Hello, dear readers of the KtoNaNovenkogo.ru blog. Today I want to continue filling the Electronic Money section with materials. Before this, I wrote about Qiwi, Yandex Money and WebMoney, which are the most popular payment systems in RuNet. But not RuNet alone... In the world now the most popular system is Paypal, that’s what I want to talk about in this article.

True, for users from the countries of the former Soviet Union, which form the bulk of today’s RuNet (Ukraine, Belarus and other countries except Russia and the Baltic countries), Paypal does not provide the maximum range of functions, but, as a rule, they are enough for almost everyone. More democratic in this regard is the international monetary system Moneybookers (moneybookers). And Payeer or PerfectMoney look completely unprincipled.

For Russia, since 2011, it has become possible to top up your PayPal account from a linked bank card, and since September 2013, it has become possible to use such currency as rubles for transactions, as well as withdraw funds earned or received as a result of a transfer to your account in a Russian bank ( no commission).

What has been talked about for so long has happened - PayPal has finally come to Russia . Now, little by little, the assortment of Runet online stores will include the ability to pay for goods with this electronic currency, and the Ebay online auction will add more sellers from Russia, who previously could only withdraw their earnings to US banks in dollars, but now have the opportunity to operate in rubles.

Registration instructions:

You can ask questions about how to register with PayPal on our forum.

Go to PayPal.com. Your country of residence and, accordingly, the interface language should be determined automatically.

Screenshot from PayPal.com

Whether PayPal has identified the country correctly or not can be determined by the flag icon that is usually displayed in the lower right corner of the screen. Depending on the device on which you open the site (smartphone, tablet), the location of the flag on the screen may change.

The Russian language is automatically installed only for PayPal Russia (residents of the Russian Federation). For Ukraine, Kazakhstan, and the Republic of Belarus, the default language is English, and registration with PayPal must also be carried out in it.

If PayPal has determined the country incorrectly or you just want to change the interface language, just click on the checkbox, open the list of countries and select the appropriate one.

The choice of language does not affect further registration; the country of residence will be selected separately during further registration.

Then, on PayPal.com, in the upper right corner, click the “Sign Up” button.

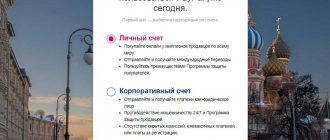

On the next page you need to select the type of account you want to create. There are two types to choose from:

- Personal account – for individuals (individuals)

- Corporate – for a company (legal entities)

By selecting your account type and clicking “Continue,” you will be taken to a page where you will be asked to:

Answer the question: “Which country should I indicate when registering?” very simple. Indicate the country whose passport you can present if verification is required. If PayPal is closed in your country or there is no registration option at all, remember: the company takes any data falsification extremely seriously, and can easily identify such accounts and freeze them (along with associated accounts). And, as a rule, together with funds on the balance sheet, which will then be almost impossible to withdraw. The owners of these accounts are prohibited from opening new ones - they will also be closed sooner or later.

The issue of choosing the country of registration is very important, which is why we paid so much attention to it. Our advice: if you are opening a PayPal account and your business model involves receiving funds from customers, but this is not possible in your country, remember that there are other completely legal methods of receiving. The most famous is, of course, the American company 2CO.com, which provides a comprehensive payment solution, incl. and accepting PayPal. Thousands of immigrants from the countries of the former Soviet Union have been cooperating with her for many years.

- Select your country of residence . Take this very seriously! We repeat: according to PayPal rules, a user can only have one account . There is no option to change the country in your account, and if you move/change citizenship, the support service recommends applying to close your previous account and opening a new one - this will take 6-12 months. The fact is that for different countries PayPal provides a different set of services, different tariffs, etc.

- Enter your email address (e-mail).

We have already given our recommendations for choosing it above. If you do not currently have an address, please register one first. Don't use someone else's address. The email address will be your Paypal account ID, i.e. If someone asks for account details to transfer funds, it will be enough to provide an email. Therefore, for convenience, it should be easy to read and, preferably, memorable. A sign of good manners: a short, memorable address. Subsequently, the email can be changed. - Password and its confirmation . Minimum eight characters. At least one number and one symbol are required.

Methods for withdrawing money from a Paypal account for Russia

The ability to withdraw money to accounts in Russian banks and store funds in ruble equivalent appeared in PayPal only in September 2013. Personally, I learned about this in a rather roundabout way. I came across a topic on Sercha (this is one of the most popular SEO forums on the Runet) that WebMoney has an official opportunity to exchange sticks on their own exchange.

I have already written in some detail about exchanging WebMoney through the Exchanger exchange and, what is noteworthy, I still use this method, because it turns out to be quite profitable. But that's not the point. Another thing is that they have a new section where you can change PayPal to WebMoney and vice versa. It's called Paypal.exchanger.ru .

The principle of operation on this exchange exchange remains the same as the one where different WebMoney currencies are exchanged among themselves (read more about this at the link given just above). In order to make an exchange, I had to link my PayPal account to my account (for which I logged in).

A few years ago, I was very surprised when, having gone and logged in to the official Paypal website, instead of almost four hundred dollars that I needed to change, I saw the amount in rubles, which can be seen in the screenshots given in this article. This screenshot was taken a long time ago, when the service interface had a different look:

It turns out that my Paypal dollars were converted into rubles without my knowledge and, what’s nice, they didn’t charge any interest. After that, I went to their help to read about the possibilities of withdrawing these rubles in real life and found out that you can easily transfer them to your current account as an individual entrepreneur and, again, no commission will be charged. Well, in general everything is chocolate.

Alternatively, you can withdraw money from Pai Pal to the account of any bank card that you probably have. find out the details of the account linked to the card (its number and BIC) either by calling the bank or through online banking, if you have one connected.

All that remains is to go to the “Account” tab and click on the “Withdraw Funds” (the exact same button is available on the main page of the service called “Review”).

If you have not yet added a bank account to your account, now is the time to do so (by clicking on the corresponding button on the “Account” tab from the top menu):

Next, you will be asked to check the entered details, and after clicking on the “Continue” button, you will be informed that the account in a Russian bank needs to be verified . The process of this action is quite simple and is described in the screenshot below.

When the transfers arrive, all you have to do is log in through Internet banking and look at the specific transfer numbers. You will need to enter them on the same “Account” tab.

Actually, all that remains is to enter them:

Personal information of the owner of the PayPal account

The form is quite simple and there should be no problems filling it out. You need to enter information for PayPal in Russia in Russian, entering data in strict accordance with your passport (passport of a citizen of the Russian Federation).

For residents of other countries, the best option is to enter data in Latin letters (in English), if possible focusing on the international passport. The only advice that can be given is: if you already have an account on ebay auction, try to ensure that the registration data on PayPal and ebay match (e-mail, address, spelling of first and last name, etc.).

Enter information carefully. Please note that all items are required to be completed. As an example, we entered abstract data into the questionnaire.

Name – Your Name (For example Andrey)

Patronymic – Your Patronymic (For example Petrovich)

Last Name – Your Last Name (For example, Ivanov)

Please note that the form contains the first name first, then the last name and only lastly the middle name.

Date of Birth – Select your date of birth that matches your passport.

Nationality – select your nationality. Or simply leave the previously selected country.

For Russians, registering with PayPal requires entering the number and series of a civil passport. Enter the number and series in a row, without spaces.

Also, only Russians are required to enter the details of one of three documents to choose from when registering.

- Insurance number of an individual personal account (SNILS) - the number that you will find on the insurance certificate of state pension insurance.

- TIN is a taxpayer identification number, a digital code that is assigned to all taxpayers in the Russian Federation. The TIN of an individual consists of 12 digits; it can be found in the certificate of registration with the territorial body of the Federal Tax Service of Russia.

- Compulsory medical insurance – compulsory health insurance policy number.

Street / House / Apartment (Street Address) - enter the address that you can confirm. If PayPal has any doubts about the user, he is asked to provide copies of documents containing his first name, last name and address (for example, utility bills) to confirm his address. An additional line in the form is given if the address does not fit in the first one. This address has nothing to do with the delivery address of purchases.

Region, district (Province / Region) – Specify the requested data. For Russia you can simply enter RU, for Ukraine - UA, for Kazakhstan - KZ, for Lithuania - LT, etc.

Postal Code – postal code (optional).

City – your locality (city).

Mobile phone number (mobile) . Please enter your mobile phone number carefully, as... it will be used when creating your account. The number is entered in the format: international country code, city code, telephone number (Russia code - 7, Ukraine code - 38). If the number is not accepted, you probably put an extra character somewhere, try writing it down without spaces.

Replenishment in Euroset and Svyaznoy salons

The Euroset and Svyaznoy stores provide services for replenishing your PayPal account. And here the operators working in the salons come to the rescue. Of course, if you wish, you can find all the necessary information on the websites of the companies svyaznoy.ru and euroset.ru. The one-time replenishment limit is a maximum of 15,000 rubles. The user can deposit no more than 40,000 rubles into the account per month. You can only top up your ruble wallet. This service has nothing to do with corporate accounts.

User Agreement and Privacy Policy

Please accept PayPal's Terms of Use and Privacy Policy below. You can read it, but these are standard legal documents that are not very easy to read. Just check the box and click the “Agree and create account” button.

Payment card

Now you will be asked to enter the details of the payment card that will be used when working with PayPal. You can do this later and skip this registration step - just close the window and log into your PayPal.com account. All subsequent actions can be performed there.

If there are no funds on your card (at least the equivalent of several US dollars), then you should postpone entering its details, because... the system will not be able to authorize the card, during which the amount of $1 is blocked for some time and then returned. For residents of the Russian Federation who can accept payments to their PayPal accounts, this amount will be immediately added to their balance.

Credit card number – enter the number indicated on the front side of your payment card. Without spaces.

The expiration date is the so- called “Expiration Date” – card expiration date. Month and year. Indicated on the title side of the card.

Security code is a verification code (also called CVC, CVV2). These are the last 3 digits on the back of the card (4 digits for American Express cards). If there is no number on the card, you need to call the bank that issued your card to find out.

If Paypal does not accept your payment card, do not rush to get upset. First of all, you need to figure out why the card was rejected: there can be many reasons for this. Our article will help you, in which we briefly tried to analyze the most likely options.

Pay for online purchases via PayPal

So, you have created your e-wallet, and now you are wondering how to pay for your purchase via PayPal. Well, firstly, it is necessary that the online store where you intend to pay in this way accepts this payment method. There are several ways to find out. For example, the PayPal icon may be in the footer, that is, at the bottom of the site. Or information about this is contained in the “Payment Methods” section. Sometimes you can find out how to transfer money only after the item has been added to your cart.

PayPal payment instructions will be approximately the same for most online stores. For this:

- On the page of the selected product, click on the “Buy” or “Add to Cart” button.

- Open the cart and click on the “Pay” link.

- PayPal is the preferred payment method.

- Log in to your e-wallet account.

- Make a purchase.

But the websites of different stores may have their own special ordering and payment procedures for goods. Let's look at an example of how to pay for a purchase on eBay via PayPal. Buying from an American online auction is not as difficult as it might seem. For this:

- On the product page, click the “Buy” button.

- Select payment method – PayPal.

- Fill out the fields of the order form.

- Log in to the wallet.

- Confirm payment.

An important nuance: to purchase at this online auction, you must register and attach a wallet to your account. The instructions on how to link PayPal to eBay are simple. For this:

- Open the “Account settings” settings on the American website.

- Here you go to the “PayPal Account” section.

- On the page that opens, click on the “Link My PayPal Account” link.

When making a purchase, you are likely to encounter a phenomenon called PayPal error 601. What is this overlay and how to fix it? She talks about incorrect bank details. You will have to verify the specified name and other personal data. But there may be other reasons:

- payment from someone else's computer;

- payment from another country;

- outdated browser.

Other troubles also happen. For example, the buyer never received his goods. Or the item turned out to be defective. Then you will need to figure out how to return money via PayPal. The peculiarity of this payment system is that it is possible to reimburse your funds. And they do this through a dispute or a claim.

Let's look at how to open a dispute on PayPal. To do this, you need to contact the Problem Resolution Center through your wallet. From here they send a message in which they describe their situation in detail. It must be accompanied by an operation code.

By the way, the ability to open such disputes was one of the reasons why the Chinese online hypermarket AliExpress no longer accepts money through the American payment system. Therefore, if you are looking for a way to pay PayPal on AliExpress, do not waste your time. You will have to transfer money another way.

But there are other sites where you can pay with PayPal. And these are not only Chinese sites, but also Russian online stores. In Russia, clothes, electronics, books and much more are bought this way.

Verification of e-mail address

If the card was successfully authorized, you decide to enter it later, or even if it was rejected, the system will still ask you to complete the next step: confirm the e-mail address that was specified in the registration form.

Check your inbox in the email address you specified during registration. If there is an email from PayPal with the subject “Welcome to PayPal”, find the “Activate” button in it and click it.

You will be taken to the PayPal website, where you will also need to enter the password you selected during registration for confirmation. Immediately you will be asked to come up with two security questions, the answer to which you will need to enter if you ever forget your password.

If the link in the letter does not work, then log into your PayPal account and in the “Task List” tab, select “Confirm email address”.

Then on the next page in “Step 2”, select “Click this link if this button is in the body of the email” and enter the confirmation number from the email you received.

If you have not received any emails from PayPal, then you can send yourself a letter with a verification code again. To do this, click on the link “request a new confirmation number” at the bottom of the same page.

Learn how to accept payments to your PayPal address

For those who don’t know how to get money on PayPal, let’s reveal a little secret. Money is automatically credited to the user's account when someone sends it to him. You just need to give the payer your ID, that is, your email address.

There is another way to accept payment on PayPal. When you are waiting for a transfer and it still doesn’t arrive, there is a special option that allows you to remind the payer of his obligations. To do this, open the “Money Transfers” section. And here they switch from the “Submit” form to the “Request” page. And enter the PayPal address of your debtor. And he, in turn, will receive a notification.

The only difficulty that the owner of the wallet may encounter is the limitation on limits. When the transfer amount exceeds the established limit, the payment will not be credited to the account. Then you need to verify your account to remove this obstacle.

But that's not all. To receive money from other users, the payment system has launched a service such as PayPal.me. What is this service and how to use it? With its help, anyone can create a payment link. By clicking on it, the payer will immediately be taken to the payment page. Here you enter the amount and indicate the transfer currency. And then they confirm the payment in their wallet.

Card verification

Now, to fully work with PayPal, you need to verify your payment card. This is an additional security measure that will confirm that you are the owner of the card you are using. By going through this procedure, you will also raise the limits (trade limits) of your PayPal account.

The card verification process is quite simple. Its essence is as follows: $1.95 is withdrawn from your card (this money is subsequently returned either to the card or to the balance), then in the statement of card transactions, in the details of this payment, you find a 4-digit code (payment payment details will look like approximately like this: “1234PayPal – *EXPUSE” (options are possible), the first 4 digits are your code), which must be entered on the PayPal website. You can find out this code through online banking, calling the bank's support service, or by receiving a statement of card transactions. This issue is covered in more detail in the article: PayPal. Account verification.

According to reviews from many users: it is advisable to verify the card immediately after registering an account, because Before the card is verified, there are quite strict limits on the amount of one-time payment sent. Card verification, as a rule, does not cause any particular difficulties for anyone.

Adding a bank account

After adding your card details, you will need to add your bank account details to your PayPal account (each card has its own bank account details).

It is checked in the same way - a certain amount is debited from the account, which will be noted in the next bank statement. With this data you can then confirm your details in your PayPal account.

We will then need the bank account information to withdraw money from the account - it will just go to the bank account.

Helpful information

- If you live in one of the CIS countries (except for the Russian Federation and the Baltic countries), then after registering with PayPal your balance will be zero. Don't worry - there's nothing wrong with that, that's how it should be. Funds will be withdrawn from your bank card as needed. When returning, the funds are returned directly to the card.

- Residents of the Russian Federation and the Baltic countries are allowed to accept payments. The funds withdrawn from the card during registration and verification will be immediately credited to their account balance. In order to send a payment, they do not need to replenish the balance - funds can be withdrawn both from the account and directly from the payment card. For example, if there is a certain amount on your balance, but you need to pay more, then the missing funds will be charged from the card.

- In Ukraine and Kazakhstan, you cannot accept payments via PayPal, as well as withdraw funds from PayPal to a bank account.

- After linking the card, no matter what currency it is in, be sure to immediately change the conversion center, setting the default center not to Paypal, but to your bank. Otherwise, there will be extra expenses.

- Don't experiment with PayPal by introducing other people's cards, different bank accounts, etc. Don't draw attention to yourself. Otherwise, you risk being audited.

- Do not give your PayPal account login and password to third parties. Do not participate in dubious transactions or accept dubious offers where you are asked to pay for something, promising huge commissions.

- If you log into your PayPal account from different countries (calculated by IP address) or there are simply a large number of logins from different computers, it is possible that the security service may suspect that unauthorized persons have accessed your account. Such an account risks being blocked, and you may be asked to send copies of documents.

- Very often, scammers send fake emails online that look like real letters from ebay, PayPal, City Bank, etc. These letters vary in content, but ultimately require one thing from the user: follow the link in the letter and enter your login and password. As you probably guessed, this whole scheme is designed to trick you into giving you your username and password. By following the link, you will be taken to a fake website (usually just a couple of pages) of the company on behalf of which the letter was sent, where you are asked to log in. If you fall for this scam and provide personal information to scammers, you can get into serious trouble. There is only one way out: do not believe everything that comes to you by e-mail, no matter how plausible it may look. Check links carefully. Enter your username and password only on the authorization page, which you reached by typing the address yourself, or using a link from your browser bookmarks. And remember: if we are talking about a real payment system, then it will never require your login and password by e-mail. If you receive such a letter, it means that it was sent by scammers.

- Do not use “instant” (or prepaid/gift) payment cards that can be purchased online. Such cards, as a rule, do not have the owner’s first and last name (any name can be specified), as well as a plastic carrier - they simply send you a number and expiration date. The cost of using such a card in PayPal can be high - your account will be blocked once and for all. Remember: only a bank can issue a credit (or debit) card after carefully checking your personal data.

- When returning funds (full refund through “Dispute” or partial refund), the money does not appear on the card immediately. Usually your bank (and the timing depends only on it) keeps them in a “frozen” state for another 3-20 days.

How to use PayPal in different countries

It should be immediately warned that, despite its international status, the PayPal e-wallet has a different set of functions in different countries. How the PayPal payment system works:

- For some countries, only the option of transferring money from a card is open without the possibility of receiving and storing funds;

- in other countries you can keep funds in your account and also use them for online purchases;

- still others allow you to both accept payments and withdraw funds to a card or bank account.

In particular, in Russia, the full functionality of the payment system is open to Internet users. And PayPal in Crimea is completely blocked. Since 2015, the payment system has stopped serving users living on the peninsula. And in order to continue paying through your account, you have to use various tricks and tricks.

PayPal in Ukraine only allows you to send money from your card. Registration is possible, but receiving funds into your account, much less withdrawing them, is prohibited. Some manage to get around these conditions. And they open electronic wallets using the details of neighboring countries.

Those who decide to open a PayPal account in Belarus will also face similar restrictions. It is also necessary to keep in mind that not every bank card issued in the Republic will work with PayPal. Therefore, you should first familiarize yourself with the list of banks that issue suitable credit cards.

However, not all countries of the post-Soviet space are forced to put up with such restrictions. For example, PayPal in Kazakhstan - wallet registration and monetary transactions - work in any direction. Here you can freely transfer funds from one account to another, and also easily withdraw the contents of your account to a card.