» Business » Business ideas

Just a few years ago, no one knew the meaning of the words “bitcoin”, “blockchain”, “mining”. But today, millions of people around the world are receiving real income from cryptocurrency transactions. Creating your own cryptocurrency exchange will allow the owner to receive his share of each transaction made.

- 2 What are the benefits of opening your own exchange?

- 3 What is needed to open

- 4 Step-by-step instructions for creating a cryptocurrency exchange

- 5 How to promote

- 6 Possible problems

What is a cryptocurrency exchange

A cryptocurrency exchange is an electronic intermediary platform between a seller and a buyer for conducting transactions with cryptocurrencies (buying and selling, exchanging for fiat money, etc.). The first online platform for transactions with cryptocurrencies was opened in 2010 by Jed McCaleb and was called MtGox.com.

Already in 2011, the number of trading platforms on the Internet increased significantly: cryptocurrency exchanges grew around the world like mushrooms after rain. The popularity of the service is due to growing interest in cryptocurrencies, an increase in the number of market participants and the desire of users to turn “electronic coins” into real means of payment.

Experts divide cryptocurrency exchanges into several types depending on the operations carried out on them:

- Platforms designed for exchanging cryptocurrencies for fiat money (real means of payment for world states);

- Platforms that allow you to exchange some cryptocurrencies for others (for example, Bitcoin for ether);

- Platforms that allow exchange only for various Bitcoin forks.

The principle of operation of all cryptocurrency exchanges is the desire to sell at a higher price and buy at a lower price. Profit is obtained from the difference in price when performing these transactions. The essence of trading completely coincides with classical trading.

The main difference between a cryptocurrency exchange and any other is high volatility . The price of the most popular cryptocurrency, Bitcoin, increased by 5000% in 2013 alone. High volatility allows you to quickly make a fortune or lose everything. For successful trading, users use fundamental analysis, special news and tools.

The success of any electronic exchange lies in the activity of its users. In order for the exchange to work and bring income to the owner, it is first necessary to attract a sufficient number of active participants who are ready to invest money and make transactions. Each trader pays a commission on transactions to the owner of the exchange, which is the main income of the intermediary.

Working cases

Exchanger as an advertising tool

The fact of launching an exchanger in itself is an excellent information source.

The main advantage of working through a legal exchanger is that the end client does not have to have accounts in payment systems and exchanges, does not have to delve into the nuances of currency legislation and does not have to fight with banking services, he always has supporting documents and can legalize income from the sale of cryptocurrency. The exchanger can work as a channel for attracting audiences and converting to other sites. Under certain conditions, it becomes possible to legally advertise the service on Facebook and Google.

Exchanger as a private club

An exchanger initiated by a single investor or a group of investors in order to meet the needs of a limited circle of people will make it possible to partially or fully legalize income - i.e.

receive the necessary supporting documents, submit a 3-NDFL declaration and pay the tax. This can be your own scheme with full control over companies, assets, accounts and chains of transactions. Risks associated with the human factor can be worked out and reduced to a reasonable minimum.

Thanks to a foreign company, the purchase and sale of cryptocurrencies is carried out at favorable rates directly on connected exchanges, where corporate accounts are opened with extended transaction limits.

What are the benefits of opening your own exchange?

Your own cryptocurrency exchange can bring the owner decent passive income

A popular electronic platform for cryptocurrency transactions can bring its owner thousands of dollars every day. It is important that this income is not associated with high risks and is completely legal today.

Monetizing a cryptocurrency exchange isn’t just about commissions. You can charge money from users both for including traders in the general listing and for subscribing to educational materials.

A well-promoted cryptocurrency exchange, like any other electronic resource, can attract sponsors who are ready to invest real funds in the development of the exchange, as well as advertisers. Both will turn their attention only to a truly popular platform with a large number of participants and high turnover.

About major investors

This is not our first project and we know how investors work and what most of them want. I would like to say right away that if you are going to make an offer, then we are not interested in options in which you give us a million rubles and take a controlling stake. This is simply ridiculous, but such proposals have already been received.

In theory, we can develop independently by launching new rounds of crowdfunding. However, we are currently negotiating with several representatives of funds that invest in fintech - we’ll see what comes of it.

What is needed to open

To become the owner of a cryptocurrency exchange, you must fulfill a number of special conditions:

- Get software that you can buy ready-made or create from scratch;

- Determine the scale and geographical boundaries of the auction (within one state, region or the whole world);

- Comply with the requirements of the KYC (Know Your Client) program;

- Enter into an agreement with an accredited bank that has an online platform at its disposal - this will allow you to withdraw funds in the form of fiat money;

- Draw up a plan or strategy to increase the liquidity of the exchange by attracting traders and creating high trading activity;

- Ensuring IT security at all levels;

- Availability of trained customer support service.

Possible problems

In any business, the greatest problems and troubles that an entrepreneur experiences are administrative issues and organizational problems of the business. Pay attention to the core of programmers (let them always feel your control and grip: yes, they are more professional, but you must be more prudent). Do not allow uncontrollable initiatives to form in their environment - you risk losing control over the project.

You should not (especially at first) take on those administrative issues that you do not have the means (time and money) to resolve. It’s better to sidestep the problem (by the way, about the introduction of fiat currencies).

Most likely, security problems will definitely appear (that’s why the pike is in the lake, so that the crucian carp doesn’t doze off). I would like to wish the organizers of such projects to quickly overcome such difficulties. Well, and of course minimal financial losses (and, unfortunately, they will definitely happen!).

Step-by-step instructions for creating a cryptocurrency exchange

Software is the first step to create a cryptocurrency exchange

Step 1. The process of creating a cryptocurrency exchange should, of course, begin with the purchase or development of software. Regardless of which path is chosen, the software must include the following elements:

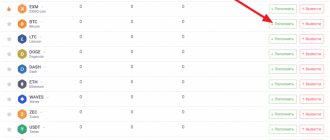

- User’s personal account with identification parameters and the ability to manage the account balance (deposit and withdraw funds);

- Dedicated gateways for connecting participants to the trading platform;

- A fairly powerful aggregator that can create its own cryptocurrency;

- The trading core, which includes all the main functions of the exchange.

Step 2. To popularize the exchange and attract new active users, you should adapt the software for mobile gadgets (iOS, Android) and acquire a convenient, friendly interface.

Step 3. Develop an advertising campaign that will attract users and investors.

Comparison of solutions

How much does a cryptocurrency exchange cost? What other advantages and disadvantages do each development option have? We present all this data in the comparative table below.

| Independent development of a crypto exchange | White label turnkey crypto exchange | White label crypto exchange to order | |

| Development complexity | High | Low –> Ready to use immediately after purchase | Low |

| Price | High | Economically feasible | Less expensive solution |

| Development and launch time | More than 1 year | Few weeks | A few months |

| Settings | Exactly meets your requirements | Ready solution | Improved settings |

comparison table

How to promote

The owner of a cryptocurrency exchange begins to earn income as the platform’s popularity among real trading participants increases. This is not easy to achieve - rapid promotion is hampered by high competition and the specifics of the advertising product.

Experts in the field of Internet marketing identify several of the most effective methods of advertising cryptocurrency exchanges:

- Advertising on thematic forums and websites.

- Ordering paid advertising posts from famous bloggers, traders, analysts.

- Offering potential users to test the exchange's capabilities for free.

- Adding new and most popular cryptocurrencies to the exchange listing.

Important! Saving on advertising when it comes to promoting a new cryptocurrency exchange means burying the opportunity to earn money. Investment in advertising in this case is directly proportional to the future profitability of the project.

In addition to the usual marketing techniques, owners of online sites resort to some tricks to attract new active users:

- Organization of fictitious trading, that is, carrying out trading operations through nominees. This technique creates the illusion of activity;

- Using an interface that copies the style of another already popular site. This may also include the use of a very similar address and name;

- Connecting to a network of exchanges whose trading activities are interconnected. In other words, participation in a major project with other creators of cryptocurrency trading platforms.

The creation and promotion of a cryptocurrency exchange is, first of all, a business project. Therefore, to successfully make money, it is recommended to refer to the rules for working with business projects:

- Drawing up a detailed business plan.

- Analysis of prospects and market segment.

- Compliance with current trends.

- Working in a team of professionals.

Scheme participants and their activities

1. The client initiates a transaction and sends the crypt to the Operator

- registers on the website of a foreign operating company;

- uploads documents for KYC;

- agrees with the transaction price and commission, creates an exchange request;

- transfers cryptocurrency to the company’s wallet;

- receives a loan agreement electronically.

2. The Operator issues a loan agreement to the Client

with an obligation on its part to repay the debt upon demand and the right to assign the debt.

3. The client sells the loan to the Partner

- The Partner contacts the Client and offers to repurchase the loan with a discount - a predetermined commission for the transaction;

- The client provides loan agreement data, goes through simplified identification (KYC) again, and provides bank card or account details;

- receives and signs the assignment agreement and the certificate of services rendered, according to which the loan and the right of claim are completely assigned to the Partner

4. The Partner pays the Client money

in rubles to a card or account in a Russian bank.

5. The Partner issues supporting documents to the Client

, sends documents on the transaction electronically, instructions to the bank in case of any questions, recommendations for filling out a tax return - everything that is necessary for legalizing income and filing 3-NDFL at the end of the year.

6. The Partner presents the loan to the Operator for repayment

– sends the loan agreement, assignment agreement and the Client’s data with a request to repay the debt.

7. The Operator pays the Partner money

to a foreign currency account in a Russian bank.

End client

Individual, cryptocurrency seller, resident of the Russian Federation.

Foreign company (Operator)

Legal entity in a crypto-friendly jurisdiction (Estonia, Malta, etc.). Has several accounts in banks and payment systems for settlements with partners and corporate accounts on exchanges for buying and selling cryptocurrencies. According to the laws of its jurisdiction, it can freely buy and sell cryptocurrencies and reflect all transactions in accounting. To carry out operations of exchanging crypto for fiat and providing services to individuals, it has the appropriate license or accreditation (for example, Providing services of exchanging a virtual currency against a fiat currency

- for Estonia). The company buys cryptocurrency from end clients and subsequently sells it on the exchange at the most favorable rate.

The Operator’s website has a client’s personal account, in which end clients register, upload documents for KYC, see the current exchange rate, create exchange requests and download the necessary documents. The exchange rate is generated manually or automatically taking into account expenses (exchange rates, fees for transactions in the blockchain, bank commissions, exchange rate differences) and the built-in margin.

After creating an application, the client transfers cryptocurrency to the company’s wallet and receives a loan agreement. The operating company is ready to repay the loan agreement at any time immediately after the transaction is confirmed in the blockchain. Payment can be made either in a foreign office or through a partner in Russia. It is possible to implement the terms of the scheme and loan agreement in such a way that payment is made only after the entire chain of transactions has gone through and the money has been received by the Russian company.

Russian company (Partner)

One or more legal entities in the Russian Federation, ordinary LLCs without any special licenses, permits or accreditations.

The main activity is the provision of information and consulting services on financial intermediation. Has several accounts in banks and payment systems for settlements with the operating company and payments to individuals. The partner buys loans from end clients at a discount and repays them to a foreign company at full cost. Payment of funds to the end client occurs by non-cash method to the account/card of an individual in a Russian bank or payment system. Payment in cash requires separate consideration due to legislative risks, risks of blocking bank accounts as part of AML/CFT procedures, etc. security and collection costs.

The partner company does not necessarily have to have a website or even a public office. If a meeting with a client is necessary, for the purpose of identifying the client, as well as for the purpose of exchanging documents, it can be carried out by a visiting specialist by agreement.

A partner can provide consulting services and help with the preparation of a 3-NDFL tax return and, for example, help restore documents for the purchase of cryptocurrency so that you do not have to pay 13% tax on the entire sale amount, but only on the difference between the sale price and the purchase price.

How to make your own cryptocurrency on your computer based on Bitcoin?

Bitcoin forks (cryptocurrencies created based on the Bitcoin source code) seem to many users to be a very promising way to make money. Moreover, there are already successful forks of the very first and most expensive cryptocurrency on the network - Litecoin, Bitcoin Cash and others. And creating your own altcoin based on Bitcoin is possible for every user who has at least some knowledge of the C++ programming language - the language in which more than 80% of the Bitcoin source code is written.

The way to make your own cryptocurrency on your computer based on Bitcoin is both simple and complex. To do this, you need to download the source code of the first cryptocurrency from the network, make your changes to it (change the name, set the generation time of new blocks, emission limits, etc.), and then upload the new altcoin to the server. Next, you need to start a campaign to promote the new cryptocurrency and simultaneously improve and optimize your creation so that it corresponds to the latest market trends.

Ideas for creating a successful electronic currency

At the beginning of 2022, there were more than 2,000 cryptocurrencies operating on the network, with new projects being launched almost every day. And of course, only a small part of new electronic currencies will achieve success in the future, and more than 90% of projects will be unprofitable. According to experts from the autosorfing company Bitfork Develop, most of the projects were created by people in pursuit of “quick money.” The creators of fork clones of Bitcoin and Ethereum were eager to repeat the success of the developers of these highly liquid cryptocurrencies, but users are not interested in copies of what already exists. According to experts, only those new cryptocurrencies that have fundamental differences for the better from existing projects will be promising.

In order to create a successful cryptocurrency that may be of interest to users, you need to consider the following:

- Technical implementation of an electronic system that would solve the problems and shortcomings found in existing cryptocurrencies (insufficient transaction speed, monopolization of mining by large farms, etc.)

- A memorable and attractive name and logo (here we can cite the example of Dogecoin, a cryptocurrency that gained popularity thanks to its logo with a popular Internet meme of a dog)

- The ability to use the blockchain electronic payment system for commercial purposes (following the example of Ripple, NEM, etc.).

Requirements for foreign and Russian companies:

- All participants in the scheme must be unaffiliated

with each other; - Both companies must be full-fledged businesses, have an economic meaning

for their existence, i.e. generate profit from each transaction, pay taxes (industry average, according to the arm's length rule), employee salaries and dividends to beneficiaries; - Both companies must have substance

, i.e. physical presence in their countries, office, telephone, address, real directors and competent employees; - A foreign operating company must have a license

or accreditation for cryptocurrency exchange operations in its jurisdiction, conduct internal and external

compliance

, implement and apply

KYC/AML policies

; - A partner in the Russian Federation should not explicitly position its services as a cryptocurrency exchange. The company must carry out customer identification (KYC) and constantly update the risk model

.