Almost every product that has value is sold in some shape or form. After all, we have been investing in natural elements and man-made assets since time immemorial. So when cryptocurrencies like Bitcoin took the world by storm, it was only natural that the investment world would want a piece.

While digital coins are now popular among both retail and institutional investors, there is also widespread skepticism about the legitimacy of cryptocurrencies as an asset class. This kind of skepticism should no longer exist, especially considering some of the major players currently involved in this space.

However, if you want to get into the cryptocurrency investment space, you need a trading platform that can fulfill your orders while also offering reliable resources about the cryptocurrency market.

In this guide, we explore the best cryptocurrency trading platforms of 2022.

Content

Eightcap - an adjustable platform with tight spreads

Our rating

- Minimum deposit is only $250

- 100% commission-free platform with tight spreads

- Free payments using debit/credit cards and e-wallets

- Thousands of CFD markets including Forex, stocks, commodities and cryptocurrencies

Visit Eightcap now

Start your journey to achieving all your financial goals right here.

How to trade cryptocurrencies?

In its most basic form, cryptocurrency trading is an exchange of cryptocurrencies. The way it works is very similar to stock or forex trading, where you speculate on the price of a financial instrument and hope to make a profit from it.

There are many cryptocurrencies available in the market today. However, the two most dominant coins are Bitcoin and Ethereum. Most cryptocurrencies are incentivized by Blockchain technology, and each has different levels of volatility. Their potential is now expected to greatly impact the financial market, opening up investment and trading opportunities for people of all shapes and sizes. sizes.

While the mechanics of cryptocurrency trading may be the same as others, the strategies behind predicting market movements are completely different. This is because cryptocurrency is not affected by actions that affect other trading markets. For example, a country's economic situation can have a significant impact on the US dollar or British pound, but rarely on cryptocurrency.

On the other hand, if you look at factors such as security flaws or legal bans on cryptocurrencies, this could potentially affect the investment status of the coin in question.

Best cryptocurrency exchanges by reliability rating

For any exchange of Bitcoin and other digital coins, the reliability criterion is fundamental. No existing platform can guarantee the safety of client funds. The task of a newcomer to the cryptocurrency market is to carefully study security issues and get acquainted with the rating based on reviews of experts and users. The most reliable exchanges for trading are:

- Binance is a leading platform in terms of stability, trading volume, functionality, and the number of pairs of crypto coins;

- BitMex - since 2014, not a single hack or theft of client funds has been recorded;

- Huobi - to ensure the safety of user data, a special decentralized protection system is used, more than 98% of funds are in “cold wallets” with multi-signature;

- Okex is a Chinese platform, translated into 10 languages and supporting classic and margin trading;

- BitForex is a platform characterized by high turnover, simple registration and does not require mandatory verification.

A factor influencing reliability is the duration of the exchange’s operation in the cryptocurrency market. In this regard, preference should be given to platforms that have been operating for several years and have a positive reputation among users.

What are cryptocurrency trading platforms?

The cryptocurrency trading platform allows the investor to engage in cryptocurrency trading. You can buy and sell these cryptocurrencies by opening an account and making trades. When you know which cryptocurrency you want to trade, you transfer the information to the trading platform and this will make the transaction much easier for you.

An investor can approach cryptocurrency trading in two ways. The first is the purchase of digital currency in its original form. Since cryptocurrency is completely digital, you will store it in your cryptocurrency wallet. Another option is to trade using CFDs, which allows you to go long or short on the cryptocurrency of your choice without taking ownership.

Since cryptocurrency trading is still relatively new to the investment sector, you will find that not all trading platforms are regulated. This is especially true if you want to invest in cryptocurrencies and acquire the underlying asset in the most accurate form. So, if you are ready to trade cryptocurrencies via CFDs, then there is no shortage of trading platforms licensed by regulatory authorities such as the FCA and CySEC.

Similar to how a traditional brokerage system works, you will need to pay fees and commissions on your chosen trading platform. This depends on the trading platform, as well as the scale of your investment. However, it is not that difficult to find trading platforms that offer zero commissions on trades along with a competitive commission structure.

Exchanges for trading futures (options)

A derivative is a contract, in order to fulfill the terms of which one user undertakes to transfer cryptocurrency to another within a certain period and at a certain price. When trading derivatives, traders do not own the underlying asset itself, but make money on changes in its market rate and provide risk hedging.

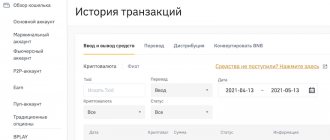

Contract trading interface on the BitMEX exchange

Most often, when trading contracts, leverage is used, which can significantly increase possible earnings, but in the event of an unsuccessful transaction, losses also increase significantly.

Futures are contracts for the sale/purchase of an asset in the future at an agreed price. Futures can also be perpetual, meaning they can be sold at any time. Options differ from futures in that they do not oblige the trader to buy a specified asset, but give the right to do so.

Examples of cryptocurrency futures exchanges:

Get a 10% discount on trading fees on Binance using the code “ CRYPTOSLIVA ” or by registering using this link

- Binance Futures

- FTX.COM

- Deribit

Why should you trade on cryptocurrency trading sites?

Although direct buying is available in the cryptocurrency arena, there are more benefits to choosing a CFD trading site. First, many of these trading sites give you access to other assets as well. So, if you want to try your luck in cryptocurrency while still trading other financial instruments, you can choose a trading site that covers both bases.

Here are some of the benefits of trading with a cryptocurrency CFD broker:

- Gain access to the cryptocurrency trading industry

- Ability to open both long and short positions using CFDs

- Open 24 hours a day

- Various payment methods available

- Easy registration process

- Competitive fee structure

- Choosing to work with regulated investment platforms

On the other hand, cryptocurrency trading is still considered risky. If you don't have in-depth knowledge of both cryptocurrency and the investment industry, making a profit can be quite difficult. There are also the occasional security breach that could significantly impact broader cryptocurrency prices, so keep that in mind.

First of all, since some parts of the industry are not regulated, it is imperative that you stick to trading platforms that are licensed by the first tier authorities.

Top Cryptocurrency Exchanges by Trading Volume

Trading volume characterizes the popularity of the platform and the opportunity for active trading. At the end of 2022, the top 10 exchanges are as follows.

| No. | Exchange name | Trading volume for 24 hours, $ million. | Year of foundation |

| 1 | Binance | 341500 | 2017 |

| 2 | Coinsbit | 82333 | 2018 |

| 3 | Bithumb | 60684 | 2014 |

| 4 | ZB | 51274 | 2017 |

| 5 | Coinbase Pro | 50283 | 2012 |

| 6 | Huobi | 45681 | 2013 |

| 7 | BigOne | 41604 | 2017 |

| 8 | Poloniex | 38627 | 2014 |

| 9 | UpBit | 35784 | 2017 |

| 10 | BKex | 33183 | 2018 |

Types of Cryptocurrency Trading Platforms

In the previous section, we mentioned two different approaches that investors can use to invest in the digital currency space - traditional ownership and CFD trading.

Below we discuss these two approaches in more detail.

Ownership of cryptocurrencies

Traders can always buy and own cryptocurrencies to trade them later. Investors look at the long-term trend in the market, hoping that the price will rise in the future. Although cryptocurrencies are only 11 years old, they have taken a positive direction to rise in value many times over.

In this case, you agree to 100% ownership of the asset and store it in your personal wallet. As long as they remain in your wallet, the collapse of the trading platform will not affect you. However, private wallets are always vulnerable to hacking, so you need to take extra care in protecting your assets.

Experts recommended storing cryptocurrency in a hardware wallet. While this is safer, it can make the process of transacting with Bitcoin a little more complicated. If you hope to trade frequently, you need a better alternative that is more efficient.

Trading cryptocurrencies through CFDs.

Most cryptocurrency trading platforms allow you to trade cryptocurrency without actually owning the coins. Contracts for difference (CFDs), better known as CFDs, allow you to trade assets by paying the difference in price when opening and closing the contract.

Cryptocurrency CFDs are relatively expensive, but they come with the ease of trading at the click of a button. By using CFDs, investors only speculate on the value of the coins, rather than owning them.

For example, let's say you're speculating on Bitcoin and you're feeling bullish. Instead of buying a coin with the intention of selling it for a profit, you simply invest in the coin and expect the price to rise. One of the significant benefits of using CFDs is that you can also short sell cryptocurrencies. Additionally, most regulated cryptocurrency trading platforms encourage trading through CFDs instead of owning coins.

What are the different Bitcoin platforms?

Despite the fact that cryptocurrency exchanges are largely similar in functionality, each of them is unique in one way or another. The main characteristics by which sites are classified:

- Trading instruments . The exchange can be spot or futures. In the first case, it can be used to carry out spot trading - with instant settlement of transactions. In the second case, the main instrument is derivatives - contracts for which settlements are made in the future, within a predetermined time frame. Futures trading allows you to make money on rising and falling prices, even without directly owning the asset. This option is actively used by traders to hedge risks.

- With/without fiat . On most modern Bitcoin platforms you can buy BTC for rubles, dollars or other fiat currency, which is very convenient. If the exchange does not support fiat, then to work on it you will have to purchase cryptocurrency in advance elsewhere, and then top up your exchange account.

- Centralized ( CEX) and decentralized ( DEX) . The former are managed by a single server through which all operations take place; such sites also store user funds and often collect confidential information about participants. Decentralized exchanges are limited to providing functionality for matching trade orders through which assets are exchanged. Users store their funds independently, using an external wallet. DEX allows you to work anonymously without providing information about yourself.

- With and without verification . This parameter depends on the extent to which the platform is subject to the regulatory authorities of a particular country in the world. Regulators set rules aimed at combating money laundering, terrorist financing and other illegal activities. To do this, they require information about the identity of all users and their transactions. A user who wants to use the services of a regulated exchange must undergo verification - a standard KYC (Know Your Customer) check.

In this article, we will look at platforms for buying Bitcoins belonging to different categories. All of them allow you to make money on cryptocurrency in one way or another - both through purchase/sale and through investment instruments.

How to deposit money into cryptocurrency trading platforms?

Until recently, accessing cryptocurrency trading using fiat money was virtually impossible. This was especially difficult with regulated brokers, requiring you to turn to unregulated trading platforms and be prepared to avoid being scammed.

Now that the cryptocurrency industry is taking off, more trading platforms are supporting fiat money and secure payment methods to ease the transition. Just like other trading platforms, having a deposit account will make your trading more convenient. Today, available payment methods include bank cards, local bank transfer, wire transfer and even e-wallets such as Skrill, Paypal and Neteller.

No matter where you are in the world, you can find deposit and withdrawal facilities. However, you may have to pay a small fee to facilitate the transaction. Additionally, some trading platforms also require you to maintain a minimum deposit amount in your account.

List of cryptocurrencies: rates, charts, calendars

CoinMarketCap.com

— quotes, charts, capitalization of the market where currencies and altcoins are traded, issue volume. You can create your own investment portfolio and watch the growth/decline of coins on your PC or from a smartphone application. Perhaps one of the most popular services among crypto investors and traders around the world.

СryptoCompare.com

— list of currencies by capitalization, value, price changes. Like Coinmarketcap, this service allows you to explore data on capitalization, trading volumes and prices of various cryptocurrencies. Here you can also study information about various crypto exchanges, wallets and mining companies.

CoinGeckho.com

— The uniqueness of this service is that here you can analyze the activity of the community in social networks. networks. Shows activity analytics data on communities on Reddit, Twitter and Facebook, data on repositories on Github and statistics on queries in Bing.

TradingView.com

— technical analysis in one click. There are all the necessary indicators for professional traders. There is a notification system and chat. It also has a well-organized system of “blogs” for traders, with the ability to publish their technical analysis. Such graphs are called “ideas”. Users can subscribe to the authors of similar “ideas” and use recommendations in further trading.

DefiPulse.com

is a website that presents the latest analytics and ratings of DeFi protocols. DeFi Pulse tracks the total value of smart contracts for popular DeFi applications and protocols. DeFi is financial instruments in the form of services and applications created on the Ethereum blockchain. The main task of decentralized finance is to become an alternative to the banking sector and replace traditional technologies of the current financial system with open source protocols one code. The main task of decentralized finance is to open up access to decentralized lending and new investment platforms to a large number of people. And allow them to receive passive income from cryptocurrency assets, as well as save on commission fees for transfers, loans and deposits.

ICOstats.com

— this tool allows you to track the capitalization of past ICOs over time. It is a wonderful tool for analyzing past ICOs. Reflects the current status for many cryptocurrency projects in real time. It is possible to compare data in relation to USD, BTC, ETH. Has a comparative chart for various ICOs. Cruptocompare A lot of metadata for all presented cryptocurrencies. There is a free API with unique data.

CroptoWat.ch

— first of all, Croptowatch is an aggregator of various cryptocurrency exchanges — information from a wide variety of platforms is displayed here, including futures for some coins. Most of the tools are presented from the Poloniex exchange. Next in descending order are Bitfinex, Kraken, Bittrex, Quoine, BitMEX, BTC-e, Bitstamp, Bithumb, GDAX, OKCoin, QuadrigaCX, BitFluer, CEX-IO, Qruptos, Bitsquare, Gemini and Luno. It is convenient to view in real time such data as: price, volumes, orders, list of completed transactions. There is an API.

TradeBlock.com

— in general it is positioned as a tool for enterprise traders. It is unique in that it provides many tools for analyzing the Bitcoin and Ethereum blockchain. Provides transaction charts, commissions, block analytics, mempools - all in one place. Plus a convenient calculator for Bitcoin mining, which calculates profitability for 5 years in advance.

Coin.dance

- excellent varied statistics and infographics on Bitcoin in different sections. The service shows data such as: legal status in different countries; trading volumes in different countries, including on Localbitcoins; Google Trends queries for different countries; Bitcoin audience analytics (by gender, age, interests); statistics on mining pools; Comprehensive statistics on blocks and nodes.

Blockchair.com

— powerful search on the Bitcoin blockchain. Allows you to search for all the data in the block that is possible.

CoinCheckup.com

— the site contains much more data than just basic information about cryptocurrencies and their current market capitalization. The website also publishes certain price forecasts that may be useful even if you are already familiar with a particular cryptocurrency. All information is available in the form of a simple and minimalistic interface, which you can customize for yourself.

Coins.live

— a convenient and popular resource for tracking virtual coin rates. The functionality is not limited to just cryptocurrency prices: you can save tokens as bookmarks, maintain an investor’s portfolio, and analyze news from the aggregator for the largest online news publications.

CoinTracker.io

– the service will help you collect all your transactions and commissions in one place. The site automatically pulls data from wallets and online accounts. Among other things, it is possible to track cryptocurrency rates in real time.

ProfitGid.ru

— a page with cryptocurrency rates, where at any time you can find a suitable one in the search, or instantly convert the value into fiat equivalent.

Coinmarketcal.com

— in order to keep abreast of upcoming events on the cryptocurrencies you are interested in, you need to know about this event calendar. Here you will always find out in advance about an upcoming event or fork.

СoinDar.org

— a calendar similar to the first one, with a friendlier design and the presence of a Russian version. But it’s better to keep two sites in your arsenal so as not to miss important news.

CryptoCalendar.pro

— another calendar, choose the one that is more convenient for you.

Fees and commissions on cryptocurrency trading platforms

Crypto traders charge you for their services in the form of commissions. There are different types of commissions that every investor should be aware of before starting a business with a trading website.

This includes:

Spreads

spread is an indirect fee that you will find on the vast majority of cryptocurrency trading platforms. It is calculated as the difference between the purchase price and sale price of the asset. When it comes to cryptocurrencies, the spread should only be considered if you are trading via CFDs.

Let's look at this example.

- You register on the trading platform to invest in cryptocurrency

- You place a purchase order for $50,000.

- The sell order is valued at $51,000.

The spread of this transaction is 2%.

You need to make at least a 2% profit on this trade for it to break even. That's why you need a trading platform that offers tight spreads that won't eat into your profits.

Commission

Depending on the trading platform, you will also have to pay a commission on each trade. Fees are charged on both ends of the transaction, meaning you will have to pay fees on both the purchase and sale. The commission is presented as a percentage and its amount depends on the trading capital.

Consider this case:

- Your trading site has a 1% commission.

- When you buy $100 worth of Bitcoin, you are charged $1.

- When you sell the same Bitcoin for $200, you are charged an additional $2.

As shown, you will pay a total of $3, which is a commission on both the purchase and sale.

Fees for deposits and withdrawals

Some trading platforms also charge investors fees for deposits and withdrawals. In this case, you will have to pay a fee calculated as a percentage of the total amount.

However, it is not difficult to find trading platforms that do not charge deposit fees for transactions. Popular brokers also neglect commission rates, so the first thing to consider is the spread.

What cryptocurrencies can you trade?

There are currently thousands of cryptocurrencies in the digital currency market. They were launched following the success of Bitcoin and are today commonly known as “alt coins.” While altcoins are still considered very volatile compared to Bitcoin, they can also be more difficult to trade.

At the same time, coins such as Ethereum, Ripple and Stellar Lumens are attracting increased attention from investors. These alt coins are also high risk, so you need to be careful in how you speculate on them.

Bitcoin on decentralized exchanges

If you want to trade Bitcoin on decentralized exchanges, then the best choice would be to use stablecoins tied to this cryptocurrency: BTC analogues have already been launched on other networks, for example:

- on the Ethereum blockchain - WBTC;

- also on Ethereum – Huobi BTC (HBTC);

- on the Binance Chain blockchain - Bitcoin BEP2.

By transferring your actual bitcoins into these tokens, you can trade freely using the DEX. At any time, nothing prevents you from making a reverse exchange to the original BTC. Exchanges for trading tokens on ether – Uniswap, 1inch, Pancakeswap, etc.

How to sell cryptocurrency short?

We previously mentioned that short selling cryptocurrencies is possible through CFDs. This simply means that you take a bearish trade on a particular cryptocurrency, hoping to profit from its subsequent decline.

Let's demonstrate how short selling works on the cryptocurrency CFD platform.

- Do you expect Bitcoin prices to decline in the near future?

- You first place a sell order with your broker

- You are selling at a bid of $10,000.

- Bitcoin price fell 2%

- With a bet of $10,000, this gives a profit of $200.

- You place a buy order to take profit and exit the trade.

In a real-life scenario, selling the asset before owning it is not possible. This is where CFDs come into the picture. In other words, by using CFDs, investors do not need to own cryptocurrency in order to sell them first. Rather, you are speculating only on its future price.

Is leverage possible with cryptocurrencies?

There is no getting away from the fact that there are more and more people looking to trade cryptocurrencies such as Bitcoin and Ethereum. With this in mind, cryptocurrency trading platforms have since made leverage available to investors. Again, leverage only applies if you are trading via CFDs.

The amount of leverage available to you depends on your experience as an investor and the policies of the cryptocurrency trading platform you choose. Each country also has its own set of regulations regarding cryptocurrency trading. This will also have a significant impact on how much leverage you can apply. Such rules prevent retail investors from trading large amounts and incurring huge losses.

- Let's say you can trade with 5:1 leverage.

- This means that you can trade with 5 times the amount you have in your deposit account.

- So, if you have a balance of $100, you can trade with a bet of $500 by applying leverage.

- Please note that any profit or loss will also be multiplied by the multiplier you choose.

If you want higher leverage, you can always find unregulated brokers offering them. For new traders, combining leverage and cryptocurrencies can be a deadly combination due to the high risks associated with both. So make sure you learn the ins and outs of risk management before you part with your money!

Spot exchanges

Cryptocurrency spot exchanges are more suitable for beginners and novice traders. The peculiarity of spot trading is that for each transaction, settlements are made at the same moment as it was completed.

Spot platforms support two main types of trading orders, market (market) and limit. Market is suitable for instant purchase or sale at the currently available rate. The limit one allows you to set your own price, as a result of which the order will be closed only when a counter order appears at a similar price.

Creating a limit order on the Binance cryptocurrency exchange

The market is formed by makers and takers. In short, a maker is the one who creates limit orders, and a taker is the one who closes it by creating a market order. Since the maker plays a key role in shaping the market, trading commissions for him are usually an order of magnitude lower or even zero.

Popular spot cryptocurrency exchanges:

- Binance.com

- Coinbase.com

- Kraken.com

- Yobit.com

How secure are cryptocurrency trading platforms?

Cryptocurrency is not completely secure from hackers and therefore investors can never ignore the possibility of losing their money. In previous hacking events, several shopping sites were able to repay their customers. However, this is not the case for every broker in this area.

When you compare unregulated and regulated trading platforms, this is the first factor you should weigh. If you work with regulated platforms, you have a better chance of being protected. If you live in the UK, you are looking for FCA accreditation in Australia ASIC / TASK SPECIFIC INTEGRATED CIRCUIT Cyprus through CySEC. Having a license certainly increases the reliability and reputation of a trading site.

Besides regulation, there are several other features that you should take into account if you decide to use a non-CFD platform. In other words, you are purchasing cryptocurrency in its true form - which means you are 100% responsible for its safety.

Hot and cold storage

You can store your cryptocurrencies in hot or cold storage. Hot storage means your wallet will be connected to the Internet. This will not happen in cold storage. Although hot wallets are more convenient to set up, cold wallets are more secure. You preferably need a trading site that stores your assets in cold storage. This will protect your account from external security threats.

Authentication

Many trading platforms are moving to two-factor authentication. To do this, you need to connect your account to your phone or email and then add another layer of security to your trading account. Typically, you will receive a one-time password on your phone, which you need to enter when logging into the site.

Multisig Wallets

Trading sites that allow investors to have multiple signature accounts will require two or more signatures to access the funds. Depending on the site, Multisig can be used for both withdrawals and deposits.

Data encryption

When using a payment method such as a debit or credit card, you want to look for merchant sites that encrypt your personal information. Since all information stored on a website can be hacked, you should also protect your payment information.

How to start using the cryptocurrency trading platform

For those with any form of trading experience, taking a risk on cryptocurrencies will only mean adding another asset to your portfolio. On the other hand, beginners will probably need a little more help. With that in mind, below we provide a step-by-step guide on how to start trading on a cryptocurrency trading site today.

Choose your shopping site

When you have hundreds of platforms to choose from, it becomes increasingly difficult to determine which broker is right for you. First you need to figure out what features you are looking for and which site best suits your interests. Regardless of your trading style, you need to choose a regulated website and one that offers competitive fees and accessible customer support.

If you need more help, we've listed the best trading platforms of 2022 at the end of the guide.

Register and confirm your account.

To start the trading process, the first step is to open an account on the appropriate website. Typically, you will be required to provide your personal information, including your full name, address, nationality and contact details.

However, in order to start trading, the site must first verify your details. You will be required to provide a valid government issued ID along with proof of address. Some sites accept bank statements for rentals or utility bills as proof of address. Once your identity is verified, you will have full access to the platform and its features.

Add funds to your account.

Every cryptocurrency platform requires trading capital to be deposited into your account. This ensures that the broker can fulfill your orders in seconds. You can add money using one of the payment methods we discussed earlier.

Start trading

Depending on your trading account, you will have access to a range of cryptocurrencies - both in the form of fiat-to-crypto and crypto-to-crypto exchanges. If you have done some technical research, you can start trading right away. All you need to do is select which pair you want to trade and place a buy or sell order.

The amount you trade will be withdrawn from your deposit account and any profit or loss will also be reflected automatically.

Withdrawing coins

If you purchase coins through direct ownership, you will have the option to withdraw the purchased cryptocurrency. Some investors prefer to store coins in site wallets; however, this is not recommended for security reasons.

You must withdraw your coins to your personal crypto wallet. Here are the steps to follow

- Select a withdrawal option on your trading site

- Copy and paste your personal wallet address into the withdrawal section

- Enter the amount you want to withdraw

- Process payment

Cryptocurrencies should be in your account within minutes or hours, depending on the trading platform's processing time.

If you trade via CFDs, the steps are more or less the same, except you don't have the option to withdraw coins. Since you are trading contracts, no coins are exchanged.

AirDrop and faucets: free cryptocurrency!

AirDrop What is it? AirDrop

is a free distribution of cryptocurrency, the so-called “faucets”. When an exchange or coins want to attract users with such a marketing ploy. You can track free coin giveaways on the following sites:

Airdrops.io

— a VPN may be needed if the site does not open.

airdropbob.com

- another service for tracking free distribution of Bitcoin and other coins.

airdropalert.com

— the third service for receiving airdrops and bounties. There are not many coins, but you can receive alerts when they are distributed.