Greetings!

Today I want to talk in an accessible and understandable language about such a concept as margin trading. What are the nuances and pitfalls here? In which markets are margin trading available and what are the risks?

I will show examples of calculations and transactions, and demonstrate real reviews from traders about trading with leverage. And at the end I will show which leverage ratio can be considered acceptable, and which will definitely lead to losses.

Its time to begin!

What is margin and margin trading in simple words

Hurry up to take advantage of the doubling of the tax deduction until December 31, 2022.

Margin trading is a transaction with financial assets that involves the use of borrowed funds provided by a stock market broker or forex dealer on the security of the purchased assets.

In practice, this means that the trader can use more money than he has, but in losses he is limited only by his capital.

Margin is the amount of equity that is required to conclude a transaction with a certain asset with the participation of available borrowed capital.

What is initial margin and minimum margin

The initial requirements for margin trading are the amount of funds required to open a position, taking into account the leverage provided.

The minimum margin, in turn, shows the level of funds upon reaching which the trader’s position can be forcibly closed by the broker at market value, and a loss is recorded.

How leverage works

To determine the principle of operation of margin trading, I will give a simple mathematical example.

If a trader has 10,000 rubles in his account, the broker is ready to provide the client with a leverage of 1:2, then the participant can open a position in the amount of 20,000 rubles.

At the same time, he must be aware that a 50% movement in asset prices in the opposite direction will make him bankrupt. The same principle works the other way around: a 50% movement in quotes into the positive zone will result in the trader’s account doubling.

The role of a broker in margin trading

The broker provides tools and opportunities for margin trading, but, of course, it does not do it for free. Positions opened with borrowed money will be subject to the lending rate.

In this case, the broker excludes the possibility of the client losing the borrowed funds issued to him. To do this, the financial agent monitors the status of traders' accounts and forcibly closes the client's positions if his level of funds approaches the minimum indicators established by the brokerage firm itself.

Why resort to margin trading?

Traders can use margin trading to:

- increase current income from transactions with financial assets;

- hedge the opening of a position.

What does leverage depend on?

The level of borrowed funds provided for trading may depend on the following factors:

- Legislative regulation.

- Liquidity and volatility of assets against which a margin position is opened.

- Qualifications and legal status of the investor.

- Market conditions.

- Other parameters set by a specific broker or exchange.

What is a margin call and when is it placed?

Margin call is a risk limit, after which the broker requires the client to replenish his account with the amount required for collateral or decides to close the client’s positions with market orders.

That is, the broker issues a margin call after the funds in the trader’s open positions fall to the minimum margin level.

Basic Leverage Operations

A trader using margin trading can perform the following operations:

- to purchase an asset (LONG);

- to sell an asset without covering (SHORT).

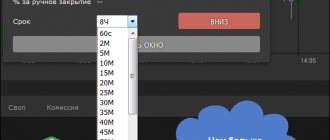

Displaying values in the MT4 terminal

The main platform for Forex is MetaTrader 4. It records margins in aggregate for all positions. To monitor the data, you need to go through several steps:

- Open a deal.

- At the top of MT4, click on the “View” button.

- From the drop-down list, select the line “Terminal”.

- A window will appear at the bottom in which you need to open the “Trade” tab.

Under the orders there is information on the balance and collateral.

Margin data in MetaTrader 4

Example of margin trading on Forex

Lot sizes in the Forex market reach large sizes, often inaccessible to retail investors.

Let's assume that a trader has $1,250 in his account. He believes that the British pound against the dollar (GBP/USD) will rise in the near future and wants to make money on it.

If one trading lot for the pair (GBP/USD) costs about $125,000, then the client needs to use leverage in the coefficient to purchase it:

125 000 / 1 250 = 100 (1:100).

If a trader wants to buy a fractional lot equal to 0.05 of the full size, then he will have enough leverage in the amount of:

125 000 * 0,05 / 1 250 = 5 (1:5).

Moreover, in the first case, the trader will lose all his funds if the price moves against him by 1%, and in the second - if the pound/dollar quotes fall by 20%.

Long position long

Operation long (from English “long, long”) is, in essence, the purchase of an asset. This name indicates that the position can be held for a long time and does not require coverage in the future.

For example, if an investor in the securities market bought a share of a company, he is said to have made a long trading operation.

However, when using margin funds, the position begins to depend on the level of margin and market quotes, which carries additional risks.

Opening a short position

Short (from English - “short”) is a game to reduce an instrument or sell an asset that the investor does not initially have.

This position operates on the following principle. For example, a trader believes that stock prices will decline in the near future and wants to make money on it. Let the current price of securities be equal to 100 rubles.

The client asks the broker to lend him such shares and then sells them on the market at a price of 100 rubles. After some time, the securities really fell in price, now they cost 80 rubles. per piece, then the client goes to the market buys these shares and returns them to the broker. Through such an operation, the trader will earn a profit of 20 rubles.

Another important point is that the broker will agree to lend shares only if the client has enough available funds to cover the position in the future, taking into account the margin trading rates provided to him.

What instruments are available using borrowed funds?

Brokers actively provide their clients with the opportunity to use leverage. This allows them to earn more through trading turnover and receive additional interest for issuing short-term loans.

Brokerage companies provide margin trading on almost all types of financial instruments:

- Blue Chip Stocks;

- Second tier shares;

- OFZ;

- Liquid corporate bonds;

- Long positions on ETFs;

- Currencies;

- Futures;

- Options;

Depending on the situation, some securities may cease to be marginal. Moreover, the same assets may be available for leveraged trading with some brokers and not available with others.

Current requirements can be found on the official websites of brokers. The requirements for margin and cost of margin lending are also indicated there:

- How to trade on the stock exchange for a beginner;

- How to buy shares for individuals - detailed instructions;

- How to make money on stocks - a complete manual;

- How to trade shares on the stock exchange;

- How to make money on the stock exchange;

Client Risk Profile

Clients are divided into classes depending on their risk. Brokers usually divide all clients into three groups:

- CRMS (client with standard risk level);

- CPUR (client with an increased level of risk);

- KOUR (client with a special level of risk);

Naturally, CRMS will provide more opportunities than KOSD.

Examples of calculating the volume of a margin position

For example, an investor has 100,000 rubles in his account for trading on the stock market.

Let's assume that a trader wants to buy the maximum number of shares in his portfolio (risk rate = 17%). Thus, the highest rate for using the securities of this issuer will be calculated as the amount of funds/risk ratio. It turns out:

100,000 / 0.17 = 588,236 rubles.

With an MTS share price of 270 rubles. per piece the maximum number of securities available for purchase by an investor for 100 thousand rubles will be equal to 2,139 pieces. or 213 lots (1 standard lot accumulates 10 MTS shares).

Now I'll complicate things a little and change the portfolio structure. In this case, the investor decided to build his trading from several positions: 100 shares of Lukoil at a price of 5,400 rubles. per piece (risk rate = 17%) and 200 shares of Mvideo at a price of 420 rubles. per piece (risk rate = 50%).

Such a portfolio will be equal to:

100 * 5400 + 200 * 420 = 624,000 rub.

Now I will try to calculate the minimum margin level for this portfolio:

(100 * 5400) * 0.17 + (200 * 420) * 0.5 = 91,800 + 42,000 = 133,800 rubles.

The initial level for margin trading will look like the difference between total assets and the minimum indicator:

624,000 - 133,800 = 490,200 rub.

That is, in order to reproduce the same portfolio for an investor, taking into account the margin trading opportunities provided, you need to have 490,200 rubles in your account.

How to Calculate Margin Using Excel

Let's calculate gross (GM) and net margin (NM) for trading over several periods using an Excel spreadsheet.

| Period | Revenue excluding VAT | Purchase price of goods | Associated costs | Shaft. profit | VM, % | Operating income | Operation expenses | Out of reality. income | Out of reality. expenses | Net profit, thousand $ | World Cup,% |

| I quarter 2019 | 300 | 190 | 50 | 60 | 20,00 | 20 | 15 | 12 | 53 | 17,67 | |

| II quarter 2019 | 360 | 220 | 50 | 90 | 25,00 | 14 | 15 | 11 | 78 | 21,67 | |

| III quarter 2019 | 320 | 240 | 60 | 20 | 6,25 | 17 | 15 | 9 | 13 | 18 | 5,63 |

| IV quarter 2019 | 410 | 300 | 65 | 45 | 10,98 | 18 | 16 | 4 | 15 | 36 | 8,78 |

| I quarter 2020 | 330 | 240 | 60 | 30 | 9,09 | 10 | 16 | 5 | 11 | 18 | 5,45 |

| II quarter 2020 | 370 | 250 | 60 | 60 | 16,22 | 11 | 16 | 3 | 15 | 43 | 11,62 |

| III quarter 2020 | 490 | 310 | 70 | 110 | 22,45 | 13 | 17 | 10 | 16 | 100 | 20,41 |

As can be seen from the table, in the periods from the third quarter of 2022 to the first quarter of 2020, the company operated with minimal profit. This is due to an increase in purchase prices and related costs. Starting from the second quarter of 2022, the situation improved: sales volume and the percentage of trade margins increased, which contributed to the growth of gross and net margins.

Advantages and disadvantages

Among the advantages of margin trading, the following opportunities are worth highlighting:

- Using more funds than the investor has and potentially making large profits from the transactions.

- Earnings on both growth and decline of assets.

- More competent management of existing positions through instrument hedging.

- The ability to provide not only money, but also financial assets as collateral.

The main disadvantages that need to be identified when trading on margin are:

- Increased risks in transactions.

- Payment for the use of borrowed funds.

Risks and pitfalls

First of all, when building your trading, you need to take into account the market risk of losing funds due to price fluctuations.

And here it is important to note that the risk grows in proportion to the amount of leverage provided.

You should also evaluate the risk associated with the credit rate set by the broker for using margin trading services. This applies to a greater extent specifically to the stock market.

For example, this could be a rate of 15% per annum, then the potential profit from the transaction must significantly exceed this value in order for the trader to open a margin position.

Beyond this, the investor must consider simple mathematical truths. For example, having taken leverage in his trading and lost 50% of the account, in order to restore the previous level of funds, he needs to earn 100% of the current capital.

Content

- What is margin in simple words

- How does margin differ from profit and markup?

- Types of margin

- Gross Margin

- Profit margin (net margin)

- Bank interest margin

- Guarantee Margin

- Solvency margin

- Front margin

- Back margin

- Free margin

- Variation margin

- Margin in trading

- What it is

- How to count

- Why is it needed?

- Margin in banking

- Margin on investment

Real reviews

Traders have varying opinions on margin trading. Some see high leverage and active debt management as only opportunity and potential rewards, while others insist on risks and potential losses.

conclusions

Trading with borrowed funds cannot be called evil or good. Depends on how you use the tool. Maximum leverage, an order for half the deposit or more, and the absence of stop losses will quickly take a participant out of the market.

For trading to become profitable, you need to treat it carefully: apply money management, calculate the margin in advance, avoid assets with high volatility and not be greedy when choosing leverage.

Subscribe

New telegram channel to help the novice trader! All the most useful things - every day!

Telegram