Hello, dear friends! Those who keep their savings in foreign currency and want to put their money to work face a difficulty - bank interest rates are only slightly faster than inflation. By putting dollars or euros in the bank, after a year you will receive a real return of less than 1%. In such a situation, Eurobonds You can get a yield of 5-8% with reliability comparable to banking. Today we will take a closer look at how to organize an investment in Eurobonds and what results you should expect. Join the review.

What is a Eurobond

The prefix “ euro ” does not change the essence of this instrument. The meaning of a Eurobond is that its issuer attracts borrowed funds , guaranteeing the buyer a certain percentage (coupon income) as a reward for using the money. If you understand what Eurobonds are, that is, what they are in simple words, they can be called a loan in foreign currency .

A Eurobond differs from a regular bond only in that it is denominated in a currency foreign to the borrower . This is the only way Eurobonds differ from Russian bonds. For other countries the same dependence remains. If, for example, bonds are issued in Japan in yen, these are simple bonds. If bonds in rubles are issued in the same country, they will be considered Eurobonds for the Japanese borrower.

The key advantage of Eurobonds is their yield , which is several times higher than the bank interest rate. At the time of preparation of the review in dollars, the maximum rate is 2.41% (according to banki.ru). Other offers are much worse; there is a stated yield of around 0.3-0.4%.

For comparison, in the USA in 2022, inflation at the end of the year was 2.28%. That is, taking into account the decline in the purchasing power of the dollar, the real return on the deposit would be, at best, 0.1-0.2%. Dollar bonds, even taking into account inflation, could bring in more than 5% income.

How much can you earn

The profitability of Eurobonds depends on the credit rating of the issuer (the one who issued the Eurobond). The higher the reliability of the issuer, the lower the yield of the Eurobond.

The most reliable securities are government ones, due to their high credit rating.

The largest top companies (Gazprom, Lukoil, Sberbank) provide higher returns.

At the time of writing this article, the yield on corporate (non-state) Eurobonds ranged from 3 to 8% per annum in dollars.

As a rule, the longer the maturity of a Eurobond, the higher the yield of this paper. Here's an example:

What's better? Foreign currency deposits VS Eurobonds

We will make a comparison based on 4 key points.

- Interest rate . Eurobonds are at least 2-3 times higher than the best offer from banks. For corporate bonds, the yield can be 3-5 times higher or even more.

- Deposit Insurance Agency Limit . In banks, money is protected. So far, the upper limit of insurance is set at 1.4 million rubles. (it is possible that in the near future the threshold will be increased to 10 million rubles). In the case of bonds, you can work with issuers that are as reliable as banks. The risk of default on bonds issued, for example, by systemically important corporations is almost zero.

- Conversion of funds. If the bank goes bankrupt, the DIA will compensate for the cost of the deposit (up to 1.4 million rubles), but money will be paid in rubles. In this case, the ruble exchange rate at the time of the occurrence of the insured event is accepted as the calculated one. If the bank managed to add interest to the body of the deposit before this date, they are also insured, but the low yield may not cover the loss due to unfavorable changes in the exchange rate. In our example, the investor could lose more than 20% due to this. DIA insurance compensated for the deposit in dollars; the loss was ensured by the strengthening of the ruble against the dollar.

- Inflation . The dollar, euro and other currencies also depreciate over time. In 2022, annual inflation in the USA reached 2.28%, the best offer from banks exceeds it by 0.1-0.2% - this is real income.

- Early closure of the deposit . Banks hedge their bets and impose penalties; usually, in this scenario, most of the income is eliminated. You will be returned the deposit amount + a meager percentage compared to what you expected. Bonds can be resold at any time; the accumulated coupon income will not go anywhere .

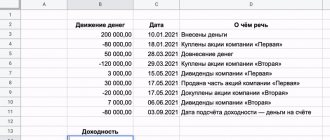

For convenience, I will compare both tools in tabular form.

| Bank deposit | Eurobonds | |

| Interest rate | The ceiling is 2.0-2.4%, barely covering inflation | Even for super-reliable ones, the percentage is 2-3 times higher. For example, according to VEB.RF-10-2023-ev (issuer - Vnesheconombank), the coupon is 5.95% per year |

| DIA insurance | Up to 1.4 million rubles, high probability of increase | DIA does not insure securities |

| Conversion of funds | Occurs forcibly upon the occurrence of an insured event | The repayment date is known exactly |

| Inflation | The interest on the deposit “eats” almost 100% | Profit is several times greater than currency depreciation |

| Early closure | The bank returns only the body of the deposit | Accumulated income is not lost, resale of Eurobonds is not limited |

Interesting!

One of the best investment tools for the common investor are ETFs. It is ETFs that allow the “ordinary person” to beat inflation and, moreover, to learn to earn significantly more than what can be earned on Eurobonds.

In 2007, legendary investor Warren Buffett made a $1,000,000 bet with a hedge fund manager that hedge funds (managed by some of the toughest investors in the world) would not outperform the S&P 500 index (to which some ETFs are linked). -s) over a period of 10 years! And he won this argument!!!

Here I talk in detail about ETFs - for anyone interested: Guide to ETFs - 15 main questions: What are ETF funds, How do they work, How to make money on them, etc.

It is on such ETFs that I earn 12-15-20-30 or more percent in dollars per year!

However, choosing the “right” ETFs from almost 6 thousand available is quite a task! Therefore, based on numerous requests from subscribers, I recorded an incredibly inexpensive mini-course on choosing ETFs.

Mini-course “How to choose the best American ETFs.” Get step-by-step instructions with dozens of screenshots of how I choose ETFs for myself (!!!) and for clients. ETF is exactly the tool that allows you to earn from 10-20% (and more) in dollars per year! Price - only 1,800 rubles! Find out more here.

Types of Eurobonds and their parameters

We’ll figure out how to buy Eurobonds for an individual a little later. For now, let’s take a closer look at the features of this type of investment instrument.

Classification of Eurobonds

The division into groups is determined by the selected criteria. Depending on the issuer, there are:

- Government Eurobonds. Individual subjects of the Russian Federation can also borrow money in this way. As a rule, the volume is limited to 30% of budget revenues.

- Municipal.

- Corporate Eurobonds . They are produced by separate companies. The yield on them is higher than on government ones, but the risk also increases proportionally. Eurobonds of Russian companies are most often issued in dollars and euros.

According to the type of repayment, Eurobonds are divided into:

- Securities with the impossibility of early repayment. The deadline for the borrower to repay the debt is set at the time the bonds are issued. Repayment is not possible before this date.

- With an option to buy or sell. In the first case, the issuer has the right (option) to repay the loan early (buy it back) from you. In the second, the bondholder can demand repayment of the debt at predetermined time intervals. There are subtypes with buy/sell options only.

- The rarest type is with the possibility of early repayment from a special fund . The issuer regularly makes contributions to a special account and then buys back the bonds.

Depending on the frequency of coupon income accrual, there are:

- Options with accrual of profit once a year .

- Less often this happens twice a year .

- Quarterly accrual is typical for securities with floating interest rates.

Based on coupon type, Eurobonds are classified into:

- Fixed income securities. Its size is agreed upon in advance.

- Zero coupon bonds.

- Eurobonds with floating rates . Typically calculated as LIBOR + a certain premium.

If the coupon is zero, then the buyer’s profit is formed by the difference between the purchase and redemption prices:

- Deep discount bond - in this case, securities are purchased at a price much lower than the cost at maturity. Depending on the term, the discount can reach 60-70%.

- Capital growth bond – the price at the time of purchase is equal to the face value, but repayment is guaranteed to occur at a higher price.

It will be useful!

——————-

Where and how the MoneyPap family invests (successfully) (PDF) . In this document, I honestly tell you what profitable instruments my family invests in. Download the PDF for free - here.

——————-

20 Financial Forms, Tables and Calculators for Independent Total Financial Management. I have been creating these shapes for many years. I'm giving it away for the price of a couple of cups of coffee - 179 rubles! Best-seller! See here .

Basic parameters of bonds

When evaluating Eurobonds, pay attention to the following parameters:

- Nominal cost . This is the payment that you will receive when the issuer redeems the Eurobonds. For example, for government Eurobonds rus-28 the par value is $1000. If you have 10 securities of this type, then in addition to regularly paid coupons you will also receive $1000 x 10 = $10,000 when you redeem the Eurobonds.

- maturity date – indicates when the issuer will repurchase the Eurobonds and repay the loan.

- Annual return. It is set as a percentage of the face value, for our example (rus-28) it is equal to 12.75%, that is, the holder of these Eurobonds receives $127.5 per year. Since coupons are paid out once every six months, the size of one is equal to $63.75.

- Accumulated coupon income. Shows what amount is due to the Eurobond holder as of the current date, constantly recalculated using the formula NKD = N x C x T / B. In it, N is the par value , C is the annual yield in fractions of a unit , T is the time in days since the last coupon was accrued , B is the number of days in a year . For our example, 165 days have passed since December 24, 2019 (the date of the previous coupon accrual), and the annual income is 0.1275, which means the cash flow = $1000 x 0.1275 x 165 / 365 = $57.63 . We see the same number in the description of the Eurobond; the slight difference is explained by rounding in the calculations. If the holder of the securities sold them right now, the NKD would not be lost and the money would be credited to his brokerage account.

- Coupon payment date. On this day, money is credited to the Eurobond holder's account.

Concept

The sound of the term “Eurobonds” (in professional slang - Eurobonds) brings to mind the debt obligations of European companies.

But it is not so. Eurobonds are debt obligations issued by the issuing company in a foreign currency. In other words, these are bonds that are foreign to both the issuer and the investor. This term owes its history to the prefix “euro”. The first Eurobonds were issued in the 60s of the 20th century in Italy, and since then this new financial instrument has become increasingly popular on the stock exchange. Now many Russian companies are looking for investors overseas, and some local investors prefer to invest in foreign corporations.

The principle of operation of Eurobonds is the same as that of ordinary bonds. The investor purchases them at par value for a certain period. During this time, he receives coupon income (usually 1-2 times a year). At the end of the bond's life, the investor is returned the face value of the security.

Basic concepts regarding Eurobonds:

- Par value

is the price per unit of a security. - Coupon income

is a periodic payment to the current owner of the security. Typically expressed as a percentage, it refers to the amount of income the holder will receive per unit of bond per year. - Maturity date

– the date when a bond is presented to the issuer for redemption. The period from the moment of issue of a security to its presentation is the period of life of the bond. Until it ends, the issuer must make coupon payments to the investor. - Market value

is the current price on the stock market. Eurobonds can be sold at a price higher or lower than the sum of their par value and coupon yield. The longer the time until the maturity date, the higher the market price of the security. - Current yield

is the profit from a bond, expressed as a percentage and calculated taking into account the price of the security on the market at the moment.

To make it clearer, let's give an example. Let the nominal value at which the holder purchased the Eurobond be 10,000 rubles. The amount of coupon income on it is equal to 8% per annum, which means that for the year it will be 800 rubles. The security has a maturity date of five years. That is, for the entire life of the bond, the holder will receive 800 rubles. per year, which will ultimately amount to 4,000 rubles. in five years. A year later, the holder, having received 800 rubles, decides to sell the Eurobond at a price of 10,800 rubles. – this will be the market price of the security. A new holder, purchasing it, will have a lower current yield, since the market price of the security is higher than the nominal value.

Despite their common features, Eurobonds have some distinctive features:

- Issued for a period from 1 year to 40 years. But recently, perpetual Eurobonds have begun to appear. In Russia, until recently, they were available only to a very limited circle of people due to the high risk.

- The par value of the security is expressed in US dollars.

- The currency of Eurobonds is foreign for both the issuer and the investor.

- Eurobonds can be listed on the stock exchanges of several countries simultaneously.

- The coupon income is paid to the holder in full, without interest tax being withheld, as is the case with ordinary bonds.

The established minimum value of one Eurobond is $1,000. The amount seems to be small and quite accessible to the average investor. However, there is one small nuance - most Eurobonds are sold in lots. And one lot can contain one hundred or two hundred units of securities. Therefore, the amount became significant, which eliminated most of the investors interested in this financial instrument. In 2015, the MICEX allowed the division of lots, providing access to them to a wider range of people.

Taxation and Eurobonds

Starting from 2022, the Russian Federation has eased the tax burden for investors investing in securities of the Ministry of Finance of the Russian Federation. For such instruments, personal income tax is not charged on coupon income. After redemption, tax is charged only on the possible profit generated due to changes in the exchange rate.

For example, 10 government Eurobonds with a par value of $1000 were purchased at a USDRUB rate of 67.00. In 3 years, $1,500 worth of coupons were received, and at the time of redemption, the USDRUD rate rose to 70.00. Due to this, 30,000 RUB of profit was added to $1,500, and you will need to pay 13% on it. In this example, personal income tax will be 3900 RUB.

If, under the same conditions, the rate fell to 65.00 RUB, then personal income tax would not have to be paid. If the Eurobonds were not state-owned, but corporate, then personal income tax is charged both on coupons, and on possible profit due to changes in the exchange rate, and on the discount. This is compensated by the higher yield of corporate Eurobonds.

There are a number of loopholes :

- If corporate securities were purchased on the Moscow Exchange and held for 3+ years , then the Tax Code of the Russian Federation provides for a tax deduction . It applies to income received from the sale of securities and is calculated using the formula N x 3 million rubles, where N is the number of years of ownership of the securities. That is, after 3 years, income from the sale of Eurobonds in the amount of up to 9 million rubles. not subject to personal income tax.

- If an IIS type B is opened , then all income received through trading operations is exempt from personal income tax.

The above is true for residents of the Russian Federation . Otherwise tax:

- It may be zero if a Russian tax agent (broker) is not involved in the payment of income. The recipient of the funds will deal with the tax authorities of his country himself.

- It can reach 30% if a Russian broker is involved, who is a tax agent of the Russian Federation.

It is not profitable to resell Eurobonds frequently . As for which securities are best to work with, from the point of view of taxes, the optimal choice is those in which the Ministry of Finance of the Russian Federation is the issuer. Previously, an article was published about what government bonds are, be sure to read it.

Classification

There are 2 main types of Eurobonds:

- Eurobonds

- Euronotes

The distinctive features and features of these types of Eurobonds are discussed in the table:

Comparative characteristics of Eurobonds and Euronotes

Name of the type of EurobondsEurobondsEuronotes

| Type of securities | Bearer securities | registered securities |

| Popular | In developing countries | In countries with market economies |

| Availability of reserved collateral | absent | Provides |

In addition to dividing into types, Eurobonds also have other classification features. For example, they are divided into subtypes depending on the method of payment of income or the method of repayment.

Eurobonds, like any type of bonds, can be short-term (from 1 to 5 years) and long-term (up to 40 years!). The average duration of such investments is 10 years.

Eurobonds are also classified by quality. They are divided into “senior” and “subordinated” (or “junior”). The latter are, as it were, secondary securities (more secondary). They, first of all, protect the issuing company, but the holders of such bonds are exposed to risks. In addition, as rates increase, such bonds will vary more in price. But holders of “senior” Eurobonds are maximally protected from risks.

In simple terms, a subordinated bond is a loan from a company that will rank below other loans and borrowings if the company goes into liquidation or bankruptcy.

Examples of Eurobonds and calculation of potential earnings

Let's start with examples of government and corporate Eurobonds; for convenience, I will present them in table format.

| Name | Denomination, $ | Payment frequency, once a year | Income, % per year | ISIN |

| Russia-2028-7t | 1000 | 2 | 12.75 | XS0088543193 |

| Russia-2035 | 200 000 | 2 | 5.1 | RU000A1006S9 |

| Rosneft-2-2022 | 1000 | 2 | 4.199 | XS0861981180 |

| Gazprom Neft-05-23 | 1000 | 2 | 6 | XS0997544860 |

| Evraz-11-2022 | 1000 | 2 | 6.75 | XS1405775377 |

| VEB.RF-10-2023 | 1000 | 2 | 5.942 | XS0993162683 |

Let's assume the investor's capital is $10,000 . Let’s estimate the estimated earnings for 3 different Eurobonds and start with rus-28 :

- For convenience of calculations, we assume that the securities were purchased on December 25, 2022, immediately after the coupon payment. The price was +74% of the face value or $1740 for 1 security. For the starting $10,000, 5 Eurobonds are purchased.

- If the investor holds the securities until maturity , he will have time to receive 17 coupon payments of $63.75. In total, earnings during this period will be $5,418.75.

- 5 x $1740 = $8700 was spent on purchasing the bonds, but upon redemption the investor will receive only 5 x $1000 = $5000, a loss of $3700 .

- Total income in this scenario would be $1718,75. Not the most profitable option. The main disadvantage of this example is that Eurobonds are too expensive and there is not much time left until maturity.

Let's move on to corporate ( Evraz-11-2022 ), the starting amount is the same - $1000:

- Let’s assume that at the very start, 10 securities with a face value of $1000 each were purchased.

- Before maturity, the investor will have time to receive 11 coupons of $33.75 each.

- During this time profit will be $3712,50 or 26.93%.

And one more example, now with Gazprom :

- Securities are not purchased immediately after placement, but after 6 years. At the time of purchase, quotes exceed par value by 12.5%, 8 Eurobonds were purchased for $10,000.

- For the remaining period until maturity, the investor will receive 8 coupons of $30 each. The total income is $1920 .

- Upon repayment, it is formed lesion at $125 x 8 = $1000. As a result, the earnings are not $1920, but only $920.

Here are a couple of conclusions. Consider not only the interest rate offered by the issuer, but also the period remaining until maturity and the price of Eurobonds. It may turn out that high-yield securities turn out to be unprofitable due to the fact that they are traded at a large premium and there is little time left until maturity.

TOP 10 most profitable

10 most profitable Eurobonds, regardless of maturity.

| Issuer | Release | Profitability per year, % | Stability 1 piece, $ | Nominal value, $ | maturity date |

| Gazprom | Gazprom 2034 | 5,62 | 1325 | 1000 | 28-04-2034 |

| VEB | Vnesheconombank 2025 | 5,34 | 1099,9 | — | 22-11-2025 |

| VEB | Vnesheconombank 2023 | 5,01 | 1047 | — | 21-11-2023 |

| VEB | Vnesheconombank 2022 | 4,72 | 1049,99 | — | 05-07-2022 |

| Rosneft | Rosneft 2022 | 4,47 | 1000,5 | — | 06-03-2022 |

| Ministry of Finance of the Russian Federation | Russia 2028 | 4,47 | 1622,7 | — | 24-06-2028 |

| Norilsk Nickel | Norilsk Nickel 2022 | 4,45 | 1073,5 | — | 14-10-2022 |

| Gazpromneft | Gazpromneft 23 | 4,45 | 1090 | — | 27-11-2023 |

| VEB | Vnesheconombank 2020 | 4,35 | 1031 | — | 09-07-2020 |

| Pipe Metallurgical Company | TMK 2020 | 4,01 | 1027,4 | — | 03-04-2020 |

How to buy Eurobonds

As for how to invest in Eurobonds, you can buy this type of securities both in Kwik and through brokers’ own applications. For example, Tinkoff does not use specialized software, but Eurobonds are still available.

Working with Tinkoff Investments

The instructions look like this:

- You need to open a brokerage account ( an IIS will do ) and log in.

- Select the desired asset from the catalog. A list of split Eurobonds is available here . The yield and maturity date are indicated.

- The lot volume is equal to 1 bond.

The price will be increased by 0.3% . This is done to ensure that the order is guaranteed to be executed regardless of price fluctuations. To confirm the transaction, you need to confirm the purchase by entering the code from the SMS message.

You can also buy Eurobonds using your smartphone . The functionality is the same; in the list of available assets, you just need to select the section with Eurobonds, indicate the volume of the transaction and confirm it.

Buy Eurobonds through Tinkoff

Purchasing through QUIK and the My Broker application

In the Quick terminal, buying Eurobonds is no different from working with ordinary shares. The only caveat is that you must not make a mistake when choosing securities; there is no corresponding item in the current trading table. Instead, you will come across the designation “Bonds (settled in USD)” or in EUR, these are the tools you need.

Then everything is standard:

- Select an asset.

- Open the stock glass.

- We send the application. The price is indicated not in currency, but as a percentage of the face value, for example, 100.5.

Purchases are also possible through the “My Broker” mobile application. To buy, you need to go to the “Quotes” section, select the desired instrument, set the purchase volume and confirm the transaction. Money is debited from the card.

Open an account in BCS

I recommend that beginners go through an educational program on where it is better to open a brokerage account. There are many good companies. Based on my own experience, I can recommend Tinkoff or BCS. I will summarize the main conditions for them in a table.

| Company | BKS | Tinkoff investments |

| Minimum deposit | from 50,000 rub. | Unlimited , you can even buy 1 share, they recommend starting from RUB 30,000. |

| Transaction fee | At the “Investor” tariff – 0.1% of the transaction amount, at the “Trader” tariff it is reduced to 0.015% | 0.3% for the “Investor” tariff |

| Additional charges | If the account has less than 30,000 rubles - 300 rubles/month. for access to QUIK and 200 rub./month. for access to the mobile version of QUIK, | — |

| Account maintenance cost | 0 RUR/month on the “Investor” tariff, on other tariffs, funds are debited only if there was activity on the account this month | Free for the "Investor" tariff |

| Leverage | Calculated for each share, within the range of 1 to 2 – 1 to 5 | Calculated for different instruments, the calculation is linked to the risk rate |

| Margin call | Calculated based on the risk for each security | Depends on the asset |

| Trading terminals | My broker, QUIK, WebQUIK, mobile QUIK, MetaTrader5 | The purchase of shares is implemented like an online store, professional software is not used |

| Available markets for trading | Foreign exchange, stock, commodity markets, there is access to foreign exchanges | American and Russian stock markets |

| License | TSB RF | TSB RF |

| Open an account | Open an account |

Investor reviews

Investor reviews on Forbes.

- Investment department of Uralsib Bank.

- Veles Capital.

- FG BKS.

Investing in mutual funds

Mutual investment funds are convenient because their composition is selected by the manager. The investor can only buy shares and wait.

BCS has 2 main mutual funds, the shares of which include Eurobonds. The first is BKS Osnova , a fairly old fund, operating since 2003. The price of a unit of this mutual fund has increased by more than 400%. The management strategy is not high risk. The cost of a share starts from 50,000 rubles.

BCS Eurobonds specializes in Eurobonds and is positioned as a replacement for a foreign currency deposit. The mutual fund is young, launched in June 2022. During the pandemic, the price of the unit dropped significantly, but then a confident recovery began. There is a high entry threshold - from $15,000 per share.

BCS has other interesting mutual funds; I will give the conditions for them in tabular form.

| Name of mutual fund | The basis | Russian shares | Perspective | Russian Eurobonds | International bonds |

| Beginning of work | 26.12.2003 | 21.02.2005 | 10.05.2000 | 04.06.2019 | 04.06.2019 |

| NAV as of April 23, 2020, million rubles. | 872,07 | 506,459 | 527,129 | 138,73 | 593,314 |

| Growth of the share from its inception to 04/23/2020 | 400,34% | 454,38% | 1032,04% | 4.43% (in USD), about 20% in RUR | -4.69% (USD), increase 8.62% in RUR |

| Manager's commission | 1,5% | 3,9% | 3,9% | 1,0% | 1,5% |

| Depository fee | 0,3% | 0,3% | 0,3% | 0,5% | 0,5% |

| Minimum investment amount | 50,000 rub. first time, 10,000 rub. – second and subsequent | 1 million rub. or $15,000 | |||

| Open an account in BCS | |||||

Purchase

There are two types of Eurobonds:

- Corporate – issuers are commercial banks and companies. For example, Gazprom, Novatek, NorNickel, Lukoil, Alrosa, Alfa-Bank, VTB and others. As of December 2022, there are 134 items on the list of those admitted to trading on the Moscow Exchange. Denomination – from 1,000 in foreign currency. A lot is equal to 1 paper.

- State-owned, in which the issuer is the Ministry of Finance of Russia. There are currently 14 instruments in circulation on the Moscow Exchange. Of these, only two are available to most investors: RUS-28 and RUS-30. The rest start from 100,000 and 200,000 dollars and euros.

Both options are available today for purchase by qualified and unqualified investors. Despite the fact that the face value of some securities reaches $200,000, even an ordinary investor can choose the most suitable option for himself to invest money in foreign currency assets.

Option 1. Independent purchase.

In this case, the platform is the exchange, and the intermediary is the broker. Possible purchase schemes:

- the investor transfers money from his foreign currency bank account to a broker, who buys securities on the stock exchange;

- the investor transfers money from his ruble account to the broker, who buys currency on the foreign exchange exchange and bonds on the stock exchange.

Option 2: Buy ETF shares.

Let me remind you that an ETF is an exchange-traded index fund that includes many securities at once. It copies a specific index. The main advantages for an investor when purchasing ETFs are diversification and a low entry barrier. Today there are 3 Eurobond funds on the Moscow Exchange: FXRU, FXRB and RUSB.

The first two are from Finex. These include 28 securities as of December 2022. RUSB from ITI Funds includes 14 Eurobonds. The profitability for the year was 14.53%, the market price as of December 26, 2019 was 1,740 rubles.

Option 3. Purchase of mutual fund shares.

A mutual fund is a mutual investment fund that is not traded on an exchange. It is a portfolio of securities collected by the manager. You can buy shares from the management company.

Examples of such mutual funds:

- “VTB – Emerging Markets Eurobond Fund.” One share costs only 25.76 rubles. For a year, the yield is only 2.43%, for 3 years - 24.69%.

- “VTB – Eurobond Fund”. The cost of the share is 13.86 rubles. Yield for the year is 0%, for 3 years – 17.96%.

- “Sberbank – Eurobonds”. Profitability for 3 years – 14.85%, for a year – -0.05%. The cost of the share was 2,552.1 rubles.

Option 4. Buying a mutual investment fund.

BPIF is the same mutual fund, only it is traded on the stock exchange. That is, its composition is formed by the management company, and it can be bought and sold through a broker during stock exchange business hours, like any security. Exchange-traded funds have recently appeared on our exchange, so it is not yet possible to create an objective picture of their profitability.

Example. The SBCB fund from the management company of Sberbank was traded for 1,036 rubles on December 26. per share. It follows the Moscow Exchange index for the most liquid Eurobonds. The fund includes 10 types of securities. Now try to determine how much money you would need to assemble such a portfolio yourself.

Risks when investing in Eurobonds

I can highlight several dangers that await an investor in Eurobonds:

- Technical default – payments are maintained, but the schedule is violated.

- Complete default is the most unpleasant thing; payments stop.

- Changes in exchange rates . Under unfavorable circumstances, income in USD may turn into a loss in rubles.

It will not be possible to completely eliminate the risks, but we can at least reduce them. I recommend excluding subordinated bonds from the portfolio - securities issued by banks.

Remember 2022, then Binbank, Promsvyazbank and Otkritie fell under reorganization. According to the current rules, if capital adequacy falls below the threshold or the DIA begins to work with a financial institution to prevent bankruptcy, then the subordination is simply written off. In theory, they could be converted into shares, but most of the subordinated bonds of the Russian Federation are non-convertible . As a result, those who invested in them simply lost their money completely. You can filter such securities on rusbonds.com and through the MICEX. Read the description of the bond and do not mess with the subords .

FAQ

Is it possible to buy Eurobonds on an IIS account?

Even necessary. For more or less significant amounts, it is better to use type B , which provides exemption from personal income tax on profits received through trading operations. You top up your account in rubles, then RUB is converted into foreign currency, and Eurobonds are purchased with it. They are then sold or redeemed and USD or EUR are converted into RUB and withdrawn back to the bank account.

How does taxation work for individuals?

For state Eurobonds, personal income tax is paid only if income is generated due to exchange rate differences. For corporate – and from coupon income. You can get a tax deduction if you hold securities for more than 3 years.

I have a sufficient amount in EUR, I want to buy Eurobonds denominated in EUR, how can I avoid conversions?

Open a foreign currency account at a bank, then transfer funds to a brokerage account (opened in the same currency). With this scheme there will be no unnecessary conversions.

Will there be conversion if the money is in euros, but I buy bonds in dollars?

If the currencies are different, then you cannot do without conversion.

Summary

Eurobonds cannot be considered a solution to all investor problems. Risks of issuer default remain, and changes in exchange rates can also greatly affect profitability. But Eurobonds are the only way to get the maximum return in foreign currency . According to this criterion, bank deposits are inferior by more than 2 times. Considering the behavior of the ruble in recent years, I consider it justified to convert at least part of the funds into foreign currency and invest in Eurobonds. There is a high probability that in the future you will make a profit both due to coupons and due to the next weakening of the ruble. Moreover, for this you do not need to be a qualified investor or have a multimillion-dollar capital.

For beginners, I recommend reading the post on how to buy shares for an individual in Russia. You will work with Eurobonds according to the same scheme. In the comments, be sure to share your experience of working with Eurobonds. If something remains unclear, ask questions - I will try to answer everyone. And don’t forget to subscribe to blog updates, so you don’t miss the release of new materials. With this I say goodbye to you. All the best and good luck in investing!

If you find an error in the text, please select a piece of text and press Ctrl+Enter. Thanks for helping my blog get better!

Flaws

- Possible default of the issuer. For example, you bought a high-yield Eurobond of a company, and this company went bankrupt.

- Change in the market price of a Eurobond. As I already said, the price of Eurobonds can change, unlike deposits, where the “body” of the deposit is unchanged. It may happen that you urgently need money, and the market price of your Eurobond, according to the Law of Meanness, will fall. Then you will have to sell your Eurobonds at a loss. On the other hand, the market price may be higher.

- There is no capital insurance on broker accounts, like insurance on bank deposits. And brokers can go bankrupt.