Why do we even fall? The most important thing is to understand the situation globally.

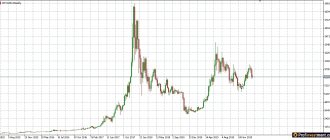

If we take the Bitcoin chart from the beginning of 2022 (picture below), we will see that while there is growth (green line), volumes (red line) are falling.

And this is what Technical Analysis tells us: If the price rises (green line), forming new highs, and the RSI oscillator chart, on the contrary, goes down (red line), then soon the price chart (trend) should turn around and go down.

Bearish divergence, Bitcoin volumes

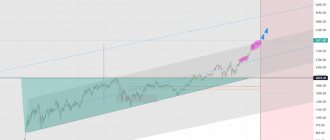

But the question is where will we go down from? After all, Bitcoin can draw another peak that clearly fits both into the trend and into the divergence according to the RSI (yellow on the chart below) and only then go down - easy!

Bearish RSI divergence, Bitcoin

But one way or another, it’s a matter of time before we go to a correction and after it to new highs.

Bitcoin forecast for the week and month March 2021

The forecast of the previous week worked out 100% and we are waiting for a new week from March 22 to 28, where we will simulate the Bitcoin rate during the week.

We have two options: positive and negative. In the positive scenario, we trample and fight off the trend line; in the negative scenario, we break through it and inevitably go to $50,000 - $49,000.

Positive alignment

Situation on Bitcoin and cryptocurrencies as of March 23. I expect a rebound from the current $55,836 or after we touch ~$52,900 (green line on the chart below).

Bitcoin forecast for 2022

Bitcoin exchange rate forecast

Most of the bitcoin exchange rate forecasts for 2022 voiced by analysts and bloggers could be divided into two directions.

At the end of the section, we will summarize which of the cryptanalysts was closest to the real price of Bitcoin at the end of 2019.

Optimistic forecast

The rise from $3,200 to $14,000 in 2022 was seen by many as preparation for a more global bullrun, which in theory would have been driven by the launch of the Bakkt platform and the approval of the Bitcoin ETF by the US Securities and Exchange Commission.

But in the end, everything turned out somewhat differently: the first event did not bring the expected upward push in the exchange rate, and the second was once again postponed, which was accompanied by a significant decline in the price of Bitcoin.

☝️

We recommend reading: Bakkt: a rocket to fly to the moon or a Bitcoin killer

However, there was no reason to panic, since a correction is a completely natural event after an increase of 4.5 times, and many people made forecasts for Bitcoin, drawing a bright future for it, and the very near future.

For example, technical analyst Alessio Rastani allowed the exchange rate to decline up to $7,000, after which he expected the implementation of the “wild card”

— a sharp rebound followed by an assault on the 2022 ATH and, if successful, reaching $39,000.

Chris from the MMCrypto YouTube channel had a similar opinion, arguing that $14,000 is not the peak of the new Tuzemoon, and, therefore, it is too early to expect a complete market reversal to the side of the bears. For more information about these forecasts, watch our video message to everyone who is still waiting for the opportunity to buy Bitcoin at $3,000:

Prediction: Will Bitcoin reach $3000?

Also, the renewal of highs by the end of 2022 was predicted by the famous financial analyst Max Kaiser - in his opinion, the breaking of the $10,000 mark opened the way for Bitcoin to $28,000, where it may go after the correction is completed.

The head of the crypto bank Galaxy Digital, Mike Novogratz, gave slightly different figures - he was confident that already in the fourth quarter of 2019, the Bitcoin rate would reach $20,000 due to the entry of investment banks into the game. Moreover, after this the bullish rally will not end, and the price of the main cryptocurrency will begin a confident movement towards the $40,000 mark.

Andy Chung, chief operating officer of the OKEx crypto exchange, gave a similar forecast for Bitcoin, expecting an influx of institutional investors into the market in the very near future.

And YouTube blogger Sunny Decree even saw the $90,000 mark on the chart by the end of 2022. He came to this conclusion by making the assumption that the growth of 2017 was an analogue of the preparatory stage of 2013, after which a real bullish rally followed.

YouTube blogger Sunny Decree

As for the autumn correction, Sunny believed that a drawdown of 40% was a completely normal phenomenon, behind which lies the additional accumulation of positions by the market maker before the next breakthrough.

In addition, he argued that for a trend to reverse downward, a price peak must be reached that exceeds the previous ATH, which has not yet happened. And the correction that occurred after exiting the triangle, which was considered by many as a bullish figure, is a standard deceptive maneuver to unload extra “passengers” before continuing the upward movement.

A less optimistic forecast for Bitcoin was given by Crypto Zombie, which looked at a fractal on the chart that had previously led to a significant increase in the rate. At the same time, he did not specify what numbers he was talking about, and did not guarantee that everything would go according to a similar scenario. What made him doubtful was the almost formed bearish flag on the chart, which increased the likelihood of the continuation of the downward movement.

The details of this two-pronged forecast can be seen in our video on making decisions based on Bitcoin behavior:

What will the Bitcoin rate be?

It also provides examples of non-standard market indicators from the Crypto Daily channel, confirming the possibility of a new bullish rally starting soon. In particular, we are talking about the growth of capitalization of the stablecoin Tether (USDT), as well as an increase in the number of “whale” wallets (with 1000 or more BTC in the account).

Well, now that 2020 has already arrived, we can draw conclusions which of the above analysts managed to predict the movement of the Bitcoin rate until the end of last year.

Let's start with the overly optimistic blogger Sunny Decree

- in 2019, he did not wait for Bitcoin to reach $90,000. Financial analyst

Max Kaiser

, who predicted Bitcoin would overcome the $14,000 mark and then double its price, was also wrong.

Mike Novogratz called slightly lower numbers

, however, his expectation of $20,000 per 1 BTC by the end of 2022 also did not come true.

Crypto Zombie

forecast into account, since he did not name specific numbers and hinted at the development of a fractal with an upward movement, without excluding a possible drawdown.

Alessio Rastani turned out to be closest to the real state of affairs

: as he expected, in the fall of 2019 the price of Bitcoin dropped to almost $7,000 and then a “wild card” was realized - an unexpected sharp jump up by $3,000 within two days. True, after this there was no predicted assault on the level of $14,000, much less $39,000, the downtrend continued and the rate dropped to $6,500. Thus, only the first half of Rastani’s forecast came true, which in general is not so bad, given the absolute failures of the rest of the Bitcoins -optimists.

Pessimistic forecast

Pessimistic price forecast

Bitcoin has already repeatedly experienced so-called price bubbles, accompanied by panicked cries of the crowd in the “everything is lost” style, but each time after that a new one happened. This means that there is still a chance of seeing a Bitcoin rate of $50,000, $100,000 or even $200,000.

But there is also bad news - for example, after the rapid rise of 2013, the market took about 2 years to transition to a new stable growth phase, which ended in December 2017. That is, almost 4 years passed between the tops of these cycles on the Bitcoin chart.

Now, not even three years have passed since the end of the last bull run. This means that before the start of a new rally, there may well be another 1-2 years, which Bitcoin will spend in a wide-range flat, and maybe even in a downward trend with updated loys.

Bears in the market

In October 2019, only the bearish figures looming on the Bitcoin chart hinted at the fact that there would be no native moon in the near future, but they could be “helped” at any moment by fundamental reasons such as a ban in some country or another robbery by hackers of a large exchange exchange cryptocurrencies Many feared that the panicking crowd would help push the price down and, before we knew it, we would be exploring a “new bottom.”

In addition, the “bull run” of 2022 could well be a full-fledged market mini-cycle, the result of which, as always, should be “shaking out weak hands” and lowering the rate to levels convenient for the market maker to accumulate Bitcoin before the next breakthrough. If we draw an analogy with the last cycle, then the last three months of 2019 we were in approximately the same state as in December 2018, that is, in the stage of accumulation at the local bottom.

It was assumed that these would be levels around $8,000, or lower levels of $7,000-$7,200, which Tony Weiss and Alessio Rastani pointed to, expecting that there could be a reversal from there, after which Bitcoin would finally go to storm new ATHs.

And if the rebound did not follow, panic sales could well have occurred, which would have brought Bitcoin to the level of $5,000, and maybe even $4,000. We discussed this option in our next video from six months ago:

Bitcoin price forecast: Where is the local bottom

Even the eternal optimist Sunny Decree pointed out the possibility of such a scenario. In his opinion, the rate could easily go to $6,000 or lower, since there was an unclosed gap in Bitcoin futures at this level. But he did not consider this circumstance as a threat to the cryptocurrency market, still expecting the beginning of a sustainable upward trend in the medium to long term.

Legendary trader Peter Brant was more pessimistic, suggesting that the inability of the bulls to keep Bitcoin above $10,000 indicates the possibility of a deeper correction up to 80% of the 2022 high (from $14,000), the movement towards which can well be considered as a growth cycle.

Also worth paying attention to was the opinion of American investor Tyler Jenks, according to which Bitcoin needs to correct well, even to the same $3,000, in order to ensure healthy growth in the future. In parallel with this, Bitcoin was supposed to gain market dominance of about 90%. Otherwise, we, of course, could go to the moon without the mentioned drawdowns and quite reach the level of $30,000–$50,000.

But this will happen without the entry of new investors into the market and the growth of general acceptance of cryptocurrencies, after which a real collapse will occur with the search for the deepest bottom within 5 or even 10 years.

We cannot yet evaluate such a long-term prediction, but the descent to $3,000 predicted by Jencks has not yet materialized. As well as Peter Brunt's 80% correction.

Rastani and Weiss were also not entirely right - the rebound from $7,300 that occurred at the end of October fits well into their forecasts, but until the end of 2019 there was neither an ATH update nor panic sales to $4,000 - 5,000.

The most accurate guess was Sunny Decree

about a decline to $6,000 before continuing to grow - in December, Bitcoin found a local bottom around the $6,400 level.

☝️

We recommend: Earning money on cryptocurrency: 11 ways without and with investments

Update for 24.03

Bitcoin fell to $53k, to the red line on the chart as we said and bounced back to $55,5330 at the moment.

Bitcoin price forecast for March 24

As expected, there is a 90% probability of the outcome of all events this week.

What should you pay attention to?

The most important thing is the news that will come out this week; we all remember Elon Musk’s tweets during the previous correction and what they led to.

- Positive or negative news.

- How powerful is this news?

- March 26th is the end of the option period for $6 billion (their owners will go into cash or re-enter the cryptocurrency again).

- Whale purchases (so today, an hour ago, 12,000 BTC was withdrawn from Coinbase for $500,000,000,000) + what other purchases will there be this week.

- What will happen with the allocation of another +3 trillion $ for US support?

- And other important news that we broadcast daily online in our telegram channel ru:Crypto - Subscribe.

What are we expecting?

Over the next 2-3 days, I expect movement within the contracting triangle, with an exit in one direction or another, which we will report on in the following posts.

We consider the first long target for Bitcoin this week to be consolidation above $55,000.

Bitcoin forecast for 2022

Bitcoin forecast in 2022

Let's start with the Bitcoin forecast for 2022, which has almost come true. Thus, back on December 13, 2022, when the first cryptocurrency was trading at $18,000, the famous billionaire and business coach Robert Kiyosaki predicted the growth of Bitcoin to $50,000 in the near future. He also advised buying Bitcoin below $20,000. He named the main reason for the growth entry of institutional money into the market:

To fulfill this forecast, Bitcoin lacked some $100. The growth trigger was the news of a $1.5 billion investment in Bitcoin by Tesla, which is owned by Elon Musk. This allowed the first cryptocurrency to break through the $40,000 resistance and rise 20% in just one day, reaching a high of $48,997 over the next few days.

More information about Robert Kiyosaki's forecast in the video below:

Bitcoin forecast by Robert Kiyosaki

☝️

Overall, the most popular Bitcoin forecast for 2022, which seems quite realistic, is to reach $100,000 by the end of the year.

This opinion is shared by the same Robert Kiyosaki and co-founder of Morgan Creek Digital Anthony Pompiliano. He believes that by the end of 2021, the main cryptocurrency will rise in price to $100,000 with a 75% probability. Moreover, the rise to this level will not be recoilless.

“I expect many drawdowns of 20–30% of the new ATH as the value of this asset rises. These mini-cycles of ups and downs should not be a cause for panic, but should be viewed as the natural market dynamics of an asset that rapidly increases in price over a short period of time.”

Pompiliano wrote back in the summer of 2022 in a letter to Morgan Creek clients

In his Bitcoin forecast, he names the main reasons for growth as a strong increase in demand with limited supply, including due to a 50% reduction in emissions in May 2022, and the spread of cryptocurrencies among institutions.

Sunny Decree fully agrees with this Bitcoin forecast, however, in his opinion, such figures can be achieved no earlier than in one market cycle. Preliminarily, in the next year, which is expected to end in 2022, the $200,000 mark should be reached.

In general, three scenarios can be distinguished for Bitcoin in 2022, and all of them are positive:

- Rapid growth to $50,000

in the first half of 2022 and then a “crypto winter” similar to 2018. Already now (mid-February 2022), the first part of this scenario has actually been fulfilled, but regarding the second, nothing indicates its implementation in the near future; - According to the most minimal estimates, growth to $200,000

by the end of 2022, if this year the cryptosphere develops like 2022. Based on this, it can be assumed that by the end of 2022 Bitcoin could grow by 8000-1600%; - Growth to $500,000

in 2022. This is a longer-term forecast, but provides a stable future for the first cryptocurrency. In this case, Bitcoin's capitalization will be on par with other financial markets.

Three Bitcoin Predictions for 2022

Update for March 25

The global fall of all markets: the stock market, the cryptocurrency market, and what’s more, even traditional assets into which investors flee when they fall, such as Silver, are falling.

Bitcoin has broken through the uptrend line, which will send it to the $50,000 area. Perhaps the fall will end in the area of $49k-$50k, $44k-$45k, $40k-$42k and $28k-$32k.

Globally, Bitcoin will still rise to more than $100,000, it’s a matter of time, but for the next 2-3 weeks we expect a decline and recovery. Although a large-scale ransom cannot be ruled out, as has happened more than once, see our Telegram channel about this. ⚡

There's nothing to worry about yet

According to Nikita Zuborev, senior analyst at Bestchange.ru, there is no need to worry just yet. “A decline in the value of Bitcoin is a fairly typical market reaction to a new all-time high,” he says. This was reported on the RBC website.

In addition, the analyst recalled that in the spring of 2022, the price of Bitcoin fell by almost 45%. Then, at the end of July, she began to actively recover. And after a few months, she even set a new maximum. Therefore, the expert does not see anything terrible in yesterday’s fall.

“In a global sense, nothing has changed; the long-term expectations of large investors are still extremely optimistic. Many, on the contrary, use the current correction as a reason to increase their position in the portfolio,” Zuborev explained.

In addition, he is confident that the value of the cryptocurrency will continue to decline until the end of the year. Zubarev expects a decrease to $36-37 thousand. This means a drop of 23% from current levels. However, don't despair. “Over the next few years, expectations are more positive,” the analyst added.

His colleague, trader Nicholas Merten, agrees with him. According to Merten, Bitcoin needs time to “grow up” again. According to his optimistic forecast, the value of the cryptocurrency will increase in March next year. The man does not exclude the possibility of growth up to $200 thousand, RBC reports.

Another expert “foresees” an even larger increase. The author of the Stock-to-Flow (S2F) model PlanB claims that in December the cost of the first cryptocurrency will exceed $135 thousand. This means that the estimated amount will exceed $500 thousand.

News that came out this week March 22 – March 28, 2022

News is updated as the week progresses:

- Microsoft is asking Xbox Live users about adding a Bitcoin payment option.

- Jordan Belfort "The Wolf of Wall Street" believes that Bitcoin will rise to $100,000.

- TIME is hiring a new CFO with knowledge of Bitcoin and cryptocurrencies.

- Fed Chairman Powell: Bitcoin Could Replace Gold, Not the Dollar

- The NYT has learned about the Biden team’s plan to support the economy by $3 trillion, RBC reports.

- Mining is booming. Greenidge will be the first publicly traded mining company with its own power plant to be listed on the Nasdaq exchange.

- Nigeria's central bank approves peer-to-peer bitcoin trading.

- Rapper Soulja Boy is looking forward to the rise of Ethereum.

What to do if Bitcoin falls below $53,000

In the event of a breakdown of the ascending dynamic line (red line on the chart below) and consolidation below at least an hourly candle, it will serve as a signal for a further fall and a likely end to the trend in the near future.

Bitcoin price forecast for March

We will record a minimum of 50% of your deposit and transfer it to USD.

“All forecasts regarding cryptocurrencies should be taken with a high degree of skepticism”

This was stated by Nikita Soshnikov, director of the Alfacash cryptocurrency exchange service. He questioned the above predictions of fellow experts. In addition, Soshnikov believes that Bitcoin will take much longer to recover. In his opinion, it will last until mid-2023. However, he does not rule out that the growth in the value of the cryptocurrency may be affected by the launch of the first spot Bitcoin ETF in the United States.

The co-founder of Crypterium, Vladimir Gorbunov, also thinks so. “If I were personally asked whether I believe that Bitcoin will cost $500 thousand in a few years, without fixing on how many years exactly, I would say definitely yes,” the expert noted. He sees no reason for Bitcoin to fall further. Following the new US cryptocurrency, Bitcoin should also increase in price.

When will Bitcoin rise?

To continue the upward trend, we must consolidate above the purple line on the chart above, around $58,000. And then, break through the previous maximum ATH $62,000.

Join us on telegram