Instructions for choosing a crypto exchange

Below is a list of criteria based on which everyone can choose a reliable cryptocurrency exchange. We will evaluate your reputation, trading conditions, and comfort of working with the exchange.

Reputation and reliability

Complex question, when solving it, do the following:

- Assess the operating life of the cryptocurrency exchange and its reputation . It is desirable that there are no hacks in the history, and if there were, then that clients receive compensation.

- Find out the jurisdiction in which the site operates. The tougher it is, the lower the likelihood of deception and disregard for the client.

- Evaluate the openness of information about offices and teams.

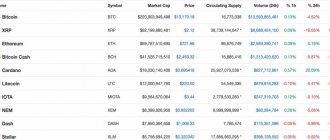

- Trading volume – the higher it is, the better.

- Study reviews , various ratings, for example, on coinmarketcap com. They cannot be the decisive criterion for choosing, but they will indicate the public’s attitude towards the cryptocurrency exchange.

Ideally, the exchange should operate for several years, have no hacks, and have a high rating in the ratings.

I also recommend reading:

IEO on the stock exchange - what is it in simple words? What is the difference from ICO?

The ICO boom occurred in 2022, thousands of new projects successfully sold coins, but most token sales had only […]

Working conditions

Here you will have to take into account not only the conditions of the cryptocurrency exchange itself, but also the expected style of work:

- Verification – it is advisable that the exchange does not force clients to go through it immediately. Basic functionality should be available immediately.

- Fiat currency support.

- Geographical restrictions.

- If you plan to implement advanced strategies, for example, calendar spread trading, then you need platforms that support crypto futures. If you plan to simply speculate on cryptocurrency rates, then a regular exchange will do.

- For margin trading, leverage is required; not all crypto exchanges provide it.

- Commissions – the lower the better. You will feel the influence of this factor as the speed increases.

- Number of supported crypto pairs . For example, Payeer is a good exchange, but it is not suitable for active traders. It simply does not have the abundance of altcoins that, for example, Binance offers.

- Restrictions on replenishment/withdrawal of funds . For example, on the BTCAlpha crypto exchange there is a limit on the withdrawal of funds for unverified traders of $5 thousand per day, but for most traders this limit will not be an obstacle.

Be sure to compare the working conditions with your own requirements.

Trading terminal and work comfort

Here the requirements are:

- There must be a live chart, all indicators and graphical analysis tools are available.

- It is desirable that limit orders and buy stop orders be available.

- Terminal freezing is unacceptable.

- High speed of order execution is desirable.

- The advantage will be the ability to customize the terminal (setting the location of individual elements).

Comfort in general is also important. The location of individual elements should be intuitive; unspoken standards have already been established for their placement.

Bitfinex exchange trading terminal

Additional requirements

We include:

- The possibility of passive income – the availability of staking will be an advantage when choosing a crypto exchange.

- Earn money by lending to other users.

- Having your own Visa or MasterCard.

- Scenarios for using the internal token.

- Incubators for blockchain projects.

- Adequacy of technical support work.

- Full translation of the site into Russian.

None of the above points are considered decisive. But if both exchanges are approximately equal in other indicators, then you will have to compare them according to additional indicators.

I also recommend reading:

The Cup with Handle pattern is a reliable pattern for trend trading

The Cup & Handle pattern is a trend continuation pattern. First used in trade in the 80s […]

Coinbase

Website www.coinbase.com. Coinbase, founded in June 2012, is very large, its investment valuation exceeds $1 billion. It is a wallet and platform for cryptocurrencies. Located in San Francisco, California.

Coinbase combines an attractive interface. The Coinbase iOS app is the most downloaded app in the US and Europe. Allows you to easily deposit/withdraw fiat with a debit card and multiple online wallets. But in Ukraine and Russia there is no such opportunity. There are more than 4,800,000 registered users, including 45,000 merchants and 9,000 developer applications. Works well for European, American and Canadian clients. The company does everything in accordance with the laws and requires that a lot of personal information be disclosed and transferred to the tax service.

Pros:

- The exchange is really easy to use

- Many long-time clients

- Online wallet available

Minuses:

- Much more work required for account verification

Rating of cryptocurrency exchanges in 2022 - from 1st to 7th place

- Binance

- Huobi

- BTCAlpha

- Bitfinex

- YoBit

- Bitmex

- Payeer

1 place

Binance

. An uncompromising option, it takes 1-2 places in most ratings. Hundreds of crypto assets, futures are available, and there are opportunities for passive income.

2nd place

Huobi

. Formally, it is inferior to Binance, but in terms of trading and investment opportunities it can compete with it. It gets second place rather because of its slightly less recognizable brand.

3rd place

BTC

Alpha

. Relatively low turnover is the main problem of the crypto exchange. However, liquidity for popular pairs involving major cryptocurrencies such as BTC, ETH, LTC, etc. is quite good. Withdrawals are fast, verification is not required, and the limit for unverified users is quite high. Thus, here you can confidently trade and make money through speculation on major cryptocurrencies.

4th place

Bitfinex

. The main disadvantage is tedious verification. This cryptocurrency exchange cannot claim first place due to poorer investment opportunities compared to Binance and fees. At the same time, the crypto exchange is included in the pool of leaders, so fourth place is well-deserved.

5th place

YoBit

. An inconvenient terminal and the lack of futures bring the exchange to fifth place, but does not make it bad. Let's note the killer advantage - fiat support and the absence of verification requirements.

6th place

BitMEX

. This site came in 6th place solely because it is aimed more at professionals. The rating is compiled taking into account the requirements of the average trader/investor.

7th place

Payeer

. Formally, this is the final position in the rating, but this is not explained by low reliability or poor trading organization. The problem is solely in the number of supported currencies and the lack of additional earning opportunities.

Loading …

I also recommend reading:

What is a Bitcoin faucet? Bitcoin faucets 2022 that pay

What is a Bitcoin faucet? This question is often of interest to those who are just starting to explore the world of cryptocurrencies. In simple terms […]

Bittrex

Website bittrex.com. The exchange is based and fully regulated in the USA. Comfortable and practically does not freeze. Bittrex is recommended - for traders who trade altcoins, there are quite a lot of them, about 200 trading pairs.

Registration of new accounts is currently suspended. Bittrex is a contender for the throne of the world's largest crypto exchange.

Pros:

- One of the most popular crypto exchangers

- One of the best trading interfaces for mobile and desktop browsers

- Has high volumes and many different pairs for all major altcoins

Minuses:

- Wallets may be disconnected due to rate fluctuations

- Small amounts for withdrawal - within 0.4 BTC per day

The most important parameters

A profitable deal

Among the great variety of exchanges and criteria for their evaluation, reliability

trading Internet resource. No matter what favorable conditions the site offers, if it is not able to ensure the integrity of clients’ funds, it is worth opting for another one.

- Striving to maintain a decent reputation, exchanges are constantly developing and improving the protection of user accounts from hacker attacks and technical problems.

- There are exchanges whose multi-level protection successfully copes with hacking attempts, preventing cases of unauthorized intervention.

You can assess the reliability of a trading resource based on security ratings compiled based on expert opinions and user reviews.

The second important factor for choosing an exchange is the volume of trading operations

. The more of them are produced per unit of time, the more obvious the trust of a larger number of users in the Internet resource becomes and the more successful the prospect of implementing their own trading strategy. With a low turnover, there is no guarantee that anyone will buy the currency put up for sale at the price of interest, or that the asset needed for purchase will not be available.

Information about the size of their trading turnover is posted by the exchanges themselves and analytical Internet resources. But you shouldn’t always trust them blindly; some trading platforms, trying to increase their attractiveness for users, inflate the volume of turnover, reflecting non-existent transactions.

Experienced players will be able to identify such inconsistencies by comparing the information on the order books. Beginners should carefully study data from several credible sources, relying not only on exchange reports.

ProBit

The list of the best crypto exchanges is completed by a newcomer. It appeared relatively recently, but immediately showed itself to be a confident rival for mastodons. Now more than a million users trade crypto here and the database is replenished every day. There are not many coins, but the basic BTC and ETH are represented. There is also its own PROB token, when using which you can receive additional bonuses.

To recruit clients, ProBit arranges promotions with good frequency, although this will definitely appeal to traders with experience. No verification is required, so complete anonymity of transactions is guaranteed.

How to choose an exchange: criteria

When choosing a platform for trading cryptocurrency, a trader is driven primarily by commercial interest. By registering on the trading platform, the user wants to increase his capital. And this is natural! For the exchange to become an additional or even the main source of income, you need to carefully study the lists of platforms and choose the one where it is most profitable to buy and trade currency. In general, there are many selection criteria. We offer the main ones that you need to pay attention to first of all:

- Reliability;

- Trading volume;

- Number of available pairs;

- Amount of commissions;

- Methods for replenishing your account and withdrawing money;

- Timing of operations.

Based on these criteria, we present to you the ranking of the best cryptocurrency exchanges for 2022.

Bitstamp

Website www.bitstamp.net. European and fully licensed exchange, operating since 2011. For those who value reliability.

Good volumes are available for large transactions. Both deposits in Euros and US dollars are accepted. They really focus on being a pure Bitcoin exchange (as of 2022, Bitstamp started adding popular altcoins).

Pros:

- Reliable

- HQ Located in Luxembourg

- Well suited for large transactions, yet easy to use for beginners

Minuses:

- Not available outside the EU and US

CEX

Founded in 2013 as the first cloud computing provider, CEX.IO has become a feature-rich cryptocurrency exchange trusted by over a million users. Although this exchange is smaller than the previous ones, the most important advantage is the ability to withdraw fiat money to a bank card.

CEX.IO offers cross-platform trading via website, mobile app, WebSocket and REST API, providing access to a high-level order book for the leading currency pairs in the market. Instant buying and selling of bitcoins is carried out using a simplified interface package.

Registration of new accounts is currently disabled.

CEX is one of those international Bitcoin exchanges that accept Euros, British Pounds, US Dollars, Russian Rubles, Ethereum, Zcash and Dash. Needless to say, CEX is very popular in these currency regions. There is a simple landing page that gives you the option to buy or sell $100, $200, $500 or $1000 worth of Bitcoin. Good security techniques are available. CEX is a really good alternative to Coinbase that is optimized for beginners.

Pros:

- Bank transfer and credit card deposits

- Very easy to use and great for beginners

- Users know how much they will pay before registering

Minuses:

- Until recently, Litecoin was not registered

Bottom line

Trading on a cryptocurrency exchange

Choosing an exchange is one of the first steps towards mastering the cryptocurrency markets. The more responsible the attitude to the analysis of available information about trading platforms, the more effective further trading and the more likely it is to make a profit from transactions.

In a constantly changing market situation, prompt response to changes becomes the key to success.

To help traders, a huge amount of useful information is posted on the Internet, both from the official websites of exchanges and from exchange analysts, rating agencies, user reviews and experts. Learning to correctly use the information received is a worthy goal for every novice trader.

HitBTC

Website hitbtc.com. Founded in 2013 with €6 million in venture capital, the HitBTC trading platform is known for its advanced matching engine, wide range of blockchain solution support and friendly customer service.

HitBTC is a reliable European platform with multi-currency support. The exchange has markets for trading digital assets, tokens and ICOs and provides a wide range of tools as well as stable uptime. The core-compatible engine is one of the most advanced technology products in its class and provides innovative features such as real-time cleaning. There is a demo mode.

Pros:

- No restrictions on input/output of assets

- Low commission

- High level of security

Minuses:

- Few altcoin pairs

Gemini

Gemini.com. Owned by the Winklevoss Brothers, the world's first Bitcoin billionaires. The BTC futures price is based on this exchange.

A fully regulated, fully compliant New York exchange for both individuals and institutions.

Pros:

- High requirements for capital reserves and compliance standards

- Regulated by the New York State Department of Financial Services and protects the interests and assets of clients first

Minuses:

- It only works in America for now.

Brief information

Bitcoin trading

Today there is hardly a person who has not encountered such concepts as Bitcoin, digital currency and exchanges. Making a profit from the difference in the price of buying and selling assets is the cherished goal of every trader. But not everyone and not always manages to effectively carry out trading operations that generate income.

The purchase and sale of electronic money is impossible without a specialized intermediary - a cryptocurrency exchange, which is an Internet resource through which assets are traded online.

Currently, there are hundreds of such exchanges, providing their own list of services and setting different prices for the same cryptocurrencies. This price difference also gives traders an opportunity to make money, this is called cryptocurrency arbitrage.

The high volatility of digital money and the differences in their value on different exchanges attract traders with the chance to get rich in a short time, but we should not forget about the significant risk of such operations.

An important point for successful participation in trading is the correct choice of a suitable cryptocurrency exchange that provides optimal conditions for a specific client, taking into account his strategy, experience, volume of transactions and other requests.

- For beginners, it is wiser to choose exchanges with a clear and user-friendly interface that allow you to receive maximum useful information, offer training and protect against rash steps.

- Experienced players value trading volume, variety of assets, speed and convenience of withdrawals, up-to-date analytics and efficiency.

On exchanges, both fiat currencies, officially issued and recognized by states, and numerous cryptocurrencies, divided into bitcoin and altcoins, are in use. There are more than 3,000 cryptocurrencies, which are essentially records in databases that are changed only when certain conditions occur.

Large exchanges issue their own cryptocurrencies, such as Binance Coin (BNB), BUSD, BF and others.

GDAX

Website www.gdax.com. GDAX is a trading platform owned by Coinbase.

Great for technical traders and offers good liquidity. Deposits are in US dollars and can be processed very quickly. It is considered to be the best exchange for serious players in this space.

Pros:

- An integral part of the Coinbase brand

- Optimized as a serious shopping site

Minuses:

- More ID processing steps than Chinese marketplaces

- Does not support clients from the CIS

Conclusion:

How many exchanges are there in total? There are hundreds of them. There are also Ukrainian exchanges Kuna.io and BTC-trade.com.ua. They are almost the same, but the first one has a slightly lower commission, but a higher price. Small volumes, low activity.

The largest exchanges are becoming victims of hacking. Bitfinex, Polonix, Bitstamp. That is, no matter what exchange it is, it’s not very reliable. Problems with the law - servers are confiscated. But previous exchanges at least somehow returned the money, but Mt.Gox and Cryptsy did not return anything at all and there were no attempts.

Why is it so important to choose bitcoin trading platforms carefully?

Bitcoin trading on the stock exchange online is a serious and responsible matter. Each platform has its own strengths and weaknesses. The service should be selected based on your current goals. You don’t have to limit yourself to one trading platform. One electronic cryptocurrency exchange can be used for the purchase of crypto coins with a long-term perspective, another for everyday trading, and a third for transactions with less common cryptocurrencies that are not available on other platforms. And then the fourth and fifth can go. There are many options and you are not limited by anything.

When you register on any crypto exchange, you automatically entrust your savings to third parties (service developers). Decentralized platforms are just beginning to emerge. The future is theirs, as they will provide users with complete control over monetary assets (private keys, use of cryptography).

Poloniex

This exchange is the flagship of cryptocurrency trading; its daily turnover reached 68216 BTC / 16999 ETH / 99175891 USDT at the time of publication of the article. These numbers fell approximately twofold due to a reduction in the overall turnover of cryptocurrencies. For example, if in mid-June trading in Bitcoin (BTC) reached 1.3 billion US dollars per day, and in Litecoin (LTC) 1 billion, today this volume has dropped significantly:

The Poloniex cryptocurrency exchange is quite popular due to its simplicity of operation, there are no cluttered columns of rates and options, complex combinations and parameters, you also don’t have to go through full verification (just indicate your full name and country) if you don’t intend to withdraw currency outside the exchange daily in an amount greater than for $2000. If your turnover allows you to exceed this amount, fill in more detailed information about the address, telephone number and identification data.

The exchange allows you to trade a huge amount of cryptocurrency, which makes it popular for investing in digital currencies at the start of their development.

At the same time, the Poloniex exchange has recently had a number of problems; users are increasingly complaining about the blocking of their accounts, the inability to receive confirmation emails in their email accounts, and the temporary blocking of some cryptocurrencies. Thus, for more than a week, users could not carry out operations to deposit Zcash (ZEC), LTC, ETC on the exchange.

The big disadvantage of the exchange is the slow work of technical support, from which you can wait months for a response. This exchange does not allow the withdrawal of rubles or hryvnia.

Poloniex exchange commission depends on the volume of your transactions and ranges from 0.00% if ≥ 120,000 BTC to 0.25% if < 600 BTC.

Kraken

Go – https://www.kraken.com/

Country: USA

Domain registration: 04/03/2000

One of the best crypto exchanges, Kraken, is rightfully one of the old-timers, since its official opening took place back in 2011. Recently, the platform has become very popular, as evidenced by the impressive daily trading volumes - about $300 million. Kraken is constantly improving the interface and monitoring the level of security. The platform is focused on trading fiat and bitcoin, and transactions with other cryptocurrencies are carried out in a smaller volume.

Advantages of the exchange:

- a large number of currency pairs;

- possibility of margin trading;

- several types of orders;

- good exchange rate and high liquidity;

- availability of a corporate program;

- the ability to replenish your wallet with both regular and cryptocurrency;

- API and two-step authentication;

- PGP/GPG data encryption technology;

- excellent reputation;

- operational support service;

- Availability of an application for iOS.

Disadvantages of the exchange:

- confusing interface;

- high transaction fees;

- verification requirement;

- limited language range and the absence of the Russian language.

LocalBitcoins

Go – https://localbitcoins.net

Country: Finland

Domain registration: 06/05/2012

The creators of the LocalBitcoins cryptocurrency exchange in 2012 relied on the platform’s lack of attachment to any region and they were right. The project is developing through social networks – Facebook, Twitter and Instagram. The uniqueness of LocalBitcoins is that cryptocurrency can be purchased at the closest geographical point, since the site helps you find offers by IP address. Since trading takes place on a P2P basis, directly between users, the exchange has a rating system for traders to help avoid fraud.

Advantages of the exchange:

- experience;

- large trading volume;

- wide range of payment options;

- purchase opportunity

- 100% money security;

- user-friendly interface;

- lack of verification.

Disadvantages of the exchange:

- overvalued cryptocurrencies;

- exchange commission is 1%;

- the exchange takes place manually and takes a long time;

- focuses on Bitcoin;

- The possibility of fraud cannot be ruled out.

Bitfinex

Website www.bitfinex.com. This exchange is recommended for trading BTC/USD. The daily trading volume for this pair is $1 billion.

The exchange is convenient. There are many types of orders. There is margin trading. For now, you can register an account only by invite. The exchange was suspected of manipulating rates, as sharp short-term fluctuations were noticed, which led to losses for traders. The exchange is also suspected of heating up the BTC rate.

Pros:

- Convenient for trading

- Large volume on Bitcoin

Minuses:

- Difficult to pass verification

- Difficult to deposit/withdraw fiat