Cryptocurrency trading is gaining popularity among users. Many people realize that this is a complex process that requires certain training and skills.

Therefore, users are trying to find a way out and use bots to trade cryptocurrency. But is this the right approach and is it possible to earn something in the future with the help of robots?

Automated trading has long proven itself in binary options and Forex trading, and now it has come to cryptocurrency exchanges. What is a bot for trading cryptocurrency, can such a program be trusted, and which robots are the most reliable?

Types of cryptocurrency bots

A robot (bot) is a program that has a specific algorithm. She buys or sells assets based on the market situation. The first trading robots appeared in 2012, and since then they have become more and more advanced.

According to some estimates, in Forex and binary options, more than 90% of short-term transactions are concluded either by bots or with their participation.

There are 4 types of bots for trading cryptocurrency:

| View | Peculiarities |

| Exchange | Valid on a specific trading platform. Earnings are made on different timeframes from short to long. |

| Arbitration | Valid on two or more trading platforms, the main earnings are from the difference in rates between them. |

| In the Telegram channel | Looking for buyers or sellers in Telegram. |

| Bots for collecting cryptocurrency through faucets | Faucets are online services that distribute Satoshi or other cryptocurrency pennies for free. They are quite well protected from bots and require you to enter a captcha. Good robots that can make decent money on faucets have not yet been written; there are only promising, but not ideally working, developments. |

Telegram bots for earning Eth

GetFreeETH

This Telegram faucet will allow you to earn coins of the popular cryptocurrency - Ethereum. Now she is just at the growth stage. Daily clog bonus ranging from 15 to 50 clogs. Conclusion: 0.025 EtH (2500 clogs). Referral program.

ETH faucet - NOT PAYING!!!

A very fat bot for mining Ethereum in Telegram. Every 30 seconds it produces an average of 24 to 100 szabo. Withdrawal upon reaching a balance of 0.05 ETH. Affiliate program 20%. Bot commands:

/faucet - get szabo,

/account - account details.

/upgrade - improve your account,

/withdraw — withdraw ETH,

/stat — faucet statistics.

Operating principles of a robot trader

Bots for automated cryptocurrency trading operate using special algorithms and trading strategies, which, in turn, are created on the basis of technical analysis of patterns. To conduct an independent analysis, you will need historical data on exchange rate changes (graphs for at least the last year); sometimes it is possible to detect a relationship with the news.

In addition, after identifying patterns, the strategy is tested on the same historical data, and the number of potential losses and profits is calculated. And if the results are satisfactory, the rules of the robot’s trading strategy for the cryptocurrency exchange are created based on them. Some bots additionally use indicators that allow you to analyze the current situation on the market, others are executed only when certain market conditions arise.

The trading strategy of stock exchange and arbitrage bots can be very simple, for example this:

- When the price of a cryptocurrency decreases, you need to buy it.

- When the price rises, it needs to be sold.

Or much more complex. The algorithm can take into account recent historical data, indicators, and be guided by signals. High-quality bots analyze more than a hundred parameters when placing orders.

In some programs, the algorithm does not change, but there are bots for which you can connect or configure additional parameters. This option is well suited for experienced traders who have their own trading style preferences.

A standard bot can perform the following actions:

- Assess the market situation, monitor the exchange rate over a given period of time, and make a forecast. In manual trading, it can show signals for the trader.

- Create sell or buy orders.

- Provide reporting on profit or loss received.

Free and shareware bots

There are also free versions of popular programs with limited versions and trial versions, which make it possible to fully test the trading system in a short period - for example, 7 or 30 days.

| Name | Supported exchanges for free version | Availability of a paid version | Free version features | Free access period | Interface |

| 3commas | 23 | Yes | Full package at the “Professional” tariff | 3 days | web |

| Cryptorg | 10 | Yes | 1 bot, 10 access to exchanges, all filters and strategies | 14 days | web |

| Stratum-bot | Yobit | Yes | 1 stream, support only Yobit exchange, automatic selection of parameters, statistics in the cloud | ∞ | application |

| Simple bot | 4 | Yes | Support for YoBit, EXMO, Binance, BitMex exchanges | ∞ | application |

| ProfitTrailer | 4 | Yes | Support for Binance (+Futures), Bybit, Kucoin exchanges | 1 month | web |

| Gimmer.net | 9 | Yes | 1 free bot with 3 indicators to choose from | ∞ | application |

| Moonbot | Binance Bittrex | Yes | Tick chart, 12 algorithms, fixed list of parameters in the algorithm constructor | ∞ | application |

| Zenbot | 10 | No | — | — | script |

| Enigma Catalyst | 4 | No | — | — | script |

| Zignaly | 5 | Yes | All features available, no credit card required | 30 days | web |

| Exchange Valet | Binance Bittrex | Yes | No restrictions on functions | 14 days | web |

| Bitsgap | 11 | Yes | No limits | 14 days | web |

| Live Trader | 7 | Yes | Full access to any tariff | 7 days | web |

| Cryptohopper | 9 | Yes | Access to the initial tariff: 80 items, limit of 15 selected coins, 2 triggers, purchase in 10-minute intervals | 7 days | web |

Enigma Catalyst, Zignaly, Exchange Valet, Bitsgap and Live Trader deserve special attention.

Enigma Catalyst

Enigma is an algorithmic trading system for advanced Python developers. Installation is possible both through pip itself and using conda, which is part of Anaconda. The latter option is preferable due to the support of numpy and scipy.

The project is well established due to its integration with the best machine learning libraries and an active community.

Zignaly

Official website: https://zignaly.com

Zignaly supports working with exchanges:

- Binance;

- KuCoin;

- VCC Exchange;

- BitMex;

- FTX.

Experienced traders can create their own strategies for trading on platforms.

One of the main advantages of Zignaly is the openness of the development team, which listens to the community.

If you are interested in bots only for the Binance exchange, we recommend reading the article https://cryptotradestocks.com/boty-dlya-binance.

Exchange Valet

Official website: https://exchangevalet.com

Exchange Valet is not a robot, but an investment portfolio management system and a set of trading tools, which brings it closer to MT4.

Most crypto exchanges have a modest range of options. Exchange Valet fills this gap by providing users with an arsenal of popular tools, including simultaneous stop losses and take profits.

Bitsgap

Official website: https://bitsgap.com

The bot allows you to automatically place each order. He buys cryptocurrency when the price falls and sells when it rises.

The cryptocurrency bot has a high level of security and allows you to quickly switch between different exchanges.

It allows you to monitor all updates of the cryptocurrency market within one window.

The bot has many tools, including:

- arbitration;

- recording profits and losses;

- demo mode.

Special mention should be made of the demo mode. It allows you to simulate real cryptocurrency trading, helping the user become familiar with the platform without financial losses.

Live Trader

Official website: https://livetrader.io

Live Trader is a universal bot platform where users have access to 25, 250 or 1,000 unique trading robots, depending on their trading plan. There is also a free version of Live Trader with limited features.

Live Trader is created for those who prefer algorithmic trading. In addition to the wide range of algorithms from the Live Trader team, users can purchase them in the internal marketplace.

Where can I get bots for cryptocurrencies?

There are three options for obtaining robots for trading electronic coins:

- Create a program yourself.

- Purchase.

- Downloading the robot is free.

The first option is suitable for those who are familiar with programming. All bots are written exclusively for a particular exchange. Accordingly, the site must offer an API. This is a complex of information about the state of trading and a set of functions that allows you to start trading according to user-specified parameters. When it comes to arbitration bots, they are written for several platforms.

The second option is suitable for those who do not know how to program or do not know how to write their own application. Today, quite a lot of companies are engaged in writing this kind of software. Moreover, it is proposed not only to purchase, but also to temporarily rent an advisor.

Professional traders can order advisors from programmers, defining in the technical specifications all the necessary aspects that must be present in the program.

The third option is to download bots for free. There are advantages here in that you don’t need to invent anything, write programs or pay money. But the disadvantage is that the user cannot be sure that the adviser will not, for example, begin to transfer all earnings to internal accounts of third parties.

About the cost of licenses

Below we will indicate the cost of each license package.

The price is indicated for mid-March, so we recommend checking the price directly on the official website.

The validity period and capabilities have not changed almost since the creation of the service.

- Initial license. The cost is about 0.028 BTC. Validity period: 3 months. You can use 2 bots for each type. There are 14 trading indicators available and there are 5 capital safety net offers. It is prohibited to use candles (templates).

- Standard license. Price 0.08 BTC. Validity period – 90 days. 3 bots of each performance category are used. Up to 30 indicators are available to users. There are 10 capital insurance options to choose from. The license includes standard limited versions of candlestick templates.

- Optimal (or Advanced). Cost – 0.049 BTC. You can use an unlimited number of available robots. The number of trading indicators is over 50. A large selection of capital insurance, candlestick templates and additional options.

You can order a license for 6 months and 1 calendar year. You can also order the full version on the website

In general, Haasbot is considered non-universal and not ideal for making money on the stock exchange in one click.

But on the other hand, there is one significant advantage - the use of available auto trading tools for automatic trading by brokers based on detailed technical analysis.

The service can help beginners, but only as a “trading tutorial”; most often the service is used by experienced brokers.

go

Should I use bots in trading?

This question is individual. It is definitely not recommended to give the adviser complete freedom of action.

In this case, there is a risk of significant losses. Some Forex traders recommend running robots and monitoring their performance.

But in this case, the very meaning of their use is lost. After all, a trader has to constantly be near the computer. Why not make decisions yourself?

In the world of cryptocurrencies, by the way, other problems are added to the problems with analysis. In particular:

- Some bots may transfer profits or a portion of them to the developer rather than the owner. Moreover, this may not happen immediately, but after some time, when a certain amount is collected in the owner’s account.

- Instead of trading, they collect information about the owner and transfer it to the developer.

- They sabotage the trader’s work in every possible way, trade in the wrong assets, and give deliberately incorrect signals.

The main advantages of robots for trading cryptocurrencies

- Speed of decision making . Even experienced traders need some time to analyze the market situation. Beginners do everything even slower. As a result, a trading opportunity may be missed. In order to avoid such situations, many traders prefer to use bots. They analyze everything much faster and make decisions more quickly than humans.

- Ability to analyze an unlimited number of pairs . If we compare a bot with a human in this parameter, the advantage again goes to the former. A person is simply not able to analyze a large number of assets and make an adequate decision. But some are trying to provide this work to bots, using only ready-made results from the work.

- No errors in the algorithm . A person in the process of market analysis can make mistakes. This is due not only to the level of training, but also to the psychological state of the trader. Bots work strictly within the framework of the algorithm. If there is a signal, he will use it.

- 24/7 trading . A person needs rest. Many people cannot devote more than two hours a day to trading. The bot works around the clock, it does not need to write or rest.

- The user has free time . Using bots involves giving a person more free time. After all, he doesn’t need to analyze anything. And many algorithms are configured to fully automate trading from the moment a signal appears until a decision is made.

- Lack of emotions . A person is susceptible to various psychological states. He is passionate, may experience a feeling of fear or become depressed. This affects trading results. The bot does not experience any emotions. He doesn't have passion. It only works within the framework of its algorithm.

- Discipline . Traders often make one serious mistake. They do not know how to manage capital wisely. A bot for the cryptocurrency market will act according to a pre-built algorithm. If the trade size limit is set to $10, for example, the bot will never change it on its own.

Disadvantages of bots for cryptocurrency exchanges

- Templates of actions . This has already been discussed above. Bots are not capable of independent analysis. They cannot understand when the market situation changes. Accordingly, errors begin that can lead to a complete loss of the deposit.

- The absence of emotions is an advantage on the one hand, but on the other hand, it is also a disadvantage. The fact is that a person, after a certain number of unprofitable trades, can decide to end trading for the day, for example. After some time, he may make changes to the system and start working again. The bot will trade until it is stopped by a trader or the funds in the account run out.

- The need for constant monitoring on the part of the trader . This is an important disadvantage that cancels out almost all the advantages. The point is that a robot cannot be left to work on its own. If it is written on the basis of an oscillator, then it should be used during the period of horizontal ranges. If the robot is written on the basis of trend indicators, it is better to use it when there is a clear trend in the market.

Price issue

A high price for a bot does not always mean high quality or profit. Moreover, truly advanced bots that generate income for their developers are not available to the general public.

The cryptocurrency market remains a “gray area,” and this also applies to the development of robots. A huge number of scammers continue to operate in the market, stealing funds from users’ wallets and passing off useless programs as the best solution to all the problems of novice traders. Therefore, before purchasing a bot, it is recommended to study community reviews.

If you have no experience working with a particular bot, then it is recommended to start your purchase with the simplest, economy package. Typically, economy package bots are provided for only a month and are equipped with only basic functions. This is enough to check if it is right for you.

In the segment of free bots, scripted systems without a user-friendly interface, designed for more experienced users, perform best. Beginners who want to get a fairly powerful and convenient system will probably have to allocate some money for the purchase.

Another option is to work with bots that charge not a clearly fixed fee, but a percentage of the profit brought by the system. In this case, the development team is interested in the profitability of the system.

TOP 10 best bots for automatic trading of cryptocurrencies in 2022

Trading bots are very common in the cryptocurrency space. For optimal use, customized software is built into many exchanges.

Analysis of market information and trading occurs automatically. All you have to do is pray that the trade goes in your favor and increases your profits.

With so many clients, some developers create scam software to deceive naive people. To help you avoid any mishaps, we have compiled a list of the 10 best trading bots for trading Bitcoin and altcoins.

Centobot

The Centobot platform is the undisputed leader among bots for automated crypto trading. The service is as simple and easy to use as possible for beginners, while offering advanced functionality for experienced traders.

The Centobot service was launched in 2022 and offers either creating your own robot yourself or using one of the bots in the database. No subscription fee.

There are several robots to choose from:

Cryptobot v2.0

The robot is configured for automatic trading of the most popular and reliable cryptocurrencies, based on MAC and RSI technical indicators. Up to 300% per month.

Crypto Majors

The Crypto Majors robot works with top cryptocurrencies - Bitcoin, Ethereum, Ripple. The analysis is based on technical indicators such as MACD and CCI.

Ethereum Rise v1.1

The robot works using the CCU algorithm and Stochastic technical indicators, based on Ethereum. Trade the second most popular cryptocurrency after Bitcoin.

Cryptobot v2.1

The robot is configured to trade with the most popular and used cryptocurrencies on the market, with a profitability of up to 250%. A complex of various trading indicators is used.

The official website of the Centobot platform is https://centobot.com/

Altcoins Combo

Auto trading on this robot occurs using several altcoins. The algorithm allows you to diversify risks by investing in several cryptocurrencies at once.

Cap.Club

Cap.Club was created in order to trade according to its own rules for both beginners and professionals:

- a wide range of tools for effective trading (Trailing mechanisms for buying and selling, simultaneously operating StopLoss and TakeProfit, managing strategies through signals);

- visual editor;

- demo account for training trading skills;

- high speed of order execution.

The free version of the platform is available without restrictions on time and tools, but there are limits on the number of strategies, API keys and notifications. The PRO version costs only $30 per month or $300 per year.

The Cap.Club team is actively releasing platform updates, adding new tools, and plans to connect new exchanges in the near future. Binance and Bittrex are currently supported.

The platform interface is simple and intuitive. There is also a series of videos on working with the platform, regular newsletters and educational letters. If you have a question, you can always write to the Cap.Club chat and quickly receive an answer or recommendation from the support team.

Haasbot

Haasbot is a Bitcoin bot that was developed by HaasOnline in January 2014. It is supported by many exchanges such as Huobi, Poloniex, Bitfinex, BTCC, GDAX, Kraken and Gemini. The bot automatically trades Bitcoin and many other altcoins on these services.

The software analyzes market information on behalf of the user, but requires your participation in the trading process. It is customizable and equipped with technical indicators. Haasbot displays trending patterns that users can use to trade Bitcoin.

For optimal results, Haasbot owners must be serious about Bitcoin trading to make a reasonable profit. The program costs approximately 0.32 BTC, paid every three months.

Trality

The Trality platform was founded in 2022. Since then, it has been actively developing the best tools for creating trading bots for private crypto investors.

Unlike other platforms that offer ready-made and identical bots to all users, with the help of Trality you can easily create your own bots for both beginners and advanced crypto traders. However, a set of templates for bots is also available.

Why is Traity interesting for users:

- Rule Builder

is a graphical Drag'n'Drop editor for creating bots based on a sequence of logical rules. - Code Editor

is the first browser-based code editor for writing bots based on Python. - Backtester

is a tool for testing bots on a large amount of historical data. - Virtual trading

- the ability to trade virtual funds to test bots in real time. - API connection to Exchanges

- created bots can be securely connected via official APIs to exchanges such as Binance, Coinbase Pro, Kraken and Bitpanda. - Cloud infrastructure

- does not require installation of additional software, all operations take place on cloud servers to ensure uninterrupted trading 24/7. - Affordable pricing

- free and unlimited time subscription with access to all tools, paid subscriptions from 9.99 to 59.99 euros per month.

To summarize, we can say that Trality really deserves attention, due to how the platform and its functionality are actively developing, while maintaining affordable prices for subscriptions. In addition, the developers plan to launch a marketplace for bots, where bot creators will be able to safely rent them out to anyone.

Zenbot

Zenbot is included in the list of open source bots. The bot is available for major operating systems and can be customized by the user. Zenbot is developed using artificial intelligence technology.

Therefore, the software can execute high-frequency trades and utilize arbitrage opportunities. In addition, the software can simultaneously carry out multiple multi-transactions with cryptocurrencies.

The trading bot is supported by major cryptocurrency exchanges including Gemini, Kraken, Poloniex, GDAX, Bittrex and Quadriga. Zenbot developers say they are still looking to improve their product and will add it to all exchanges in the future.

The current version of Zenbot 3.5 shows impressive results this year. It had an investment return of 1.531 percent for the quarter.

RevenueBot

RevenueBot is a cloud-based bot for automated trading on popular crypto exchanges with break-even martingale-based strategies. The bot trades 24/7 “from the cloud” using API keys of crypto exchanges. There is no need to install the software on your computer and leave it turned on so that the bot’s work is not interrupted.

The bot is suitable for careful trading without big risks and, with the correct settings, brings a constant income of 0.2-0.7% per day to the deposit. At the same time, it does not take much time to monitor the bot’s work.

Working with the bot is safe, since all funds are in user accounts on crypto exchanges. RevenueBot does not accept or store user funds, and does not have access to withdraw user funds from crypto exchanges.

Using break-even strategies, the bot can successfully work both in a growing market (LONG algorithm) and in a falling market (SHORT algorithm).

- In the LONG algorithm, the bot first buys an asset in parts when the price falls, and then sells everything purchased when the price rises.

- In the SHORT algorithm, the bot first sells the asset in parts when the price rises, and then buys back everything sold when the price falls.

Payment for bot services is 20% of the profit received. This is beneficial for clients with a small deposit. The maximum commission is only 50 USD (per calendar month) in BTC equivalent, which is beneficial for clients with a large depository. The commission is debited from the internal RevenueBot account. You top up your account with the amount you choose.

Create as many bots as you like with different settings and pairs for trading on several crypto exchanges at the same time.

For convenience, there are ready-made trading strategies, filters for starting, automatic switching of pairs based on trading signals and indicators, the ability to save your presets, and you can also simulate the work of the bot with different settings over the past period of 60 days on real price charts.

The official website of the platform is https://revenuebot.io

Crypto Trader

A popular Bitcoin bot among traders. This is primarily cloud-based software that does not need to be installed on computers; the program can be modified by the user.

It allows you to create algorithmic trading modifications within minutes.

Crypto Trader is equipped with a “strategic market” feature that allows users to trade strategies.

Another feature is the backtesting tool, which allows users to test their trading strategy by comparing it with backtested data as well as various market conditions. Crypto Trader is supported by major exchanges including Coinbase, BTCe and Bitstamp.

BTC Robot

BTC Robot is one of the pioneers of Bitcoin bots. It supports major operating systems, but prices vary. Windows users can buy a package called Silver software for as little as $149. Mac users need to pay more.

The bot is easy to install and use. However, some people don't realize that small technical changes result in big losses. Others fear a modest income. The trading bot offers a trial period with a 60-day refund policy.

Gunbot

Gunbot trading bot has many built-in strategies including Bollinger Bands, Gain, Step Gain and Ping Pong. Most users seem to think that the Bollinger strategy is the best and that it produces reasonable profits.

The trading bot has three different pricing packages depending on the features you need. Prices range from 0.1 BTC to 0.3 BTC. Gunbot is supported by many exchanges, including Bittrex, Kraken, Poloniex and Cryptopia.

It is recommended that users pay attention to their trades as they are subject to greater market volatility. In case of high volatility, disable it and leave the order in the books.

Leonardo

Leonardo is a new bot that is supported by Bittrex, Bitstamp, Bitfinex, Poloniex, OKCoin and Huobi. The developers are making significant changes, and the software will soon be added to other exchanges.

The bot is equipped with two trading strategies: Ping Pong and Margin Maker. Leonardo is by far the most beautiful and customizable of all the competitors. It used to cost 0.5 BTC per month, but is now available for $89 for a lifetime license.

HaasOnline

For many users, HaasOnline is the main bot for trading cryptocurrencies. Its software uses a kind of kernel algorithm that gradually learns to take into account the wishes of the owner.

New exchanges and indicators are added on a regular basis. The application's flexible policy allows you to earn good money using the HaasOnline bot for automatic trading of digital currencies. It is suitable for both beginners and experienced traders.

PHP Trader

Many users have probably not heard of this program. It was created by Christian Haschek, who put together the most powerful trading algorithms. At first, the program was only applicable for trading Bitcoin, but now it can also be used to work with Ethereum.

The design of the application is quite simple, but it has all the functionality you would expect from such solutions. To use the program, you must have an account on the Coinbase exchange. This is the only platform it works with. But since the bot is written in PHP, it is easy to assume that its capabilities will be expanded in the future.

In terms of convenience, this bot has everything for quality trading for novice traders, even if it does not perform data analysis or predict price trends. With such features, the application is not suitable for large investments, but is an ideal starter program for those new to the market.

Bot page on GitHub - https://github.com/chrisiaut/phptrader

Automated cryptocurrency trading

These bots were developed by investment professionals who have been involved in quant trading for large financial institutions for over twenty years. They will allow you to easily imitate their strategies in your personal trading account.

You can create your own set of strategies using their library while maintaining control over the situation. Napbot then automatically executes trades for you 24/7. Your money will never sit idle again.

Napbot currently supports 15 different strategies for the seven most liquid cryptocurrencies. These strategies support timeframes ranging from hourly to weekly, allowing them to adapt to your trading style. They are designed using proven trend-following and mean-reversal approaches that are also used in quant hedge funds. Typically these methods are only available to hedge fund managers.

Napbot is very easy to use

- Step 1: Connect your trading exchange account to the platform using an API key.

- Step 2: Develop your own set of strategies using the provided library.

- Step 3: Choose from very competitive plans.

Types of bot trading strategies

Most often, bots use two strategies: arbitrage and market making (market creation).

Arbitration

The cryptocurrency arbitrage bot works simultaneously on several platforms. His task is to buy cheaper in one place and sell more expensive in another. Crypto exchanges do not have a single control center and therefore the price of the same coin can differ significantly on different sites. This strategy may include working with futures contracts.

Market creation

Robots using a market-making strategy create limit buy and sell orders, taking profit when the exchange rate fluctuates. Thus, they increase the liquidity of this cryptocurrency on the exchange, for which the trader can be given a bonus in the form of a reduction in the trading commission. But if competition is too high, such a strategy can cause losses. This is especially true for small traders.

The creators of cryptobots integrate into their programs an insurance system against sudden drawdowns and other force majeure circumstances. Services may have a Sell Only Mode , and then, under certain parameters, the robot will not buy coins. For example, when stopping stop orders are closed with a loss, or there is a sharp imbalance between the purchase and sale of a specific digital asset. Part of the deposit is also frozen to avoid its complete loss in the event of a sharp decline in the exchange rate.

What strategies do robots use?

A strategy called “scalping” is often used. This is a trading style that is used to make money with minor price fluctuations. This style of trading is popular even among professional crypto traders.

But doing this manually can be tedious since a large number of such trades need to be closed to make a profit. This is why trading bots were created! By automating the process, the robot can trade for you when suitable conditions arise while you are away. This allows you to receive income almost passively at any time of the day.

Disadvantages of cryptocurrency exchange robots

An automatic trading program does not always react correctly to sudden changes in the situation, and drives the trader to bankruptcy or leaves him without potential profit. A complete absence of emotions is not always a plus, so people shouldn’t relax. Most cryptobots are quite expensive and difficult for a beginner to set up.

Not all malware immediately steals your deposit; some work quite correctly at first, and the money is drained after the amount has multiplied. It happens that robots transfer part of the profit to the developer without the user’s knowledge or collect data about his digital wallets.

Advantages and disadvantages

pros

- Instant analysis of any changes in the market.

- Lack of emotions, which often force traders to make unprofitable decisions.

- Elimination of routine - no need to manually create many orders, which takes both time and effort.

- The bot functions even when you are asleep or absent.

Minuses

- There may be weaknesses in the security system.

- Bots are not completely independent, they still require supervision.

- There is no guaranteed return.

Where is the best place to buy cryptocurrency?

For safe and convenient purchase of cryptocurrencies, we have prepared a rating of the most reliable and popular cryptocurrency exchanges that support deposits and withdrawals of funds in rubles, hryvnias, dollars and euros.

The reliability of the site is primarily determined by the trading volume and the number of users. By all key metrics, the largest cryptocurrency exchange in the world is Binance. Binance is also the most popular crypto exchange in Russia and the CIS, since it has the largest cash turnover and supports transfers in rubles from Visa/MasterCard and payment systems QIWI, Advcash, Payeer .

Especially for beginners, we have prepared a detailed guide: How to buy Bitcoin on a crypto exchange for rubles?

Rating of TOP 5 cryptocurrency exchanges:

| # | Exchange: | Website: | Grade: |

| 1 | Binance (Editor's Choice) | https://binance.com | 9.7 |

| 2 | Bybit | https://bybit.com | 7.5 |

| 3 | OKEx | https://okex.com | 7.1 |

| 4 | Exmo | https://exmo.me | 6.9 |

| 5 | Huobi | https://huobi.com | 6.5 |

The criteria by which the rating is given in our rating of crypto exchanges:

- Reliability of operation

- stable access to all functions of the platform, including uninterrupted trading, deposits and withdrawals of funds, as well as the period of operation on the market and daily trading volume. - Commissions – the amount of commission for trading operations within the platform and withdrawal of assets.

- Reviews and support – we analyze user reviews and the quality of technical support.

- Interface convenience – we evaluate the functionality and intuitiveness of the interface, possible errors and failures when working with the exchange.

- Features of the platform are the presence of additional features - futures, options, staking, etc.

- The final score is the average number of points for all indicators, determines the place in the ranking.

Tips for using API keys securely

It's reasonable to assume that protecting your own APIs is critical. These are like the keys to the lock of a safe, which cannot simply be handed over to any third-party software. Connect your APIs only to reliable cryptobots that have an impeccable reputation among the community.

Reputation is the key

Avoid fast fly-by-night companies, as well as platforms that promise incredible profits. None of those who offer legal earnings of cryptocurrency on bots can guarantee profit. Any service that tries to convince you otherwise in its advertising should be considered unsafe.

Ban on withdrawal

You should also be careful about the permissions you grant when working with the API. A reliable crypto trading robot will only request permission for trading operations. Do not use an API that will allow withdrawal of funds from your exchange account!

Only you can perform the withdrawal operation yourself and only manually, using mandatory 2FA protection to log into your account in order to prevent phishing attempts from unscrupulous software providers.

Account protection

In most cases, scammers only need your email address and your password. This is all that attackers need to steal accounts and funds from them. You need to use 2FA not only for all exchanges you use, but also for your email.

Using a new account

Another great idea is to register a completely new separate account on a cryptocurrency exchange for your trading bot. This prevents fraudsters from gaining access to your real accounts and API accounts in the event of a security breach or shady business.

Safe income

The bot only needs to give out the amount of money that is required for active trading. For your own protection, be sure to deposit your profits into a secure wallet. It is best to use a hardware wallet, but even any online wallet will be better than leaving a large amount of cryptocurrency to be stored on an exchange.

Do beginners need stock bots?

Beginner traders make a lot of mistakes. The first attempts to trade cryptocurrency are usually unsuccessful. However, it is human nature to learn from mistakes. Over time, a beginner can become an experienced and successful trader.

Unlike a person, a program will only work according to a given algorithm. Therefore, if a beginner starts using a robot for trading, he will not learn anything.

The cost of primitive trading advisors is approximately 10 USD per month. Arbitration robots – 500 USD, and even more. Note that they are designed only for some typical situations that occur extremely rarely in stock trading. Thus, a trader who pays a large sum for using the software may not receive any profit at all.

Theoretically, robots are capable of generating good income. However, for them to be profitable, a significant number of factors must be observed.

From the income generated by the assistant program, subtract:

- exchange commissions;

- payment of bills for the use of electricity;

- the price of the robot itself.

Cheap programs, costing 15-25 USD, take a long time to pay off. In many cases, such robots will not return the money spent on them. Expensive technical advisors from renowned developers can pay off over time, and even bring in good profits.

However, remember that the market is alive and will not specifically adapt to program algorithms. Therefore, using such software is an extremely risky decision. It makes sense to use assistants only for professionals who are able to reconfigure the program to the constantly changing market situation. Traders cope with this task independently, without the use of robots. For beginners, we do not recommend starting cryptocurrency trading using special assistant programs.

How do cryptobots work?

Each bot is a set of indicators and parameters that automatically execute a trade on the exchange (or semi-automatically: with operator confirmation) when a buy or sell signal is detected. Most of the time, the bot is tuned to a specific market and time period to make the results more predictable.

This is not magic that makes only successful trades and brings 146%. The average yield is 1-2% per day, taking into account the volatility and strong influence of news on the exchanges.

There are different types of bots:

- trading bots - trade based on user-selected indicators. These bots are highly customizable and you can use a combination of indicators to create your trading signals.

- arbitrage bots - used to profit from price differences between different exchanges. Option 1: bought on one exchange, transferred to another and sold there - this threatens low income (or loss), since transactions take a long time and the difference may already disappear. Option 2: one exchange has dollars, the other has cryptocurrency. On an exchange with a low rate we buy coins, on an exchange with a high rate we sell the same amount at the same moment. Then the reverse operation is performed (also plus or minus, but less than the profit from the previous transaction) - the difference from the exchange rate is in your pocket. Example: Exchange1 - ETH costs $1000 here, enter this amount. Exchange2 - we have 1 ETH, and it costs $1,200 here. We buy ETH on exchange1 for 1000, sell ETH on exchange2 for 1200. We wait for a mirror situation and make the transaction again - as a result, the balances will be as follows: exchange1 - $1200, exchange2 - 1 ETH and $200 (ideally, excluding commissions).

- Order bots are custom bots that execute when certain market conditions unfold. They can be combined together to automate trading strategies.

- I also highlight some “scripts” separately.

Smart Rebalance for Portfolio Management

Sometimes the growth of the crypto market begins with a sharp increase in the price of one coin. For example, the price of Bitcoin rises by 10% and hits a resistance level, and a few hours later the rest of the cryptocurrencies follow suit. In such a situation, you can increase your profit if you sell part of the bitcoin and buy other coins.

The Smart Rebalance bot uses this principle to manage your investment portfolio. The user sets the portfolio proportions and rebalance conditions: when the proportions change or according to a timer.

Launching the Smart Rebalance bot:

- Select one of the ready-made portfolios or click the Customize to create a new one.

- Add cryptocurrencies to your portfolio and adjust the proportions.

- Enter the amount you want to transfer to the bot.

Smart Rebalance interface.

Portfolio proportions can be adjusted in four ways: manually, equally, based on historical data and capitalization. Example: a trader sets up a Smart Rebalance bot with a portfolio of 50% BTC, 40% ETH, 10% DOGE and rebalance if there is a 5% deviation. After a week, Bitcoin rises and the asset ratio changes to 56% BTC, 32% ETH and 12% DOGE.

The bot sells Bitcoin and buys Ethereum to bring the portfolio to 50% BTC, 40% ETH and 10% DOGE. The next day, Ethereum and DOGE rise following Bitcoin, and the trader makes additional profit by purchasing ETH.

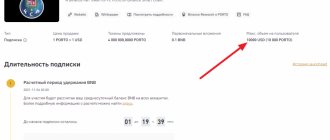

Testing KuCoin bots

We decided to check how much income trading KuCoin bots will generate within one day.

DCA and Smart Rebalance will show results in a few weeks, so we launched Grid bots for random trading pairs:

- Spot Grid: WILD/USDT with a deposit of 42 USDT;

- Futures Grid: Long for SHIBPERP/USDT with a deposit of 50 USDT.

During the day, Futures Grid carried out 42 trades and lost $0.07. Spot Grid performed better and earned $3.13 in 67 trades. Its APR was 1330% or 7% of the deposit per day.

At the time of writing, the Floating PNL of the Spot Grid bot is $2.66. This is unrealized profit - the bot bought cryptocurrency and is waiting for growth to close the position.