Timur Danilov 03/09/2018

The development of the crypto industry as a full-fledged business has led to the emergence of a large number of projects designed to facilitate the integration of blockchain into various areas of activity, as well as to serve companies operating in networks that lack the necessary functions.

It also became obvious that many networks are not able to withstand a huge number of transactions, this causes queues for making payments and a refusal to further operations, that is, from using a specific cryptocurrency.

The Kyber Network has an ambitious goal of becoming a kind of hybrid of NASDAQ and VISA in just 5-10 years, offering clients unique working conditions.

History of creation

The developers presented a test format of the platform in August 2017, giving the opportunity to use only ICO participants who submitted applications. As a result, they managed to raise $50 million. The platform received recognition from experts and users, and also attracted the attention of investors.

Kyber Network was co-founded by 3 people:

- CEO Loy Luu, known for his work with Oyente, Ethereum, SmartPool;

- CTO Yaron Welner, co-founder and developer of SmartPool;

- Lead Engineer Victor Tran, Linux system administrator and SmartPool developer.

The entire team consists of 7 people. Among the consultants to improve the platform are the founder of Ethereum Vitaly Buterin, professor of the National University of Singapore Prateke Saxen, co-founder of Shentilium Technologies, TrackRecord Asia, CEO of Tudor Capital Singapore, managing director of Goldman Sachs Leng Hong Lon. The project is constantly trying to expand the list of partners. Among them are Request Network, Wax, Storm and other large services. Today, the Kyber Network infrastructure has been adopted by various applications, including Set Protocol, bZx, InstaDApp and the Coinbase wallet.

Dodo (DODO)

Dodo's goal is to change the way market makers and exchanges operate by introducing an innovative protocol known as Proactive Market Marker (PMM). Most exchanges, including the popular Uniswap (UNI), use the Automated Market Maker (AMM) protocol, which uses liquidity pools to execute trades.

Under this protocol, the market maker sets prices following a specific algorithm and trades can be executed immediately using the liquidity provided by these pools. But this approach has its drawbacks, including high slippage rates and short-term losses.

Dodo aims to minimize these drawbacks by implementing its proprietary PMM protocol, which uses oracle-driven algorithms to optimize trades, reserves and other important market-making variables, allowing professional market makers and retail investors to implement their strategies without the restrictions that often exist for other protocols.

- Cryptocurrency: DODO

- Token: DODO

- Market capitalization: USD 122 million

- Maximum supply: 1 billion

- In circulation: 110 million

- All-time high: 8.51 USD (February 20, 2021)

- All-time low: $0.06 (October 19, 2020)

The DODO token was launched on April 1, 2022, making it one of the last DeFi coins to be released this year. Since then, its value has dropped by 66.5%, as the development team revealed that hackers were able to steal a total of $3.8 million from some of the project's crowdpools.

A total of $1.89 million was recovered by one of the hackers, who turned out to be a white hat hacker - a person who penetrates a network to discover its flaws and help developers improve the code and prevent further attacks.

The remaining funds were not returned, and this undermined confidence in the project. However, DODO's offering is still quite interesting, and with its current market capitalization of $155 million, the growth potential remains strong as long as the development team can prevent further unauthorized intrusion into the network.

According to Wallet Investor, the DODO token should reach a value of $8.15 within a year, based on an analysis of recent price and trend action.

DODO price forecast for 2021-2022

How the platform works

The described platform combines a payment system and a decentralized exchange service that allows you to instantly convert and exchange electronic coins. On Kyber Network, currency is exchanged through a smart contract. Such a decentralized transaction is carried out only by the seller and the buyer - without the intervention of a third party. The operation occurs instantly, immediately after it is registered by the blockchain. Its peculiarity and main advantage is that you can send, for example, litecoins, and the buyer’s account will be credited with the currency he needs. The platform performs conversion when transferring funds, while charging a transaction fee.

For example, the user needs to purchase software that is sold for ethers. In this case, the buyer only has bitcoins in his wallet. The owner of BTC can transfer the required number of coins, having familiarized himself with the exact exchange rate in advance, and the required amount of ether will be credited to the buyer’s account. You can start trading immediately after connecting to the Cyber network through your wallet. The client will be able to see all trading pairs that the platform offers. Any pair has at least 2 different pools and can be used to carry out a trading operation.

The exchange process begins after the user's request is sent. The Kyber Network service checks whether the correct amount was transferred. After this, the tokens are credited to the address specified by the sender. The difference received when converting one electronic coin into another is sent to the reserve.

The operating principle of the Kyber Network platform is shown in the picture:

How the platform works

Cyber Network does not store the assets of its clients, so there is no risk that they will be stolen during a hacking of the resource. To ensure that the platform remains liquid, it transfers some of the tokens to the reserve. The users themselves can do this. After payments are made to participants, some of the remaining tokens are destroyed. Thus, there is a decrease in the number of electronic money, which means that their price will increase.

What is Kyber Network

The project started at the beginning of 2022. The service positions itself as an exchanger and a payment system at the same time.

The highlight on which the bet is made are smart contracts for conducting exchange operations and almost instantaneous exchanges implemented with the help of reserve managers.

The company's ICO was more than successful, collecting $50,000,000.

The funds were distributed according to the already formed roadmap, although some deadlines were changed:

- Q1-2018. Start of the project in version 1.0, supporting Ethereum tokens;

- Q2-2018. Implementation of support for tokens of other crypto networks;

- Q3-2018. Supplementing the trading platform with cryptocurrencies with the largest capitalization and market activity;

- Q1-2019. Implementation of trading processes between cryptocurrency networks and ecosystems.

There is no need to worry too much about the fact that the plan will be brought to life, since the advisor of the project is Vitalik Buterin, a legend in the crypto industry (co-founder of the Ethereum network) .

The first step in implementing the plan was testing the system, which started on February 11, 2022.

Not everyone took part in it, but only those registered in the WhiteList posted during the ICO.

The task of testers is to search for bugs and errors, as well as test fixes in real time in order to exclude force majeure after a full start.

go

Advantages

Experts note the following advantages of the Kyber Network platform:

- Reliability.

- Speed of transactions.

- Availability of reserve.

- Blocked conversion rate.

- No registration or authentication requirements.

- Ease of use for settlements under smart contracts between counterparties, at the user level.

System security and preventing hackers from accessing backup pools are ensured through several measures. To begin with, Kyber sends a request to approve the exchange rate if there is a discrepancy with the established boundaries. Capital protection in a public reserve occurs through transparent asset management. Another security measure is that money from public reserves can only be sent to pre-approved addresses.

How the Kyber Network works

In order to become a member of the network, no registration or verification is required, since trading is carried out P2P.

To work, you will need to connect wallets with currencies in the system for which transactions will be made:

- Trezor and Ledger Nano hardware storage;

- Software wallets - Trust Wallet, ImToken, Coin Manager.

We are currently working to expand the number of partners.

When the project launches, a new “Kyber” tab will appear in the accounts of all wallets.

go

Comparison with competitors

The competition for the described platform today is 0x. However, these projects have significant differences. Cyber operates within a single blockchain using a backup warehouse. Therefore, the exchange occurs without delay. 0x operates via an order book and performs off-chain order matching. As a result, the application must be confirmed by the other party, which may take some time.

0x is still superior to Cyber thanks to participation in such large projects as Ethfinex, Augur, District0x. The project has a high chance of becoming an exchanger popular with a wide range of users.

Another close competitor to Cyber is ShapeShift. Which of them will gain more popularity directly depends on the amount of commission that Kyber will charge.

Receiving and sending payments

The network implements a payment API interface that allows buyers to pay for goods/services with any coins or tokens, and sellers to accept only those currencies that are beneficial to them.

That is, the seller indicates in his account the main currency into which any customer payments will be converted.

Let's look at an example.

The buyer only has MANA tokens to make transactions.

The seller only accepts ETH for their product or service. Cyber network technology allows you to recalculate such payments “on the fly” and transfer the corresponding number of target coins for the transaction to the seller.

This can be done through the “locked conversion rate”.

It allows both parties to calculate the amount required for payment by the buyer and the final amount received by the seller before the transaction begins.

If we leave behind the complex names and definitions, it turns out that the conversion of assets demanded by sellers is also carried out through volatility managers, which makes the circulation of tokens of promising projects easier.

go

Features of the KNC cryptocurrency

The cryptocurrency issued by the platform is called KNC (Kyber Network Crystals). It was named after the crystals from the Star Wars saga that were used to charge lightsabers. The token sale started in September 2022.

KNC cryptocurrency can be used in two ways:

- Purchase so that managers of crypto fund pools (reserves) can place their offers and to accrue rewards to network participants.

- Activate reserves and increase prices. After each settlement cycle, the collected commission tokens are destroyed, which leads to an increase in the value of the cryptocurrency.

In 2022, analysts included the KNC token in the top 20 electronic money recommended for investment. It occupied 54th position in the ranking by capitalization.

Advantages and disadvantages of the Kyber Network

PROS:

- The idea and approach to its implementation are generally very good. They will promote cryptocurrencies as means of payment, as was originally intended. Instant transfers, absolute reliability and the absence of an intermediary in the form of traditional exchanges can leave the latter without work;

- Team. The project recruited people with extensive experience in the industry, most of whom had successful launches of crypto projects behind them;

- Cyber Network is the second project where Vitalik Buterin acts as an advisor. His second brainchild is Omise GO tokens, which after the ICO increased their capitalization by 37 times in just two months;

- The KNC token not only circulates on the Cyber network, but also generates profit by being invested in reserve funds or held in accounts in hopes of increasing in value due to the burning of unused tokens at the end of the settlement cycle.

CONS:

- The solution to creating reserves to support liquidity will require serious capital, especially when the number of instruments traded on the site reaches the designed value. Holding reserves for unpopular tokens will freeze serious capital with relatively low profitability;

- The final stage of the development of the project “Trade between cryptocurrency ecosystems” will take a long time, if it can be implemented in principle, and this will require even more funds;

- The work of the Cyber network is slower than that of its closest competitor “0x”, and therefore it will be difficult to switch users who are comfortable working with “0x”

go

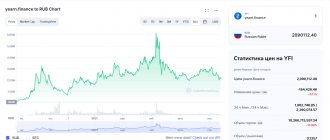

Token rate overview

As of May 20, 2022, the capitalization of the described currency was $117,475,389. The rate was kept at $0.65 per 1 KNC.

During the life of the token, its maximum price was $6. It was recorded shortly after the launch of the Kyber Network platform - January 9, 2022 - and, obviously, was explained by the interest of users in the new coin. The rate collapse was observed on February 6, 2022. Then for 1 KNC they gave $0.113539.

Token rate overview

The trading volume for the day amounted to $59,945,900.

Conclusion

It's time to sum it up. According to its concept, KNC is closer to the ShapeShift cryptocurrency exchanger than to the 0x platform. However, which of the two platforms will be preferred by ordinary users depends on the size of the commissions that Cyber plans to collect. It has advantages over 0x relays in the form of fast transaction speeds and liquidity guarantees, but only if the level of fees is approximately the same. However, if the Kyber Network commission turns out to be significantly higher, most users will undoubtedly choose 0x. How events will actually unfold, only time will tell.

Where to store

Since KNC is an ERC-20 token, it can be stored in any wallet that is suitable for this. The best and safest mobile wallets today are:

- Coinomi;

- Trust.

If you plan to store tokens on your computer, then it is better to install Atomic Wallet. Among the hardware devices for storing “cyber crystals”, Ledger Nano S and Trezor are well suited. Web wallets are also convenient for this purpose, for example, MyEtherWallet, MetaMask.

The choice of wallet for storage depends on personal preferences, security requirements and regularity of transactions. If we are talking about constant trading and exchange, then it is better to use mobile and computer applications for storing cryptocurrencies. For long-term investing, it is worth considering using a hardware wallet.

The main uses of KyberNetwork include:

- Exchange : Convert and exchange chips securely and instantly. Currently, KyberNetwork does not charge fees for user exchange transactions.

- Proxy payments : Users can pay anyone in any token with their tokens. Kyber performs the conversion and forwards the payment.

- Derivatives : Users can hedge against price fluctuations by engaging in forward transactions.

- Cross-chain payments . For example, users can receive payments in Bitcoin and other cryptocurrencies.

KyberNetwork does everything on-chain because off-chain channels do not provide settlement guarantees, rely on trusted third parties, and have low compatibility with Ethereum smart contracts.

KyberNetwork can provide instant liquidity because they have a backup system. Initially, Kyber will be the sole manager of the reserve to ensure that they have tokens available when users request an exchange. Over time, anyone can become a reserve manager, providing liquidity and earning income from that role.