Bitcoin farms

You cannot buy or sell Bitcoin for yuan on Chinese exchanges, but mining is booming in China. The largest Bitcoin farms in the world are located in the north of China. Entire high-rise buildings and former factories are dedicated to circuits with video cards.

Why is China popular? Because in China you can buy land cheaply outside the cities, there is cheap labor for hired workers and cheap electricity and equipment (you can buy Chinese video cards at a reduced price). Some professional miners power their farms autonomously: they build wind turbines, solar panels and even small hydroelectric power stations. It is even more profitable to purchase and install an autonomous power supply.

Chinese exchange September 2022: the end of the Bitcoin era in the country

The fateful day of Bitcoin holders in China. From that day on, the government banned the circulation of bitcoins. Can't sell, can't buy. Previously, the exchange of fiat currency for digital was prohibited only for banks and financial institutions, and it was possible to buy from independent sellers. The new stage of the cleanup included:

- Closing of exchange exchanges. The world's largest crypto exchanges BTCChina and ViaBTC announced the cessation of operations on September 30. Local search engines removed them and other exchanges from search results. It is no longer possible to buy Bitcoin on a Chinese exchange.

- Investigation of the activities of companies related to Bitcoin and ICO. On September 4th they were obliged to return all the money to investors. For small companies without an alternative source of financing, this decision turned out to be devastating.

- Closing of small bitcoin exchangers. In total, a little more than 60 of them were cleared. There are no places left where you can buy Bitcoin without risk.

Fake news from China

In March 2014, a fake article was published on the Sina Weibo website, in which there was a rumor that the Central Bank of China would allegedly ban all transactions in BTC within a month. The fact that there was misinformation in the publication was quickly revealed, but this did not prevent another collapse in the price of Bitcoin.

BTC price dynamics from 2014 to 2022

Almost at the same period, the Chinese crypto exchange FXBTC announced its own closure due to threats from financial regulators. The combination of these two news contributed to the price of BTC decreasing from $709 to $346. However, investors perceived this as a profitable opportunity to accumulate coins, and after a couple of months the price of Bitcoin rose above $600.

Consequences

Bitcoin holders were forced to urgently withdraw their savings from Chinese exchanges before this became prohibited. People missed out on potential profits. If China had not banned cryptocurrency, today exchanges would probably trade Bitcoin for more than 20 thousand dollars, the Chinese would have multiplied their investments by at least 4 times.

Chinese exchanges have lost a multi-million dollar source of income. The damage to exchangers is so great that it is impossible to calculate it accurately, since it is unknown how much the Chinese could buy Bitcoin for in a year or two, and what commission they would leave.

Only Chinese miners continued to work. Now they are selling digital gold on foreign exchanges for dollars in order to buy yuan for American currency.

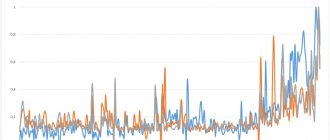

News of the ban and the ban itself plunged the exchange rate by 15 percent. This can be seen very clearly on the graph.

The graph shows that after the collapse there was a sharp rise. This is due to the fact that investors rushed to the exchanges to buy cheaper Bitcoin, hoping that its price would soon rise. And they were not mistaken. If not for Chinese legislative initiatives, there might not have been a sharp increase, and the exchange rate would have continued to increase at a slow pace.

Bitcoin falls below $42,000 amid tightening regulation of crypto trading in China

09/24/2021 Artem Galunov

#Bitcoin ban#China#People's Bank of China#regulation

Over the past hour, Bitcoin has fallen in price by more than $2,000 - at the moment the price fell below $42,000. This happened against the backdrop of reports that spread on September 24 about another Chinese crackdown on the cryptocurrency industry.

At the time of writing, digital gold is trading near $42,193.

BTC/USDT hourly chart of the Binance exchange. Data: TradingView.

Chinese journalist Colin Wu posted a link to a document from the State Development and Reform Committee of the People's Republic of China, dated September 24. According to the report, the suppression of enterprises engaged in the extraction of cryptocurrencies has become part of the efficiency indicator of municipal authorities.

Breaking: The Chinese government released detailed documents on cracking down on cryptocurrency mining. https://t.co/yxGjzkUeLp

— Wu Blockchain (@WuBlockchain) September 24, 2021

The committee emphasized that mining consumes too much energy, which has a negative impact on the environment. In addition, its contribution to the Chinese economy is “insignificant”, and the risks associated with cryptocurrency transactions are very high.

According to the report, local authorities must ensure “strict monitoring, strict risk prevention, as well as the introduction of a ban on the increase [of enterprise equipment fleet] and control over the proper disposal of existing mining farms.”

According to Wu, the document classifies mining as a “dissolved industry” and prohibits investment in the sector.

3, The document lists virtual currency mining as an eliminated industry and prohibitions investment.

— Wu Blockchain (@WuBlockchain) September 24, 2021

Community members also drew attention to the notice that appeared on the People's Bank of China (PBOC) WeChat page. The regulator believes that the activities of platforms providing the exchange of digital assets among themselves or for fiat currency are illegal.

“Virtual currency does not have the same legal status as official currency. […] Business activities related to virtual currency are classified as illegal financial activities. […] Providing virtual currency exchange services to Chinese residents via the Internet is also an illegal financial activity,” the document says.

This approach makes it impossible for over-the-counter platforms that allow Chinese people to exchange fiat for cryptocurrencies and participate in the industry. Exchanges such as Huobi, OKEx and Binance have similar services.

Despite the market reaction, some community members called the widespread information FUD. A representative of the venture capital company eGirl Capital under the nickname Molly noted that the notice “on the prevention of cryptocurrency trading” was published on September 15, and the Committee’s document appeared online even earlier - on September 3.

PBOC's announcement about ban crypto got widespread today is was ANNOUNCEED ON SEPTEMBER 15TH, but got posted online today. The market has already reacted on those regulatory fud.https://t.co/BPlVQEMVMt pic.twitter.com/e0U7gbEHnY

— Molly (@bigmagicdao) September 24, 2021

“The market learned about this news in mid-September and has already responded to it. Don’t fall for this FUD again,” she added.

Earlier, the director of the NBK's payments and settlements department, Wen Xinxiang, called cryptocurrencies and stablecoins a threat to the traditional financial system.

Let us recall that in May, Vice-Premier of the State Council of the People's Republic of China Liu He announced upcoming measures regarding Bitcoin mining and trading.

In June, the NBK held a meeting with representatives of financial institutions and prohibited them from participating in transactions with cryptocurrencies.

In July, the regulator’s deputy chairman, Fan Yifei, called Bitcoin and stablecoins speculative instruments that threaten the security of the financial system and social stability.

In August, the NBK warned investors about the lack of real value of Bitcoin and announced continued regulatory pressure on crypto trading.

Subscribe to ForkLog news in Telegram: ForkLog Feed - the entire news feed, ForkLog - the most important news, infographics and opinions.

Found an error in the text? Select it and press CTRL+ENTER

What's next?

We still see China's harsh policies against exchanges, and today there is no reason to believe that the policy will change anytime soon. The communist system in China cannot allow the formation of an alternative currency within the PRC. There are several options for further developments.

- First, Bitcoin will become a real strong alternative to fiat money and will be used in many countries, and China will be forced to rehabilitate its cryptocurrency exchanges in order to join the number of progressive countries, following the natural path of development.

- Second, Bitcoin will become an alternative, but China will not compromise and will isolate its economy, leaving priority to the yuan.

- Third, Bitcoin will remain only a tool for investors and will not have a global impact on the economic structure of the country. Then the Chinese authorities will definitely have no reason to lift the ban.

What do you think about this? What is the future for Chinese exchanges? Will the government resume crypto trading? Write about it in the comments to the article.

Want more news? Watch here and on Telegram. Follow us on social media. networks: Twitter, Youtube, Google+, Instagram, Facebook, , . Subscribe. If you liked the article, share it with your friends, on forums, on social media. networks - it’s not difficult for you