Litecoin cryptocurrency

Like most other projects that appeared at the dawn of the crypto industry, Litecoin was just a fork of Bitcoin with a slightly modernized blockchain code. However, in the first two years of its existence, it went from an unknown coin to the holder of the honorary title of “digital silver”.

In addition, Litecoin became the first altcoin whose capitalization reached $1 billion.

☝️

And during the bullish crypto rally of 2017, it was one of the record holders among the top alts in terms of value growth - during the year it increased in price by 90 times (!).

Today, despite the emergence of many more technologically advanced projects on the market, Litecoin still remains one of the most popular cryptocurrencies, as evidenced by its continued presence in the TOP 10 of the CoinMarketCap rating.

- What is Litecoin and the history of its creation

- Team

- Litecoin technology Litecoin hashing algorithm

- Mining

- Transactions

- Litecoin to ruble exchange rate

What is Litecoin and the history of its creation

What is Litecoin

Litecoin (LTC)

is a decentralized payment system; the function of smart contracts, unlike the Ethereum cryptocurrency, has not been developed, i.e. Litecoin is a digital decentralized currency for making secure payments without involving a third party as an intermediary (for example, a bank).

Litecoin was created by former Google employee Charlie Lee. The release of client 0.8.5.1 (the first version of Litecoin) took place on October 7, 2011. The project code was published on GitHub. However, according to Charlie Lee's statements, Litecoin's official birthday is October 13th.

Until 2013, the Litecoin (LTC) cryptocurrency remained a not very well-known alcoin, but in January it showed phenomenal growth - 20 times! By the end of November 2013, the market capitalization of the coin was $1 billion. Litecoin began to be considered as a cryptocurrency that could replace Bitcoin in the event of its depreciation.

Unlike most coins that are created in the last three to four years, LTC tokens were not released through an ICO. Moreover, at the very beginning of the development of the Litecoin cryptocurrency, there was neither a company nor even a team - everything was done by the creator, Charlie Lee.

☝️

Official Litecoin website

Mining LiteCoin

In the Litecoin system, coin mining is much more difficult than in Bitcoin. LTC cryptocurrency cannot be mined using CPU power alone. You will also have to forget about mining through conventional graphics cards: this will not even bring the user to self-sufficiency, not to mention any profit. In addition, so much electricity will be spent that the cost of the coins received will not cover the cost of mining them.

In this state of affairs, the most correct solution for mining coins in the Litecoin system is to use special computer systems (professional farms), which were developed for mining cryptocurrencies. But here, too, the user will encounter a problem: the simplest farm costs at least 2 thousand dollars, and it will take a very long time to pay off. In order for a participant in the system to make a net profit, he will need to use very powerful farms, and they cost several times more than usual. This option for coin mining is more suitable for industrial mining, which is already practiced by a considerable number of companies around the world today. What should ordinary users do? There are two ways for them:

- Rent a powerful farm. Today there are many companies that offer a similar service. One of the most famous is Machoster.

- Join the pool. To do this, you need to have a powerful computer with a high-performance video card and a special miner program, which is available for download on the official Litecoin website. In this program, you need to register in one of the thematic pools and, together with other users, begin to open new blocks.

Due to the fact that the market value of the Litecoin cryptocurrency is quite low, there is a risk of losing more money than gaining. And in general, this coin is not worth enough to spend your savings on buying mining equipment. In this situation, the most correct decision is to simply buy coins.

Team

Litecoin Team

The core Litecoin (LTC) team consists of only a few people:

- Charlie Lee

is the founder and managing director. Born and raised in the African country of Côte d'Ivoire. At the age of 13, he moved to the USA, where he first received a school education and then a higher education in Computer Science. After graduating from university, he worked in various IT companies, and in 2007 he got a job at Google. In 2011 he created Litecoin, and in 2013 he went to work for one of the largest crypto exchanges Coinbase, continuing to support his project. In the summer of 2022, he quits the Coinbase exchange, where at that time he held the post of technical director, in order to fully focus on the development of the Litecoin (LTC) cryptocurrency; - Xinxi Wang

is a member of the board of directors. Singaporean developer and crypto investor. He studied computer science at the National University of Singapore. Doctor of philosophical science. Founder of the Coinnut trading platform. Member of the Litecoin team since April 2017; - Franklin Richards

is a member of the Litecoin board of directors. British developer. Participates in the development of another open source project, Zulu Republic; - Zing Yang

is a member of the board of directors. She received her bachelor's degree from Singapore Management University. Advisor to the open-source project Untitled INC. In the past, she held leading positions in companies such as East Ventures, Temasek.

The project is supported and developed by Litecoin Core, which also includes full-time Litecoin developers and specialists from the Litecoin Foundation. All of them work on the technical development of the project, as well as advertising, marketing and popularization of Litecoin.

Litecoin technology

Technically, Litecoin is a fork of Bitcoin, but Charlie Lee made changes to the code that allowed for faster, cheaper and more secure transactions compared to Bitcoin.

Litecoin hashing algorithm

Litecoin Blockchain

Unlike Bitcoin, which uses SHA-256 to hash information in blocks, Litecoin uses a different encryption algorithm - Scrypt. Its main difference from the previous one is that it is not so demanding on the speed of the computing device as on RAM.

At the initial stages of Litecoin’s development, this feature of Scrypt made it possible to make LTC mining “AISI-resistant” - early miners were excellent at mining coins using central processors and video cards. However, everything changed in 2014 after mining giant Bitmain developed an ASIC miner for Scrypt.

Mining

Consensus in the Litecoin network, like Bitcoin, is achieved through the Proof-of-Work algorithm, i.e. miners solve a complex mathematical problem to generate blocks and receive a reward for this, which simultaneously serves as the issue of new LTC.

☝️

In total, the Litecoin code indicates the maximum number of coins - 84 million (Bitcoin has 21 million).

At the moment, the reward for finding a nonce in the Litecoin network and forming a block is 12.5 LTC. The number of coins received as a reward decreases every 840,000 blocks. Blocks are created every 2.5 minutes, which is four times faster than the Bitcoin network. Emission also occurs four times faster.

☝️

Read the full article: Litecoin mining: methods, how to calculate, profit prospects

Transactions

LTC Transactions

As mentioned above, the Litecoin blockchain is four times faster than Bitcoin, i.e. it is capable of processing one block every 2.5 minutes. The network speed (a metric that indicates how many transactions per second the network can process) is about 56 transactions per second.

However, at the beginning of September 2022, the Litecoin cryptocurrency added support for Lightning Network technology, which improved the scalability of the network and made it possible to send LTC without having to pay a commission. A few months earlier, another soft fork was carried out - Segregated Witness (SegWit), which doubled the block size.

Atomic swaps on the Litecoin network

Another current technology that has been introduced into Litecoin transactions is atomic swaps. At the end of September 2022, the creator of the cryptocurrency, Charlie Lee, announced the successful completion of three cross-chain transactions at once: with Decred (DCR), Vertcoin (VTC) and Bitcoin (BTC).

In addition, Litecoin developers managed to combine the capabilities of atomic swaps and smart contracts for sending transactions, which include certain conditions.

So, Charlie Lee sent 10 LTC, which his partner received only after Lee sent 0.1137 BTC in return.

This was achieved through the use of an atomic swap in combination with a hashed contract that supports the time-locking option (HTLC).

Also watch the video review of this coin, which will allow you to better understand the topic:

Litecoin Cryptocurrency Review

Information

Detailed information about cryptocurrency as of July 19, 2019:

| Name | Litecoin (Litecoin) |

| Ticker | LTC |

| Type | Cryptocurrency |

| Capitalization | $6 073 883 301 |

| Number of transactions per second | 28 |

| Confirmation time for one block | 2,5 |

| Cost | $4,30 |

| Current issue | 62,732,587 LTC |

| Maximum emission | 84,000,000 LTC |

| Consensus algorithm | Proof-of-work |

| Mining algorithm | Scrypt |

| Website | https://litecoin.com/; https://litecoin.org/ |

| Launch year | 2011 |

| A country | Singapore |

| CEO | Charles Lee |

| Blockchain Explorer | https://explorer.litecoin.net/chain/Litecoin |

| https://twitter.com/LitecoinProject | |

| Exchangers | 60cek, Prostocash, Matbea, Baksman, Nicechange, Kassa, Ramon Cash, Platov and others |

| List of exchanges | EXMO, Binance, Crex24, Bitmex, BTC-Alpha, Livecoin, STEX, Currency, DSX, Bitforex, Kucoin, Okex, Cex, Huobi, BitMax, Gate, etc. |

Litecoin rate

LTC market rate

When talking about the Litecoin rate, we usually mean the cost of this cryptocurrency in US dollars or in its digital analogues - stablecoins (USDT, BUSD, TUSD, etc.).

In addition, the Litecoin (LTC) rate can be considered in the context of other popular trading pairs. For example, LTC/BTC or LTC/ETH, where the price is expressed in Bitcoin or Ether.

It should also be noted that Litecoin itself can act as a price-setting currency - altcoins are traded against it on many exchanges. True, such trading pairs are not particularly popular among traders.

At the time of writing (01/24/2021), the Litecoin rate is consolidating near the level of $188.56. Thus, Litecoin is now trading at slightly less than half its ATH ($370), reached in December 2017.

Litecoin rate in dollars (CoinMarketCap)

☝️

You can track the Litecoin to dollar exchange rate in real time on the CoinMarketCap website

Litecoin to ruble exchange rate

The Litecoin to ruble exchange rate can be found on analytical sites (CoinMarketCap, Coingecko), many exchangers and some exchanges that accept ruble deposits (EXMO, YoBit). At the time of writing this material, 1 LTC costs 13,836 rubles.

Litecoin to ruble exchange rate (CoinMarketCap)

It is worth considering that the Litecoin rate is secondary, since the volume of ruble trading in comparison with dollar ones is scanty, which means it is impossible to adequately determine demand based on these data. Therefore, first the Litecoin to dollar rate is determined, then the dollar to ruble rate, and only then the LTC/RUB pair is formed.

The cost of cryptocurrencies on each site is formed independently based on the existing supply and demand ratio. At the same time, even the smallest exchanges try to maintain the dollar exchange rate at the same level as market leaders like Binance.

But with ruble pairs, not everything is so simple. The Litecoin to ruble exchange rate on different sites may differ significantly from the market average due to a lack of liquidity. Therefore, this trading pair may be of interest to those involved in cryptocurrency arbitrage.

☝️

You can track the Litecoin to dollar exchange rate in real time on the CoinMarketCap website

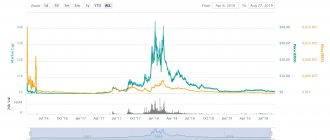

Litecoin rate (graph)

The easiest way to monitor the Litecoin rate is using a graph that clearly demonstrates the ups and downs of this cryptocurrency. At the same time, you can find out not only the current cost of LTC, but also its price at any point in time in the past.

You can find a Litecoin chart on any cryptocurrency exchange that supports trading of this asset or on the websites of online analytical services. For example, this is what the Litecoin price looks like on the CoinMarketCap chart for its entire history:

Litecoin historical chart on CoinMarketCap

On it we see a line expressing the average market values of fluctuations in the value of LTC. If you study the Litecoin rate on the chart of any exchange, the information will most often be displayed in the form of bars or candles demonstrating price changes over certain time periods.

Litecoin (Binance) candlestick chart

The Litecoin chart also has some features that need to be taken into account when studying it:

- LTC first began trading on exchanges in 2013, so there are no charts with its rate before April 13th (although the Litecoin network was launched in 2011);

- There is a strong correlation between digital “gold” and “silver” and, if you compare the charts of Litecoin and Bitcoin on the same CoinMarketCap, you will notice that LTC generally repeats the movements of its “big brother”, albeit with some delay.

Otherwise, the price movements of Litecoin, like any other cryptocurrency, are determined by the current ratio of supply and demand, changes in which are displayed in real time on the chart of the trading platform used for trading.

Features of the Litecoin cryptocurrency

Being a fork of the cue ball, the Litecoin cryptocurrency , as mentioned above, has many characteristics identical to the first virtual ecosystem: anonymity, decentralization, Blockchain technology, open fundamental code, which is posted for public viewing on the GitHub resource, etc. Let's consider the parameters - innovative technologies that highlight the ecosystem, which were first integrated into the digital architecture as an experiment, and subsequently proved their worth and relevance. These include:

- SegWit protocol (Segregated Witness, which in Russian sounds like “separate witness”).

- Lightning Network Layer 2 Protocol.

To understand how the SegWit technology, integrated into the LTC cryptocurrency in the spring of 2022 and reducing the load experienced by the Blockchain by several orders of magnitude, functions, it is necessary to understand the structure of the block. It is divided into two components: the first part contains information about the transfer amount, recipient, sender, and the second contains a code confirming the financial transaction. SegWit aims to output the second half of the block, reducing the transaction size by 48%. This made it possible to place several transactions in one block without increasing the volume of the latter (1 MB), which would inexorably require a hard fork of the ecosystem.

In addition to scalability, the LTC cryptocurrency solved the problem of high fees thanks to the introduction of the innovative development of the Lightning Network - a cross-chain or an additional blockchain located on top of the Blockchain. In the fall of 2022, an exchange between various blockchains was carried out without the intervention of intermediaries in the form of online exchangers and cryptocurrency exchanges: Litecoin and Decree. During this period, the workload of the cue ball was unprecedented; it was necessary to give up to 40% of the total transfer amount in order for the transaction to quickly go to its destination. Somewhat later, at the beginning of 2022, 700,000 LTC was transferred within the ecosystem for only 40 cents. This fact is still mentioned by major financiers and the media.

Important! Mining the LTC cryptocurrency, as well as BTC, is an unprofitable activity even in a pool due to the need to use powerful computing equipment and a large amount of operating memory to “mine” a coin. Real income comes only from the industrial “digging” of a coin using LTC devices specially “sharpened” for mining - ASIC chips (the cost of one starts from 2 thousand North American dollars).

Litecoin wallet

Wallet for LTC

The first thing a future Litecoin owner should do is find a place to store coins. There are usually no problems with choosing a wallet, because... for LTC suitable:

- Hardware wallets - devices ]Trezor[/anchor] or Ledger (the same nano S) are designed to store several hundred cryptocurrencies, including Litecoin. If you have a large amount of cryptocurrency and security comes first, then cold hardware storage is the best option;

- Multicurrency crypto wallets with Litecoin support - these include online services and applications for PCs and smartphones. The coin is supported by Jaxx, Electrum (version of the wallet for Litecoin), Exodus and the same Block.io. You can find reviews of some of the listed wallets on our website;

- The official LitecoinCore wallet is created by analogy with Bitcoin Core and is the only official (!) wallet supported by the Charlie Lee team. To work, you need to download the full blockchain network, but its size is an order of magnitude smaller than that of Bitcoin, so the wallet will work normally even on not the most powerful PCs.

You can also use a service for generating paper wallets (liteadress.org). The site will generate a public and private key, as well as QR codes for quick scanning. Print the wallet and use the received keys to send and receive transactions. However, to perform transactions you will need a user interface in any case, so paper wallets have limited functionality.

☝️

Read the full article: Litecoin wallet: how to create and what options are there

How much is Litecoin (LTC) worth in dollars?

Today, the value of assets, including Litecoin, depends on many factors.

Litecoin (LTC) price in dollars directly depends on the price of Bitcoin. When the BTC rate rises, Litecoin also rises in price. The price of Litecoin is influenced by the following factors.

- Information from communities and developers. When new services, platforms, and software are developed, errors and bugs are eliminated, the digital coin grows accordingly in relation to the American currency.

- News. The Litecoin rate depends on the news background.

- Halving. When blocks are solved, rewards are halved. Accordingly, this affects the exchange rate.

- Regulation of financial enterprises and government agencies. The formation of new legislation in relation to the cryptocurrency market, as well as the work of financial organizations, greatly influence the price of digital currencies.

Most of the coins have already been mined, but for the next few years, Litecoin will be relevant and in demand. Also, this platform will not disappear quickly, since many users use it for investing and making payments.

Where to buy Litecoin

Buying Litecoin

Despite the fact that Litecoin is not the first or even the second cryptocurrency, even the 7th position on CoinMarketCap is enough to buy LTC on various services with virtually no restrictions. Available for purchase:

- Exchangers - on Bestchange you can exchange Litecoin for other major cryptocurrencies or for fiat using payment systems, bank cards or online banking. In general, it is convenient and fast, but the rate may differ from the current one + you need to pay a commission;

- Exchanges - on the same Binance, Litecoin can be bought for fiat currencies, it is also traded in the LTC/ETH pair, and BitMex offers the LTC/BTC pair. The coin can be found on almost any platform, the only question is the number of trading pairs. However, purchasing Litecoin on an exchange requires registration and, as a rule, verification, which is longer and more difficult than through exchangers.

In large cities of the Russian Federation and Ukraine there are also “live” exchangers where you can purchase cryptocurrency for cash, but most of them do not work with altcoins.

Conclusion

Despite the difficulty of mining, Litecoin is successfully traded on all major reputable cryptocurrency exchanges, where it can be purchased for your own investment portfolio. Analysts are convinced that Litecoin will eventually reach the capitalization and value of the Bitcoin. The following determining factors speak volumes about this:

- Limited volume of emissions.

- The experimental use of innovative technologies with the subsequent integration of successful developments into the ecosystem, that is, Litecoin is one step ahead of Bitcoin.

- Popularity among the population (users) - it is known from authoritative sources that LTC has significantly displaced BTC on the darknet, where unauthorized trading of prohibited goods takes place.

The last factor for an investor can be decisive in the question of whether to buy LTC cryptocurrency or not.

Advantages and Disadvantages of Litecoin

Pros and Cons of LTC The

Litecoin cryptocurrency is not much different and basically has the same pros and cons as “digital gold”. But there are several key features of this coin. The advantages of Litecoin are as follows:

Faster block generation and higher security - Litecoin's block generation time is four times faster than Bitcoin's. This allows you to make the network not only faster, but also more secure, since due to the faster formation of blocks, the transaction quickly receives the necessary number of confirmations for its verification. However, compared to other coins, such as the Dogecoin cryptocurrency (which is a fork of Litecoin), which has a generation speed of only 1 minute, “digital silver” lags far behind.

Less monopolization of mining - until 2014, LTC mining was available to ordinary miners, due to the fact that the use of video cards and even central processors was economically justified. However, in 2014, Bitmain released an ASIC that is capable of solving problems using the Scrypt algorithm, which led to a greater monopolization of the mining industry. However, despite this, Litecoin remains much more accessible in terms of mining than Bitcoin, especially given the results of a recent study conducted by the Diar scientific group, which proved that, in fact, Bitmain is the only one who makes a profit from mining.

Lack of pre-mining and large centralization of coins - unlike most modern cryptocurrencies, which go “to the masses” only after an ICO, which implies the need for pre-mining, Litecoin did not undergo the procedure of preliminary coin mining. Thanks to this, Litecoin does not have holders who own a very large percentage of the coins, as happened with other cryptocurrencies. Just a year ago, the creator of “digital silver” himself had a good capital in LTC, but in December 2022, according to his statements, he sold all his coins.

However, there are also disadvantages:

The ability to create smart contracts is undeveloped - like Bitcoin, the Litecoin cryptocurrency is used as a decentralized digital currency, and its blockchain does not allow the creation of functional smart contracts, as can be done with other cryptocurrencies (for example, Ethereum or NEO).

Mining is not profitable for ordinary users - Litecoin mining has become an unprofitable activity for ordinary users who used to mine coins using GPUs or CPUs. Now, due to the massive sale of ASIC miners, LTC mining can only be done with an expensive farm.

Bitcoin is not popular - despite the fact that the Litecoin cryptocurrency uses the same technology as Bitcoin, it is very far from the popularity of the latter. Bitcoin has become synonymous with the words “blockchain” and “cryptocurrency”, and the Litecoin cryptocurrency is just one of the coins in the TOP 10.

How to earn Litecoins?

The three most obvious ways to mine Litecoin are:

Mining on your own equipment

Litecoin appears in the same way as Bitcoin. Miners use computer processing power to generate new coins.

They install a special program on their computer, which turns it into a tool for making money. The computer begins to solve the problem of selecting the correct combination. And if the problem is solved using your computing power, you will receive a reward of 25 coins.

I must honestly say that mining Litecoin on a regular computer alone is absolutely not profitable. The fact is that a huge amount of computing power is involved in mining and the chance that your computer will solve the problem is negligible.

Therefore, miners are united in systems called pools. If one of the pool participants solves the problem, then the reward is distributed among all participants. But this mining method also ceased to be profitable after the Litecoin rate dropped.

The only profitable way to mine Litecoins is industrial mining. For this purpose, special equipment is purchased, which is designed only for mining. This equipment can work both at home and in industrial settings.

If you have free computing power and free or very cheap electricity, then you can try mining Litecoins.

Cloud mining

The idea of cloud mining is that you do not load your equipment with work, but rent computing power and use it to generate Litecoin.

I am suspicious of cloud mining. Because it turns out that it is more profitable for these companies to rent out equipment than to mine coins on it themselves.

So this all reminds me of the gold rush times in the USA. Then the people who served the gold miners earned much more than the miners themselves.

Litecoin Partners

Cryptocurrency Litecoin cooperation

The cryptocurrency Litecoin is quite popular, so it has a number of partners. The most significant and influential of them are the following:

- HTC

, a well-known Taiwanese company, is developing the HTC Exodus blockchain smartphone, which is expected to be released on October 22, 2022. LTC will be one of the available cryptocurrencies on the new device. In addition, Charlie Lee became an advisor to the HTC Exodus project; - Gemini

, an exchange created by the Winklevoss brothers, announced in mid-October 2018 that it was adding LTC to its platform. It is noteworthy that management decided to take this step only after receiving permission from the New York Department of Financial Services (NYDFS); - Robinhood

, a popular American payment platform that claims to have 5 million clients, has added support for LTC; - TapJets

, an American service for booking airline tickets, has added Litecoin as one of the available payment methods for services. The company noted that it considers LTC to be a safe and reliable cryptocurrency; - Aliant Payment Systems

- the company became the first processor for the Litecoin cryptocurrency. Thanks to this collaboration, coin users have reliable and verified payment processing.

Litecoin Forecast

Litecoin Forecast

When Litecoin was trading at $30 at the beginning of 2022, and a trend reversal was observed in the market, it was promised a bright and cloudless future with the achievement of new price records. It was expected that the August halving would play a key role in this.

And the growth really happened - by the end of June, 1 LTC was given $140. But then everything did not go as expected. Repeating the price movements of the main cryptocurrency, the price of Litecoin went into a correction and fell to $78 in less than a month. Then, on the eve of the halving, the rate increased slightly to $105.

Charlie Lee was confident that even with a reward of 25 LTC per block, miners would remain in the black due to rising costs. But immediately after the event (August 5), the Litecoin rate continued to fall, which ended only at the end of the year at $37.

In 2020, when the Litecoin rate rose to $82, the coin was predicted to temporarily decline to $50 and then rise to $100 and above. It was assumed that halving does affect the rate, but only in the long term, since the market needs time to react to the decrease in supply.

However, these expectations were prevented from being realized by the greatest drop in the history of the crypto market - on March 13, the price of Litecoin immediately dropped to $25. This was followed by a 2-week consolidation with a gradual “squeezing” towards the $40 mark.

It was not easy to immediately predict further development. Some saw a bearish figure on the chart, which, if worked out, the price of Litecoin could drop below $20. Others, on the contrary, expected the rate to return to the levels that were before the last fall, that is, at least to $60.

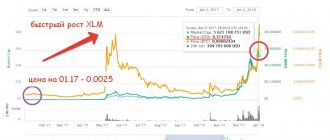

Litecoin price forecast

But after the March spill, the rate of Litecoin, like other cryptocurrencies, not only recovered to the level from which it fell, but also went higher. At the end of December 2022, the cryptocurrency was trading above $135, and in February 2022 a local high of $247 was recorded:

Litecoin rate 2020-2021

In 2022, there are high hopes for Litecoin in terms of growth. One of the reasons is the presence of this coin in the fund of the largest crypto asset management company Grayscale.

The first target for Litecoin is $300, which will ensure further growth and renewal of the historical maximum of $370. To do this, Bitcoin must be in a stage of active growth.

If we take into account the fact that during previous growth cycles Litecoin showed growth of 3000-8000%, which allows us to predict growth to a conditional $5,000 at the peak.

But if we look more realistically, in 2022 the maximum price of Litecoin may be at the level of $1,000-$1,200, provided that Bitcoin consolidates above $50,000.

For a more complete Litecoin forecast for 2022 and the long term, see the video below:

Litecoin forecast 2021