Stock exchange and market - what is it?

A stock exchange is a specially organized place that provides the opportunity to carry out transactions with securities. It provides control over participants, and also guarantees fairness and speed of transactions. Each transaction performed is subject to registration.

Every minute a large number of transactions are carried out on the exchange, in which several participants are involved:

- Investor. An investor can be either a legal entity or an individual. Its purpose is to invest capital with the aim of making a profit. To achieve his financial goals, an investor can buy and sell stocks, bonds, mutual funds, futures or other stock market instruments.

- Issuer. It issues securities primarily to raise capital. The issuer can be a company, a city, or even a state. The exchange is a platform for issuers to sell issued securities.

- Broker. Acts as an intermediary between the issuer and the investor. When making transactions on the market, brokers act exclusively on behalf of the investor. The investor, in turn, does not have the right to carry out any transactions on the stock exchange without concluding an agreement with a broker and opening a brokerage account.

- Registrar. He maintains a register of all securities. This way the company knows who its shareholders are.

- Depository. This is another professional stock market participant. He stores securities and also keeps records of the transfer of rights to them when concluding transactions.

- Regulator. The activities of the exchange in Russia are regulated by the Central Bank. It also issues operating licenses to professional participants in the securities market. This is necessary to protect investors from unscrupulous companies.

How to buy shares

To buy shares you need to open an account with a broker that provides access to exchanges.

The most famous brokers in the US market:

- Fidelity

- TD Ameritrade

- Vanguard

- Schwab

- Interactive brokers

The most famous on the Russian stock market:

- Finam

- Opening

- Alfa Bank

- VTB

The full list can be viewed on the Moscow Exchange website.

You cannot buy shares directly on the stock exchange. The exchange provides the technical infrastructure, and brokers are mandatory intermediaries in the purchase and sale of financial assets.

What types of exchanges are there?

There is a classification of exchanges. They mainly differ in the following characteristics:

- Product type. In addition to stock exchanges, there are commodity, cryptocurrency and currency exchanges. We have already figured out that securities purchase and sale transactions are executed in stock markets. Cryptocurrency is traded on cryptocurrency exchanges, which have emerged quite recently. On commodity exchanges - real goods (agricultural products, oil, gas, precious metals). As for currency exchanges, they trade currencies. There are also so-called derivatives markets - these are markets where trading of industrial financial instruments (futures, options, etc.) takes place.

- Form of participation. There are two types of exchanges - open and closed. On open exchanges, transactions can be carried out by sellers, members of exchanges, as well as buyers. On closed ones, only exchange members have the right to trade.

- Principle of organization. Most existing exchanges are joint stock companies. Exchanges may also be of a mixed type if the shareholder is the government in addition to private companies.

- Role in world trade. Exchanges are divided into national and international. National exchanges are relatively small, and they trade securities of small companies that do not meet the requirements of an international exchange.

Market of goods

On the commodity exchange, they sell and buy any goods. But, we are talking only about those products that can be classified as “exchange” products. This includes those products that meet the following requirements:

- The product is highly liquid and there is great demand for it, which ensures market movement;

- Regardless of the manufacturer, the product structure must be uniform;

- The product meets specific standardization criteria and is interchangeable;

- One of the main conditions is that the products must be transportable. That is, delivery from point A to point B should not cause any difficulties. The same goes for storage. The buyer and seller must be able to store the goods for a sufficiently long period and, at the same time, without losing its original characteristics.

Among the main types of exchange products, the following can be distinguished:

- Industrial raw materials;

- Cereals;

- Textile raw materials;

- Metals (including precious);

- Seed processing product and the seeds themselves;

- Food products;

- Meat and animals;

- Energy raw materials.

If the market sells most of the products listed above, it can be considered universal . At the same time, in such markets you can often purchase currency and securities.

If only products of a specific group are sold on the exchange, it is usually called specialized . These include such types of exchanges as grain, oil, metal markets, as well as exchanges of radioactive and nuclear materials.

Speaking about the functions of a trading exchange, one of the main ones is pricing for the types of products present on it. Thanks to the Internet, information about trading results can be obtained instantly from anywhere in the world. Thus, sellers, focusing on the international market, set similar prices for their products.

Almost all commodity transactions are carried out for hedging purposes through futures contracts. In this way, the parties insure risks in case of changes in the price of a specific product. Despite the fact that most of the transactions are of a calculated nature, some of the goods are still sold through actual purchases. On the market side, guarantees are provided by a sufficiently large number of products in our own warehouse.

Main tasks of the stock exchange

The Exchange supports fair pricing in the securities market. She also organizes auctions. All issuers are required to provide the exchange with their financial statements before being admitted to trading. Transactions occur at certain times according to the rules established by the exchange. Information about them is publicly available and can be found on the website of the exchange you are interested in.

If we talk about the main functions of the exchange, we can highlight the following points:

- Creation of a permanent securities market.

- Redistribution of funds between countries, various sectors of the economy and industry within one country, as well as between individual organizations.

- Fixation of the investor's share of participation in a particular valuable asset.

- Ensuring liquidity and guarantees for the execution of transactions concluded on the exchange.

What is sold on the stock exchange

The stock exchange trades stocks, shares of mutual funds, bonds and other financial instruments.

We have already found out that securities are issued by issuers to attract capital. The issuer can offer the buyer a stake in its company by issuing shares. By purchasing such shares, an investor becomes a co-owner of a particular company. When issuing bonds, issuers borrow money from investors, promising interest payments for using the borrowed funds.

Securities have their own key parameters, which are determined by the company that issued them, namely: type of security, par value, quantity. Securities undergo a mandatory registration procedure in a special register and are then placed on the stock exchange.

Exchanges in Russia

The main exchanges in the Russian Federation are considered to be Moscow and St. Petersburg. Securities, foreign currency and precious metals can be purchased on the Moscow Exchange. If you want to buy or sell foreign securities, you can do this on the St. Petersburg Stock Exchange.

The regulator of exchanges in Russia is the Central Bank. It publishes information about the legality of the actions of the exchange, as well as trading on it.

Why does an ordinary person need this?

It is clear that the main goal of legal entities offering for sale or buying securities is to generate income. The aspirations of an ordinary person are not original.

Among other goals, one of the main ones is to achieve material well-being. If a person has some savings , then he wants them to generate income .

One of the ways of investment (investing funds for subsequent profit) is the purchase of securities.

After they increase in price , they can be sold and receive income. The logic is simple.

How do transactions take place on the stock exchange?

Many people imagine the stock exchange as a place where there is constant noise, active trading, and shouting - just like in the movies. Previously, everything was really like this, and bidders shouted out offers for purchase and sale. Now almost all activity on exchanges has been transformed into a digital format.

Each transaction made on the stock exchange necessarily goes through several stages:

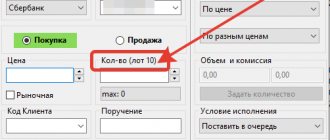

- Application. The buyer can submit a request online or by phone call. Then the purchase or sale application enters the electronic system.

- Reconciliation. All parameters of the transaction are carefully checked by both the investor and the seller of securities.

- Clearing (the so-called mutual settlements that occur on the stock exchange). During this procedure, the correctness of the transaction is checked. Also at this step the paperwork is completed.

- Execution of the transaction. At the last stage, the securities are directly exchanged for the investor's funds.

It is worth noting that in the stock market there are certain periods of time during which it is possible to carry out purchase and sale transactions. For example, if you trade on the Moscow Exchange, then you should know that transactions on stocks, bonds and ETFs (as foreign investment funds are called) can be carried out from 10:00 to 18:44 (Moscow time) and only on weekdays. There are also evening sessions, which take place from 19:05 to 23:50, where you can buy some shares. You can always find out more about the schedule on the official website of the Moscow Exchange: https://www.moex.com/s1167. The opening hours of the St. Petersburg Stock Exchange are slightly different from the Moscow Stock Exchange. Thus, you can trade securities from 10:00 to 22:59 (Moscow time) on weekdays. A more accurate and detailed description can also be found on the official website: https://spbexchange.ru/ru/stocks/inostrannye/raspisanie/. It is important to remember that exchanges are closed on weekends. The Moscow Exchange is also closed on Russian public holidays, and the St. Petersburg Exchange is closed on US public holidays.

How to make money on the stock exchange

Profit on the stock exchange is far from luck. Income depends on many factors: strategy, market trends, state of the economy. One way or another, income can be predicted.

Let's look at an example of how trading on the stock exchange works: you buy and resell stocks and bonds. Over time, shares become more expensive or cheaper; income comes from their timely sale and purchase. Some stocks can bring you dividends, bonds provide income in the form of guaranteed interest - coupons. Income from bonds is less, but more reliable.

Your profit will also depend on the chosen strategy. Typically, the higher the yield, the higher the risk of losing money. The return on the stock market may be higher than on deposits. But it is important to keep in mind that it is not guaranteed. Because securities investments are not insured, you run the risk of losing some, or sometimes all, of your investment. Remember to invest wisely. Before making transactions on the stock exchange, we recommend that novice investors acquire basic knowledge and skills, decide on their strategy, and choose a reliable broker or trustee.

Risks associated with trading on the stock exchange

Remember that when you trade in the stock market, you risk losing some of your capital, even if you have a trustee acting on your behalf. Basically, the risk arises from a fall in the value of a particular security. Unfavorable market conditions can cause prices to fall on the stock exchange. For example, the introduction of any sanctions against Russia may negatively affect the value of securities. News about an increase in the company's dividends may, on the contrary, have a positive impact on the price of securities. However, we should not forget that there is a risk of bankruptcy of the company. Thus, both the broker and the management company may go bankrupt. Investors in Russia are not insured against such a risk, but, in the event of an unfavorable set of circumstances, they can transfer money to another broker.

Who is a trustee and how to work with him

A fiduciary is an individual or legal entity authorized to act on behalf of its client in transactions on the stock exchange.

For inexperienced or unsure clients, a person who knows how to invest in the stock market and is able to choose the right financial behavior strategy is needed.

The trustee enters into an agreement with his client, on the basis of which he receives the right to dispose of funds and assets. He develops a strategy, coordinates it with the client, and makes him aware of the possible risks and the amount of profit. For his work, the trustee receives compensation in one form or another. Actions with the client’s assets are carried out by him in his own name, but with the note “D. U."

According to the agreement, actions with the investor’s assets can be performed in his absence, without personal participation. The peculiarity of the trustee is the lack of guaranteed income. The steps taken can become a source of profit, but an unfavorable outcome is also possible. There are cases when unsuccessful actions of the remote control led the client to a complete loss of funds. The term “trusted” has only a legal meaning, since, as a rule, real trusted relationships do not arise.

What to remember

- The stock exchange trades securities issued by issuers.

- The activities of the exchange in Russia are under strict control of the Central Bank.

- Carrying out transactions on the stock exchange is easier than it seems, but it requires basic knowledge.

- To trade on the stock exchange, you need a reliable broker or trustee.

- Remember that returns in the stock market are not guaranteed, so you need to be smart about your investments.

- You can always contact a financial advisor for advice.

- #Broker account

- #Bonds

- #Tips for beginners

- #Stock

- #Beginners

- #Financial Advisor

Was the article helpful?

Thanks for the answer!

Principle of operation

The management of the stock exchange formulates the rules of trading and operation of the trading platform:

- The basis of the work is the trading system. Software and hardware environment for concluding agreements between the parties and maintaining records, including dedicated communication channels to common traffic exchange points. This is the most complex and expensive component of the stock exchange.

- The second is the clearing house, which provides clearing, intermediate or final. Counting all client transactions on the market during a trading session.

- Finally, the job of the depository is to maintain records of shareholders' rights in the securities purchased. Maintained in non-documentary form, electronic records.

Tools of the trade

Briefly, on the stock exchange, trading instruments are securities (stocks, bonds, depositary receipts), derivatives (futures, options). Additionally - currency and shares of exchange-traded investment funds.

Example - Moscow Exchange. The listed tools are available on it.