Evgeny Khokhlov In the field of cryptocurrencies since 2015. Specialist in exchanges and trading instruments on the portal cryptalk.ru. A dedicated crypto evangelist.

25.11.2019

697

0

Bitcoin cryptocurrency is the first decentralized digital coin used as a medium of exchange. It was invented in 2009 by unknown developers hiding under the pseudonym Satoshi Nakamoto. This currency is not tied to real assets; accordingly, its price is regulated solely by supply and demand.

Bitcoin is certainly the main cryptocurrency, its share in the total capitalization is more than 40%. Over the entire existence of Bitcoin, its value has risen and fallen. The popularization of cryptocurrencies in 2017 led to unprecedented demand for the coin and its price rose from 1,000 USD to 20,000 USD over the year. The growth of the rate was facilitated by the limited supply of cue balls on the market, as well as interest in the coin from large financial companies and individual investors. After updating the absolute maximum price, the Bitcoin rate began to fall.

Currently known reasons for the fall of Bitcoin

Today, the reasons for the fall of Bitcoin are a series of events. The main factor that influenced the fall in the value of the coin at the beginning of 2018 was the unprecedented increase in price in December 2022. After the rush of demand for this digital asset, a period of inevitable rate correction began.

In January, the Bitcoin rate falls due to profit-taking by large players who bought it at a fairly low price. Investors began to sell coins, thereby creating an excess supply in the market and the Bitcoin rate fell by almost 20%. Smaller players who do not influence the market repeated the actions of large investors, thereby creating even greater excitement. Without understanding the reasons why the Bitcoin rate was falling, small coin holders succumbed to panic and market pressure.

Additional factors that spurred the depreciation were negative news from financial regulators in various countries:

- India . The government of this country promised to pass a law on strict regulation of the cryptocurrency market, and although it was not adopted, this had a negative impact on the price of Bitcoin.

- China . This is not the first time that the financial regulator of this country has promised to take strict measures to control the circulation of digital money. This time, there are plans to limit the access of Chinese residents to cryptocurrency exchanges of other countries. These measures will reduce the outflow of capital from the country.

- South Korea . The changes affected cryptocurrency traders; the government obliges them to undergo an identification procedure through the country’s banks.

The cryptocurrency market is always sensitive to news from Southeast Asia; they account for the bulk of the turnover of all digital coins, and the largest mining centers are also located here.

Another reason for the continued fall of Bitcoin in January 2018 is the approach of the Chinese New Year. At this time, traditionally, cryptocurrency users sell digital assets, creating additional excess supply.

The combination of these factors led to the fact that on February 6, Bitcoin fell below 7,000 USD per 1BTC. From now on, Bitcoin quotes will rise almost all the time until March 5, 2022. By this day, the Bitcoin rate will exceed 11,000 USD. On March 6, 2018, a number of statements appeared from users of the Binance exchange about the disappearance of their funds in cryptocurrency. Many people complain that created trade orders were closed without their intervention. The community suspected the management of the exchange of this.

Suspicion of hacking of the exchange or fraudulent actions of the leaders of one of the largest cryptocurrency exchanges led to the fact that the Bitcoin rate fell to its lowest level in the last 3 months. Over the next month, there was a stepwise increase in quotes to the level of mid-January and the price of the coin did not fall below 8,000 USD.

At the beginning of March 2022, a new fall in the price of Bitcoin began. There are several reasons why Bitcoin is falling again:

- negative news background;

- development of programs for further regulation of the cryptocurrency market in Russia, Germany and other countries;

- Chinese policy, systematically tightening legislative regulation of the circulation of digital coins;

- a statement by the famous billionaire Warren Buffett, who predicted Bitcoin's death and further decline.

All this led to the fact that in early April, Bitcoin fell in price to the level of February 2022.

Today, experts do not undertake to make predictions on the topic of how long Bitcoin will fall. Much depends on the policies of states in the field of legalizing the circulation of cryptocurrencies and mining, but now successful stock traders are earning huge sums from such price surges.

Biden announced plans to keep Jerome Powell as head of the Fed

US President Joe Biden announced his intention to nominate Jerome Powell for a second term as Fed Chairman.

The founder of the crypto bank Galaxy Digital, Mike Novogratz, saw this as a risk for Bitcoin. In his opinion, the reappointed Fed chairman may choose a more aggressive approach to monetary policy.

History of price declines

The fall of Bitcoin in 2022 is not an isolated case. During the existence of the cryptocurrency, the price of Bitcoin has plummeted many times. Chronology of sharp drops in exchange rate:

- 2011. As a result of the hacking of the Mt.Gox exchange, the Bitcoin rate dropped from 30 USD to a few cents. The value recovery took place over several months.

- 2012, February. The refusal of the popular exchange Paxum to work with Bitcoin led to a decrease in the price by a third.

- 2012, March. After the theft of cryptocurrency on the Linode platform, Bitcoin fell again, and the total capitalization amounted to 240 thousand USD.

- 2012, August. A new 20% drop in the Bitcoin rate is associated with the refusal of the Bitcoin Saving & Trust fund to pay cryptocurrency for its obligations. This decision was made by company owner Trendon Shavers.

- 2013, April. A DDoS attack on the Bitcoin network led to a drop in the exchange rate to 120 USD, or 30% of the price.

- 2013, October. The arrest of the owner of the SilkRoad website led to a jump in the exchange rate by 45% in one hour, but the previous value of 120 USD was restored within 24 hours. Bitcoin never fell below this level again.

- 2013, December. After the rate rose to 1000 USD, a blow to the cryptocurrency came from China, where the People’s Bank banned all financial transactions with this cryptocurrency. As a result, the price dropped to 800 USD.

- 2014, February. During the month, Bitcoin was plagued by a series of troubles: a DDoS attack on popular exchanges, disputes between miners and developers over the block size, and the last straw was the closure of the scandalous Mt.Gox exchange. The result of the month was a reduction in the cost of one coin to 550 USD.

- 2014, March. Following the events of February, came a statement from the United States Internal Revenue Service recognizing cryptocurrency as a taxable asset. The rate fell again to 450 USD.

- 2015, August. For almost a year, Bitcoin has been slowly falling in price. A new sharp jump down occurred on August 19, this is associated with the release of a new BitcoinXT client, which is positioned as an alternative to BitcoinCore.

- 2016, January. Traditionally, at the beginning of the year there was a sharp drop in the exchange rate. This time the reason was the statement of one of the developers of the Bitcoin client, Mike Hearn. He spoke about the existence of a systemic crisis in Bitcoin blockchain technology. The fall was short-lived and soon the price began to rise.

- 2016, August. The value of the first cryptocurrency collapsed again by almost 30%. The reason was the largest theft in the world of cryptocurrencies. 120 thousand BTC were stolen from the popular Bitfinex exchange. Subsequently, the management of the site settled accounts with its clients and restored the operation of the exchange.

- 2017, January. A new fall in the exchange rate, traditionally at the beginning of the year. The rate fell by 30% after the statement of the People's Bank of China, which introduced further restrictions on working with cryptocurrencies. The price of one bitcoin dropped to 800 USD.

What else happened in the mining industry?

- The Russian Federation received applications for the placement of 1.8 million devices after the ban on mining in China.

- Canaan delivered 2,000 Avalon Bitcoin miners to Kazakhstan.

- The authorities of Abkhazia admitted their inability to organize work to combat illegal mining.

How to make money on a falling cryptocurrency market

Since the beginning of the year, there has been a trend towards a systematic decline in the value of most cryptocurrency assets. Many users have taken a wait-and-see approach, and risky traders want to make money from the falling Bitcoin rate. One way is margin trading. This service is provided by some cryptocurrency platforms.

The behavior algorithm is as follows:

- expecting a fall in the price of Bitcoin, the user opens a margin loan from the exchange in this cryptocurrency;

- an exchange is carried out for an asset for which forecasts predict a maximum drawdown in the exchange rate;

- the exchange rate falls to a certain value;

- a reverse exchange is made for bitcoin, but at a lower rate.

The margin loan is returned to the cryptocurrency exchange, and due to the difference in the exchange rate, the user is left with some profit.

To use this method, you must have good stock trading skills. You need to be able to work with market analysis tools and have information from reliable sources about the prospects for price movements of various digital coins. A non-professional using this method may lose his funds, for example, if the rate of the selected currency pair does not fall, but rises.

Grayscale predicted annual revenue growth for the Web 3.0 metaverse sector to $1 trillion

The annual revenue of the Web 3.0 metaverse sector could soon reach $1 trillion. Grayscale Investments specialists came to this conclusion.

According to their data, since 2022, the number of active wallets in metaverses has grown 10 times and approached 50,000 in June 2022. Gaming blockchain companies raised $1 billion in 14 deals in the third quarter.

On November 24, the quotes for the GameFi metaverse tokens Decentraland (MANA) and The Sandbox (SAND) reached new historical highs at $5.33 and $7.26, respectively.

How long will Bitcoin fall?

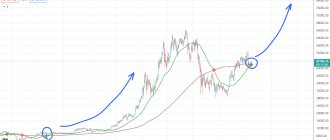

Throughout March and the beginning of April 2022, the cost of the first cryptocurrency is kept in the corridor from 6.5 thousand to 9 thousand, and at the moment it is $7,510.02. Periods of decline are quickly replaced by corrections and the price returns to its original value. You can get acquainted with today's Bitcoin exchange rate in relation to world currencies and gold, as well as the situation on the market in the graph below.

Analyzing this behavior of Bitcoin, we can conclude that its price is hampered by the news background, which forces large investors in the digital coin market to be cautious and invest not only in cryptocurrencies, but to look for alternatives.

How much longer will Bitcoin fall and to what price level is a question that worries many traders. Analysts predict that Bitcoin will rise in price in 2018, but not as high as in 2022.

The Bitcoin rate will stop falling and will again become interesting for major market players after receiving a certain status in the global financial system. Until then, many investors will treat digital currencies as just another speculative instrument.

Serious preconditions for an increase in the price of Bitcoin will appear if:

- there will be legalization of cryptocurrencies in most major economies of the world;

- it will be possible to use digital coins in everyday payments;

- The technical component of the technology is being improved.

According to some optimistic scenarios, the estimated growth potential of Bitcoin is 100 thousand USD by 2022. Opponents of this theory predict the collapse of Bitcoin and many other cryptocurrencies.

hit or miss

In the first half of 2022, real anarchy occurred in the ICO market. The general interest in the crypto industry has provoked an explosive growth of various scam projects (from the English scam - fraud, "scam"). The new-fashioned analogue of an IPO, when a company raises funds by distributing its own tokens among investors, which can subsequently be listed on the stock exchange with the prospect of an increase in value, has turned out to be fertile ground for scammers. All this ended with the largest social networks - Facebook, Instagram, Google, Twitter, Snapchat, Baidu, Weibo - introducing a ban on any ICO advertising, which undoubtedly dealt a blow to the entire industry.

Should you buy Bitcoin in 2022 despite the fall?

After a significant drop in the price of Bitcoin in the previous year, many investors decided to sell their cryptocurrency assets and exit the market. This gives new players the opportunity to buy coins at a reduced rate. Recently, positive news has begun to arrive about the legalization of Bitcoin in different countries, which has led to a slight increase in activity in the market and a slight increase in most digital coins.

In a situation where even minor news affects the exchange rate, it is difficult to make long-term forecasts. Any assumptions on what the Bitcoin exchange rate may depend on are not a guarantee of accuracy, and purchasing decisions are made based on the trader’s personal experience.

An optimistic factor that speaks in favor of buying cryptocurrencies is that Bitcoin, during its existence, has withstood many tests. It has repeatedly proven its viability and the presence of supporters of introducing digital money into everyday life.

What else happened in the USA?

- The Senate requested information from stablecoin issuers on the principles of their operation.

- Banking regulators will prepare guidance on digital assets in 2022.

- Hillary Clinton warned about the manipulation of cryptocurrencies in the Russian Federation and China.

The second Polkadot parachain auction has ended. The Moonbeam project won

The Moonbeam project won the auction for the second slot of the Polkadot parachain. In support of it, users blocked 35.7 million DOTs with a total value of ~$1.43 billion.

Moonbeam has surpassed the Acala project, which won the first slot a week ago, in terms of the volume of blocked funds.

Vitalik Buterin proposed a method to reduce the cost of transactions in L2 for Ethereum

Vitalik Buterin presented a roadmap for the development of second-level (L2) solutions based on Rollups technology for Ethereum. To increase throughput, he proposed limiting the amount of data in a block and gradually introducing sharding.

According to Buterin, it’s worth starting by limiting the amount of calldata in a block and reducing the cost of corresponding operations from 16 units of gas per byte to three. This space stores the information provided when calling the smart contract.

Indian government to introduce bill to ban 'most private cryptocurrencies'

On November 23, it became known that the Indian government will introduce a bill to regulate the digital asset market during the winter session of Parliament. According to the preliminary agenda, authorities plan to ban most “private cryptocurrencies.”

The news caused panic among traders - on November 24, the rates of major cryptocurrencies on platforms in India were trading below global values.

Also on ForkLog:

- Adidas has entered into a partnership with Bitcoin exchange Coinbase.

- Elon Musk “forced” Binance to reveal details of a glitch with old Dogecoin transactions.

- The hamster crypto trader Mr. Gox has died.

- A DuneDAO member bought a print version of Jodorowsky's Dune for $3.8 million.