Hello! In this article we will talk about a promising type of investment – crowdinvesting.

Today you will learn:

- How to give a start to your ideas for the future of business;

- What are crowdinvesting projects and on what platforms you can learn about them;

- Who can become an investor?

Content

- Crowdfunding and crowdinvesting: the essence of the concepts

- Pros and cons of crowdinvesting

- How did crowdinvesting develop?

- Crowdinvesting participants

- Classification of crowdinvesting

- The principle of operation of the sites

- Who can engage in crowdinvesting

- What is the life path of a project on the crowdinvesting platform?

- Is it possible to earn a lot on crowdinvesting?

- Advice for novice investors

- Who can place their project on a specialized site

- How does crowdinvesting differ from other forms of investment?

- The most famous platforms for crowdinvesting in Russia

- Is it possible to do without platforms?

- How crowdinvesting can help at the country level

FAQ

Question 1. Boomstarter does not give away money, what should I do?

Try contacting the project manager, email, support service, etc. Both negative and positive reviews about the company were found online.

Some negative reviews contain information that the project is moderated and published on the site in the 3rd week, some that they do not pay (don’t give) money.

But you shouldn’t draw conclusions based on several reviews about the site. Read all the terms and conditions of participation on the site, clarify all questions and nuances before posting the project on the platform.

Question 2. How to create a project on the Kickstarter platform?

Since the site is currently presented in a foreign language, you need to use a translator. You also need to find intermediaries in the USA and other Western countries due to the Amazon Payments service (currently not working in the Russian Federation) to withdraw funds if the transaction is successfully completed.

Crowdfunding and crowdinvesting: the essence of the concepts

There is individual and collective investment. In the first case, one owner of equity capital uses it in directions beneficial to him.

The second form of investment involves the presence of a large group of people, often even strangers to each other and living in different parts of the globe. They buy shares in a large project and subsequently make a profit.

This collective form of investment is inherent in crowdfunding. This concept is a type of investing in some new risky project (startup), most often with the goal of supporting its owner financially without any benefit. You simply do charity out of your own motives and give others the opportunity to realize their dreams.

Crowdinvesting is one of the types of crowdfunding, which does not involve gratuitous assistance, but a return of invested funds with favorable interest rates. You give money for the development of some business, which, upon further implementation, gives you a share of its profits.

What are the main risks

Crowdinvestment is a rather risky undertaking. When investing in this type of project, an investor must be prepared to face the following types of risks:

- Risk of non-return of invested funds;

- Risk of loss of profitability;

- Risk of “freezing” of invested funds.

The risk of non-return of invested money consists of a possible complete loss of all investor funds for one of the following reasons:

- Bankruptcy of the financed project. There are often cases when the money received for the development of a project is used extremely ineffectively, which leads to inevitable failure. However, in this case, there is a ghostly opportunity to return at least part of the invested funds through the court (unless, of course, after bankruptcy the company still has any assets that can be put up for auction to pay off creditors);

- Fraud on the part of the management of the funded project. Unfortunately, there are often situations when fundraising occurs for fake projects created for the sole purpose of collecting these same funds. In this case, there can be no talk of any return of the invested money;

- Fraud on the part of the crowdinvesting site or its bankruptcy. And it also happens that the platform itself turns out to be insolvent as a result of bankruptcy, or its creators, under the guise of investing in profitable projects, initially collect money exclusively for their own needs (in order to subsequently escape with it in a direction known only to them).

Investors investing in pools of projects may face risk of less profitability Initially counting on a high percentage of income, in the end it is quite possible to face the fact that the lion’s share of the projects included in the pool will turn out to be dummies. And the profit brought by those who remained, in relation to the invested capital, will amount to interest barely exceeding the profit on a bank deposit. Considering the initially high level of risk, such a meager profit is almost equivalent to failure (although such an outcome of events, of course, is much more favorable than the one in which the investor loses everything).

Finally, none of the investors is immune from the fact that the company that received money from them will seriously stagnate in its development. Initially announced plans for business development can be greatly adjusted towards longer deadlines. In this case, the investor faces the risk of “freezing” the funds invested in the project. As a result, he may receive them back, even along with the promised dividends, but far from the time he originally planned. Naturally, this can hit his pocket hard, namely, it will reduce the expected return as a percentage per annum without giving him the opportunity to invest frozen funds in other projects.

Pros and cons of crowdinvesting

Crowdinvesting has several advantages that attract new investors:

- Possibility to invest a small amount (for those who do not have large sums to invest);

- Having a high income when choosing a far-reaching project;

- You can invest in several projects so as not to lose your money and definitely make a profit.

At the same time, crowdinvesting is not suitable for everyone, as there are also disadvantages:

- The development of fraud in this area (an unscrupulous person can take your money and spend it for his own purposes. He will not return a penny to investors);

- The project may not raise the required amount (then the startup will not be implemented);

- Perhaps the implemented project will not bring any profit or will be unprofitable;

- There are few legislative norms regulating the relations of participants;

- There is a risk of bankruptcy of the platform itself, which acts as an intermediary between investors and project owners;

- You will not be able to predict the outcome of the transaction in advance (you may lose 100% of your invested funds).

By placing your project on display for potential investors, its owner receives the following advantages:

- You can promote your idea even if you do not have the funds to implement it;

- You can collect a string from the world and get the desired amount (you do not depend on two or three large investors dictating their terms);

- An easy process of raising money (you just register on a special platform, and don’t run around the city looking for sponsors).

How to raise money through crowdfunding - 5 simple steps

The first thing you need to decide on is an original idea. Not abstract, but preferably thought out to the smallest detail. One that will seem promising to the investor and will force him to make a contribution immediately after reviewing it.

The further algorithm is presented in the form of a step-by-step guide.

Step 1. Select a platform for crowdfunding

There are plenty of resources online that provide access to everyone. Depending on the topic of the project, final goals and method of implementation, choose the most suitable platform. By default, the site should be functional, reliable and verified.

Step 2. Create an account on the site

The next step is registration and account creation.

Provide real data if you want investors to trust you.

Step 3. Prepare a project description

Each site has its own conditions for submitting an application. In some cases it is enough to indicate the goal, but more often it is necessary to describe in detail what the essence, originality and commercial attractiveness of the project are. It is advisable to identify the target audience and describe how investors’ money will be spent. Photos and videos will not be superfluous.

A real example of a project from the StartTrack site

buys 200-300 g batches of scrap gold from pawnshops, combines them into one large lot and sells them to scrap gold processing plants.

The gold scrap market in the Russian Federation is about 4 billion rubles per month, and the company plans to take a share of 10-15% of this market. To implement the project, about 250 million rubles are needed. working capital. The project is designed for serious investors with long-term plans.

Step 4. Specify the required amount and time limit for collecting funds

The site allocates a limited time for fundraising. If you do not have time to collect the required amount of funds, the fate of the deposits depends on the crowdinvesting model operating on the sites. Most likely, the funds will simply be returned to the owners.

Step 5. Calculate the costs of gifts to investors and launch the project

Investors love gifts and prizes, so this item should be included in expenses in advance.

Have you thought through all the nuances, calculated all the articles? Launch the project and wait for investment. If your budget allows, launch a parallel PR campaign in the media.

For examples of other investment options, see the articles “Investing in MFOs” and “Investing in Agriculture.”

How did crowdinvesting develop?

Crowdinvesting is a relatively new concept both for foreign countries and for Russia. For the first time, Americans began investing in projects. The idea then spread to Great Britain and Italy. Today, this form of investment is also known in Russia.

The first site appeared in America in 2005. 2011 was a landmark year for the development of crowdfunding in the UK. And in 2012, the first site was launched in our country.

The American population actively invests in startups; this type of investment has long been known in the United States, and therefore has managed to gather many fans. European sites are actively operating and increasing the number of their clients, as well as successfully implemented projects.

In Russia, over the short years of the existence of crowdfunding, there have already been several cases when sites were closed. This suggests that this area is just beginning to sprout in the country. Our population is accustomed to keeping money under their pillows or in bank deposits. No one even thinks about giving them to risky projects through crowdinvesting sites in Russia, which could go bankrupt.

Nevertheless, there are already positive results from the introduction of crowdinvesting. For example, a well-known company raised funds for business development thanks to other investors. What’s most interesting is that investors in Russian startups are mostly Americans.

Today crowdfunding is most developed in the USA and the European Union. South Africa, Australia and Russia are far behind them.

Crowdinvesting platforms

The investor can invest in both Russian and foreign companies. Each of them has pros and cons, the choice is a personal matter for everyone. Let's look at several crowdinvesting platforms.

Foreign sites

Crowdinvesting platforms exist all over the world. Most of the companies are located in the USA and Europe. Below is an infographic showing the number of platforms by country and their development potential.

It is not possible to consider all sites. Let's take a look at industry leaders.

Venue 1. Funding Circle

English company. Is a world leader in crowdinvesting. Among its investors are multinational companies and even the governments of some countries.

The average yield is 6.2% per annum. For European organizations this is a very high figure, it exceeds the return on deposits by 3 times (European banks give about 2% per year).

Peculiarities:

- works only with ready-made businesses;

- loans are not available to individuals;

- minimum investment amount is £20;

- the maximum limit is not limited;

- Commission for the investor is 1%.

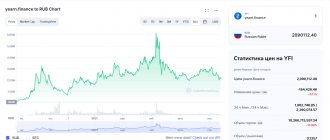

Venue 2. Republic

Popular French service. Most of the projects operate on the principle of equity crowdfunding.

Platform features:

- The minimum deposit amount is $25;

- maximum - $107,000;

- cooperates only with accredited investors;

- allows you to invest in cryptocurrency.

The platform provides an opportunity to become a real crypto investor. The user gets access to IEO, private sales, and purchase of tokens.

You may be wondering: what are ICOs and IEOs? How to invest in ICO?

Crowdinvesting sites in Russia

Site 1. StartTrack

The largest platform in Russia has proven its reliability and earned credibility among investors. Provides two options for earning money: enter into a loan agreement (yield of about 25% per annum) and purchase a share of the company’s assets.

Features of the site:

- the minimum amount for investment is 100,000 rubles;

- commission - 5% of the invested amount;

- works only with accredited investors.

All transactions can be completed online. The procedure takes no more than five minutes.

Site 2. City of Money

The company specializes in small business lending. Most of the enterprises presented on the site operate in the field of trade and services. Employees claim that all entrepreneurs have an unblemished credit history and a solid annual income.

Platform features:

- the minimum amount for investment is 50,000 rubles;

- investment period - from 1 to 3 years;

- commission for services - 2%;

- maximum yield - 30% per annum.

The platform is perfect for beginners, as it works with users without accreditation and allows you to start with a small amount.

Venue 3. Penenza

The company is a member of the working group on crowdinvesting at the Central Bank of the Russian Federation. Specializes in issuing short-term loans at high interest rates.

Platform features:

- the minimum amount for investment is 5,000 rubles;

- minimum investment period - 2 months;

- the average income level is 20% per annum.

In addition to the above, the site has its own department for working with accounts receivable. This allows you to increase the return rate to 95.4%.

Venue 4. Venture Club

It is a venture fund available to a limited number of clients. Slightly different from classic crowdinvesting. To gain access to investments, you need to make a one-time contribution of 100,000 rubles.

Features of the project:

- the minimum amount for investment is 10,000 rubles;

- There is no site commission.

An investor has the opportunity to make a profit in two ways: by purchasing a share of the enterprise or by issuing a loan.

Crowdinvesting participants

Crowdinvesting implies the presence of several participants in the transaction (objects and subjects).

These parties are:

- The startups themselves (projects that need funds for promotion);

- Micro-investors (individuals who invest small amounts of money);

- Platforms (all kinds of platforms for virtual meetings of project owners and investors);

- Venture funds (special organizations that raise funds for the development of high-risk projects);

- Professional private investors (these are millionaires who want to increase their wealth);

- Business angels (individuals who have great wealth and are willing to spend it on developing projects at the idea stage. They are most often interested in technological developments);

- The state (in Russia, this party currently ranks last among participants, since there are no laws regulating the activities of platforms as such).

Classification of crowdinvesting

There are three main crowdinvesting models:

- Royalty;

- Lending with the help of the masses;

- Joint Stock.

The first model implies that if the startup is successfully implemented, the investor will receive some income from the company’s profits. This form is applicable in the field of cinema, music, games, etc.

The second option is similar to issuing a loan to the startup owner to develop his idea. After collecting money for the project, it is implemented. After this, investors receive a return on their investment and interest.

Shareholder crowdfunding is the most interesting model that allows you to become the owner of company shares. When the startup owner is able to place shares on the stock exchange, all investors have the right to purchase them and can also participate in the company’s shareholder meetings.

The following categories of crowdfunding are also divided:

- According to the purposes of creating the project (social, political or creative);

- According to the type of income of the investor (charitable - which does not imply profit for the investor and financial - with the payment of interest).

What is crowdfunding, the whole point

If we try to explain what crowdfunding is in simple words, we will get something like this. Crowdfunding is a way to attract investment to implement your idea. Moreover, the required amount is donated by people interested in the project. As a result, as they say, “the whole world” can promote some invention, idea, game and more.

The term crowdfunding is about 15 years old . It was first used by a famous foreign journalist writing an article about collective investments on the Internet, and quickly came into use, becoming an independent phenomenon with its own rules and features.

Translated into Russian, crowdfunding means “crowd financing.”

“If you are the author of a unique idea, but cannot bring it to life due to lack of funds , then crowdfunding will come to your aid. What is the main essence of this phenomenon? It's simple. We can say that it brings together interested people who are ready to donate their money for a common goal.”

Knowing what crowdfunding is and how it works, you can become a successful businessman, try yourself as an investor, or feel like a philanthropist. After all, most donors or, as they are also called, backers, give money free of charge, without claiming a return.

Related material: How do I earn $5,000 a month on websites!?

How does crowdfunding work?

What crowdfunding is is clear in general terms. Now it's time to move on to how it works? There is nothing complicated here either:

- the author or group of authors develop the project;

- calculate the budget required for implementation;

- announce a fundraiser on a personal website, but a crowdfunding platform will be more effective;

- interested donors transfer money;

- when the required amount is reached, a transfer is made to the author’s account;

- implementation begins .

It is important to take into account that a standard crowdfunding campaign is not an uncontrolled collection of money. On special platforms, curators track all projects, and the author reports to investors.

Methods of financing crowdfunding platforms

Crowdfunding platforms offer different funding models to authors and backers:

- free of charge - money is transferred without the possibility of returning it or making any profit, but even in this case it is considered important to report on the stages of implementation of the idea;

- for a bonus or product – investors are initially offered a small gift or the result of a implemented project (disc, game, useful invention and more);

- receiving part of the profit - the backer is considered a full-fledged investor who will receive part of the profit from the implementation of the project for life or on other terms.

The last point indicates that making money on crowdfunding is possible. Although most donors do not expect significant income at all.

Law on crowdfunding in Russia

Crowdfunding in Russia, unfortunately, does not have a legal basis. And this means that:

- invested funds cannot be insured;

- the investor bears all risks of loss;

- in crowdfunding there is a high risk of encountering scammers;

- The author of the project can refuse his obligations at any stage.

The absence of any guarantees is something that many potential donors see as a significant disadvantage of crowdfunding. Abroad, this activity is clearly regulated and the risks for backers are practically reduced to zero.

The principle of operation of the sites

The intermediary between the investor and the project is a special platform that has its own characteristics. This is a kind of exchange that helps startupers (development owners) realize their ideas with the help of a large number of investors. It gathers a large number of people who want to invest their money in the project.

To become a member of this site, you just need to go to the site and register. Transferring money in favor of a project you like occurs in just a few clicks. First, you need to deposit funds into the site’s account. Then transfer them to the startuper’s account.

Fundraising takes varying amounts of time. It all depends on the size of the required amount and the nature of the project. As soon as the project collects the required money, it begins to implement its developments.

There are fees for various types of transactions. Their size is determined by the working conditions of a particular site. Some platforms take a commission on the total amount raised by the project, while others charge a commission on each payment to the startup.

Who can engage in crowdinvesting

If you want to invest your accumulated funds in any project, you need to think in advance about all the risks and the amount of return you would like to receive.

Crowdinvesting is suitable for you if you:

- You are not afraid of losing the money invested (the riskiness of the transaction is due to the fact that the project may not be realized);

- Are you ready to wait a long time (this area involves receiving income only after a few years);

- You realize that you are not investing in a finished project, but only in an idea (all crowdinvesting implies the presence of several stages of investment);

- You have extra money (if you have been saving for some important purchase, you should not risk it);

- You will be able to assess the future prospects of the project yourself (not all exchanges check startups for their compliance with reality).

What is the life path of a project on the crowdinvesting platform?

Implementing a startup is a long process that can take several years.

The main stages of its development include:

- Registration on the site (choosing a direction and laying out all the necessary information for potential investors);

- Collection of the amount;

- Going beyond the platform (when the required amount is collected and the startup begins to be implemented in life);

- Starting a business (getting started);

- Development of the company (the emergence of regular customers and an increase in their number);

- Receiving your first net profit (after several years).

When a project goes off-site, the investor needs to constantly monitor its implementation. He should be interested in how the company is doing, so that in case of possible failure he can sell his share and not be left in the red.

Transfer of shares in the company

The transfer of a share in the authorized capital or a certain number of shares to the investor is carried out by concluding standard agreements for such a procedure.

Things are more complicated in cases where there is no company as such, the size of the authorized capital or the number of shares is unknown. Some lawyers advise in these cases to enter into an agreement on the intention to make a transaction in the future or to use the “credit” model of crowdinvesting, and subsequently accept a share as offset for the fulfillment of loan obligations. Such a move is just a theory. It was not possible to find any real examples of its implementation.

Is it possible to earn a lot on crowdinvesting?

The more risky the project, the more you can earn from it. But this statement only applies to successful startups. If you invest in several unpromising projects, you will lose every share purchased.

When you invest a small amount in one project, there is a 90% chance that you will not get it back. Therefore, when investing in venture capital, it is better to diversify the portfolio, that is, distribute the available funds in different directions.

In the case of crowdinvesting and a small available amount, it is better to invest the latter in equal shares in several startups. If at least one of them wins, then the income received will cover all losses from the others.

Currently, there are a large number of sites with a high barrier to entry. If you have an amount of less than 100,000 rubles, you will not be able to become a member of one of them. True, platforms with a lower participation rate also exist, and you can register on them even with 1000 rubles in your pocket.

In some countries, the minimum total threshold for joining such a platform is established at the legislative level. And if your annual income is below the legal limit, then you won’t be able to become an investor.

Existing platforms understand that it is easier to make money on a project with the help of a large number of investors who invest small amounts. If you deposit 1000 rubles, of course, your profit will not bring in millions, but it is quite possible to get up to 1000% in a year. It all depends on the investor’s intuition and chance.

Advice for novice investors

If you decide to finance a project, then first you need to conduct its examination. This action in some cases is carried out by the platform on which the project is hosted.

The site owners immediately weed out unpromising areas after a thorough analysis. They study the business plan presented for general review and compare various indicators. If the obtained values clearly cannot be implemented in life, then the fate of such a startup will not be decided by the platform.

There are sites that offer investors untested projects. Investors themselves must analyze their viability.

To invest money in the “right” startup, follow these recommendations:

- Pay attention to the risks indicated in the plan (correlate their magnitude with your possible losses);

- Look through the entire object and try to understand whether it will gain its fans and whether the product of its implementation will be in demand;

- Find out as much information as possible about the owner of the startup (how much money he has already raised for the project or how much he personally has available for implementation purposes. If he already has some kind of enterprise, pay attention to finding information about it).

How do crowdfunding platforms make money?

Earnings from crowdfunding platforms are mainly based on receiving commissions from projects. The commission on different sites may be different, for some it is 5%, for others 15% .

Platforms can also generate additional income, for example, some platforms that raise funds for creative projects then sell albums, books and other similar products.

The same applies to some sites focused on commercial projects, which subsequently sell various products.

Commissions are not taken at all from charitable and very often social projects.

For example, the Russian crowdfunding platform Rusini does not charge a commission at all, since it is intended to solve social problems

Who can place their project on a specialized site

If you have developed an interesting plan, you can implement it using different means:

- Using personal savings;

- Receive financial assistance from the state in the form of a grant;

- Take out a bank loan;

- Find an investor.

Most often, your own savings are not enough to implement your ideas, and therefore borrowed funds are a way out of the situation. Support from the regional administration can only be useful if you need a small amount.

Also, government assistance involves several stages of obtaining money - from collecting a large package of documents to speaking before a commission, which may not approve of your ideas.

A bank loan implies a too high interest rate. And if your project is not implemented, you will also have to repay the loan amount with all interest.

The best way to promote your development is to find an investor whose goals coincide with yours. Most often, they demand income only if their undertakings are successfully implemented.

If the startup fails, you won't owe anyone anything. In order not to waste time searching for a good investor, you can register your business plan on one of the specialized platforms. Here you can find a large number of helpers. Collecting money does not burden you, since this is done by the platform using a well-functioning automatic system.

Latest news on the crowdfunding market

1) In 2014, she announced the launch of her crowdfunding platform “ Together: for good deeds ,” which is designed to simplify the collection of money via the Internet for various charitable needs and social projects.

2) The WebMoney payment system has launched a new one, which allows service users to join groups to collect funds for the purpose of purchasing goods from wholesale suppliers at low prices or for other large orders in foreign stores;

3) WebMoney Transfer has created a new service “ Funding ”, which has 4 directions for collecting funds. Thanks to this service, you can raise money not only through classic crowdfunding, but also finance charitable projects, make collective purchases, organize various events, and so on.

How does crowdinvesting differ from other forms of investment?

You must be aware of the risk of your investment. Crowdinvesting is a form of venture investment. You can get a high return or lose all your invested money.

Unlike mutual funds, individual investment accounts or investments in securities, you are investing specifically in the idea of a future project (which it may not become).

At the beginning of investing, you yourself choose which startup to invest in, the amount for these purposes and the platform. You need to control the entire process of implementing your idea outside the platform.

This activity is quite difficult for inexperienced private investors. And due to the financial illiteracy of our population, some do not even know that they can earn money in this way.

Crowdinvesting carries great risks, and therefore only those who are not afraid of losing money or have a large sum to diversify the project can engage in this type of investment. You also will not know a clear completion time for the project. This date may not coincide with that indicated in the business plan, and therefore the deadline for making a profit may be delayed.

In what form can you make a profit in crowdinvesting - 3 main forms

Now about what ways there are to make a profit for investors in certain projects.

In fact, there are more than 3, but we will look at the most common options.

Form 1. Royalty

Reward in the form of a portion of the profit that the financed project will bring. The royalty amount depends on the amount of the deposit. This form is practiced in the music industry (for example, the platform for young musicians SonicAngel), in the development of computer games, and in the creation of films.

The royalty principle is promising and very effective. The investor is motivated to receive income, and the investor’s element of involvement with the project is preserved.

Form 2. Fixed interest and repayment of the debt amount

The investor knows in advance when he will receive his funds back and what the percentage of profit will be. This form is the leader in terms of the amount of funds raised. The creator of the project has broader prospects than with bank loans, and the investor receives definite guarantees of return of funds.

The source of financing is exclusively the capital of individuals. Most foreign crowdinvesting platforms work exactly according to this scheme. Examples are the American platform Lending Club (annual income more than $1 billion), the British Funding Circle, and the German Smava.

Form 3. Participation in share capital

This form is considered the most advanced in the world of crowdinvesting. As a reward for the contribution, the investor receives a share of ownership, the right to receive dividends and votes at the general meeting of shareholders.

Another article on the topic of profitable investments is “Individual investment account.”

The most famous platforms for crowdinvesting in Russia

There are several Russian platforms that are the most popular.

These include:

- StartTrack - appeared in 2014, the minimum entry threshold is 10,000 rubles, and the profitability is up to 35%. This is one of the most famous platforms, which has established itself as a reliable crowdinvesting platform;

- Aktivo – developed by the owner of the KupiVip and CarPrice platforms. It invests in commercial real estate, which is leased to the Pyaterochka and Victoria supermarkets. To become a participant, you need to deposit at least 500,000 rubles. Promised profitability – up to 17% per annum;

- Stream is a project of Alfa-Bank. The minimum amount is 10,000 rubles, which must be kept for at least six months. The profitability promised by the bank is 30%;

- Simex – the company has existed since 2015. In its short period of operation, it has already successfully implemented 29 projects. A special feature of the site is the possibility of passive income by attracting referrals (you invite other people to the exchange, from each of whose transactions you will receive income).

Crowdinvesting is collective investment. Crowd - crowd, Investing - investment. That is, crowdinvesting is “investing in a crowd.”

The principle is simple: a person came up with a startup - people chipped in to implement it - the profit from the business is divided among everyone in pre-agreed proportions.

Crowdinvesting is one of the varieties of crowdfunding (Crowd - crowd, Funding - financing).

Crowdfunding

Usually, special crowdfunding platforms - specialized sites that organize the entire crowdfunding process (vetting and analysis of startups, allowing startups and investors to find each other, fundraising, transfer of funds, legal issues, advertising, etc.).

Crowdfunding comes in three directions:

No remuneration (charity). Until 2012 it was the dominant direction. A striking example in Russia is Dobro Mail.ru

With non-financial reward. Non-financial rewards usually include copies of the final product (book, disc, ticket, etc.), autographs, mentions in the credits, participation in the process, and generally anything that the author of the idea can offer. This is the most popular direction of crowdfunding today. The most famous platforms in Russia working in this direction are Boomstarter and Planeta. Around the world - Kickstarter and Indiegogo.

With financial reward (crowdinvesting). Actually, this is what will be discussed in this article.

Types of crowdinvesting

In turn, crowdinvesting comes in three types:

Royalty. With this form of crowdinvesting, the investor has the right to count on a share of the profit of the financed project. This approach is often used when financing music projects (SonicAngel), films (Slated) and games (LookAtMyGame). There is even a platform that allows you to “sell your soul into slavery” for 10 years - Upstart. A person leaves his resume, describing what he needs money for - people chip in - for 10 years a person pays them a certain part of his income.

Public lending (crowdlending). Allows individuals to lend to other individuals or companies. At the same time, the lender receives a higher interest rate than banks offer, and the borrower receives a lower loan interest rate than banks offer, as well as a simplified procedure for obtaining a loan. A special case of public lending is social lending. Here, loan rates are symbolic or non-existent. It turns out to be a kind of mixture between lending and charity.

Crowdlending provides an opportunity, through the crowdlending platform, for lenders and borrowers to bypass intermediaries in the form of banks, which is beneficial both for the lenders and borrowers themselves and for the crowdlending platform.

Equity crowdfunding. The most advanced form of crowdinvesting, in which the investor becomes the owner of part of the financed project (shareholder), with all that it entails (the right to participate in the management of the company, the right to receive dividends). However, this form of crowdinvesting is contrary to the laws of many countries. The bureaucracy puts a spoke in the wheels of the crowdinvesting machine. However, more and more countries are passing laws legalizing and regulating this form of crowdinvesting, which undoubtedly has a positive effect on the development of the economies of these countries.

Advantages and disadvantages

Let's look at the pros and cons of crowdinvesting.

First, let's look at what pros and cons an investor will have to face.

Pros:

- Possibility to invest small amounts

- Opportunity to find a “gold mine”

- Wide opportunities for diversification

Minuses:

- Fraud risk

- The risk that the project will not be able to raise the necessary funds

- The risk that the project will be unprofitable

- There are no laws protecting the interests of investors in this area

- Risk of bankruptcy of a crowdinvesting platform

As you can see, there are plenty of disadvantages for investors. But for a startup , crowdinvesting has a lot of advantages:

- Opportunity to manage your own startup

- No dependence on one or two large investors

- Investor brand loyalty

- Ease of attracting investments

Crowdinvesting in the world

The first crowdinvesting platforms began to appear in 2005 in the USA.

The legislation of most countries greatly hindered the development of crowdinvesting. However, some of their governments began to amend laws that favored the development of “investment in startups for the people.” For example, the most famous black president, so “loved” by the Russian peasant, signed the Startup Financing Act (JOBS Act) in April 2012, designed to stimulate financing of small businesses by private investors and make the crowdinvesting industry more liberal.

In Europe, the UK and Italy have the most liberal legislation in the field of crowdinvesting. By the way, the British sites Seedrs and CrowdCube accept investments from 10 pounds.

Perhaps the most famous sites in the world today are: USA: EquityNet, AngelList, SeedInvest, Funders Club, CircleUP

UK: CrowdCube, Seedrs, Zopa (there must be a joke here about the fact that many of our compatriots invest money in Zopa