PayPal is a service with which you can pay for goods, transfer and receive money. Only registered users can use the system functionality. Access is provided to individuals and legal entities after entering data. Using your login and password, you can log into your personal account from any device with Internet access.

Cash loans for any purpose

- Rate from 5,9% !

- Up to 7 years !

- Loan amount up to 5 million. rubles !

Submit your application

About company

PayPal was founded in 1998. In 2014, the company processed about 4 billion transactions, ¼ of which were carried out using a mobile phone.

As of 2022, the company has developed a convenient and secure payment method. The platform operates in 202 countries. Payments are available in 25 currencies.

PayPal cooperates with many large stores. Among the partners:

- Ozone.

- Poster.

- Tutu.ru.

- LitRes.

- Aliexpress.

Advantages and disadvantages of use

Payment via PayPal is a common method of payment online. It is especially in demand when shopping outside the Russian Federation.

Easy to use. To make a payment online, just enter your email and password. This is enough to log into your Pay account to confirm your payment details.

Rapidity. All operations take place in a matter of minutes. After payment, PayPal instantly sends the seller's information and transfers the money to him. The seller, after receiving the money, sends the goods.

You can send money to friends through your personal account. All you need to do is specify the recipient's address.

Buyer Protection Service. If the purchased product is of poor quality and it is not possible to resolve the issue of replacement with the seller, then buyer protection should be enabled. PayPal itself will verify the details of the purchase of the goods. If the client is right, then the money will be returned to him.

Postage paid by PayPal. If the item is not suitable, it can be sent to the seller using PayPal. 12 free returns available per year. It is important that the amount sent for each return does not exceed 1,500 rubles. The service is activated in your account.

There is a free mobile application.

There is no need to pay for the service.

All transactions take place over a secure network.

All information about transactions is stored on the main US server. When registering an account, an agreement is signed according to which the user consents to the transfer of personal data outside the Russian Federation. Where exactly is not reported.

PayPal shares personal information with third parties. This is necessary to process the transaction. It is unknown how third-party companies will use personal data.

Sellers must pay a tax of 4% on the PayPal amount. If the seller refuses to pay, the money is withheld from the buyer.

A fee applies when using a PayPal credit card to pay for items.

Creating a personal account for a legal entity takes a lot of time. The payment system takes a long time to verify the information.

Why are payments with PayPal more profitable?

Users of the system have the opportunity to send money from a real bank account that is linked to the system. When paying, real money is transferred, not electronic money (analogues), which are popular.

The benefit of the calculations is that registering an account and purchasing with PayPal is free. Exceptions are the purchase of goods from foreign partners. In this case, currency conversion occurs when sending.

For transfers in rubles to friends or relatives from the account balance, no commission is charged.

Advantages and disadvantages

The system has a number of undeniable advantages and disadvantages:

| Advantages | Flaws |

|

|

Creating a PayPal wallet

Only authorized users can make purchases, send transfers, and request money. Not only individuals, but also legal entities can gain access.

Registering a personal account

To gain access to the personal account (PA) of an individual, you need to go to the official website of the company. Then follow a few simple steps.

Step-by-step instructions for registering a personal account in the Russian version:

- Click “Register” for personal purposes.

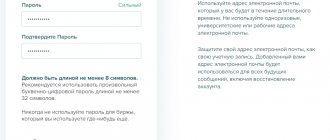

- Register your email, phone number and create a password. After entering the information, click “Next”.

- Fill out the form. You will need to indicate: citizenship, full name, date of birth, passport details, address at the place of registration, SNILS number.

- After filling out the information, check the box in the “User Agreements and Privacy Statement” section.

- Additionally, at this step you can check the box “Remember me and do not ask for a password every time you make a purchase from this device.”

- After entering the data, click “Check and open an account.”

- The last thing you need to do is link your bank card or account. To link a card, you will need to provide data on the front and back sides. After entering the data, click “Link card”. To link an account, you must specify the account number and BIC. After entering, click “Agree and bind”.

You can link a card or account at any time in the “Wallet” section; this can be done in 5 minutes.

The operation is available from the age of 14, after receiving a passport. However, it is important to understand that you can only act as a seller after 18 years of age.

Open PayPal wallet

Corporate account registration

A corporate account is opened by individual entrepreneurs and LLCs exclusively for conducting business activities.

The process of opening an account takes no more than 2 weeks. There is no need to notify the tax organization about opening an account, since the system sends the information independently.

To create a business account for a legal entity you need:

- Go to the portal. The tab is located under the corporate account. For convenience, you can go directly to the link https://www.paypal.com/bizsignup/#/checkAccount.

- Enter your email and click “Got it.”

- Fill out all fields of the form. You should indicate: login and password, full name of the manager, name of the individual entrepreneur or LLC, what business, work phone number, legal address. After filling out all the information, select the main currency for the account and click “Accept and continue”.

- Select the organizational and legal form of the organization, the scope and type of activity, the date of registration and the company website, if available.

- Complete the sections about the primary representative. You should indicate: date of birth, citizenship, actual address of residence.

- The next step will require you to read the questions regarding the company and select a “yes” or “no” answer.

- The last thing left to do is to check the correctness of the entered information, confirm and send. This completes the first stage of the registration procedure.

To use the service, you will only need to confirm your email (go through verification). To do this you should:

- log in to your mailbox;

- open an email from PayPal;

- follow the link.

After confirmation, you will need to add and confirm a bank current account. To do this you will need:

- Select “Add a bank account” in the user’s personal account, in the “Money” category.

- Indicate the company name and BIC. The system itself will determine the bank and load the necessary details. The main thing is to check them and make changes if necessary.

- Then click “Confirm” and receive 2 deposits from PayPal in the amount of 0.01 to 0.99 rubles.

- Go to the “Profile” section, in the “Profile and Settings” tab. To do this, you will need to return to the main page of the service. Go to the “My Money” section and in the “Bank Accounts” section select “Update”.

- After updating, click “Confirm” and indicate the exact 2 amounts that were credited as a deposit.

Finally, you will need to provide information about the individual entrepreneur or LLC . To do this, you need to prepare a package of documents 2-4 days after registration, scan it and upload it to your personal account. A window for uploading documents will appear on the main page after logging in.

Requested:

- information about the general director of the LLC or individual entrepreneur;

- certificate of availability of account;

- account holder's passport;

- statutory documents of the company;

- information about beneficial and additional owners.

You will also need to provide all account details and click “Continue”. Next, you have to choose from the proposed options and fill out a form: indicate the document details, who is the owner.

The submitted information is checked (verified) within 14 days. If successful, the restriction will be lifted and all the functionality of your personal account will be available.

Open a corporate account

How to create PayPal without a passport if you are under 18 years old

The only thing we must not forget is that you must be of legal age to create a PayPal account and open an e-wallet. But even at this point, eyes are often closed if registering a PayPal account is used only for personal payments via the Internet.

How to register with PayPal if you are under 18? Without a passport indicating your age, it is also possible to create a wallet. This is possible due to the fact that during the process of creating an account there is no need to upload copies of your documents to the payment system website. And when filling out personal data, instead of the passport number, they simply enter any numbers and a fictitious date of birth.

However, those who resort to such a scam should still be prepared for the fact that their PayPal account may be blocked at any time.

How to log into your Paypal account

To log in to the system, you will need to go to the portal. The tab is located in the top menu.

For authorization the following is requested:

- email address (login);

- password.

After entering, click “Login”.

If the user has forgotten the password, then its recovery is available in this section. To restore it, select “Unable to log into account” and enter your email. Then enter the code that will be sent to the linked phone number.

User Agreement and Privacy Policy

Please accept PayPal's Terms of Use and Privacy Policy below. You can read it, but these are standard legal documents that are not very easy to read. Just check the box and click the “Agree and create account” button.

Personal account functionality

The main tool of PayPal is a personal account. Depending on the client’s status, it can be personal or corporate. A personal account is used to purchase goods for oneself and transfers to friends, and a corporate account is used to conduct business.

With a personal account you can:

- change profile settings;

- create and edit automatic payments;

- pay for goods in an online store;

- send a money transfer to a friend or relative, both within the Russian Federation and abroad;

- request money to your account;

- link a bank card or bank account to the account;

- view transaction history;

- connect available services;

- study offers from the company.

LC system settings

You can customize your personal account for yourself after registering and linking a card or account. To change your profile:

- Log in to your personal account.

- Select "Settings" in the top menu.

- Edit data.

In the tab you can change:

- Username;

- Mobile phone number;

- date of birth;

- residential address;

- account status: from personal to corporate;

- close an account.

To change your password, you will need to go to the “Security” tab. In the section you can:

- set a new password;

- change your security question;

- activate or disable OneTouch.

Personal information of the owner of the PayPal account

The form is quite simple and there should be no problems filling it out. You need to enter information for PayPal in Russia in Russian, entering data in strict accordance with your passport (passport of a citizen of the Russian Federation).

For residents of other countries, the best option is to enter data in Latin letters (in English), if possible focusing on the international passport. The only advice that can be given is: if you already have an account on ebay auction, try to ensure that the registration data on PayPal and ebay match (e-mail, address, spelling of first and last name, etc.).

Enter information carefully. Please note that all items are required to be completed. As an example, we entered abstract data into the questionnaire.

Name – Your Name (For example Andrey)

Patronymic – Your Patronymic (For example Petrovich)

Last Name – Your Last Name (For example, Ivanov)

Please note that the form contains the first name first, then the last name and only lastly the middle name.

Date of Birth – Select your date of birth that matches your passport.

Nationality – select your nationality. Or simply leave the previously selected country.

For Russians, registering with PayPal requires entering the number and series of a civil passport. Enter the number and series in a row, without spaces.

Also, only Russians are required to enter the details of one of three documents to choose from when registering.

- Insurance number of an individual personal account (SNILS) - the number that you will find on the insurance certificate of state pension insurance.

- TIN is a taxpayer identification number, a digital code that is assigned to all taxpayers in the Russian Federation. The TIN of an individual consists of 12 digits; it can be found in the certificate of registration with the territorial body of the Federal Tax Service of Russia.

- Compulsory medical insurance – compulsory health insurance policy number.

Street / House / Apartment (Street Address) - enter the address that you can confirm. If PayPal has any doubts about the user, he is asked to provide copies of documents containing his first name, last name and address (for example, utility bills) to confirm his address. An additional line in the form is given if the address does not fit in the first one. This address has nothing to do with the delivery address of purchases.

Region, district (Province / Region) – Specify the requested data. For Russia you can simply enter RU, for Ukraine - UA, for Kazakhstan - KZ, for Lithuania - LT, etc.

Postal Code – postal code (optional).

City – your locality (city).

Mobile phone number (mobile) . Please enter your mobile phone number carefully, as... it will be used when creating your account. The number is entered in the format: international country code, city code, telephone number (Russia code - 7, Ukraine code - 38). If the number is not accepted, you probably put an extra character somewhere, try writing it down without spaces.

Payments and transfers to PayPal

You can send a payment through the system provided that a bank card or account is linked. To transfer money, you will need to log in and go to the “Money Transfers” section.

Then you have to select the desired subsection, make a payment using your login or email address in the payment system. Money is transferred instantly.

If the recipient is not registered in the system, he will receive a notification to his personal email address. To receive money, he will need to register.

You can request money into your account through the “Money Transfers” tab. To do this you will need:

- select the appropriate subsection;

- indicate the email or login of the counterparty;

- add a comment if necessary;

- send a message with a link to the personal account of the sender of the money.

My account

Through the “Account” section, located in the top menu of your personal account, you can view account information. Reflected:

- what accounts are open, indicating the currency;

- recent transactions on the selected account;

- which card or account is linked to your personal account;

- The rest of money.

The tab is available if the balance is zero.

What is the service fee?

Before making a transaction through the system, you should pay attention to the size of the commission.

| Personal transfers | — 3.4% of the total amount +10 rubles for each transaction when using a bank card; — From 0.4 to 1.5% for transfers abroad. If the money comes from your bank card, then a transaction fee of 3.4% + 10 rubles is charged; — International transfers: 149.99 – 299.99 rubles using account balance and 3.4% + 10 rubles when paying with a bank card. |

| Sales | — Charges up to 3.9% + 10 rubles for selling goods within the country; — Flexible PayPal commissions for sellers from 2.9% +10 rubles, depending on sales volume. — From 4 to 6% for international transactions. |

| Shopping | For free |

| Withdrawal of funds from the balance | For free |

International payments are subject to an additional fee ranging from 0.4% to 1.5% depending on the destination country.

Nuances of registration and use

To use the system, you must adhere to the following rules:

- A corporate account cannot be used for personal, family or household needs. A personal account is not used to conduct business.

- officially registered legal entities and individual entrepreneurs can open a corporate account

- To transfer money, there must be an appropriate balance in the account, including fees.

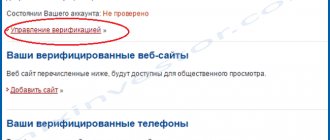

- To be able to use a corporate account, the client must pass verification. Personal account holders are subject to verification to increase transaction limits.

- You can link debit, credit, and prepaid cards to PayPal. If several cards are linked to the system, you should select the preferred account from which transactions will be carried out first.

- Email can be registered with any mail service, but mail in the .com domain zone will allow the client to enjoy higher limits, even with an anonymous wallet.

- Conversion of funds should be carried out through a bank account.

How to disable your personal account?

Before deleting your account, it is important to understand that you will not be able to open it again. After disconnecting, the entire history of operations will be deleted, without the possibility of recovery.

To disable the cabinet you will need:

- Log in to your personal account on the web version of the system.

- Go to the "Settings" section. The icon in the upper right corner, in the form of a gear.

- In the “Account” section, select “Close account”.

- Confirm the operation and receive confirmation. After this, the account will be blocked.

To delete your account permanently, you should write to support using the “Problem Resolution Center” form. Each new request is created as if from scratch, in an empty request form.

What to do if it fails

There are situations when it is impossible to open and then identify a wallet. Try the following:

- Check your email. Perhaps it received information with recommendations from the administration to fix the problem.

- Make sure you enter the correct information.

- Go to paypal.com/disputes and report any difficulties you encounter.

- Write to support paypal.com/ru/smarthelp/contact-us.

In most cases, there are rarely any difficulties with account creation and verification. If they occur, service specialists will help solve the problem.

Mobile app

You can send money anywhere in the world or pay for goods using your mobile phone. To complete the transaction, you will need to download the “PayPal” application on the website or in the market of your phone.

To download via the site:

- Go to the portal.

- Enter the “Personal” menu.

- Go to the “Download the PayPal app” subsection.

- Select a download method based on your phone's operating system.

- Launch and install the application. If it was downloaded via a computer, you should transfer it to your phone using a cable or email.

To download the application via phone you need:

- Log in to the App Store or Goole Play (on Android).

- Enter "PayPal" in the search.

- Download and install the program.

Alternatives to PayPal in Russia

EPS PayPal is not always suitable for Russians. Some have serious difficulties conducting transactions.

However, you can use alternative services that are not inferior to competitors in terms of security and speed of financial transactions.

Stripe

The service was created in 2010. It has proven itself and is actively developing, conquering the market. The service is different:

- efficiency of transaction processing;

- convenience.

Payments are subject to fees starting from 2.9% + $0.30. It is possible to pay for purchases on Amazon.

Authorize

The service has been operating since 1996:

- he has won many prestigious awards;

- acts as a subsidiary of Visa Inc.

Customers can expect prompt money transfers and 24-hour technical support. Commissions from 2.9% + $0.30.

Dwolla

The service was founded in 2010. The interface and options, the way of doing business are similar to Pay Pal:

- transactions are carried out instantly;

- 24/7 support service;

- There are several types of accounts.

Skrill

Operating since 2001:

- offers standard types of accounts;

- carries out transactions promptly.

Commissions from 2.9% + $0.30. It has a high level of safety and is widely known throughout the CIS.

Google Wallet

Launched in 2011. Designed to work with smartphones running Android OS. To create a wallet, you need to have a gmail account.

The functionality of the Google Wallet service is limited. You can only purchase content from the app store.

Payoneer

EPS accepts payments from debit and credit cards. Charges from 3% of the transfer amount.

It is considered a leader in the speed of financial transactions. Clients do not have to wait more than 2 hours for money to arrive.

WebMoney

The most famous EPS in the CIS. Operates since 1998. Allows you to make local and international transfers to bank cards:

- Visa;

- Mastercard;

- WORLD.

You can also transfer funds to bank accounts, Yandex electronic wallets, pay for services and purchases.

In addition, the service allows you to take out a loan. WebMoney's minimum commission is 0.8%.

Customer support

To get help solving the problem, you can contact support. You can contact her using the personal account menu.

To get advice from a specialist from LC you should:

- Login to the application.

- Select the “Contact Us” section – It is located in the bottom menu of the site.

- Click “Message Processing Center” and write the essence of the question.

In the same section you can control the status of consideration of the application.

Additionally, through the official website, you can go to the “Contact support service” section:

- Write a request.

- Request a call back (it is better to choose this option to save time).

- Call via the Internet, click “Call us using a guest entry.”

You can call the hotline at:

- 8, free hotline in Russia;

- +353 1 536 4800, contact for international calls.

The support service accepts requests from Monday to Friday from 10:00 to 20:30 Moscow time.

Feedback on using PayPal

More than 200 million clients use the service. You can find a huge number of reviews about PayPal on the Internet.

Most account holders are satisfied with the payment system. They highlight the following advantages:

- the ability to make purchases abroad on popular platforms: eBay, Amazon;

- the ability to transfer money to bank accounts;

- payment for services;

- prompt replenishment/transfers;

- functional mobile application;

- constant development;

- license to conduct activities in the Russian Federation;

- 24/7 support;

- simple verification, registration;

- ease of transactions, etc.

PayPal is constantly improving its service level. The site becomes more convenient over time, options expand, as does the zone of influence.

Thanks to this, the number of customers increases and most of them recommend the system to others.

PayPal reviews

On the Internet you can find numerous reviews about the service. After studying them, it becomes clear that there are satisfied and dissatisfied users.

Satisfied users note the simple interface of their personal account and the ability to pay for goods in real time. Special attention is devoted. Thanks to it, customers can refuse the goods and return them without paying shipping costs.

Dissatisfied users note the inflated commission amount, especially for conversion. In their opinion, conducting transactions in foreign currency is not profitable.

Advantages of PayPal in Russia

Pay Pal appeared in the Russian Federation not long ago, but managed to win the trust of Russian users.

A high level of service, efficiency of financial transactions and security make EPS indispensable. The service has a wide range of advantages.

Globality

Many people know what PayPal is. The service has been on the market for 22 years. He managed to prove himself well. At the same time, it is actively developing.

The list of services is gradually expanding. Supported:

- Money transfers;

- loans;

- payment for services and purchases.

At the same time, the geography of influence is growing. Today, residents from 200 countries can use Paypal.

Users can carry out operations using 25 currencies. Customer support offices are gradually opening in different countries.

Shopping security

PayPal guarantees customer safety. EPS adheres to the Privacy Policy. Does not transfer data to third parties.

The recipient of the funds sees only the email, other information is hidden.

The EPS website uses https encryption. At the same time, customer information is stored in encrypted form.

When visiting an account, the system checks whether the legal owner wants to use the money in the account.

The German inspection service TÜV-Saarland checked the Paypal security system and was satisfied with the results.

Wallet owners do not have to worry about their money ending up in the hands of scammers. The likelihood of this happening is extremely low.

Simplicity

Many people know how to use PayPal. Most users note the ease of working with the service.

You just need to provide your payment details and confirm the transaction by entering a code for the transfer to be completed.

The website contains detailed instructions that allow you to quickly carry out financial transactions.

Convenient payment method

The Paypal service allows you to quickly pay for purchases abroad, on E-bay and in local stores.

Conduct transactions easily from PC and mobile devices. Account owners can exchange funds and transfer money within the system in a matter of seconds.

Additional guarantees of transaction security

As part of the fight against fraudulent schemes and deception of buyers, the PayPal system provides for blocking payment until the buyer confirms receipt of the goods. Only after this the seller gets access to his profit. This may seem overly strict to some, but the reviews available on PayPal confirm that this approach is completely justified. If the buyer does not receive the goods or it does not correspond to the stated description, he has the right to challenge the transaction within 45 days.

Payment limits and withdrawal restrictions in PayPal

There are several nuances that are worth knowing and taking into account when working with your wallet. This payment system has such a thing as a limit on a one-time payment (there is also a monthly limit, but for RuNet users the first option is most often used). For residents of the countries of the former Soviet Union (Ukraine, Belarus, etc.), this same limit on a one-time payment can vary and at a minimum is only $50 (usually more). This is very little even when purchased in a Chinese store.

For Russia, now everything has changed a lot for the better (you can keep rubles in your account and withdraw them to your bank) - the bar has risen to quite large amounts. there is no commission charged for withdrawing money from your PayPal account to the bank :

You can view your current limits in the new interface by scrolling to the bottom of the main page and finding the “Check your account limits” :

For example, in my country (Russia) the amount of a one-time payment cannot exceed 60,000 rubles. This is enough for me, but you can make a reserve for the future and click on the “Increase limits” :

Your account limits and capabilities will depend on how much information you have verified about yourself. Ideally, you need to confirm not only the Email box, but also add and then confirm the card attached to the account. Well, in order to get maximum opportunities, you will also need to confirm your passport details by sending a scan of your passport.

In this regard, Paypal turns out to be a payment system that is far from anonymous, but it significantly increases the security of work. It is precisely because of this that it has become the most popular method of payment for won items on eBay, and at the same time in all major online stores of the bourgeoisie. PayPal is not yet so popular in RuNet, but most likely this is a temporary phenomenon, especially in light of the fact that now you can open your account there in rubles and they can, if necessary, be withdrawn to your account in any Russian bank without additional commission. .

PayPal Buyer Protection

Unlike other EPS, the PayPal wallet helps its users receive compensation if the purchased product turns out to be defective or does not match the description. Having proven that he is right, the buyer receives full compensation for the purchase price.

To do this you need:

- within 180 calendar days from the date of payment, open a dispute through the Problem Resolution Center;

- after opening a dispute, there are 20 days left to convert the dispute into a claim;

- provide documentary evidence of your innocence. In addition to the purchase price, you can also receive shipping compensation. To do this, you need to submit a corresponding request within 14 calendar days after sending the goods to the seller.

The program does not apply to purchases of transport, industrial equipment, or real estate.

FAQ

How do I find my PayPal account number?

Many system users do not understand how to find out their PayPal account number. If you look at your personal page, it cannot be detected.

This is a unique feature of the service. This is due to the fact that the system does not work based on the account number.

To make a transfer you must provide an email address. No need to figure out how to find your PayPal account. To carry out transactions, only email is indicated.

How do I regain access to my PayPal account?

If a user has lost their account password, they will need to answer a security question to recover it.

After this, the system will send a letter containing a link. You need to go through it and change the password to a new one.

If you lose your email, you will have to register a new account.

How to close your PayPal account?

You will first need to transfer money from the account and delete the card. After this, you need to go to the “Account Parameters” tab, select “Delete Account”, indicate the reason.

The EPS may ask additional questions. After answering them, the account will be liquidated.

How do I verify my email address?

It is important for beginners to know how PayPal works. To make payments, you need to confirm your email.

After registering on the service website, an email is sent to you. It contains a link. You need to go through it, after which the account and mail are considered confirmed.

Is it possible to cancel a payment that has already been sent?

Only unclaimed payments are allowed to be cancelled. If the transaction has gone through, you should contact the recipient of the funds and request a refund.

Why is my PayPal payment pending?

This situation occurs when the recipient cancels the transaction. The money is returned to the account after 30 days.

Is it possible to have multiple PayPal accounts?

It is allowed to have Personal and Corporate accounts at the same time. One user should not have 2 identical accounts.

Why does my PayPal account only allow me to send payments?

Restrictions apply for some users. It is recommended to find out about them from technical support before receiving money via PayPal.

How to add, change or delete a card in PayPal?

Before you can top up PayPal from your card, you need to add it. To do this, log into your account and select the “Profile” tab.

To add a card in the “Debit and Credit Cards” tab, click on the “Add” button and enter the number.

To change the plastic or delete it, also go to your Profile. Then click the Update button and select Change or Delete.

After that, unlink the card or change the number.

How to make PayPal more secure?

Before using PayPal, we recommend that you maximize security:

- enable two-step authentication . Each time you log into your account, in addition to entering your password, you will need to enter a code from an SMS message or use a smartphone application that generates a code;

- indicate 2 secret questions , the answers to which are known only to you;

- set the service pin code . This 6-digit number will be used to confirm transactions within the wallet (transfer of funds to another PayPal wallet, withdrawal to a bank card, payment for a purchase in an online store);

- You can revoke granted permissions for suspicious sites . You can also disable the One Touch feature in certain browsers and on certain devices; it allows you to automatically log in when making a purchase in an online store.

Don't forget about phishing; attackers can mass send fake emails from PayPal to email addresses in order to steal login data. Don’t rush to follow the link in the letter, first go through your browser to your personal account and check the notifications in your personal account, check with technical support.

Withdrawing money

In Russia, until recently, it was not possible to withdraw money from the system, so many Internet services appeared that offered this service on a paid basis. The commission for such a transaction is quite high, so when setting up a business on the Internet, this had to be taken into account. At the moment, exchange sites are used by citizens of other CIS countries if there is a need to receive money to their bank account or to another payment system from PayPal. User reviews confirm that the services really work, but the commission is not encouraging.

However, at the moment in Russia it is possible to withdraw money to a bank account without interest or any overpayments. Just select the “Withdraw funds” item in the menu, the system itself will offer your bank account. The only inconvenience is that the operation takes from 5 to 7 business days. A notification will be sent via email.

There's nothing complicated about PayPal - expand your capabilities!

PayPal Features: Limits and Security

The limit of funds that can be used in the PayPal system depends on the level of account verification. If you use an unconfirmed account, the user can spend or accept no more than 15 thousand rubles or the currency equivalent of the specified amount per day. The monthly limit on the movement of funds on the account is 40 thousand rubles. PayPal imposes such restrictions on users for security reasons. How to enjoy more freedom and expand the limit? All you need to do is verify your account.

The system has two types of verification: simplified and complete. After passing the simplified limit, the limit increases to 60 thousand rubles per day and up to 200 thousand per month. Full verification makes it possible to send up to 550 thousand rubles in a one-time payment, this significantly expands the user’s capabilities.

Linking a bank card

Another important step required to start working with the system is linking a bank card to your account. This is done so that you can use the money in your account to pay for various goods and services on the Internet; it is to this card that you can withdraw money from the system.

You need to enter the number, expiration date and code located on the back of the card. After this, the system will begin checking it. It is advisable that it is not a credit card, but a debit card, that is, a payment card. PayPal charges a small amount of money from the card to verify the possibility of contact and transfer of funds. It's usually $1.9 and it's not a service fee. After the cardholder confirms that the withdrawal of money was made with his knowledge and is completely legal, the card is considered confirmed and the funds are returned to the bank account.