Formerly a platform for combining blockchains, it has become one of the best solutions for scaling Ethereum. A project that some consider promising, while others consider it overrated. Today we find out what’s under the hood of the Matic, which has changed its sign to Polygon.

- Name: Polygon (ex-Matic Network), ticker MATIC

- Project launch: 2022

- Protocol: Proof-of-Stake

- Mining method: staking

- Cap limit: 10,000,000,000

- Current stage: active expanding project

general information

The history of Matic Network dates back to 2022, when the decentralized finance market was just beginning to take its first steps.

Rebranding

During the cryptocurrency boom, the team of the young project presented a solution to two main problems of Ethereum - scalability and unfriendly user interface.

The co-founders of the project are immigrants from India who are actively involved in the development of the country’s blockchain industry:

Jaynti Kanani, CEO. Former Data Scientist at Housing.com. Sandeep Nailwal , COO. Previously, he served as CEO of Scopeweaver and CTO of Welspun Group. Anurag Arjun, CPO. Engineer and product manager.

Core Team assembled

The list of co-founders includes Mihailo Bjelic, however, he joined the site at the rebranding stage.

Consultants are representatives of the Ethereum Foundation, ConsenSys, Coinbase.

Of course, Matic does not solve the problem directly, and the task of increasing the block capacity of the Ethereum main network is still relevant to Buterin’s team. Matic’s idea is to launch sidechains, side chains, along with the main Ethereum blockchain, which, by using them, can reduce the load on ETH.

MN developers planned to develop scaling solutions for other projects. With the advent of 2022, the strategy changed - the startup decided to focus on Ethereum. A rebranding was timed to coincide with the change of course - now Matic Network is known as Polygon (sometimes 0xPolygon). The token ticker remains the same – MATIC.

From this point on, the platform transforms from a layer 2 solution into a kind of L2 aggregator. In addition to its own scaling technologies, the Polygon team implements support for competing ZK-Rollups and Optimistic Rollups.

So far, the infrastructure built around the ether looks like this...

...and it will look like this

Finally, in July 2021, the company announced the launch of the gaming studio Polygon Games. From it, gamers can expect more exciting projects with support for blockchain and NFTs.

What is Matic cryptocurrency

The blockchain industry is increasingly developing and becoming more efficient. But most existing networks are not capable of providing the necessary level of scalability. Slow block confirmation is one of the main problems of the current blockchain economy.

The project bore the full name Matic Network. The company announced a rebranding and is now called Polygon. But we will address her in the old way. This is a decentralized blockchain created to increase the speed of transactions and reduce commissions.

The project runs on Ethereum and solves its problem by placing side chains called Plasma on top of the Ethereum network. Thus, transfers have become faster and at the same time safe.

Plasma is a protocol built on top of Ethereum. The structure is a side chain that independently processes its own blockchain and controls the work of validators and consensus.

Matic is a kind of new network on which developers can migrate their products from the Ethereum platform to avoid scalability problems. According to the developers, their network is capable of carrying out 7 thousand transactions per second. The commissions are very low.

In addition, the development team took care of the availability of products for all users in the form of mobile applications, wallets and browser extensions. This creates an entire ecosystem that does not require special knowledge or complex manipulations.

On topic: Bittorrent cryptocurrency prospects and what to expect.

Principle of operation

The network user transfers the token to the Ethereum smart contract. The transaction is confirmed using the Matic Bridge and enters the Chain chain. Next, the token is sent to the Matic sadchain with a minimum commission. The whole process takes no more than 1 second. In simple terms, Matic Network offers a high-speed network interoperable with Ethereum.

The technology can be widely used in the field of trading operations on decentralized exchanges and on gaming blockchain platforms. The developers plan to introduce atomic transactions (high-speed cryptocurrency exchange).

With Matic, any project can use blockchain - a network that combines the best characteristics (scalability, reliability, convenience).

Pros and cons of Matic

Like any project, Matic has its advantages and disadvantages.

Pros:

— maintaining cooperation with large companies in the crypto industry, which allows for more active penetration into the market;

— launchpad and listing on the Binance exchange;

— your own mobile application Matic Wallet, where you can store your assets;

— scalable, fast and low-commission blockchain;

— ease of use (native mobile applications, programs);

— high level of reliability and security provided by the POS algorithm;

— mobility of the asset (the token can move freely among various platforms);

— DeFi (decentralized finance).

Minuses:

— the market today already has similar solutions and it is not yet known whether Matic will be able to compete with analogue projects (Celeb Network, Loom Network, Skale, POA); — a little-known team (the CEO has previously taken part in similar areas and has experience, and the remaining members have not previously been seen in the crypto industry).

The presence of shortcomings is more than forged by advantages. All that remains is the full implementation of all plans.

Topic: Which cryptocurrency will grow in the near future?

What is it like?

The ecosystem provides several tools for users and developers. Among them:

Matic Wallet (Polygon Web Wallet). Web wallet of the official Polygon portal. Allows you to manage the native token and numerous supported cryptocurrencies. Also opens access to network bridging and stacking. To start working with Polygon Wallet, you will need to log in using a third-party wallet, for example, MetaMask Ethereum. Step by step it looks like this:

Go to wallet.matic.network

We allow connection in our MetaMask (or other) wallet

We use Polygon Web Wallet v2

Dagger. A tool that allows you to monitor transactions on the network – both confirmed and unconfirmed.

SDK. The Polygon provides everyone with access to its own development environment, with the help of which the creation of Ethereum-compatible applications becomes much easier. The SDK supports the Solidity and Vyper languages, is compatible with MetaMask and other wallets, libp2p, gRPC, and other components.

Projects using the Polygon architecture. The list includes the prediction market Polymarket (analogous to Augur), the aggregator of DeFi financial services Easyfi (an offshoot of Compound), the collection game Aavegotchi and others.

The appearance of the last one on the list is not accidental. Aave, a DeFi protocol connecting those who need a loan with those who are ready to issue it, has migrated to the Polygon platform.

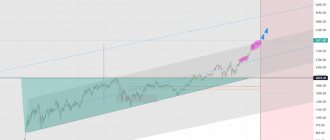

Matic cryptocurrency forecast for 2022

The technology is quite explosive and investor interest speaks to this. The coin is showing good and steady growth. An additional reason is the overall positive trend in cryptocurrency. To roughly understand what results can be achieved, let’s turn to the opinion of CoinArbitrageBot analysts.

They predict the price will rise to $2 by the end of this year. This forecast is based on historical data. In December 2022 the asset showed an increase of more than 180% in the monthly period and cost $0.037. Over the past four months, the cryptocurrency has grown by more than 1000%.

In an annual perspective, the coin may reach $4, and in the next three years we can expect $10. It is important to understand that this is all just an opinion. No one knows how Matic will actually show himself. A lot of factors influence price indicators.

Technology

In fact, there are not one, but two bridges connecting Polygon and Ethereum. Users shouldn’t worry too much about this, but third-party developers are advised to take into account:

Polygon Plasma. The first and safer bridge. Disadvantage: 7-day withdrawal period.

Polygon PoS Chain. A new solution that is considered less secure. It has the advantage of fast withdrawals - the latter is provided by trusted validators.

Also, the “polygon” network can be divided into 4 layers, from top to bottom:

Execution Layer. Includes Ethereum Virtual Machine (EVM), smart contracts, EWASM, execution environment.

Networks Layer. Includes mechanisms for consensus, reconciliation of transactions, orders, and data processing.

Security Layer. Validation, management of a set of validators, proof generation.

Ethereum Layer. Responsible for completion, staking, resolution of inconsistencies between blockchains and data exchange.

Matic Token

This is the internal digital currency of the project, used as a unit of account in the crypto industry market. Matic will also be used as a means of stimulating users when providing computing power.

The first distribution of coins was carried out on the Binance exchange. The procedure took place in an unusual way in the form of a lottery. The lottery could be obtained by staking bnb in Launchpad. 16,666 winning tickets were recorded.

The total issue amounted to 10 billion assets. 19% were sold at the initial stage. At the time of writing, it is trading at $0.94. According to Coinmarketcap, Matic ranks 39th with a total capitalization of over $4.5 billion.

Mining new coins

The crypto asset is mined using the Proof of Stake (POS) algorithm. It looks like this: we keep assets on the wallet and processes of “printing” new assets occur. Many areas are switching to Pos mining. Including Ethereum.

Advantages and disadvantages

First, let's list the positive aspects:

- The team is actively working to introduce it to the market by concluding cooperation agreements with other crypto projects, for example, Decentraland or Quarkchain .

- Token pre-sale on Binance Launchpad. Conducting an IEO on the stock exchange increases the level of investor confidence and helps promote the startup.

- Extensive potential for use due to compatibility with other blockchains.

- Polygon is highly secure with regular checkpoints that ensure consistency throughout the transaction lifecycle.

- Matic successfully leverages features such as Plasma, ZK0 rolls, and PoS that its competitors have failed to implement.

- Heimdall architecture helps improve network scalability.

- Polygon is highly customizable and allows developers with experience building Ethereum-based applications to use the language of their choice.

- Polygon is designed to take full advantage of the Ethereum network. Thanks to its decentralized approach, it allows for a thousand times more transactions.

And now, about the disadvantages of Polygon:

- High level of competition in this market segment. Blockchain engineers have created a number of similar solutions, for example, Lighting Network.

The team invites you to work remotely; there are 25 open positions posted on the website https://polygon.technology/careers in the career section.

Mining Polygon

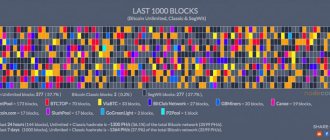

Polygon cryptocurrency is not mined using ASICs or GPU rigs. Transaction processing is carried out by validators who place their bets for the right to participate in the PoS consensus mechanism on side branches.

Extraction occurs through staking. A validator is the owner of a node responsible for validating transactions on the blockchain. For Polygon, any participant can qualify as a validator. You need to run a full node on a PC or remote server to receive rewards for processing transactions and creating blocks. To ensure their reliability, validators must lock up a certain amount of Polygon tokens as a stake in the ecosystem.

Validators on the network are selected through an auction process that occurs at regular intervals. Selected nodes participate as block producers and verifiers. Those who are unable to run a full node can participate in maintaining the network as a delegator. Delegators send part of their funds to one of the validators and receive a share of the reward.

Staking rewards calculator - https://wallet.polygon.technology/staking/rewards-calculator

Bottom line

Polygon was the subject of our discussion. Thanks to its potential and relevance, all investments in it will pay off. A really good investment if you want to hold the coin for a long time. To be clear, these forecasts are usually not the most important factor when choosing a purchase.

According to experts, their conclusions are influenced by technical analysis and external variables. It's also good to gather your ideas and then use predictions to form your point of view. Finally, it's good that you don't rely on price forecasts.

Let us know if there is anything left untouched related to Polygon price forecast.

We will contact you as quickly as possible. Share this Article:

Prospects for Matic cryptocurrency

The further future of the company will depend on the speed of implementation of its plans, as well as the stable and correct operation of the network. Currently, there is positive development of the project. There is a slight lack of marketing solutions to attract a wider range of investors and partners.

Main partners are: Decentraland, Zebi, Maker DAO, Hey Coral. Not long ago, management announced a possible collaboration with the Blockade Games project and the startup Troy.

Where to buy and hold tokens

You can purchase Matic through exchange services, but the best option is to buy on cryptocurrency exchanges. The main volume of coins is traded on the Binance and Huobi exchanges. The cryptocurrency is also traded on the large American exchange Coinbase, but unfortunately it is not available to CIS citizens.

Binance provides the greatest liquidity. The following currency pairs are available here:

— Matic/bnb; - Matic/btc; — Matic/usdt.

Let's not stop at registration. The purchasing procedure is simple.

- To do this, you need to go to the Binance trading terminal.

2. Click “trade” - “classic”. We select the trading pair for which we want to purchase tokens. In the window that opens, enter the amount and click “Buy”. This will create an order.

3. The purchased coins will be displayed on the spot wallet.

Selling happens the same way.

If you purchase a crypto asset for an average period, you can store it on the exchange. Every crypto exchange has wallets. Long-term investors are better off using separate wallets. Since the token is built on the basis of Ethereum, it is supported by storage facilities with the ERC-20 standard. The most reliable and popular include MyEtherWallet and MetaMask.

How high will MATIC's share price go? Polygon price forecast

Anyone looking to invest in Polygon inevitably looks at MATIC's current forecasts. In our opinion, the fundamental situation plays a key role in the further development of the share price. The fundamental evaluation criteria are qualitative in nature, so there are no hard key indicators that indicate a rise or fall in price.

Implementation of the roadmap is critical to the development of the project. In the case of Polygon, this means that the implementation of roll-ups, sidechains and enterprise chains plays an important role above all. Of course, what's particularly interesting is the Polygon software development kit (SDK). An SDK is a collection of suitable programming tools.

Protected circuits and offline circuits also play an important role in the further development of the network. Secure chains use blockchain networks to provide proof as a service. However, they sacrifice some network independence and flexibility to achieve a high level of security.

On the other hand, autonomous chains are sovereign Ethereum networks. Stand-alone circuits in particular provide additional independence and flexibility. The downside, however, is that it can sometimes be difficult to assemble a pool of validators.

We anticipate that the introduction of new features and services will help increase usage of Polygon and have a positive impact on the share price.