Nasdaq 100 is called one of the main US stock indices. Nasdaq- 100

index is considered high-tech, this is due to the fact that representatives of the financial sector are excluded from the basket, and the main contribution is made by technology companies.

Otherwise, the development approach is standard - a modified capitalization-weighted index, including the hundred largest companies listed on Nasdaq. Along with the S&P 500, it is one of the largest US stock indices. From this article you will learn:

- A brief excursion into history

- Composition of the Nasdaq 100 basket

- Calculation formula

- Stock selection criteria

- How to Invest in the Nasdaq 100

- Conclusion

A brief excursion into the history of the Nasdaq 100

The National Association of Dealers (NASD) launched the Nasdaq 100 at the end of January 1985. The Nasdaq 100 was the second technology index, formally led by the NYSE ARCA Tech 100 Index, which was launched in 1982. The starting value of the Nasdaq index was set at 100 points.

The developers deliberately decided to make the Nasdaq 100 a technology index; for this purpose, the financial sector was excluded from the basket. At the initial stage, only American companies were included in the basket, but since 1998 the rules have been relaxed and now the Nasdaq 100 can also include securities of foreign companies.

The basket contains companies such as Amazon, Apple, Microsoft and other giants. This explains the impressive capitalization; at the end of 2022, the index's capitalization exceeded $15 trillion .

Due to the active growth of the IT sector, the TR version in the period from 2008 to 2022 overtook the S&P 500 TR in terms of profitability by almost half. This discrepancy is explained by increased demand for technology stocks in the past decade.

Early on, the Nasdaq 100 was more vulnerable. So, after the dot-com crash, quotes fell by about 6 times, and it took about 14 years to recover. This is the main drawback of the index - it is not diversified enough and is critically dependent on the growth of the high technology sector.

There are other indices in the Nasdaq family:

- Nasdaq 100 Financials - Focuses on financial companies.

- Nasdaq Composite.

- Nasdaq Biotechnology.

There are also standard subtypes of the basic Nasdaq 100 - Total Return (reinvestment of dividends is taken into account) and Net Total Return (dividends are also reinvested, but taking into account the payment of taxes). This is the same Nasdaq 100, the basket and the methodology for calculating quotes do not change, there is always a 100% direct correlation between the listed versions.

Interesting facts about the index

Between the first peak of the NASDAQ index and the second, almost 17 years of development passed, entire new industries appeared, many technologies went from elite to mass, however, the coefficient took a long time to recover. The 2008 crisis had its say here too.

NASDAQ is expanding into Europe. The first attempt to buy the London LSE was blocked, but the acquisition of the Swedish OMX made it possible to seize a bridgehead in the Old World.

What affects the price

The price depends on the general world market conditions and the state of the American market in particular. However, the NASDAQ is based on companies registered in the United States. The coefficient reacts to the dollar exchange rate, political events, statements of significant persons, and fundamental indicators of the economy.

Analyst forecast and prospects

Corrections and downturns are inevitable both over the years and over shorter periods - days or weeks.

But in general, the growth of the NASDAQ index is undeniable, just as there is no doubt about the progress of technology and the development of human civilization. After all, it is precisely advanced achievements and their penetration into everyday life that largely reflect the performance of the NASDAQ indices.

Similar indexes

NASDAQ in its fluctuations correlates well with other American ratios:

- Dow Jones;

- S&P

The explanation here is simple: these numbers consist of a large number of indicators of American companies. The fall or rise of several shares cannot have a strong impact on the movement of the index itself; this requires global changes. That is why these indicators are so important in assessing the overall economic situation in the United States and the world.

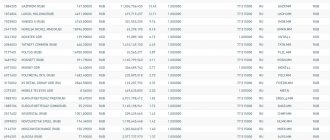

Composition of the Nasdaq 100 basket

Nasdaq 100 composition proves tech sector dominance:

- If we evaluate individual companies, the combined weight of Apple, Amazon and Microsoft exceeds 30%. It is thanks to this trio that the index’s steady growth in the second half of the 2010s was ensured.

- In total, the technology sector accounts for more than 50% of the basket. Formally, the composition includes both the healthcare sector and the telecommunications sector, but their shares are small and they do not greatly influence the quotes.

The composition of the basket is not fixed; it will be removed if they no longer meet the requirements. One thing remains unchanged - the number of components; it corresponds to the digital index in the name Nasdaq 100. The full list of companies included in the index is available on the provider’s website.

The basket formation approach has been criticized. Developers were unable to cope with the overheating of the index amid the sharp growth of the high-tech sector. Because of this, it was necessary to intervene in the calculation of quotes several times in the past. In 1993 and 1994 The index provider manually reduced quotes in an attempt to cope with overheating due to the accelerating growth of the IT sector.

Calculation formula

Uses standard formula for capitalization-weighted indices

The following notations are used:

- t – the point in time when the Nasdaq 100 quote is calculated.

- Shares Outstanding – number of shares issued.

- SharePrice – cost of 1 share.

- k is a correction factor used to convert the stock’s quotation currency to the US dollar.

- Divisor – divisor.

Nasdaq 100 quotes are recalculated every second, quotes are available in real time.

I also recommend reading:

How to choose stocks to invest in? 19 indicators for evaluating companies

Investing differs from trading in terms of planning horizon. In short- or medium-term trading, the trader is not interested in the price of securities in a few years, […]

Stock selection criteria

The document on the methodology for compiling the index specifies a whole set of requirements that securities applying for entry into the Nasdaq 100 basket must meet. Below is a brief overview of these criteria:

- The basket may include ADRs (American Depositary Receipts), ordinary shares and so-called tracking stocks (a type of shares issued to subsidiaries).

- A US company must be listed on the Nasdaq Global Select Market/Nasdaq Global Market.

- Non-U.S. companies must have options traded on U.S. exchanges or at least meet the requirements to do so.

- Only non-financial companies are considered.

- For at least 3 calendar months, the average daily volume of shares traded must not fall below 200,000 shares. The month in which the basket is revised is also taken into account.

- Shares must be traded on one of the following markets: Nasdaq Global Select Market, Nasdaq Global Market/Nasdaq Capital Market, CBOE BZX, NYSE. Securities must be traded on this platform for at least 3 months before the committee meeting. The month in which the listing took place is not taken into account.

- The Committee does not consider companies in bankruptcy.

There are no minimum capitalization or free-float requirements. But, taking into account other requirements, small businesses have no chance of getting into the basket.

I also recommend reading:

What is revaluation in simple words? Causes and consequences

Revaluation of a currency exchange rate means its strengthening, at first glance this seems to be a positive phenomenon, but in reality an undesirable strengthening of the national currency […]

Revision of the basket composition

There are clear regulations for revising the composition of the Nasdaq 100 index:

- The day before, a list of the 100 largest companies by capitalization that meet all the criteria is compiled . From this list, companies ranked from 1st to 75th place inclusive are automatically added to the basket.

- The rest of the list is estimated at 76-100 places . If companies from this segment were previously in the Nasdaq 100 basket, then they are also included in the basket.

Sometimes after the first 2 steps you don’t get 100 companies. In this scenario, positions from 100 to 125 are evaluated; if there are stocks in this segment that were previously in the TOP 100 by capitalization, they are added to the Nasdaq 100.

If this is not enough to form an index basket, then the remainder is filled with the remaining companies from the TOP-100 list.

There are strict regulations on deadlines:

- The actual revision of the basket is carried out on the third Friday of December; this procedure is performed once a year.

- Data on shares (outstanding) as of the end of November is used. Other characteristics of securities are taken for October.

In addition to revising the composition of the basket, rebalancing is also being carried out - a revision of the “weights” of individual companies. Rebalancing is carried out quarterly, the logic is as follows:

- If the company’s “weight” does not exceed 24%, then no changes are made. Otherwise, the “weight” is reduced based on logic by no more than 20% per company.

- The total share of shares whose “weight” exceeds 4.5%, but corresponds to the previous point, should not exceed 48%. Otherwise, rebalancing occurs so that these companies in total account for no more than 40%.

I also recommend reading:

Warrant - what is it in simple words? Security Review

A warrant is a security that gives its holder the right to purchase (or sell) the number of securities specified in the document […]

Annual rebalancing is also carried out, the criteria are slightly different:

- The share of individual companies is estimated; it should not exceed 15% . If the threshold value is exceeded, the “weight” of the shares is reduced to 14%.

- The total “weight” of the 5 largest companies by capitalization is estimated; it should not exceed 40% . If this requirement is not met, then rebalancing is carried out and their total share is reduced to 38.5%. Also, the “weight” of one company cannot exceed 4.4% or the “weight” of the 5th company by capitalization in the basket.

Despite these rules, the index is poorly diversified. Even with this approach, the 3 largest companies in the Nasdaq 100 index account for about 30% of the basket.

How to get on the Nasdaq exchange

An investor who wants to get on the NASDAQ exchange must have access to a licensed broker operating on international exchanges. In addition, if you choose a Russian broker, you must have the status of a qualified investor. To obtain this status, there are two conditions:

- the amount placed on the accounts is at least 6 million rubles;

- have at least 2 years of experience in financial markets.

So, we list several ways to enter the NASDAQ stock exchange:

- Through a Russian licensed broker. These include Sberbank, VTB, BCS, Otkritie, etc.

- If you are placing only shares and do not have the status of a qualified investor, you can place your securities through the St. Petersburg Exchange, in which the NASDAQ exchange owns a share. Confirmation of status is required to list an ETF.

- Through foreign subsidiaries of Russian brokers. There is one nuance here: an extra intermediate link appears in the form of partners of such companies abroad, which increases the time for withdrawing funds.

- Through an American broker, for example, Interactive Brokers, where there is Russian support, or Just2Trade.

The listing procedure takes 4-6 weeks and includes the following steps:

- consideration of the application by the commission;

- drawing up a review letter with a list of errors to be eliminated and sending a verdict;

- error correction;

- consideration of a new application.