Hashrate is the speed at which a calculation completes an operation in the Bitcoin or other cryptocurrency code. A higher hash rate is better for mining as it increases your likelihood of finding the next block and getting your reward.

Simply put:

HashRate is a unit of measurement of the hashing power of a blockchain network , or how much total individual hashing power is contributed to secure the network .

Hashrate refers to the speed at which the hardware (video card or ASIC) can decrypt hashes. This is the basis of cryptocurrency mining.

The more hashes your farm (video cards) has, the more you will receive.

In the case of the Bitcoin blockchain, the first PoW-based blockchain and network, the Hash Rate is used to algorithmically determine how difficult each equation or “puzzle” must be to validate the next block .

The higher the Hash Rate, the more users or organizations are involved in trying to secure the network, so the more difficult the puzzle must be.

Hash Rate is measured in hashes per second ( H/s ) , so if a network has a Hash Rate of 5 TH/s, this means the network can perform 5 trillion calculations per second to solve the next block's "puzzle". The different hashrate values are listed below:

- 1 kH/s is 1000 (one thousand) hashes per second.

- 1 MH/s is 1,000,000 (one million) hashes per second.

- 1 GH/s is 1000000000 (one billion) hashes per second.

- 1 TH/s is 1000000000000 (one trillion) hashes per second.

- 1 PH/s is 1,000,000,000,000,000 (one quadrillion) hashes per second.

- 1 EH/s is 1,000,000,000,000,000,000 (one quintillion) hashes per second.

Hashrate Determination

Simply put, hashrate can be defined as the speed at which your video card or ASIC operates. Cryptocurrency mining is the process of searching for blocks using complex calculations. Blocks are like math puzzles. Video cards or ASICs must perform thousands or even millions of operations per second to find the correct answers to solve a block.

In other words, to effectively mine a block, a miner must hash the block header so that it is lower than or equal to the "target". The goal changes with each difficulty change. To achieve a given hash (or target), a miner must change some block headers, which are known as "nonces".

Each nonce starts at "0" and is incremented each time to get the required hash (or target).

Considering that the nonce change is random, the chances of getting a given hash (or target) are very low. Therefore, the miner makes many attempts, changing the nonce. The number of attempts a miner makes per second is called hashrate or hash power.

How is hashrate measured?

Mining ability is measured by the number of attempts the miner's hardware sends to find a hash (transform a block). With each attempt, a so-called candidate block is created that must match the established hash. Since attempts are sent continuously, mining power is measured in attempts per second [H/s].

The more people with their equipment take part in the mining process, the higher the hash rate. If the hashrate is too high, the difficulty level increases. If the hashrate becomes too slow, the difficulty level decreases.

Hashrate designations:

| Prefix | Symbol | Designation |

| zetta | Z | Sextillion |

| exa | E | Quintillion |

| peta | P | Quadrillion |

| tera | T | Trillion |

| giga | G | Billion |

| mega | M | Million |

| kilo | k | Thousand |

Measuring hash rate and its units

The hash rate is calculated in hash/second (h/s).

In addition to h/s, there are terms such as:

- Mega hash

- Giga hash

- Tera hash

For example, a mining farm or ASIC working at a speed of 60 hashes per second does 60 tasks per second when trying to solve a block.

Kilohash (KH/s) is used for 1000 hashes, megahash (MH/s) for 1000 kilohashes, terahash (TH/s) for 1000 megahash and petahash (PH/s) for 1000 terahashes.

Our website has a convenient power conversion calculator - conversion to kH/s, MH/s, GH/s, TH/s, PH/s.

Roughly speaking, it’s like in cars, the more horsepower, the more powerful the machine, and in mining, the more hashes, the more coins and therefore the money you’ll get.

For each algorithm, the hashrate is not much different for the same video card, for example, 1 RX570 for 8 gigabytes will produce:

- Ethash – 29 Mh/s

- CryptoNightR – 730 h/s

- Beam – 13 h/s

- Zhash – 19 h/s

- X16R – 6.5 Mh/s

As you can see, map 1, and the hashrate is different everywhere. For example, on Ethash it is only 29 Mh/s, and on CryptoNightR it is as much as 730 h/s. But in this case, a larger hash does not mean more profitable mining. The Rx570 video card is designed for the Ethash algorithm, and the more hashrate you have for this algorithm on Rx570 video cards, the more you will receive.

Hashrate table for video cards and ASICs for mining (in numbers)

| Hashrate of popular video cards for the Ethash algorithm | |

| AMD RX560 | 10-14 MH/s |

| Nvidia GTX1080 | 30-40 MH/s |

| AMD RX5600XT | 42 MH/s |

| Nvidia GTX1080Ti | 40-50 MH/s |

| Nvidia RTX 2080Ti | 50-57 MH/s |

| Hashrate of ASICs using the SHA256 algorithm | |

| Hummer Miner Mars H1 | 80GH/s |

| Todek Toddminer C1 Pro | 3TH/s |

| Bitmain Antminer S17+ | 76 TH/s |

| Bitmain Antminer S19 Pro | 110 TH/s |

Based on the numbers in this table, it may seem that ASICs are thousands and millions of times more powerful than video cards, but the difference in algorithms played a big role here. Since Bitcoin is often mined on ASICs, and ether is mined on video cards, efficiency can only be compared within the same algorithm.

How is Hash Rate measured?

Hash Rate and Hash Power are measured in the same way , that is, using hashes per second ( H/s ) . One hash can be thought of as one calculation used to attempt to solve the block equation .

As more Hash Power is introduced into the network as more people want to secure it and earn rewards, the Hash Rate increases, making it difficult for each miner to correctly guess the next result.

Currently, when Hash Power is transmitted to the Bitcoin network, Hash Power is measured in terahashes per second (TH/s), which means how many trillions of calculations per second can be performed with the amount of hashing power on the network.

While it is impossible to know the exact hash rate of the Bitcoin blockchain or any other network with a PoW consensus mechanism, the hash rate can be accurately estimated based on the current block difficulty and the number of blocks being mined .

The Bitcoin network did not exceed 1 terahash per second until May 2011, approximately 3 years after its creation. The current hash rate of the Bitcoin network is 120 million terahashes per second , which has made the network's security 120 million times better than it was in 2011.

What is cloud mining

What is cloud mining

Cloud mining

- this type of cryptocurrency mining frees the miner from the costs of equipment and electricity, as well as from other, less expensive, but more labor-intensive difficulties, such as setting up equipment.

Companies that rent out their equipment usually have large data centers that use ASIC miners and mining card farms. They offer mining for Bitcoin and almost all altcoins. It all depends on the service you use.

How does this benefit the companies themselves, you ask? The answer is simple - they purchase equipment directly from giants such as Bitmain, and often with deep discounts. In addition, each company sets its own commission, which can be daily or monthly. Again, it all depends on the service. Thus, the cost of mining and the cost of maintaining mining equipment are reduced significantly, which allows both the renter and the lessor to earn money.

And since every year it becomes more and more difficult for an ordinary user to start mining cryptocurrency on a home computer using a GPU, cloud mining services are gaining more and more popularity.

Because of this, renting equipment from trusted companies is not so easy - new capacity positions are sold out almost immediately after they are added to the site.

How is hashrate distributed?

Since all you have to do to contribute to the security of the Bitcoin blockchain or any other PoW blockchain is to provide hash power for verification , anyone around the world can participate in blockchain verification if they have the appropriate hardware.

This means that the Bitcoin network hashrate will be distributed globally based on the amount of hashing power each area contributes to the network.

When you look at the current distribution of hash power and global hash rate, you will see a very interesting picture of the geographical state of the blockchain network .

The first thing to consider is that all the major manufacturers in the mining industry are located in China. This factor, coupled with their notoriously electricity prices especially during the rainy season), gives China the perfect opportunity to dominate the Bitcoin mining process.

The most efficient way to mine Bitcoin is by using a mining pool, which gathers together a hash of the power of the different users connected to that pool, and upon solving a block with that high power, receives a reward based on the proportional percentage of the power that each entity contributes, regardless of whether the pool has verified the block or not.

Since it is difficult for individual entities to compete with large competitors, a mining pool allows smaller players to receive proportionate rewards. This also helps miners have a more predictable income stream.

The three largest mining pools, Poolin, F2Pool and AntPool, control almost 50% of Bitcoin's hashing power and are all located in China. Although China currently dominates Bitcoin mining, it is predicted that more mining capacity and hashing power will be produced in regions with lower electricity prices in America, such as parts of Texas.

If one mining pool controlled more than 50% of the network's mining power, then they could theoretically carry out a 51% attack .

Attack 51% and 34%

Well, everything is clear with legal ways to increase cryptocurrency. What about illegal ones? CryptoCash.guru – we’ll teach you the bad stuff!

It was the 2000s, the sun was shining, MTV was on all TV screens, and Max Pokrovsky was singing not just any “Hara Mamburu”, but a song about the fact that not every fence will be painted on...

The 51% attack is a popular way to hack cryptocurrency networks. Based on taking control of more than half of the computing power. By controlling 51% of the hashrate, a group of miners - the pool - can confirm blocks with obviously fraudulent transactions.

Examples of hacked networks are Ethereum Classic, Bitcoin SV, Bitcoin Gold, Grin.

A more “budget” option is a 34% attack. Having concentrated a third of the power in their hands, attackers can reject or carry out transactions on the IOTA network. The reason lies in the features of the technology - instead of blockchain, IOTA is based on Tangle technology. However, hackers will also have to consider some other variables.

Explanation of difficulty and miner rewards

As the security level of the network increases as more hashing power is fed increases in proportion to the increase in hashing power to ensure the security of the network.

If the difficulty level were not changed, then introducing hashing power would make it too easy to solve the “puzzle” of validating the next block, weakening the security of the network.

The reward for mining on the network is set according to a predetermined schedule and decreases over time if the cryptocurrency is deflationary.

Looking at Bitcoin mining rewards, you can see the reward halving every 210,000 blocks mined, roughly every four years , known as “halving.”

The initial reward for validating a block on the Bitcoin network at the creation of the network was 50 BTC, but after its third halving in May 2022, the current reward dropped to 6.25 BTC per block mined.

As Bitcoin becomes increasingly difficult to mine due to increased competition and hashing power, many miners have started mining BTC in pools as described above.

In these mining pools, each miner who allocates hash power to the network receives a proportional payout regardless of whether they actually participated in mining the block .

Because many of these mining pools are so large, they can estimate how much hashing power they contribute compared to the rest of the network, and can almost accurately estimate how many blocks they will be able to mine compared to the rest of the market.

This allows mining pools to create a reward schedule to consistently pay out BTC to participants regardless of whether they succeed in mining the current block, since they know their statistical odds of mining future blocks and how much they will earn in rewards.

Actual and declared hashrate

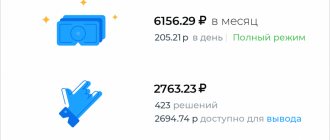

If you mine coins in a pool, then you will have two hashrates: actual and declared.

Actual hashrate. An accurate metric based on the number of correct hashes sent from your hardware to the pool. It also takes into account shares - an indicator of how many computing resources a particular miner invested in searching for blocks, including rejected and late ones. And other factors.

Claimed hashrate. A less accurate indicator is displayed on the miner's side.

Because of the difference between the two hashrate indicators, some of the disputes arise in the spirit of “The pool is stealing resources!” However, some people actually steal, yes.

What is a good hashrate?

A good hash rate is subjective and depends on the size of the network . It is better to have as high a hash rate as possible , as this means that it will take significantly more resources .

If you look at the hashrate of the Bitcoin network, it has grown exponentially to levels that many would not have even imagined when it was created. Looking at the second most popular cryptocurrency, Ethereum, you see a current hash rate of approximately 200,000 GH/s or 200,000 billion hashes per second, which is much less than Bitcoin's 120 million terahashes or 120 million trillion hashes per second .

For most cryptocurrency networks, the Ethereum hashrate is huge and is considered a great hashrate , but if you compare it to the Bitcoin network hashrate, it is still significantly less.

Hash and hashing

Well, we've sorted out the very basics. Now let’s talk about what a hash is and what kind of block mining task it is – hashing.

The essence of cryptography is to take a word or even an entire message of any length and turn it into a set of letters and numbers of a fixed length. This set is the hash.

Hashing allows you to verify the integrity and authenticity of the transmitted data. For example, the hash of a document will not match even if a minimal change has been made to it, such as an extra comma.

And the points are important. Especially those above E

The technology has found application in data exchange, creating electronic signatures and, of course, in all kinds of blockchain solutions.

What hashrate is profitable?

The profitability of hashrate depends on the mining difficulty of the network, as well as the reward schedule, the cost of mining equipment and electricity costs .

The higher the mining difficulty of a network, the more resources must be allocated to compete for the block reward. If the reward for mining a block is high, it makes it more financially worthwhile to dedicate resources to keeping the network secure.

Another very important factor is the power output of your mining hardware . Although the Antminer S9 can produce 14 TH/s, it costs thousands of dollars and the Bitcoin mining reward recently dropped from 12.5 to 6.25 BTC per block.

You should also consider that the lower your electricity costs, the more cost-effective it is to run your mining hardware (as it consumes a large amount of energy).

mining hash rate is profitable for you is to use an online mining profitability calculator, which will tell you your expected profitability based on your hashing power, power consumption, cost of electricity, mining pool fees.

Every 10 minutes - according to a riddle

You may be surprised, but at the heart of the Bitcoin mining process is solving riddles. Problems are set by the system, and they are solved by miners—or rather, powerful computing devices.

We won't go into detail about how these puzzles work, other than to say that miners need to find a number that meets certain requirements. Moreover, you cannot simply solve the problem as an equation: you need to sort through millions of potential solutions and broadcast them to other miners so that they can check them for correctness.

The mysterious creator of Bitcoin, Satoshi Nakamoto, set up the system in such a way that solving a cryptographic problem requires enormous computational effort, but checking for correctness is very simple. When all the miners in the network agree that the number found is correct, a new block is added to the network - and the system immediately produces a new riddle. On average this happens every 10 minutes.

This algorithm is called Proof-of-Work (PoW), that is, “proof of work.” This can be understood this way: by broadcasting potential solutions to the network, the miner proves that he has completed computational work.

The one who is the first to find the coveted number - or rather, the one whose solution is the first to be recognized as correct by others - receives bitcoins as a reward. In 2022, the block reward is 6.25 BTC.

History of Bitcoin hashrate

The history of Bitcoin hashrate is a history of exponential growth . From humble beginnings, the Bitcoin network now has a mammoth hash rate of 120 million TH/s, which is 120,000,000,000,000,000,000 calculations per second .

All of this hashing power is channeled from all over the world and has grown to over 0.21% of the entire global energy supply. This level of energy consumption continues to rise as more organizations dedicate hashing power to the network, with the Bitcoin network's energy consumption levels being higher than the total energy consumption in all of Switzerland .

How to start cloud mining

Equipment for cloud mining

To start mining cryptocurrencies through cloud mining services, you will need to follow a few simple steps:

- Decide on a service provider

. You should not rush to make a deposit on the first site that offers favorable conditions - first you need to study as many similar services as possible, compare the offered conditions, try to find out the reliability of the options under consideration by evaluating them according to a number of criteria (reputation, reviews, etc.). - Register on the website of the selected service

, paying attention to the terms of service with which you agree. - Select a tariff

(plan) on the basis of which a contract for renting computing power from the service will be concluded. In this case, you need to focus on the supported cryptocurrency algorithm, the hash rate, the cost and duration of the contract, payment terms (advance for the entire term or monthly payments), the presence and size of fees for equipment maintenance, minimum limits on profit withdrawal, etc. If different tariffs are offered for the same cryptocurrency, it is worth evaluating each of them based on the cost/profit ratio in order to choose the most profitable one. - Fulfill the terms of payment for the selected contract

and start using the purchased service. As a rule, the cloud mining process starts without user intervention, since the service provider is responsible for setting up the equipment. If the tariff is not fixed, settings will be available in the user account to change the amount of computing power used, which will allow you to regulate the amount of costs.

Current Bitcoin hash rate

Bitcoin's current hash rate is 120 million TH/s, which is 120 million trillion hashes per second.

If you assume that every user mining on the Bitcoin blockchain uses an Antminer S9 with 14 TH/s, this would mean that there are approximately 8.5 million Bitcoin miners in the world.

The actual number of miners worldwide is likely much higher given the high price and high hashing power from this particular mining hardware.

Best cloud mining

The best cloud mining

When studying the cryptocurrency cloud mining market, you should look at at least four indicators:

- Date of foundation of the company and creation of the service.

- Total capacity.

- How many users did the company serve?

- Photo and video materials directly from data centers. Also a big plus is the publicity of the team of employees.

Over the past few years, three companies have proven themselves to be the most reliable in the cryptocurrency cloud mining market:

- HashFlare is a company founded in 2015. Equipment used from companies such as Bitmain, Bitfury, Inno3d and others. Over the entire period, the service has been provided to 2.5 million users.

- IQMining – the company was founded at the end of 2016. The largest data centers are located in China, Russia, Canada, Iceland, Georgia and Algeria. It provides the opportunity to mine cryptocurrency using the most popular algorithms.

- Genesis Mining is a company founded in 2013, but its first data center appeared in Iceland in 2014. Over the years, more than 2 million clients from more than 100 countries have been served. GM offers mining of 10+ cryptocurrencies using 6 main algorithms.

Of course, there are many more such companies than three, but the rest have not yet managed to establish themselves at the same level, so below we will talk about each of them in more detail.

Cloud Mining: HashFlare

This service provides equipment rental for a year for cloud mining of cryptocurrencies using five algorithms - SHA-256 (Bitcoin), Scrypt (Litecoin), Ethash (Ethereum), Equihash (Zcash), X11 (DASH). And, what’s most interesting, at the moment the equipment is only available for ETH mining. And this indicates the popularity of the service.

Prices for all contracts:

- Bitcoin – $0.60 for 10 GH/s. Service is $0.0035 / 10 GH/s / 24 hours;

- Litecoin – $1.80 per 1 MH/s. Service is $0.005 / 1 MH/s / 24 hours;

- Ethereum – $1.40 per 100 KH/s. There is no service fee;

- Zcash – $1.40 per 1 H/s. There is no service fee;

- DASH – $3.20 per 1 MH/s. There is no service fee.

Cloud mining service HashFlare // Source: hashflare.io

Cloud mining HashFlare offers rental capacity for a year with the possibility of increasing the hashrate at any time. Each new contract is concluded for a new term. Since several large mining pools are available to the user at once, the user has the right to choose it himself, or to distribute his capacity among several.

Also quite interesting is the possibility of reinvestment. That is, the earned cryptocurrency can be immediately spent on renting new capacities. For those who decide to mine this or that coin in the long term, this is especially useful.

HashFlare tariffs

// Source: hashflare.io

Note that the HashFlare service does not charge a commission for withdrawing cryptocurrency. When withdrawing, only the standard Bitcoin network fee is charged. According to user reviews, investments pay off within six months, and then there is net income.

The HashFlare service has virtually no downsides. Some customers complain that they have to request every withdrawal. That is, the process is not automated. Others don’t like the fact that renting capacity is not so easy - most of it is already rented, and you have to wait until it becomes available.

But if you think about it, these are not such disadvantages. Especially when you consider the number of advantages.

IQMining

This service is somewhat different from the same HashFlare. For example, the fact that for each tariff there are three categories - Bronze, Silver and Gold. That is, when choosing one of them, the client sees his approximate income and how much he will pay for the tariff and what the commission will be.

IQMining offers cloud mining using three algorithms – SHA-256, Ethash and Equihash. At the same time, there are four tariffs themselves - SHA-256, SHA-256 PRO, Ethereum and Equihash Out of stock.

SHA-256

The minimum rental power (Bronze package) is 500 GH/s at a price of $13 per year. It is also possible to conclude a contract for two or five years, as well as the so-called “lifetime contract”.

The cost of servicing the minimum package per day for every 10 GH/s is $0.001. Note that when purchasing a Silver contract (from 3000 GH/s) or Gold (from 30,000 GH/s), the cost of every 10 GH/s decreases.

SHA-256 PRO

The minimum power in the Bronze package is 1200 GH/s and costs $30. The commission is also $0.001 per 10 GH/s per day.

If we talk about service and the contracts themselves for SHA-256, that is, when mining Bitcoin, the maximum rental capacity is 500,000 GH/s.

IQMining tariffs

// Source: iqmining.com

Ethereum

The contract is for two years with an option for five years. For rental in the Bronze package, a minimum power of 2 MH/s is available for $20. And the maximum capacity is 1000 MH/s. A special feature of ETH mining through this cloud service is that there is no commission.

Equihash

The minimum hashrate is 0.6 kSol with a contract price of $42 per 1 kSol. The commission is equal to $0.07 per 1 kSol per day.

The main difference between IQMining and other services is that cryptocurrency mining is carried out not for a specific coin, but for many altcoins with subsequent resale and distribution of profits. For example, with the SHA-256 PRO tariff, mining occurs for 100+ tokens at once.

This allowed us to achieve a profitability of 128% per annum. However, this applies specifically to the PRO tariff. For example, in regular SHA-256, the historical profitability is at the level of 73%, which the company honestly writes about on its website. True, mining Ethereum or Equihash is also profitable and gives a good income of more than 100% per annum.

For users from Russia, the IQMining service will be really convenient, since in addition to the usual purchase of capacity (like other services) for cryptocurrency or through a bank card, you can make a purchase through Sberbank Online, Alfa Bank or PromSvyazBank.

Genesis Mining

Genesis Mining

Genesis Mining provides hardware for cloud mining of Bitcoin, Ethereum, DASH, Litecoin, Monero and Zcash. Unfortunately, at the time of writing, equipment rental is only available for DASH mining.

For each cryptocurrency, cloud mining Genesis offers 4 tariff plans that differ in power - gold, platinum, diamond and an individual package, in which the client chooses how much power he wants to rent.

Let us note that when it comes to commissions, Genesis Mining is probably the least profitable of the three companies we have presented. However, this does not prevent it from being reliable.

- Bitcoin – the minimum package for BTC mining costs $77 for 2.5 TH/s, and the maximum package costs $5600 for 200 TH/s. The contract is for 9 months, and the daily service fee is $0.099 per TH/s. In this case, the fee is fixed in USD, but is calculated from daily payments in BTC;

- DASH – the minimum package costs $57.50 for 5000 MH/s, and the maximum package costs $4750 for 500,000 MH/s. The contract is for 2 years, and the commission is $0.00001 per MH/s per day;

- Ethereum – the minimum tariff is $525 for 25 MH/s, and the maximum is $6650 for 350 MH/s. The contract is also for 2 years, and the commission per MH/s per day is $0.004.

Tariffs for Genesis-Mining // Source: www.genesis-mining.ru

- Litecoin – the minimum tariff is $28 for 2 MH/s, and the maximum is $2400 for 200 MH/s. The advantage is that there is no service fee and the contract is for 2 years;

- Monero – the minimum contract is $830 for 1000 H/s, and the maximum is $7200 for 9000 H/s. By renting equipment for mining this coin, the client has the opportunity to receive payments in Zcash, DASH and other altcoins using the auto-distribution function. There is also no service fee. Contract duration is 2 years;

- Zcash – the minimum tariff costs $530 for 200 H/s, and the maximum is $7650 for 3000 H/s. Since the coin is mined using the Equihash algorithm, the client can receive payout in BTC, ETH and other coins. There is no commission and the contract is valid for 2 years.

Based on user reviews, Genesis Mining cannot be called the most profitable. Commissions play a significant role in this, as does the state of the market as a whole. But the company has been operating for a long time and has established itself as a reliable supplier of capacity.

☝️

We recommend Genesis Mining review

Conclusion

Both hash power and hash rate are extremely important aspects of any PoW-mined cryptocurrency such as Bitcoin.

Bitcoin hash rates continue to grow at an astronomical rate, as do the capabilities of ASIC miners and users working to verify the security of the Bitcoin network.

Without hashes, Blockchains would not be able to function as distributed ledgers, since decentralized computing power would not be used or allocated to a specific function.

While there is a learning curve when it comes to cryptocurrency mining, it is an important part of the ecosystem and an important topic that every cryptocurrency user, investor, and trader should understand.

Why are GPUs so good for cryptocurrency mining?

In the early days of cryptography, people used CPUs for mining. But they soon realized that GPUs were much better than CPUs at processing the 32-bit instructions used in solving equations that are part of the transaction verification process. Additionally, they were easy to chain together and create mining rigs. They were also easy to buy and relatively cheap.

Currently, ASIC hardware specifically designed to perform hashing functions mines most Bitcoins and some other coins. You can try using your graphics card to mine Bitcoin, but it will not be profitable. The fact is that most cryptocurrencies cope with the increase in the number of mining agents in their blockchain network by increasing the complexity of the equations. The more computing power there is on the network, the more powerful mining hardware is needed to remain profitable.

This is why most Bitcoin miners use huge ASIC farms to mine the coin. The Bitcoin network is huge, so you will need many modern graphics cards to fit even one ASIC device. But GPUs are still extremely popular for Ethereum mining because the creators of the currency made sure that their coin was not profitable for ASIC mining.

They did this by combining solving equations with working with huge data sets that take up a lot of video memory. So, using ASIC hardware to mine Ethereum is very expensive because you need to equip these machines with an incredible amount of relatively fast video memory to keep up with their insane hash rates.

And as the amount of memory required to store these data sets increases along with the complexity of the equations, miners need to upgrade their GPUs with new models that come with more memory, which is also faster, in order for their operations to be profitable.

Getting started with HashFlare

As usual, you need to start with registration, but even before that we recommend registering a personal BTC wallet so that you have somewhere to withdraw your earnings. This can be done later, but it’s somehow calmer this way.

Registration involves simply filling out a standard form, then confirmation via email.

You choose a tariff, then decide on the amount of capacity you are willing to buy and, naturally, the amount required for this.

Payment for capacity is possible in different ways. You can, for example, pay with bitcoins, or you can carry out this operation through a bank card (for many this is more understandable and familiar). All that remains is to fill in the field for the wallet details of the cryptocurrency you want to mine; to do this, create your own personal wallet. After all these actions, your “mission” comes down to monitoring the daily accruals of funds and withdrawing them to your wallet.

Advice! We would like to say a few words about withdrawing or not withdrawing funds to your wallet. Many experienced miners note as their mistake the fact that they were in a hurry to withdraw the mined cryptocurrency. Of course, the temptation is great, especially if this is the first money you earned from the service. But if you do not need funds, it may be more logical to refinance your profit into additional capacity, thus increasing your overall income and providing yourself with more serious income in the future. However, this is just advice, and everyone must decide for themselves whether to use it or not.

Visual instructions:

After registration, you will be taken to the control panel, where there will be many options. First, we need to buy power. To do this, click on “Buy hashrate” in the menu on the left:

And we choose what capacities we will buy, for example SHA-256 or SCRYPT. After this, a page will open on which you need to use a special slider to indicate how much capacity we will take:

Select the required amount of power and click “Next”. After which you will be redirected to a page with the details of your order. Click “Select payment method” at the bottom right and actually choose what we will pay with:

As you can see, there are not many payment methods, but the main thing is that you can pay with a bank card, which will be very convenient for many.

After paying for the order, the power will immediately be credited to your account and will begin to generate income for you. The first deposits to your account will be after 00:00 UTC. Sometimes the first accruals occur only after 24 hours, but this does not play a significant role.

High hashrate video cards

There is a wide selection of video cards on the modern market, but not all of them are suitable for mining. We present in the table the technical characteristics of several models that demonstrate good performance:

Data is as of January 2022, but may quickly become outdated as hashing difficulty continues to increase. Today it is impossible to predict how computing power and payback periods for this or that equipment will change, even a month in advance.

EoBot

The EoBot platform is one of the leaders in cloud mining, which managed to gain a foothold in the market even before the emergence of cryptocurrency trends, namely in 2013. The service offers services for hashrate rental.

This site has two clouds GHS and KHS. That is, Eobot is essentially an exchange of gigahashes (a unit of measurement for mining speed). You don’t need to buy expensive equipment, you can just invest money. By the way, the CEX service is one of the first, which has already lost a little of its popularity.

Actually, GHS is designed to mine the most popular liquid currency – Bitcoin. This is a mining mechanism, and hashrates allow you to split values up to 8 decimal places. That is, you can buy one GHS for literally cents (up to a dollar). But this only makes sense if you plan to test the platform. Otherwise, there is little point in mining with small amounts.

Cloud mining without investment

Cloud mining without investment

In theory, mining cryptocurrencies through cloud mining does not always require investment. Some sites offer new users a small amount of computing power for free and without investment to test the service before investing in it.

True, serious companies now rarely resort to this practice.

Typically, such offers can be found on sites that only masquerade as cloud mining services, but in fact are ordinary hype, luring gullible customers with the help of free “samples”.

Fakes in free cloud mining

On such a web resource, you can try to earn some minimum while it continues to function and make payments. True, in most cases it turns out that in order to withdraw funds you need to make a real deposit, which not everyone is lucky enough to get back.

Of all the verified companies, only BitDeer currently has the option of receiving free test access for a short period. When registering a new account on the site, the user receives 1 TH/s free of charge for 3 days.

Of course, you won’t be able to earn a lot from this, but it will be enough to get acquainted with the process of cloud mining. To withdraw the profit of several tens of cents obtained in this way, you will have to purchase one of the tariff packages available on the site and wait until your account balance increases to the minimum withdrawal limit.

As a result, cloud mining without investment is more suitable for testing services than for real earnings on the Internet.

How much can you earn from cloud mining?

You will have to spend money to rent. You must choose the investment amount yourself. Such services, however, like any other money-making business, are not designed to make a profit. You may be able to recoup your investment within a year. The next time, net profit will be accrued. Thus, the profit will be 100% per annum, which is quite good.

As for the extraction process, this should also be approached wisely. The generation procedure starts in one click, but you need to select the tokens to be created. Of course, you can focus on one, but as you know, it is better to diversify your portfolio. Moreover, this option is implemented directly on the Diversify platform.

If you still decide to mine several cryptocurrencies at once, then the process has a 10-minute period for each position. This is a great opportunity not only to receive different digital money, but also to overclock the cloud.