Bonds are among the most conservative and affordable investment options. They have a low to medium risk, so large investors often include them in their investment portfolio in order to diversify their investments and protect against losses. In this article we will tell you what bonds are, what they are like and what to look for when choosing.

What types of bonds are there?

A bond is a security that is a receipt from the issuer for receiving funds from the borrower and returning them within the agreed time frame with interest. When you buy bonds, you are essentially lending to the issuer and earning interest.

Features of bonds:

- the holder of the security receives payment of interest accrued on the face value - coupons;

- The par value of one bond is usually 1000 rubles;

- in the event of liquidation of an enterprise, the issuer's bonds are settled first;

- the maturity date of the bond is always known in advance, depending on it, the debt security can be short-term (up to 12 months), medium-term (1-2 years), long-term (3-5 years);

- bonds can be issued by the state (OFZ), municipal authorities and individual companies;

- Based on the nominal currency, a distinction is made between ruble bonds and Eurobonds, and the latter can be quoted in dollars, euros and other currencies.

Investing in bonds for individuals is possible only by opening a brokerage account or an individual investment account with the possibility of receiving a tax deduction in the amount of up to 52,000 rubles per year. The second option is relevant for investors who have official taxable income and are ready to invest money for a period of more than 3 years.

Comparison of a portfolio with bonds and a portfolio without them

A non-bond portfolio consists only of stocks or other assets. It will be more profitable, but along with the profitability, the investor’s risk also increases. There is no portfolio protection in the form of bonds if the market falls, so the risk of losing all your money will be higher.

A bond portfolio can not only reduce risk, but with proper regular rebalancing, it can increase investor returns.

Even if you are comfortable with risk, it is better to keep part of your assets in the form of bonds. Everyone may overestimate their ability to withstand stress, and if you have no experience investing during major downturns, it is better to insure your portfolio.

During a crisis, you can sell bonds and buy cheaper shares and rebalance your portfolio with more promising assets. Bonds may also fall in price, but not as much as stocks. Moreover, in the period before the crisis, bonds will generate income in the form of coupons.

The optimal ratio of stocks and bonds in a portfolio is 20/80 if your financial goal is less than 5 years away or you are not willing to take risks. For all other investors, the ratio between shares of shares and bonds will be established individually. Some stock market participants do not take bonds into their portfolio at all, but only you can decide whether you should do the same.

Give your rating

about the author

Klavdiya Treskova - higher education with qualification “Economist”, with specializations “Economics and Management” and “Computer Technologies” at PSU. She worked in a bank in positions from operator to acting. Head of the Department for servicing private and corporate clients. Every year she successfully passed certifications, education and training in banking services. Total work experience in the bank is more than 15 years. [email protected]

Is this article useful? Not really

Help us find out how much this article helped you. If something is missing or the information is not accurate, please report it below in the comments or write to us by email

How much income can you get?

Against the backdrop of low deposit rates, bonds are an attractive investment option for conservative investors. They are reliable and in most cases provide a stable and regular income.

Depending on the form of profit, bonds are:

- discount (they do not provide for the payment of a coupon, income is formed from the difference between the purchase price and the sale price of the security);

- interest (provide for the payment of interest in a fixed or variable amount);

- mixed (combine both discount and interest).

Each bond has a par value, usually 1 thousand rubles. The market price of a bond is determined on the stock exchange during the trading process and depends on the economic situation, demand for the paper and other factors. It can be either higher or lower than face value.

The coupon is the principal return on the bond. If you want to invest money in bonds, pay attention to the size of the coupon. A coupon that is too high indicates a high risk of non-refund.

The coupon is accrued daily, but its payment is made within the time limits established by the issuer: once a quarter, once a year, 2 times a year. If you want to sell your securities before the maturity date, you can safely count on a profit. The new owner of the securities will pay you the accumulated coupon income (ACI).

What it is?

Bonds are the closest alternative to bank deposits in the stock market.

These are securities (debt obligations of companies or the state) that work on approximately the same principle as a bank deposit. You buy a bond for 100 rubles, and after a year (or any other agreed period) you are promised to return these 100 rubles, plus a fixed percentage of income, which can be paid once a quarter, half a year or year. When purchasing a bond with a face value of 100 rubles. for 100 rub. with an interest rate of 10% per annum for a period of 1 year, in a year you will receive 110 rubles. Bonds are traded on the stock market. They can be purchased either independently by opening an account with a broker, or through a management company by purchasing a share in a mutual fund.

Bonds are issued for a specific period. It can be 1, 2, 3 years or more. If you decide to sell the bonds ahead of schedule, for example, in six months, then if the market situation is favorable, you can return their full value and receive interest for six months in full, that is, 100+5 rubles.

Bonds are traded on the stock market and their value may decline. It depends on the international situation, the policy of the Central Bank, the situation in a particular company or industry. Market participants buy and sell securities every day. For this reason, if you decide to sell what you bought for 100 rubles. bond six months after purchase, against the backdrop of negative news, you can make a mistake. You, of course, will receive all the interest on it for 6 months, that is, 5 rubles, but at the same time, the cost of the security itself may fall to 95 rubles. This is the amount it can be sold for. In the end, at best, you will remain with your own.

But if the situation changes in your favor and, for example, the United States lifts sanctions on Russia, the value of the bonds, on the contrary, will increase, and you will be able to sell it, for example, for 105 rubles, and again receive your interest in the amount of 5 rubles. However, we repeat, you can be guaranteed to return your 100 rubles plus 10% per annum only when the previously agreed release date has passed.

Unlike a bank deposit, where the state guarantees the return of 1.4 million rubles. in the event of a bank closure, the return of funds on the bond is guaranteed only by the one who issued the bond - the state in the case of government bonds or the company. For this reason, when choosing a suitable bond, you need to focus not only on its term and profitability, but also on the reliability of the company that issued it.

An example of calculating coupon yield on a bond

Let's assume that an investor purchased a bond with a 3-year validity period immediately after placement for 980 rubles. The nominal value of the bond is 1000 rubles. The promised income is 9% per annum. What will be the investor's income minus personal income tax?

Calculation

Coupon income: 1000*0.09*3 = 270 rubles.

Exchange rate income when the bond is redeemed: 1000-980 = 20 rubles.

Total income: 270+20 = 290 rubles.

Income minus personal income tax = 290 * 0.87 = 252.3 rubles.

Thus, the investor’s income for a long-term investment of 3 years after repayment of the par value amounted to 252.3 rubles or 8.3% per year.

The role of intermediaries

As a rule, the issuer offers investments in the purchase of bonds through intermediaries - financial-credit and financial-investment companies.

Intermediaries can perform the following functions:

- development of conditions, documentation of the issue prospectus, registration with government financial authorities and notification of possible investors;

- organizing a subscription syndicate that undertakes to purchase the loan (or part of the issue);

- organization of primary placement and secondary trading;

- organization of coupon payments and payment of repayment amounts to investors.

The development of a bond investment project should include draft agreements with intermediaries. Moreover, usually one of the intermediaries is identified, called the general agent, who assumes the main obligations.

Please note that the initiative of an emission project is always punishable by the expenditure of time and money on the preparation and registration of the emission prospectus in direct form or in the form of commissions to intermediaries.

Investing in bonds: criteria for selecting securities

Let's take a closer look at what you need to pay attention to when choosing debt securities in order to minimize risks and make a reliable investment.

Issuer's creditworthiness

An important criterion for choosing a bond is the reliability of the issuer. The investor must evaluate the creditworthiness of the corporation that issued the security. This can be done by determining the issuer's rating.

To calculate the credit rating of the issuing enterprise, the current and past financial history of the corporation, the amount of equity capital and the level of debt obligations in total assets are assessed. International agencies such as Moody's and Fitch, Standard & Poors often publish ratings of large corporations. In Russia, such expert agencies are considered to be Expert RA, the National Rating Agency, and RusRating.

Bond yield level

You should not purchase securities whose yield significantly exceeds the market average. Most likely, such enterprises are experiencing financial problems, forcing them to take extreme measures to improve the attractiveness of the investment instrument - significantly increase the interest rate.

Types of profitability:

- current – denotes the ratio of the accrued coupon to the current market price of the bond;

- coupon - the interest that the issuer is going to pay on each denomination;

- • effective yield at maturity - the full yield of the bond, taking into account the reinvestment of coupons.

Risk assessment

Bond investors face several types of risk: credit risk, interest rate risk, inflation risk, and liquidity risk. Credit risk is realized when the issuer's solvency deteriorates, interest risk is associated with changes in interest rates, and inflation risk is associated with rising inflation.

The risk of loss of funds and shortfall in income on bonds may be associated with default of the issuer. This is why federal loan bonds (OFZ) are considered the most reliable. The risk of bankruptcy of companies is always present, therefore, such securities are assigned a risk category of medium.

When investing, pay attention to the liquidity of securities. If they are actively bought and sold on the stock exchange, it means they are popular among investors. Those securities that are easy to buy but difficult to sell are considered less liquid.

The mutual fund of financial instruments “International Bonds” was included by the Bank of Russia in the register of mutual funds on June 16, 2021, trust management rules No. 4471-SD. *DTS (Duration Times Spread) is a measure characterizing the volatility of bond prices. It is calculated as the product of the maturity of the instrument and the credit premium. Credit premium is the difference between the yield of an instrument and the risk-free rate of similar maturity. *Scenarios of average annual returns are calculated based on the historical values of the prices of assets from the strategy portfolio and/or indices, with which the results of mutual fund management in the strategy portfolio are compared, for 5 years, subject to investing in the strategy for at least 3 years. To calculate the neutral scenario, the median return value of all possible values on a given time horizon is used, to calculate the positive scenario, 10% of the best return indicators are used, to calculate the negative scenario - 10% of the worst return indicators, to calculate the stress scenario - less than 1% of the worst return indicators . The above profitability scenarios cannot be considered as a guarantee or guide to the profitability of an investment in accordance with the proposed investment strategy. The scenarios are calculated taking into account the management company's commissions. Joint Stock Company "Sber Asset Management" was registered by the Moscow Registration Chamber on April 1, 1996. License of the Federal Securities Commission of Russia No. 045-06044-001000 dated June 7, 2002 to carry out securities management activities. License of the Federal Commission for the Securities Market of Russia to carry out activities related to the management of investment funds, mutual funds and non-state pension funds No. 21-000-1-00010 dated September 12, 1996. Before concluding a trust management agreement, interested parties can familiarize themselves with the terms of asset management, obtain information about Sber Asset Management JSC and other information that must be provided in accordance with federal law and other regulatory legal acts of the Russian Federation at the address: 121170, Moscow, st. Poklonnaya, 3, bldg. 1, 20th floor, on the website ww.sber-am.ru, by phone or at the contact information center by phone. The performance of the securities manager in the past does not determine the future income of the management founder. Before making an investment decision, you should carefully read the trust agreement and risk declaration. The concluded trust management agreement is not a bank deposit or bank account agreement. The funds transferred to management are not insured by the state corporation “Deposit Insurance Agency” in accordance with the federal law “On insurance of deposits in banks of the Russian Federation”; the state, Sberbank PJSC and the company do not provide any guarantees of the safety and return of invested funds. Trust management services are provided by Sber Asset Management JSC. Funds for management are received by Sber Asset Management JSC, and not by Sberbank PJSC. Sberbank PJSC and Sber Asset Management JSC are different entities with independent liability that are not liable for each other’s obligations. Trust management services mean investing money in securities. Investing in securities involves credit and market risks, including the risk of losing all or part of the funds invested. Investing in securities all or most of the client's funds may lead to the loss of all his savings, as well as the client's bankruptcy. To submit complaints, as well as out-of-court resolution of disputes related to trust management services, the client has the right to contact the company (mailing address: 121170, Moscow, Poklonnaya St., 3, building 1, 20 floor, telephone, email. address, website: ww.sber-am.ru), in PJSC Sberbank, in NAUFOR, in the Central Bank of the Russian Federation. If it is impossible to resolve the dispute out of court, the client has the right to go to court.

Tax issue

It is known that coupon income from bonds is taxed at 13%. Corporate bonds issued after January 1, 2022 are exempt from tax if their yield does not exceed the Central Bank refinancing rate by 5%. When purchasing OFZs, coupon income tax is not charged.

An example of calculating benefits on OFZs and corporate bonds, taking into account tax

Suppose the yield on OFZ is 6%, and on corporate bonds – 6.8%. The amount available for investment is 150 thousand rubles. Which bonds are more profitable for investors?

Income from OFZ: 150 * 0.06 = 9 thousand rubles.

Income from corporate bonds: 150*0.068*0.87 = 8.874 thousand rubles.

Thus, if the interest rate on corporate bonds differs slightly from the OFZ coupon yield, it is more profitable to purchase government loan bonds, since they are not subject to income tax.

Wheel

The essence of the Wheel investment scheme is the effect of compound interest.

Formula for calculating compound interest

The task is to create a bond portfolio so that the income received from some bonds is constantly reinvested in others throughout the year. Those. it is necessary to create a cyclical movement of capital, which would grow much faster through constant reinvestment.

What is needed for this (as an example):

- 4 equal shares of OFZ-type securities or corporate bonds with quarterly coupon payments are purchased. Moreover, purchases are made so that payments on coupons are close to the terms of purchases of others. If we have 4 tranches of bonds, then we distribute them quarterly - for example, January, March, June, September.

- Let’s assume that coupon payments for the first tranche are due in January—this money is used to buy securities for which the first tranche of payments will be made in March, then coupons from the March tranche are invested in the June tranche, etc. It turns out to be a closed scheme, when income from some securities is immediately reinvested in other instruments. If you use 4 packages, as in the example, then the capital turnover increases accordingly by 4 times. If you construct such a scheme with monthly or even weekly turnover, then the rate of capital turnover increases by 12 or 52 times, respectively.

This scheme is quite difficult to manage. Any liquid debt securities with regular coupon payments are suitable for this scheme.

Compound versus simple interest rate chart

Peculiarities:

- Compatible with IIS. It can be used on an IIS, but a careful selection of papers is required to create the diagram.

- Risks. relatively low risk, since the scheme usually uses debt instruments with a high reliability rating, for example, OFZs and/or corporations from the top 100 list of exchange-traded bonds.

- Compared to other methods. This option provides a steadily growing financial flow of profit for the investor in the time periods specified by him - once a month, quarterly or even weekly.

How to buy bonds

To invest in bonds, you need to choose a broker and open a brokerage account. A list of brokers can be found on the Moscow Exchange. When choosing a broker, we recommend paying attention to whether he has a license from the Central Bank of Russia. Without it, the broker has no right to carry out transactions on the stock exchange. You can find out whether a broker has a license on the website of the Central Bank of Russia.

Another important selection criterion is service tariffs. In addition to commissions for transactions, the broker may charge fees for depository services, account maintenance, deposits and withdrawals of funds, use of the trading platform, voice orders to complete a transaction, and SMS alerts.

Open a brokerage account

You can purchase bonds by opening an account with a brokerage company. To do this, you must first choose a broker. The full list can be viewed on the Moscow Exchange website.

Top 15 brokers with the lowest commissions

To conclude a contract, you will need a passport. The broker will open a brokerage account and help you install a trading program on your computer, and also explain how to buy a particular security.

The broker earns from client commissions from trading operations. In order not to overpay, you must ask to select a tariff for your specific needs. Let them know that you intend to make a minimum number of transactions, that is, buy and sell the paper in a year or two. The bond can be purchased through your personal account after you have installed the trading application on your computer, following the instructions of the broker. When you decide to withdraw funds, inform the broker about this desire. The money will be transferred from the brokerage account to the bank account, and from there it can be withdrawn at the cash register or through an ATM.

The commission for the purchase/sale of bonds ranges from 0.025% of the transaction amount. You also need to pay 100-177 rubles. per year for storing securities in the depository. An additional small amount will have to be paid for withdrawing funds (approximately 10-50 rubles). The amount of commissions depends on the broker and transaction amounts.

IIS

You can invest in bonds through an individual investment account (IIA). It is opened through a broker and gives the right to receive a tax deduction in the amount of 13% (no more than 52 thousand rubles per year). You can top up your account and apply for deductions annually, provided you have official taxable income.

Features of IIS:

- maximum contribution amount – up to 1 million rubles per year;

- annually, if you choose deduction type “A”, you can receive a deduction of up to 52,000 rubles;

- Type “B” deduction allows you to avoid paying tax on investment income;

- The minimum period for using IIS is 3 years;

- a citizen can open only one account.

If you urgently need money and want to withdraw it from your account, be prepared for the fact that you will have to return the tax deduction you received.

From the issuer's perspective

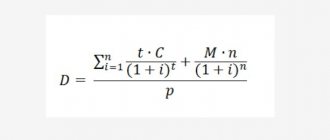

For the debtor issuer, the effectiveness of bond placement is determined by:

- costs of organizing the issue, incl. costs of commissions to intermediaries and publication of information about the issuer required by law;

- proceeds from the sale of bonds;

- debt service costs, incl. coupon payments and redemption costs.

For the issuer, the effectiveness of the investment project is assessed in a standard way, taking into account all elements of the payment flow. This takes into account:

- organizational costs adjusted to the start of placement;

- the number of bonds placed at a particular point in time;

- the nominal price of the bond equal to the redemption price;

- the selling price of the bond (in monetary units) at a certain moment;

- coupon payments at a certain moment on one bond placed at a specific moment;

- base lending rate.

If the issuer places the issue at once (for example, sells all bonds to intermediary underwriters), then the calculation is simplified.

Positive net present value (NPV) means the advantage of issuing compared to receiving a loan at the rate. The option with the highest NPV is preferable.

The rate that ensures that the NPV is equal to zero represents the IRR of the project and can serve to select the best organizational option, but is recommended only for a one-time placement of bonds.

Also see “Internal rate of return of an investment project.”

When placing bonds during the implementation of an investment project, estimates contain the most important uncertainty factors:

- placement schedule;

- sales price chart.

Overestimation of these quantities is a dangerous feature of many poorly designed projects.

Also see “How to Make Decisions Under Uncertainty and Risk.”

conclusions

- If interest rates are expected to decline, it is more profitable to buy “long” bonds, and if growth is expected, it is more profitable to buy “short” ones.

- You need to choose a measure of risk for your bond portfolio that matches your risk appetite. You can use the Arsagera Asset Certification ranking system to complete this task.

These two simple tips will allow you to independently form a bond portfolio and manage it effectively.

- To improve the efficiency of portfolio management, it is necessary to compare bonds with each other within each group, as well as calculate and constantly monitor their potential profitability. This is a time-consuming process that we can carry out for you as part of your bond portfolio management.