What is meant by interest rate futures ? Investors call this the obligation to sell/buy a financial instrument (deposits, loans) on a certain date set in advance.

Currently, interest rate futures are an excellent option to hedge against the wide range of fluctuations in prevailing interest rates. Before the advent of interest rate futures, there was no efficient market for so-called interest-bearing assets. Thus, it was not possible to perform risk sharing to change interest rates directly among trading participants.

The object of sales of interest rate futures is a contract in which a specific implementation date is fixed. Sellers of such contracts undertake to sell the number of bonds clearly stated in the contract at a specific time and at a predetermined price. Thus, it is the buyer's responsibility to accept the papers. The parties to a transaction rarely deliver bonds to each other in real life (statistics show that on average there is about 2 percent of cases). Often, one party pays the other party the difference in the price of a financial instrument.

The futures contract was first registered in 1975 at the Chicago Mercantile Exchange. From that very moment to the present, there has been a definite trend towards a rapid increase in the number of trades. The choice of tools is also expanding.

A little history

The first interest rate futures were issued in 1975. The deal took place on the Chicago Stock Exchange. After which the situation changed dramatically. The market has seen an increase in trading volumes. The list of tools used is also expanding. The object of bidding is contracts with a specific execution date.

The seller’s obligation is to sell a certain number of bonds within the period specified in the contract and at the price agreed upon by the parties. The buyer must accept the securities.

Participants in a transaction rarely actually fulfill their obligations. According to statistics, the transfer of securities occurs only in 2% of cases. Typically, a payment is made to the difference in the price of the financial instrument used.

How do interest rate futures work?

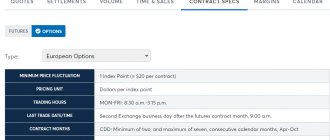

As mentioned earlier, interest rate futures can have any interest-bearing security as the underlying asset. Futures contracts are a legal agreement to deliver an interest-bearing security at maturity or to settle the contract in cash. Most often, futures are settled in cash. Interest rate futures are traded on centralized exchanges and have several specific components:

- The underlying asset is an interest-bearing security on which the future interest rate depends.

- Expiration Date - The date on which the contract will be settled by physical delivery. If it is paid in cash, this will be the last settlement of this type.

- Size – total face amount of the contract

- Margin Requirement - For cash-settled futures, this is the initial amount required to enter into the futures contract. The maintenance margin must remain above the initial margin.

Depending on the underlying instrument, there are a number of different types of interest rate futures. They can also be short term or long term. Short-term interest rate futures have an underlying instrument with a maturity of less than one year, while long-term interest rate futures have an underlying instrument with a maturity of more than one year.

The contract will also specify whether settlement is in cash or whether the underlying asset is physically delivered upon expiration. For futures, cash settlement is based on current market prices and the difference in value is calculated on a daily basis rather than being aggregated to the expiration date.

Physically delivered futures contracts do not require delivery of a specific bond. Instead, specific requirements for an interest-bearing security will be provided. This gives the short position the flexibility to take delivery of the cheapest eligible securities.

Types of futures

There are two types of interest rate futures: short-term and long-term. A short-term futures means a standard agreement that is based on a short-term bank rate. Such futures belong to the category of contracts aimed at difference. In fact, the difference in the contract value is paid, but without delivery of the object of the transaction. Parameters of short-term contracts:

- Price. The value of the underlying asset is determined by the exchange. Such an asset can be a currency pair, stocks, indices or commodities.

- Price step. The term implies a minimum change in the interest rate. Moreover, the number of decimal places is taken into account. The generally accepted price increment is one hundredth (0.1%).

- Cost per step. The indicator is calculated as follows: the above-mentioned characteristic is multiplied by the value of the asset and the validity period of the futures contract.

- Delivery period. In fact, no delivery is made. However, it must be specified in the contract. On the last day of the contract, the transaction is closed at the exchange price.

- Exchange value. Indicates the size of the deposit rate as of the last working day.

Long-term interest rate futures make it possible to fix the value of an asset. The link goes to the date of its purchase. Such contracts act as a guarantee against changes in long-term rates. Two sides win at once. The owner of the asset can sell a long-term interest rate futures before the sale, thereby protecting himself from an unplanned increase in rates. The dealer has the right to purchase a futures contract and avoid the risk of their fall.

In long-term futures, assets are necessarily transferred to the buyer. The transaction value is calculated using the following formula: VALUE = 0.01 × EDSP × FV× Factor + %. Where, EDSP is the contract value on the delivery date, Factor is the conversion factor, % is the available interest. The mentioned coefficient serves as an adjustment indicator. It is determined by the exchange.

Interest futures

An interest rate is an obligation to purchase or sell on a specified date a financial instrument, which can be loans and deposits.

Interest rate futures are considered an excellent option for hedging against interest rate fluctuations. Before interest rate futures appeared, there was no efficient market for interest-bearing assets, and therefore there was no way to spread the risk of interest rate changes among trading participants. The first futures contract was registered in 1975 on the Chicago Mercantile Exchange - since then to this day there has been a trend towards increasing trading volumes and expanding the range of instruments.

The object of interest rate futures trading is a contract with a fixed sale date. The seller of such a contract assumes the obligation to sell the number of bonds specified in the contract within a specified period and at a predetermined price, and the buyer - accordingly, to accept the securities. It is worth noting that the parties to a transaction very rarely actually deliver securities to each other (according to statistics, in only 2% of cases) - most often, one party simply pays the difference in the value of the financial instrument to the other.

Types of interest rate futures

It is problematic to characterize interest rate futures without first considering their classification:

- A short-term futures is a standard contract based on a short-term bank rate. Short-term futures are contracts for difference where only the difference in price is paid and no delivery is made.

The main characteristics of short-term futures contracts are as follows:

- Price. This refers to the price of the underlying asset of the contract determined by the exchange (read about what the underlying asset is here -).

— Price step (also called tick by traders) is the minimum change in the interest rate taken into account, which is measured by the number of decimal places. The standard step is one hundredth (0.01%).

— Step cost (cost of minimal change). This indicator is calculated simply: the first characteristic discussed above is multiplied by the second and by the “lifetime” of the futures. Let's say a futures worth $50,000 with a duration of six months provides the following method for calculating the step price:

— Delivery period. As stated before, no actual delivery is made. On the final day of the delivery period (which must appear in the contract one way or another), the transaction is closed at the exchange price.

— Exchange price. The amount of the deposit rate on the date of the final working day.

Let's look at another example:

Let's say that on July 1, 91-day U.S. Treasury bills are quoted at $80 per unit, which translates to an interest rate of 10%. An investor buys 5 futures at $80 each. For October, the interest rate drops to 9%. If an investor closes contracts at a price of $81 per share, he will earn:

5 * 10000 $ * (10% – 9%) = 50000 $

- Long-term futures allow you to now fix the price at which an asset will be purchased later. This is a kind of insurance against changes in long-term interest rates. A bond owner can sell long-term futures ahead of the sale to protect himself from a likely rise in bank rates, just as a market dealer can buy futures in advance to protect himself from the risk of falling interest rates.

Long-term interest rate futures are the only contracts in which the asset is actually transferred to the buyer. The contract value is usually calculated using the following formula:

It is necessary to clarify what is what in this formula. EDSP is the futures price on the delivery date, FV is the nominal value of the asset, Factor is the conversion factor, % is accumulated interest. The recalculation coefficient, which is unknown to us, is an adjustment value and is set by the exchange - an investor can find it out from a special table.

Let's try to calculate an example:

The security has a nominal value of 30,000 euros, delivers on 10/01/2015, and matures on 10/01/2025 (the difference is 10 years or 120 months). It is the difference in timing that determines the conversion factor: in our case it is 1.0528. The settlement futures price is 50 euros, and the interest rate has already increased to 550%. We have everything to calculate the contract value:

The peculiarity of long-term interest rate futures is that the concepts of “price” and “value” in relation to a contract are not identical: the value of the contract is the face value of the bond, and the price is expressed as a percentage of the face value.

Distinctive features of interest rate futures

Interest rate contracts have the following distinctive features:

- The standard specification includes generally accepted characteristics, such as the deadline for the transaction, the cost of the contract, and the minimum step.

- Offset operations involve the mutual closure of positions in different directions on the same financial instrument. In fact, only a small portion of futures contracts last until maturity.

- Public market. Quotes are publicly published, so finding them is not difficult.

- The trade intermediary is the clearing house, which reduces credit risk to a minimum.

Features of futures

Distinctive features of contracts:

- The basic specification contains the deadline for the transaction, its price and the minimum step.

- Offset operations involve mutual closing of incompatible positions for a specific instrument. In practice, only a small number of contracts are valid until the expiration of the specified period.

- Quotes are printed openly. Anyone can obtain the necessary information.

- Credit risks are minimized due to the fact that the clearing house acts as an intermediary in transactions.