You don't have to be a clairvoyant to get an idea of what's in store for ripple in 2022. But forecasts for the ripple cryptocurrency for 2022 appear regularly. Many of them are positive, but there are also pessimistic ones, indicating that the coin will burst or significantly drop in price. Not surprising, because 2022 was not the best year for cryptocurrency. The exchange rate has been falling rapidly for several days now. But is this really the end? We very much doubt it, because the decline occurred after rapid growth, the peak of which also falls in 2022.

Despite the fact that this cryptocurrency does not have a blockchain, its capitalization is amazing. Today it is $124 billion. And, despite the jumps in the exchange rate, and quite radical ones at that, there is a chance that the prospects for ripple in 2018 will be not just positive, but phenomenal. And today’s jump in the exchange rate can be perceived positively, because users have the opportunity to buy a lot of coins at a price that is ridiculous for them. And after some time, when the exchange rate increases significantly again, you can make a big profit using the knowledge learned from the forecasts. All that remains is to choose what to believe: positive or negative forecasts.

A few words about the Ripple cryptocurrency

To be honest, this cryptocurrency is one of the oldest, although it received the title of cryptocurrency not so long ago. Its story began at the beginning of the two thousandth in Canada. Only at that time the name was Rippleplay, not Ripple. The main idea of the then project was to provide everyone with the opportunity to create personal finances, even if these finances were virtual:

- This system was first presented publicly only in 2005;

- It received a new status in 2011, thanks to which users had the opportunity to gain equality on the network using the confirmation procedure;

- Only in 2012 did significant changes take place in the team, and it was decided that the system could be supplemented with a digital currency, which many were already talking about at that time. The development of the Ripple protocol began, the OpenCoin company took on it and almost completed it by the end of 2012;

In 2013, the protocol, which allows funds to be transferred directly from person to person, was connected to a decent number of financial institutions;- In 2016, Ripple received the XRP encryption and the title of a fiat currency.

Considering how many years ripple has been heading towards success and recognition, the prospects for 2022 could be very good. The fact is that its history is one of the richest in the history of crypto coins. Bitcoin itself was created only in 2009, but Ripple, although not in the status of a cryptocurrency, was known long before that.

In order to clarify in more detail about the prospects of the coin, let's look at the pros and cons of Ripple, because, like any newly-minted financial concept, it has its pros and cons. Let's start with the good, namely the pros:

- Calculations are carried out without the participation of third parties directly between the parties to the financial transaction;

- There are commission fees, but they are so negligible that they are almost unnoticeable. Therefore, when using Ripple, you don’t have to worry about the amount of commissions, which sometimes hit your pocket quite hard when we talk about other cryptocurrencies. So you can safely pay for services or goods using the online form;

- Operations and transactions are completed in record time. Typically, the maximum amount of time users need to wait is a few seconds. This is the main advantage of the cryptocurrency in question, since so far no other coin has been able to beat it in this indicator;

- If something happens, the system concept allows you to simply return the transaction;

- Ripple can process up to seventy thousand payments per second. This is an incredibly high figure;

- The cryptocurrency was initially released in full, so it is not subject to inflation;

- Interestingly, currency is capable of self-destruction. And we were not mistaken with the category, this is really a plus, although, at first glance, it does not seem so. The way it works is that when a transaction is carried out, one hundred thousandth of 1 Ripley is destroyed. Based on this, the volume of cryptocurrency decreases, thereby increasing the price of one coin.

The creators are initially ready to sacrifice their profits in order to make the system more stable. But the likelihood of cyber attacks is much less. But since we are considering the prospects for the ripple cryptocurrency for 2022, we cannot ignore the disadvantages of the system:

- Many assessments give rise to the focus of the concept on the banking sector. This allows us to strengthen the direct interdependence of the system with the bank;

- Risk of hacker attacks since the network is open. Once it was even stated that the open source code of the system is too vulnerable, which brings many problems to users;

- Judging by the concept of the system, it is something like a large storage bank where XRP funds are stored, because the release of all coins occurred at the same time. But 2/3 of the total cryptocurrency volume was blocked. So there is a risk of pressure from the system on coin owners;

- There is a risk of a market collapse due to the closure of the system. In this case, it will be impossible to get your “deposits” of cryptocurrency.

So, despite the obvious advantages and convenience of cryptocurrency and the system, it has significant disadvantages, the risks of which must be taken into account.

Stablecoins

What are stablecoins?

The official purpose of stablecoins is to be a tool for waiting out high volatility in the market or the entire “crypto winter”. And also serve as a payment instrument, because when purchasing with bitcoins, due to rate fluctuations, one of the parties may find itself at a serious disadvantage. And one USDT, as a rule, almost always costs one dollar, which eliminates these problems.

Ben Armstrong notes that there are many fears regarding Tether, most often related to whether this token is backed by real dollars. What if they just print them out of the blue and there are no real assets behind it? It must be said that Tether had problems on this front, they had to admit that at times the collateral was partial and other assets were used besides dollars.

But in general, despite all the revelations and investigations by law enforcement agencies against Tether, it is still the leading stablecoin with a capitalization of over $62 billion. And this market continues to develop rapidly, which is worth the appearance of its closest competitor USD Coin in the TOP 10 cryptocurrencies with a capitalization of $26 billion. Also, algorithmic stablecoins linked to cryptocurrencies have already been created, and every self-respecting cryptocurrency exchange offers its own stable coin, the best example is BUSD from Binance, plus another $10 billion.

Stablecoins have another function. It is very difficult for a cryptocurrency exchange to obtain permission to work with the dollar or other fiat currency. Also, all payments in fiat go through the banking system, which means additional commissions and control. And stableclions are a very convenient tool to bypass such restrictions. And regulators really don’t like this, because they see that technology is defeating their prohibitions.

Will Ripple grow – prerequisites

Considering the prospects for the ripple cryptocurrency, there are all the prerequisites for the growth of this coin in 2022. Among the most important are the following:

- Ripple has a low commission, and as already mentioned, this is the main advantage of this system. The developers continue to develop their project and enlist the support of more banks in the world. There are already prerequisites that thanks to this approach, by the end of 2018 the token price will be more than $10.

- The second prerequisite for an increase in the price of cryptocurrency is its excellent scalability. In other words, users can safely make transactions and not wait several days for the transaction to go through online. This is an important nuance, since the greater the load on the network of other cryptocurrencies, the longer you have to wait. Bitcoin and Ethereum have already faced this problem. This may affect how much ripple will cost in 2022, because today there are coins costing more than $2, although many experts spoke about such a cost only by the end of this year. Apparently, this happened because transferring money from one country to another takes only a few seconds, and the bandwidth reserve is more than impressive and makes you convinced of the stability of the system. For example, to transfer bitcoins, it will take from an hour to five hours with a commission of 1 to 3 dollars. And in Ripple, the transaction takes from 3 to 10 seconds, and the commission is even less than a cent.

- You cannot mine cryptocurrency; it has already been released in full.

- The main area of activity is focused on international translations, without taking into account any global, unrealistic goals. Ripple has specific scenarios for using coins. It is not surprising that investors are interested in cryptocurrency, because it is stable, one can even say that it is the electronic currency of the future. To some extent, this currency is somehow undervalued, but it seems that this is temporary.

- It helps a lot to promote cryptocurrency that Ripple cooperates with many financial institutions almost all over the world. The company's goal is to involve the entire financial sector. In the future, experts expect that the technology will be adopted by all banks in the world to conduct instant transactions at an international level. So far, there are already eleven thousand financial institutions located in two hundred countries on the blockchain network.

- Ripple's powerful technology will influence how much the coin will be worth in 2022. The fact is that transaction processing does not imply one or two transactions per second - the system is capable of performing about 70,000 transactions per second. By comparison, Bitcoin processes a maximum of 7 transactions per second. Ripple technology in the future may even replace such a powerful international payment system as VISA. And at the same time, the cost of implementing instant transactions decreases.

- Cryptocurrency has high trust not only from users, but also from banking institutions. This is ensured by its high safety. The success of cryptocurrencies in 2022 has already become a factor that has influenced the demand for coins in 2022. So far, Ripple has few competitors in terms of growth, which means good prospects.

- Despite the high prospects of the cryptocurrency in question, few people know about it, preferring Bitcoin or Ethereum. As soon as the popularity of the coins reaches the same level as the already named leaders, their price will rise even higher.

Overall, Ripple has all the potential to become one of the most traded and most used cryptocurrencies in the world.

Ripple prospects for investors and forecasts

Let's consider what the prospects of the project are and how interesting it may be for investors from the point of view of long-term investment.

First of all, unlike most other systems, Ripple is a legal entity registered in the United States. This is a big plus in terms of potential investment.

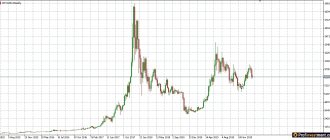

The technology itself is attracting the attention of banks . But at the same time, as noted above, this has nothing to do with XRP yet. If you look closely at the graph above, you can clearly see that the growth at the end of 2022, at the beginning of 2022 was nothing more than hype.

Most likely, the influx of numerous unqualified investors provoked such a serious increase. And their outflow then also significantly affected the value of the cryptocurrency.

What could attract investors at that time?

Most likely, this was information about numerous areas of cooperation between Ripple and the largest banks on the planet.

But, at the same time, they hardly took into account the fact that the XRP cryptocurrency itself has practically nothing to do with this cooperation.

This awareness, as well as the general downward trends in the cryptocurrency industry, became the reason for the subsequent fall of Ripple.

The article mentioned the possibility of banks switching to the xRapid system. In this case, XRP will indeed see wider use.

But at the moment there are a number of significant limitations.

Firstly , for transactions in this case, banks will have to purchase the intermediate currency XRP.

So far, the cost per unit fluctuates between $0.5-0.6.

But the deflationary model will gradually increase the value of the token.

Accordingly, such operations will become increasingly more expensive for banks.

In addition , trading cryptocurrency on exchanges can contribute to significant fluctuations (depending on liquidity) and this also does not speak in favor of XRP.

Banks are unlikely to want to switch to a system in which they will have to buy a certain cryptocurrency with enormous volatility in its exchange rate. After all, this significantly increases risks, as well as operating costs.

Users who are looking to invest in XRP should keep the following points in mind:

- The market that this technology is trying to enter is currently quite competitive. The same SWIFT has been working here for a long time, and even though banks are not satisfied with the commissions and speed of transactions, they are not yet ready to take risks and change anything.

- The XRP cryptocurrency should not be overestimated. It was already mentioned above that it has slightly different goals than most existing coins.

- The significant growth at the end of 2022 and the fall at the beginning of 2018 to almost previous levels is very reminiscent of a dump after a pump (that is, a dump of cryptocurrency after a serious speculative pumping). And now it is not known whether a serious upward trend will begin for this cryptocurrency.

go

Quote chart analysis

The prospects for the digital financial asset in question have recently become better and better. To begin with, Ripple’s forecasts for 2022, which were made a couple of months ago, justified themselves. In particular, it was said that in 2022 the coin rate would be about two dollars per unit, and this is what we see at the beginning of 2022 - the rate actually reached two dollars per coin and even more. The current rate is $3.21.

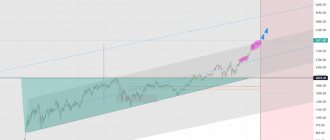

More details about what happened with the price chart of the cryptocurrency in question can be seen below. So, according to the current chart, we see that the quote of the Ripple cryptocurrency is in a long-term GROWING TREND. In September 2022, the coin went through the formation of the “Triangle” technical figure.

If you believe the rules of technical analysis, the triangle will contribute to the formation of an upper trend. At that time, the first immediate growth target was at $0.28914, and the second was already at $0.32017. As for the current situation, the forecast made on the basis of these results did not justify itself, and at the end of 2022 the coin rate was not at the level of $0.4. But no one complains, since the rate is significantly higher:

- The first quite significant jump in the price range occurred in November 2022, when the rate was $0.2986 from the previous level of $0.2539;

- From the eleventh to the twelfth of December, the coin rate increased from $0.25 to $0.37, and on the 13th it was already $0.47. But the growth did not stop there, but there was another big jump to $0.86 per coin;

- After rapid growth, the next day the rate fell to $0.76, which lasted two days (December 15 and 16), after which it fell to $0.72;

- On December 21, the rate exceeded the one dollar line and was already $1.16, but on the 25th it fell slightly and was quoted at $1.03;

- On the 27th, the rate rose to $1.41, after which on December 29 it rose to $2.21;

- On January 3, 2022, the rate rose above three dollars and remains at this level, without falling below for several days.

Considering all this, the prospects for the ripple exchange rate for 2022 are more than good. After all, as they say: “How you celebrate the New Year is how you will spend it.” In the case of Ripple, this saying has only a positive meaning, because despite the fact that experts spoke about a rate of no higher than 0.4 dollars per coin, today we have a rate that has exceeded three dollars.

The specific data depends on which exchange you work on. In addition, the rate is growing too quickly to keep up with current data. One day is enough for a coin to rise or fall in price by several tens of cents. Given such rapid growth, it is quite possible to expect that the coin will cross the border of ten dollars per unit not by the end of 2022, but in just a month or two.

Experts say that the price of Ripple directly depends on the Bitcoin exchange rate for today. That is, the more expensive Bitcoin is, the higher Ripley’s price rises. Since it is the main tool for exchanging cryptocurrencies.

Financial institutions accept cryptocurrencies

If 2022 was marked by the arrival of many speculators on the market, then in 2022 we should expect the entry of institutional players, including asset managers, pension funds, payment operators, etc.

Following Bitcoin futures, which have already been issued by CBOE and CME Group, derivatives based on other cryptocurrencies will appear. The first signs are expected in the summer of 2022.

The industry will also face a number of difficulties. Regulation, forks, banking issues. The uncertainty of the regulatory framework in the United States, China and other countries may hinder the development of the market.

Ripple price forecast for 2022

It is obvious that ripple's forecasts for 2022 are positive - growth, growth and only growth. Even leading digital currency market participants believe in this. And the reasons for this are more than significant, since prices for xrp depend on many factors, and not least of all it depends on the support from investors. Let's look at it in order:

- Ripple Labs recently received a $9 billion investment from IDG Capital Partners and Core Innovation Capital. This allowed for development, which means making a positive forecast for cryptocurrency growth for 2022 even more likely;

- Among all cryptocurrencies, Ripple coins are currently the only option if you need to exchange coins for precious metals and vice versa. Naturally, this increases the popularity of the coin, and the greater its popularity, the higher the rate jumps. This makes Ripple a guaranteed leader in the cryptocurrency market not only for 2022, but also according to forecasts for the ripple exchange rate for the next few years, or even longer;

- Ripple coin has often become used by investment funds. Moreover, its task is to be a tool for long-term investment. Naturally, thanks to this, the exchange rate will not only grow, but also stabilize, that is, it simply will not be allowed to fall very low.

- Ripple coin ranks second in terms of market capitalization. The total price of coins is currently $126,692,111,916, but is in a decline phase. But, despite this, the forecast for the ripple cryptocurrency is positive, since growth began at the end of 2022, just like the growth of Bitcoin, and a decline of 20% is not such a big loss.

Last year, Ripple rose about 50% from 0.18355 to a high of 0.28072, and is now trading at almost three dollars. Of course, it cannot be compared with the growth rate of the same Bitcoin, but the pace is more than good. It is quite possible that the forecast of 10-20 dollars is not the limit.

It’s funny, but just a few months ago, forecasts with a price for one Ripple coin (xrp) of 3-10 dollars at the end of 2022 were considered optimistic. Now we see that the cryptocurrency is already worth more than $3. Every day has its own forecast. For an example, see the following:

| date | Name | Forecast | Exodus. well | Change % |

| 05.01.2018 | Artil Company | Height | 2.7719 | +1.17% |

| 05.01.2018 | Nerea Ner | Height | 2.8300 | -1.77% |

| 05.01.2018 | Putilin Roman | Decline | 2.8360 | +1.12% |

| 05.01.2018 | İlker İlker | Height | 2.8320 | -0.98% |

| 05.01.2018 | Serdal Karabuz | Height | 2.8450 | -1.43% |

| 05.01.2018 | Alberto Galla | Height | 2.8500 | -1.61% |

| 05.01.2018 | Gizem Bütün | Height | 2.7830 | +0.76% |

| 05.01.2018 | alexey fominikh | Height | 2.7629 | +1.49% |

| 05.01.2018 | Kirill Shipnyagov | Height | 2.7650 | +1.42% |

| 05.01.2018 | engin hobere | Decline | 2.7700 | -1.23% |

| 05.01.2018 | Felix Gurvits | Height | 2.7600 | +1.60% |

| 05.01.2018 | Feshchenko Volodymyr | Height | 2.7635 | +1.47% |

| 05.01.2018 | Kasun Kariyawasam | Height | 2.7725 | +1.14% |

| 05.01.2018 | Dino Radulic | Height | 2.7150 | +3.29% |

| 05.01.2018 | soner ünlücan | Height | 2.7300 | +2.72% |

| 05.01.2018 | oğuz kağan metiner | Decline | 2.7300 | -2.72% |

| 05.01.2018 | Ahmet Yavuz | Height | 2.8032 | +0.04% |

| 05.01.2018 | Sergey Egorov | Decline | 2.8200 | -0.56% |

| 05.01.2018 | marcelo togna | Decline | 2.8743 | -2.44% |

| 05.01.2018 | ünal şahin | Decline | 2.8250 | -0.74% |

| 05.01.2018 | MURAT CAN CAYHAN | Decline | 2.8300 | -0.91% |

| 05.01.2018 | Nuri ÖNDER | Decline | 2.8900 | -2.97% |

| 05.01.2018 | Barış ÇELİK | Decline | 2.8300 | -0.91% |

| 05.01.2018 | Richard Kappenberger | Height | 2.8300 | +0.91% |

| 05.01.2018 | Burhan Can Kurt | Decline | 2.8668 | -2.18% |

| 05.01.2018 | Death Machine | Decline | 2.8668 | -2.18% |

| 05.01.2018 | Dragan Gogov | Decline | 2.9330 | -4.39% |

| 05.01.2018 | Max Fadeev | Decline | 2.9900 | -6.21% |

| 05.01.2018 | tommy diakalis | Decline | 2.9871 | -6.12% |

| 05.01.2018 | Sergey Skachko | Decline | 2.9800 | -5.90% |

| 05.01.2018 | Ajay Gaur | Decline | 2.9736 | -5.70% |

| 05.01.2018 | Charif Talama | Height | 2.9800 | +5.90% |

| 05.01.2018 | hayal perest | Decline | 2.9450 | -4.78% |

| 05.01.2018 | Pavel Shashkov | Height | 2.9400 | +4.90% |

| 05.01.2018 | Nicholas Deswysen | Decline | 2.8880 | -2.90% |

| 05.01.2018 | Yaroslav Turenko | Decline | 2.8416 | -1.32% |

| 05.01.2018 | Evgeniy Ivanov | Decline | 2.8586 | -1.90% |

| 05.01.2018 | Gerardo Rivero Ordaz | Height | 2.8450 | +1.43% |

| 05.01.2018 | Quoc Nguyen | Height | 2.7200 | +3.10% |

| 05.01.2018 | Mehmet Karci | Decline | 2.7200 | -3.10% |

| 05.01.2018 | Jack TD Duong | Decline | 2.7599 | -1.61% |

| 05.01.2018 | Ahmet Buluk | Height | 2.6500 | +5.82% |

| 05.01.2018 | Ing Noel Espinosa | Height | 2.6578 | +5.51% |

| 05.01.2018 | Roman Kukartsev | Height | 2.6400 | +6.22% |

| 05.01.2018 | Marco Gilmore | Height | 2.6800 | +4.63% |

| 05.01.2018 | Orhan Saracoğlu | Height | 2.6821 | +4.55% |

| 05.01.2018 | Jorge Gordillo | Height | 2.6536 | +5.67% |

| 05.01.2018 | Leonid Opanasyuk | Height | 2.7731 | +1.12% |

| 05.01.2018 | Francisco Javier ... | Height | 2.7600 | +1.60% |

Such close attention is understandable, since the flat has been continuing since the fall. It was he who demonstrated the stability of ripple. Moreover, the beginning of the flat was marked by good news:

- We started testing the system on the basis of banks in Japan and South Korea;

- There was an investment from the CME Group.

As soon as this became known, the price quadrupled.

This is exactly the forecast for the Ripple cryptocurrency that was made in 2022. High demand has translated the price into a sideways movement. Experts regarded the flat as an accumulation of energy, and this is what happened when the rate rose several times in just a few days. So ripple should be in the center of your attention so as not to miss favorable conditions for working with this cryptocurrency. Experts make the following assumptions:

- Analysis of volatility and regular release of good news from the system proves that growth to the level of 4-5 dollars during the first months of 2022 is quite possible. This is also facilitated by the growth of speculation with the Ripple cryptocurrency;

- Given today's events and increasing interest in the coin, by the end of 2022 the price of Ripple could reach $10 per coin;

- Trading volume is approaching that of the most popular currencies: BTC and ETH. Already today, Ripple is in second place in terms of capitalization.

Reasons for containing Ripple's value

The main brake on the rise in the price of the coin was the lawsuit filed by the SEC (US Securities Commission) against the Ripple company. This decision greatly influenced the platform and its development.

This happened in December 2022. The rate fell overnight by more than 30% after this news. The SEC accused the company of raising $1.3 billion by selling unregistered securities under the guise of XRP.

As a result, some crypto exchanges delisted the token (removed it from trading): OSL, Coinsbit, Beaxy, Cross Tower. But on other exchanges the asset continued to be traded and continues to do so to this day.

But the situation is still unpleasant and this casts doubt on the company’s activities. The SEC is asking the court to prohibit further transactions with this asset, return the proceeds from the sale of the crypto asset and pay a fine.

Of course, all this greatly constrains the price. Most investors are still afraid to invest money in this asset. Several hearings have already passed and everyone is hinting at benefits from Ripple management.

XRP is not a means of payment and is not a security, which is precisely the argument that the securities commission initially latched on to. By and large, they don’t have a serious argument yet and the cards are stacked in favor of Ripple.

Topic: Vet cryptocurrency, is it worth buying?

We remember that the SEC tried to do the same thing with the popular Telegram messenger when the latter released its digital asset. Sec then asked for the funds to be returned to investors. But attacks from outside did not lead to the closure of the company.

True, there is one sad situation where the organization still had to close its activities. The crypto bank AriseBank came under criminal liability. I am sure that these are not the last organizations that have come and will come to the attention of the sinister SEC.

Recommendations for buying Ripple

Do you want to become an investor in the Ripple cryptocurrency?

Then you need to figure out how to buy coins. This is a great way to increase money. The fact is that coins of this type are not anti-banking, that is, they deny the possibility of cooperation with other financial institutions. They complement the capabilities of banks by allowing them to take advantage of innovative technologies. So, given the current cryptocurrency rate, investing in coins is profitable, since this investment can pay off in a short time. The three dollar mark has already been passed, and perhaps in a few months Ripple will cross the line of 5 or even 6 dollars. Having found out how profitable it is, it’s time to find out how to buy this cryptocurrency:

- At the current market price. Since the cryptocurrency is currently falling slightly in price, the coin needs to be purchased at the best price. Over the course of even one day, a coin can fall by several cents (from 5 to 20 cents) to a dollar or more. Considering the prospects for the cost of ripple in 2022, you should buy when the cost is as low as possible.

- In the event of an upper correction, it is possible to sell the currency at the most favorable price. In addition, in this case, you can average the price for your benefit.

- For a short-term investment, the best level to sell XRP/USD is the price of 4-5 dollars and above.

- For long-term investments, users may be suitable for the level of 6-7 dollars, which Ripple will reach in a few months, and perhaps faster. And by the end of 2022, according to competent experts, it will definitely reach $10.

And we must not forget about the reliability of our trading and investment work. For successful activities with cryptocurrencies, it is best to use proven exchanges.

But remember, you cannot completely trust technical data and recommendations. The situation on the cryptocurrency market changes frequently, especially when it comes to Ripple. To be successful in cryptocurrency trading, you need to be able to not only take into account statistics and forecasts, but also have a flair, even some kind of intuition, in order to take successful steps. And choose the right exchange for trading.

Which exchanges trade cryptocurrency:

| EXCHANGE | PAIR | WELL | XRP VOLUME | VOLUME % |

| Bithumb | XRP/KRW | 4280 KRW | 484229528,180 | 23.2% |

| Binance | XRP/BTC | 0.0001673 BTC | 227085707,000 | 10.88% |

| Bittrex | XRP/BTC | 0.00016763 BTC | 206978762,295 | 9.92% |

| Bitfinex | XRP/USD | $2,656 | 201612924,722 | 9.66% |

| Poloniex | XRP/BTC | 0.00016495 BTC | 188370080,303 | 9.03% |

| Bitstamp | XRP/USD | 2.68573 USD | 94100994,422 | 4.51% |

| Coinone | XRP/KRW | 4269 KRW | 93531341,621 | 4.48% |

| Bitfinex | XRP/BTC | 0.0001657 BTC | 65213843,184 | 3.12% |

| Binance | XRP/ETH | 0.00275264 ETH | 61360840,000 | 2.94% |

| Korbit | XRP/KRW | 4259 KRW | 54365441,158 | 2.6% |

| Hitbtc | XRP/BTC | 0.000165 BTC | 46657740,000 | 2.24% |

| Poloniex | XRP/USDT | 2.65764389 USDT | 41369141,004 | 1.98% |

| Bitstamp | XRP/EUR | 2.22 EUR | 40303698,875 | 1.93% |

| Bitstamp | XRP/BTC | 0.00016598 BTC | 39637081,395 | 1.9% |

| Kraken | XRP/EUR | 2.2 EUR | 36608144,805 | 1.75% |

| Huobi | XRP/USDT | 2.7 USDT | 29703120,379 | 1.42% |

| Kraken | XRP/USD | 2.63846 USD | 29320632,607 | 1.4% |

| Kraken | XRP/XBT | 0.000163 XBT | 25833577,468 | 1.24% |

| Bittrex | XRP/USDT | 2.67 USDT | 25214232,908 | 1.21% |

| sex | XRP/USD | 2.9321 USD | 16256614,628 | 0.78% |

| Huobi | XRP/BTC | 0.00016699 BTC | 15773934,301 | 0.76% |

| Exmo | XRP/USD | $2,856 | 15337625,279 | 0.73% |

| Bittrex | XRP/ETH | 0.00275014 ETH | 13261574,371 | 0.64% |

| Exmo | XRP/BTC | 0.00017 BTC | 7417482,762 | 0.36% |

| bx thailand | XRP/THB | 97 THB | 7310622,895 | 0.35% |

| Bitcoin indonesia | XRP/IDR | 40750 IDR | 6791627,654 | 0.33% |

| Bitcoin indonesia | XRP/BTC | 0.00016555 BTC | 3907140,516 | 0.19% |

| Exmo | XRP/RUB | 166.2 RUB | 3244375,253 | 0.16% |

| sex | XRP/BTC | 0.00017222 BTC | 2922531,219 | 0.14% |

| sex | XRP/EUR | 2.34 EUR | 1091563,947 | 0.05% |

| Hitbtc | XRP/ETH | 0.00273 ETH | 949378,000 | 0.05% |

| Gate | XRP/USDT | 3.2301 USDT | 481166,147 | 0.02% |

| Qryptos | XRP/BTC | 0.000167 BTC | 287792,357 | 0.01% |

| Anx | XRP/BTC | 0.000172 BTC | 242895,924 | 0.01% |

| Abucoins | XRP/BTC | 0.0001788 BTC | 191738,806 | 0.01% |

What is XRP

Previously, this direction was called Ripple (RIPPLE) and is a peer-to-peer system with a differentiated registry that does not use blockchain technology. XRP was not created to compete with the #1 cryptocurrency.

According to the developers themselves, the project was created to improve the cryptocurrency direction. The main task is to create a global web where all users will be able to freely, instantly and with minimal fees exchange digital funds. The main priority is to reduce commission fees.

History of creation

The project dates back to 2012. But there are mentions of Ripple much earlier. Back in 2004, Canadian programmer Rain Fugger talked about the development of a new payment system, RipplePay. But at that time, society was not ready for the new financial system and the project did not gain wide popularity.

In 2011, this system was noticed by the founder of the MtGox crypto exchange, Jed McCaleb. Together with new investors, the platform was reviewed and modified, which broke into the top three cryptocurrencies in terms of popularity and, accordingly, capitalization. But the authors of the network are Arthur Britto, David Schwartz and Ryan Fugger.

XRP Vice President James Wallis confirms cooperation with major banks in the development of digital currencies. In one of the interviews, it is said that Ripple plays a key role in the creation of central bank virtual currencies. But the goal is not to eradicate the existing financial system, but rather to improve it.

According to 2022 data alone, out of the 100 largest banks in the world, a little more than 40 have already tested and some have implemented Ripple’s cross-border payment technology. One of these banks was the Japanese holding Mitsubishi UFJ Financial Group, which manages more than $2.5 trillion.

Partners are also:

- English financial conglomerate HSBC Holdings PLC; — Bank of America; - French conglomerate Credit Aqricole and many others.

All this speaks to the attractiveness and value of the technology, the idea and the company itself. Some analysts even put forward the idea that the matter with the SEC is a special deterrent. Banks do not need the hype around this project and need to shake off as many extra players as possible.

Topic: Vtho cryptocurrency, project review

XRP cryptocurrency forecast for 2022

If it weren’t for the trial, then most likely Ripple would have already gone public. They have been planning to do this since last year. In other words, the company may become public and much will depend on the court’s conclusion, which has been postponed again.

In April, the coin showed growth, albeit not great, but still. The reason was positive news regarding the court case. Sec is still unable to fully use its arguments and the court is increasingly leaning towards the Ripple team.

As soon as the main brake (SEC) is released, the coin is definitely waiting for “Tuzemune”. Some analysts predict a rise to $10 immediately after the victory in court. It is important to understand that institutional investors are interested in the technology, who are planning, and some are already using xrp technology.

Attention! This article does not constitute financial advice and is for informational purposes only. Each investor independently bears the risks for his actions.