Lazy Investor Blog > Stock Exchange

Stock or stock indices are indicators of the price dynamics of a group of assets, showing how much the market has risen or fallen over a certain period of time. Depending on the composition of the index, it can characterize the state of a particular sector of the economy or the state as a whole. Indices well reflect current market sentiment, regardless of the direction of movement of the instruments included. There are indices that characterize the Russian securities market. One of them is the Moscow Exchange index (formerly MICEX) - the main index of the Moscow Exchange, which most accurately characterizes the state of the domestic stock market. On the Moscow Exchange the index is designated IMOEX.

Information about the index can be useful for novice investors and traders. In this article I will talk about the following points:

- Index history;

- Issuers of the Moscow Exchange Index;

- Leading Russian companies in stock indices;

- Return of the Moscow Exchange index;

- How the index is calculated.

What is a stock index in simple words

A stock index (from the English “Stock index”) is an indicator that reflects weighted changes in the value of the largest shares of a company in the country.

In fact, a stock index is a weighted average of all companies trading on the stock market. It is sometimes called a “stock index” or “stock index.”

Story

The concept of a stock index was first introduced by Charles Henry Dow in 1884. It was called the Dow Jones Industrial Average. The composition included only 11 companies:

- American Cotton Oil Company (part of Unilever);

- American Sugar Company (now called Domino Foods, Inc.);

- American Tobacco Company (divided in 1911 under antitrust laws);

- Chicago Gas Company (part of Integrys Energy Group);

- Distilling & Cattle Feeding Company (now called Millennium Chemicals and a division of LyondellBasell);

- Laclede Gas Light Company (now called The Laclede Group, expelled 1899);

- National Lead Company (now NL Industries, dropped 1916);

- North American Company (excluded 4 months after launch, then included in 1928, then excluded again in 1930. Broken into parts in the 1940s);

- Tennessee Coal, Iron and Railroad Company (joined U.S. Steel in 1907);

- US Leather Company (dissolved 1952);

- United States Rubber Company (now owned by Michelin);

- General Electric (absent from the index from September 1898 to April 1899 and from April 1901 to November 1907);

As of 2022, only General Electric remained in the Dow Jones from those times. At the moment, this index is one of the key ones in the world. Its membership has expanded significantly to more than 30 industrial companies.

A stock index is similar to an investment portfolio (sometimes called a “basket of stocks”). It includes dozens of different stocks in different proportions. For a more general picture of the entire market, there is a maximum weight for one company.

Indices help quickly determine the state of the price of securities. It also reflects the mood of investors: if the day closed in positive territory, then the majority buys; if in negative terms, then they sell accordingly.

Note Not all companies are included in the calculation of the stock index. This largely depends on the size of capitalization and freefloat. For example, if freefloat is small, then despite the size of the company its weight will be 0.

For example, a stock index for the Russian market may include the following set of shares (weights are taken as an example):

- 20% Sberbank;

- 20% Gazprom;

- 15% Lukoil;

- 15% MMC Norilsk Nickel;

- 10% Rosneft;

- 10% Surgutneftegaz;

- 5% Gazpromneft;

- 5% Severstal;

We have compiled our own index, which reflects the weighted behavior of a group of blue chips. Naturally, the greater the weighting coefficient of each asset, the stronger its impact on the overall result.

There are stock indices not only for stocks, but also for bonds. For example, the government bond index (RGBITR). It contains the total cost of OFZ price dynamics.

How is the stock index calculated - formula and example

When calculating an index, a fixed initial value is taken (most often 100) and the price of the shares included in it is fixed. To simplify the calculation, we can draw an analogy with an investment portfolio.

Let's imagine that we have 1 million rubles, we can buy a group of companies with this money. In accordance with our example, we will buy Sberbank for 200 thousand, Gazprom for 200 thousand, Lukoil for 150 thousand, etc.

Let our index equal to 100 be equivalent to 1 million rubles. For example, on the first day of trading, Sberbank grew by 1%, Gazprom by 0.5%, MMC Norilsk Nickel by 2%, Lukoil in the red by 0.2%, Rosneft in the green by 0.3%, etc.

In total, the balance sheet by the end of the day amounted to 1.012 million rubles. This means the index grew by 1.12%, and its value will be 101.12.

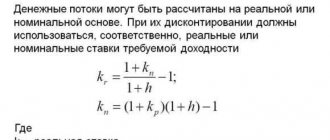

For example, if we take 1000 as the base index value, then the formula for calculating it is as follows:

Formula for calculating the stock index:

Index = 1000 + 100 × [ ∑(weighti × pricei) - start_index]/start_index

Where:

- start_index is the initial value of the total asset value, it corresponds to an index value of 1000;

- weighti — weight coefficient of the i-th stock (from 0.0 to 1.0);

- pricei — the cost of the i-th share;

Investor's Dictionary

In conclusion, it is worth paying attention to several terms that are used on the MICEX more often than others.

Central counterparty. This definition means an intermediary who is the link between the seller and the buyer. Among its main tasks is ensuring the security of the transaction.

Partial provision. This is a situation in which the exchange issues a loan to the buyer when there is not enough money in his account.

The order book is a conditional place in Moscow Exchange PJSC, in which the best orders submitted for sale and purchase are collected.

Delayed execution. This is a process in which the purchased stock assets are available to the buyer within 2 days. Then the payment is made.

What is the MICEX and RTS index in simple words

There are two main stock indices in Russia: MICEX and RTS.

MICEX (from the English “MICEX, Moscow Interbank Currency Exchange”, ticker IMOEX) is a stock index calculated by the Moscow Interbank Currency Exchange since September 22, 1997. Initially it included 30 companies, but then the list expanded to 50. In 2022, the list was reduced to 41. The prices of the shares included in it are calculated in rubles.

RTS (RTS Index, ticker RTSI) is a stock index calculated by the Russian Trading System exchange since 1996. It includes 50 companies, the prices of shares included in it are calculated in dollars.

In 2011, the MICEX and RTS exchanges merged. Now this is a conventionally single index, but one is considered to be in dollars, and the second is considered to be in rubles.

For both indices, the base value is 100 basis points. As of 2022, IMOEX and RTSI have the same composition of shares, but settlements for them are carried out in different currencies: IMOEX in rubles, RTSI in dollars.

Almost immediately after the start, the value of the MICEX index increased 19 times to the value of 1970 (December 12, 1997). A year later, there was a default in Russia and its value at the lowest point was 18.53 (October 5, 1998). This is the absolute minimum for the entire observation period.

Table with information about MICEX:

| Code | IMOEX |

| Bloomberg Code | IMOEX |

| Reuters code | .IMOEX |

| ISIN code | RU000A0JP7K5 |

| Type | Price, capitalization weighted (free-float) |

| Number of shares on the list | Variable |

| Calculation time (Moscow time) | From 10:00 to 18:50 |

| Calculation frequency | 1 time per second |

| Start of calculation | September 22, 1997 |

| Initial value | 100 |

| Limit on the weight of one issuer | 15% |

| Weight limit of five issuers | 55% |

| Dates for changing the list | Third Friday of March, June, September and December |

| FB Moscow Exchange (MOEX) | IMOEX |

Note The IMOEX and RTS indices do not take into account dividend payments, but they do take into account the dividend gap in quotes. To put it simply: shareholders still have income in the form of dividends, which the index does not reflect. You can view a chart of stock growth taking into account dividends using the MCFTR ticker.

| MCFTR | Moscow Exchange total return index “gross”. |

| MCFTRN | Moscow Exchange total return index “net” (based on tax rates of foreign organizations). |

| MCFTRR | Moscow Exchange total return index “net” (based on tax rates of Russian organizations). |

- What does gross and net mean?

Each country has its own stock indices. There are ten most influential people in the world. Most often they reflect different sectors of the economy. For example, only the banking sector or the raw materials sector. They can also include only young companies (second-tier shares) or only the largest (blue chips).

Below is a list of the most influential global indices.

- UK - FTSE (Futsee-100). The calculation includes 101 companies;

- Germany - DAX. Includes 30 companies;

- France - CAC. There are different options for the number of shares: 40, 80, 120, etc.;

- Japan - N225Jap (Nikkei). Exists since 1949;

- USA - SandP-500 (S&P 500), NASDAQ, D&J-ind;

- China - CSI300 (Shanghai Shanzhen);

The S&P 500 is the most influential index in the world. In existence since 1923. It includes the 505 largest companies, not the 500. Includes only the 90 stocks that were in its basket before 1948.

NASDAQ is a reflection of the dynamics of stock quotes of US high-tech companies (Apple, Alphabet, AMD, Nvidia, Microsoft, Amazon).

There is a group of MSCI world indices that reflect the dynamics of developing countries. For example, the index for the Russian stock market is called MSCI Russia. Getting into it with a large weight is considered very prestigious, since it will cause a large influx of passive investments in stocks. Many companies specifically increase their freefloat in order to get into MSCI Russia with maximum weight.

Index mutual funds and ETFs

Another option for investing in an index, although the index itself is not a trading instrument, is to purchase an exchange-traded fund. It gives us the opportunity to invest in shares of large Russian companies.

At the moment, there are 3 main tools:

- The oldest FXRL fund from FinEx. It is registered in Ireland. Management costs here amount to 0.9% per year of the fund's net asset value. FXRL does not pay dividends, it reinvests them and uses them to purchase additional securities. At the same time, the fund pays tax at a rate of 10% on dividends received. The fund has been trading since 2016. It can be bought for rubles and dollars from some brokers. Over the entire history of its existence, FXRL has proven itself quite well because it shows minimal tracking error.

- Russia Equity Fund from ITI Funds. This is a Luxembourg ETF that has been traded on the Moscow Exchange since April 2022. This is a fairly young instrument. You can buy for rubles, dollars and euros. Management costs are 0.65% per year. It also pays dividends in dollars once a year. But you need to understand that the fund pays tax at a rate of 15% on dividends received. And then the investor pays another 13% on these dividends. The result is double taxation of dividends.

- SBMX Foundation from . This is not an ETF, this is an exchange-traded mutual fund. It appeared in September 2022. You can only buy it for rubles. A distinctive feature of the fund is that it is registered in Russia. Management costs here will be higher - up to 1.1% per year. Dividends are not paid, income is also reinvested. But due to the fact that SBMX has the status of a mutual fund, it does not pay taxes on dividends received, which are then reinvested.

These are 3 quite different tools. FXRL has quite a long history. And this is also important for such a financial instrument. Russia Equity from ITI Funds has lower management costs. It also pays dividends. Although taxation on them is not so profitable. Here you need to look very carefully to see how justified these dividends are. And SBMX has a tax benefit on dividends. In addition, SBMX is a Russian instrument. This means it is suitable for civil servants. And this, by the way, is a very important argument.

It is difficult to say which fund of these three is more attractive, because each fund has its own pros and cons. You need to choose for yourself what suits you specifically.

There are 2 more young exchange-traded funds that track the Russian market. But first you need to see how they will perform at least on the horizon of the year:

- Exchange-traded mutual fund VTBX from VTB Capital. It launched in March 2020. The commission is 0.78%.

- RCMX Fund from Raiffeisenbank. It tracks the total return index. It was launched in May 2022. Our commission here is 1%.

Exchange-traded fund fees are the main counter-argument of people who do not buy funds. In any case, you pay a commission to the management company, which eats away part of your profit. If you look at a long enough time horizon, then the compound interest method will work here, which will increase your losses. Of course, ETFs and exchange-traded mutual funds available on the Russian market are much more expensive to maintain than the same American counterparts from Vanguard or BlackRock. Unfortunately, this is still our reality. I think that gradually the costs for investors will decrease due to competition. I would really like to hope so.

How to buy a stock index for an individual

The index is not traded on a stock exchange, but there are two options for purchasing it.

1 You can buy futures on the RTS or MICEX. This is one of the most liquid instruments on the derivatives market of the Moscow Exchange. Instead of delivery, an analogue is made in the form of money on the closing date.

In addition to futures, you can purchase options on the MICEX and RTS.

2 Buy an ETF fund for the index. This is an exchange-traded fund that contains the same set of stocks as the index. They are listed on stock exchanges like ordinary assets.

More than 50 ETF funds are traded on the MICEX. Let's look at a few as examples.

| Description and title | Ticker | Currency |

| 1. FinEx Russian RTS Equity UCITS ETF (USD) RTS Net Total Return Index (at tax rates of Russian organizations) (RTSTRR) | FXRL | $ |

| 2. ITI Funds RTS Equity ETF RTS Index (RTSI$ Index) | RUSE | $ |

| 3. FinEx MSCI Germany UCITS ETF (EUR) MSCI Daily TR Net Germany Local Index / German shares | FXDE | € |

| 4. FinEx MSCI USA Information Technology UCITS ETF (USD) MSCI Daily USA Information Technology Net TR Index / IT Sector in the USA | FXIT | $ |

| 5. FinEx MSCI USA UCITS ETF (USD) MSCI Daily TR Net USA Index / Shares of the largest US companies | FXUS | $ |

| 6. FinEx MSCI China UCITS ETF (USD) MSCI Daily TR Net China USD Index / Chinese shares | FXCN | $ |

| 7. Sberbank - Moscow Exchange Total Return Index “gross” Moscow Exchange Total Return Index “gross” (MCFTR) | SBMX | ₽ |

| 8. Sberbank – S&P 500 (BPIF) Standard & Poor`s 500 Index (S&P 500) / Copying the composition of SP500 | SBSP | ₽/$ |

| 9. Alpha - Technologies 100 (BPIF) BPIF invests in shares of a foreign investment fund focused on the dynamics of the index of shares of the 100 largest companies traded on the American stock exchange NASDAQ | AKNX | $ |

| 10. Alpha - Capital S&P 500 (S&P 500) (BPIF) Standard & Poor`s 500 Index (S&P 500) / Copying the composition of SP500 | AKSP | $ |

To buy futures or ETFs, you must register with a stockbroker. I recommend the following companies:

- Finam (promotion: Free Trade tariff, trading without commission forever)

- BCS Broker

Next, you need to open a brokerage account. Registration and opening of a brokerage agreement is done online. After which you will have access to trading terminals and will be able to trade.

I recommend reading the following articles:

- How to buy shares as a private person;

- How to make money on stocks;

- Trading on the securities exchange for beginners;

- How to trade on cryptocurrency exchanges - detailed instructions;

- How to trade shares on the stock exchange;

- How to trade futures;

Buy a stock index through ETF now »

Why are both indexes needed?

Indices are needed to track the market. They are like a benchmark that reflects the current state of the market. Almost all Russian mutual investment funds are built on them. There are even separate mutual funds for many banks and other organizations, which include only shares of the MICEX, RTS or MICEX-10.

If, when recalculating the index, it suddenly turns out that the situation has gone beyond certain limits, the exchange stops. By pausing, you can achieve two effects at once:

- Calm the situation on the stock exchange - perhaps the sharp fluctuations were influenced by a psychological factor associated with some news.

- Slow down speculators who, for some reason, decided to shake up the market and manipulate the prices of certain shares.

Consequently, indices act as a kind of regulatory lever that allows you to manage the stock exchange. Such management allows you to avoid critical moments and situations when traders begin to lose money in a wave of panic.

What stocks are included in the MICEX index?

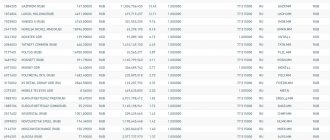

Below is a table and weights of the top 10 shares from the MICEX index (information taken from the official website moex.com) as of April 2022.

| Code | Company | Capitalization, million rubles | Free float | Weight | Industry |

| LKOH | Lukoil, JSC | 4421 | 55% | 16% | Oil and gas |

| SBER | Sberbank, JSC | 4629 | 48% | 14,2% | finance |

| GAZP | Gazprom, JSC | 3542 | 46% | 12,4% | Oil and gas |

| GMKN | Norilsk Nickel JSC | 2171 | 38% | 6,3% | Metals and mining |

| NVTK | Novatek, JSC | 3274 | 21% | 5,2% | Oil and gas |

| ROSN | Rosneft, JSC | 4366 | 11% | 4,9% | Oil and gas |

| TATN | Tatneft, JSC | 1645 | 32% | 4,4% | Oil and gas |

| YNDX | Yandex, JSC | 671 | 96% | 3,3% | Consumer sector |

| MGNT | Magnit, JSC | 371 | 71% | 2,7% | Consumer sector |

| ALRS | Alrosa, JSC | 681 | 34% | 2,4% | Consumer sector |

Other stocks that are included in the index with a small weight (data may be out of date!):

- VTB;

- MTS;

- Surgutneftegaz, JSC, etc.;

- Moscow Exchange;

- NLMK;

- Severstal;

- Polymetal International;

- INTER RAO;

- RUSAL Plc;

- Pole;

- Transneft;

- RusHydro;

- PhosAgro;

- MMK;

- Aeroflot;

- Megaphone;

- Tatneft;

- Rostelecom;

- AFK Sistema;

- PIK Group of Companies;

- FGC UES;

- RussNeft;

- Mechel;

- Credit Bank of Moscow;

- Unipro;

- SAFMAR Financial investments;

- Child's world;

- TMK;

- NPK UWC;

- Novorossiysk sea trade port;

- M Video;

- Rosseti;

Central counterparty of the Central Committee

An important characteristic of an exchange is the presence of a central counterparty. In the Moscow Exchange group, its role is played by the National Clearing Center. Among its main tasks are ensuring the security of the transaction and performing the technical side of the issue.

Thus, for the seller and the buyer, the transaction is completed in one click. The Central Committee carries out numerous operations to purchase an asset, make a payment, transfer the asset to the buyer, and receive the cash equivalent.

MICEX sectoral stock indices

There are the following types of MICEX stock index by economic sector:

- MICEX O&G (oil and gas);

- MICEX FNL (finance);

- MICEX PWR (electricity);

- MICEX M&M (metallurgy and metal mining);

- MICEX TLC (telecommunications);

- MICEX CGS (consumer sector);

- MICEX MNF (mechanical engineering);

- MICEX CHM (chemical industry);

By market capitalization:

- MICEX LC (high capitalization);

- MICEX MC (standard capitalization);

- MICEX SC (base capitalization);

Important changes for 2022

From Wikipedia: On November 10, 2022, the Bank of Russia registered a new edition of the methodology for calculating Moscow Exchange Indices:

- The MICEX Index (Moscow Interbank Currency Exchange) changes its name to the Moscow Exchange Index;

- The number of shares in the Moscow Exchange Index will become variable and will be revised quarterly taking into account the liquidity ratio (the ratio of annual trading volume to capitalization taking into account the number of shares in free float - free-float);

- For the first time, the liquidity ratio is used as a criterion, which must be at least 15%; if its value is below 10%, the issuer is excluded from the index;

- Transactions in shares included in the index must be concluded daily;

- The number of the issuer's shares in free float (free-float) must be at least 10% (currently at least 5%), the exclusion criterion remains at the same level - 5%;

- New shares will be able to enter the index with weights of at least 0.25%; shares with weights of less than 0.2% will be excluded from the index basket;

Watch also the video “What is a stock index: Moscow Exchange (MICEX), RTS”:

Related posts:

- Consumer Price Index (CPI) - what is it

- MSCI Russia Index - how it is calculated, where it is published

- How to trade stock indices on Forex

- Beta (β) in stock analysis - what...

- What is more profitable: buying ETFs or shares - detailed review

- The Big Mac Index - what it is and how it is calculated

- Stock tickers in trading - what they are, detailed description

- Free Float coefficient for stocks - what is it and why is it needed?

How is it considered?

Let's not go too deep into the jungle and calculations. I'll explain it in simple language. Using the stock index as an example.

The “best” companies are selected and must be traded on the stock market. Each company is assigned a certain weight. Depending on its capitalization, impact on the country’s economy, free float and liquidity. There are several other indicators. But these are the main ones.

Conventionally, if a company is one of the most expensive on the market, its securities are liquid and the share of free float is large, it is assigned greater weight.

The “kids” get a smaller share of the index pie.

For understanding and assimilation, let's look at examples.

Imagine that there are 2 farmers in a village. They grow cucumbers. The cost (capitalization) of their farms is approximately the same. 1 million rubles.

If you compile an index only based on them, then it is logical to assume that the share of each farm will be 50%.

Over time, the first farmer acquired equipment, hired workers, and expanded the greenhouses. Production has increased. So is profit. Naturally, the value of his business also increased. Up to 3 million rubles.

The second one is unchanged. No development.

If we combine all this into an index, we get an increase of 100%. Although the first farmer increased the value of his company by 200%. But due to the fact that the second half of the index remained in place, we see an overall increase of half.

It seems that initially everyone was on equal terms. And after a while, everything changed radically.

And the larger this gap in capitalization is, the more distorted the picture the index shows.

In 10 years, the first farmer will grow into an agricultural holding. The business will be valued at hundreds of millions. And the second person will remain with his million. And the following may happen...

The giant will suffer a loss in one bad year. Let’s say there was a crop failure, locusts, spider beetles ate everything. The value of the business immediately decreased by 50 million.

And the “baby” simply outdid himself, expanded his business a little, and got a good harvest. And he earned over 300 thousand. Now his company is no longer worth some fucking million. And as much as one and a half.

What's the result? One company lost 50 million, and the other earned 300 thousand. In money, we see a drop of many tens of millions. And judging by the index, there was an increase of 15%.

This is probably wrong. And you need to change the weights. Increase the first one. Reduce the second one. Depending on the capitalization of their business. Give the giant a percentage of 99.9%. And the baby gets the remaining shares of interest.

And to avoid such disagreements in the future, we need to promptly review the composition of the index. Not once every year or two or three, but a little more often.

On the Moscow Exchange, the composition and weights of indices are reviewed every quarter.

Now about freefloat and liquidity.

Imagine there are 2 diamond mines. Each one costs 1 billion.

Everything is as it should be: slaves mine and process diamonds. Making diamonds out of them.

All this comes true in Antwerp or London. Slaves receive a crust of bread and a glass of water for their work. On holidays and weekends - a glass of beer and a fried chicken leg.

In short, the costs are small. And the profits were multimillion-dollar. Money flows like a river. Companies also pay good dividends to their shareholders.

There is only one thing...

The first mine is owned 20% by Warren "Petrovich" Buffett. The rest (80%) is traded on the stock exchange. And anyone can buy themselves a piece of happiness and become a slave owner and a diamond (if not a king, then at least a small co-owner) investor.

The second mine is almost entirely owned (95%) by Donald “Ivanovich” Trump. And only a small fraction of shares (only 5%) are in free float. And then, almost the entire remainder was bought up by “clean” boys, with the prospect of good income.

Buffett's shares are quite liquid. Anyone can buy and sell them. Anytime. And most importantly at a fair price. At least 100 thousand, at least a million or two. There will always be buyers and sellers ready to close a counter transaction.

There are tens to hundreds of times fewer “Trump” shares on the market. And any little significant interest on the part of a large buyer can cause a sharp increase in the stock exchange. The same goes for selling. If a large investor wants to “throw off only 10 million shares (or 20% of all shares available for trading), the market will immediately react by reducing the price.

Or there will be no buyer for the full amount. And you will have to “sell” the papers in small lots over several weeks, or even months.

Based on all this, it is more logical to allocate unequal shares to the mines in the index (although they are identical in terms of capitalization).

Buffett's company is more liquid, with a large number of shares in free float (free float - 0.8). And the weight in the index should be many times higher.

As a result, summing up all these indicators, a calculation base is built for the index and the companies included in it with a certain share of weight.