When engaging in various activities on the Internet, for example, earning electronic money, running your own business or making online purchases, you will certainly need an electronic wallet in one of the payment systems. Today there are quite a lot of them and each payment system has its own characteristics, so beginners often ask themselves: what is the best web wallet to create?

I decided to help you with this issue and tell you about the best electronic wallets of payment systems that are popular in Russia, Ukraine, Belarus, LDPR and beyond. We will consider in detail their features, advantages and disadvantages in use, as well as nuances during creation.

Well, I’ll start this article with information regarding electronic money. They are the basis of all mutual settlements in any electronic payment system (EPS). Therefore, it is important to understand what they are, what value they carry, in what form they exist and how they are exchanged for real money.

What is electronic money, where is it stored and how can it be used?

In simple terms, electronic money is the digital cash that we use in the real world. Despite the fact that they exist in electronic form and only on the Internet, these funds are completely equivalent to real currency.

That is, 1 electronic ruble = 1 real Russian ruble. Other currencies of the world have the same 1 to 1 ratio - dollars, euros, hryvnias, and so on.

Electronic money is stored in electronic wallets (e-wallets), which in turn exist in various payment systems. Moreover, the system that issues electronic money fully guarantees its provision with real money.

And most importantly, electronic money issued by one or another payment service is recognized not only within this service, but also by external counterparties. For example, with electronic money you can buy real goods in an online store, pay for services, fines, Internet, mobile communications and much more.

In addition, you can directly link a bank card to the best payment services and withdraw electronic money to it. Thus, these digital funds are easily exchanged for a paper equivalent. You just need to go to an ATM and withdraw cash.

Some electronic payment systems, in addition to having an electronic wallet, offer a virtual card. It can be linked to a mobile device and paid in real stores using contactless payment.

To start using one or another electronic wallet of the payment system, you need to go through the registration process. It is quite simple, but it has its own nuances. I will talk about this in more detail later.

Withdrawal of virtual money in Ukraine, how to do it?

The withdrawal system itself is very simple. When withdrawing money, the user receives slightly less real money than he had virtual.

Here are brief instructions for withdrawing virtual money:

- Attach your payment card to the virtual wallet;

- Scan or photograph your passport and TIN for subsequent authorization.

- Requesting the user's personal documents is a very important step. Here a person must provide a high-quality scan or photo of his documents, because if they are not of the required quality, the service administration may refuse a potential user.

- Receive confirmation from the system (usually in the form of SMS or email) and further withdrawal of the necessary funds.

Features of registering/creating an electronic wallet in 2021

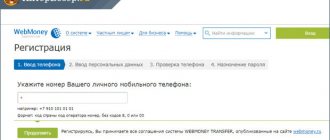

Creating an electronic wallet is a fairly quick and completely free process. As a rule, to get started you need to specify:

- valid email address;

- real personal data – full name, date of birth;

- valid telephone number;

- come up with a password to log into your wallet.

After this, you are given, so to speak, a basic version of an electronic wallet with limited capabilities and limits. As a rule, you can only accept funds and make payments within the country.

To remove all restrictions and increase limits, you will need to go through a mandatory identity verification process. You must upload scanned copies of your documents to your payment system profile. When moderators check the data for compliance, your wallet becomes verified and receives a full range of capabilities.

There is no need to be afraid to upload scans of your documents. Payment systems store them securely on their servers in encrypted form and do not transfer them to third parties.

As for security, storing electronic money in a web wallet is extremely safe. You set your profile protection yourself in the payment system settings; in particular, you can use two-factor authentication.

We figured out the registration procedure. But now the most important question is - which electronic wallet is better to choose and open in the CIS countries? This is what we will look into further.

Who can use an online wallet?

The list of potential web wallet users is quite large:

- Customers who make purchases online;

- For those who work remotely;

- Entrepreneurs, those who do business online and make a profit through websites, blogs and social networks;

- Advertisers and SMM managers who place advertisements online;

- Users who make bookmaker bets or those who play on various paid servers.

In other words, an online wallet is suitable for almost all users.

Advantages and disadvantages of electronic payment systems (EPS)

The use of electronic payment systems and web wallets has both a number of positive and negative aspects. Be sure to read them before starting work to be as knowledgeable as possible on this issue.

Pros:

- e-wallets are incredibly convenient to use - using a computer or even a mobile device, you can make various payments without even leaving your own home;

- payments in electronic wallets occur very quickly - as a rule, transferring money to other users and paying for purchases is instantaneous, and withdrawals to bank cards take 10-15 minutes;

- EPS are extremely easy to use and have an intuitive interface - this allows even beginners to actively use electronic money;

- electronic wallets provide extensive functionality - with their help you can pay for all kinds of goods and services, taxes, fines, loans, credits and much more;

- electronic money can be sent to a person in another country with a minimum commission;

- EPS are reliable and safe - it is almost impossible to lose your money from your wallet. Most electronic money thefts occur due to the stupidity of the users themselves;

- electronic wallets are free to use;

- payment systems save the entire history of transactions, so you can find out your level of income and expenses at any time;

- electronic money does not expire and does not wear out;

- When making payments online, you can remain anonymous;

- For residents of the LPR and DPR, electronic wallets are almost the only way to make online payments without traveling to the Russian Federation or Ukraine to receive a bank card.

Minuses:

- access to your electronic money can only be obtained via the Internet;

- not all stores and companies accept electronic money;

- almost all monetary transactions, even within the payment system, are subject to commission;

- If you lose your personal data to log into your wallet, it will take time to restore it through the support service;

- To fully use electronic wallets, identity verification is required.

In my opinion, the shortcomings of payment systems are completely insignificant. Moreover, considering the cool work opportunities they provide.

Types of electronic gamans

E-gamans are classified into one type according to several parameters:

- Options for replenishment: through a payment terminal, ATM, using an additional special prepayment card, from a mobile phone balance, from a bank card, and so on.

- Commission fee for financial transactions.

- We are committed to the security of data and transfers.

- Currency support: transactions are carried out only with national groschen, transactions with various currencies.

- Services provided by the payment system and its partners: auto payments, currency exchange, virtual card issuance, cashback and similar offers.

- User-friendliness of the interface.

- Service support from customer service providers and up-to-date software updates.

In other parameters, this is a combination of forward points.

What kind of electronic gaman is more beautiful than vibrati?

The skin electronic gamut has its own merits; in the minds of fierce competition for financial flows there are two new products.

Who will have enough mobile electronic pennies to pay for basic services, but who wants more functionality: choosing to keep track of the requirements that a specific person needs.

It is often necessary to get a few Hamants:

- pay for services and transfer virtual money from cards with a minimal commission in your country;

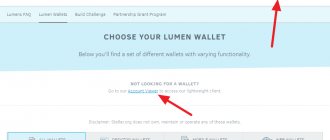

- buy goods on foreign trading platforms, such as AliExpress, Amazon, E-Bay and others;

- invest in cryptocurrency or high-value metals;

- deduct penny transfers as payment for work from foreign agents;

- save money.

For example, WebMoney can block Gamanets for participating in HYIP projects under the Perfect Money or Payeer admin.

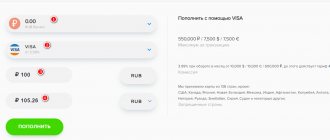

Qiwi and AdvCash do not charge a commission for transfers between their merchants, and transferring money to the card is easy with Perfect Money (from 2%) or Payeer (1.99%).

It is important for Varto to get to know the minds of these services, the services provided and the currency of the Gamanians. Only in this way will you be able to make the optimal choice that will satisfy all the needs of the customer.

How to withdraw money from electronic money

You can deposit virtual currency in the following ways:

- Through a bank or payment card.

- In penny or by postal transfer to your name.

- Through dealers, who transfer electronic pennies from the preparation, earning money on hundreds.

For transferring money to the card, a commission fee is incurred, which can vary greatly among different payment systems. At the same time, transfers in the middle of the system may be without a commission, and the dealer will pay less than the amount shown on the card.

The choice of electronic devices can complement the folding ones due to their diversity. We suspect that the article turned out to be useful and could ease the searches of certain services.

Rating of the best Hamants

Since 2016, Ukraine has limited access to several popular electronic devices on the territory of the country. Prote, many will continue to swear by the use of an additional VPN, which is not entirely legal.

On the right is that companies from protected payment systems operate on the international market and introduce manual tools, which are important to find a suitable alternative.

Therefore, those systems that won the trust of investors and achieved the greatest popularity were included in the rating of electronic gamblers.

WebMoney

The leader in electronic services for a number of reasons. It is clear to them:

- It is possible to create a number of gamans, linking them to the required currency, including cryptocurrencies and precious metals.

- There are no options for replenishing hamantz and breeding fruits.

- High level of security and constant thoroughness.

- There are a large number of manual services.

- Small commission for transactions carried out in the system, only 0.8%

- Possibility of lending in the middle of the system if a significant level of business certificate is evident. You can take out a loan, or you can get into the business of getting loans yourself, earning $100.

- The project's popularity is over 40 million registrations.

- Since November 17, 2015, WebMoney has been officially operating in the UK and Europe.

- You can link other payment systems to WebMoney: Qiwi, EasyPay or Yandex.Money.

The National Bank of Ukraine has closed the registration of WebMoney, through which it is no longer possible to pay for utility bills, upgrade your mobile phone, and it is now difficult to withdraw money to your card.

Qiwi

Since 2012, Qiwi and the international payment system Visa have become strategic partners. Then, in addition to the secure virtual one, it became possible to swipe a physical debit card. The service currently offers three types of cards:

- standard QIWI payWave: three days, no-cost service, no commission charged for transferring cards from another bank, unless the amount is increased by 2000 rubles. more;

- QIWI payWave+: with the same brains as the first card. The only difference is that there are 5 rocks;

- QIWI Priority: entry into the same add-on. A customer who has signed up for Priority will receive greater restrictions on cooking, premium service and cost-free SMS notifications.

These cards can be used for offline purchases, and they can also be linked to Apple Pay.

As a result of the commission, Qiwi promotes the most efficient means for preparing large sums of money and transfers in the middle of the system. For these service operations you will be charged 2% (+50 rubles) and 0% automatically.

In Ukraine, the payment system is subject to sanctions.

YuMoney (formerly Yandex.Groshi)

YuMoney is paid for its simple functionality, the ability to pay for various services online. The service also offers cashback, affiliate discounts and special offers.

Gamanets allows you to issue both a virtual and a plastic card for purchases in stores, food purchases, auto payments and other operations.

The YuMoney payment system is blocked in Ukraine.

EasyPay

There are a number of ways to pay for goods or services at a minimum by using EasyPay.

- Visa or MasterCard plastic card. To do this, enter the card number, terms and conditions and CVV code.

- Cooking in terminals, of which there are already more than ten thousand in Ukraine. When filling out orders in an online store, customers can enable the “Deposit Payment” function. The confirmation code will be sent via SMS and will need to be entered into the terminal and the purchase will be paid for.

- Electronic pennies from the virtual account.

- From a mobile phone for subscribers of the Kyivstar operator.

All operations can be carried out from the EasyPay website or mobile app, available for iOS and Android. Most popular services can be paid for without a commission by linking a virtual or special EasyPay card from Forward Bank to Gaman.

You can create a number of electronic cards in the system, saving different bank cards. Let us also point out some advantages:

- regular payments;

- setting up templates, so that different amounts are required for the same details;

- cashback 1% on the value of card purchases;

- earning points for the loyalty program, which can be used to pay for services or deduct discounts from program partners.

The payment service has been operating since 2007 with the largest number of terminals in Ukraine.

SharPay and Smart Money

Electronic money from mobile operators Vodafone and Kyivstar.

SharPay is a mobile add-on of the Vodafone operator, which must be installed in order to use your mobile phone account. Tsikavo, you can get hired as a servant for any mobile operator.

Kyivstar provides the service to prepaid subscribers.

What services are available:

- Transfer of funds to the bank card.

- Payment for utilities and other services online.

- Applying for a loan.

- Shopping in online stores.

- Transfer of funds to other merchants.

Here you can repay a loan, pay a fine, use the Internet, buy a ticket - manually and quickly.

LeoWallet (unavailable for a while)

Since today 2022, Gamanets has slowed down the work. On the service’s website, the reason is that the customer identification system is not ready. As of 2022, LeoWallet is still inactive.

The internet boom in smartphones, which is rapidly developing around 2022. New functions are added, capabilities become wider, problems are quickly corrected.

You can renew your account in the terminal, from your mobile phone or bank card.

Simple registration - all you need is a phone number. Great amount of cashback - up to 25%, commission for withdrawal to the main account is not deducted. In general, most operations in Gamanets are carried out without a commission, and the bank will charge 3% for withdrawing funds onto the card.

The limit on the balance of pennies per rakhanka is 14,000 hryvnia per month, and the river turnover of hamants per river is no more than 62,000 hryvnia. These are the norms “Regulations on electronic money in Ukraine”.

Global Money

Payment system as it has been operating in Ukraine since 2009. To register, please contact us via email and phone number.

98% of over a thousand available services can be paid for without a fee. Global Money offers convenient transfers between cards of Ukrainian banks - commission 0.5% + 5 UAH.

Gamanets has a high security level, which corresponds to the international PCI DSS standard. This makes it possible to receive reports from all over the world.

After the release of the Global 24 mobile app, the popularity of the platform has grown significantly.

The list of Hamarians generally has one shortcoming: it is possible to pay for goods and services only in the middle of the country, and for international payments the following options are used.

PayPal

In Ukraine, the service is available, but it operates with exchange rates, and the hryvnia is not in the list of currencies.

You can only earn money through PayPal: pay for purchases in foreign online stores or transfer money to other merchants using PayPal. In Ukraine, such a send only system operates in 90+ countries around the world.

In the beginning of 2022, the Ministry of Digital Transformation announced that it will change the plans for PayPal to fully enter the Ukrainian market. The payment service itself has not yet announced that it plans to secure Ukraine from its business expansion plans.

Payeer

A handy platform for freelancers who work with foreign money makers. Transfers are available in 127 countries around the world through dozens of different methods.

Payeer encourages the anonymity of contributors: you only need the email address to which you will receive the sheet with further instructions.

The system allows you to replenish your balance and enter cash on VISA, MasterCard, Maestro/Cirrus, MIR cards with a commission of 1.99%. The owner is not required to register with Payeer; the system will automatically create an account and register a large selection of virtual currency.

Є internal cryptocurrency exchange.

You can issue a plastic card and transfer money into cash at Ukrainian ATMs.

AdvCash

International, multicurrency exchanger with internal exchanger – euro, dollar, hryvnia, ruble, cryptocurrency is also present. Allows you to carry out transfers in over 20 countries around the world.

Registration is not important: you just need to enter your email address. The interface is also simple and intuitive. Accounts can be set up independently for the protection of their funds, immediately after registering the account.

With technical advice, you can drink Russian milk, which is a great plus for the rich.

Transactions throughout the system in any currency are costless. If you want to repay the Gamanets with a hryvnia or ruble card - a commission of 2.5%. There is also a commission for the withdrawal of funds. For example, in order to transfer money from a bank account to a Ukrainian bank card, you will have to pay 2.5%.

The service has its own virtual and plastic cards.

Perfect Money

A single platform that pays hundreds of pennies per month for the cost of koristuvach - 4% of the river.

The system will not require mandatory confirmation of specialness. You can contribute anonymously, but as far as possible, the service will only provide assistance to those who have passed the verification process. For example, after verification, you can withdraw lower commissions, and it is also easier to restore access to your account if you immediately forget your login or password.

Perfect Money offers the option to save assets from cryptocurrency, you can get more right here by renewing the Perfect Money V.