Before starting speculation, let alone investing in digital assets, the first commandment of a crypto activist is to study all their ins and outs, starting from the emergence of a project to the latest news, one way or another relating to a particular crypto asset. This is the only way to understand the essence of an asset, its reaction to certain events, both political and economic trends, and not only in the crypto community, but in the entire financial and even raw materials industry.

Everything in the world is interconnected, and if you constantly remember the butterfly effect, then possible financial risks and threats can be, if not completely eliminated, then definitely minimized losses. Especially in such a chaotic world, which is the world and not only one of its spheres of cryptocurrencies, but the entire system of relationships.

You don’t have to look far for examples: let’s take the unpredictability of the behavior of the Trump administration, where every day there is a whole set of mutually exclusive statements that cause panic not only among politicians, but also businessmen and financiers of global importance.

The following review of Ripple is by no means the final and highest truth, but the view of the editors of CryptoPrognoz.ru on the prospects of XRP (this is exactly the official ticket this ecosystem has), taking into account the history of its appearance, the historical volatility of its quotes, otherwise, achievements and failures, and also the state of her current health.

History of the creation of the XRP token

The appearance of Ripple should be thanked to programmers such as Ryan Fugere, as well as Jed McCaleb, who joined the project in 2011. At the beginning of the 2000s, and to be precise, in 2004, Ryan conceived the system, and he also came up with a name for it, like water ripples, which made noise the following year in 2005 in connection with the launch of a payment system called Ripleplay.

The system was constantly being improved and after the appearance of Bitka, and also when it became common not only for crypto activists to use such a definition as blockchain, as well as the introduction of technologies based on decentralization, Ryan decided not to waste time on small improvements to the system, but on a radical change in the platform. In other words, to introduce into the system, firstly, blockchain and, secondly, to abandon mining, which, judging by Bitka, greatly slowed down transactions, which significantly affected the speed of transactions or transactions.

Around this time, a certain Chris Larsen asked to be partners with Ryan and Jed, who, as it turned out, would later win over most of Fuger’s team and already in 2013, the so-called Ripple Laboratory or Ripple Labs was conceived based on the previously created OpenCoins.

In the process of all these transformations or rebranding, it so happened that Larsen took the reins, while significantly changing the previously accepted priorities of the project, shifting them towards cooperation exclusively with financial structures. Which brought results quite quickly. And about a year later, in 2014, large banks began asking to become partners.

The first to join Ripple Labs was the German Fidor. And there, as they say in our country, it’s a big deal, it would be a start, Western Union became a partner, and from there it went all the way to the Commonwealth Bank of Austria.

For the sake of fairness, despite Chris’s not entirely gentlemanly behavior towards Ryan and Jed, he successfully reformatted the project from, in fact, not successful into quite promising and quite profitable (you will find out how profitable for Larsen himself below).

And gradually, starting in 2016, the number of users began to grow, which resulted in 55 million dollar investments. And this, in turn, led to a real explosion in the opening of wallets in 2017, which affected the XRP quotes. Moreover, despite the small, relatively small cost compared to other crypto assets, the growth in quotations was due to institutional investors, such as, for example, Google, as well as SBI Holdings. As for the latter corporation, cooperation with it brought Ripple to such huge markets as trading platforms in Asia, including China, as well as Japan and South Korea. Moreover, Larsen, a Canadian with a passport, could not refuse cooperation with domestic banks and met them halfway, including them in the partner list.

As for Fuger’s fate, it is not known for certain. But McCaleb, having broken pots due to disagreements with Larsen, began developing a project related to Ripple. Moreover, as he saw fit, he launched his own project, which is called nothing less than Stellar Lumens, having a universally recognized ticket in the form of XLM, somewhat similar to the previous project, to which he had a hand and a hand.

Where to buy Ripple?

If the price of Ripple today seems profitable to you, and you predict its further growth, then you should not wait long - you can immediately purchase it, simply by choosing a suitable place for this. It could be:

- Online exchanger. Using this type of service, you can purchase cryptocurrency at its current rate by paying in fiat funds (dollars, rubles, hryvnia, etc.) or exchanging another cryptocurrency for Ripple. Be sure to take into account the fact that the exchanger charges its own fixed commission, but one of the advantages of such companies is that using the exchanger does not require registration and account verification, which is very convenient.

- Cryptocurrency exchange. You can always look at the rating of the best crypto exchanges on our website and, having decided on your favorite, you can purchase Ripple there at an equally favorable rate, but also with a lower commission. True, you must register on the exchange in order to trade, buy or sell cryptocurrency. Some exchanges also require account verification.

You can always find a suitable exchanger or crypto exchange where you can buy Ripple on our website. Track the exact exchange rate of cryptocurrencies online in real time, buy or sell XPR, look for sites where cryptocurrencies are exchanged for other cryptocurrencies or fiat money, analyze, forecast and trade.

Analysis of historical Ripple quotes

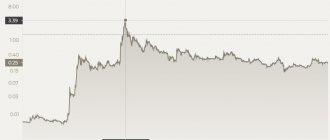

The historiography of the project can be divided into two stages - the fiat and the digital part of the existence of the ecosystem. There is a transition period between them, which began with the arrival of first McCaleb and then Larsen. Moreover, the first stage began, as we already said, in 2004, and the second - starting in 2013. As for the latter, which we present in graphical form:

Ripple chart from the very beginning

That, in turn, has several key points of its own. About which below.

Regarding the transition period, it consisted in the fact that during 2011 and 2012, McCaleb was first involved in the project, who attracted Larsen, as it turned out to be on his own account, when he headed the project after Fugere refused leadership, preferring power functions to occupations with loved ones he likes programming. Chris Larsen turned out to be more aggressive than McCaleb thought he was, and by the end of 2012, he first joined the board of directors, and then replaced McCaleb in his post, heading this governing body and, moreover, becoming a co-founder of the project. After which the transition period began to be considered completely completed.

The digital implementation of the project began in 2013, when a blockchain chain was proposed, which did not require any special gateways or trusted persons for confirmation and was at the same time a fairly secure system. This affected the influx of investments, although not very large, but, nevertheless, 1.5 million American money was attracted in 2013.

From 2013 to 2015, there was a period of formation of the organization in charge of the development of this ecosystem, which became known as Ripple Labs. In 2014, a special option was introduced to freeze assets, which was tested on McCaleb, who left the project, who had a large investment asset in the form of XRP tokens. His assets were first frozen and then completely taken away, thereby showing that decentralization is not the path that the Ripple ecosystem intends to follow in life.

After this event, Ripple received a flurry of, to put it mildly, unflattering reviews. In addition, Ripple Labs was sanctioned with a $700 fine for non-compliance with bank authorization requirements by selling crypto assets without it.

The peak of Ripple’s popularity came at the beginning of 2018, when quotes reached a maximum of $3.31, while showing a fantastic growth of 57.1 thousand% over the previous three quarters.

At the same time, a magazine such as Forbes, which on the one hand performs PR functions, and on the other hand exposes oligarchs, published data on Larsen’s condition. Estimating his capital at neither more nor less, but at $50 billion. Thus showing that Chris is one of the richest Pinocchios on the planet, having 17 percent of Ripple’s assets in his pocket.

Now the dynamics of the quotes of this crypto asset has a steady bullish trend, with periodic surges in quotes, which are most likely provoked by the speculators, in order to cheat inexperienced players out of money.

As for the current exchange rate indicators, the daily drop is 0.6 percent, the drop during the week is within 3.4, and over a two-week period the rate fell by 8.5 percent. Over the course of a month, quotes decreased by 27 percent, while in two months they increased by 26 percent, and over the year - by 83 percent. At the same time, the daily cost of Ripple is now on average 61.5 American cents.

Average prices table

- by month

- by days

- on years

| Month | Price, USD |

| January 2022 | 0.7745 |

| December 2021 | 0.83795 |

| November 2021 | 1.1052499999999998 |

| October 2021 | 1.089 |

| September 2021 | 1.07775 |

| August 2021 | 1.123 |

| July 2021 | 0.6309499999999999 |

| June 2021 | 0.839225 |

| May 2021 | 1.396 |

| April 2021 | 1.2875 |

| March 2021 | 0.4724 |

| February 2021 | 0.485425 |

| January 2021 | 0.2822 |

| date | Price, USD |

| 13.01.2022 | 0.79305 |

| 12.01.2022 | 0.7825500000000001 |

| 11.01.2022 | 0.7534000000000001 |

| 10.01.2022 | 0.7285 |

| 09.01.2022 | 0.7527 |

| 08.01.2022 | 0.7499 |

| 07.01.2022 | 0.75455 |

| 06.01.2022 | 0.76485 |

| 05.01.2022 | 0.7745 |

| 04.01.2022 | 0.8301000000000001 |

| 03.01.2022 | 0.8404499999999999 |

| 02.01.2022 | 0.8514999999999999 |

| 01.01.2022 | 0.84255 |

| 31.12.2021 | 0.82845 |

| 30.12.2021 | 0.8308500000000001 |

| 29.12.2021 | 0.83795 |

| 28.12.2021 | 0.8867499999999999 |

| 27.12.2021 | 0.93535 |

| 26.12.2021 | 0.9195 |

| 25.12.2021 | 0.9171 |

| 24.12.2021 | 0.94765 |

| 23.12.2021 | 0.9771000000000001 |

| 22.12.2021 | 0.94865 |

| 21.12.2021 | 0.9071 |

| 20.12.2021 | 0.87005 |

| 19.12.2021 | 0.8345 |

| 18.12.2021 | 0.813 |

| 17.12.2021 | 0.8043 |

| 16.12.2021 | 0.8201 |

| 15.12.2021 | 0.8089500000000001 |

| 14.12.2021 | 0.79745 |

| 13.12.2021 | 0.80295 |

| 12.12.2021 | 0.83325 |

| 11.12.2021 | 0.81485 |

| 10.12.2021 | 0.83805 |

| 09.12.2021 | 0.8834500000000001 |

| 08.12.2021 | 0.8446 |

| 07.12.2021 | 0.8258 |

| 06.12.2021 | 0.79065 |

| 05.12.2021 | 0.81765 |

| 04.12.2021 | 0.7664 |

| 03.12.2021 | 0.9411 |

| 02.12.2021 | 0.97355 |

| 01.12.2021 | 0.9995499999999999 |

| 30.11.2021 | 1.00065 |

| 29.11.2021 | 0.9838499999999999 |

| 28.11.2021 | 0.92805 |

| 27.11.2021 | 0.9503999999999999 |

| 26.11.2021 | 0.9802 |

| 25.11.2021 | 1.0434999999999999 |

| 24.11.2021 | 1.0405 |

| 23.11.2021 | 1.047 |

| 22.11.2021 | 1.0495 |

| 21.11.2021 | 1.0785 |

| 20.11.2021 | 1.0830000000000002 |

| 19.11.2021 | 1.061 |

| 18.11.2021 | 1.0885 |

| 17.11.2021 | 1.087 |

| 16.11.2021 | 1.1084999999999998 |

| 15.11.2021 | 1.1935 |

| 14.11.2021 | 1.1840000000000002 |

| 13.11.2021 | 1.1855 |

| 12.11.2021 | 1.1945000000000001 |

| 11.11.2021 | 1.2155 |

| 10.11.2021 | 1.237 |

| 09.11.2021 | 1.2570000000000001 |

| 08.11.2021 | 1.2574999999999998 |

| 07.11.2021 | 1.1920000000000002 |

| 06.11.2021 | 1.139 |

| 05.11.2021 | 1.168 |

| 04.11.2021 | 1.2105000000000001 |

| 03.11.2021 | 1.1815 |

| 02.11.2021 | 1.117 |

| 01.11.2021 | 1.1019999999999999 |

| 31.10.2021 | 1.1115 |

| 30.10.2021 | 1.089 |

| 29.10.2021 | 1.0725 |

| 28.10.2021 | 1.03145 |

| 27.10.2021 | 1.0404499999999999 |

| 26.10.2021 | 1.1255000000000002 |

| 25.10.2021 | 1.091 |

| 24.10.2021 | 1.0750000000000002 |

| 23.10.2021 | 1.0895000000000001 |

| 22.10.2021 | 1.101 |

| 21.10.2021 | 1.125 |

| 20.10.2021 | 1.1205 |

| 19.10.2021 | 1.0835 |

| 18.10.2021 | 1.0855000000000001 |

| 17.10.2021 | 1.0815 |

| 16.10.2021 | 1.1575 |

| 15.10.2021 | 1.1295 |

| 14.10.2021 | 1.1375000000000002 |

| 13.10.2021 | 1.107 |

| 12.10.2021 | 1.1015000000000001 |

| 11.10.2021 | 1.1435 |

| 10.10.2021 | 1.1785 |

| 09.10.2021 | 1.133 |

| 08.10.2021 | 1.072 |

| 07.10.2021 | 1.0695000000000001 |

| 06.10.2021 | 1.0630000000000002 |

| 05.10.2021 | 1.0635 |

| 04.10.2021 | 1.034 |

| 03.10.2021 | 1.056 |

| 02.10.2021 | 1.0405 |

| 01.10.2021 | 1.0056 |

| 30.09.2021 | 0.9431499999999999 |

| 29.09.2021 | 0.9394 |

| 28.09.2021 | 0.9174500000000001 |

| 27.09.2021 | 0.95145 |

| 26.09.2021 | 0.9253 |

| 25.09.2021 | 0.93755 |

| 24.09.2021 | 0.9455 |

| 23.09.2021 | 0.99315 |

| 22.09.2021 | 0.9385 |

| 21.09.2021 | 0.9091499999999999 |

| 20.09.2021 | 0.96375 |

| 19.09.2021 | 1.062 |

| 18.09.2021 | 1.076 |

| 17.09.2021 | 1.0775000000000001 |

| 16.09.2021 | 1.0985 |

| 15.09.2021 | 1.105 |

| 14.09.2021 | 1.078 |

| 13.09.2021 | 1.0764999999999998 |

| 12.09.2021 | 1.0924999999999998 |

| 11.09.2021 | 1.082 |

| 10.09.2021 | 1.137 |

| 09.09.2021 | 1.113 |

| 08.09.2021 | 1.0825 |

| 07.09.2021 | 1.1754499999999999 |

| 06.09.2021 | 1.361 |

| 05.09.2021 | 1.275 |

| 04.09.2021 | 1.267 |

| 03.09.2021 | 1.272 |

| 02.09.2021 | 1.259 |

| 01.09.2021 | 1.1989999999999998 |

| 31.08.2021 | 1.1675 |

| 30.08.2021 | 1.123 |

| 29.08.2021 | 1.141 |

| 28.08.2021 | 1.1655 |

| 27.08.2021 | 1.1219999999999999 |

| 26.08.2021 | 1.1255 |

| 25.08.2021 | 1.1435 |

| 24.08.2021 | 1.1955 |

| 23.08.2021 | 1.2570000000000001 |

| 22.08.2021 | 1.2189999999999999 |

| 21.08.2021 | 1.2445 |

| 20.08.2021 | 1.2445 |

| 19.08.2021 | 1.1640000000000001 |

| 18.08.2021 | 1.123 |

| 17.08.2021 | 1.1555 |

| Data is provided for the dates on which the auction took place. Therefore, there is no data for weekends and holidays. | |

| The table is too large to display on the screen. | |

| Year | Price, USD |

| 2022 | 0.7745 |

| 2021 | 0.8910499999999999 |

| 2020 | 0.235925 |

| 2019 | 0.3074 |

| 2018 | 0.5074 |

| 2017 | 0.191 |

| 2016 | 0.006644 |

| 2015 | 0.0079 |

| 2014 | 0.0 |

| 2013 | 0.0 |

Does Ripple have any prospects?

In order to answer this question, we will not state our opinion, but will present several facts that will allow the readers themselves to draw the appropriate conclusions. So:

- at the time of the release of Ripple tokens, their emission was in the amount of 100 billion. At the same time, they were distributed so that almost 80 percent of the coins went to the company itself, and the rest were acquired by three investors, including Larsen, who grabbed 9.5 billion for himself, as, by the way, McCaleb also got 9.5 billion, and McCaleb’s children also got around 2 billion coins;

- then Larsen gave the 7 billion that belonged to him to a certain charity fund, where McCaleb transferred his 1.5 billion and 1 billion was acquired by some investor named Arthur Brito;

- when McCaleb said goodbye to the company, he took crypto assets with him, which seriously frightened the management, since he could at any moment cause a collapse in quotes and bury the entire project under the rubble. Therefore, the board of directors insisted that McCaleb enter into an agreement with the company to meet certain quotas for the sale of Ripple tokens. But subsequently, the top Ripple tore up the agreement, attributing violations of the contract to McCaleb, and first froze and then confiscated his assets;

- As for the tokens at the full disposal of the Ripple company, more than 80 billion. Intentions are being voiced such as donating and selling them through exchanges. Thereby receiving funds supposedly for the development of the project;

- among other things, if back in 2014, on the official resource of the project, everyone could see information about the number of tokens that the company has at its disposal, and which belong to so-called third parties. Since 2015, the reporting format has been changed, and this information has become classified;

- although in 2017, data on such parameters as the number of shares owned by the company, the number of distributed tokens, and how many of them were placed in escrow again became available. The data from the end of January 2018 according to the corresponding lines of the report looked like the figure in the first position was 7 billion, in the second - 39 billion, and in the third - 55 billion. Which led to a complete stupor of all experts and analysts, since these data were not connected in any way with the data that had been made public earlier.

In general, in the Ripple ecosystem there is complete freedom in handling numbers, which cannot but alarm ordinary users, as well as investors and speculators.

What is the ripple exchange rate for today and how to find it out

What is the ripple exchange rate for today and how to find it out

Let's go back to today, because most people want to know the exact rate of ripple right now. Where can you watch it, because there are too many sites on the Internet with graphs, charts and other statistics? It turns out there are several ways to view the exact Ripple exchange rate for today or for past periods. All of them are described below.

Ripple rate on cryptocurrency exchanges

Ripple rate on cryptocurrency exchanges

Where else, if not on cryptocurrency exchanges, is there an up-to-date and accurate exchange rate for any digital coin? Ripple is no exception. The exchanges have all its quotes in relation to other popular currencies, for example, the dollar, the ruble. All figures are indicated with great accuracy. For example, after the decimal point there are several characters at once, up to one hundred thousandths. The fact is that even these precisions are important for investors and traders.

The Ripple rate on a cryptocurrency exchange can be found in a table or other list that shows quotes for all digital coins. The most interesting thing is that they are often “live”, that is, the rate changes every second of time. It all depends on the functionality of the exchange itself.

The following quotes are important for the user:

- XRP/Other currency. The quote displays how many Ripple coins can be obtained for one unit of another currency. For example: XRP/RUB - means how much Ripple the user will receive for 1 ruble. In place of the ruble there may be another abbreviation.

- Other currency/XRP. The quote means how much other currency you need to give to buy 1 digital Ripple coin. For example: USD/XRP - displays how many dollars 1 ripple costs. Instead of the dollar, there are other currencies, that is, their abbreviations.

Each quote corresponds to a specific number. For example: RUB/XRP = 200 rubles. This means that 1 Ripple costs 200 rubles. This is exactly how much you need to pay to buy one coin of this cryptocurrency.

Ripple rate on the chart

Ripple rate on the chart

In addition to quotes, cryptocurrency exchanges must have charts:

- Live - with online broadcast of the course in real time.

- Regular stock charts, where quotes change quickly, but not online.

- Stock charts with the ability to change parameters and functionality. For example, you can set the time settings and see the ripple rate not for 1 day, but for one hour, week, month, year, etc.

In general, the graphs show everything clearly and in dynamics. They show the trend, trends, peaks, drops, plateaus, and important indicators. They are used by professional traders, investors, experts, analysts and advanced users. A stock chart looks like a diagram, or rather a curve. It contains peaks, dips, flat areas - everything depends on course fluctuations. Instructions on how to use charts to find out the ripple rate:

- You should find the desired date on the x-axis - a specific hour in the day, day of the week, etc. By the way, on exchanges you can often change the settings and set your own period: the rate for a week, a month or even one hour.

- We draw a vertical line at a right angle upward until we touch the graph curve itself. At the intersection point, draw a straight horizontal line to the y-axis. At the point of intersection with it, we will find out the exact rate of the cryptocurrency in monetary terms. By the way, usually the y-axis parameters can also be changed, for example, you can apply the desired exchange rate: in rubles, dollars, etc.

More extensive functionality has been designed for professionals. It is located directly on the chart: below, on the left, on the right, or in another part.

Many people actively use candlestick charts, which are also available on cryptocurrency exchanges or other thematic resources. They were called that because the rate curve of Ripple or other digital currency is more like candles. Visually, it seems that they are connected to each other in one line, usually in a curve.

Deciphering a candlestick chart with the Ripple rate

Candlestick charts contain the rate of ripple over a certain period of time: day, week, month, etc. As a rule, you can also set the time yourself. Each candle is the cryptocurrency rate on a certain date. In fact, it looks more like a rectangle with a vertical line at the bottom and top. Sometimes, instead of a candle, a regular feature with lines is visible. There are only candles of two colors on the chart.

Each candle displays not just the Ripple rate, but also the trading price of this cryptocurrency. More precisely, in the rectangle you can see the following prices:

- Discoveries.

- Closings.

- Maximum and minimum.

Users rarely pay attention to what price they offered for cryptocurrency during trading. But for traders, analysts, experts and others, this data is very important. They use it for technical analysis. For these purposes, cryptocurrency exchanges also provide other analytical indicators, statistics, etc. Of course, without knowledge and practice, they will only do harm to the average user. For professionals, all these numbers are very important, and they actively use them.

Ripple rate on exchangers

Ripple rate on exchangers

For many, the word “exchangers” is associated only with currency exchange. On the Internet, they also play another important role. These are sites where you can find out online exchange rates, including digital ones, make an exchange and withdraw funds in one of the specified methods. Nowadays, a large number of online exchange sites include popular cryptocurrencies, including ripple. Thanks to this, you can find out its exchange rate in relation to other currencies on the exchanger.

How to find out the Ripple rate on online exchangers:

- Go to the exchange service website. There are quite a lot of such resources on the Internet. There are even special aggregator sites. On them you should select exchange directions to see the list of rates on different exchangers. Next, click on the appropriate one and go to the exchanger’s website. But if there is already a specific site in mind, then we immediately go to its main page.

- On the main page of the online exchanger there is a list of exchange directions. There are two of them in total. The first is the currency that the user wants to give, and the second direction is the currency that he wants to buy. More precisely, there is a process of exchange, not purchase.

- First, select the first exchange direction. If we are talking about the Ripple exchange rate, then users want to either buy or sell this digital coin. If you need to change your currency to Ripple, then select it as the second exchange direction. If you need to exchange a cryptocurrency for another, then indicate it in the first direction.

- Be sure to indicate the exact amounts - how many Ripple coins or other currency need to be exchanged.

- An accurate recalculation will immediately occur on the resource. The user sees both the Ripple rate and how much currency he will receive after the exchange.

- If you need to carry out an exchange operation and withdraw funds from the resource, you must first register. No registration is required to view the course. It is already available on the main page.

The exchanger indicates the rate corresponding to the market (weighted average). Sometimes it is higher or lower. In the first case, this is how the exchanger attracts users, but you need to understand that a commission is charged when exchanging and withdrawing funds. Tariffs are always specified in the site rules. You need to familiarize yourself with them, as well as the terms and rules of exchange and withdrawal, in advance.

How to find out the Ripple rate online - in real time

How to find out the Ripple rate online - in real time

Millions of users daily search for information about the Ripple exchange rate for today. They find answers on thematic resources, websites about cryptocurrencies, and news portals. Often the information there is out of date, even if the publication was added on the same day. What is the reason? The fact is that cryptocurrency quotes change every second. Trading is constantly taking place on the exchanges, and the exchange rate changes up to a hundred thousandth of it.

If you need to find out the exact Ripple exchange rate for today or at this very second, then it is better to turn to specialized sites:

- Cryptocurrency exchanges with live charts.

- Sites where there are the same live online charts or tables with quotes changing in real time.

If you go to such a resource and look at the graph, table with the rate of Ripple and other cryptocurrencies, you can clearly see that the values change every second. You can even see how much money traders have sold and bought, and how the trading is going. Usually, cryptocurrency exchanges provide a complete picture - they have live charts and other dynamic indicators.

Does it make sense to buy Ripple today?

Is it worth buying or investing in Ripple, and are there any chances of making money through trading?

- Regarding the first part of the question, we would recommend caution regarding medium- and long-term investment in this crypto asset. At the same time, it is necessary to try to do this with the help of those means that you do not mind losing them irretrievably.

- Regarding the second part of the question, it all depends on the experience of the speculator; on the one hand, the volatility of tokens makes it possible to have decent incomes (if you play at large bets). On the other hand, there are very high risks of being left with nothing, since the behavior of this asset may turn out to be so chaotic that it cannot be described in oral or written words. Do you need this?

Moreover, we have given quite a lot of examples where the company that regulates the activities of the Ripple ecosystem quite freely interprets agreements and contracts in its favor, both with investors and ordinary users.

One more example of such behavior will not be superfluous. Back in 2016, Ripple’s management entered into a contract with a corporation such as R3, promising the latter an option for a major transaction with Ripple, at a rate of no more than 0.8 cents per token with the possibility of expiration in 2019, but did not keep its word. After R3 filed a lawsuit against Ripple, it itself was attacked in the form of a counterclaim for allegedly violating the contract. So not everything is so smooth and clear with this cryptocurrency...

How to buy Ripple?

Ripple (XRP) is in great demand, and if you also want to acquire this cryptocurrency, then you need to:

- Register a Ripple wallet. This can be either a specialized hardware wallet (looks like a flash card) or a desktop one. In addition, there are now a lot of offers to create a mobile or browser wallet.

- Choose a place to buy.

- Top up your wallet with a certain amount.

- Store your private keys in your wallet until you decide to sell or exchange your cryptocurrency.

Many traders recommend opening a Ripple wallet, but you can also store cryptocurrency on a personal account in one of the exchanges on which you are registered. You can withdraw crypto from there in different ways, but which option is more acceptable is up to you to decide.

Please note that to activate a Ripple wallet, your account must have at least 20 XPR, which is considered the minimum balance. By comparison, the Bitcoin wallet does not provide this, so it is actually free.

Ripp (Ripple) – cryptocurrency Ripple (XRP)

The Ripple company appeared in 2012, but then no one had heard of it. The development team worked to create an alternative currency that could be used for payments by banks.

Of course, ordinary users could also use tokens, but the main focus was on financial organizations.

Looking ahead, we will present our Ripple forecasts for 2022. In the first half of the year, the rate should rise to at least $5, and in the second half of the year, quotes should reach $8.

In general, Ripple is not very different from its analogues; you can buy, sell, and exchange coins in the same way. The coins are protected at the cryptographic level.

The emission is fixed, tokens are distributed over the internal private network. Translated from English, the word Ripple is a ripple on the water, so its millionth part is called a drop.

Today, the capitalization of the Ripp currency exceeds $72 billion; it is one of the most popular altcoins.

The algorithm by which cryptocurrency works is somewhat different from the Bitcoin network. These distinctive features make tokens more secure from hacking.

In 2013, the OpenCoin currency was created, which was later renamed Ripple.

A lot of interesting things have happened in the history of cryptocurrency development. For example, when one of the founders left the company, embezzling billions of coins. But this did not stop the project from gaining popularity.

Buying Ripple through exchangers

It’s even easier to buy cryptocurrency through exchangers, but in this case, the rate will not be as favorable as on exchanges. But you can directly buy Ripple from a Sberbank card, for rubles, Qiwi, Yandex.Money and other currencies.

First of all, you will still need to open your wallet, because your coins must be stored somewhere.

It’s even easier to open an online wallet for Ripple through the Cryptonator service. On the same site you can change cryptocurrencies, but the conditions there are not always favorable. Therefore, the system is more suitable for use as a wallet.

Thousands of exchangers on the network are ready to exchange fiat money for cryptocurrency. Each of them has its own course, so you need to first analyze the offers. To avoid doing this manually, go to BestChange and select the exchange direction:

For example, we chose to purchase Ripple for rubles from a Sberbank card. The system instantly checks exchanger offers and produces the following list:

As you can see, between the first and last site the difference in rate is almost 80 rubles. Obviously, it is better to buy coins at the first exchanger.

Further actions are no different, you need to indicate the amount, fill out additional forms (if a transfer is made from a card, then the details of its holder are required) and confirm the operation:

There may be differences in design, depending on the selected exchanger. It is necessary to indicate the card number, the address of the Ripple wallet where the coins and personal data will be sent.

If you exchange electronic money (for example, QIWI), then there will be no form with your first name, last name, and so on.