STEX (Russian STEX, short for Stocks Exchange, this is the old name of the site) is a licensed trading platform focused on buying and selling cryptocurrency. The platform provides good trading volumes, speed and liquidity, thanks to the use of several high-frequency trading algorithms. According to information on the official website, the platform was launched by the Estonian private company Etna Development OÜ, therefore, it is subject to the laws of Estonia and the European Union. Fiat deposit and withdrawal methods are supported (USD, RUB, EUR, JPY).

Update : The STEX exchange, at the request of the regulator, introduces mandatory verification for all clients. Check out the list of crypto exchanges without verification.

Official website: stex.com

STEX user funds are stored in both hot and cold wallets for security. The exchange is currently used by more than 300,000 users, who note the time-tested stability of the site, low trading commissions (from 0.05%), as well as the availability of a full set of necessary licenses and a friendly interface.

The list of digital assets on STEX is huge - more than 400 trading pairs with Bitcoin, Ethereum, Litecoin, Tether, etc.

Please note: STEX.com has no relation to another site with a similar name STEX Exchange (domain stex.exchange, but now redirects to trade.50x.com). These are two different cryptocurrency exchanges.

History of the exchange

The exchange began operating in the summer of 2022. At the time of launch, the service was at the testing stage. According to the documentation, the exchange is registered in Estonia.

After the successful launch of the platform, the creators launched a preliminary sale of their coins - ICO. Official sales began in September of the same year. Over the entire period of sales, the company managed to collect 15 million tokens.

ICO sales ended a month later, in November 2022. As a result, the exchange was at the testing stage for 5 months. During all this time, quite a lot of changes and improvements have been made. The developers have equipped the trading terminal with new tools and corrected the load on the servers. Thanks to this, the performance of the platform and trader demand for it have greatly increased.

As a result of all this, the main goal was achieved. Today, Stex autonomously selects offers from similar exchanges and introduces them into its trading system.

The testing phase ended on March 27, 2022. Thus, all the goals that the developers set for themselves were achieved.

Main characteristics

| Official site | https://www.stex.com |

| Social media | |

| Location | Tallinn, Estonia |

| Founder | Nikolay Price |

| Year of foundation | 2017 |

| Deposit/withdrawal method | Cryptocurrency, fiat |

| Available cryptocurrencies and tokens | Ethereum, Litecoin, EOS, Bitcoin Cash, XRP (about 100 coins in total) |

| Number of trading pairs | more than 170 |

| Own token | STEX |

| Commissions | 0.05% - 0.2% on each transaction |

| Languages | |

| Verification | Optional, but reduces trading fees and allows you to interact with fiat currencies. |

| Mobile app | Google Play, App Store |

Home Page Overview

Let's look at the main page of the exchange and determine its capabilities:

- Bidding page:

• Trade – main trading page• Simplified mode – simplified trading section

- Exchange sections:

• Support- User support

• FAQ

- FAQ

• MarketCup

– Information about the exchange on third-party resources: CoinMarketCap, Coinlib, CoinGecko, CoinMarketDaddy, CoinPriceToday

• Launchpad (IEO)

– IEO purchase

• xEURO

– xEURO token page (the most transparent and legally compliant stablecoin, automatically convertible to fiat)

- Login to the exchange / Registration (Sign in / Sign up)

- Partners and advantages of the exchange

- Latest exchange news

- Links to download the exchange application for IOS, Android

- Repeated field for entering the exchange or registering

- The footer of the site contains the following information:

• Name and legal address

• Links to social networks of the project

• Documentation, agreements

• Form for listing (adding your token to the platform)

• Privacy Policy and Platform Use Agreement

• Branding

• API documentation

• Link to the application in Google Play and App Store

Please note that after registration, the Russian language will be available on the platform.

Registration process on the Stex exchange

To register for the service you need:

- On the main page, click on the “Sign Up” button or simply follow the link: https://app.stex.com/register.

- Select a language in the upper right corner, read the terms of the user agreement and give your consent.

- Enter your real email address and create a password.

- If you have a referral, enter the code.

- Confirm your age (21 years old).

- Solve the captcha and click on “Submit”.

- Find the letter that was sent to the specified email address and click on the “Verify” button.

Registration ends here; all that remains is to go to the platform itself, enter your data and start trading.

Account verification

To verify your account you will need:

- Log in to your personal account and open the “menu” tab on the left.

- Find the line “data verification”.

- Select the most convenient verification method from those offered.

The exchange provides 3 verification methods:

- Through the STEX platform itself. In this case, trading commissions will be 0.1%.

- The PrivatBank method provides for similar commission fees - 0.1%.

- The Cryptonomica service offers a commission of 0.05%.

Next will be the verification process, where you will need to indicate your passport details and confirm them.

This procedure will allow the user to reduce trading commissions and start working with fiat currencies. And if you lose your account, restore it using 2-factor authentication.

Technical support

If you encounter a problem that is not described in the FAQ section, you can contact a support agent. The response usually takes several hours. To speed up the solution process, it is advisable to immediately indicate all the data about the problem that may be needed: cryptocurrency, wallet address, TxID, order number, etc.

STEX has a Twitter account, but it's mainly for project news rather than support. In any case, you can go there too. Phone support is not available.

Reviews about the support service are good. Most users say that their issue was resolved efficiently, although not very quickly.

Replenishment and withdrawal of funds

The balance is topped up as follows:

- On your personal account page, you need to select the “Balance” section.

- Select the desired currency and click on “Deposit”.

- A little lower on the page, click on “Deposit Address”.

- Make a payment to the address displayed (it is important to pay in the appropriate currency, otherwise all sent funds will be lost).

On the page you can find all the necessary information about the minimum amount for depositing funds (different for each token).

The platform also provides for replenishment with fiat funds. You can do this in the following ways:

- Dollars ( USD ) – Payeer, Advcash, EPAY, Perfect Money.

- Rubles ( RUB ) – Perfect Money, Payeer.

- Euro ( EUR ) – SEPA, Payeer, Advcash, EPAY, Perfect Money, Rapid, Skrill.

- Japanese Yen ( JPY ) – EPAY.

The conclusion is as follows:

- On your personal account page, go to the “Balance” section.

- Having selected the desired currency, click “Withdraw”.

- Indicate the required address and the required amount.

The minimum amount for withdrawal also depends on the selected currency. Withdrawal is also possible via fiat.

Commissions

On the STEX trading platform, there is no difference between fees for makers and takers. Fixed fee:

- 0.2% of each transaction after registration

- 0.1% after verification through the STEX exchange or PrivatBank

- 0.05% after account verification through Cryptonomica.

This is below the market average of 0.25%.

The withdrawal fee depends on the chosen cryptocurrency or fiat payment system. Thus, when withdrawing Bitcoin, 0.001 BTC is charged; Tether – 0.002 BTC; Ethereum - 0.003 ETH, etc.

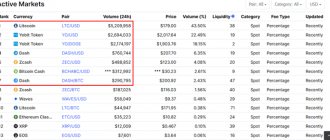

List of tradable tokens

Popular coins on the exchange and trading pairs with the highest turnover:

| Cryptocurrency | Trading pair |

| Litecoin | LTC/BTC LTC/USDT |

| Ethereum | ETH/BTC |

| Bitcoin | BTC/USDT BTC/USD BTC/RUB |

| Ignis | IGNIS/BTC |

| Nxt | NXT/BTC |

| Ardor | ARDR/BTC |

| bitCEO | BCEO/ETH |

| Aidos Kuneen | ADK/USD ADK/ETH ADK/EUR ADK/BTC |

| Revain | R/USDT |

| VestChain | VEST/BTC |

| XRP | XRP/USDT |

How to trade on the stock exchange

On the main page of the service, at the top of the screen there is a “Trade” section, when you click on it, the trading terminal will open.

After which, having topped up your personal account, you can successfully start trading.

Interface

- All currency pairs are located in the lower right corner of the site.

- Next to each is the volume, current price and changes, which greatly simplifies working with the market.

- There is a search bar just above for more convenient use of the tab.

- If you switch to a suitable currency pair, a buy/sell window will open.

“Simplified mode” is also available on the exchange:

Placing orders

In the trading order book located below, you can select “Order Mode”:

- stop limit;

- ordinary.

Then you need to select the desired currency pair and indicate the required number of coins and their price. Next, you need to set your token price or select an existing one. The number of coins can be set manually or all can be set by clicking on the amount in the personal account.

After specifying the amount and price, you should select the action “buy” or “sell”. After which, the placed order will be put up for trading until a client is found. Once a suitable counter order is found, the procedure is completed.

Unfortunately, the exchange does not support margin trading.

Markets PLM AIM SFM PSM

The main task of the London Stock Exchange is to redistribute the assets of companies among investors. If small companies trade with big ones in one place, there will be a commotion. Therefore, within the LSE there are 4 markets for companies with different capitalizations.

Business sharks live in the premium stock market, which is called PLM, or Premium Listing Market. Smaller companies are located on other LSE platforms:

| AIM | Alternative Investment Market | Alternative investment market | Marketplace for new companies that have opted for a simplified listing process |

| SFM | Specialist Fund Market | Professional stock market | Market for institutional investors |

| PSM | Professional Securities Market | Specialized stock market | Trading and exchange of depositary receipts |

In addition to these markets, the London Stock Exchange has secondary platforms for trading various securities: ETFs, bonds, options, and so on.

Safety

The developers took a very responsible approach to the safety of their clients. In addition to two-factor authentication, which can be configured by each user. It provides: authorization via SMS notifications and a registered IP address, which allows you to receive information if the login was made from another device.

A big plus in this matter is the fact that the exchange has never been hacked. For attackers, the biggest difficulty is cloud hosting, which is located in several corners of the globe. Each of the systems is protected by software code; only employees of the organization have access to the platform.

There is also no need to worry about the security of your wallets. After all, even if the site is hacked, access to users’ personal accounts will be blocked, since each of them is protected by a system of “cold wallets” that do not have access to the network.

Thus, the developers have ensured traders’ safety as much as possible. And this exchange can safely be called one of the most secure.

Referral program

To receive a referral link you need:

- In your personal account window, click on the “referral program” button.

- Receive an individual link and code.

If someone enters this data in the appropriate window during registration, then the referrer will receive 25% of the commissions from trading operations carried out by referrals.

The referral program is done quite well. By collecting the required number of active referrals, you can receive stable passive income.

Investment

The developers have provided the opportunity to become an investor and receive passive income. Until April 11, you can buy STE tokens

. The ICO program of the STeX exchange has been launched. Currency holders will receive their share of 100% of the dividends.

The STeX exchange has released 2 types of tokens: A2A and STE. any2any tokens are required for all users planning to trade. The commission size is halved. The deduction occurs from tokens, but not from cryptocurrency.

A good opportunity to make a significant profit. The price of such assets increases many times over. An example of BNB tokens on the Binance cryptocurrency exchange. The initial cost of BNB is 10 cents. The price rose to $10 in a short period of time.

STE tokens entitle you to receive substantial dividends and 10% A2A utility tokens as a gift from STeX. Selling STE is not recommended. This is equivalent to roasting the goose that lays the golden eggs.

What problems can you encounter on the stock exchange?

There are not many problems on the platform itself. However, the biggest one is the lack of margin trading. This fact may stop many potential traders from using the site.

The lesser problem is that access to fiat currencies is only possible after account verification. Not everyone is ready to undergo verification to gain access to this service. This task is made easier by the fact that verification reduces commission fees by almost 2 times, which is nice.