Constant progress in the electronic payment niche is forcing people to open virtual wallets. This is a really convenient way to manage money, because without leaving your home you can transfer funds or pay for services at any time. And if you use anonymous payments, then confidentiality is also maintained.

The payment system (Advanced Cash) appeared much later than its main competitors, but quickly became a leader.

It has a number of compelling advantages, we will tell you about them, and also provide instructions on how to replenish, verify, withdraw and other actions on the account.

Offshore electronic wallet Advcash

In 2014, a new payment system, Advanced Cash, became available to users. It suggests creating a multi-currency wallet, depositing and withdrawing funds, making money transfers, and paying for services around the world.

The wallet has a number of advantages for which clients choose it:

- the wallet is really easy to use, and it opens in just a couple of minutes;

- verification is not mandatory, it also takes no more than 5 minutes to complete;

- users receive 4 wallet accounts for dollars, euros, pounds and rubles;

- When making internal transfers, no commission is charged;

- The Russian version of the site is of high quality;

- you can send money to unregistered users (via Email);

- deposits and withdrawals are available through cryptocurrency exchanges;

- This payment system has a much lower commission for input and output than its competitors;

- high level of security, two-level authorization is available in your personal account;

- popularity is growing, payment in Advcash is already available on many services;

- quickly and easily withdraw money to bank cards and other wallets.

The main feature is increased confidentiality. Below we will talk about the ban in Russia, but it only affected plastic cards. By the way, this is precisely why many people chose the payment system.

It was possible to order an offshore plastic card and anonymously withdraw money anywhere in the world.

Despite some problems with the cards, the payment system continues to be used.

Through it, it is convenient to set up payment acceptance, there are automatic payments, and it is easy to convert currencies. The most important thing is that they do not collect information about users here, as other payment systems do.

Is it possible to restore access to a blocked Adv wallet?

As we were able to verify, the list of prohibitions is so long that a user can be blocked even if he has not actually done anything illegal. But it is almost impossible to restore your account. Admins are subject to the following requirements:

- Change your account to business from personal. You must provide information about your company and your affiliation with it.

- Connecting payment acceptance with the provision of a set of notarized documents.

- The administrator can provide a legal certificate from Adv Cash, where experts prove why he can accept funds for circulation without a license.

As for ordinary users, the free withdrawal of earnings from payment cards is stopped; now transactions can be carried out taking into account a number of requirements, providing:

- copy of passport;

- utility bill at your place of residence;

- bank account statement;

- letter of recommendation from the bank;

- criminal record certificate;

- documents confirming the source of income;

- selfie with passport.

It is logical that not everyone will be able to provide such a package of documents. For example, a freelancer or a HYIP investor is unlikely to have a certificate confirming their income. Although you work legally. And if there is no income, what do you plan to withdraw?

Advcash is banned in Russia, is it true?

At the end of 2022, people began to actively write about the ban on Advcash in Russia. Indeed, in October, MasterCard changed its terms and conditions, causing Advanced Cash cards to no longer be supported outside of Europe.

Simply put, residents of Russia, Ukraine and many other countries will no longer be able to use plastic and virtual cards.

However, the payment system itself is not prohibited in the Russian Federation . It can also be used, the official website continues to work and in the news the administration writes that it is currently looking for ways to solve the problem.

As of January 10, 2022, the cards are no longer operational and are no longer issued.

You can continue to use your e-wallet. If there is a need for a payment system that issues its own plastic cards, then the best option is QIWI. The company issues cards for just 150 rubles; their balance is integrated with an electronic account.

New fines

Now the State Duma and the Government Office are preparing another package of amendments concerning changes to the Russian Code of Administrative Offenses and the Law “On CFA”. All of them relate to the rules of activity with cryptocurrencies.

In particular, a number of changes are proposed to be made to the law on digital financial assets:

If an operator is engaged in issuing digital coins and is not included in the Central Bank register, he faces serious fines. For example, a citizen can receive a fine from 50 to 500,000 rubles, an official from 100,000 to 1,000,000 million, or he can be disqualified for up to 1 year, and a legal entity can be charged up to 2,000,000 million rubles

If for some reason an operator decides to start issuing coins and does not receive permission, and it can take a very long time to get permission, if such an operator is identified, he will be fined. Taking into account the practice of applying fines in the country, the maximum amounts will be collected.

If an operator (individual, company) decides to organize transactions with digital assets, including transactions with assets of information systems of foreign law, and they are not included in the register, they will also receive fines, from 50 to 500,000 rubles per individual, for an official from 100,000 to 1,000,000 million; from a legal entity an amount of up to 2,000,000 million rubles will be recovered.

If a user or company has violated the rules for making transactions, which are specified in the law “On DFA”, and they are spelled out very vaguely and require improvement, they receive fines. They can recover up to 200,000 thousand rubles from a user, and up to a million rubles from a legal entity. Moreover, the authorities also receive the right to seize the object of the violation.

That is, the user not only receives an impressive fine, but the cryptocurrencies themselves may also be confiscated. The amendments to the law do not clearly indicate that this should be done necessarily, but the regulatory authority has been given such an opportunity. There is no doubt that the crypto asset will be confiscated.

If a user accepts a cryptocoin as payment in Russia and does not have the right to such acceptance, he is subject to penalties. An ordinary user will be charged up to 200,000 rubles, an official up to 400,000, and a legal user up to a million rubles. At the same time, the crypto asset can also be confiscated if they wish.

Who will handle all types of inspections? Federal Tax Service. Given that the department is experiencing a shortage of lower-level staff and they are already overworked, the service is urgently requesting that additional funds be allocated to hire new employees.

They will be engaged in identifying cases of violation of the circulation of cryptocurrencies. Since new employees are unlikely to be professionally trained in terms of understanding what cryptoassets are, how they work, and what the structure of the cryptoeconomy is, we should expect punitive measures against anyone currently involved in cryptocurrencies.

The Federal Tax Service has long had a practice of imposing maximum fines, so users and companies need to be prepared for huge expenses if the tax service seems to have violated the legislation in this area. It will be extremely difficult to prove your case in court, given the vague wording of the law “On CFA” itself.

But the matter does not stop there.

As it became known, following the results of meetings held at the end of 2022 in the Government Office, a preliminary decision was made that the Ministry of Finance of the Russian Federation would finalize its proposals regarding criminal liability for illegal trafficking in cryptocurrencies.

Interview with an expert: “Everyone will have to accept cryptocurrency!” Part 1

Official website of Advcash and registration in the payment system

Many Advanced Cash users have chosen this wallet because it is easy to use and registration takes a couple of minutes. When passing it, you need to indicate your first and last name.

This data is not transferred to third parties, even if you run a business and hide taxes, your confidential data will not be revealed to anyone:

Do I need to enter real data? You may need to undergo verification in the future, so it is better to provide real information. Immediately after registration, you can already top up your Advcash wallet, make transfers and use other tools.

Violation of the law with the circulation of cryptocurrencies: a prison sentence is possible

Officials intend to expand Article 63 of the Criminal Code with a new aggravating circumstance “committing a crime using digital currency.” For now, this issue is being developed by the Ministry of Finance and other federal bodies together with the FSB and the Prosecutor General’s Office.

Several bills that are currently being drafted indicate that a digital asset should receive the status of property for criminal purposes, and if a crime was committed using a digital currency, this will be an additional aggravating circumstance when the case is considered in court.

To put it simply, a user or company operating cryptocurrencies may also face criminal prosecution if the bills are passed.

Advcash verification

As a rule, identity verification was carried out to obtain a plastic card. Now they have stopped producing them, so the only reason is increased limits.

Unverified users can conduct transactions for a maximum amount of $2,500 per month. The check is carried out in three stages:

- First, the identity is verified. They ask you to upload a scan of your driver's license or passport (with photo).

- Then the address is checked, as a rule, for this they send a scan of the passport page with registration.

- The last step is to verify the phone number. Just enter the number and receive an SMS with a code.

Just like registration, verification on AdvancedCash does not take much time. You can use the wallet without this check if you have enough limits.

How to get verified in Advcash

Identity confirmation is needed in order to use all available functions of the service. The process requires uploading documents to confirm your identity, residential address, and mobile phone number. To pass verification in AdvCash, you need:

- Go to the “Profile” section and select “Verification”.

- At the first stage, go through personal identification.

- Confirm your residential address.

- Go through mobile phone verification.

- Wait until the documents are verified and a decision will be made within the specified time frame.

If you have worked with AdvCash or have questions, please leave your comments and feedback about the AdvCash payment system.

Registration in Advcash

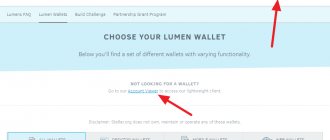

Advcash commissions

Registration is free, nothing is charged for internal transfers, as well as for replenishment via SWIFT/SEPA. All data on commissions are presented on the official website in the “Tariffs” section. For example, when replenishing from any bank card, the commission is 2.95%:

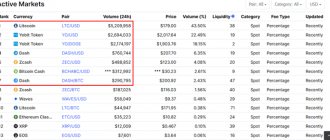

Interestingly, AdvancedCash offers direct handling of cryptographic money. Through exchanges such as Exmo, you can create codes for both depositing and withdrawing funds. Moreover, they offer to buy crypto at the current rate without commission:

If you compare interest rates with other payment methods, there are unprofitable methods of depositing and withdrawing. However, this is one of the factors in choosing payment systems. Everyone uses their own methods, so you need to consider commissions individually.

Why AdvCash blocks clients

And now to the most important thing! If this did not concern you before, then now these times are in the past. Not only investors, but also ordinary users now need to be afraid of blocking. Moreover, they can block only because they block everywhere and always. Your account is blocked if you:

- trade in medicines and other medicines;

- sell medals and orders;

- offer illegal devices for “safeguards”;

- sell archaeological and historical valuables;

- perishable goods are also prohibited;

- offer advertising.

It is prohibited to accept finance, to participate in financial transactions, that is, you can’t do everything and you can do nothing.

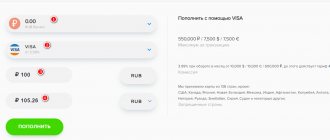

How to top up Advcash?

Deposit money to your wallet without verification. Before you do this, look at what accounts are available in the system. By default, balances are opened for rubles, dollars and euros. But you can add wallets for 4 more national currencies:

Depositing funds into your AdvancedCash wallet is not a difficult task. In your personal account you need to select the appropriate item, indicate the amount and under this form, select the transfer method:

Bank cards come first; to use them, verification is required. Scroll down the page and select payment systems; identity verification is not required for this:

For convenience, the system immediately calculates how much will be debited from the wallet. As you can see, when replenishing via Payeer, a commission is charged a little less than 1%, and if you use Bitcoin, there will be no commission at all.

How to keep your AdvCash wallet safe from hacking

Any wallet that holds at least some decent money must have adequate security against hacking and theft of funds. Many people don’t think about this because they believe that a good password is the best degree of protection. This is a misconception, a good hacker can crack any password, and this is happening very often lately.

The AdvCash wallet is packed with different methods of protecting your account, which makes it impenetrable. The developers did their best. Today, Advanced Cash has one of the best account protection systems among other electronic payment systems. The main thing is to take full advantage of the capabilities of this system.

You can make the necessary settings by clicking on the “Security Settings” button in the top menu.

Let's consider what ways there are to increase security:

1. Intelligent identification . This method of protection will be automatically enabled for you after registration. The system will check some data the next time you log into your account, for example, IP address. If the IP address is different from the one from which you logged into your account last time, then you will be sent a verification code by email, which you must enter in a special field on the AdvCash website. Only after this you will be able to log into your account. Not only IP, but also other parameters can be checked, and if the system suspects something, a login code will be instantly sent to you by email.

2. Binding to IP addresses . By enabling this method and certain settings, you can ensure that your account can only be accessed from a specific IP address that you set. I advise you not to use this method or use it carefully, because if your IP changes, you will not be able to log into your wallet. You need to monitor your IP and change it on time. This method is especially inconvenient if you have a dynamic IP (constantly changing).

3. Login to your account using SMS code . By enabling this option, you will receive a code on your phone when you want to log in to your wallet. Only after entering this code will you be able to access your account. A very reliable method, I advise you to use it.

4. Payment password . When performing any financial transaction, you will be required to enter this password. It is set in advance when this method is enabled. A very popular method, used almost everywhere, not only in AdvCash.

5. Code card . You will be given a card with codes in graphic format. There will be a total of 50 numbered codes. When making any transaction, you will need to enter a code under a certain number.

6. Login to your account using tokens . And finally, the best method of protection at the moment. You can install a program on Android or iOS called Protectimus SMART. It will generate one-time passwords for you for each operation. The password is valid only once. The program can be installed for free. You can also use a paid solution, namely by purchasing a special electronic device that will generate passwords for you. It's called Protectimus One

. You can order it on the AdvCash website for $25 with home delivery.

a

How to withdraw from Advcash?

Even a beginner will figure out how to withdraw money from this payment card. In the main menu there is an item for transferring funds. It was really convenient to transfer Advcash to the card, but now they are blocked and you have to use other methods:

For example, you can make a transfer to your bank card. All conditions are shown in the image above. The standard form for sending money is:

Make transfers in any currency, money is automatically converted. To avoid paying such large commissions, you can spend electronic money. Now many large sites accept this currency.

Exchange and transfer to Advcash

In almost all directions, you can make a transfer directly in your personal account. But you can also use exchangers. To find the best rate, use.

There is no need to register on this site, just enter the direction of exchange and get a list of exchange offices:

The data is constantly updated, and the sites with the most favorable conditions are presented on the first lines. After going to any exchanger, you will see a standard form, you need to fill out the details and indicate the amount:

Further actions depend on which wallet you are making the transfer from. In addition to payment systems, you can select bank cards on BestChange and transfer funds through Sberbank, Alfa-Bank and other banks.

Earnings from the Advanced Cash affiliate program

We can’t help but tell you about the opportunity to receive money from AdvCash for attracting new clients. In each user’s personal account, there is a section with a referral program, where a personal link is issued, promotional materials are available and statistics are kept:

20% of the commission is paid on all transactions of invited people. Share the link with your friends, publish it on social networks, record videos on YouTube, write reviews on forums.