulgarian Lev (BGN) | 0% | 2.01.2020 | FSC Bulgaria |

| Bosnia and Herzegovina | Central Bank of BiH | Convertible Mark (BAM) | 2.88% | 02.2020 | Central Bank of BiH |

| Hungary | National Library of Hungary | Hungarian forint (HUF) | 0.6% | 02.2020 | HFSA Hungary |

| Gibraltar | Treasury of Gibraltar | Gibraltar pound(GIP) | 0.25% | 05.2020 | Treasury of Gibraltar |

| Denmark | National Bank of Denmark | Danish krone (DKK) | -0.6% | 09.2020 | DFSA Denmark |

| Iceland | Central Bank of Iceland | Icelandic krona (ISK) | 2.75% | 03.2020 | FSA Iceland |

| Moldova | National Bank of Moldova | Moldovan leu (MDL) | 2.65% | 06.11.2020 | Licensing Chamber |

| Norway | Norwegian Bank | Norwegian krone (NOK) | 0% | 7.05.2020 | NFSA |

| Poland | National Bank of Poland | Polish zloty (PLN) | 0.1% | 07.2020 | PFSA/KNF |

| Russia | Bank of Russia | Russian ruble (RUB) | 4.25% | 08.2020 | Bank of Russia (until 2013, Federal Financial Markets Service) |

| Romania | National Bank of Romania | Romanian leu (RON) | 1.5% | 05.08.2020 | A.S.F. |

| North Macedonia | People's Bank of the Republic of North Macedonia | Macedonian dinar (MKD) | 2% | 05.2020 | National Library of Macedonia |

| Serbia | People's Bank of Serbia | Serbian dinar (RSD) | 1.25% | 11.2020 | National Library of Serbia |

| Ukraine | National Bank of Ukraine | Ukrainian hryvnia (UAH) | 6% | 12.06.2020 | NCCPF |

| Croatia | Croatian People's Bank | Croatian kuna (HRK) | 2.5% | 09.2020 | HANFA |

| Czech | National Bank of the Czech Republic | Czech crown (CZK) | 0.25% | 11.2020 | CNB |

| Sweden | Bank of Sweden | Swedish krona (SEK) | 0% | 12.02.2020 | (FSA Sweden) |

| Forex currencies in Asia | |||||

| Azerbaijan | Central Bank of the Azerbaijan Republic | Azerbaijani manat (AZN) | 7% | 19.06.2020 | MBA |

| Armenia | Central Bank of the Republic of Armenia | Armenian dram (AMD) | 4.25% | 15.09.2020 | Ministry of Finance |

| Afghanistan | Yes Afghanistan Bank | Afghan Afghani (AFN) | 15% | 03.2020 | Yes Afghanistan Bank |

| Bangladesh | Bangladesh Bank | Bangladeshi Taka (BDT) | 6% | 03.2020 | Bangladesh Bank |

| Bahrain | Central Bank of Bahrain | Bahraini Dinar (BHD) | 1% | 03.2020 | Central Bank of Bahrain |

| Brunei | Brunei Monetary Authority | Brunei dollar (BND) | 5.5% | 03.2020 | UDOB |

| Butane | Royal Monetary Authority of Bhutan | Ngultrum (BTN) | 7.04% | 03.2020 | HLC Bhutan |

| Vietnam | GB of Vietnam | Vietnamese dong (VND) | 5% | 03.2020 | SSC |

| Georgia | National Library of Georgia | Georgian lari (GEL) | 8% | 09.2020 | National Library of Georgia |

| Israel | Bank of Israel | Israeli shekel (ILS) | 0.1% | 05.2020 | ISA |

| India | Reserve Bank of India | Indian Rupee (INR) | 4% | 05.2020 | SEBI |

| Indonesia | Bank Indonesia | Indonesian rupiah (IDR) | 3.75% | 11.2020 | Bappebti |

| Jordan | Central Bank of Jordan | Jordanian dinar (JOD) | 2.5% | 03.2020 | Central Bank of Jordan |

| Iraq | Central Bank of Iraq | Iraqi dinar (IQD) | 4% | 03.2020 | Central Bank of Iraq |

| Iran | Central Bank of the Islamic Republic of Iran | Iranian rial (IRR) | 18% | 03.2020 | Central Bank of Iran |

| Yemen | Central Bank of Yemen | Yemeni rial (YER) | 27% | 03.2020 | Central Bank of Yemen |

| Kazakhstan | National Bank of the Republic of Kazakhstan | Kazakhstan tenge (KZT) | 12% | 17.03.2020 | AFSA |

| Cambodia | National Bank of Cambodia | Cambodian riel (KHR) | 1.46% | 03.2020 | National Library of Cambodia |

| Qatar | Central Bank of Qatar | Qatari rial (QAR) | 2.5% | 06.2020 | Central Bank of Qatar |

| Kyrgyzstan | National Bank of the Kyrgyz Republic | Kyrgyzstani som (KGS) | 5% | 01.2020 | National Library of Kyrgyzstan |

| DPRK | Central Bank of the DPRK | North Korean won (KPW) | n.d. | n.d. | Central Bank of the DPRK |

| The Republic of Korea | Bank of South Korea | won (KRW) | 0.75% | 16.03.2020 | FSC |

| Kuwait | Central Bank of Kuwait | Kuwaiti Dinar (KWD) | 1.5% | 16.03.2020 | Central Bank of Kuwait |

| Laos | Bank of Lao PDR | Laotian kip (LAK) | 4% | 03.2020 | Bank Lao PDR |

| Lebanon | Bank of Lebanon | Lebanese pound (LBP) | 6.75% | 03.2020 | Bank of Lebanon |

| Malaysia | Bank Negara Malaysia | Malaysian ringgit (MYR) | 2.5% | 03.2020 | Bank Negara Malaysia |

| Macau | Macau Currency Authority | Macau pataca (MOP) | 0.86% | 03.2020 | UDOM |

| Mongolia | Bank of Mongolia | Mongolian tugrik (MNT) | 6% | 11.2020 | Financial Regulatory Committee of Mongolia |

| Myanmar | Central Bank of Myanmar | Myanmar Kyat (MMK) | 10% | 03.2020 | Central Bank of Myanmar |

| Nepal | Nepal Rastra Bank | Nepalese rupee (NPR) | 5.5% | 03.2020 | Nepal Rastra Bank |

| UAE | Central Bank of the UAE | UAE dirham (AED) | 1.5% | 03.2020 | Dubai FSA |

| Oman | Central Bank of Oman | Omani rial (OMR) | 2.15% | 03.2020 | CMA |

| Pakistan | State Bank of Pakistan | Pakistani rupee (PKR) | 12.25% | 05.2020 | GB of Pakistan |

| Saudi Arabia | ADO SA | Saudi Riyal (SAR) | 1% | 03.2020 | CMA |

| Syria | Central Bank of Syria | Syrian pound (SYP) | 0% | 03.2020 | Central Bank of Syria |

| Tajikistan | National Bank of Tajikistan | Tajikistani somoni (TJS) | 11.75% | 04.2020 | National Library of Tajikistan |

| Thailand | Bank of Thailand | Thai baht (THB) | 1.25% | 05.02.2020 | Bank of Thailand |

| Taiwan | Central Bank of the Republic of China (Taiwan) | Taiwan dollar (TWD) | 1.13% | 07.2020 | Central Bank of the Republic of China (Taiwan) |

| Turkmenistan | Central Bank of Turkmenistan | Turkmen manat (TMT) | 5% | 01.2020 | Central Bank of Turkmenistan |

| Türkiye | Central Bank of Turkey | Turkish lira (TRY) | 10.25% | 24.09.2020 | C.M.B. |

| Uzbekistan | Central Bank of Uzbekistan | Uzbek som (UZS) | 15% | 04.2020 | Central Bank of the Republic of Uzbekistan |

| Philippines | Central Bank of the Philippines | Philippine Peso (USD) | 4.5% | 11.2020 | Central Bank of the Philippines |

| Sri Lanka | Central Bank of Sri Lanka | Sri Lankan rupee (LKR) | 7.5% | 03.2020 | Central Bank of Sri Lanka |

| Official Forex Currencies in Africa | |||||

| Algeria | Bank of Algiers | Algerian dinar (DZD) | 3.75% | 03.2020 | EFSA |

| Angola | National Library of Angola | Angolan Kwanzaa (AOA) | 15.5% | 05.2020 | National Library of Angola |

| Benin | Central Banks of West African States | West African franc (XOF) | 4.5% | 05.2020 | Central Bank ZAG |

| Botswana | Bank of Botswana | Botswana Pula (BWP) | 4.25% | 05.2020 | Bank of Botswana |

| Burundi | Bank of the Republic of Burundi | Burundian franc (BIF) | 5.25% | 05.2020 | Bank of the Republic of Burundi |

| Guinea | Central Bank of the Republic of Guinea | Guinean franc (GNF) | 11% | 05.2020 | Central Bank of the Republic of Guinea |

| Egypt | Central Bank of Egypt | Egyptian pound (EGP) | 12.25% | 16.01.2020 | COSOB |

| Zambia | Bank of Zambia | Zambian kwacha (ZMW) | 11.5% | 05.2020 | SEC |

| Cameroon | Bank of Central African States | Central African franc (XAF) | 3.25% | 05.2020 | B GCA |

| Kenya | Central Bank of Kenya | Kenyan shilling (KES) | 7% | 05.2020 | Central Bank of Kenya |

| Congo | Central Bank of Congo | Congolese franc (CDF) | 7.5% | 05.2020 | Central Bank of Congo |

| Libya | Central Bank of Libya | Libyan dinar (LYD) | 3.32% | 05.2020 | Central Bank of Libya |

| Mauritius | Bank of Mauritius | Mauritian rupee (MUR) | 2,85% | 05.2020 | Bank of Mauritius |

| Mauritania | Central Bank of Mauritania | Mauritanian ouguiya (MRU) | 6.5% | 05.2020 | Central Bank of Mauritania |

| Madagascar | Central Bank of Madagascar | Malagasy Ariary (MGA) | 9.5% | 05.2020 | Central Bank of Madagascar |

| Morocco | Bank al-Maghrib | Moroccan Dirham (USD) | 2.25% | 03.2020 | AMMC |

| Mozambique | Bank of Mozambique | Mozambican metical (MZN) | 11.25% | 03.2020 | Bank of Mozambique |

| Namibia | Bank of Namibia | Namibian dollar (NAD) | — | 05.2020 | Bank of Namibia |

| Nigeria | Central Bank of Nigeria | Nigerian Naira (NGN) | 13.5% | 05.2020 | SEC Nigeria |

| Rwanda | National Library of Rwanda | Rwandan franc (RWF) | 05.2020 | National Library of Rwanda | |

| Seychelles | Central Bank of Seychelles | Seychelles rupee (SCR) | 5% | 05.2020 | FSA (SC) |

| Somalia | Central Bank of Somalia | Somali shilling (SOS) | — | 05.2020 | Central Bank of Somalia |

| Sudan | Central Bank of Sudan | Sudanese pound (SDG) | 16.5% | 05.2020 | Central Bank of Sudan |

| Tanzania | Bank of Tanzania | Tanzanian shilling (TZS) | 5% | 05.2020 | CMSA |

| Tunisia | Central Bank of Tunisia | Tunisian dinar (TND) | 7.75% | 02. 2020 | Central Bank of Tunisia |

| Uganda | Bank of Uganda | Ugandan shilling (UGX) | 8% | 05.2020 | Bank of Uganda |

| Ethiopia | National Bank of Ethiopia | Ethiopian birr (ETB) | 5.21% | 05.2020 | National Bank of Ethiopia |

| South Africa | South African Reserve Bank | South African rand (ZAR) | 3.5% | 07.2020 | FSCA |

| Forex currencies in Latin America | |||||

| Argentina | Central Bank of Argentina | Argentine Peso (ARS) | 36% | 11.2020 | CNV |

| Bahamas | Central Bank of the Bahamas | Bahamian dollar (BSD) | 4% | 04.2020 | SCB |

| Belize | Central Bank of Belize | Belize dollar (BZD) | 2.3% | 04.2020 | IFSC |

| Bermuda | Parole Bermuda | Bermudian dollar (BMD) | 0% | 04.2020 | B.M.A. |

| Bolivia | Central Bank of Bolivia | Boliviano (BOB) | 2.79% | 03.2020 | ASFI |

| Brazil | Central Bank of Brazil | Brazilian real (BRL) | 2% | 11.2020 | CVM |

| Venezuela | Central Bank of Venezuela | Sovereign Bolivar (VES) | 38.76% | 09.2020 | Central Bank of Venezuela |

| Haiti | Bank of the Republic of Haiti | Haitian gourde (HTG) | 22% | 04.2020 | Bank of Haiti |

| Honduras | Central Bank of Honduras | Honduran Lempira (HNL) | 4.5% | 04.2020 | Central Bank of Honduras |

| Grenada | Eastern Caribbean Central Bank | East Caribbean dollar (XCD) | 0.25% | 04.2020 | Eastern Caribbean Central Bank |

| Dominican Republic | Central Bank of the DR | Dominican Peso (DOP) | 3% | 09.2020 | DFSU |

| Colombia | Bank of the Republic | Colombian peso (COP) | 1.75% | 11.2020 | Bank of the Republic |

| Costa Rica | Central Bank of Costa Rica | Costa Rican colon (CRC) | 2.79% | 03.2020 | SUGEVAL |

| Cuba | Central Bank of Cuba | Cuban Peso (CUP) | 2.25% | 01.2020 | Central Bank of Cuba |

| Mexico | Bank of Mexico | Mexican Peso (MXN) | 4.25% | 11.2020 | CNBV |

| Nicaragua | Central Bank of Nicaragua | Nicaraguan Cordoba (NIO) | 7.2% | 04.2020 | SIBOIF |

| Panama | NB of Panama | Panamanian Balboa (PAB) | 1.36% | 04.2020 | NB of Panama |

| Paraguay | Central Bank of Paraguay | Paraguayan Guarani (PYG) | 1.25% | 04.2020 | Central Bank of Paraguay |

| Peru | RB Peru | Peruvian salt (PEN) | 0.25% | 11.2020 | SBS, SMV |

| Uruguay | Central Bank of Uruguay | Uruguayan peso (UYU) | 9.25% | 11.2020 | Central Bank of Uruguay |

| Chile | Central Bank of Chile | Chilean peso (CLP) | 1.75% | 30.01.2020 | SBIF |

| Jamaica | Bank of Jamaica | Jamaican dollar (JMD) | 0.5% | 03.2020 | FSC Jamaica |

Sources for fundamental analysis of the Chinese Yuan

- The economy of China - gold and foreign exchange reserves by countries of the world, countries of Asia, Beijing - the capital of China, nominal GDP by countries of the world, retirement age by countries of Asia, inflation by countries of the world;

- Currency of China - Chinese yuan, banknotes (bills) of China, money of China, exchange rate of the Chinese yuan, small change coins of China, Chinese yuan - the world reserve currency, is the Chinese yuan a freely convertible currency?;

- Financial regulators of China and its exchange rate (CNY) - CSRC - China Securities Regulatory Commission and People's Bank of China (PBC);

- Exchanges of China : Dalian Commodity Exchange, SZSE (Shenzhen Stock Exchange), HKE (Hong Kong Exchange), SSE (Shanghai Stock Exchange);

- Chinese stock market and its stock indices : SSE 50, SZI, SSE Composite;

- Brokers in China: FXCM, FOREX.com, Admiral Markets, HYCM, FXPro, GKFX, EXNESS, FBS, Dukascopy Bank SA;

- National payment systems of China - Bank of China, WeChat Pay, AliPay, UnionPay;

- International payment systems with CNY conversion - Apple Pay, Neteller, JCB, Global Payments, Paysafecard, VISA, Sofort, Wallet One, Mastercard, Western Union, Shopify, Pay pro, etc.

Epilogue

In general, trading the Chinese yuan seems quite interesting and very promising. In Forex, the Chinese Yuan can be predicted quite accurately using both technical analysis and fundamental analysis. In addition, in the latter case, for example, the same PMI production index creates very significant pressure on the economy of the Pacific and Asian regions, which is why the AUD/USD instrument, and not just USD/CNH, can be used to earn money.

Definitely, such a strong economy as the Chinese economy must be taken into account by a Forex trader who is trying to increase his capital and ensure a comfortable existence for himself.

Recommended Brokers for Yuan Trading on the Forex Market

Forex brokers provide the opportunity to open a deposit (trading account) for Forex trading. For more than 12 years, the Masterforex-V Academy has been collecting data and compiling an independent rating of Forex brokers, which is based on more than 30 objective criteria (for example, the size of spreads and swaps, the presence or absence of licenses from financial regulators, the presence of NDD, ECN, STP technologies, as well as PAMM and LAMM accounts, whether hedging or scalping is allowed, whether there is a large variety of financial instruments, whether there is access to stock, futures, cryptocurrency, foreign exchange and commodity exchanges.

Below are just 12 “best forex brokers” of the major league and another 20 reserve companies from the 2nd league (out of more than 400 brokers present on the market).

| № | Broker name, year founded | Financial instruments | Licenses from financial regulators | ||||

| Currencies | Goods | Stock market | Cryptocurrencies | PAMM | |||

| Major League | |||||||

| 1. | NordFX (2008) | + | + | + | + | + | CySEC, MiFID |

| 2. | Swissquote (1996) | + | + | + | + | — | FINMA, FCA, SFC, Dubai FSA |

| 3. | Dukascopy (1998) | + | + | + | — | — | FINMA, FCMC |

| 4. | Alpari (1998) | + | + | + | + | + | ARFIN |

| 5. | FxPro (2006) | + | + | + | — | — | FCA, CySEC, FSB, Dubai FSA, BaFin, ACPR, CNMV |

| 6. | Interactive Brokers (1977) | + | + | + | — | — | NFA, CFTC, FCA, IIROC |

| 7. | Oanda (1996) | + | + | + | — | — | NFA, CFTC, FCA, IIROC, MAS, ASIC |

| 8. | FXCM (1999) | + | + | + | + | — | FCA, BaFin, ACPR, AMF, Dubai FSA ,SFC, ISA, ASIC, FSB |

| 9. | Saxo Bank (1992) | + | + | + | — | — | Danish FSA, Consob, CNB, ASIC, MAS, FINMA, JFSA, SFC Hong Kong |

| 10. | FOREX.com (1999) | + | + | + | + | — | NFA, CFTC, FCA, ASIC, JSDA, MAS, SFC |

| 11. | FIBO Group (1998) | + | + | + | + | + | CySEC |

| 12. | FINAM FOREX (1994) | + | — | — | — | — | Bank of Russia |

| Second League | |||||||

| 13. | Forex Club (1997) | + | + | + | + | — | ARFIN |

| 14. | TeleTrade (Teletrade) (1994) | + | + | + | + | — | ARFIN |

| 15. | ActivTrades (2001) | + | + | + | + | — | FCA, SCB |

| 16 | FreshForex (Fresh Forex) (2004) | + | + | + | + | — | — |

| 17. | eToro (eToro) (2007) | + | + | + | + | — | ASIC, FCA, CySEC |

| 18. | FortFS (2010) | + | + | + | + | + | IFSC Belize |

| 19. | (2011) | + | + | + | + | — | ASIC, IFSC, CySEC |

| 20. | BCS Forex (2004) | + | + | + | + | — | — |

| 21. | GKFX (2009) | + | + | + | + | — | FCA, JFSA, DMCC, BaFin, AMF, AFM, Consob, CNMV, , CNB, NBS |

| 22. | NPBFX (Nefteprombank) (2016) | + | + | + | + | — | — |

| 23. | Admiral Markets (2001) | + | + | + | + | — | ASIC, FCA, EFSA, CySEC |

| 24. | Grand Capital (Grand Capital) (2006) | + | + | + | + | + | — |

| 25. | RoboForex (Roboforex) (2009) | + | + | + | + | + | CySEC, IFSC Belize |

| 26. | FinmaxFX (2018) | + | + | + | + | — | CROFR, VFSC Vanuatu |

| 27. | FXOpen (2005) | + | + | + | + | — | FCA |

| 28. | Forex Optimum Group Limited (2009) | + | + | + | — | — | — |

| 29. | EXNESS (Exness) (2008) | + | + | + | + | — | FSA Seychelles |

| 30. | HYCM (1989) | + | + | + | + | — | FCA, CySEC, CIMA, Dubai FSA |

| 31. | Alfa Forex (Alfa Bank) (2003) | + | — | — | — | — | Bank of Russia |

| 32. | Forex4you (Forex fo you) (2007) | + | + | + | + | — | FSC BVI |

Sincerely, wiki Masterforex-V, free (school) and professional training courses Masterforex-V.

How to decipher the price of a product

What currency is RMB (or CNY)? Whatever currency is indicated on the price tag, only yuan and its components will be accepted as payment. The monetary unit of the People's Republic of China is non-standard, since it is divided not into one hundred parts, but into ten: the yuan consists of 10 jiao, in turn, the jiao is divided into 10 fen. If the price is indicated as 5.24, it will be announced as: 5 yuan 2 jiao 4 fen.

Local residents often replace these names when communicating. Yuan becomes "kuai" (from the word "piece"), and jiao becomes "mao" (from the word "small part"). Thus, the same amount equal to 5.24 will sound like this: 5 kuai 2 mao 4 fen. In writing, most likely, the following abbreviation will be used: 5.24 RMB. What kind of currency, besides the Celestial Yuan, can boast of so many designations?