A coupon bond is what savvy investors prefer as the most attractive way to invest, earn, or save money. Purchasing securities is beneficial not only because the face value is returned within a specified period (savings), but also by accruing interest on the total amount (accumulation and profit). This part of the profit on bonds is the accumulated coupon income. The cash flow on bonds is a dynamic value that depends on the time interval between payments.

What is NKD

The coupon rate on bonds is a parameter that implements the mechanism of interest charges and payments. The NKD allows the owner of the bonds to sell them before the maturity date. In this case, interest income is not lost.

This definition may not be clear without a visual illustration. Let's consider it. Conditional buyer N purchased a bond with a face value of 1 thousand rubles from seller M. It is known that its profitability is 20%, and payments occur every quarter (4 times). Hence:

- The coupon size is 200:4=50 rubles;

- frequency of payments – 365:4=91 days.

The accumulated coupon income is formed as a result of interest accrual.

Every three months, the owner of the paper will receive 50 rubles. After the next payment (50 rubles), the coupon is “reset to zero”. And throughout the entire period (91 days) there is a uniform accumulation. It turns out to be a kind of cyclicity - the end of one period falls on the beginning of the next.

It is important to understand how to find out the income tax if the end of the payment period has not yet arrived. They use a special formula. It shows the amount of coupon income at each fixed point in time.

It follows from this that the accumulated coupon does not have a constant value and depends on the period and on the number of days that have passed since the beginning or end date of this period. That is, changes in the NKD occur daily. For example, after a month and a half, the accumulated coupon in the example given will be 24 rubles 66 kopecks.

NKD is always less than the coupon size. The moment they become equal will mean the end of the accumulation period. The coupon income will be written off.

EAC is taken into account when issuing, as well as purchasing/selling a bond and is included in its price. That is, the security is more expensive by exactly the coupon rate.

From the example it follows that the price of one bond on the stock market will be equal to 1200 rubles. A similar cost calculation is used for all types of securities, both for Eurobonds and for domestic bonds (including corporate ones, for example, Sberbank, Gazprombank, B&N Bank, etc.).

Interest rate

The coupon (interest) rate is the level of income established by the issuing company, paid to the bond owner in the form of coupon payments. This is the interest rate on the coupon. The rate is always indicated in annual percentage taken from the nominal price of the security.

All payments are calculated in monetary units; they can be transferred to the investor at different (indicated initially) frequencies - once a quarter/six months/year, etc. The most valuable bonds are those on which the interest rate is paid more often. Thus, government OFZs require payments to be made twice a year.

If we are talking about government bonds and considering what the NKD is, then you need to remember: here the size of the coupon directly depends on the key rate of the Central Bank, and it is determined, in turn, based on the calculation of the state of the country’s economy. The rate is largely influenced by the prices of oil, domestic currency, gold and other factors.

The better the state’s economy develops, the lower the rate and the lower the investor’s profit from OFZs. This is why Russian bonds provide high income and are very attractive to investors from abroad.

Corporate bonds are considered differently, since here the issuer is a private company that wants to make a profit to pay off all debts and improve its condition. Here the rate may vary and is determined only by the level of risk and market confidence in a particular issuing company issuing securities.

When purchasing corporate debt, it is important to exercise caution and take the issuer you choose seriously. True, some levers save the investor from a complete loss of funds: so, according to the law, in the event of a company’s bankruptcy, it first fully pays off all creditors and only after that the shareholders receive theirs.

Thus, we can conclude that government bonds are the most reliable and low-yielding, while securities of private companies can provide high income, but the risks are commensurately higher.

NCD from the buyer's side

The conditional broker bought 10 bonds on the exchange. The nominal value of each of them is 1000 rubles, the frequency of payments is 3 months. The purchase occurs when 2 months have passed since the beginning of the coupon period. Calculation:

- total purchase amount – 10* (1000 rubles + tax accrual for 2 months);

- owner's income – return of 100% of the cost of paper + accrued income for 2 months;

- buyer's profit – accumulated coupon income on bonds for 1 month.

For each of the parties to the transaction, the calculation will be made differently

That is, the broker, when purchasing bonds, compensates their owner for accumulative income for 2 months. He himself receives from the issuing organization the full value of the asset upon expiration of the specified period. That is, his profit will be NKD for the month that the bonds were actually in his hands.

NCD from the seller

The conditional owner sold 5 securities on the secondary market and gave a price for them of 1000 rubles. Payment frequency is 3 months. The sale occurs when only 1 month has passed. from the beginning of the coupon period. The buyer pays 100% of the cost + savings coupon for 1 month. for each bond.

Calculation:

- total expense – 5* (RUB 1000 + accrual tax for 1 month);

- the seller’s income is the return of the par value of the coupon bond + cash income for 1 month;

- buyer's profit - accumulated income for 2 months.

When selling, the owner not only returns the money spent on purchasing bonds on the primary market, but also receives the income tax for the current period that the securities were in his portfolio, i.e., for 1 month.

In such calculations, for both parties there is not only reliability, but also fairness of the transaction.

Taxes

On March 22, the State Duma adopted at its third reading meeting a law exempting individuals and legal entities from the need to pay personal income tax on coupon profits on ruble-type bonds issued from January 1, 2022 to December 31, 2022. The text of the law states that private investors should not pay a tax of 13% on coupon income from securities of Russian issuers. In addition, provided that the security is held until maturity, the investor is exempt from paying personal income tax on the difference between the price of the security and its par value.

This law does not apply to corporate bonds whose coupon exceeds the Central Bank refinancing rate by 5 points or more. So, if the refinancing rate is 7%, for example, then when purchasing bonds of a company with a profitability above 13%, the investor must pay taxes.

But there are practically no bonds with such a coupon on the market at the moment. True, if the Central Bank again lowers the key rate, then, accordingly, the threshold level of tax-free interest will be lowered and a larger number of securities will be included in the circle of high-yield bonds.

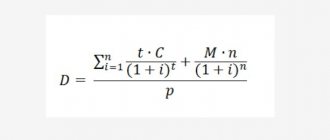

How is NKD calculated?

You can calculate the savings coupon using a simple method. To convert profitability to a specific accrual income, a standard formula is used:

NKD=N*(C/100)*T/B, where

N – nominal value.

C – interest rate.

T – number of days that have passed since the beginning of the coupon period.

B – calculation base (can be 365 or 366 days).

Certain formulas are used for calculations

For example, there is an issue and purchase of a bond with a face value of 1 thousand rubles, the yield of which is 20%, and coupon payments occur 4 times a year (every quarter). The accumulated coupon on the 30th day of a non-leap year is calculated as follows:

NKD = 1000 *(20/100)*30/365 = 16 rubles. 44kop.

Payments are made in rubles.

There is another method of calculation; some investors often use it. The size of the accrual variable is set for each day, and only then multiplied by the number of days.

Let's look at how to calculate the coupon yield on bonds when the value of the bond is more or less than 100% of the face value, using specific example problems.

The conditional investor purchased a short-term bond (1 year) for 80% of the par value (a certain discount discount) with a 20% coupon. At the end of the year, he will receive a yield to maturity of 40% (20% is the coupon, 20% is the difference in cost). If he does not wait for the maturity date, then upon sale he will receive only a 20% coupon yield.

The conditional broker bought a paper with a face value of 110% with a 20% coupon. Therefore, the yield to maturity at the end of the term will be a difference of 10%. Sales before the end of the term will be paid from the actual accumulated coupon (20%).

Types of coupons

Coupons can be different, suggesting different profit calculation schemes and payment features. It is advisable to initially study the types of payments in order to be able to calculate the income from the bond.

Main types of coupons:

- Constant – the amount of payments is static throughout the entire period. The simplest and most popular method of calculating income, which is usually used in large transactions.

- Variable - the coupon value is not disclosed in advance; the issuer announces the rate only for the next coupon period, having the opportunity to change it again later. Floating rate bonds were not very popular before the 80s, but with the advent of sharp currency fluctuations they became in demand. A variable coupon is typical for Eurobonds.

- Fixed - assumes that income is regulated by the rules of the contract and is not affected by exchange rates.

Indexed is a subtype of variable income bond. In this case, the nominal price is periodically recalculated, taking into account the growth of indices, and profit is calculated based on changes in the nominal value. The inflation index is most often used, which attracts investors with protection against losses. In some cases, other indices are taken - for example, in Mexico, the bond coupon was calculated based on the rise in oil prices; in the USA and Russia, securities were once provided by the gold standard.- Zero – such bonds are rare, but they also provide a certain profit, which is calculated as follows: Profit = Placement price – Redemption cost.

How to find out the size of the income tax before buying a bond

It is clear that no one calculates NKD manually; for this purpose, automatic programs and calculators are used on special sites.

You can find out the NCD of a bond in circulation in two ways:

- On the website rusbonds.ru. To view the NKD, you need to select the “bond search” section and find the one you are looking for. Next, click on the “general information” column. At the bottom of the list is the NDC of one of the government savings loan securities (OGSS) - this is the value of the bond’s coupon.

- In the QUIK trading terminal - a special program designed for quick access to stock trading from a mobile gadget or other device. That is, you need to install a mobile application. NKD is calculated here on a daily basis. Its size is listed in a separate column for convenient use. NKD on the listed resources are posted online.

You can check the NKD in various ways

Let's sum it up

Bonds are an excellent alternative to bank deposits. The yield on exchange-traded assets is higher, and you can sell your securities at any time without losing the accumulated interest.

And if you purchase bonds using an individual investment account, you can also count on tax benefits, which makes investing even more profitable.

I hope the article was useful and understandable. Don't forget to subscribe to blog updates so you don't miss new publications.

Profit to everyone!