The Fisher formula is named after Irving Fisher, an American economist who is known for his significant contributions to the theory of money. According to this formula, the initial interest rate and the price of any product (or service) must be adjusted through the degree of inflation. The formula makes it possible to estimate real investment profit.

In accordance with the theory of money, developed back in the 18th century in France, the value of monetary units is inversely dependent on their quantity. In other words, the more money is involved in circulation, the less its value becomes.

A little later, already in the 20th century, the theory of money received its final mathematical justification with the help of the equation of exchange, better known in the world of finance as the “Fisher equation.” The monetary circulation formula received its name in honor of its founder, the American economist Irving Fisher.

The Fisher formula determines the value of the complex annual interest rate, which ensures the real efficiency of a credit operation at a known annual inflation rate. This formula essentially shows the amount, called the inflation premium, that must be added to the original rate of return to compensate for inflation losses. At low inflation rates and low interest rates (this situation is typical for countries with developed market economies), an approximate version of the Fisher formula is also used.

Quantity theory of money

The quantity theory of money is an economic theory that studies the effects of money on the economic system. In accordance with the model put forward by Irving Fisher, the state must regulate the volume of money supply in the economy in order to avoid its shortage or excessive quantity.

According to this theory, the phenomenon of inflation occurs due to non-compliance with these principles. An insufficient or excessive amount of money supply in circulation entails an increase in the rate of inflation. In turn, an increase in inflation implies an increase in the nominal interest rate.

The nominal interest rate reflects only the current income from deposits without taking into account inflation. The real interest rate is the nominal interest rate minus the expected inflation rate. The Fisher equation describes the relationship that arises between these two indicators and the inflation rate.

Fisher's formula for calculating the dependence of the cost of goods on the amount of money

In general, Fisher’s formula for calculating the dependence of the cost of goods on the amount of money has the following entry:

MV = PQ

Where:

- M is the volume of money in circulation;

- V is the frequency with which money is used;

- P is the level of cost of goods;

- Q - quantities of goods in circulation.

By transforming this entry, we can express the price level: P=MV/Q .

The main conclusion from this formula is the inverse proportionality between the value of money and its quantity. Thus, for normal circulation of goods within the state, control of the amount of money in circulation is required. An increase in the quantity of goods and their prices requires an increase in the amount of money, and if these indicators decrease, the money supply should be reduced. This kind of regulation of the volume of money in circulation is entrusted to the state apparatus.

Types of interest calculation

As a rule, interest is calculated in accordance with the compound interest formula. Compound interest is a method of calculating interest in profits, in which they are added to the principal amount and subsequently participate in the creation of new profits. A short summary of the compound interest formula looks like this:

K = X * (1 + %)n

Where: K is the total amount;

X - initial amount;

% - percentage value of payments;

n is the number of periods.

At the same time, the real interest you will receive by investing at compound interest will be less, the higher the inflation rate.

At the same time, for any type of investment it makes sense to calculate the effective (real) interest rate: in essence, this is the percentage of the initial deposit that the investor will receive at the end of the investment period. In simple terms, it is the ratio of the amount received to the amount originally invested.

r(ef) = (Pn - P)/P

Where:

ref—effective percentage;

Pn—total amount;

P is the initial contribution.

Using the compound interest formula, we get: ref = (1 + r/m) m - 1 Where m is the number of accruals for the period.

Where does the real interest rate apply?

Wherever an income is expected or a payment is made, expressed as a percentage, the real interest rate can be calculated. The bank or broker will not do this for you. The percentage that you see in the loan agreement, deposit agreement or brokerage report will be nominal.

Loans

The real interest rate is not calculated on a loan, although it works just as well for lending as it does for income, and may even make the borrower a little more optimistic. For example, today you took out a loan at 10% per annum, and inflation in the country is predicted to be 4% in the next 3-5 years. This means that every year your real rate will be less than the nominal rate by this 4%. Isn't this a reason for joy?

Imagine that you deposit RUB 30,000 monthly. towards repayment of the loan. Over time, the actual payment will “get cheaper”, because 30,000 rubles. in 5–10 years it’s not the same 30,000 rubles. today, but much less due to the depreciation of money. Even better, if you can refinance at a lower interest rate, then the effect will be even stronger.

The calculation of the real rate has become more widespread when determining the return on investments: in investments or bank deposits.

Investments

For an investor, real rather than nominal interest is of greater value, which will help determine the profitability of investing in various instruments. For example, when you select bonds in the card of a specific instrument, you will see several types of yield at once, but they are all nominal.

To determine the real profitability, you need to use the Fisher formula. For bonds, there will be only one forecast value that can distort the picture in the future - inflation. And another important parameter is precisely known several years in advance - coupon income. In the example above, the OFZ-26207-PD bond will mature only in 2027. The annual coupon income for all these years will be 8.15% per annum.

The situation is different for stocks. We can determine the future only on the basis of forecast values of profitability and inflation. All investors know the rule that past performance is no guarantee of future performance. Therefore, making forecasts based on values obtained in previous years is a thankless task. All that remains is a fundamental analysis of the company. But chance can interfere with any well-conducted analysis and invalidate all the conclusions drawn.

This does not mean that real profitability should not be taken into account at all. For a long-term investor, you can determine the effectiveness of your investments in a particular instrument based on the results of the year based on the actual values obtained. If you have been experiencing negative real returns for 2-3 years, you may want to reconsider your portfolio and investment strategy.

Deposits

Don’t be fooled when you see eye-catching deposit interest rates in the next commercial from the bank. This is just your future nominal income, which may not seem so attractive when you calculate the real one adjusted for inflation.

When calculating the real return on a deposit, you will, similar to bonds, operate not on the forecast inflation, but on the known interest specified in the contract. It’s good when the country’s economy is stable for several years in a row, and money depreciates within 1–2%. Then it is easy to calculate your actual profit from keeping capital on deposit. But this story is not about Russia. Our citizens have seen inflation of 4 and 2,500%, so it is easy to get zero or negative returns.

A simple example. You deposited 1,000,000 rubles in the bank. for 1 year at 4% per annum. Inflation in May 2022 was 6% year on year. By the end of the year, the Bank of Russia forecasts it to be around 5.4–5.8%. Let's assume that the value is 5.8%. Let's calculate the investor's income:

- nominal income: 1,000,000 * 1.04 – 1,000,000 = 40,000 rubles;

- real interest rate: (4 – 5.8) / (100 + 5.8) * 100 = –1.70%;

- real income: 1,000,000 * 0.9858 – 1,000,000 = –14,200 rub.

The purchasing power of your money decreased by 1.70% or by 14,200 rubles.

International Fisher effect

The International Fisher Effect is an exchange rate theory put forward by Irving Fisher. The essence of this model is to calculate present and future nominal interest rates in order to determine the dynamics of changes in currency exchange rates. This theory works in its pure form if capital moves freely between states whose currencies can be correlated with each other in value.

Analyzing the precedents of rising inflation in different countries, Fisher noticed a pattern that real interest rates, despite the growth in the quantity of money, do not increase. This phenomenon is explained by the fact that both parameters are balanced over time through market arbitrage.

This balance is maintained because the interest rate is set taking into account the risk of inflation and market forecasts for the currency pair. This phenomenon is called the Fisher effect. Extrapolating this theory to international economic relations, Irving Fisher concluded that changes in nominal interest rates have a direct impact on the rise or fall in price of a currency. This model has never been tested in real conditions.

Its main disadvantage is considered to be the need to implement purchasing power parity (the same cost of similar goods in different countries) for accurate forecasting. And, besides, it is not known whether the international Fisher effect can be used in modern conditions, taking into account fluctuating exchange rates.

Recommendations

- https://archive.org/details/appreciationinte00fish

- https://www.policonomics.com/irving-fisher/

- https://199.169.211.101/publications/research/economic_review/1983/pdf/er690301.pdf[permanent dead link

] - Hanke, Steve H. "Project Re-Evaluation During Inflation: Addressing Turvey's Relative Price Change Problem." Water Resources Research

.

17

: 1737–1738. Bibcode:1981WRR…. 17.1737H. Doi:10.1029/WR017i006p01737.

Inflation forecasting

The phenomenon of inflation is an excessive amount of money circulating in a country, which leads to its depreciation. Inflation is classified according to the following criteria: Uniformity - the dependence of the inflation rate on time. Homogeneity - distribution of influence across all goods and resources. Inflation forecasting is calculated using the inflation index and hidden inflation.

The main factors when forecasting inflation are: changes in exchange rates; increase in the amount of money; changes in interest rates; Another common method is to calculate the inflation rate based on the GDP deflator.

For forecasting, this technique records the following changes in the economy: changes in profits; changes in payments to consumers; changes in import and export prices; change in rates. Calculation of investment return with and without inflation The return on investment is usually considered to be the percentage of profit received to the amount of the initial contribution.

The return formula without taking into account inflation will look like this:

X = ((Pn - P) / P )*100%

Where:

X - profitability;

Pn—total amount;

P - initial payment;

In this form, the final profitability is calculated without taking into account the time spent. In order to calculate the yield as a percentage per annum, you must use the following formula: Xt = ((Pn - P) / P ) * (365 / T) * 100% Where T is the number of days of holding the asset.

Both methods do not take into account the impact of inflation on profitability. Inflation-adjusted return (real return) should be calculated using the formula:

R = (1 + X) / (1 + i) - 1

R - real profitability;

X is the nominal rate of return;

i — inflation.

Based on Fisher's model, one main conclusion can be drawn: inflation does not bring income. The increase in the nominal rate due to inflation will never be greater than the amount of money invested that has depreciated. In addition, a high rate of inflation growth implies significant risks for banks, and compensation for these risks falls on the shoulders of depositors.

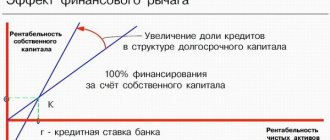

Taking into account inflation when calculating an investment project

Taking inflation into account in such investments plays a key role. Inflation can affect the implementation of the project in two aspects:

- In physical terms - that is, entail a change in the project implementation plan.

- In monetary terms, that is, to influence the final profitability of the project.

Ways to influence an investment project in case of rising inflation:

- Changes in currency flows depending on inflation;

- Taking into account the inflation premium in the discount rate.

Analysis of the level of inflation and its possible impact on the investment project requires the following measures:

- consumer index accounting;

- forecasting changes in the inflation index;

- forecasting changes in population income;

- forecasting the volume of cash collections.

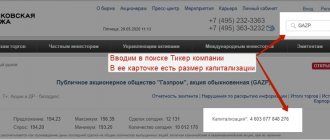

Application of the Fisher formula in international investment

As you can see, in the above formulas and examples, a high level of inflation always reduces the return on investment, given a constant nominal rate. Thus, the main criterion for the reliability of an investment is not the volume of payments in percentage terms, but the target inflation rate. This is confirmed by the ranking of countries that receive the most investments. The first places in it are occupied by China and the USA. Inflation growth in these countries over the past 5 years has not exceeded 3%.

Description of the Russian investment market using the formula

Fisher The above model can be clearly seen using the example of the investment market of the Russian Federation. The fall in inflation in 2011-2013 from 8.78% to 6.5% led to an increase in foreign investment: in 2008-2009 they did not exceed 43 billion. dollars per year, and by 2013 reached 70 billion. dollars. The sharp increase in inflation in 2014-2015 led to a decrease in foreign investment to a historical low. Over these two years, the amount of investments in the Russian economy amounted to only 29 billion. dollars. At the moment, inflation in Russia has fallen to 2.09%, which has already led to an influx of new investments from investors. In this example, it can be noted that in matters of international investment, the main parameter is the real interest rate, which is calculated using the Fisher formula.

An example of the relationship between changes in interest rates and the level of inflation for Russia

Using the example of Russia, one can notice the direct dependence of interest rates on deposits on inflation

| Year | Interest rate, % | Inflation, % |

| 2017 | 9.75-7.75 | 2.09 |

| 2016 | 10.5-10.0 | 5.38 |

| 2015 | 15.0-11.0 | 12.91 |

| 2014 | 7.0-17.0 | 11.36 |

Thus, it is clear that the instability of external conditions and increased volatility in financial markets forces the Central Bank to reduce rates when inflation rises.

Fisher's formula applied to monopoly and competitive pricing

A pure monopoly primarily presupposes that one producer has complete control of the market and perfect awareness of its state. The main goal of a monopoly is to maximize profits with minimal costs. A monopoly always sets its price above marginal cost and output below that of perfect competition.

The presence of a monopolist manufacturer in the market usually has serious economic consequences: the consumer spends more money than in conditions of fierce competition, while prices rise along with the inflation index. If the change in these parameters is taken into account in the Fisher formula, then we get an increase in the money supply and a constant decrease in the number of goods in circulation.

This situation leads the economy to a vicious cycle in which an increase in the inflation rate only leads to an increase in prices, which ultimately further stimulates the rate of inflation. A competitive market, in turn, reacts to an increase in the inflation index in a completely different way. Market arbitrage brings prices into line with market conditions. Thus, competition prevents an excessive increase in the money supply in circulation.

Fisher effect

The Fisher effect as a phenomenon, as a pattern, was described by the great American economist Irving Fisher in 1896. The general idea is that there is a long-term relationship between expected inflation and interest rates (yields on long-term bonds). Content - an increase in expected inflation causes approximately the same increase in the interest rate and vice versa. The Fisher equation is a formula for quantifying the relationship between expected inflation and interest rates.

Simplified equation: If the nominal interest rate N is 10, expected inflation I is 6, R is the real interest rate, then the real interest rate is 4 because R = N – I or N = R + I.

Exact equation. The real interest rate will differ as many times from the nominal as the price changes. 1 + R = (1 + N)/(1 + I). If we open the brackets, then in the resulting equation the value of NI for N and I less than 10% can be considered tending to zero.

As a result, we get a simplified formula. Calculation using the exact equation with N equal to 10 and I equal to 6 will give the following value of R. 1 + R = (1 + N)/(1 + I), 1 + R = (1 + 0.1)/(1 + 0, 06), R = 3.77%. In the simplified equation, we got 4 percent. Obviously, the limit for using the simplified equation is the value of inflation and the nominal rate of less than 10%.

How does Fisher's equation of monetary exchange work?

Imagine an investor who is offered to buy a large industrial plant on favorable terms in one of the countries with a developing economy. There is all the information, a detailed business plan and positive forecasts for the transaction. Since our investor is experienced, such a profitable offer worries him. He decides to independently assess the potential of the proposed transaction and begins the analysis by studying the economic situation of the country in which the plant will be located. There are extended data for the last two years:

| 2017 | 2018 |

| GDP = US$3 trillion | GDP = US$3.1 trillion |

| Total money flow = US$600 billion | Total money flow = US$800 billion |

| Speed of money movement = 5 revolutions per full calendar year | Speed of money movement = 5 revolutions per full calendar year |

From the data obtained it is clear that over the year the speed of money movement has not changed, but GDP and the total flow of money supply have increased. This suggests that the country has serious problems with inflation. If this is so, then it becomes clear why a profitable industrial plant is sold on favorable terms: inflation is increasing in the country → there is a sharp outflow of foreign capital → industrial development is under threat → the plant being sold may soon stop making a profit and risks going bankrupt.

The reason for selling the plant is clear. Now, in order to make a decision on a transaction, you need to estimate the inflation rate and, based on the data obtained, calculate action scenarios. In our case, it is convenient to calculate inflation using the Fisher equation. To do this, we just need to calculate the GDP deflator for 2022, perform a similar calculation for 2022, compare the data and obtain the inflation growth rate. We count.

Fisher equation formula.

We calculate GDP deflators and determine the inflation rate for the period 2017-2018. We get 29%.

It turns out that the industrial plant is located in a country with galloping inflation (10-50%), which is dangerous for the economy and needs urgent anti-crisis measures. If the government of such a state does nothing to stabilize the situation, then galloping inflation may develop into hyperinflation. Hyperinflation means that for some long period the economy will go into a state of protracted crisis and it will be unprofitable to engage in production.

We return to our investor, who saw the catch in the deal and can now react to it properly. We list several likely scenarios that are suitable for such a case:

- You can refuse to purchase a plant, save capital or direct it to a more promising asset.

- You can study the government program of anti-crisis measures, evaluate its effectiveness and postpone the deal to a later period. If the government's actions reduce the rate of inflation, then we can return to negotiations again. If there are no real steps, then there is no need to discuss anything.

- You can reduce the price several times and agree to purchase.

- You can agree to the proposed price, but first agree with the buyer on favorable government benefits.

- You can invite partners and conduct a transaction under a collective investment program.

The investor can choose any option or come up with something else. It is not important. The important thing is that he tracked high inflation in time and protected himself from a bad deal. The Fisher equation is used for approximately this purpose. If you find this information useful, look at the next section, which outlines the theory of monetary exchange.

The essence of inflation

Imagine that in a secluded northern village all workers' salaries were doubled. What will change in a local store if the supply of, for example, chocolate remains unchanged? How would its equilibrium price change? Why does the same chocolate bar become more expensive? The money supply available to the population of this village has increased, and demand has increased accordingly, while the amount of chocolate has not increased.

As a result, the price of chocolate increased. But a rise in chocolate prices is not inflation. Even if all food products in the village become more expensive, this will not yet be inflation. And even if all goods and all services in this village become more expensive, this will not be inflation either. Inflation is a long-term, sustained increase in the general price level.

Inflation is the process of depreciation of money, which occurs as a result of the overflow of circulation channels with the money supply. How much money must circulate in a country for the price level to be stable? The equation of exchange - Fisher's formula - allows you to calculate the money supply required for circulation:

MV = PY, where M is the amount of money in circulation;

V is the velocity of money circulation, which shows how many times 1 ruble changes hands over a certain period of time;

P is the average price per unit of production;

Y is real gross domestic product;

PY is nominal GDP.

The equation of exchange shows that each year the economy needs the amount of money required to pay for the value of the GDP produced. If more money is put into circulation or the velocity of its circulation has increased, then the price level rises. When the growth rate of the money supply exceeds the growth rate of the commodity supply: MV > PY, equilibrium is restored as a result of rising prices: MY = P|Y.

Overflow of money circulation channels can occur if the velocity of money circulation increases. The same consequences can be caused by a reduction in the supply of goods on the market (a drop in production volume). The degree of depreciation of money is determined in practice by measuring the rate of price growth.

In order for the price level in the economy to be stable, the government must maintain the growth rate of the money supply at the level of the average growth rate of real GDP. The size of the money supply is regulated by the Central Bank. Issue is the release of additional money into circulation. Depending on the rate of inflation, inflation is conventionally divided into:

- moderate,

- galloping,

- high,

- hyperinflation.

If prices grow slowly, up to about 10% per year, then they usually talk about moderate, “creeping” inflation.

If there is a rapid and abrupt increase in prices, measured in double digits, then inflation becomes galloping. With such inflation, prices rise no more than twice.

Inflation is considered high when the price increase exceeds 100%, that is, prices increase several times.

Hyperinflation occurs when the process of depreciation of money becomes self-sustaining and uncontrollable, and the rate of growth of prices and money supply becomes extremely high.

Hyperinflation is usually associated with war, economic devastation, political instability, and erroneous government policies. The rate of price growth during hyperinflation exceeds 1000%, i.e., prices rise more than 10 times during the year. The intensive development of inflation causes distrust in money, and therefore there is a massive desire to turn it into real values, and a “flight from money” begins.

There is an increase in the velocity of circulation of money, which leads to an acceleration of its depreciation. Money ceases to fulfill its functions, and the monetary system falls into complete disorder and decay. This is manifested, in particular, in the introduction into circulation of various monetary surrogates (coupons, cards, other local monetary units), as well as hard foreign currency.

The collapse of the monetary system as a result of hyperinflation in turn causes degradation of the entire national economy. Production is falling, normal economic ties are being disrupted, and the share of barter transactions is growing. There is a desire for economic isolation of different regions of the country. Social tension is growing.

Political instability manifests itself in a lack of trust in government. This also increases distrust in money and its depreciation. A classic example of hyperinflation is the state of the monetary circulation of Germany after the First World War in 1922-1923, when the rate of price growth reached 30,000% per month, or 20% per day.

In different economic systems, inflation manifests itself in different ways. In a market system, prices are formed under the influence of supply and demand; depreciation of money is open. In a centralized system, prices are formed by directive, inflation is suppressed and hidden. Its manifestations are a shortage of goods and services, an increase in cash savings, and the development of the shadow economy.

Factors that cause inflation can be both monetary and non-monetary in nature. Let's look at the main ones. Demand-pull inflation results from excessive increases in government, consumer, and private investment spending. Another cause of demand inflation may be the issue of money to finance government spending.

With cost-push inflation, prices rise as a result of firms' higher production costs. For example, wage growth, if it outpaces labor productivity growth, can cause cost-push inflation.

Conclusions: Inflation is a general increase in prices. It is caused by the excess of the growth rate of the money supply over the commodity supply. Based on the rate of price growth, there are four types of inflation, of which the most severe is hyperinflation, which destroys the economy. Inflation is unpredictable. People on fixed incomes suffer the most from its consequences.

ECONOMIC SCHOOL

50 topics and literature for students to prepare reports on economics

FISCHER EFFECT

Fisher effect is a concept that formally takes into account the impact of inflation on the interest rate on a loan or bond.

In the equation proposed by Irwin Fisher (1867-1947), the nominal interest rate on a loan is expressed as the sum of the real interest rate and the rate of inflation expected over the life of the loan: R = r + F, where R is the nominal interest rate, r is the real interest rate, and F is the annual inflation rate. 1

So, if inflation is

6% per year and the real interest rate is 4%, then the nominal interest rate will be 10%. The inflation premium (6%), included in the nominal interest rate, allows to compensate for the losses of creditors associated with the fall in the purchasing power of money loaned by the time they are returned by borrowers.

The Fisher effect suggests a direct relationship between inflation and nominal interest rates, where changes in the annual rate of inflation lead to corresponding changes in nominal interest rates.

__________________

1

Here is a simplified version of the Fisher equation that gives a good approximation for low interest rates and

inflation rate. The exact formula is: R = r + F + rF. In the example conditions, the exact value is R = 0.06 + 0.04 + 0.06 • 0.04 = 0.1024, i.e. 10.24% per annum. (Editor's note)

See Fisher

Irving

Fisher

Irving (1867 - 1947), From Irving Fisher to Alexander Konyus (Economic school, lecture 19.2) or the same in pdf file

I. Fisher. The influence of monetary systems on the purchasing power of money,

I. Fisher. The influence of the quantity of money and other factors on the purchasing power of money and on each other

QUANTITATIVE THEORY OF MONEY

Modern monetary theory

(Modern Monetary Theory)

Modern Monetary Theory is an unorthodox macroeconomic theory that holds that full employment and controlled inflation are achieved through changes in government spending financed by the sale of government bonds to the country's central bank. (P.I.Grebennikov)

NOMINAL INTEREST RATE

nominal interest rate - the interest rate paid on a loan without adjusting for inflation.

Wed. REAL INTEREST RATE.

ABOUT STAGFLATION

REAL INTEREST RATE

(real interest rate) - the interest rate paid on the loan, adjusted for inflation.

If a borrower were to pay, for example, 10% (the nominal interest rate) on a loan during a year in which the inflation rate was 6%, then the real interest rate would be only 4%. Inflation reduces the real interest burden on borrowers while reducing the real rewards to lenders. See FISCHER EFFECT.

INFLATION

(inflation) is an increase in the general level of prices in the economy that continues for a certain period of time. Annual price increases can be small and gradual (creeping inflation) or large and accelerating (hyperinflation). The rate of inflation can be measured, for example, by the consumer price index (see price index), which reflects the annual percentage changes in the prices of consumer goods. See fig. 43. It should be noted that inflation reduces the purchasing power of money (see real values).

Rice. 42. Inflation gap

,

A.

The aggregate supply schedule is depicted as a 45° line because firms will plan any level of output only if they expect that aggregate spending (aggregate demand) will be such that it will allow them to sell all the output they produce.

However, if the economy reaches the level of national income corresponding to full employment (OY 1

), then output cannot be increased and at this level the aggregate supply line becomes vertical.

If aggregate demand is at the level indicated by line AD, the economy will operate at full employment without inflation (point E). However, if aggregate demand is at a higher level, like AD 1

, this excess aggregate demand will create an inflationary gap (equal to EG), pushing prices up,

b

.

In an alternative model, where aggregate demand and aggregate supply are expressed in terms of real national income and the price level, the inflation gap is expressed as the difference between the price level (PR), related to the level of aggregate demand at full employment (AD), and the price level ( PR1

) , relating to a higher level of aggregate demand (AD

1

) at the level of real national income OY

1

. See demand-pull inflation.

Overcoming inflation has long been one of the main goals of macroeconomic policy. Inflation is seen as an undesirable phenomenon: it adversely affects income distribution (inflation hurts people on fixed incomes), lending and borrowing (lenders suffer losses, borrowers benefit), increases speculation (savings are diverted from production to speculation in goods and real estate), and worsens competitiveness in international trade (exports become relatively more expensive and imports become cheaper). Hyperinflation is especially dangerous because people lose confidence in money as a medium of exchange and the economic system falls into a state close to collapse.

There are two main explanations for the causes of inflation:

(a) the presence of excess demand at full employment, which pushes up prices (demand inflation);

(b) an increase in the cost of factors of production (labor and raw materials), which pushes up prices (cost inflation).

According to the concept of the monetarist school (see MONETARISM), demand inflation is caused by the creation of an excess amount of money. Monetarists propose strict controls on the money supply as a means of reducing excess aggregate spending (see monetary policy). The Keynesian school also advocates a policy of reducing aggregate expenditure as a way to curb excess demand, but proposes to implement this policy by increasing taxes and reducing government spending (see fiscal policy). Cost inflation is caused primarily by excess increases in money wage rates (i.e., wage rates higher than what can actually be paid by increased productivity growth) and occasional surges in the prices of raw materials (a clear example of this is This may be due to the increase in oil prices carried out by OPEC in 1973 and 1979). Cost inflation resulting from demands for excessive wage increases can be limited or eliminated either directly by the imposition of price and income controls (see price and income policy) or indirectly through "exhortations" and measures aimed at reducing the monopoly power of trade unions.

See INFLATION SPIRAL, PURCHASING POWER, PHILLIPS CURVE, EXPECTATION-ADVANTAGE/INCREMENTAL PHILLIPS CURVE, ADAPTIVE EXPECTATIONS, QUANTITATIVE THEORY OF MONEY, INDEXING, INTERNAL-EXTERNAL EQUILIBRIUM MODEL, ABOUT STA ABOUT STAGFLATION

Pyotr Ilyich Grebennikov. Economics (2019), Inflation (Material from Wikipedia - the free encyclopedia), Inflation (CPI) - OECD DATA, UNDERSTANDING INFLATION

COSTLY INFLATION

(cost-push inflation) - a general increase in prices caused by an increase in the cost of production factors. The cost of factors of production may rise due to an increase in the cost of raw materials and energy due to their shortage on a global scale, or as a result of the action of cartels (for example, oil), or a fall in the country's exchange rate (see devaluation), or because wage rates in the economy are growing faster than per capita output (productivity). In the latter case, institutional factors such as the use of wage comparability and differentiation in collective bargaining negotiations, as well as the persistence of restrictive labor practices, can push up wages and limit opportunities for productivity growth. Faced with rising factor costs, increased costs by charging higher prices. To keep unit gross margins constant, producers need to fully offset the increased costs by inflating prices, but whether they can do this or not depends on the price elasticity of demand for their products.

See inflation, inflationary spiral, collective bargaining agreement.

COMPARABILITY

(comparability) - an approach to determining wages in which, during collective bargaining negotiations, the level or rate of wage growth of a particular group of workers or industry is linked to the level or rate of wage growth of people in other occupations or industries.

Comparability can lead to costly inflation

DEMAND

-PULL INFLATION - an increase in the general price level as a result of an excess of aggregate demand compared to potential supply in the economy. At the level of output corresponding to full employment (potential gross national product), excess demand drives up prices while real output remains unchanged (see inflation gap). According to the concept of monetarism, excess demand occurs due to too rapid growth in the supply of money.

See inflation, quantity theory of money, cost inflation.

GNP DEFLACTOR

(GNP deflator) - a price index used to adjust monetary gross national product (GNP) to obtain real GNP (see real values). Real GNP is important because it reflects the physical output of goods and services, not the sum of their monetary values. Sometimes it appears that the production of goods and services in the economy has increased (economic growth) because monetary GNP has increased, but this may be a consequence of rising prices (inflation), which is not accompanied by an increase in physical output. The GNP deflator is designed to eliminate the impact of price changes and take into account only real changes.

See From Irving Fisher to Alexander Konyus (Economic School, lecture 19.2) or the same in pdf file

DEFLATION

(deflation) - a decrease in the level of national income and output, usually accompanied by a fall in the general price level (disinflation).

Authorities often deliberately cause deflation in order to reduce inflation and improve the balance of payments by reducing the demand for imports. Deflationary policies use fiscal measures (such as raising taxes) and monetary measures (such as raising interest rates).

See monetary policy, fiscal policy

INTERNATIONAL FISCHER EFFECT

(international Fisher effect) - a situation in which the difference in nominal interest rates in different countries reflects the expected rate of change in the exchange rate of their currencies.

For example, if UK investors expect the US dollar to appreciate by, say, 5% per year relative to the pound sterling, then to create currency parity between the two countries they are willing to allow annual interest rates on dollar-denominated securities to be would be approximately 5% less than the annual interest rates on securities denominated in pounds sterling. From the borrower's point of view, under the Fisher effect, the cost of equivalent loans in these alternative currencies will be the same, despite the difference in interest rates.

The international Fisher effect can be compared to the domestic Fisher effect, where nominal interest rates reflect expected real interest rates and the expected rate of change in prices (inflation). The international equivalent of inflation is changes in exchange rates.

See interest arbitrage,

Brigham Y., Gapenski L. Financial management: a complete course : In 2 volumes / Transl. from English edited by V.V. Kovaleva. St. Petersburg 2001 T.1.ХХХ+497 pp., T.2. 669 pp. Chapter 27. Financial management in transnational corporations,

Evolution of the theory of finance, Pyotr Ilyich Grebennikov. Economy

COMPOUND INTEREST

(compound interest) - interest on a loan, which is accrued not only on the original amount of the loan, but also on those interests that have accrued earlier. This means that interest payments grow exponentially over time; for example, for a loan of 100 pounds. Art. with compound interest equal to 10% per annum, the debt will accumulate at the end of the first year to 110l. Art., by the end of the second year - by 121 f. Art. etc. according to the following formula:

See simple interest,

Brigham Y., Gapenski L. Financial management : a complete course : In 2 volumes / Transl. from English edited by V.V. Kovaleva. St. Petersburg 2001 T.1.ХХХ+497 pp., T.2. 669 pp. /

Appendix I. Discounted cash flow analysis: overview of methodology.

SIMPLE INTEREST

(simple interest) - interest on a loan, which is accrued only from the initial loan amount. This means that the interest amount increases linearly over time. For example, a loan of 100 pounds. Art. with simple interest equal to 10% per annum, increases to £110. Art. by the end of the first year, up to 120 l. Art. by the end of the second year, etc.

Wed. compound interest

Search for terminology, biographical materials, textbooks and scientific works on the websites of the School of Economics:

Return

Coordination of materials.

Economic school Economic school 90

What the Fisher Equation Doesn't Show

Let's talk about criticism of the quantity theory of money. Here, almost every economist has his own set of comments, so we will highlight only a few of the main ones. Leave your additions in the comments below the article.

First note. The Fisher equation and the entire quantitative theory of money are not applicable on a state scale, since to obtain accurate data it is necessary to take into account all the capital involved in the economy. The situation may change when society abandons cash and begins to use a complex computing system to record all electronic payments.

It is important that this new system takes into account even anonymous cryptocurrency transactions. Until something similar happens, the Fisher equation is appropriate to use only in those organizations that are able to keep strict records of their cash flows.

Second note. The Fisher equation is based on the postulate that the quantity of money affects the price. Many economists disagree with this and believe that the amount of money issued depends on the size of the price:

| The amount of money affects the price | Price affects the amount of money |

| 100 coins and 20 goods issued → one product is valued at 5 coins | 20 products were issued at 5 coins each → all together valued at 100 coins |

If there is no crisis, then both models are equivalent and have no advantages over each other. Everything changes when any economic disruption occurs:

| The amount of money affects the price | Price affects the amount of money |

| 1000 coins and 20 goods are issued → the cost of one product is estimated at 50 coins → the solvency of the population falls → the economy suffers | 200 goods were issued at 5 coins each → all together are valued at 1000 coins → the solvency of the population has not changed → excess products are imported → the economy is developing |

As you can see, the second postulate is more profitable and it is precisely this that China is trying to adhere to in its economic model. If in the future this model spreads to other countries, then the Fisher equation and most of the provisions of the quantity theory of money will become irrelevant.

Third note. The Fisher equation does not adjust for where the money supply is moving. Because of this, the meaning of the same indicators in different situations will differ:

| Free money flows into the international market | Free money flows into the domestic market |

| ↓ | ↓ |

| The country's economy is developing | Inflation is developing |

| ↓ | ↓ |

| Free money is used to purchase new assets | Free money is used to meet current needs |

The problems with the quantity theory of money are not related to the pace of development of the modern economy. The point is in incompletely calculated patterns, most of which the author invented and published in the form of hypotheses. As a result, these miscalculations led to the fact that a few days before Black Monday, Irving Fisher recommended that investors bet on the growth of stock prices.

Consequences of the 1929 stock market crash. After this day, Irving Fisher had to end his career, because no one else perceived him as an economist.