While most cryptocurrencies strive for at least partial decentralization from the stock market, some companies, on the contrary, issue digital coins tied to fiat currencies.

We are talking about so-called stablecoins. These are cryptocurrencies that can be pegged to the dollar, euro, or even gold and oil. They are less susceptible to exchange rate fluctuations, however, they also have significant disadvantages.

In this article we will talk about the cryptocurrency USD Coin or simply USDC, which is a digital analogue of the American dollar, and was created by the teams of the startup Circle and the Coinbase exchange.

What's special about this token?

The USDC coin is not the first or even the most popular stablecoin backed by the US dollar. This title belongs to Tether.

Tether closely monitors the state of its finances.

He claims that the bank has a real dollar for every Tether coin in circulation, but it hasn't fully disclosed its auditing processes so no one knows for sure. Please note that there have been repeated legal proceedings by the SEC regarding the Tether cryptocurrency.

However, this coin has led to the rise of other USD-backed stablecoins that have more transparent funding and auditing processes. These include Gemini dollar, True USD, Paxos, and now US Dollar Coin (USDC).

USDC is not a super unique new coin compared to its competitors, but it does stand out among other cryptocurrencies:

- Regulated: USDC's parent company is a registered Money Service company in the United States. This means it is regulated by the government's Financial Crimes Enforcement Network, which combats money laundering.

- Audit: USDC is audited by Grant Thornton, one of the top 10 accounting firms in the world.

- Fast: Sending Fiat to people and institutions can take a long time when banks are involved. USDC offers stability and fast transaction speeds.

Rate and capitalization

USDC tokens are issued by issuers, and capitalization increases when US dollars are deposited into the Center system reserve. To do this, you must have licenses from financial organizations, pass the Anti-Money Laundering (AML) check and meet the standards of the Financial Action Task Force (FATF).

Next, to become an issuer of the USD Coin cryptocurrency, you need to create a one-to-one reserve with the issued coins (1 USDC = $1) and provide an audited report on its availability every month.

According to CoinMarketCap, USD Coin ranks 31st. The number of USDC tokens issued to the market is 362,185,161, with a capitalization of $361,107,926. The daily trading volume is $94,596,108.

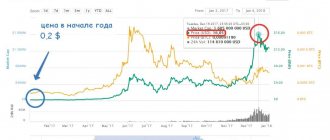

USDC rate for all time

Source: Coinmarketcap

During its existence, that is, from October 2022 to May 2022, the rate of the USD Coin cryptocurrency fluctuated on average from $0.97 to $1.05. The maximum figure a few days after the launch reached $1.11.

For example, Tether has high volatility. For all time, USDT had a maximum of $1.21 and at the same time a minimum of $0.84.

Where to store?

Since USDC is an ERC 20 token, you can store coins in wallets that support ERC20 tokens. For example: Myetherwallet, Mist and others.

You can also store coins in multi-currency wallets:

- Coinomi

- Atomicwallet

You can also store coins on the Exchange where they are traded.

History of USD Coin (USDC)

The history of USD Coin begins with the developers of the cryptocurrency; the coin was created by Circle Internet Financial Ltd together with Center. During the creation of the project, for its successful implementation, a partnership was concluded with some giants in the field of cryptocurrency. Circle is a special platform for cryptocurrency trading that appeared on the market in 2013. This exchange makes payments based on blockchain. Transactions are carried out without commissions all over the world. The main activity of the organization is financial transfers via the Internet. The main motto of the company is that money works like the Internet with openness, freedom and ubiquity with maximum protection against theft.

Circle provides 4 proprietary products:

- Invest is a project for investors who are just starting their journey in this field of activity. Suitable for people who want to invest in cryptocurrency, not only their own development USD Coin, but also in other assets.

- Pay is a special system for making financial transfers, designed to work with digital and real currency. The creators claim that the main goal is to provide a platform that will help the maximum number of people gain access. Carrying out any monetary transactions, they say, should be as simple as sending a letter via mail.

- Trade is a tool for trading cryptocurrency assets, but the platform is not considered an exchange, it acts more as an exchanger for buying or selling coins.

- Poloniex is a purchase of Circle, which is a powerful crypto exchange with impressive turnover. The main difference from other products of the company is that it is a purchased platform and not created on its own.

With the help of all 4 tools, the USDC coin is actively promoted in the market. Developers continue to constantly develop the token. Before acquiring the Poloniex exchange, Circle itself was part of a group of large companies in the cryptocurrency market.

The Coinbase exchange, which is recognizable in different parts of the world, also took part in the creation of USD Coin. It was she who was the first to provide an announcement about the release of the asset on October 25, 2018.

Among the major partners is the well-known manufacturer of mining equipment – Bitmain. The company is also the world's largest pool for mining digital currencies. The management of the organization was interested in the development of a stablecoin, as a result of which the company became the main investor in the project. $110 million was invested in the development of the Center.

The developers have also signed partnership documents with other giants in the cryptocurrency field. The main ones are:

- Tusk Ventures;

- IDG Capital;

- Blockchain Capital;

- General Catalyst.

In total, more than $3 billion was invested in the project. There were several events that preceded the creation of the coin. Among them is the USDT token used on the Poloniex exchange. The coin could not fully cover the needs, requests and functions of a classic stablecoin, as a result of which it could not become an alternative to real assets. The main difficulty was the platform used; it did not allow for normal financial audits and did not show data about the banking organizations that serviced the coin.

The developers of USD Coin claim that their token works completely transparently, because the Center company is the main regulator. It is licensed and also affiliated with partner banks that have a lot of dollars in their accounts. In addition, an independent company has been selected for the audit and conducts checks every month. In 2022, on January 15, a verification of the coin was done, showing that it is indeed backed by fiat money, so USDC can be trusted.

Where can I buy?

The coin is traded on the following exchanges:

| # | Exchange | Pair |

| 1 | BitMart | BTC/USDC |

| 2 | IDCM | BTC/USDC |

| 3 | IDCM | ETH/USDC |

| 4 | Binance | BTC/USDC |

| 5 | Binance | USDC/USDT |

| 6 | CoinEx | BTC/USDC |

| 7 | Exrates | USDC/USD |

| 8 | CoinEx | ETH/USDC |

| 9 | Coinbase Pro | BTC/USDC |

| 10 | CoinEx | LTC/USDC |

| 11 | IDCM | USDT/USDC |

| 12 | LATOKEN | USDC/USDT |

| 13 | Poloniex | BTC/USDC |

| 14 | CoinEx | XRP/USDC |

| 15 | Fatbtc | XRP/USDC |

| 16 | BitMart | USDC/USDT |

| 17 | Bitrabbit | USDC/USDT |

| 18 | Binance | ETH/USDC |

| 19 | CoinEx | BCH/USDC |

| 20 | Coinbase Pro | BAT/USDC |

| 21 | CoinEx | USDC/USDT |

| 22 | Fatbtc | EOS/USDC |

| 23 | BitMax | ETH/USDC |

| 24 | Systemkoin | USDC/TRY |

| 25 | Coinbase Pro | ETH/USDC |

| 26 | Coinbase Pro | DAI/USDC |

| 27 | BitMax | BTC/USDC |

| 28 | Huobi | USDC/HUSD |

| 29 | CoinEx | CET/USDC |

| 30 | Systemkoin | USDC/USDT |

| 31 | Folgory | BTC/USDC |

| 32 | Systemkoin | USDC/BTC |

| 33 | Bitrue | USDC/XRP |

| 34 | Binance | BNB/USDC |

| 35 | BitMax | USDC/USDT |

| 36 | OceanEx | USDC/USDT |

| 37 | Poloniex | ETH/USDC |

| 38 | Binance | XRP/USDC |

| 39 | Binance | LINK/USDC |

| 40 | Binance | LTC/USDC |

| 41 | Fatbtc | XLM/USDC |

| 42 | Binance | USDC/TUSD |

| 43 | Coinbase Pro | ZEC/USDC |

| 44 | Folgory | ETH/USDC |

| 45 | Systemkoin | USDC/ETH |

| 46 | Mercatox | ETH/USDC |

| 47 | Cyber Network | USDC/ETH |

| 48 | Poloniex | BCHSV/USDC |

| 49 | Binance | BCHABC/USDC |

| 50 | Binance | TRX/USDC |

| 51 | HitBTC | BTC/USDC |

| 52 | Mercatox | BTC/USDC |

| 53 | Poloniex | XRP/USDC |

| 54 | Binance | WIN/USDC |

| 55 | Binance | USDC/PAX |

| 56 | Poloniex | USDT/USDC |

| 57 | Hotbit | USDC/USDT |

| 58 | Hotbit | USDC/ETH |

| 59 | Binance | ZEC/USDC |

| 60 | VELIC | USDC/USDT |

| 61 | Binance | ONT/USDC |

| 62 | Binance | BAT/USDC |

| 63 | Bitrue | USDC/USDT |

| 64 | OKEx | USDC/USDT |

| 65 | Poloniex | XMR/USDC |

| 66 | Binance | ADA/USDC |

| 67 | Binance | EOS/USDC |

| 68 | Poloniex | LTC/USDC |

| 69 | Exmo | USDC/USDT |

| 70 | Exmo | USDC/USD |

| 71 | Binance | BTT/USDC |

| 72 | Exmo | USDC/ETH |

| 73 | Binance | XLM/USDC |

| 74 | Poloniex | BCHABC/USDC |

| 75 | Kucoin | BTC/USDC |

| 76 | Exmo | USDC/BTC |

| 77 | Birake Network | BTC/USDC |

| 78 | CREX24 | ETH/USDC |

| 79 | Hotbit | USDC/BTC |

| 80 | CoinField | BTC/USDC |

| 81 | Folgory | DAI/USDC |

| 82 | Liquid | BTC/USDC |

| 83 | Kucoin | USDT/USDC |

| 84 | Binance | DUSK/USDC |

| 85 | Binance | ALGO/USDC |

| 86 | Kucoin | ETH/USDC |

| 87 | Coinbase Pro | LOOM/USDC |

| 88 | Coinbase Pro | MANA/USDC |

| 89 | CREX24 | BTC/USDC |

| 90 | Binance | ETC/USDC |

| 91 | OKEx | USDC/BTC |

| 92 | Coinbase Pro | DNT/USDC |

| 93 | Binance | NEO/USDC |

| 94 | Poloniex | DOGE/USDC |

| 95 | IDEX | ETH/USDC |

| 96 | CREX24 | OTO/USDC |

| 97 | Coinbase Pro | GNT/USDC |

| 98 | Birake Network | BCH/USDC |

| 99 | Poloniex | STR/USDC |

| 100 | Binance | USD/USD |

| 101 | Binance | ATOM/USDC |

| 102 | Fatbtc | DOGE/USDC |

| 103 | Birake Network | ETH/USDC |

| 104 | Poloniex | GRIN/USDC |

| 105 | Gate.io | USDC/USDT |

| 106 | Poloniex | EOS/USDC |

| 107 | Gate.io | BTC/USDC |

| 108 | Poloniex | ATOM/USDC |

| 109 | Binance | NPXS/USDC |

| 110 | CoinField | XRP/USDC |

| 111 | Poloniex | ZEC/USDC |

| 112 | Graviex | DPT/USDC |

| 113 | Birake Network | XRP/USDC |

| 114 | Korbit | USDC/KRW |

| 115 | Binance | ONE/USDC |

| 116 | Folgory | ZEC/USDC |

| 117 | Binance | FTM/USDC |

| 118 | Bitfinex | UDC/USD |

| 119 | Coinbase Pro | CVC/USDC |

| 120 | Birake Network | EOS/USDC |

| 121 | Birake Network | LTC/USDC |

| 122 | Binance | PERL/USDC |

| 123 | Poloniex | DASH/USDC |

| 124 | OKEx | USDC/USDT |

| 125 | Binance | WAVES/USDC |

| 126 | Indodax | USDC/IDR |

| 127 | Beaxy | BTC/USDC |

| 128 | DDEX | WETH/USDC |

| 129 | Mercatox | XBASE/USDC |

| 130 | Binance | TOMO/USDC |

| 131 | Folgory | BAT/USDC |

| 132 | HitBTC | TUSD/USDC |

| 133 | DDEX | USDC/DAI |

| 134 | Graviex | BTB/USDC |

| 135 | DDEX | USDC/WETH |

| 136 | BitBay | USDC/USD |

| 137 | Poloniex | ETC/USDC |

| 138 | Beaxy | ETH/USDC |

| 139 | OKEx | USDC/BTC |

| 140 | CREX24 | USDC/USD |

| 141 | HitBTC | ETH/USDC |

| 142 | Beaxy | BXY/USDC |

| 143 | Fatbtc | KIN/USDC |

| 144 | SouthXchange | BTC/USDC |

| 145 | SouthXchange | DASH/USDC |

| 146 | HitBTC | DAI/USDC |

| 147 | coinsuper | USDC/USD |

| 148 | SouthXchange | BSV/USDC |

| 149 | OKCoin | USDC/USD |

| 150 | Mercatox | BNANA/USDC |

| 151 | IDEX | DAI/USDC |

| 152 | Liquid | ETH/USDC |

| 153 | SouthXchange | ETH/USDC |

| 154 | SouthXchange | BCH/USDC |

| 155 | IDEX | WBTC/USDC |

| 156 | Mercatox | CAJ/USDC |

| 157 | OKCoin | BTC/USDC |

| 158 | FCoin | USDC/USDT |

| 159 | Instant Bitex | BTC/USDC |

| 160 | Instant Bitex | ETH/USDC |

| 161 | Instant Bitex | XRP/USDC |

| 162 | Radar Relay | USDC/WETH |

| 163 | Radar Relay | USDC/DAI |

| 164 | Binance | BGBP/USDC |

| 165 | Korbit | BTC/USDC |

| 166 | AirSwap | USDC/ETH |

| 167 | CredoEx | CREDO/USDC |

| 168 | CredoEx | PARETO/USDC |

Distinctive features of USD Coin

Initially, when releasing USDC, the developers were aimed at traders who want to get a stable value of the coin to work with and exit from trading positions, as well as token creators who want to tokenize different contracts. For recent clients, it is important to obtain stability in the value of the coin, and not to link tokens to Bitcoin or Ethereum.

By issuing USDC, users received a service that allows them to perform any financial transactions around the world. To work, clients need to provide KYC data. According to the terms, there are no limits on token ownership, but they may appear in the future. It is possible to use cryptocurrency on any crypto exchange that supports the ERC-20 standard and store it in wallets with similar compatibility.

Like other stablecoins, the essence of the coin is to reduce the volatility of other digital currencies, which allows investors to improve the accuracy of their forecasts. This is what USDC is based on.

A distinctive feature can be considered the creation of a coin as a replacement for Tether. It is more reliable, honest, and all alternative options cannot provide such transparency and financial results after an audit, since they are located offshore, uncontrolled by the relevant authorities. Analogs have unknown partners, closed code, and operate in a closed system. USDC has eliminated all the described disadvantages, there is open reporting on transactions and security, and the work is carried out in accordance with US laws.

The work is based on the ERC-20 algorithm, which makes it possible to save money for creators, because there is no need to create new software. Clients themselves can continue to use standard wallets to store, sell and buy tokens.

It is impossible to mine coins; emission is carried out only when real dollars are deposited into the reserve.

Emission of USD Coin

The main regulator of token emission is Centre. The company complies with laws and licenses for conducting electronic financial transactions, works with banking organizations and other partners that store fiat money as a reserve. The founders provide the opportunity for auditors to evaluate USDC reserves every month.

Circle emphasizes that the token is the first of all possible stablecoins, which is able to remove all artificial boundaries for cryptocurrencies and real money, which will improve the efficiency of the market.

Compared to other fiat-backed cryptocurrencies, USD coin is the most effective tool. Users after replenishing their wallet with $1000 will automatically receive 1000 USDC. They can be transferred, sold or sent to an exchange for trading. The conclusion is similar; when you withdraw 700 USDC, the same amount of dollars is transferred to your balance.

Using the official website for the token, the client can perform verification, for which he will need to provide passport data, a photo, information about his place of residence, as well as a mobile number and email address. The process takes 5-10 minutes, after which you can purchase coins from $5, which automatically confirms your account. To simplify the work of traders and investors, a mobile application for the token has been created.

Today, only the developers, the Circle company, have emission rights in the CENTER structure. The market capitalization according to https://coinmarketcap.com is $453838278.

Conclusion

As Jeremy Allair said in an interview:

“Market infrastructure such as stablecoins will become the base layer that supports all financial applications. It must be legal, trustworthy, based on open standards. We're addressing many of these fundamental problems that exist. That's a huge difference from something like Tether, and we think the market will move towards that very quickly."

We think it will be one of the main stablecoins. After all, the support of such financial giants as Goldman Sachs, BitMain, etc. will provide a fairly solid foundation... It will gradually gain the trust of investors and push out its closest competitors such as Tether (USDT), TrueUSD (TUSD) from the market.

What is USD Coin backed by?

USD Coin is a cryptocurrency made on the basis of Ethereum using ERC20 technology. The coin is backed by real currency – US dollars. According to the developers, the audit of the fiat reserve is carried out with the help of a large company, Grant Thornton LLP. On 04/30/19, the report published data on the total number of coins and the reserve. Cash and number of coins have excellent balance. The supply of real funds is slightly larger than the issued token.

The value of the Circle company itself exceeds $3 billion, which is 6 times more than in 2016, even before the release of the cryptocurrency. The coin rate is always stable, deviations are minimal, so traders and investors do not have to worry about volatility. The token has all the advantages of digital money, the work is transparent.

USDC is a coin that acts as a digital analogue of the American dollar, but with the ability to be used on the Internet with a minimum commission, maximum speed and a high level of security. The token provides ample opportunities for the average consumer or business, regardless of geolocation.

USDC is stable, but it is this fact that has been criticized in the cryptocurrency space. This is due to the fact that the coin is completely under the control of the issuers, which violates any requirements for the decentralization of digital money.