History of the development of the Stellar cryptocurrency

A number of analysts believe that Stellar is an improved and noticeably more secure and reliable version of Ripple. Such conclusions are based on a number of serious facts.

Ripple platform appeared on the market in 2012 , many brokers became interested in this inexpensive and promising coin, which was predicted to have the brightest prospects.

However, after some time, it became clear that Ripple is not without some serious shortcomings. In particular, experts believe that this cryptocurrency has 3 significant problems:

- The company Ripple Labs, which developed and promotes the Ripple platform, is a commercial project aimed at generating its own profit;

- Ripple Labs can easily manipulate the Ripple price since it is the main holder of XRP coins;

- Ripple is a completely centralized project and any changes can only be made at the initiative of Ripple Labs;

The creators of Ripple promised to adjust the operating principles of the platform, in particular, to change the XRP distribution scheme and make the program code available. However, the first point is not implemented this way. As for the discovery of the program code, in 2013 Ripple Labs actually published it. However, the main problems of the project remained unresolved. Many considered the best way out of this situation to be a fork of Ripple, which took place under the leadership of Jed McCaleb and Joyce Kim. As a result, a new cryptocurrency was formed, called Stellar.

Features of the Stellar cryptocurrency

- Stellar is developed and promoted by the Stellar Development Foundation. The work of this non-profit foundation is not controlled by the creators of the currency.

- The Stellar cryptocurrency was created on the basis of an open protocol developed specifically for this project.

- The activities of the Stellar Development Foundation are completely transparent and open to all users. All information on investments and spending of funds is publicly available.

- 25% of the Stellar coins out of the initially created 100 billion were transferred to the management of non-profit structures. 5% are kept in the fund's accounts to cover the costs of operations.

- Large holders of coins signed a special restrictive agreement, according to which they undertake not to sell them over the next 5 years in order to prevent the possibility of influencing the cryptocurrency rate.

According to the creators of the Stellar platform, everything possible has been done to ensure that the project is completely free of the speculative component.

The project was initially supposed to use the Stellar currency of the same name, but in 2014 there was a rebranding and the coin was renamed into the Lumen cryptocurrency with the ticker XLM. The project itself acquired the main features that it has today.

Functional features and characteristics of Stellar Lumens

- Confirmation time is 3-5 seconds.

- Supports thousands of transactions per second.

- Can be used to transfer or sell any currencies, assets or tokens.

- Open source.

- Uses SCP instead of Proof of Work. Technical documentation available.

- Simple, clean API.

- Multisignature and smart contracts.

- Decentralized distributed database.

- Initially, 100 billion XLM were created.

- Fixed annual inflation of 1%.

- Distribution of coins.

- Since the Stellar network does not use mining, all coins are available when the network starts.

- The holder of most of them is the non-profit organization Stellar.org.

Lumens is the native asset of the Stellar network, which most crypto enthusiasts are somewhat familiar with. Interestingly, Stellar Lumens tokens have suddenly gained a lot of prominence as their value has suddenly started to rise in value recently.

More specifically, Lumens are built into the Stellar network, where they act as a unit of digital currency. Similar to how Bitcoin and other cryptocurrencies work, Lumen cannot be physically stored, but users can exercise digital ownership of these assets using a private key. In 2014, the Stellar network was launched with a capitalization of 100 billion, which was renamed Lumens in 2015 as part of the platform's rebranding.

The renaming process was done to avoid confusion, since the token had a name like the network itself, which raised unnecessary questions. However, it can be assumed that the Stellar network does not need a native asset. This assumption is incorrect because Lumens are designed to prevent online spam. Additionally, all Stellar accounts must have at least XLM 20 in their balance at all times.

The idea behind Lumens is how they can facilitate multiple currency transactions at a given time. The token can be used as a “bridge” between different currencies that do not have their own direct market. This brings additional benefit to the Stellar network.

The asset data suggests that there are some statistics to consider. 5% of the total funding will be kept by the team to fund the activities of Stellar.org. A certain amount of the funds will be auctioned from time to time beginning in March 2015. Most of the coins are distributed to anyone who wants to use XLM tokens, non-profit organizations and Bitcoin holders. As a result, everyone who had Bitcoin on the exchange in March 2015 received a small amount of XLM.

It's not hard to see why Stellar Lumens would be of interest to investors. The currency can be used to facilitate multi-currency transactions on blockchains, independent of existing markets and gateways. Whether this means you should invest in XLM is a question that is difficult to answer. There will always be a market for these tokens, but they may not necessarily be a speculative asset.

You can buy Stellar cryptocurrency (XLM) on cryptocurrency exchanges.

Rating of TOP 5 cryptocurrency exchanges for 2022:

| # | Cryptocurrency exchange | Official site | Site assessment |

| 1 | Binance (Editor's Choice) | https://binance.com | 9.7 |

| 2 | Huobi | https://www.huobi.com | 7.5 |

| 3 | Exmo | https://exmo.me | 6.9 |

| 4 | OKEx | https://www.okex.com | 6.3 |

| 5 | Yobit | https://yobit.io | 6.1 |

The criteria by which the rating is given in our rating of crypto exchanges:

- Reliability of operation

- stable access to all functions of the platform, including uninterrupted trading, deposits and withdrawals of funds, as well as the period of operation on the market and daily trading volume. - Commissions – the amount of commission for trading operations within the platform and withdrawal of assets.

- Reviews and support – we analyze user reviews and the quality of technical support.

- Interface convenience – we evaluate the functionality and intuitiveness of the interface, possible errors and failures when working with the exchange.

- Features of the platform are the presence of additional features - futures, options, staking, etc.

- The final score is the average number of points for all indicators, determines the place in the ranking.

How does Stellar work?

Stellar is a decentralized consensus platform on which transactions with various assets are possible. The Stellar cryptocurrency itself serves only as the main unit of account for transactions. Thus, the XLM cryptocurrency is an intermediate means of exchanging one asset for another.

For example, a user has litecoins on an exchange. He needs to transfer them to a third party but in the form of bitcoins or transfer them to his fiat account at a credit institution. To perform these operations, you simply need to register on the Stellar platform, enter the initial data, select the most suitable method that the system offers and then complete the transaction. In this case, lumens will only be required to pay the system commission. Its size is 0.0001 XLM.

The work of such a scheme is carried out on the basis of the decentralized exchange Stellar, which operates on the internal SCP algorithm, which acts as a consensus protocol. The algorithm is based on a ledger - an array of distributed data registry. Information about all completed transactions is stored here.

The functioning of the registry is based on the work of numerous independent nodes that duplicate ledger data. If one or more nodes fail, the system will continue to operate, since the data is stored on other nodes. This ensures the integrity and stability of all platforms.

Where to buy Stellar?

Buying XLM for RUB on the EXMO exchange is very easy, you just need to follow a few steps:

- Login to EXMO or create an account if you don't have one;

- Go to the “Wallet” section of your personal account;

- Select RUB currency and top up your balance;

- Go to the “Trades” page, select XLM/RUB in the list of currency pairs;

- Scroll down to “Buy XLM” and “Sell XLM”;

- Select order type: Limit, Market or Stop:

- Use Order if you want to instantly buy or sell XLM at the current market price (currently 1 XLM is 21.43 RUB). This order does not require any additional settings.

- A limit order is an order to buy (or sell) XLM at a certain, more favorable price. A buy limit order is executed only at or below the specified maximum price, and a sell limit order is executed only at or above the specified maximum price.

- A stop order is a pending order for automatic purchase or sale operations, which is executed according to previously established restrictions in order to make a profit and (or) minimize possible losses.

- Fill in the “Amount” and “Price” fields (pay attention to the transaction fee).

- Click the “Buy” or “Sell” button.

Easy, right? Now you know that purchasing Stellar and exchanging Russian rubles for Stellar are available to all users. You just need to figure it out a little.

Pros and cons of Stellar Lumens

There are several main advantages that ensure the success of the Stellar project:

- Implementation of decentralized operation of the platform based on open source;

- Ensuring equal rights for project participants;

- High speed of operations – Stellar is capable of processing about 1000 operations per second, while the confirmation time is less than 5 seconds;

- Support for all cryptocurrencies and synchronization of work with banking systems;

- Ensuring the reliability of the platform through the use of cryptographic algorithms and independent base nodes.

Among the disadvantages of the Stellar project are the lack of the ability to mine cryptocurrency and the requirement for a certain amount of currency in the account. The minimum threshold of only 20 XLM is used to prevent spammer attacks that can slow down the platform. Mining was not initially envisaged by the creators of the project.

Advantages and disadvantages

Stellar was supposed to be a powerful tool for making cross-border payments anywhere in the world. The system combines banking instruments obtained from Ripple and its own decentralized protocol.

The main advantages of Stellar:

- High speed of transaction processing - unlike the first cryptocurrency Bitcoin, in the Stellar system the transfer is sent directly to the validator. The money is credited to the recipient's account 5 seconds after the payment is created;

- Low energy consumption - no mining, thanks to the implementation of the Stellar Consensus Protocol, the transaction verification process in the Stellar network is more energy efficient than with the Proof-of-Work (PoW) consensus algorithm;

- Easy access - XLM can be used for blockchain transactions in countries where virtual assets are little known or are banned by authorities.

Disadvantages of Stellar:

- Imperfect security system - if there is any suspicion of a hacker attack, the network freezes;

- Falling cryptocurrency value - Stellar’s annual inflation is 1%;

- Low profitability of maintaining a node;

- Limited capabilities for decentralized applications.

Most often, Stellar’s services are used by companies operating in underdeveloped countries of Africa, with the exception of the IT giant IBM, which began collaborating with Stellar in 2022.

It’s easier and cheaper to launch an ICO campaign on the specialized XLM platform than on Ethereum; several young blockchain projects have already taken advantage of this. However, they do not yet represent serious value.

How to buy Stellar?

Since mining Stellar Lumens is not possible, the only way to get the Stellar cryptocurrency is to buy it.

This can be done on most major cryptocurrency exchanges.

- On Binance the coin can be purchased with Bitcoin, Ethereum and Binance Coin

- On Bittrex - for Bitcoin, Ethereum.

- On Kraken - for Bitcoin and Ethereum.

- On Poloniex - for Bitcoin.

Orange Exchange Pro recently provides the opportunity to purchase the Stellar cryptocurrency for fiat funds - dollars and rubles. This exchanger works with bank cards and various popular payment systems - Qiwi, Payeer, Perfect Money.

Where to store XLM cryptocurrency?

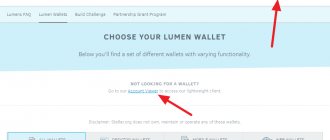

The most popular way is to use the official Stellar Wallet crypto wallet. There are several types of wallet. The most reliable of them is the desktop version.

Installation is simple and does not take much time.

- You need to go to www.stellar.org;

- In the Wallets section, first select Desktop Wallets, and then Stellar Desktop Client;

- Select the version according to the installed operating system;

- Download the required archive;

- Install the program on your PC;

- First select the “Create new account” tab, then “Create an empty account”;

- Create a password, save it in a safe place, confirm the password twice;

- Then click “Encrypt account” - the application will generate an encryption file that you need to save on your PC;

- Select “Show secret key”, copy and save the key. The key will be required to confirm transactions through the Stellar platform;

- The wallet is now configured and ready for use by the user.

On the official Stellar resource there are 14 options for crypto wallets designed to store the XLM cryptocurrency:

- Desktop versions;

- For mobile devices;

- Online wallets;

What affects the Stellar price?

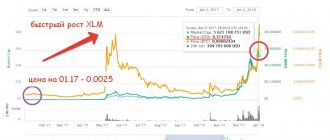

Although the currency was created in 2014, it began to be traded on XML cryptocurrency exchanges only in 2022. The first cryptocurrency exchange to offer transactions with the Stellar cryptocurrency was the Poloniex trading platform.

At the beginning of trading in the winter of 2022, the Stellar rate fluctuated around $0.06, but by the spring it had dropped to $0.01. It was officially stated that the reason for the drop in price was a cyber attack on Poloniex. A number of prominent analysts believe that the attack was targeted and clearly ordered. This version is justified by the fact that a number of traders in March 2022 played to lower the coin rate.

Until the summer, the price of XLM remained virtually unchanged. In the fall, it became known that IBM was going to begin using the Stellar platform to develop and create a comprehensive global settlement system. Recently, three more large trading platforms included cryptocurrency in their listing - Bittrex, Binance and Kraken

The value of XLM began to rise due to the influx of investments. In October 2022, it reached $0.04, and in December it jumped to $0.2.

When the cryptocurrency market plummeted in January 2022, Stellar Lumens managed to maintain its position.

The signing of new important contracts on cooperation with the Pundi X service and the start of currency trading on the OKEx trading platform caused the XLM rate to rise to $0.7. Thus, those who bought a coin in the spring for $0.01 and sold it in January for $0.7 increased their investments by 70 times.

This caused a sale of the XLM cryptocurrency and, as a result, a sharp decline in its rate. A correction has occurred and currently the exchange value of the Lumen cryptocurrency is $0.3. Currency owners who have not sold their XLM assets have the opportunity to receive significantly greater income.

Cryptocurrency Stellar Lumens (XLM)

Stellar cryptocurrency is a platform very similar to Ripple. Only more advanced, with weaknesses corrected and productivity increased. The goal of the developers is to make official non-cash payments between individuals and legal entities as simple as possible.

This platform allows you to exchange not only cryptocurrency, but also regular money, as well as smart contracts. Since 2014, the tokens of the Stellar platform are called Lumen (before that, altcoin tokens were called Stellar). Due to the fact that the system uses distributed ledger technology, its tokens can be exchanged for goods, services and other cryptocurrencies (lumen in this case will serve as a kind of bridge between the sale of one asset and receiving another in return). It's a good idea to use Lumens as a long-term investment tool, hoping that the coin will only increase in value rather than fall.

Brief history of creation

The platform was founded as a fork of Ripple by developers Joyce Kim and Jed McCaleb. The Ripple cryptocurrency has been quite successful since 2012 to this day, but it is not without its shortcomings, so Kim and McCaleb decided to create Stellar and eliminate the weak points in this platform that do not suit Ripple users. In particular, the fact that the Ripple code is closed, and only the owner of the system can manage the rate, as well as make changes to the platform.

A non-profit company, the Stellar Development Foundation, was created for development. The company has an official website where anyone can read about its activities. At the beginning of its activity, the Stellar platform worked using the Ripple protocol, but a year later it had its own, the code of which is available to everyone.

The creation of the cryptocurrency dates back to 2014, but only in 2017 the coin became available to users on the Poloniex exchange. From winter to spring 2022, the cost of Lumen fell 6 times. Exchange representatives consider this to be the consequences of a hacker attack on the resource. By October, the value of the currency had leveled off, and in December it even exceeded the previously known maximum.

At the beginning of 2022, when the cryptocurrency market collapsed, Lumen did not lose its position, but on the contrary, increased in price, thanks to the competent policy of the developers in concluding contracts with large exchanges and cryptocurrency services.

Features of the Stellar cryptocurrency

Differences and advantages:

- the database is distributed among users;

- open source and reporting available to everyone;

- the platform allows you to carry out several thousand transactions every second;

- Confirmation of each transaction takes no more than 5 seconds;

- Lumen can be used to exchange and transfer any assets, cryptocurrencies and monetary units;

- the platform runs on the open SCP protocol, which increases its performance;

- the transaction price is low;

- emissions and inflation are strictly fixed;

- the system allows the use of multi-signatures and smart contacts;

- Stellar is compatible with other representatives of the cryptocurrency market;

- high level of protection due to the use of cryptographic encryption;

- clients and plugins can be created on the basis of this platform;

- Lumen can be used for almost any type of cashless payment;

- owners of large amounts of tokens cannot manipulate the rate, since there is a restrictive agreement obliging them not to sell this cryptocurrency for 5 years;

- a quarter of all available tokens are owned by non-profit organizations, another 5% is frozen to maintain the operation of the system.

The computing power of the platform is distributed over many interchangeable servers, which ensures reliable operation of the system, even if some of the servers fail. This feature also allows the system to operate autonomously, excluding external interference.

Stellar storage methods

There are several versions of the official Stellar Wallet for storing digital coins. The most reliable of them is considered to be the desktop one. In addition to the official wallet, the following are also suitable for storage:

- desktop wallets – Ledger and Stargazer;

- mobile – Lobstr, Stargazer, Papaya, Centaurus;

- online services – Ledger, Stronghold, LuPoEx, StellarTeam, Lobstr, Papaya, Saza.

But, despite all this diversity, most owners of this cryptocurrency still prefer to store it on the desktop version of the official wallet, due to the high degree of protection of funds.

How to mine Stellar?

In the case of lumens, there is no mining and is not expected. For this system, it was not even thought about by the developers. You can become the owner of tokens only by purchasing them. And this is logical, because any mining will have an impact on the internal economic model and will not allow the system to have clearly fixed emissions and inflation. Therefore, the only way to get this cryptocurrency is to buy it.

Buying and selling

There are few exchanges that trade the Stellar cryptocurrency. The most popular of them:

- Binance;

- Bittrex;

- Poloniex;

- CEX.IO.

On these exchanges, purchasing tokens is available for Bitcoin, Ethereum and the site’s internal currency. There is also an exchanger called Orange Exchange Pro, which allows you to buy Lumen for money from QIWI, Payeer, Yandex-money electronic wallets and even from a Sberbank card. The number of exchanges where you can purchase lumens is constantly growing, developers are entering into new contracts with trading platforms, thereby strengthening this cryptocurrency even more and attracting new investments.

Project development prospects

The developers managed to realize their idea, and they came up with a faster, cheaper, more reliable, and most importantly decentralized variation of Ripple. Therefore, lumens are gaining more and more popularity, and, according to experts, they will only increase in price. In addition, the Stellar platform allows you to instantly exchange any asset using Lumens without incurring fees, which makes it unique among many competitors.

The Stellar technology itself is still being actively developed. It is already loved by many large corporations and is actively used by them, which attracts new investments in the development of the project. However, the potential for practical application of the platform is still high and has not yet been fully realized.

The world famous giant IBM also plans to use Stellar technology in the near future. After such a statement, there is no doubt about the reliability and success of this cryptocurrency. And the interest of investors, including financial ones, in the currency is growing quite quickly, which also subtly hints that this digital unit will at least stay on the market for a long time, promising its holders good profits.

Experts predict a 15-fold profit by the end of 2022 for investors who purchased Lumen, and this is not the limit. So now is a good time to invest in this cryptocurrency, while it is still not worth that much.

The main thing is not to panic when the price drops slightly and wait patiently for the right moment. Although, as a long-term investment tool, these tokens are also quite suitable. The investor’s maximum risk in this case is only a slight drop in the exchange rate, which will level out quite quickly, and perhaps even grow. But, despite the very rosy forecasts for the Stellar platform, in the long term you should still not forget to monitor the situation on the market and be prepared for any turn of events.