The author of the article, Don Tapscott, is the author of 16 books on technology in business and society, director of the Tapscott Group, and Chancellor of Trent University. In November, Thinkers50 ranked him the second most important business thinker in the world. He is also the author of Blockchain Revolution: How the Technology Behind Bitcoin is Changing Money, Business and the World and co-founder of the Blockchain Research Institute, a research center leading 70 blockchain projects. The original article Ten cryptocurrency predictions for 2022 from the co-founder of the Blockchain Research Institute was published in Quartz.

A year ago, my son Alex Tapscott (with whom I co-wrote Blockchain Revolution) and I made some predictions for 2022. At the end of the year we had the opportunity to compare our assumptions with reality. And they got along well.

At one time we said: “Bitcoin will reach $2000 (that’s right: one Bitcoin will cost $2000). Ethereum will not fall, but will become an advanced platform for new applications and business models.”

Many people mocked us when we heard that Bitcoin could triple in price. “You guys are completely crazy” is what we got most often on Twitter. And it’s true, only in this wild world of cryptocurrencies you can triple your invested funds in a year, watching how the currency outperforms forecasts almost tenfold. As for Ethereum, it continued to grow, strengthen and became the de facto platform for the development of ICOs, the boom of which helped launch a thousand distributed applications, from distributed file storage and prediction markets to applications for collecting crypto kittens.

2017 was the year when cryptocurrency managed to gain public attention. While some of us couldn't get enough of the sheer number of new apps, platforms, and bold technology moves, others were excitedly watching incredible price increases. In fact, the value of these assets has risen from $15 billion to $500 billion, making the cryptocurrency market one of the largest bull markets of our time.

Is this justified? Today's changes are reflected in tomorrow, in the future we can expect something significant and revolutionary. If you look at the market from the perspective of the future development of blockchain technologies, you can even call today’s behavior of cryptocurrencies conservative. However, it is difficult to look at the dizzying jumps in the prices of virtual crypto assets and all the excitement associated with it without a dose of healthy skepticism.

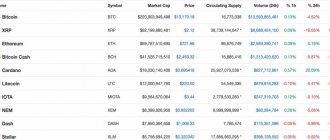

Imagine: in 2016, only one cryptocurrency - Bitcoin - had a value of more than $1 billion. Today, their number has increased to 36. Such a price increase can put even the largest bulls of conservative markets to shame. It goes without saying that many, if not most, of the new currencies, protocols, and applications will fail. However, the consequences of this Cambrian explosion of innovation will lay the technological foundation for a new Internet of value.

And yet, what have we managed to achieve?

Vitalik Buterin, the creator of Ethereum, once formulated this question eloquently:

How many people who are far from the nuances of the financial system have we managed to educate? How well do we support censorship-resistant commerce for ordinary people? How many truly useful distributed applications have we been able to create? How valuable are our smart contracts and do they live up to that value? How many Venezuelan citizens have we managed to protect from hyperinflation? How often are micropayments actually used?

Buterin considered that the level of activity was positive, but not significant enough to justify the figure of $500 billion (now more than $650 billion):

The answer to these questions is definitely not zero, and in some cases the numbers are even significant. But are they enough to justify $500 billion? Not enough.

On the one hand, the ICO market has changed the world's understanding of venture capital. On the other hand, few (if any) distributed applications funded by them are already running commercially. On the one hand, Bitcoin was massively recognized and increased enormously in price, which led to its large purchases and attractiveness in the mass and futures markets. On the other hand, burning questions around scaling and its management remain completely or partially unanswered.

Constant uncertainty surrounds Bitcoin, taking many forms, from the curiosity of enthusiastic players to the justifiable wariness of central banks regarding the cryptocurrency (not only as a store of value, but perhaps as a medium of exchange in general).

Ethereum became the first platform for creating distributed applications. However, an excess of activity around ICOs and the same trading of crypto kittens can slow down or even stop the network, as happened in December.

So, despite its breathtaking potential, blockchain is still far from changing the world.

In 2022, blockchain will have to deliver exciting innovations and meet public expectations. Otherwise, the market is in for a rude awakening. And maybe it's not as terrible as it might seem. As Chris Berniske, one of the partners of the crypto fund Placeholder Ventures, wrote:

A strong bearish crypto market in 2018 will harden us all greatly.

In preparation for hardening, I want to share with you our ten predictions for 2022.

The value of cryptocurrencies will continue to rise

We remain positive about the market's prospects. You shouldn’t even think about the possibility of a massive and irreversible collapse in prices. Crypto assets will be volatile, we should expect some drops, but they will not affect the overall picture as long as innovations in functionality continue to delight players and the public.

We are still at an early stage. Oddly enough, the incredible rise in the price of Bitcoin is pushing new investors into the market, rather than scaring them away. The market has grown to such a scale that it is simply impossible to ignore. In 2018, we will see massive institutional purchases of Bitcoin and other cryptocurrencies, but buyers will be concerned about regulatory uncertainty and scaling issues. These issues must be resolved for Bitcoin to remain sustainable.

We will see a strong influx of institutional, entrepreneurial and personal funds into the market. Many people and organizations have not yet invested because of the security issue: they were unwilling or unable to maintain private keys. They should have mastered this, but now there are players who are ready to take on the difficulties associated with investments. For example, Coinbase offers storage for crypto assets, and traditional financial companies create funds or futures markets.

But in the next few years, we should expect cryptocurrencies to be displaced from the top ten by platforms with more powerful functionality, just as the innovative leaders of the dot-com era were defeated by new and large companies like Amazon, Google or Facebook.

Bitcoin ETF

The NYSE and CBOE have long wanted to bring a Bitcoin ETF (exchange traded fund) to market, but these plans have been shelved. Dalia Blass, the SEC's director of investment management, responded to fund managers demanding answers to 31 questions. They concerned how mutual funds or ETFs planned to store and protect cryptocurrencies, as well as protect the interests of investors.

The next logical step is for the SEC to allow ETFs to go public later this year. Keep in mind that if a Bitcoin ETF comes to market, it will not be based on the price of BTC, but on the price of its futures.

Cryptocurrency madness will push the use of blockchain in business

At the Blockchain Research Institute, we study the impact of technology in ten areas: financial services, retail trade, impact on states and political systems, energy, higher education, logistics, industry, media and telecommunications, technology, healthcare and resource circulation. In all these areas we can already see an increase in innovation, supported by large organizations. One example is supply chain, a $60 trillion industry driven by giants like Foxconn and Walmart, which use blockchain technology to power their transportation schemes.

At the same time, most leading startups are created on decentralized models. This is reminiscent of the dot-com race in the 90s of the last century: many dot-com projects predictably failed, but some “grew up” and now dominate the modern digital economy. It must be assumed that many “block committees” will fail.

What is Cardano (ADA)?

Cardano (ADA) entered the cryptocurrency industry last September. Four months later, ADA is already up 1,520 percent and has a market capitalization of approximately $18.8 billion.

ADA cryptocurrency is one of the most discussed cryptocurrencies recently, and as you already know, the value of digital money is growing in direct proportion to the growth of its popularity among traders and investors.

Thanks to this, the Cardano cryptocurrency managed to quickly break into the TOP 5 of the most capitalized blockchain projects, where it ranks an honorable 5th.

Cryptocurrency rate: BTC. ETH. LTC. XMR. DASH - Real Time

Ethereum co-founder Charles Hoskinson developed the Cardano Blockchain platform to create a more fair and sustainable virtual currency system.

How the platform works

ADA uses a scientific perspective with research-based methodology. Open source technology goes through a rigorous peer review process conducted collectively by developers and scientists.

The platform turned out to be simple for both developers and clients. It uses an exclusive wallet called Daedalus, which guarantees a seamless user experience compared to other software and hardware wallets.

Compared to other virtual tokens, the development team manages Cardano centrally, without focusing on decentralization like the BTH or ETH platforms.

As a result, ADA can evolve faster and receive instant updates, unlike other cryptocurrencies. What may prevent the price of ADA from rising further is the lack of smart contracts and other important features required for development.

Cardano also claims to have the very first proof-of-stake mining algorithm that is mathematically proven to be secure.

On the other hand, the two best digital currencies in the world use proof of work to mine coins.

This means that blockchain works by having advanced computers solve complex equations. In fact, this is the easiest and most reliable way to manage the blockchain.

However, proof of work has disadvantages: an inefficient system, huge energy consumption, slow operations, and exorbitant costs for expensive tokens.

Proof of stake allows miners to mine even the newest coins and control the platform by holding currencies, resulting in greater efficiency but also less security.

The Cardano platform has all the necessary characteristics that should be present in new generation blockchain projects. But you shouldn’t expect that the popularity of Cardano will be supported not only by investment and speculative sentiments, but also by business. Now let's explain why we think so.

Firstly, the Cardano platform is a new generation project in the field of cryptocurrencies and blockchain technologies, which on the one hand is both its advantage and its disadvantage. An exceptional feature of Cardano is the ability for all blockchain projects to interact with each other, but in the current situation, this idea is not yet urgently needed.

Therefore, we believe that the Cardano project will gain more popularity in 2022 than this year. But the cost of ADA coins will increase this year as well. The main factors for its growth will be significant injections of funds into the cryptocurrency market, and since Cardano is in the TOP 5 projects, it will be a very attractive project for investment.

Most predictions for this year and beyond remain very rough due to the uncertainty surrounding the future of the token. In addition, most investors are distributed throughout the world.

According to reports, investors from Japan bought almost 95 percent of the coins during the pre-sale (ICO). The team did not allocate significant funds to marketing and promotions, focusing instead on technology development.

ADA calls itself the first third-generation cryptocurrency and aims to solve the problem of scaling and infrastructure difficulties.

These problems first became apparent in the blockchain of Bitcoin, the first-generation cryptocurrency that introduced the very idea of digital money, and Ethereum, the second-generation cryptocurrency that expanded the scope of cryptocurrencies through the idea of smart contracts.

In particular, Cardano aims to address issues related to scalability, interoperability, and sustainability on cryptocurrency platforms.

Scalability

The first problem is related to the slowdown of networks and high fees due to increased transaction volumes. An algorithm created by Cardano engineers, called Ouroboros, has been put forward as a possible solution to the problems of scaling the project (Ouroboros is an ancient mythological symbol - a snake eating its own tail).

Ouroboros uses a proof-of-stake algorithm to save energy and speed up transaction processing.

Instead of having a copy of individual blockchains on each node (as is done in Bitcoin), the Cardano blockchain reduces the effective number of nodes in the network by assigning leader nodes responsible for validating transactions from among the entire set of nodes. Subsequently, such a leader node transmits transactions to the main network.

Cardano also adopted RINA (Recursive Internetworked Architecture) to scale its network.

This network topology was first developed by John Day for heterogeneous, i.e. hierarchical networks. Hoskinson has stated that he plans to ensure that Cardano's protocols reach TCP/IP standards, the main protocol used for data exchange on the Internet.

Compatibility and Interoperability

Interoperability refers to the ease of transfer of cryptocurrency both within its natural ecosystem and in conjunction with the existing global financial ecosystem. There is currently no way to make cross-platform transactions between different cryptocurrencies or conduct “seamless” transactions involving cryptocurrencies and the global financial ecosystem.

Exchanges that periodically crash, are hacked and attacked, or charge exorbitant fees are the only intermediaries. A strict set of rules regarding customer identification and transactions has further distanced the cryptocurrency ecosystem from its global counterpart.

Cardano aims to enable the transfer of data between different cryptocurrency platforms through sidechains - “side chains” that will conduct transactions between two parties outside the main blockchain.

Developers are also exploring ways that organizations and individuals could use to selectively disclose metadata associated with transactions and the identities of the buyer and seller in order to use cryptocurrencies for trading and daily transactions.

Sustainability

Finally, sustainability lies in governance structures that provide incentives for miners and other stakeholders, and in developing a self-sustaining economic model for cryptocurrency.

In addition to this, Cardano aims to build what its creators describe as a “constitution” or agreement for the protocols. This, according to their plan, will avoid numerous hard forks (such as those that occurred in Bitcoin and Ethereum).

In the future, protocols will be hard-coded into Cardano blockchains, and applications that use the protocol, such as online exchanges and wallets, will automatically check compliance with these protocols as new applications are created.

Comparison with other coins

The rise in prices last week has led to increased interest in ADA, which will affect the profitability of investments. However, this altcoin is forced to compete with the more stable ETH, given the slow development of the currency.

Fearless forecasts say that the ADA token will rise in 2018 due to speculators who are looking for immediate revenue. However, Cardano is more of a long-term project. This blockchain seems to be ahead of its generation and has a bright future that is slowly emerging.

One of the rosy predictions points to the constant improvement of a new player in the crypto market. In fact, ADA has already overtaken more popular virtual coins such as NEO, NEM and Monero.

Observers say Cardano resembles two leaders: Bitcoin and Ethereum. The success of fiat or cryptocurrencies depends on the scale of their adoption. A currency supported by a larger community can expect greater value and widespread use.

Cardano's developers are promoting the coin as a first-of-its-kind virtual asset that is attracting consumers, speculators and regulators.

Keep in mind that regulators represent the sector most likely to legalize cryptocurrencies.

On the other hand, the altcoin focuses on its privacy feature, while Monero has earned a reputation as the most private coin, which has become a negative advertisement for it, scaring off investors.

What is attractive for investment?

There are several factors that indicate the attractiveness of investing in this currency:

- Manufacturability. The project is valuable from the point of view of the development of the blockchain sphere. In particular, this is one of the few projects that aims to combine the capabilities implemented by all developers in the field.

- Investment interest. The coins are not yet very expensive, and this also provides potential for growth. Investors can come in with a few tens of dollars, and this will already be an investment.

- Popularity. The discussion on forums continues to evolve, many large investors have begun to include ADA in their long-term asset portfolio, and this is an important factor for the currency.

- Team and openness. The project has its own team of enthusiastic developers who do not hide their work goals. The project is also open to innovative proposals.

- Market dynamics. So far, the growth of any altcoins depends on BTC and ETH, from which in 2022 they are expected to grow by 40-60% from May 2022 levels. Following them, the price of ADA will rise.

Pay attention to the value of the coin. An indicator of stable growth for Cardano will be a price rise above 0.5 USD per coin. Before this period, unpredictable jumps are possible, since the instrument has not yet gained a foothold in the desires of large investors, but has just begun to enter a serious game in the cryptocurrency market. For 2022, experts do not predict explosive increases in the price of this coin.

A new platform for value creation will emerge

Bitcoin is simply a currency and a store of some value. Think of it as the first major application that the Internet of Value offered us, much like email was the first major application of the Internet of Information. But what will become an analogue of the World Wide Web - a universal platform for creating and developing applications?

Let's look at Ethereum, which continues to grow - not only in its value, but also in the number of distributed applications that change the rules of the game as we know it. In 2018, it will switch from the proof-of-work protocol to proof-of-stake. But will Ethereum become the next generation platform for distributed applications? Will its protocol underpin the new Internet of Value, or will something else take its place? Now his team faces a number of serious tasks to increase the network capacity, including upgrades to Casper and Sharding and the same transition to proof-of-stake.

Also worth keeping an eye on in 2018 are Cosmos, Aion, ICON, and Polkadot, all of which can help solve important scalability, interoperability, and governance issues. These new platforms are very different from their predecessors, since already at the development stage they included ways to avoid some pitfalls. Now they are combined into a group called third-generation blockchains. They meet today's demands by providing smart contract capabilities, interoperability with other platforms, scalability, fine-tuning, and the ability to be both multi-disciplinary and multi-tasking. Will they be able to become successful? We will get the answer to this question in 2022.

Why has cryptocurrency grown?

Experts associate the exponential growth of coin rates with two important factors:

- The demand for Bitcoin and Ethereum has increased.

- There was a real explosion of ICOs. Companies have raised huge amounts of money for their ideas.

Enormous profitability, quick payback and prospects for the development of innovative technologies are pushing enthusiasts to create cryptocurrency projects. 2022 is likely to bring many innovations, as thanks to ICOs, ideas such as the creation of artificial intelligence raise millions of dollars in a matter of hours and even minutes.

This is good news, but let's take a more granular perspective. We want to tell you in simple words about the complex.

Transition to “value tokens” and ICQ for $10 billion.

In 2022, during the ICO, so-called utility tokens were issued. Towards the end of the year this started to cause some problems. Most of the tokens issued were bought by speculators solely for quick profit. This goes against the ICO ideology, which aims to invest in innovation rather than attract speculators.

In 2018, many new opportunities for implementing ICOs will appear. Imagine multifunctional currencies built on revolutionary advances in anonymity, scalability and fungibility. Now concepts such as product tokens, loyalty tokens or social tokens are already emerging, which represent a value other than a share in the company. So-called security tokens—cryptoassets similar to financial assets like stocks, bonds, and futures contracts—are still in their early stages of development, but they are likely to surprise us with increased value soon.

Imagine a $10 billion Tesla ICO. Let's do a thought experiment. There are at least 10 million Tesla fans in the world who cannot afford the company's products (because they live in places like Nigeria and Pakistan, where they cannot be purchased, or they simply do not have enough money). They would be happy to join the community and invest in the future of Elon Musk’s company and are willing to spend $1000 on a Model-3 coin or another TeslaToken. Thus, by conducting an ICO, Tesla will be able to raise 10 million times $1000, which will be $10 billion - much more than it could raise on the stock exchange or bond market. Such a “smart security” could simply represent a stake in a company’s new product or in the company itself, or include additional functionality, such as the ability of the token holder to leave a certain mark on the history of the enterprise.

BTC's dominance may end

It is believed that BTC may temporarily lose its place as the largest virtual currency in the world.

Cryptocurrencies are very susceptible to rumors. The range of emotions in the market in relation to cryptocurrency works surprisingly well. This also leads to the wild volatility we see in coin prices.

These emotions and the shortsightedness of some private investors could open the door for another token to gain a larger capitalization than Bitcoin.

What token could this be? The most likely option would be Ethereum, which has regularly ranked No. 2 by market cap for all of last year.

The Enterprise Ethereum Alliance, which is the largest open source blockchain initiative, currently has over 500 organizations. It involves representatives of various industries and sectors testing the Ethereum blockchain along with smart contracts tied to it.

Digital feudalism will burst at the seams

In the feudal system, the feudal lords owned vast lands. Ordinary people worked on the land, creating the necessary goods, but most of these goods were confiscated by the feudal lord. Today, the main good is data - created by us, but captured by our “feudal lords” (media giants, search engines, states, banks, etc.). We need to take back this data - our digital identity - and use it to our advantage.

With the creation of the blockchain, people can create unique, immutable entities in a “digital black box” in parallel with physical and digital objects. You can record data in it to later monetize it, use it to plan your own life or protect your privacy. We are waiting for several such blockchain solutions at once. In 2018, it's worth taking a closer look at tech companies that aim to give people back control of their identity (for example, uPort from ConsenSys, Civic and Sovrin). Innovations in this area are also being prepared by healthcare or higher education institutions, which are building blockchains to securely store the personal data of their employees and “clients.” Among other things, we will see the emergence of a new class of data aggregators. They will enter into agreements with companies and individuals to gain access to their data.

Cryptocurrencies and user security

Bitcoin is the first financial instrument to ensure the anonymity of confidential data. It is impossible to control cryptocurrency traders; no one will know how much money in the form of coins is stored in your wallet. This is great, but what about people’s ignorance of basic ways to protect their crypto funds?

Information about cryptocurrency is stored on a large number of computers that are connected to a network, and it must be the same in each account.

Bitcoin is the first financial instrument to ensure the anonymity of confidential data. It is impossible to control cryptocurrency traders; no one will know how much money in the form of coins is stored in your wallet. This is great, but what about people’s ignorance of basic ways to protect their crypto funds?

In fact, it is not difficult to acquire cryptocurrency; a person can buy it on the stock exchange, by hand or through exchangers. After purchasing coins, you need to create several wallets: online, paper and/or hardware. It is better to have hot and cold wallets with you. Hot ones are used for expenses, and cold ones are used for storing digital currency.

It is also extremely important to store passwords in a secure place, and they should not be simple. A potential attacker can use certain programs to penetrate a PC, so you should not store any access codes to cryptocurrency wallets on an electronic device - use pen and paper.

Digital conglomerates will burst into the market

About ten years ago, our team coined the term “digital conglomerates” to describe a new type of business. The enormous success of companies like Facebook, Amazon, Apple and Alphabet is built on a centralized approach and data collection.

There is no doubt that blockchain technology poses a threat to the world's largest digital conglomerates. However, in the coming year we will see how these giants will begin to enter the cryptocurrency market themselves, recognize digital currencies and implement blockchain. Be prepared for the Empire to strike back.

On December 12, 2022, it was announced that David Marcus, head of Facebook Messenger, would join the board of directors of Coinbase. I have no doubt that Facebook is exploring the possibility of introducing cryptocurrency payments or other token-related technologies within the Facebook Messenger platform. I wouldn't be surprised if Facebook wants to buy Coinbase.

If this happens, it certainly won't be the only acquisition of a blockchain company by a major digital conglomerate. Google has already become the second largest investor in blockchain technology this year, and this trend can be expected to continue given the growing public interest in blockchain.

Meanwhile, in December 2022, Amazon announced a partnership with R3 to use the Corda platform as the first distributed ledger for its web services. Does this mean Amazon is afraid of competition from blockchain marketplaces? Definitely.

Taxation and cryptocurrencies

For the third year in a row, politicians and central banks around the world are discussing cryptocurrencies. The strongest jump in this industry in 2022 forced states with developed economies to think about creating a legislative framework, rules for the purchase and exchange of tokens, as well as taxation of virtual coins.

Taxing transactions with cryptocurrencies is not as easy as the government would like.

Another interesting topic for regulating platforms is crypto to crypto. So far it has not been introduced anywhere in the world, but the exchange of various cryptocurrencies is carried out both on multi-currency wallets, exchanges, and online exchangers. The United States is preparing a bill that would allow taxation of any transactions with cryptocurrencies. Since countries often copy US decisions, many states are likely to do so.

Launch of fiat cryptocurrencies (finally)

Recalling the famous speech given by Bank of England Governor Mark Carney in 2016, many states are now actually experimenting with using blockchain to reset their own national currencies. It would not be an exaggeration to say that this decision could have consequences as important as the Bretton Woods agreement recognizing the US dollar as a reserve currency. Perhaps this step will determine the well-being of humanity for the next 100 years.

In 2022, we saw interesting developments in China, Russia, Dubai and Venezuela (and some other countries that can hardly be called pillars of democracy). Many of the proposed fiat cryptocurrencies are not actually cryptocurrencies: they only serve to maintain the image of states keeping up with the times and to crowd out truly independent cryptocurrencies. In 2018, we can expect real progress in this direction from countries such as Singapore, Switzerland, Canada, India, Estonia, South Korea, Japan and the UK.

At the same time, we should expect Bitcoin and other existing cryptocurrencies to strengthen their position as a viable medium of exchange. Today, thousands of medium and large companies accept payment for goods and services in bitcoins. Examples of such companies include Overstock.com, Newegg, Sopify.com, Dish Network, as well as Microsoft and PayPal. For most of them, 2017 was a good year in terms of profits. They did not convert their bitcoins into credit currency and took advantage of the increase in its value.

There is evidence that in 2022, even more large companies will begin to accept Bitcoin (and cryptocurrency in general) as payment. This list may include the previously mentioned Facebook and Amazon.

Additional forecast for cryptocurrencies

Some believe that a major country will join half a dozen smaller countries and ban cryptocurrencies. They are currently illegal in Bolivia, Bangladesh, Ecuador, Kyrgyzstan, Morocco and Nepal. There are also many countries where cryptography is partially prohibited, such as Venezuela and China.

Which country could be the culprit? For example, Britain. UK banks banned BTC purchases from credit cards back in February, and just weeks later the Treasury Committee announced how cryptocurrencies are impacting consumers, investors and businesses in the United Kingdom. If a major market like the UK bans cryptocurrencies, it will be a major blow to emotional retail investors.

Regulator Fever (The Good, The Bad, The Ugly)

In 2022, the popularity of blockchain and cryptocurrencies has grown so much that they have become impossible to ignore. In 2022, with continued growth, they will have no room for error. Many regulators will become stricter. And that's not necessarily a bad thing. Some short-sighted governments, such as China, have banned digital currencies, risking pushing their countries to the periphery of innovation and economic development.

The Internet of Values, arousing public interest, is changing many institutions and industries. Reasonable regulation would do him good. In many areas, such as the speculative side of the ICO market, where enterprising players raised $3 billion over the past year, regulations are necessary. In the US, the Securities and Exchange Commission (SEC) is on the right track. Since July, it has gradually begun to equate some (but not all) crypto-assets with securities. Supporting this growing market can be considered a wise decision. Last year, SEC Chairman Jay Clayton urged investors to be "extremely cautious" but added:

I believe that ICOs, whether their assets have real value or not, will become an effective way to finance innovative projects.

We're still early on, but I'm already ready to applaud the SEC for trying to understand and even support this new market. Securities regulation is one of dozens of areas, along with tax policy and intellectual property, that must be approached responsibly, but without prejudice.

Bitcoin

| Market capitalization | $271,448,263,550.64 |

| Lowest rate in 24 hours | $15,003.8955 |

| Highest rate in 24 hours | $16,455.1927 |

| Trading volume for 24 hours | $5,798,667,506.60 |

| Total score | 90,54% |

| Trading activity on major exchanges | 98,01% |

| Source code development activity | 98,08% |

Bitcoin is a unique and completely new currency that was launched online in early 2009. The need for it arose when currency trading moved from the category of “contact” markets to interactive platforms. But despite the fact that Bitcoin was the first cryptocurrency, today it has many competitors. Nevertheless, Bitcoin remains the most popular and expensive cryptocurrency in the world. True, they were not able to accept the coin immediately, but a select number of active users appreciated the advantages of the system, and thereby caused a sharp jump in the rate of the coin in question. For example, in December 2015, Bitcoin cost about $450, in July 2017 the price was already $2,600, in November 2022 $15,500, and finally, in December the maximum value was recorded, close to $20,000.

“Interactive money” can only be saved in electronic wallets. This coin does not have one control center, that is, Bitcoin is a decentralized system located on users’ equipment, creating a unique and very powerful network that is theoretically impossible to hack. The use of modern encryption methods makes the system even more secure. However, the following advantages of Bitcoin can be highlighted:

- Bitcoin is independent of inflation, which threatens every fiat currency;

- Bitcoin offers instant payouts. But in reality, transactions take quite a long time, especially during rush hour. As a rule, the transaction ends in 2-5 hours;

- Bitcoin is an innovative alternative to “real” money that cannot be counterfeited, counterfeited, or otherwise deceived the system;

- Bitcoin is perhaps the first cryptocurrency that can be granted the status of an international currency used throughout the world. This is one of the main news that every member of the Bitcoin community is waiting for;

- Transactions are completely secure, of course, if users provide the correct transfer data.

But given all this, analysts agree that the prospects for Bitcoin are mixed. Many talk about the colossal growth of its rate, but no less experts argue that this coin will experience a significant decline in 2022.

Let's first look at possible Bitcoin problems that may arise in 2022:

- The first is the issue of currency legalization. So far, only a few countries have officially legalized the coin; in particular, it is recognized in Japan. And the policy of non-intervention that many countries have chosen does not have the most favorable effect on the prospects for cryptocurrency in 2022. In addition, there is a risk that some states will “close up shop” and thereby reduce the exchange rate of the coin. While Bitcoin is in limbo, it makes no sense to talk about any prospects until this is fixed. But in Russia, Bitcoins may be legalized in 2022, judging by the latest news about the Bitcoin cryptocurrency. At the end of December, the first drafts of the future project were released, which users had already studied, where the most pressing problems of the topic under consideration were discussed.

- Due to the fact that Bitcoin is legalized (if this is done), the main advantage of Bitcoin will be lost - the anonymity of this system. Many Bitcoin fans are not happy with this. This means that a large number of users will leave the community. This could be a collapse or a significant blow to Bitcoin, because it is built on popularity and demand. The less demand, the lower the price falls. Controlling Bitcoin will negate its uniqueness, so this step must be taken with special responsibility.

- Today the coin is falling, but Bitcoin is characterized by sharp fluctuations in the exchange rate, which increases the risks when buying a coin, which means that the buyer has no guarantee that the transaction will be successful. This problem can be blamed on the main advantage of Bitcoin - its decentralization. That is, Bitcoin’s advantages are gradually turning against it. It’s hard to guess what will happen next, but the coin is considered a classic. Based on this, they will buy and sell it, rather out of habit, even if the exchange rate has fallen.

- Bitcoin is being actively replaced by other cryptocurrencies that are more advanced and easy to use. But so far this is not so noticeable, since Bitcoin remains the leader both in capitalization and in price per unit. But pessimistic experts say this could be corrected, if not in 2022, then in the coming years. Such a risk may arise from Ethereum, which is the so-called more pumped-up version of Bitcoin, which works faster and more clearly. The direct risk is evidenced by the fact that Ethereum is the second most popular cryptocurrency in the world.

- There is no compensation if users suffer due to a sharp drop in value. That is, working with bitcoins is a big risk even for professionals.

As for the positive forecasts for bitcoins in 2022, experts reassure that no significant drops in the exchange rate are expected in the near future. The fact is that so far analysts’ forecasts do not include factors that could contribute to a market collapse, but no one can exclude the possibility of force majeure.

According to optimistic growth prospects, the coins could reach $100 thousand per unit in 2022. The main argument in favor of this statement is the analogy with gold. In particular, gold is also not backed by anything, but during a crisis the value of this metal only grows, and at a pace that is difficult to keep up with. It's no surprise that Bitcoin is called digital gold.

But by legalizing the coin, Japan provoked an increase in its rate. Therefore, the more countries that recognize this currency, the greater the chances that at the end of the year traders will trade Bitcoins for one hundred thousand dollars, or even higher.

As for mining, it is impossible to get coins using it without powerful equipment. This will remove solo miners and non-professionals from the industry, paving the way for self-sufficient companies that can handle the task of mining coins.

The positive development of Bitcoin is evidenced by the fact that the first well-known Bitcoin billionaires appeared in the world, who bought this coin for another $120 for a total of $11 million. They were twin brothers Tyler and Cameron Winklevoss, who today own 1% of all bitcoins.

But keep in mind that the hype around Bitcoin created in the media significantly affects the rate. Even if the news is fake, it greatly influences the opinions of users and has an impact on the prospects of the coin. Therefore, making predictions is akin to conducting a clairvoyance session.

Social Impact: Energy and Climate Change Breakthroughs

2018 promises many opportunities for growth. For example, a “killer app” for blockchain could literally save the planet. The time has come for the development of distributed energy and p2p trading of “energy tokens” generated by sustainable sources, including non-systemic ones. In November, I spoke at the international electricity conference BIXPO 2017 in South Korea and was impressed by the blockchain initiatives of the South Korean energy company Kepko. Companies like Spectral Energy in the Netherlands, LO3 Energy and Grid+ in the US are also leaders in this area.

Blockchain and smart contracts will enable new businesses to provide better living conditions for the public. Carbon credits based on smart contracts will be traded on markets such as Veridium. I predict that companies like CarbonX Personal Carbon Trading and Zerofootprint Software will offer services to people to manage their carbon footprint and introduce incentive systems. And businesses will try to balance their carbon emissions by tracking the entire supply chain and achieving carbon neutrality in the production of products and services.

The billionaire abandoned the development of a cryptocurrency hedge fund

The market picture today, at least for some altcoins, is starting to favor bears. Billionaire Michael Novogratz is seriously considering suspending the activities of his cryptocurrency hedge fund called Galaxy Digital Assets. One of the reasons is the high price of Bitcoin.

In an interview with The Economic Times, the expert noted that there may be difficulties in purchasing bitcoins for clients. “We don't like the state of the market and we want to rethink what we're doing now,” Novogratz said on December 22, 2022.

He also admitted that he has recently sold and continues to sell most of his cryptocurrency portfolio. He previously planned to invest $150 million of his own funds, as well as raise another $350 million from investors for the Galaxy Digital Assets fund.

Another reason for the suspension of the fund’s activities was the manager’s reluctance to look unattractive by buying cryptocurrency for clients and at the same time selling his own. Novogratz is a former Goldman Sachs partner who also ran the hedge fund Fortress Group. He has been a recent supporter of Ethereum and is a friend of Vitalik Buterin.

Novogratz predicts Bitcoin price at $8,000. This level is slightly higher than Hosp's negative scenario of $5,000. He also expresses great disappointment in the cryptocurrency market and concerns about the current behavior of some altcoins.

"I don't want to deal with the schizophrenic emotional side of it," Novogratz says. “There are so many conflicts in this business. Everything turned out to be more confusing than I thought."

Ripple Forecast

One of the most promising coins of 2022 is Ripple. Why did she attract so much attention? If in the first half of the year the XRP coin cost around 20 cents, then later it reached a record high of $3.6, that is, it increased approximately 15 times. Unfortunately, this price did not last long, and at the moment the XRP coin has adjusted to $1–1.2. However, such rapid growth only once again demonstrated the great prospects of this cryptocurrency.

Why will Ripple grow? Lately, Ripple and Ethereum have come closest to Bitcoin. Moreover, at the peak of its value, Ripple even moved Ether and took an honorable 2nd place in the overall ranking of the capitalization of all cryptocurrencies. In technological terms, XRP coins are noticeably different from other crypto coins, and the Ripple system itself cannot be called completely decentralized, since a huge number of XRP units were reserved in advance by the developers for themselves.

On the other hand, it is this coin that most actively cooperates with the banking sector, providing truly profitable and attractive technologies for carrying out fast transactions with minimal commissions. More and more world banks are joining the system, which in many ways promises very bright prospects for it.

Cryptocurrency growth forecast for 2022: $10–20 per coin.

Binance exchanges .

Litecoin Forecast

In many ways, Litecoin is the same as Bitcoin, but in its “lighter” version - all transactions are carried out easier and faster. It is not surprising that this coin is growing very rapidly. Digital silver was only worth $3-$5 per coin at the start of 2022. Subsequently, the price increased to 40 and then to 120 dollars. At the end of the year, one could observe such impressive results as 300 dollars for 1 Litecoin.

The project team regularly introduces new technological innovations into its coin. For example, Lightning Network technology is used to significantly speed up transactions

this coin has been around for a long time, when the same Bitcoin community decided to use it only at the beginning of 2022. What can we say about the future prospects of the coin?

Cryptocurrency growth forecast for 2022: $1000–2000 per coin.

Where you can buy: any crypto exchanges or exchangers, for example, BestChange.

Forecast for other promising cryptocurrencies

Naturally, the entire crypto-economy is not limited to the above mentioned coins. In addition to them, it is definitely worth noting the NEO cryptocurrency, which is something like Ethereum, but in the Asian market. Don’t forget about EOS - this project is a multifunctional cryptocurrency platform that is under active development and, if all the developers’ plans are implemented, will bring many more dividends to its investors.

Cardano also has interesting prospects. This is the first project in the field of cryptocurrency that was developed with the involvement of the scientific community from several world universities. Cardano (ADA) coins were specially created taking into account all the needs of modern blockchain technologies. It is worth paying attention to such a coin as Monero. Unlike Bitcoin, this cryptocurrency is distinguished by maximum anonymity, and no one will be able to identify your identity in any way if you make money transfers through the Monero system. And today this feature is more relevant than ever, which also has a very positive effect on the rate of this asset.

Conclusion

Of course, all the positive cryptocurrency forecasts for 2022 in this article are just assumptions, which are based on the fundamental factors for the growth of digital currencies that are pushing the entire market up. More and more developed countries are seriously looking at the field of crypto-economy, the largest investment funds are gradually investing their capital in cryptocurrencies, and blockchain technologies themselves are increasingly penetrating both into business and into our everyday lives. Based on all this, we can assume that the forecast for cryptocurrencies for 2022 will be positive, and this year will bring a lot of profit to crypto investors.

Should you invest in Cardano now?

Over the past month, we have been seeing a rapid decline in the cryptocurrency market, and almost every day we are seeing how the market draws new support levels and then breaks through them.

But, over the next 2 weeks, a new trend will begin in the cryptocurrency market - a growth trend, during which the value of most coins will increase several times. That is why there is no more profitable time to invest in cryptocurrencies than now.

Every $100 invested will give you $100 in profit within a month. Considering the fact that Cardano has seen a 400% drop since its peak price, we can expect it to clear this handicap very quickly.

According to the forecasts of Cardano developers, ADA will achieve its maximum price growth within a year. Statistics show that the currency will increase by +8,623.99, it is currently hovering around US$0.729007. Market capitalization could rise to $40 billion before December 2022.

However, Bitcoin will likely remain the most important and valuable asset in the crypto world, and the situation will not change by the end of 2018.

How to make a profit?

With such a price for the ADA cryptocurrency and its smooth movement in the market, trading remains one of the methods of making a profit. To do this, you must have basic knowledge of the market and the ability to work with exchanges and exchange offices quickly enough.

Every day, the Cardano (ADA) price can rise and fall by 5-7%, and this is a great opportunity to make money on fluctuations. March, April and May 2022 provided excellent trading opportunities for investors.

Among the buying signals, you should choose the following tips:

- The exchange rate fell by more than 4% the day before. Judging by the history of trading, the currency quickly returns its balance and comes into balance the very next day.

- News about new developments. Almost all statements by the crypto development team lead to growth, but you should follow the essence of the news.

- ETH growth. It has been noted that Ethereum directly affects all similar cryptocurrencies, and ADA is no exception in this case.

- Reduction below 0.20 USD per coin. In this case, a correction of a few cents upward is very possible within a few hours. With a large volume you can make a good profit.

However, no investment or trading strategy guarantees you profit.

Trading in the cryptocurrency market remains a risky tool that can give you great increases in your capital, but also take away your entire investment in a few minutes.

You shouldn't invest or trade currencies if you don't know anything about them. It is better to first obtain the necessary information in order to make the necessary transactions on time.

Where can I buy

ADA is definitely recommended for purchase as a long-term investment. You can currently buy it only in some places, and this can be done easily and hassle-free only on the No. 1 exchange in the world - Binance.

They sell there only for BTC and ETH. Therefore, in this case, the most profitable option would be to buy Bitcoin on Advacash for rubles or dollars, and send them to Binance to make the purchase.

Bitcoin Cash (BTH)

The new Bitcoin fork immediately hit the top capitalization. Today it amounts to 21.237 billion USD. The cryptocurrency rate fell following Bitcoin (BTC). The current rate is $1269. If Bitcoin manages to withstand the pressure of the banking system, which is trying in every possible way to destroy the crypto industry, Bitcoin Cash will be able to update last year’s high of $4,100. Over the past week, the price has fallen by 2.64%.

The price of BTH fluctuates depending on the BTC rate

Stellar Lumens Forecast

Many people rightly call this cryptocurrency the younger brother of Ripple, and there are good reasons for this. A few years ago there was a serious split in the development team. So, in 2014, the famous programmer Jed McCaleb, together with a group of like-minded people, had a big quarrel with the management of Ripple over the decentralization of the coin. As a result, the developers who left the project decided to create Ripple 2.0, which was later renamed to Stellar.

This coin is promising for all the same reasons as standard Ripple. It is developed on the same protocol while maintaining all its advantages. But at the same time, the Stellar Lumens system has one key advantage, namely decentralization. Thus, some experts, from the point of view of blockchain technology, consider Stellar (XLM) coins to be more advanced than Ripple.

Forecasts for the cost of the Stellar cryptocurrency for 2022 – $12–20 per coin.

Where to buy: Binance and Poloniex exchanges.

DASH Forecast

One of the first and most respected coins in the cryptocurrency community. Interestingly, this cryptocurrency was originally conceived as a real alternative to fiat money. Now its key features are transaction speed, high anonymity and strong community support.

Today, the developers of this coin are actively focusing on the use of DASH in real business, as well as on the massive use of the coin between banks and other financial institutions. If all these plans of the developers are realized, then the value of the coin will continue to grow steadily upward.

Cryptocurrency price forecast for 2022: from $2000 for 1 DASH

Where to buy: any crypto exchanges or exchangers, for example, BestChange monitoring.

Bitcoin forecast

It is unlikely that such a well-known cryptocurrency as Bitcoin needs any special introduction. This is the first digital coin based on blockchain technology. Today there are many much more technologically advanced currencies, but in terms of its popularity and prevalence, Bitcoin remains the main currency in the cryptocurrency environment. From time to time, more and more new retail outlets appear in large cities where you can pay with cryptocurrency. This same opportunity is provided by many online stores and even individual government agencies. Moreover, Bitcoin is used as the main currency for payment, and only after that various altcoins.

Against the backdrop of all this, it is not at all surprising that the BitCoin rate in 2022 alone increased more than 10 times and reached $20,000. Naturally, if a person is just coming to the crypto-economy, then the first cryptocurrency he hears about is, of course, Bitcoin. Moreover, there is even a special strategy among investors, which consists only of buying Bitcoin and holding it for as long as possible, no matter what happens in the market. Historically, it justifies itself very well.

Cryptocurrency forecast for 2022: from $25,000–$50,000 per 1 BTC.

Where to buy: any exchange ( Exmo ) or exchangers, for example, BestChange .