Hello. Our review today is of the Meta Trade 4 terminal. This is the main program that every trader has to work with:

- if you trade on the Forex market, then using MetaTrader 4 you will conclude transactions;

- if you are planning to open a binary account, then this program will help you implement the rules of the selected algorithm.

From the article you will learn how to use Meta Trade 4. There is a lot of material, so most of the information will be presented in video format. Watch the suggested lessons, repeat after the authors and be sure to share this article with other users who are learning to make money in the financial markets with you.

MetaTrader 4 terminal - how to start trading

The platform was developed in 2005 by MetaQuotes. The terminal is free. It supports more than 40 languages, so it is used by traders in different countries of the world. The interface is convenient; it has everything you need to make transactions, for automatic trading with the help of advisors.

Although the application was originally developed for Forex, it is suitable for trading metals, indices and other assets. MT4 controls are intuitive.

Installing a program/terminal is the first step to trading

To trade independently on Forex, you first need to choose a broker, then register a personal account and open an account.

After this, the client downloads the trading terminal and installs it. The program is provided by the broker, so the trading platform is available on its website. The developers have created terminals for computers, iPads, iPhones, and devices running Android.

The general installation guide is as follows:

- After downloading the file and unpacking it, the Installation Wizard is activated.

- Select which folder the trading terminal will be installed in. By default, this is drive C, Program files folder. If you need to select another hard drive, click the “Browse” button.

- When the installation location is selected, click “Next”. The installation procedure begins, it is carried out automatically, the trader does not need to do anything.

The process ends with a shortcut appearing on the desktop. By clicking on it, you can open MT4.

Demo account in MT4 - a way to test your strategy

The work begins with the broker's client registering a demo account. It was created so that beginners who have zero knowledge can learn the basics of trading.

Although MetaTrader 4 is best for dummies, they need to gain experience, learn how to open and close trades, use charts, indicators and other tools. The instructions will help them.

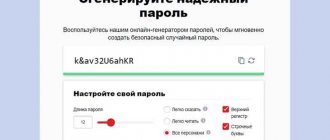

To open an account, click on “File”, and then select “Open Account”. After this, you need to enter your data and decide what the leverage will be. Most often, traders choose 1:100 or 1:500, but there are brokers that provide access to leverage of 1:1000.

When personal information and leverage are indicated, you need to click “OK”. You will receive a login and password for the trader and a password for the investor by email, which only allows you to look at the chart, but does not give access to trading operations on a real account.

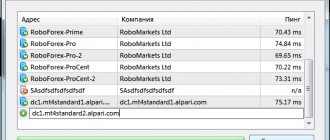

Connection to a real trading account in MetaTrader 4 for those who are already registered with the broker

Traders who have already registered with the broker can connect to a trading account. To do this, they need to select the “File” tab in the terminal menu, and then “Connect to...”. When the window opens, you should enter its number, select a server and specify a password. After this, you can start trading.

Algorithm for opening an order

The process of entering a position should be described separately. There are several ways, the main ones being:

- by clicking the “New Order” button on the toolbar;

- right-click in the price chart field and select “Trade → New order” from the menu.

In this case, the currency pair of the active chart is displayed in the window. You can change the tool by clicking on the arrow next to the symbol. It should be noted that only pairs contained in the Market Watch table are displayed.

Important: In order for the window to contain all the currencies provided by the broker, you need to right-click in the “Market Watch” field and select the line “Show all symbols”.

Next, set the lot size in the “Volume” field, as well as stop loss and take profit. The type of order execution – immediate or pending order, is selected in the corresponding field. Even lower are the current prices at which the transaction will be opened. The final stage is choosing the type of order: sell sell or buy buy, for which there are corresponding red and green buttons.

To avoid requotes (the broker’s refusal to execute at the requested price), due to a volatile market, you can activate the “Use maximum deviation from price” function.

If stop loss and take profit are set, the transaction will be closed using these orders. But it is also possible to manually exit a position at the current price, for which you need to right-click on the order line in the “Terminal” block and select “Close order” in the context menu. Following this, the order window will open, where you will need to click on the yellow order close button, which contains the closing parameters.

Why is there some strange time in MetaTrader 4 - learning the basics of working with the program

Beginners notice that the time indicated in the terminal differs from the local one. The clock in MetaTrader 4 is set to show Eastern European time, it is designated as EET. In summer it coincides with Moscow, and in winter EET is 1 hour less.

Beginners often do not know how to install MetaTrader 4 or how to use it; instructions have been developed for dummies. They must remember that the market is closed on weekends, so it will not be possible to open a new deal, close an old order or make changes to it.

The foreign exchange market opens on Monday at 00:05 EET and closes on Friday at 23:55 EET.

Refill

There are several options you will have to deal with for depositing funds to your broker. Typically, this action involves creating an account on the broker's website. When you create this account, it is connected to your trading account on the MT4 trading platform. Once you deposit funds on the broker's website, the funds will instantly appear in your Metatrader account. So, if you decide to deposit $50,000 into your trading account with a broker, then you will see it on the MetaTrader 4 platform:

Above you can see a screenshot of the Metatrader 4 operations window. All your open orders will be displayed here. In addition, your balance, funds, and free margin will also be displayed, all in real time.

How to trade on the stock exchange - Forex training for dummies

Brokers offer different instruments for trading. Most often, traders trade currencies; the most common pairs include euro/dollar, pound/dollar, Swiss franc/dollar. It is possible to trade oil, indices, and precious metals.

To find out what instruments are available, you need to select “Market Watch” in the terminal.

The trading terminal is designed so that a specialist can add instruments of interest to him by opening new windows. Those people who are interested in binary options trading can use charts to analyze the market situation.

But direct options trading through MT4 is not possible. Instead of this trading platform, clients have access to programs provided by options brokers.

How to trade oil in the MetaTrader 4 terminal - how to make money on black gold

Beginners often wonder whether it is possible to trade oil on Forex. Yes, such an opportunity is available.

Brokers offer 2 brands of oil:

- Brent. It is mined from fields located in the North Sea. In the trading terminal it is designated #BRN.

- Texas Light Sweet. It is mined in the USA and is designated on the market as #CL.

Before trading oil, you need to contact a broker. It is necessary to find out the terms of trade and what brands of raw materials are provided.

Binary options - analyzing the chart in MT 4

Although experts most often use live charts when trading binary options, you can also analyze the market using charts in MT4.

The advantages of this terminal include the following:

- many indicators that make it easy to analyze the situation;

- there are 9 timeframes, between which you can switch by pressing 1 button;

- the ability to use advisors;

- there are alerts that signal that the price has reached the required level;

- several types of charts.

In terms of these indicators, it surpasses the terminal provided by options brokers.

But MetaTrader also has disadvantages, they are the following:

- There are many tools, so it will take time for a beginner to learn how to use them. Quotes depend on the server.

- If the Internet is poor, communication failures may occur, which negatively affects the accuracy of entering the market.

But even so, Meta Trade 4 is best suited for dummies. Even experienced binary options traders study the market situation on MT 4, and receive more detailed data from the terminal provided by the options broker.

Disabling a news block

Many traders complain that the news tab gets in the way and distracts them from their work. As a rule, those who trade without fundamental analysis do not need news in principle. And for those who analyze the news, of course, such information is simply not enough. Therefore, you can safely clear space in our terminal by turning off the news block. This is done very simply. Let's go to the settings of our MT4 - to do this, first open the “Service” tab in the top menu:

Actually, on the very first “Server” tab there is the very checkbox that allows broadcasting news to our MT. Uncheck “allow news” and click “ok”.

MT4: how to use charts (setup)

In MT4 you can open up to 99 charts at the same time. To switch between them, use bookmarks.

You can change the chart parameters, for example, the color of the lines. To do this, select the “Properties” tab in the menu, and then click on “Colors”. On the left side of the window, the trader will see how much the picture will change if he chooses different options for displaying the chart.

In order to separate periods, use the “General” tab. You can scroll through the graphs to view data from previous months, and choose the type of graph that best suits your needs.

Once the trader has configured the chart the way he needs, he can save all the changes made to a separate template. Then it can be downloaded at any time when the need arises.

Grand Capital

The company was the first Forex broker to integrate options trading into standard MetaTrader along with conventional financial instruments. Moreover, Grand Capital also legally “equalized” BO transactions with ordinary ones: the company’s clients can also resolve controversial issues regarding binary deposits through the well-known arbitration company Finacom.

For BO transactions:

- the option premium reaches 86% on average;

- demo account and LAMM accounts available;

- no deposit bonus;

- transaction copying system;

- several types of options: traditional “Higher/Lower”, level breakout, “Double Tap” and express options on three assets, the premium for which can reach 444%;

- American options can be closed ahead of schedule to receive part of the profit or return % of the loss, European options are closed according to the expiration date;

- minimum deposit is $10, minimum trade is $1.

Trade BO with broker GrandCapital

Binary trades are implemented in the form of an automatic script, although the ability to use external advisors is still limited. A full overview of Grand Capital's capabilities can be found here.

Timeframe - what is it?

A time frame is the time period reflected on the chart. Most of the strategies used intraday are developed for the M30 (30 minutes) and H1 (1 hour) intervals.

All timeframes can be divided into the following types:

- Long-term. These are D1 (1 day), W1 (1 week), MN (1 month). They are rarely used in work, but such graphs are studied in order to understand which direction the trend is going.

- Urgent. These are M30, H1, H4. They are used by day traders.

- Short-term: M15, M5, M1. They are used by scalpers who make many small trades throughout the day to make a quick profit. Such timeframes are suitable for experienced traders who quickly analyze the market situation and are able to make decisions instantly.

You can make a profit by trading on any timeframe, but for each strategy you need to choose the most suitable one. For example, when trading intraday, M1-M30 is used. The work is highly intensive, many deals are being opened. This requires concentration from a trader, and not every person can work in this mode.

In medium-term trading, transactions are opened for several hours, less often they remain open for 1-2 days. Trading is carried out at an average pace, so you do not need to constantly sit at the monitor. Specialists work not only with major currency pairs, but also with cross-assets.

Long-term trading is more about investing than trading. After opening a transaction, the specialist sets a stop loss, limiting the loss, and then monitors the market condition 1-2 times a day.

A novice trader needs to determine which format of work suits him. After this, he must decide on the time frame and select assets to work with.

conclusions

The MetaTrader 4 mobile terminal offers wide functionality and many opportunities for both market analysis and opening trading positions. In general, the platform’s features are suitable for remote work in financial markets if you do not have access to a desktop trading terminal. However, when compared with the classic version of MT4, the mobile version is inferior in a number of parameters. First of all, the limited functionality for market analysis, as well as the inability to test and use automated trading advisors. And yet, the main idea of creating a mobile version of the terminal is the ability to have access to trading from anywhere in the world, and it copes with this task perfectly.

Subscribe to our newsletter so you don't miss new articles!

Types of charts

Specialists analyze price movements using charts; they can be of the following types:

- linear;

- bars;

- candles.

A line chart consists of points connected by a line, each of which represents the closing price. You can work with such charts only on small time frames.

The bar chart is suitable for working on time frames M5 and more. The bar is a vertical line, the upper border reflects the maximum price of the asset, and the lower border reflects the minimum price.

If you look at the column, there is a small line to the left of it - this is the opening price. To the right of the column is another bar showing the closing price.

Most traders use candlestick charts in their work. It is built in the same way as the bar one, but is more visual. The candle has the shape of a rectangle, its upper border is at the maximum price, and its lower border is at the minimum price.

Depending on the coloring, you can understand where the quotes are going. If the closing price is higher than the opening price, then the candle is bullish. The value of the asset is rising. If the closing price is lower than the opening price, then the quotes go down and the candle is called bearish.

Placing Toolbars

As I already said, each toolbar on the left edge contains a certain hatched column,

By holding the left mouse button, this toolbar can be moved arbitrarily. I recommend placing all 4 toolbars in one line vertically or horizontally (left or right), as shown in the pictures below. It will be convenient for anyone, based on the diagonal of the monitor.

Indicators - should you trust mathematical programs with your money?

Most trading strategies are based on trend trading, so it is important to determine the direction of price movement.

To make the analysis of the market situation easier, indicators were created. These are special programs that analyze a lot of data, process them and produce results. But there is no need to thoughtlessly trust indicators; a trader must analyze the market on his own, and programs should be used as additional assistants.

The indicators are built into the terminal; you just need to drag them onto the chart and set the parameters for operation. Specialists often use Stochastic. With its help, you can find out whether an asset is oversold or overbought, which indicates the likelihood of a trend reversal.

Traders use moving averages in their work to determine the direction of the trend. Volume indicators, oscillators and other indicators are popular.

Duplicating objects

The next MT4 setting concerns graphical analysis. Namely, duplication of objects. You can duplicate any objects; for example, let’s show you how to build a channel. Let's say we already have one line on the graph:

Click on the line twice with the mouse, then hold down Ctrl on the keyboard and drag the line up. It turns out a complete duplicate of our first line. So we can do the same uplink.

Trading positions for those who trade Forex

Traders trade to make a profit. In order to open trades, they use Buy and Sell orders, and MetaTrader 4 also allows you to open a pending order. For example, if there is a desire to buy an asset at a certain price, the specialist indicates it by setting a deferred price.

When the price reaches this level, the transaction will open automatically, without the need to be at the trading terminal. The level of losses and profits is set in advance.

Professional traders often trade with the help of advisors; these are fully automatic or semi-automatic robots that operate according to a predetermined algorithm. They open and close orders according to the conditions that have been set by the trader. But you shouldn’t rely completely on the advisor; it should be under human control.

Crosshair function

The crosshair feature is a very handy tool. To activate it, you need to press Ctrl + F. After this, below you will be able to see the current time and price in the place where the cursor will be located at the moment. With this tool you can also measure the number of bars and points. To obtain this data, you just need to click the mouse on one point and, without releasing the mouse, drag the line to another point.

InstaForex

BO can be traded through a web application with access to a “live chart” or through regular MetaTrader. The ability to open a trading account from MT4 (or MT5) is realized by installing a special plugin from the official website: “Traders” – “Options trading” - “Download the IFX Option Trade complex”. Don't forget to open access to automatic trading and allow import of functions from DLL.

After installation, you need to restart (update) the terminal. To work with options, simply connect the IFX Option Trade advisor to the chart of the selected asset. After selecting the conditions and purchasing an option, it is displayed in the “Current Options” section, and after execution it is included in the normal “Operation History”.

The company offers intraday or urgent (up to 1 month) BOs on base currency pairs and leading crosses, spot metals and CFDs on shares, the yield (most often fixed) is 80%, in some cases the return reaches 90% of the option cost, it is possible early closure.

The maximum transaction size is $1,000, a demo account and an archive of quotes are available. Contract type – only classic “Above/Below”. The client is required to have a minimum deposit of $1 (euro or ruble equivalent). There is a special Live Feed service - monitoring the necessary information for options trading (purchase/sale data, real results of other service clients, etc.). All technical tools are available for options trading, including automated trading and strategy testing.

World Forex

This broker is different in that for it currency pairs are an additional service, but binary assets are the main one. The company has been working with options since 2008; MetaTrader offers only one type: the classic “Higher/Lower”. The option premium reaches 100%, the return of loss in case of failure is no more than 14%; Early closure is possible with a 40% refund of the investment. In addition to options on major currencies, transactions on cross rates and spot metals are offered.

Eat:

- demo account;

- minimum deposit – $1;

- transaction amount – min $1 and max $300;

- European and American options, Profi options “0-100” with a fixed return of 100%;

- expiration – from 1 minute to 7 days, for Profi options – from 1 hour to 5 days;

- bonuses for replenishing a deposit from $100.

WebTrader and MT4 platforms are offered (mobile versions are available). Pending orders (options with a delay) and trading automation tools are allowed. Despite the information on the official website, in fact its activities are not regulated by any serious organizations.